简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

It’s a Scam, Not Romance: How This Woman Lost US$1 Million

Abstract:In Malaysia, pig butchering scams now rank among the most commonly reported forms of online financial crime. A woman believed she had found true love, but it ultimately cost her US$1 million.

Pig butchering scams are fast becoming one of the most dangerous forms of cyber fraud in the world. By blending emotional manipulation with fake investment schemes, these crimes are destroying personal wealth at an alarming pace. Although many headline cases emerge from the United States, the methods and money trails behind these scams are increasingly linked to Malaysia. Local authorities have repeatedly warned that online investment fraud is accelerating, not slowing down.

In Malaysia, pig butchering scams now rank among the most commonly reported forms of online financial crime. Law enforcement agencies and banks continue to flag a steady rise in cases involving fake cryptocurrency investments, online relationships and impersonation. Losses range from thousands of ringgit to life savings, with victims spanning all age groups and income levels.

In a recent case, an elderly widow from San Jose, California, lost almost US$1 million after being targeted through social media. The scam preyed on her desire for companionship after the death of her spouse, a vulnerability that criminal networks deliberately seek out.

The woman was first approached on Facebook by a man who claimed to be a successful businessman. What began as a casual conversation quickly intensified into daily romantic communication. Trust was built steadily through constant attention and emotional reassurance, a deliberate strategy used to lower a victims defences.

Once the relationship felt secure, the conversation shifted to investing. The fraudster presented himself as financially experienced and encouraged the victim to move large sums into what appeared to be a legitimate cryptocurrency trading platform. To strengthen the illusion, the platform showed steady gains through convincing screenshots and account dashboards. None of the profits were real.

Convinced her money was growing, the victim transferred funds from her retirement savings and later took out a second mortgage to invest more. This slow and calculated escalation is a defining feature of pig butchering scams, where emotional attachment is used to drain victims financially.

The scheme unravelled when the trading account was suddenly frozen. The fraudster claimed an additional US$1 million was required to release the funds, citing tax or regulatory reasons. Alarmed by the demand, the victim sought independent advice. After consulting an artificial intelligence tool, she was informed that the situation matched known scam patterns and was urged to report the case to the authorities.

Investigators later found that the stolen funds had moved through accounts in Malaysia before being withdrawn. This is a critical point for local readers. Malaysia is frequently used as a transit point in cross border fraud due to its advanced banking systems and digital payment channels. Once money leaves the original banking system, recovery is rare.

For Malaysians, the warning signs could not be clearer. Online relationships should never be linked to investment opportunities. Cryptocurrency platforms must be independently verified, and any promise of steady or guaranteed returns should be treated as a serious warning. Requests for additional payments to release profits are a clear signal to stop immediately.

Authorities continue to urge the public to pause, verify and seek professional advice before transferring funds. Checking Bank Negara Malaysias alerts, consulting licensed financial advisers, and speaking openly with family members can prevent life-changing losses.

Criminals move fast, and so must public awareness. In a digital world where trust can be manufactured and money can vanish in seconds, caution is no longer a choice. It is a necessity.

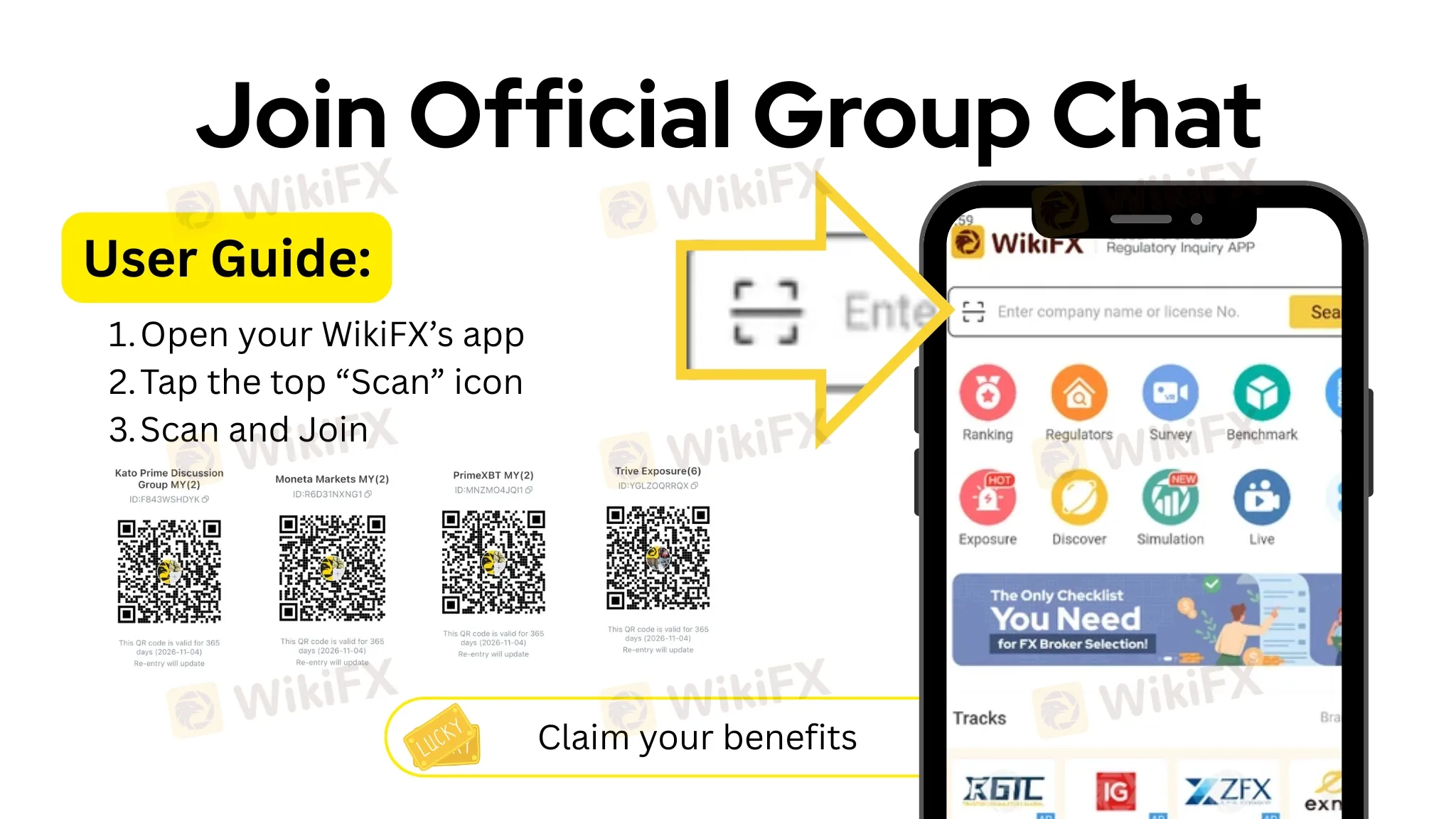

As incidents like this become increasingly common, tools such as WikiFX can play a vital role in helping individuals verify the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors easily spot red flags and avoid potential scams. By using tools like WikiFX to research a broker's background, individuals can safeguard their hard-earned savings and reduce the risk of falling victim to fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Currency Calculator