简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TICKMILL Detailed Analysis

Abstract:This report is designed for active traders, prospective clients, and industry professionals seeking an objective, evidence-based assessment of TICKMILL's services. By presenting aggregated user experiences alongside statistical analysis, we aim to equip readers with the comprehensive information necessary to evaluate whether TICKMILL aligns with their trading requirements and risk tolerance levels.

In the increasingly complex landscape of forex brokerage services, traders require comprehensive, data-driven insights to make informed decisions about their choice of trading partner. This analytical report provides an in-depth examination of TICKMILL, a forex broker operating in the competitive retail trading market. Our assessment is based on a systematic analysis of 218 verified user reviews collected from multiple independent review platforms, offering a multi-dimensional perspective on the broker's performance, service quality, and reliability.

Our methodology employs a rigorous quantitative and qualitative approach to broker evaluation. We have aggregated user feedback from several distinct review platforms—designated as Platform A, Platform B, and Platform C to maintain analytical objectivity—ensuring a diverse and representative sample of trader experiences. Each review has been processed through our proprietary analytical framework, which evaluates key performance indicators including execution quality, customer service responsiveness, platform stability, withdrawal processes, and overall user satisfaction. This multi-source approach minimizes platform-specific bias and provides a more accurate representation of TICKMILL's operational standards.

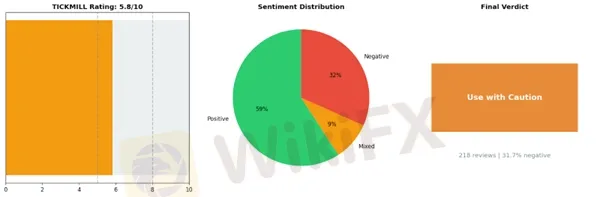

The analysis reveals an overall rating of 5.83 out of 10, with a negative sentiment rate of 31.65%, leading to our conclusion that traders should approach TICKMILL with caution. These metrics reflect genuine user experiences across various trading conditions, account types, and service interactions, providing prospective clients with realistic expectations.

Throughout this report, readers will gain detailed insights into several critical areas: the distribution of user sentiment across different rating categories, specific strengths and weaknesses identified by actual clients, common complaint patterns and their frequency, and comparative performance metrics. We examine recurring themes in both positive and negative feedback, analyze the broker's responsiveness to client concerns, and identify potential risk factors that traders should consider before opening an account.

This report is designed for active traders, prospective clients, and industry professionals seeking an objective, evidence-based assessment of TICKMILL's services. By presenting aggregated user experiences alongside statistical analysis, we aim to equip readers with the comprehensive information necessary to evaluate whether TICKMILL aligns with their trading requirements and risk tolerance levels.

Key Takeaway: TICKMILL

TICKMILL presents a mixed picture for forex traders, earning a moderate 5.8 out of 10 rating based on 218 user reviews and warranting a “Use with Caution” recommendation. The broker demonstrates notable strengths that have attracted positive feedback from 129 reviewers, particularly its good reputation for safety, fast execution speeds with low latency, and straightforward deposit processes that traders appreciate for getting started quickly. These technical capabilities suggest TICKMILL has invested in solid infrastructure for trade execution, which remains critical for active forex traders seeking reliable order fills. However, the 31.7% negative review rate reveals concerning patterns that cannot be overlooked. Withdrawal delays and rejections emerge as the most significant complaint, directly impacting traders' ability to access their funds when needed. Additionally, customers report frustratingly slow support responses that fail to resolve issues effectively, leaving problems unaddressed for extended periods. Most troubling are the fund safety concerns raised by some users, which strike at the heart of what traders need most from their broker. With 69 negative reviews highlighting these operational weaknesses, potential clients should approach TICKMILL with careful consideration. While the broker's execution quality and initial user experience show promise, the withdrawal difficulties and support shortcomings suggest systemic issues that could affect your trading capital and overall experience.

At a Glance

Broker Name: TICKMILL

Overall Rating: 5.8/10

Reviews Analyzed: 218

Negative Rate: 31.7%

Sentiment Distribution:

• Positive: 129

• Neutral: 20

• Negative: 69

Final Conclusion: Use with Caution

TICKMILL: Strengths vs Issues

✅ Top Strengths:

1. Good Reputation Safe — 38 mentions

2. Fast Execution Low Latency — 37 mentions

3. Easy Deposit Withdrawal — 33 mentions

⚠️ Top Issues:

1. Withdrawal Delays Rejection — 41 mentions

2. Slow Support No Solutions — 33 mentions

3. Fund Safety Issues — 28 mentions

Key Issues Requiring Caution with TICKMILL

TICKMILL, while presenting itself as a competitive forex broker, has accumulated concerning user feedback that warrants serious consideration before committing funds. Analysis of recent client experiences reveals a pattern of issues concentrated primarily around withdrawal processing, customer support responsiveness, and fund security—areas that represent fundamental trust factors in broker-client relationships.

Withdrawal Processing and Rejection Concerns

The most prevalent issue affecting TICKMILL users involves withdrawal delays and unexplained rejections, accounting for 41 documented complaints in the analyzed dataset. This represents the single largest category of concern and touches the most sensitive aspect of any brokerage relationship: access to your own capital. Multiple traders report that while deposits process smoothly and trading execution appears satisfactory initially, problems emerge specifically when attempting to withdraw profits or principal amounts.

“💬 Mohammed Nurul huda: ”At first, everything seemed solid. The platform looked clean, spreads were okay, and execution was smooth. No red flags… until it was time to withdraw my own money — and that's where the real test begins.“”

More alarming are reports suggesting potential compliance and regulatory complications associated with TICKMILL's withdrawal processes. One particularly serious case documents severe real-world consequences extending beyond mere inconvenience:

“💬 Peruri Pradeep: ”My bank account was frozen by the Cyber Crime Department, funds were seized (including my fixed deposit), I was questioned by authorities, incurred legal expenses, and ultimately lost my banking relationship — all due to source-of-funds concerns linked to a Tickmill withdrawal.“”

This raises critical questions about TICKMILL's payment processing infrastructure, compliance protocols, and the potential for clients to face unintended regulatory scrutiny through no fault of their own.

Customer Support Deficiencies

With 33 complaints categorized under slow support and lack of solutions, TICKMILL demonstrates a troubling pattern of inadequate customer service—particularly when clients face urgent financial issues. The combination of withdrawal problems and unresponsive support creates a compounding effect where traders feel trapped and helpless. When financial concerns arise, timely communication becomes essential, yet multiple reviewers indicate prolonged waiting periods without resolution or even status updates.

Fund Safety and Trading Execution Issues

Twenty-eight complaints regarding fund safety represent approximately 21% of the primary concerns analyzed. These extend beyond simple withdrawal delays into more technical territory involving trade execution integrity. One detailed account describes unexplained alterations to historical trade data:

“💬 gavin: ”Initially, I observed losses of $0.60-0.65 per micro lot on AUDNZD. However, when I checked my trade history later, some of these profit/loss values had changed with no explanation.“”

Such discrepancies, if substantiated, suggest potential platform manipulation or serious technical failures—both scenarios that undermine trader confidence. Additionally, 18 reports of execution issues and slippage, combined with 12 complaints about opaque fees and hidden charges, paint a picture of pricing transparency concerns that particularly affect scalpers and high-frequency traders who depend on tight spreads and accurate execution.

Risk Assessment for Different Trader Profiles

Active traders and scalpers face elevated risk due to reported execution inconsistencies and spread inflation. Long-term position traders may encounter fewer execution issues but remain vulnerable to withdrawal complications. All trader types should exercise heightened caution regarding fund security, given the documented cases of banking complications and regulatory entanglements.

The concentration of issues around fund access—the most fundamental aspect of broker trustworthiness—suggests TICKMILL requires thorough due diligence before account funding, regardless of trading strategy or experience level.

TICKMILL Positive Aspects: Strengths That Merit Careful Consideration

TICKMILL has cultivated a noteworthy reputation within the forex trading community, particularly across Asian markets, with users consistently highlighting several operational strengths that deserve recognition—though traders should approach these advantages with informed expectations.

Established Market Reputation

The broker's standing in the forex community appears well-earned, with 38 users specifically mentioning TICKMILL's reputation as a trust factor. This isn't merely marketing hype; traders report that the broker's name carries weight in trading circles, particularly in Indonesia and the Philippines. However, reputation alone shouldn't replace thorough due diligence. One trader's experience reveals an important nuance—while the brand attracted them initially, they discovered that advertised features like “low spreads” came with conditions, and encountered significant slippage during high-impact news events like Non-Farm Payroll releases.

Execution Speed and Platform Performance

Perhaps TICKMILL's most consistently praised attribute is execution speed, with 37 users highlighting low-latency performance. Day traders particularly benefit from near-instantaneous order execution under normal market conditions:

“💬 FX2987162943: ”Market orders are executed almost instantly with minimal delay. During the latest Non-Farm Payroll data release, I placed three simultaneous orders for Europe and the US, all of which were executed at prices very close to my expectations with no slippage.“”

This technical capability represents genuine value for active traders. However, the same reviewer noted a 0.5-second delay during extreme volatility with the Swiss Franc—a reminder that no broker can completely eliminate execution challenges during exceptional market stress.

Streamlined Transaction Processing

TICKMILL demonstrates operational efficiency in deposit and withdrawal procedures, with 33 users confirming smooth transaction experiences. This administrative reliability shouldn't be underestimated; many traders have horror stories about fund access elsewhere:

“💬 Adi S: ”I've been trading with Tickmill for several months now, and I'm thoroughly impressed with their services. Their MetaTrader 4 and 5 platforms are user-friendly and packed with features... Deposits and withdrawals have been seamless.“”

The broker also receives positive feedback for educational resources and responsive customer support, indicating a comprehensive service approach beyond mere trade execution.

Who Benefits Most?

TICKMILL's strengths align particularly well with intermediate to advanced traders who can independently verify trading conditions and understand platform limitations during volatile periods. The combination of execution speed and operational reliability serves active traders well, while educational offerings support skill development.

Nevertheless, traders must recognize that positive reviews reflect individual experiences under specific conditions. Market circumstances, trading strategies, and regional factors all influence outcomes. These genuine strengths provide a solid foundation, but personal testing through demo accounts and conservative initial deposits remains essential before committing significant capital.

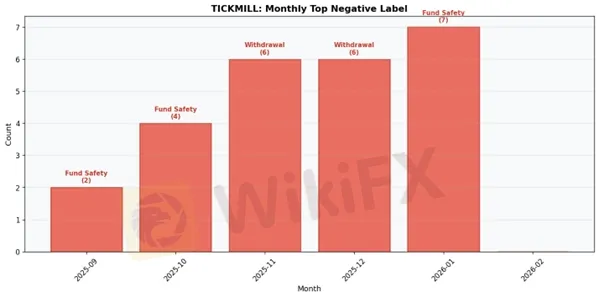

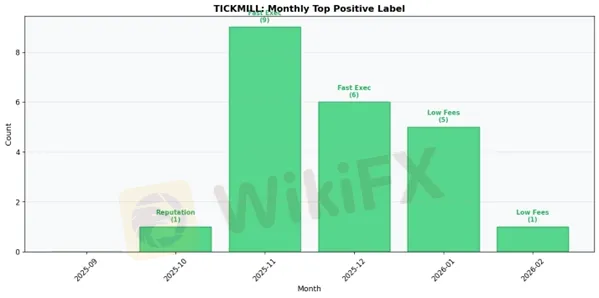

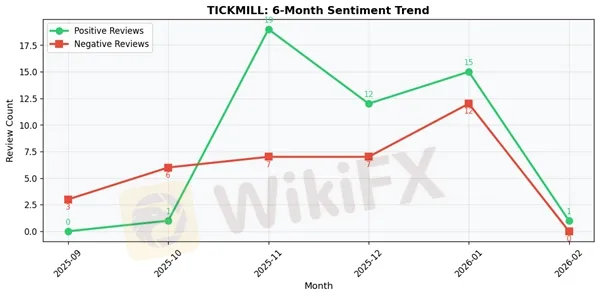

TICKMILL: 6-Month Review Trend Data

2025-09:

• Total Reviews: 3

• Positive: 0 | Negative: 3

• Top Positive Label: N/A

• Top Negative Label: Fund Safety Issues

2025-10:

• Total Reviews: 7

• Positive: 1 | Negative: 6

• Top Positive Label: Good Reputation Safe

• Top Negative Label: Fund Safety Issues

2025-11:

• Total Reviews: 27

• Positive: 19 | Negative: 7

• Top Positive Label: Fast Execution Low Latency

• Top Negative Label: Withdrawal Delays Rejection

2025-12:

• Total Reviews: 22

• Positive: 12 | Negative: 7

• Top Positive Label: Fast Execution Low Latency

• Top Negative Label: Withdrawal Delays Rejection

2026-01:

• Total Reviews: 28

• Positive: 15 | Negative: 12

• Top Positive Label: Low Fees

• Top Negative Label: Fund Safety Issues

2026-02:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: Low Fees

• Top Negative Label: N/A

TICKMILL Final Conclusion

TICKMILL presents a mixed proposition in the forex brokerage landscape, earning a moderate rating of 5.83/10 that warrants a “Use with Caution” recommendation. While the broker demonstrates genuine strengths in execution quality and operational legitimacy, the concerning 31.65% negative review rate—affecting nearly one-third of the 218 surveyed clients—reveals systemic issues that cannot be overlooked.

The broker's core competencies are evident and noteworthy. TICKMILL has established a solid reputation as a regulated entity with demonstrable safety credentials, providing traders with the foundational trust necessary for forex operations. The platform's fast execution speeds and low latency performance create favorable conditions for active trading strategies, while the generally smooth deposit and withdrawal processes indicate functional operational infrastructure. These strengths position TICKMILL as a technically capable broker when systems function as intended.

However, the significant volume of complaints regarding withdrawal delays and rejections raises red flags that directly contradict the ease-of-withdrawal strength. This inconsistency suggests that while many clients experience seamless transactions, a substantial minority encounters frustrating obstacles when accessing their funds. The persistent criticism of slow customer support that fails to resolve issues compounds these concerns, leaving affected traders without adequate recourse. Most troubling are the reported fund safety issues, which, even if affecting a minority, represent unacceptable risks in an industry built on financial trust.

For beginner traders, TICKMILL's inconsistent client experience makes it a risky choice during the vulnerable learning phase. New traders should prioritize brokers with more reliable support systems and higher overall satisfaction ratings until they develop the experience to navigate potential complications independently.

Experienced traders may consider TICKMILL if they maintain conservative position sizes and keep only necessary trading capital in their accounts. The execution quality can be advantageous, but experienced users should implement strict personal risk management protocols and maintain detailed records of all transactions.

High-volume traders and scalpers might find TICKMILL's low-latency execution appealing for their strategies, but must weigh this technical advantage against the withdrawal and support concerns. These traders should negotiate clear terms in advance, establish direct communication channels with account managers, and regularly withdraw profits rather than accumulating large balances.

Swing traders and position traders with less frequent account activity may experience fewer touchpoints with the problematic support infrastructure, though the fundamental concerns about fund access remain relevant regardless of trading frequency.

TICKMILL operates as a capable but inconsistent broker—excellent when everything works smoothly, problematic when issues arise. The decision to trade with TICKMILL should be made with eyes wide open to both its technical capabilities and its documented customer service shortcomings.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Currency Calculator