简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

XS Review 2025: Safety, Features, and Reliability

Abstract:XS is a brokerage firm established in 2022 with its headquarters in Mauritius. It is currently regulated by multiple financial authorities, including the Seychelles FSA and Malaysia LFSA, though its regulatory status across different regions shows mixed results. With a WikiFX Score of 6.09, XS holds a mid-range rating, reflecting a balance between its regulatory framework and recent feedback regarding its trading environment.

XS is a brokerage firm established in 2022 with its headquarters in Mauritius. It is currently regulated by multiple financial authorities, including the Seychelles FSA and Malaysia LFSA, though its regulatory status across different regions shows mixed results. With a WikiFX Score of 6.09, XS holds a mid-range rating, reflecting a balance between its regulatory framework and recent feedback regarding its trading environment.

Pros and Cons of XS

Based on the available data, here is a breakdown of the broker's strengths and weaknesses:

- ✅ High Leverage: Offers maximum leverage up to 1:2000.

- ✅ Platform Variety: Supports industry-standard MT4 and MT5 trading platforms.

- ✅ Account Options: Features multiple account types including Standard, Micro, and Cent accounts.

- ❌ Regulatory Warnings: Some licenses are flagged as “Exceeded Business Scope” or “Unverified.”

- ❌ Poor Trading Environment: Rated “D” for trading environment, with poor slippage and swap grades.

- ❌ User Complaints: Significant recent complaints regarding withdrawal refusals and profit cancellations.

Is XS Safe? Regulatory Analysis

XS operates under a multi-regulatory framework, but the specific status of each license varies significantly.

Regulated Entities

- Seychelles FSA: XS Ltd is regulated by the Financial Services Authority (FSA) with license number SD089. This is considered an offshore regulation.

- Malaysia LFSA: XS Finance Limited is regulated by the Labuan Financial Services Authority (License MB/21/0081). The status is noted as “Regulation in Progress.”

- Australia ASIC: XS PRIME LTD holds a license (374409) from the Australian Securities & Investments Commission. However, the data also categorizes this under a “Regulation in Progress” status in the safety analysis.

Risk Warning

The regulatory analysis flags several concerns regarding other licenses:

- South Africa (FSCA): The license held by XS ZA (Pty) Ltd (53199) is flagged as “Exceeded Business Scope.”

- Cyprus (CySEC): The status for XS Markets Ltd (412/22) is listed as “Unverified.”

Real User Feedback and Complaints

In the last three months, WikiFX has received 5 complaints. The feedback highlights severe issues regarding fund management and trade execution.

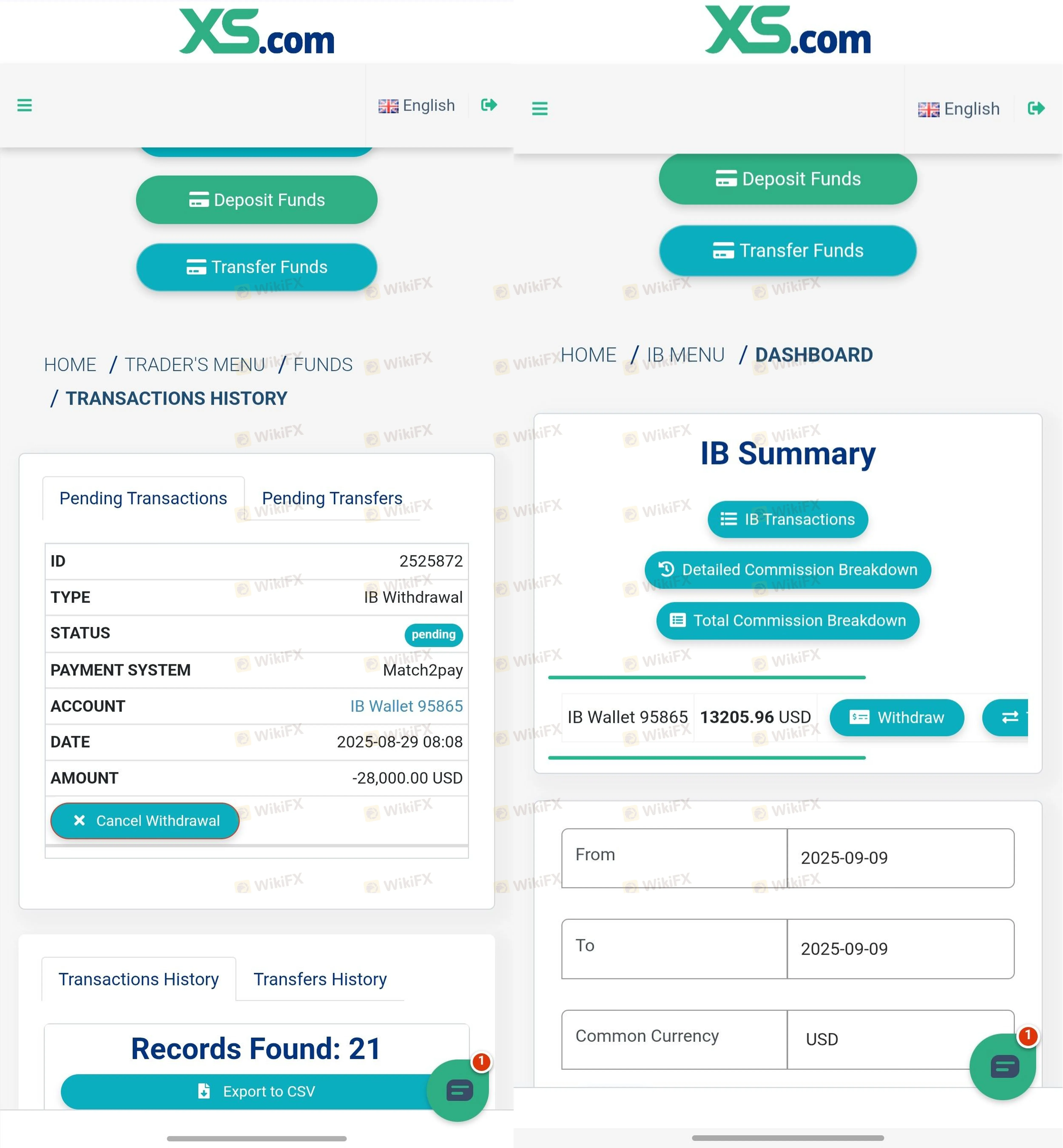

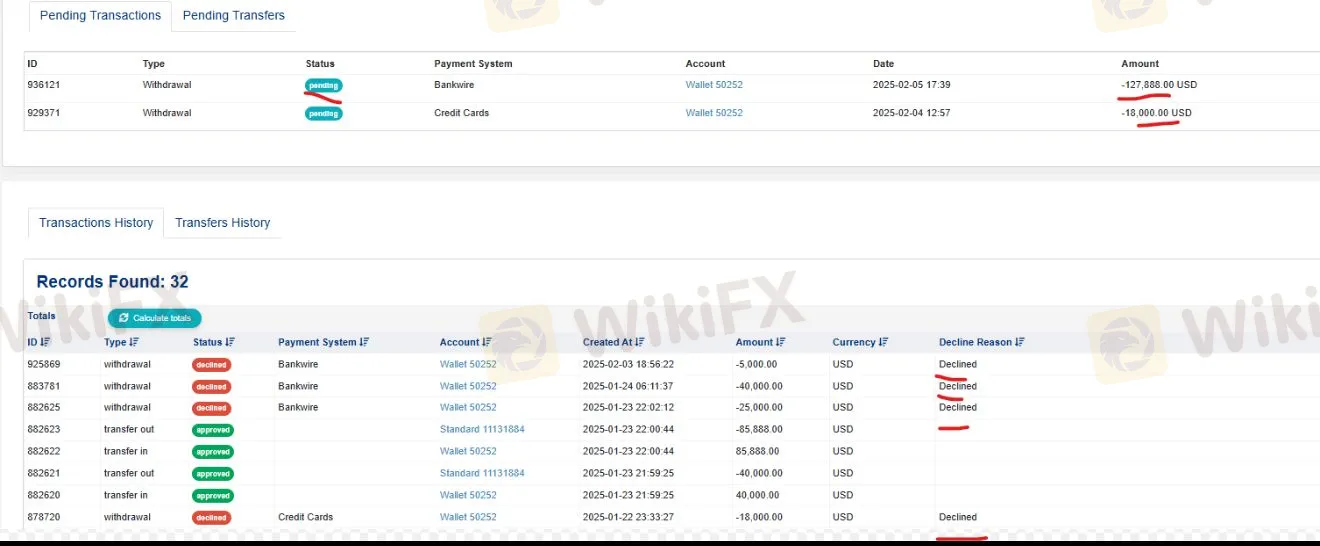

Withdrawal Issues

Multiple users reported significant delays or inability to withdraw funds.

- Case 1 (Hong Kong): A user reported that withdrawals have been pending for a month with no resolution.

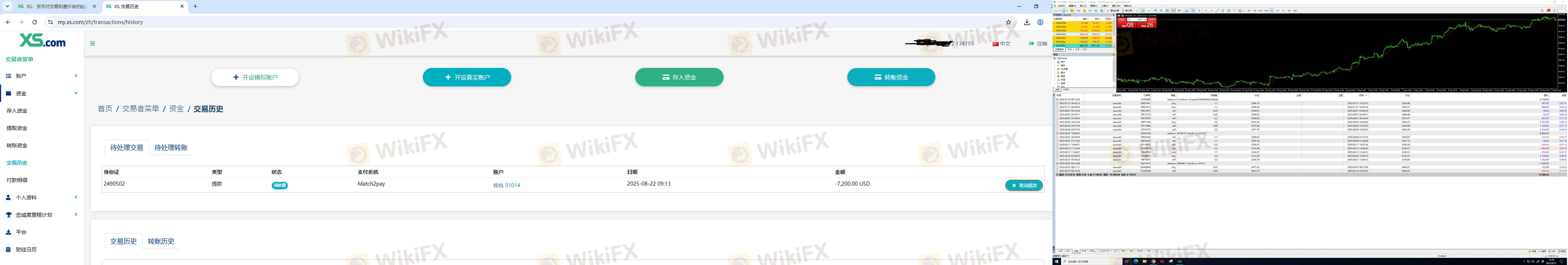

Case 2 (China) & Case 5 (Brazil): Users faced hurdles withdrawing larger amounts ($28,000 and $24,000 respectively). One user noted that while small commissions were processed, large amounts were stuck in “review” for weeks.

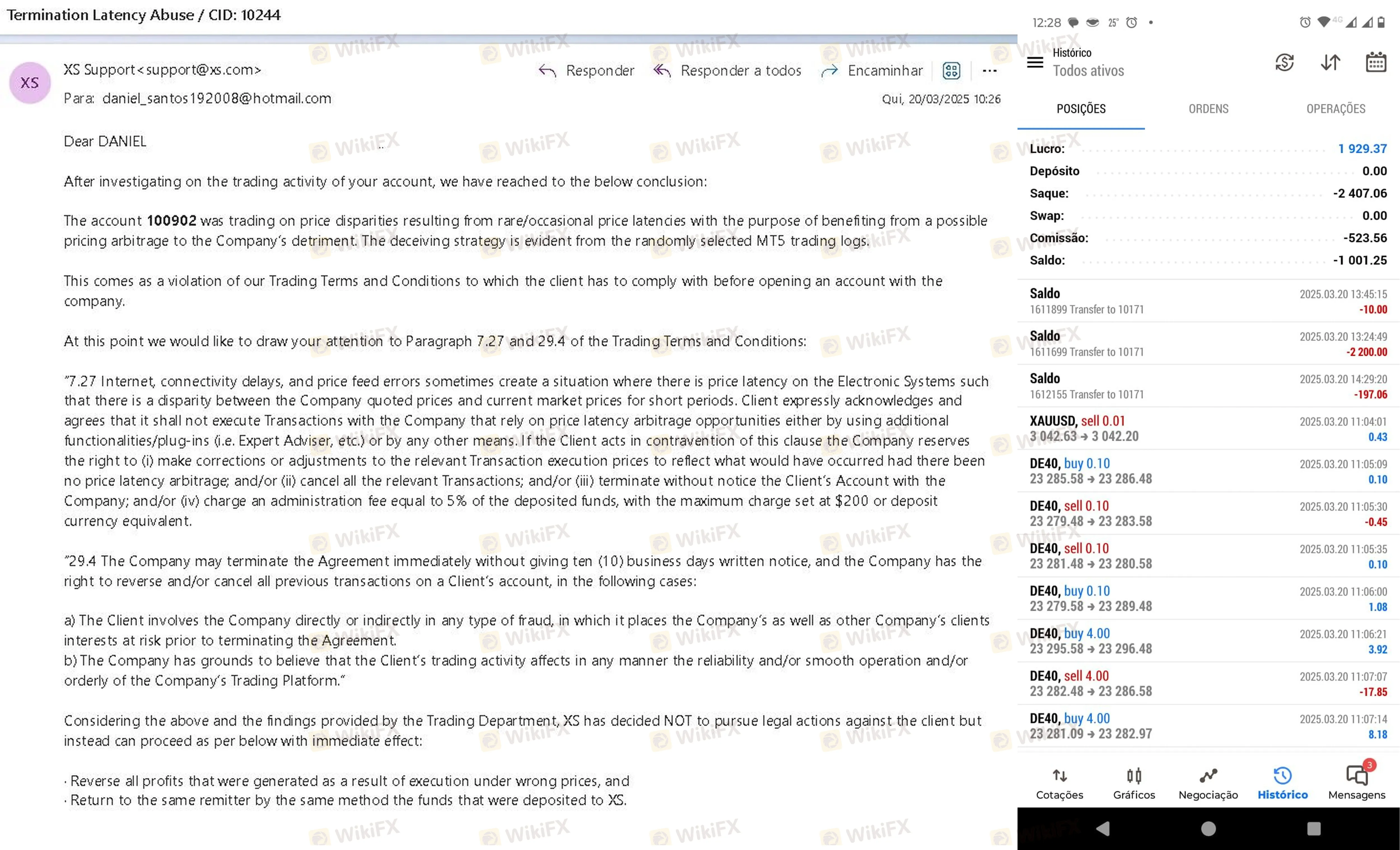

Profit Cancellation and “Abuse” Accusations

Several traders reported that their profits were removed by the broker under the accusation of “trading abuse.”

- Case 4 (UAE): A user claimed to make $127,888 in profits from gold and equity markets. XS allegedly terminated the account citing “swap arbitrage,” reversed the profits, and only allowed the withdrawal of the initial deposit.

Case 3 (Brazil): A trader with $1,400 in profit received an email claiming “abuse in negotiations” and faced potential penalties.

System Errors

- Case 6 (China): A user reported forced liquidation of BTC, Gold, and Oil positions due to a recognized system error, but claimed the broker refused compensation.

Trading Conditions and Fees

Leverage

XS offers extremely high leverage, reaching up to 1:2000 for Standard, Cent, and MT5 accounts. While this allows for significant market exposure, it substantially increases the risk of capital loss.

Spreads and Accounts

The broker offers spreads starting from 1.1 pips on its Standard, Micro, and Cent accounts.

- Account Types: Standard MT5, Standard MT4, Micro, and Cent.

- Minimum Deposit: Starts as low as 0.01 (currency unspecified, implied USD/Base unit) for Standard/Cent accounts and 0.1 for Micro accounts.

Platforms

XS utilizes the MT4 and MT5 trading platforms. Data indicates the MT5 software used is a “Main Label” (Subject to customization), rated as “Perfect” for its features, though it lacks two-step biometric authentication.

Final Verdict

XS presents itself as a modern broker with high leverage (1:2000) and access to MetaTrader platforms. Its WikiFX Score of 6.09 suggests a legitimate foundation, yet the “Poor” trading environment rating (Grade D) and specific regulatory flags (FSCA exceeded scope, CySEC unverified) warrant caution.

Most concerning are the recent user reports detailing profit cancellations and withdrawal blockers involving substantial sums. Traders should exercise high caution regarding liquidity and internal policy enforcement.

To stay safe and view the latest regulatory certificates, check XS on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Currency Calculator