简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weltrade Review 2025: Dangerous Safety Warnings & Complaints

Abstract:Weltrade is a forex and CFD broker that has been operating since 2006, headquartered in Saint Lucia. While a lifespan of nearly two decades usually suggests stability, Weltrade currently holds a concerningly low WikiFX Score of 2.55. Despite offering popular platforms like MT4 and MT5, the broker is plagued by revoked licenses, regulatory warnings, and a massive volume of client complaints regarding withdrawal refusals and severe slippage.

Weltrade is a forex and CFD broker that has been operating since 2006, headquartered in Saint Lucia. While a lifespan of nearly two decades usually suggests stability, Weltrade currently holds a concerningly low WikiFX Score of 2.55. Despite offering popular platforms like MT4 and MT5, the broker is plagued by revoked licenses, regulatory warnings, and a massive volume of client complaints regarding withdrawal refusals and severe slippage.

Is Weltrade Legit? Regulatory Status Analysis

One of the most critical factors in assessing a broker is its regulatory standing. Based on the current data, Weltrade presents significant safety risks due to the status of its licenses.

License Overview

The following table summarizes the regulatory information available for Weltrade:

| Regulatory Body | Country | License Status | Risk Level |

|---|---|---|---|

| FSCA (Financial Sector Conduct Authority) | South Africa | Exceeded | High Risk |

| FSC (Financial Services Commission) | Belize | Revoked | High Risk |

| NBRB (National Bank of the Republic of Belarus) | Belarus | Revoked | High Risk |

Regulatory Red Flags

- Exceeded & Revoked Status: Weltrade currently has no valid, active regulation for its primary operations. Its license in South Africa is marked as “Exceeded,” meaning the company is operating outside the permitted scope of its authorization. Furthermore, its licenses in Belize and Belarus have been revoked.

- Official Warnings:

- Malaysia (SC): The Securities Commission Malaysia has placed Weltrade on its Investor Alert List for carrying out unlicensed capital market activities.

- Indonesia (Bappebti): The Indonesian government has blocked Weltrade's domains for operating without authorization.

Major Complaints and Exposure

In recent months, WikiFX has received over 40 serious complaints from users globally, particularly from Thailand, Indonesia, and Malaysia. The volume and nature of these reports indicate systemic issues.

1. Withdrawal Refusals and Delays

A significant number of traders report being unable to withdraw their funds.

- Case Example (Malaysia): A user reported that a withdrawal request had been stalled for three weeks with the excuse that it was “under review.” When the user attempted to follow up, they faced demands for excessive verification documents despite having already verified their account.

- Case Example (Indonesia): A trader with over $2,000 in withdrawals pending stated that their requests were ignored, and their affiliate rewards were cancelled after trading over 1,800 lots.

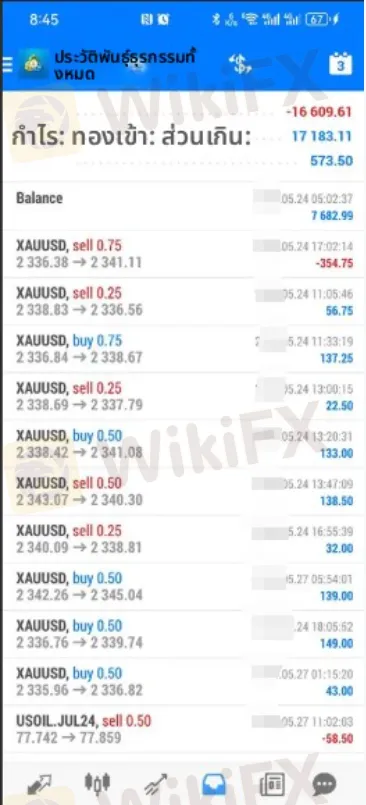

2. Severe Slippage and Data Manipulation

Multiple cases describe “anomalous” market behavior on the Weltrade platform that does not match global market data.

- Case Example (Thailand): A trader reported a loss of 64,500 THB due to platform freezing during a trade. When the system recovered, the price had shifted drastically. Customer service blamed the user's internet connection, despite them using high-speed fiber optics.

Case Example (Indonesia): Another user reported that stop-loss orders were consistently executed with negative slippage (averaging -2.8 pips), while take-profit orders were executed precisely, suggesting an algorithm designed to disadvantage the trader.

3. Account Blocking and Bonus Traps

Users have reported that utilizing bonuses often leads to funds being locked. One user in Thailand deposited 200,000 THB to get a bonus, only to find they were required to trade an impossible volume (3,000 lots) to withdraw. When they tried to cancel the bonus, they were threatened with a 50% penalty on their principal.

Trading Conditions and Fees

Despite the safety concerns, Weltrade offers competitive technical specifications on paper. However, these features come with high risk given the complaints above.

Account Types

Weltrade offers three main account types:

- Micro Account: Minimum deposit of $1, spreads starting from 1.5 pips.

- Pro Account: Minimum deposit of $10, spreads starting from 0.5 pips.

- SyntX Account: Designed for high-risk trading with leverage up to 1:10000.

Platforms & Leverage

- Platforms: The broker supports MT4, MT5, and a proprietary app.

- Leverage: The leverage offered is extremely high, ranging from 1:1000 to 1:10000. While high leverage can multiply profits, it significantly increases the risk of rapid liquidation, especially on a platform accused of slippage and data manipulation.

Trading Environment

- Rank: C (Average/Poor).

- Transaction Speed: Rated “Poor” on average, with slow execution speeds noted in user benchmarks.

- Slippage: While some metrics show “Good” slip control, user reports contradict this heavily, citing massive slippage during volatility.

Pros and Cons of Weltrade

Pros:

- Supports MT4 and MT5 platforms.

- Very low minimum deposit ($1).

- Operation history since 2006.

Cons:

- High Regulatory Risk: Licenses are Revoked or Exceeded.

- Blacklisted: Listed on investor alert lists in Malaysia and Indonesia.

- Withdrawal Issues: Numerous reports of denied withdrawals and frozen accounts.

- Platform Stability: Reports of freezing, severe slippage, and price manipulation.

- Low Score: WikiFX Score of 2.55 indicates poor reliability.

Final Review Verdict: Can You Trust Weltrade?

No, Weltrade is not considered safe. Despite being in the industry since 2006, the broker's current regulatory standing is critical. With licenses revoked in Belize and Belarus, and an “Exceeded” status in South Africa, there is no confident layer of protection for your funds. The overwhelming number of unresolved complaints regarding withdrawals and manipulated trades suggests a high risk of capital loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Currency Calculator