Perfil de la compañía

| LIMIT PRIME Resumen de la reseña | |

| Establecido | 2017 |

| País/Región Registrada | Montenegro |

| Regulación | SCMN |

| Instrumentos de Mercado | Forex, Materias primas, Índices, Acciones, Metales |

| Cuenta Demo | ✅ |

| Apalancamiento | Hasta 1:100 |

| Spread | Variable |

| Plataforma de Trading | MT5 |

| Depósito Mínimo | €100 |

| Soporte al Cliente | Teléfono: +382 68 036 998 |

| Correo electrónico: info@limitprime.com | |

| Dirección: Ulica 8 marta bb, objekat 14E, Podgorica | |

| Redes Sociales: Facebook, Instagram, LinkedIn, YouTube | |

Información sobre LIMIT PRIME

LIMIT PRIME es una firma de corretaje regulada que ofrece una variedad de herramientas de trading y opciones de pago flexibles, adecuadas para traders experimentados. Sus ventajas incluyen alta seguridad y tarifas transparentes; sin embargo, las posibles desventajas pueden ser las tarifas de cuenta inactiva y la falta de una plataforma amigable para principiantes.

Pros y Contras

| Pros | Contras |

| Bien regulado | Tipos limitados de cuentas |

| Sin comisiones | |

| Cuentas separadas | |

| Protección contra saldo negativo | |

| Cuentas demo disponibles | |

| Disponible MT5 | |

| Varios métodos de pago | |

| Varios instrumentos de trading |

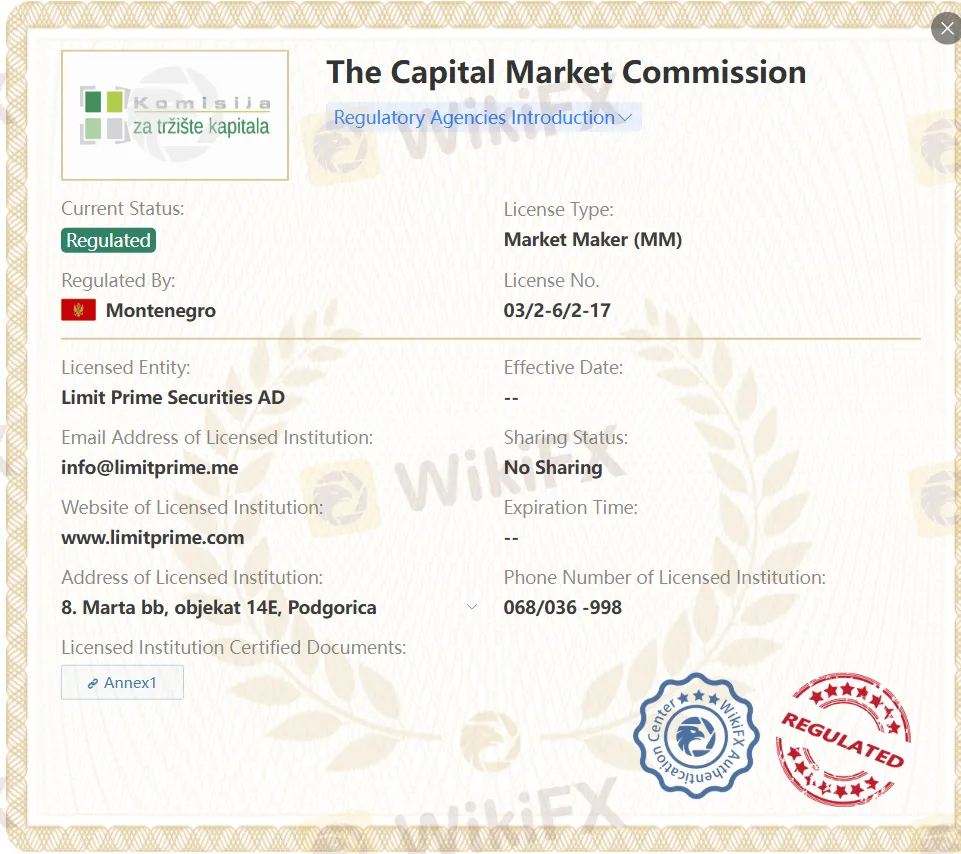

¿Es LIMIT PRIME Legítimo?

LIMIT PRIME es una firma de corretaje regulada. Limit Prime Securities está regulado bajo la regulación MIFID II, ESMA, con licencia y controlado por la Autoridad de Mercados de Capitales de Montenegro.

| País Regulado | Autoridad Reguladora | Estado Regulatorio | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión del Mercado de Capitales (SCMN) | Regulado | Limit Prime Securities AD | Creador de Mercado (MM) | 03/2-6/2-17 |

¿Qué puedo comerciar en LIMIT PRIME?

Estos son los instrumentos que se pueden negociar en LIMIT PRIME: 40 divisas, materias primas, índices, acciones y metales.

| Activo de Negociación | Disponible |

| Divisas | ✔ |

| Materias Primas | ✔ |

| Índices | ✔ |

| Acciones | ✔ |

| Metales | ✔ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| Fondos | ❌ |

| ETFs | ❌ |

Tipo de Cuenta

LIMIT PRIME ofrece una cuenta demo, que permite a los traders probar esta plataforma sin arriesgar dinero real.

LIMIT PRIME ofrece un tipo de cuenta real: Cuentas Estándar. Cuando el cliente comienza a operar, debe realizar un pago mínimo de 100 euros, lo que automáticamente los clasificará en el grupo de operaciones estándar.

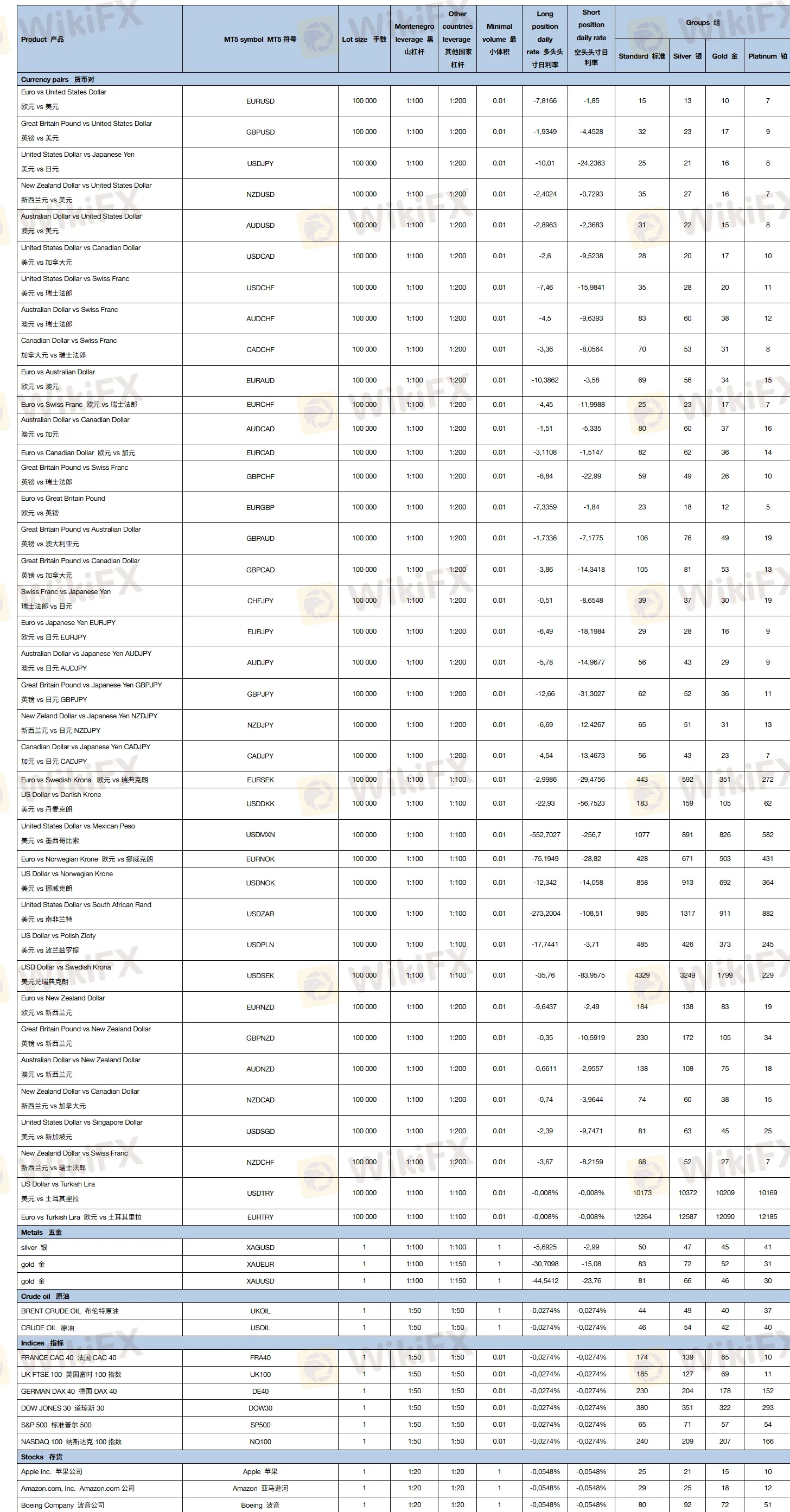

Apalancamiento

El apalancamiento de esta plataforma es de hasta 1:100. El apalancamiento se refiere al acto de pedir prestado fondos para invertir y así amplificar los rendimientos de la inversión. Permite a los inversores lograr una escala de inversión más grande con una menor cantidad de sus propios fondos, lo que les permite obtener mayores rendimientos cuando el rendimiento de la inversión es alto.

Tarifas

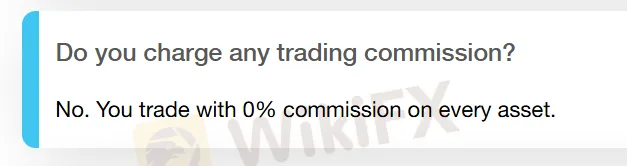

Costos directos: La empresa no cobra comisiones de negociación a sus clientes.

Siempre que haya una posición abierta durante la noche, el swap se deducirá de la cuenta del cliente.

Costos indirectos: Todos los clientes que no hayan realizado ninguna transacción y aquellos que no hayan realizado al menos una transacción dentro de los tres meses desde la fecha de aprobación de la cuenta se consideran cuentas inactivas. Se cobrará una comisión de $20 en cada retiro para las cuentas inactivas.

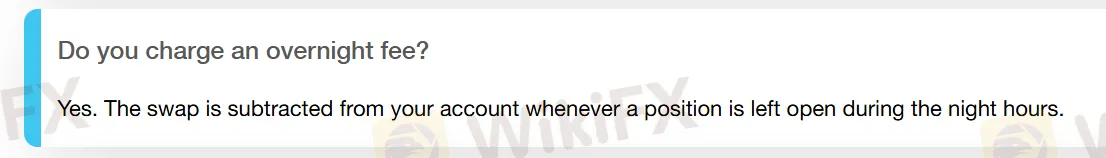

LIMIT PRIME es una empresa regulada, y sus clientes disfrutan de protección contra saldo negativo. Esto significa que la cuenta del cliente no se retirará con más fondos de los que realmente tiene.

Plataforma de Operaciones

MT5 es una de las plataformas de trading más populares en todo el mundo. Es una plataforma avanzada que admite el trading de múltiples productos financieros, proporcionando un sistema de trading automatizado, herramientas técnicas y funciones de copy trading.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| MT5 | ✔ | Escritorio, Móvil, Web | Traders experimentados |

| MT4 | ❌ | / | Principiantes |

Depósito y Retiro

LIMIT PRIME ofrece los siguientes métodos de pago: Transferencia bancaria, Mastercard, Skrill, Neteller, Visa y American Express.