Abstract:Choosing the right online broker is critical for the safety of your funds. COINEXX, established in 2018, presents itself as an ECN broker offering high leverage and low spreads. However, despite its claims of specialized trading services, the broker holds a concerningly low score on WikiFX, raising questions about its legitimacy.

Choosing the right online broker is critical for the safety of your funds. COINEXX, established in 2018, presents itself as an ECN broker offering high leverage and low spreads. However, despite its claims of specialized trading services, the broker holds a concerningly low score on WikiFX, raising questions about its legitimacy.

This review analyzes COINEXX based on its regulatory status, trading conditions, and recent user complaints regarding withdrawals.

Is COINEXX Legit? Regulatory Status and Safety

The most important factor in assessing a broker's reliability is its regulatory oversight. Based on the available data, COINEXX operates without valid regulation from any major financial authority.

Regulatory Licensing

The broker is headquartered in Comoros, an offshore jurisdiction often used by entities wishing to avoid strict financial standards. Currently, there is no evidence that COINEXX holds a license to legally offer financial services in major jurisdictions.

Why This Matters

Trading with an unregulated broker like COINEXX carries significant risk. Regulated brokers are required to segregate client funds and adhere to strict auditing standards. In contrast, unregulated entities have no legal obligation to protect your capital. The WikiFX system has assigned COINEXX a Score of 2.32, which is considered low and indicative of high risk.

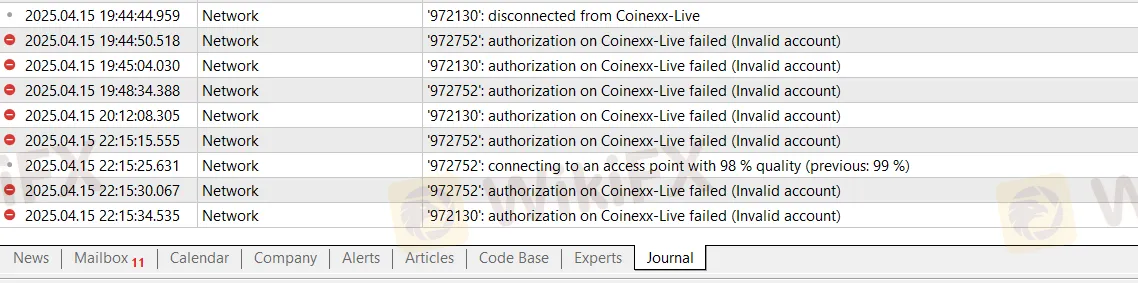

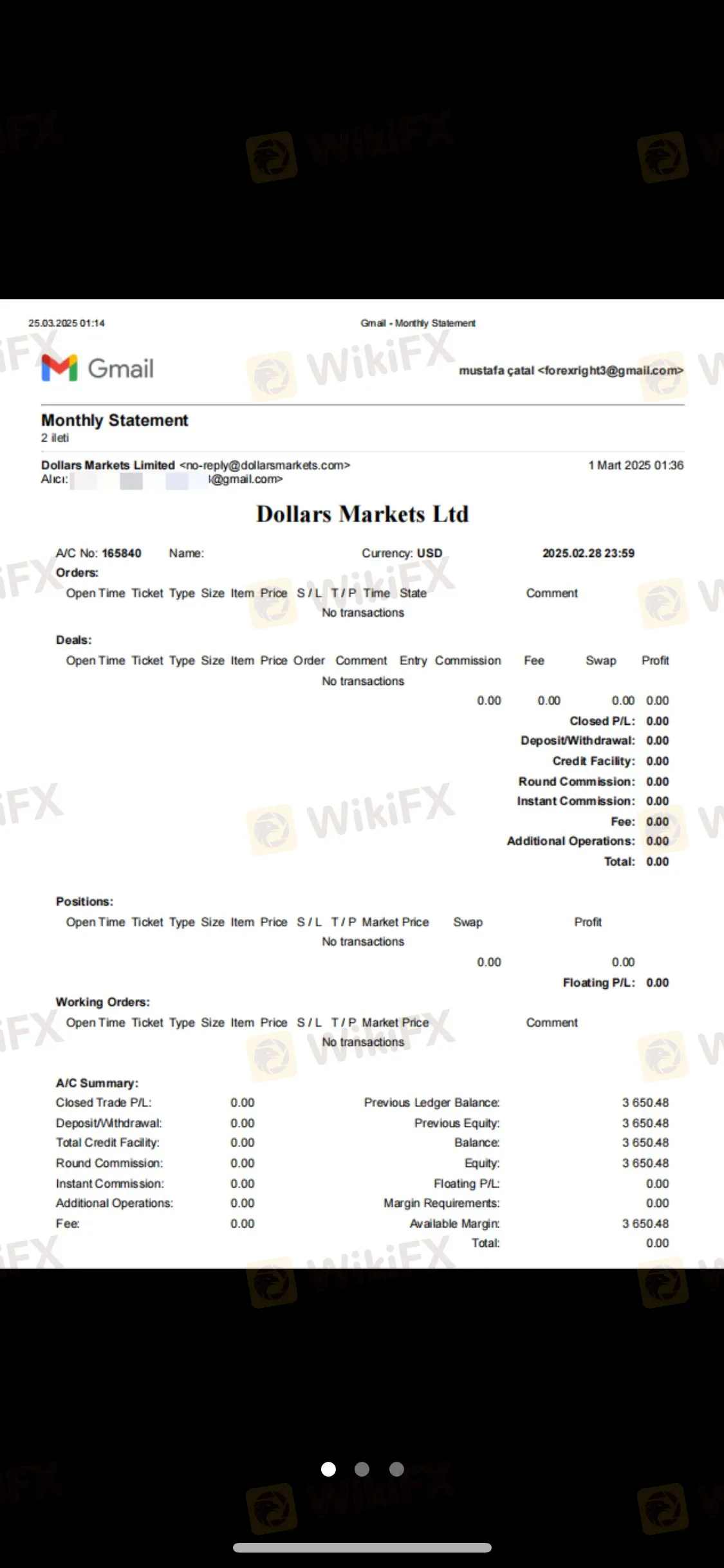

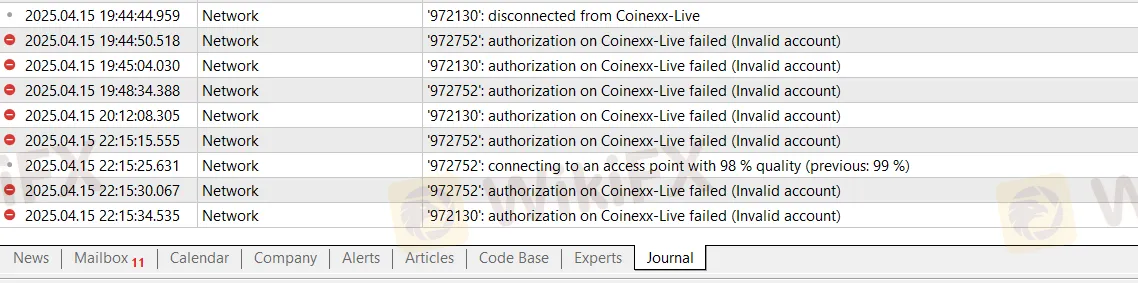

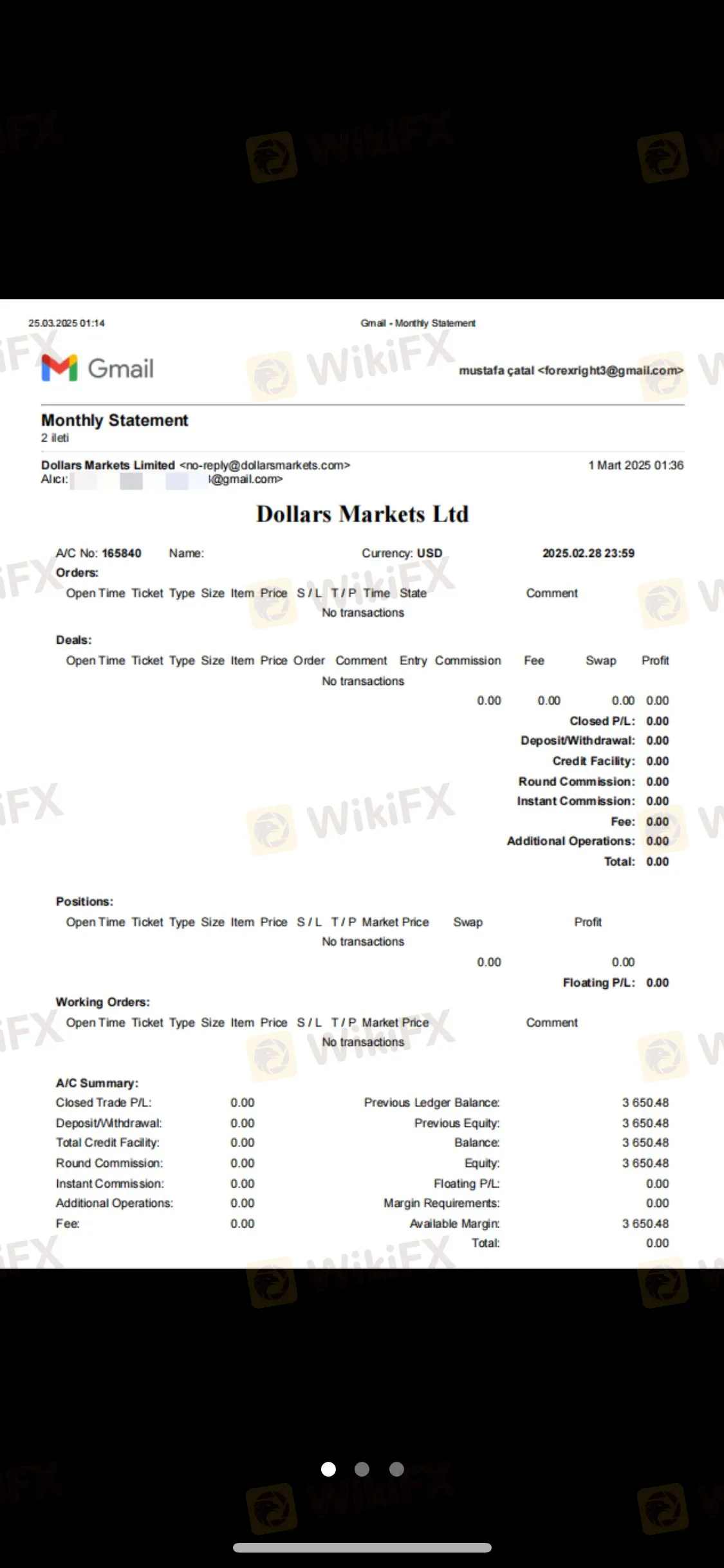

COINEXX Complaints and Exposure

A significant number of complaints have been lodged against COINEXX recently, particularly regarding withdrawal failures and account blocking. WikiFX has received 5 serious complaints in just the last three months.

- Case 3 (Venezuela - April 2024): A user reported a classic “fee scam” scenario where they were told to invest more money in order to withdraw their initial funds. When they could not pay, the withdrawal remained stuck in “verification.”

These cases highlight a pattern of behavior where clients face severe obstacles when attempting to retrieve their profits or capital.

Trading Conditions and Fees

While the safety concerns are paramount, COINEXX offers competitive trading specifications on paper, which often attracts traders initially.

Account Types and Leverage

COINEXX offers an ECN account model. The entry barrier is low, with a minimum deposit requirement of just $10.

- Maximum Leverage: Up to 1:500. While this offers high purchasing power, it also increases the risk of rapid losses.

- Spread: The broker advertises spreads starting from 0.0 pips.

Trading Platforms

A strong point for the broker is its support for industry-standard software. Clients can trade using:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

These platforms support Expert Advisors (EAs) and automated trading. However, the lack of a proprietary mobile app restricts users to the generic mobile versions of MT4/MT5.

Customer Service

COINEXX lists support via email, phone, and social media channels (Facebook, Instagram, YouTube). However, user reviews suggest that while contact methods exist, obtaining a resolution for withdrawal disputes can be difficult.

Pros and Cons of COINEXX

The following summary is based on the factual data and user feedback analyzed above.

Pros

- Supports popular MT4 and MT5 platforms.

- Low minimum deposit ($10).

- High leverage available (1:500).

- ECN execution with spreads from 0.0.

Cons

- Unregulated (No valid license).

- Low Trust Score (2.32).

- Multiple reports of blocked accounts and denied withdrawals.

- Offshore structure lacks investor protection.

Final Verdict: Can You Trust COINEXX?

Based on the evidence, COINEXX is not considered a safe broker. Although it offers popular trading platforms and attractive ECN conditions, the lack of regulation and the severity of recent client complaints regarding deleted accounts and withheld funds pose a substantial risk.

Traders looking for a secure environment should prioritize brokers with Tier-1 regulation (such as the FCA, ASIC, or NFA) to ensure their capital is protected.

Protect your capital. Before depositing money with any broker, check their regulatory status and live reviews on the WikiFX App to avoid potential scams.