Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In the complex world of online trading, a broker's regulatory status is the only safety net standing between a trader and financial ruin. Our investigation into GFS reveals a disturbing disconnect between its marketing claims and its operational reality. With a WikiFX Score of only 1.55/10, GFS lacks valid regulation and has been flagged for severe issues ranging from exorbitant hidden fees to the sudden deletion of client accounts. This report exposes the mechanisms used to trap investor funds.

In the complex world of online trading, a broker's regulatory status is the only safety net standing between a trader and financial ruin. Our investigation into GFS reveals a disturbing disconnect between its marketing claims and its operational reality. With a WikiFX Score of only 1.55/10, GFS lacks valid regulation and has been flagged for severe issues ranging from exorbitant hidden fees to the sudden deletion of client accounts. This report exposes the mechanisms used to trap investor funds.

All cases cited in this report are based on authentic user complaints and regulatory data recorded by WikiFX. To protect the privacy of the individuals involved, the identities of the traders have been anonymized.

Complaints from traders in Malaysia and China have highlighted a systematic “fee trap.” One investor detailed a harrowing experience where the cost of trading made profitability mathematically impossible. According to the user's report, GFS charged a staggering $50 USD commission per lot. Furthermore, the spread—the difference between the buy and sell price—was inflated to 0.07 basis points (roughly 7 pips on major pairs, whereas the industry standard is often below 1.5 pips).

The financial damage is compounded by questionable exchange rates. Another trader reported depositing via USDT (Tether), only to find that GFS had disabled USDT withdrawals, forcing a conversion to local currency. This authorized conversion applied an exchange rate 7.6% below the market rate, effectively seizing a significant portion of the principal immediately. When these hidden costs are combined with the high spreads, traders are effectively starting every position with a massive deficit.

While high fees are damaging, the complete inability to access funds is the most critical risk factor identified in our investigation. A pattern has emerged across multiple regions—including Vietnam, South Africa, and Malaysia—where GFS utilizes technical “maintenance” as a pretext to withhold funds.

A striking case from a South African trader illustrates this tactic perfectly. The trader deposited funds using Neteller without issue. However, when attempting to withdraw via the same method, the option was removed. Customer support claimed that Neteller withdrawals were “temporarily suspended due to maintenance,” yet the platform continued to accept deposits via Neteller. This one-way street—where money flows in easily but cannot flow out—is a classic hallmark of high-risk platforms.

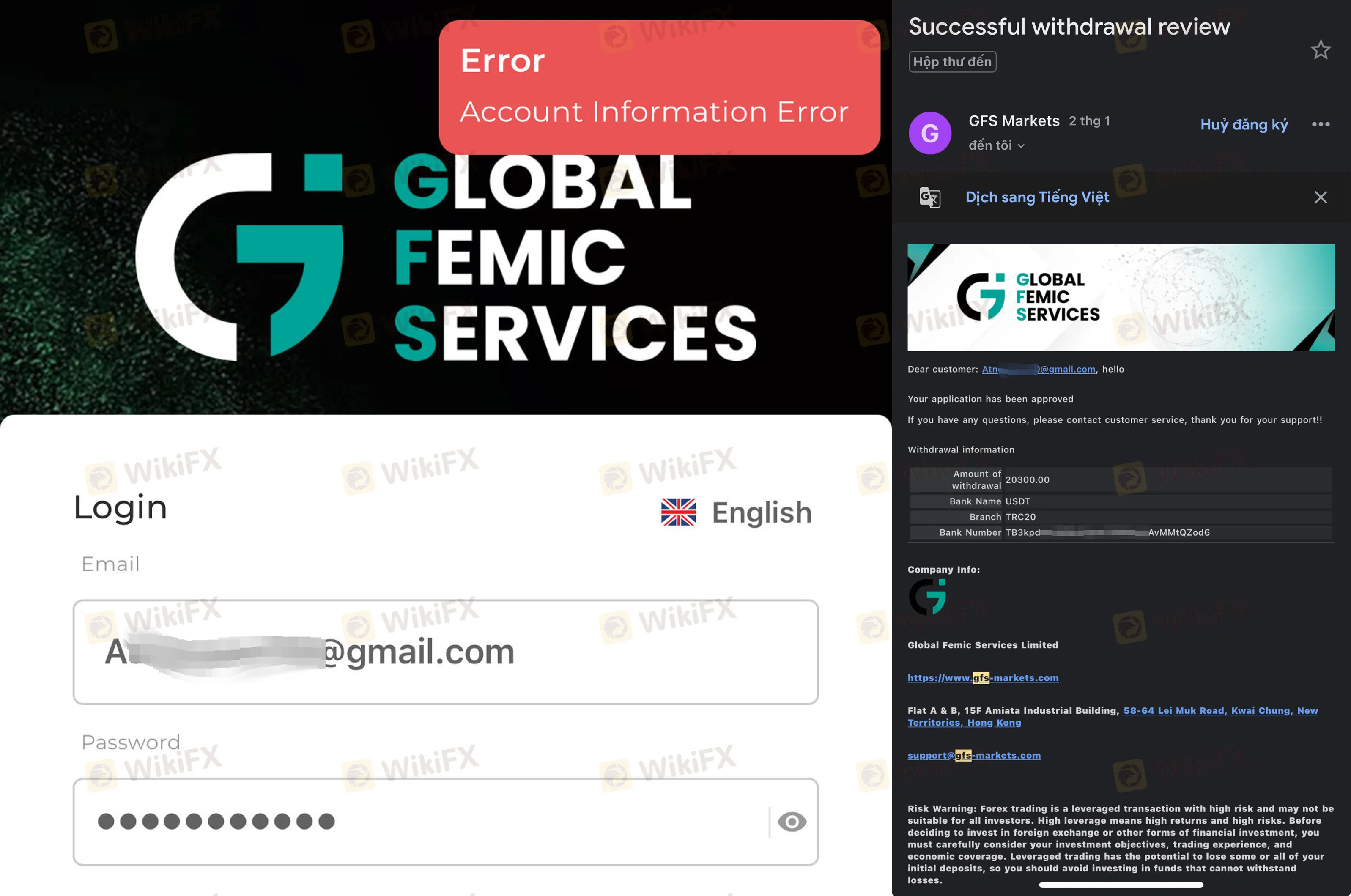

In Vietnam, the situation is equally grim. One user received an official notification from the GFS team stating that their withdrawal had been “successfully processed.” However, the blockchain data tells a different story: the USDT never arrived in the user's wallet. When pressed, the broker shifted the narrative, blaming the delay on the Lunar New Year holiday. Weeks passed after the holiday concluded, yet the funds remained missing, and emails to support went unanswered.

Perhaps the most alarming behavior exhibited by GFS is its reaction to scrutiny. Legitimate financial institutions have dispute resolution processes; GFS appears to have a “deletion protocol.”

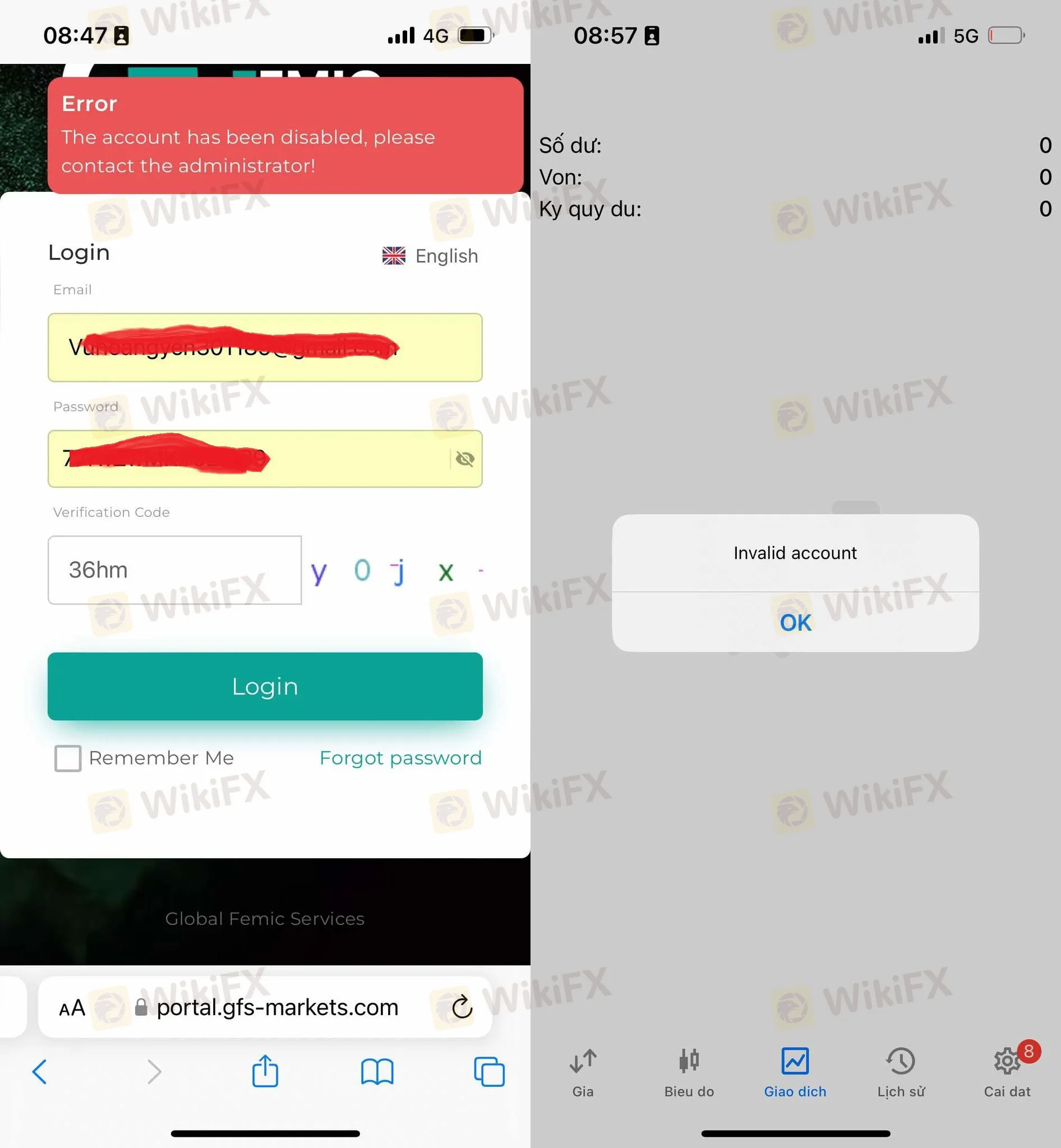

A trader from Norway reported a chilling experience after questioning the platform's integrity. After experiencing connection issues with the MetaTrader 5 (MT5) platform, the user contacted customer service. Frustrated by the lack of response, the user explicitly asked if the platform was a scam. The following day, without warning or explanation, their account was deactivated and locked. This retaliation effectively severed the trader's access to their invested capital.

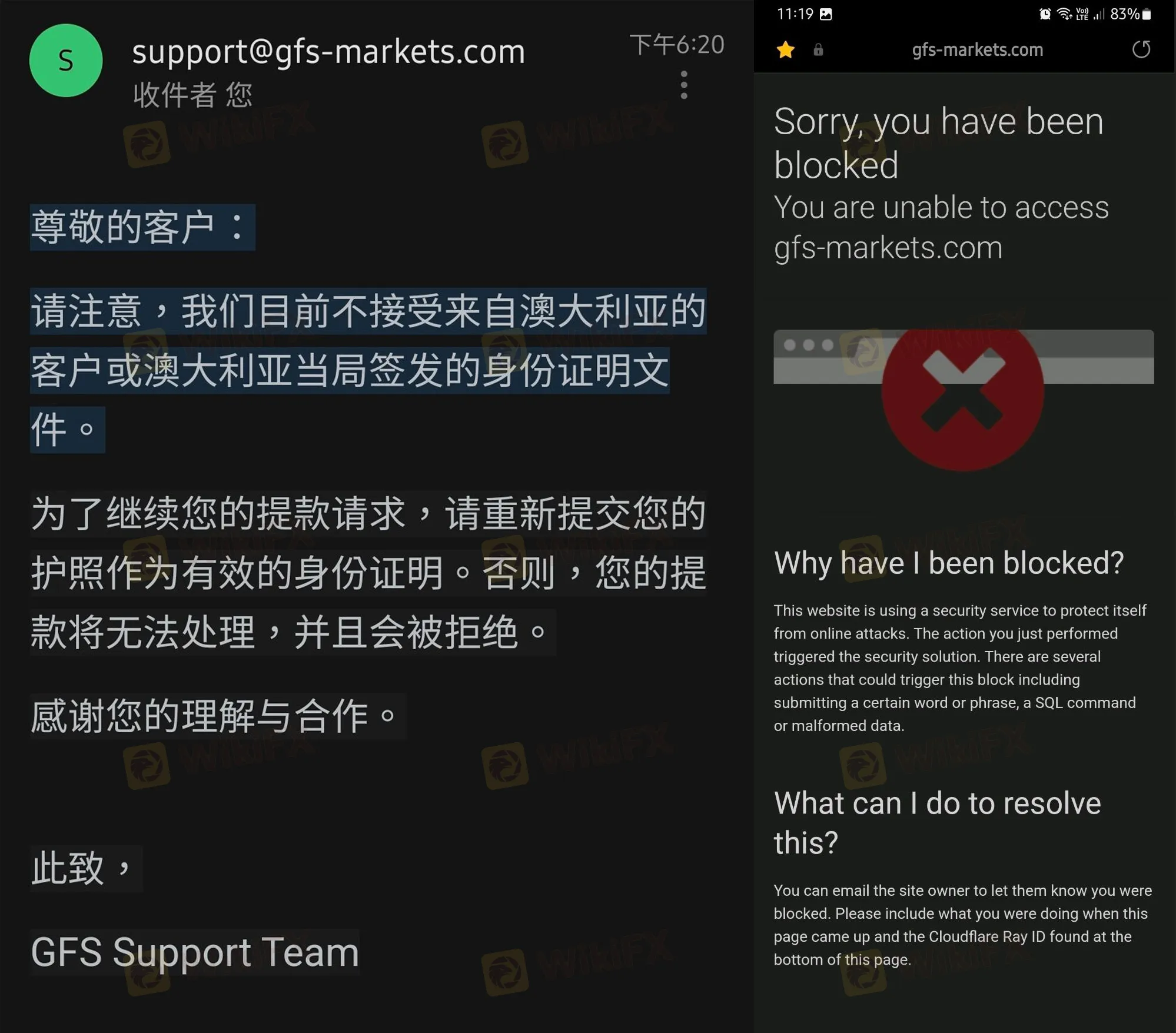

Ironically, despite claiming to be an Australia-based broker, GFS has begun blocking Australian users. A trader based in Australia reported that the website became inaccessible, and support claimed they “currently do not accept Australian KYC documents.” This is highly irregular for a company that lists its headquarters in Australia. It strongly suggests that GFS is attempting to avoid the scrutiny of the Australian Securities and Investments Commission (ASIC) by purging clients who fall under that jurisdiction.

Our analysis of the complaint text reveals a coordinated effort to lure inexperienced traders into the GFS ecosystem. Multiple reports from Asia describe “competitions” and “training classes” hosted by so-called investment teachers (referred to as “Jingcheng,” “Qingyun,” and “Jianghe”).

These figures urge followers to vote for them in trading competitions and eventually funnel them into opening GFS accounts. Once inside, followers are given trading signals that often lead to heavy losses or liquidation (margin calls). The combination of bad advice and the previously mentioned high commissions ($50/lot) suggests that these “teachers” may be acting as Introducing Brokers (IBs) who profit from the confused traders' trading volume or losses.

Marketing materials often use vague language to imply safety. GFS claims to be founded in 2019 and headquartered in Australia. However, for a broker to operate legally from Australia, it must hold an Australian Financial Services License (AFSL) issued by ASIC.

WikiFXs database confirms that GFS holds no such license.

Below is the verified regulatory status of GFS:

| Regulator Name | License Type | Current Status |

|---|---|---|

| None | N/A | Unregulated / No License |

| Australia (Claimed) | N/A | Unregulated |

The data confirms that GFS is an unregulated entity. It is not overseen by the FCA (UK), ASIC (Australia), or any tier-1 regulatory body. This means that when GFS blocks a withdrawal or deletes an account, traders have no legal recourse and no government ombudsman to appeal to.

The evidence against GFS is multifaceted and damning. From the manipulative “maintenance” excuses preventing withdrawals in South Africa to the retaliatory account closures in Europe and the predatory fee structures in Asia, the pattern is consistent.

GFS appears to operate with a singular goal: the absorption of client funds with no intention of returning them. The platforms low WikiFX score of 1.55 reflects this reality. We strongly advise all traders to avoid depositing funds with GFS. For those already involved, immediate withdrawal attempts are recommended, though the likelihood of success may be low given the documented behavior.

Trading forex and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your initial investment.

Data and regulatory status mentioned in this article are accurate as of the time of publication based on the WikiFX database.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.