Abstract:When choosing a new forex broker, the first question every trader should ask is: Will my capital be safe? This XeOne review for 2026 is a complete analysis designed to answer exactly that question. We will look beyond the advertising materials to check the facts using information anyone can find. Our detailed look will cover the most important areas for any trader: regulation (or the complete lack of it), account features, real user feedback, and how trustworthy the broker actually is. The information here is meant to help you make a smart decision, pointing out several important safety concerns that all potential users need to know about.

When choosing a new forex broker, the first question every trader should ask is: Will my capital be safe? This XeOne review for 2026 is a complete analysis designed to answer exactly that question. We will look beyond the advertising materials to check the facts using information anyone can find. Our detailed look will cover the most important areas for any trader: regulation (or the complete lack of it), account features, real user feedback, and how trustworthy the broker actually is. The information here is meant to help you make a smart decision, pointing out several important safety concerns that all potential users need to know about.

XeOne: Main Findings & Final Decision

For traders who want a quick summary, we have broken down our research into the most important findings. This section gives a high-level view of XeOne, letting you quickly judge the risk level before spending more time.

· XeOne Quick Facts:

· Regulation: Not regulated

· WikiFX Score: Below 2.13/10 (Extremely Low)

· Main Risk: High potential risk, questionable regulatory license status.

· User Feedback: Includes serious claims of fraud and withdrawal problems.

· Our Decision: Be extremely careful. The lack of proper regulation is a major warning sign that cannot be ignored.

Before choosing any broker, especially one with warning signs like these, it is essential to do your own research. We strongly recommend checking a broker's current regulatory status and user reviews on a trusted third-party platform like WikiFX. You can see the complete and updated information for XeOne on its WikiFX page.

XeOne's Serious Regulatory Problems

The single most important factor in choosing a broker is whether it is properly regulated. This is not just a preference but a basic requirement for financial safety. In XeOne's case, the findings are clear and very concerning.

No Valid Forex License

Our investigation, based on data from independent verification sources, confirms that XeOne does not have a valid forex trading license from any reputable financial authority. The broker is reportedly registered in Mauritius, a common location for offshore brokers. However, registration is not the same as regulation. Without a license from a major financial watchdog—such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus)—a broker operates without oversight, putting client funds at immediate and significant risk. The status is clear: XeOne is an unregulated company.

What “Unregulated” Means for You

Understanding what it means to trade with an unregulated broker is crucial. It is not a small detail; it completely changes the type of risk you are taking. Here is what it means in practical terms:

· No Fund Security: Regulated brokers are required to keep client funds in separate accounts, away from the company's operating capital. This protects your capital if the brokerage goes out of business. Unregulated brokers have no such requirements. Your funds can be mixed with company capital and used for business purposes, with no guarantee you will get them back. Also, you are not covered by any investor protection programs, which in regulated entities can refund part of your money if the broker fails.

· No Fair Play Oversight: Regulatory bodies enforce rules of fair conduct, ensuring transparent pricing, fair trade execution, and ethical business practices. An unregulated broker, such as XeOne, operates without supervision. There is no independent body watching their activities for price manipulation, unfair liquidations, or other harmful practices.

· No Help with Disputes: If you have a problem with a regulated broker, such as a refused withdrawal or a trade dispute, you can appeal to the regulatory authority or an independent financial ombudsman. With an unregulated broker, you have no such option. Your only choice is to deal directly with the broker, who holds all the power. As seen in user complaints, this often leads nowhere.

· High-Risk Operations: Reputable regulators impose strict limits on risky products, most notably leverage. The fact that XeOne can offer leverage up to 1:2000 is a direct result of its unregulated status. Such offerings are designed to attract traders with the promise of high returns but are a primary cause of rapid and total account loss.

XeOne Pros and Cons

To provide a structured view, it is common to weigh the pros and cons. However, in XeOne's case, it is more accurate to compare the broker's claimed advantages against the factual, documented risks. The “Cons” in this scenario are way more important and should be the main focus of any potential client.

This table clearly shows a critical point: while XeOne may advertise features that appear attractive on the surface, these are completely overshadowed by the fundamental and unacceptable risks associated with its unregulated status and poor user-reported track record.

XeOne Trading Conditions Deep-Dive

A thorough review requires examining the specific trading conditions offered. While these details are often the focus for traders, they must be viewed through the lens of the broker's unregulated status. Attractive conditions mean nothing if your funds and trades are not secure.

Account Types and Features

XeOne offers three primary account types, seemingly to cater to different levels of traders and capital.

· Standard Account: Designed for beginners, with a very low minimum deposit of $15. It features spreads starting from 1.3 pips and offers the highest available leverage, up to 1:2000. It is a commission-free account.

· Raw Spread Account: Aimed at more experienced traders, this account requires a higher minimum deposit of $500. It offers tighter spreads, starting from 0.4 pips, but charges a commission of $5 per side per lot traded. Leverage is also available up to 1:2000.

· Pro+ Account: Requiring the highest minimum deposit of $1000, this account offers a balance between the other two. Spreads start from 0.7 pips, it is commission-free, and the maximum leverage is reduced to a still-high 1:500.

Leverage: A Double-Edged Sword

XeOne aggressively markets its high leverage, offering up to 1:2000. It is vital to understand that this is not a benefit; it is a major warning sign. Reputable regulators across the globe have banned such high leverage for retail clients for a simple reason: it exponentially increases risk. With 1:2000 leverage, a tiny market movement against your position can wipe out your entire account balance in seconds. This tool is a hallmark of unregulated brokers who are not concerned with client protection or responsible trading principles.

Spreads and Fees

The broker's fee structure varies by account. The Standard and Pro+ accounts operate on a spread-only model, where the broker's fee is built into the buy/sell price difference. Spreads from 1.3 pips on the Standard account are not particularly competitive when compared to leading regulated brokers. The Raw Spread account offers more competitive raw spreads (from 0.4 pips) but adds a commission of $5 per side, totaling $10 for a round-turn trade on a standard lot. This is a relatively standard commission structure, but again, the competitiveness of fees is irrelevant when fundamental security is absent.

Available Trading Instruments

XeOne provides access to a decent range of asset classes, which can be appealing to traders looking for diversification. The available instruments include:

· Currencies (Forex)

· Commodities

· Indices (CFDs on market indices)

· Stocks (CFDs on shares)

It is important to note what is not available. Based on the provided data, XeOne does not offer trading in Bonds, Options, or ETFs.

Platforms, Payments & User Reports

The operational side of a brokerage—how you trade, fund your account, and what happens when you try to withdraw—is where the reality of its service becomes clear. For XeOne, this area reveals several more warning signs.

Trading Platform: A Discrepancy

XeOne officially states that it provides clients with the globally recognized MetaTrader 5 (MT5) platform. MT5 is a powerful and popular platform known for its advanced charting tools, algorithmic trading capabilities, and reliability. However, a point of confusion arises from user feedback. One positive review specifically mentions satisfaction with the “VertexFX platform.”

We note this discrepancy as a potential warning sign. While it could be a simple error in the user's review, it could also indicate disorganized operations, a lack of clear communication, or the use of multiple, less-common platforms. Such inconsistencies undermine confidence in the broker's professionalism. Such discrepancies are a warning sign and underscore the need for thorough verification. You can cross-reference platform details and view all user-submitted reviews, including the ones cited here, on the [comprehensive XeOne profile on WikiFX](httpss://www.wikifx.com/en/dealer/5393434199.html).

Deposits and Withdrawals: A Major Concern

The methods a broker offers for deposits and withdrawals speak volumes about its operational integrity. XeOne's payment options are limited and heavily focused on methods that offer little to no consumer protection. The listed methods include:

· Cryptocurrency (USD, EUR, SGD)

· Local Online Banking (INR specific)

· Local Depositor (INR specific)

A critical warning must be issued here: payment options like cryptocurrency are explicitly noted as not accepting refunds or chargebacks. This is an extremely dangerous situation for a trader. If you deposit funds via crypto and the broker refuses your withdrawal request, you have virtually no way to recover your capital. There is no bank or credit card company to file a dispute with. This payment policy removes a crucial layer of consumer protection and should be considered a major risk.

User Reviews and “Exposure” Reports

While a few positive reviews exist, they are overshadowed by multiple, serious “Exposure” reports from users. These are not minor complaints about slow customer service; they are direct claims of financial misconduct. We must highlight them to provide a complete picture:

· Claim 1 (from India): *“His one manager, Himanshu, is a very big fraud person; he stole my 3000 dollars and denies withdrawals.”*

· Claim 2 (from Nigeria): *“Please be careful, I was humiliated and defrauded here.”*

· Claim 3 (from Nigeria): *“Fraudulent broker! ...blocked client accounts for no reason after hitting a straight win trade & gaining profits.”*

These testimonials paint a grim picture. The recurring themes are withdrawal denials and outright accusations of fraud and theft. When multiple users from different regions report similar experiences, particularly the inability to access their profits or initial capital, it serves as one of the strongest possible warnings against using a broker.

Conclusion: Our Final Decision

In this XeOne review, we have moved beyond the broker's marketing claims to analyze the facts. The conclusion is unavoidable: XeOne operates without valid regulation from any reputable authority.

This single fact, combined with the extremely high-risk leverage, payment methods that offer no chargeback protection, and multiple, serious user complaints claiming fraud and withdrawal denial, paints a picture of a very high-risk environment for traders.

While features like a low minimum deposit and the MT5 platform might seem appealing, they do not make up for the fundamental lack of security and trustworthiness. The potential benefits are completely overshadowed by the overwhelming and unacceptable risks.

Final Recommendation: We cannot recommend trading with XeOne. The risks to your capital are substantial. We urge all traders to prioritize safety and only work with brokers that are licensed and overseen by top-tier regulatory bodies.

Your financial safety is most important. For a comprehensive and continuously updated assessment of XeOne, including the latest user feedback and regulatory alerts, we strongly advise consulting its detailed profile on WikiFX before making any decisions.

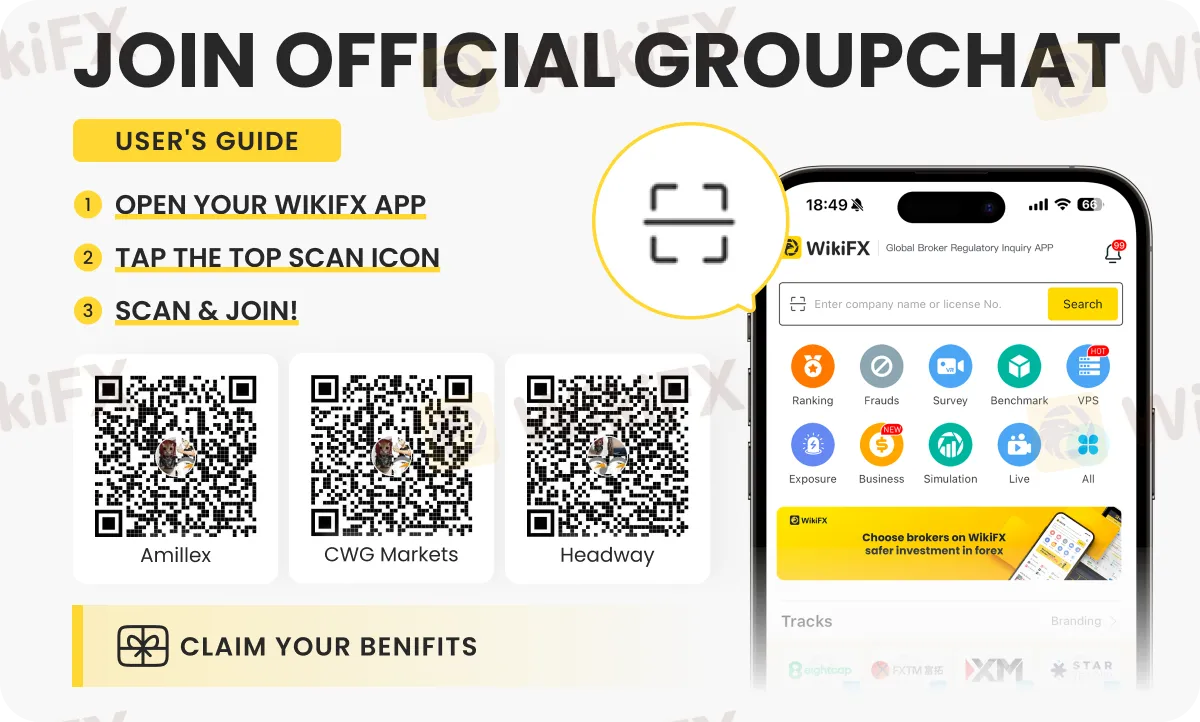

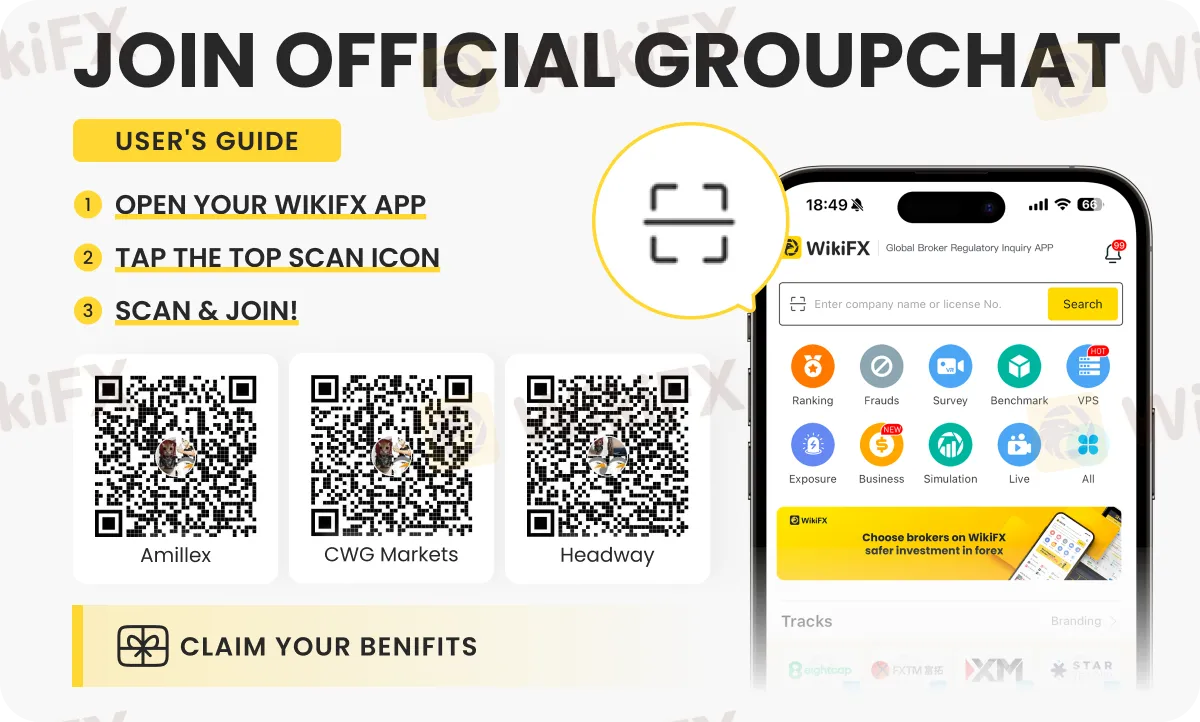

Check the latest forex updates, strategies and insights on these expert-led special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join today to start witnessing a transformative trading experience.