Abstract:As of 2026, the main question about XeOne regulation has a clear answer based on facts: this broker works without a real financial license from any trusted, top-level regulatory authority. Our research into public records and watchdog websites shows serious concerns that potential traders need to understand before working with this company. While the company, XeOne Prime Ltd, does have a business registration in Mauritius, this is an important difference that should not be confused with financial regulation. A business registration lets a company legally exist, but it does not give it permission to offer financial services, and it does not put it under the strict oversight needed to protect client capital.

This article gives a detailed, fact-based analysis of XeOne's operating status. We will break down its business standing, look at the serious complaints from users, and examine its product offerings to show the risks involved. The goal is to give you the facts needed to make a smart

As of 2026, the main question about XeOne regulation has a clear answer based on facts: this broker works without a real financial license from any trusted, top-level regulatory authority. Our research into public records and watchdog websites shows serious concerns that potential traders need to understand before working with this company. While the company, XeOne Prime Ltd, does have a business registration in Mauritius, this is an important difference that should not be confused with financial regulation. A business registration lets a company legally exist, but it does not give it permission to offer financial services, and it does not put it under the strict oversight needed to protect client capital.

This article gives a detailed, fact-based analysis of XeOne's operating status. We will break down its business standing, look at the serious complaints from users, and examine its product offerings to show the risks involved. The goal is to give you the facts needed to make a smart decision and protect your capital.

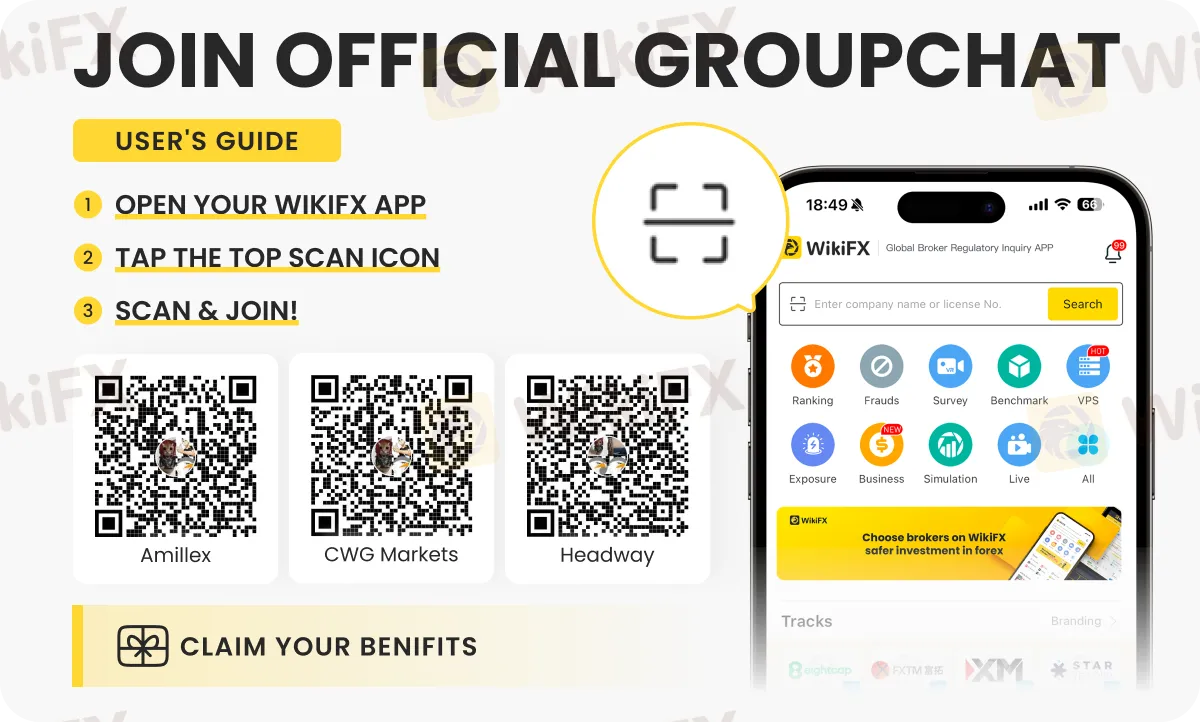

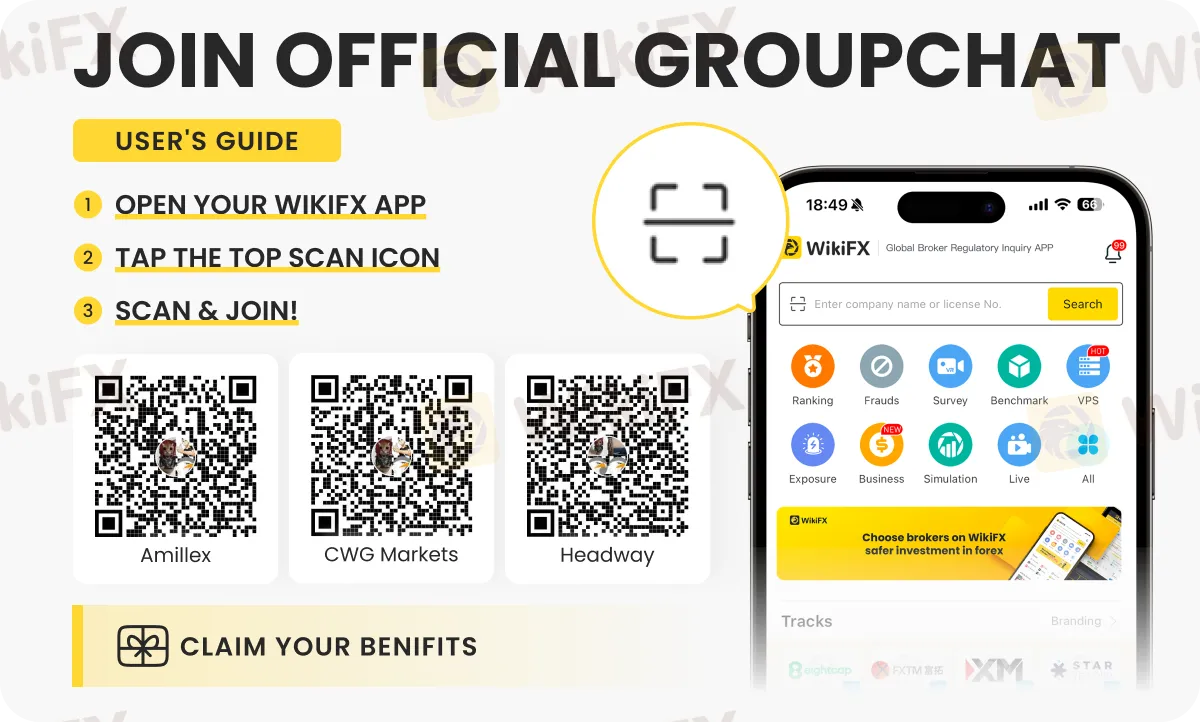

For your own safety, checking things yourself is extremely important. We will use data from the global broker inquiry app WikiFX throughout this analysis. We strongly suggest you use such tools to verify any broker's claims before putting in money.

XeOne's Official Status: Registration vs Regulation

Understanding XeOne's standing requires knowing the difference between two very different things: being a registered company and being a regulated financial services provider. The evidence shows that while XeOne meets the first condition, it fails to meet the second, which is the most important factor for trader safety.

The Mauritius Registration

Public records confirm that the company behind the brand, XeOne Prime Ltd, is registered in the Republic of Mauritius. This is a legal step that establishes the company as a business entity. However, for traders, this registration offers almost no protection. Mauritius is widely considered an offshore location. Financial oversight in such places is typically much less strict than that provided by top-level regulators like the FCA in the UK, ASIC in Australia, or CySEC in the European Union. A simple business registration in an offshore zone is not a replacement for a legitimate XeOne license for offering forex and CFD trading.

The Verdict from Public Data

Independent watchdog platforms provide a clear and direct assessment of XeOne's regulatory status. Global inquiry tools like WikiFX, which collect regulatory data, clearly list XeOne with the status “No Regulation” or “Suspicious Regulatory License.” This is not an opinion but a factual statement based on a lack of verifiable licensing from any recognized financial authority.

This lack of regulation is shown in the broker's trust score. On a scale of 1 to 10, XeOne receives a very low score of 2.13. This score is a combined measure of factors including license quality, business practices, and risk management. Such a low score serves as a significant warning with numbers. It comes with the direct advice: “Warning: Low score, please stay away!” This is the clearest possible signal of high risk.

Key Company Details

For clarity, the essential business and regulatory information for XeOne, as gathered from public sources, is presented below. This data shows a picture of a company operating for 2-5 years from an offshore base without the necessary financial oversight.

Looking at the Red Flags: User Experiences

The general risk associated with an unregulated broker becomes real when looking at the collective first-hand experiences of its users. Public platforms that allow traders to post reviews and complaints are an extremely valuable resource for checking things out. In the case of XeOne, the patterns found in these reports are deeply concerning and match perfectly with the risks suggested by its unregulated status.

A Troubling Pattern of Complaints

The “Exposure” section on broker review platforms, where users detail serious issues, contains a troubling pattern of complaints against XeOne. These are not minor complaints about platform problems or spread costs; they are severe accusations that strike at the heart of a broker's trustworthiness. The consistent themes include:

· Inability to Withdraw Funds: This is the most common and most serious complaint. Multiple users report that their attempts to withdraw their own money, including profits, have been denied or ignored.

· Claims of Stolen Money: Some claims are direct accusations of theft. One user clearly states that a manager at the company “stole my 3000 dollars and denied withdrawals.”

· Accusations of Fraud: Users have labeled the company a “fraudulent broker” and a “scam.” One report details how an account was blocked immediately after a series of successful trades, with the user concluding, “STAY AWAY FROM THIS THIEF !!”

Anonymous quotes from these public complaints add authenticity to the data: one user describes being “humiliated and defrauded here,” while another gives the stark warning that the broker will “never give withdrawal.”

Contradictory Positive Reviews

To be fair, we must acknowledge that a handful of positive reviews for XeOne exist. However, a careful analysis reveals another red flag. These positive comments are often generic, short, and lack specific detail. Phrases like “trading is smooth as butter” and “commission-free, awesome sauce!!!” contrast sharply with the detailed, specific, and severe nature of the negative reports. In the world of broker investigation, a small number of vague positive reviews set against a backdrop of serious, detailed complaints about withdrawals is often seen as a sign of fake or paid feedback.

The user-submitted reports found on platforms, such as WikiFX, are a critical step in checking things out. A pattern of withdrawal complaints, as seen here, is one of the most serious warnings a trader can find. We urge you to always check the “Exposure” section for any broker you are considering.

Breaking Down XeOne's Offerings vs Risks

Unregulated brokers often use attractive features and low entry barriers to attract new and unsuspecting traders. It is crucial to analyze these offerings not at face value, but through the critical lens of the broker's unregulated status. What may seem like a benefit can, in an unprotected environment, become a tool that magnifies risk.

The Double-Edged Sword: High Leverage

XeOne advertises leverage up to an amazing 1:2000. For a new trader, this can sound like an incredible opportunity to control a large position with a small capital. However, industry experts and regulators view this very differently. Leverage is a debt instrument that amplifies both gains and losses. At a ratio of 1:2000, even a tiny market movement against your position can lead to a complete and instant loss of your entire investment.

Top-level regulators in major locations have specifically banned such high leverage for retail clients. For example, in Europe, the UK, and Australia, leverage is typically capped at 1:30 for major forex pairs. This is done for one reason: to protect consumers from catastrophic losses. An unregulated broker offering 1:2000 leverage is not providing a benefit; it is promoting an extremely high-risk environment from which you have no protection.

Platforms, Accounts and a Missing License

The broker offers the industry-standard MetaTrader 5 (MT5) platform and a range of account types (Standard, Raw Spread, Pro+), which on the surface appear competitive. However, the core argument remains: these features are meaningless without the fundamental protection of regulation. A sophisticated trading platform and tiered account structures cannot guarantee fair trade execution, prevent price manipulation, or, most importantly, ensure you can withdraw your funds. A great platform operated by a dishonest broker is still a trap. The quality of the technology is entirely secondary to the trustworthiness and accountability of the company holding your money.

Payment Methods and Irreversibility

XeOne accepts deposits via cryptocurrency and local bank transfers. While this may seem convenient, the critical detail lies in the terms of these transactions. The source material clearly warns: “Both payment options do not accept refunds or chargebacks.” This policy is designed to heavily favor the broker. By using payment methods that are difficult or impossible to reverse, clients are left with little to no recourse in the event of a dispute. If you deposit funds and the broker refuses to process your withdrawal, you cannot simply call your credit card company to initiate a chargeback. This lack of financial recourse is a hallmark of high-risk, unregulated operations.

The following table clearly contrasts XeOne's advertised features with the underlying reality of their risk in an unregulated context.

Conclusion: The Final Verdict

After a thorough review of publicly available data, user experiences and the broker's own offerings, the verdict on XeOne's regulatory standing is decisive and clear.

A Clear Picture of High Risk

Based on all available information for 2026, XeOne operates as an unregulated broker. The business registration in Mauritius provides no meaningful investor protection. This central finding is supported by a cascade of red flags: an extremely low trust score from watchdog platforms, direct warnings to stay away, a consistent pattern of severe user complaints centered on the inability to withdraw funds, and the promotion of high-risk features such as 1:2000 leverage, which are prohibited by responsible regulators.

Your Protection Is Most Important

The absence of a proper XeOne license from a credible authority means that as a client, you have no safety net. There is no access to a financial ombudsman service to resolve disputes, no mandatory participation in an investor compensation fund, and no legal requirement for the broker to keep your funds in segregated accounts, separate from their business operational funds. In the world of online trading, regulation is not an optional feature or a “nice-to-have.” It is the fundamental requirement for safety, accountability, and the protection of your capital. The risks associated with trading with an unregulated entity like XeOne are, by any objective measure, unacceptably high.

Our analysis is built on publicly available information. To ensure your financial safety, always perform your own up-to-the-minute verification of any broker. A simple search for the broker's name on a comprehensive regulatory inquiry tool, such as WikiFX, is a non-negotiable first step before you even consider opening an account.

Want profitable forex trading strategies? Join us on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - where experts share these with you.