Perfil de la compañía

| Phillip Securities Resumen de la reseña | |

| Fundado | 1920 |

| País/Región registrado | Japón |

| Regulación | FSA |

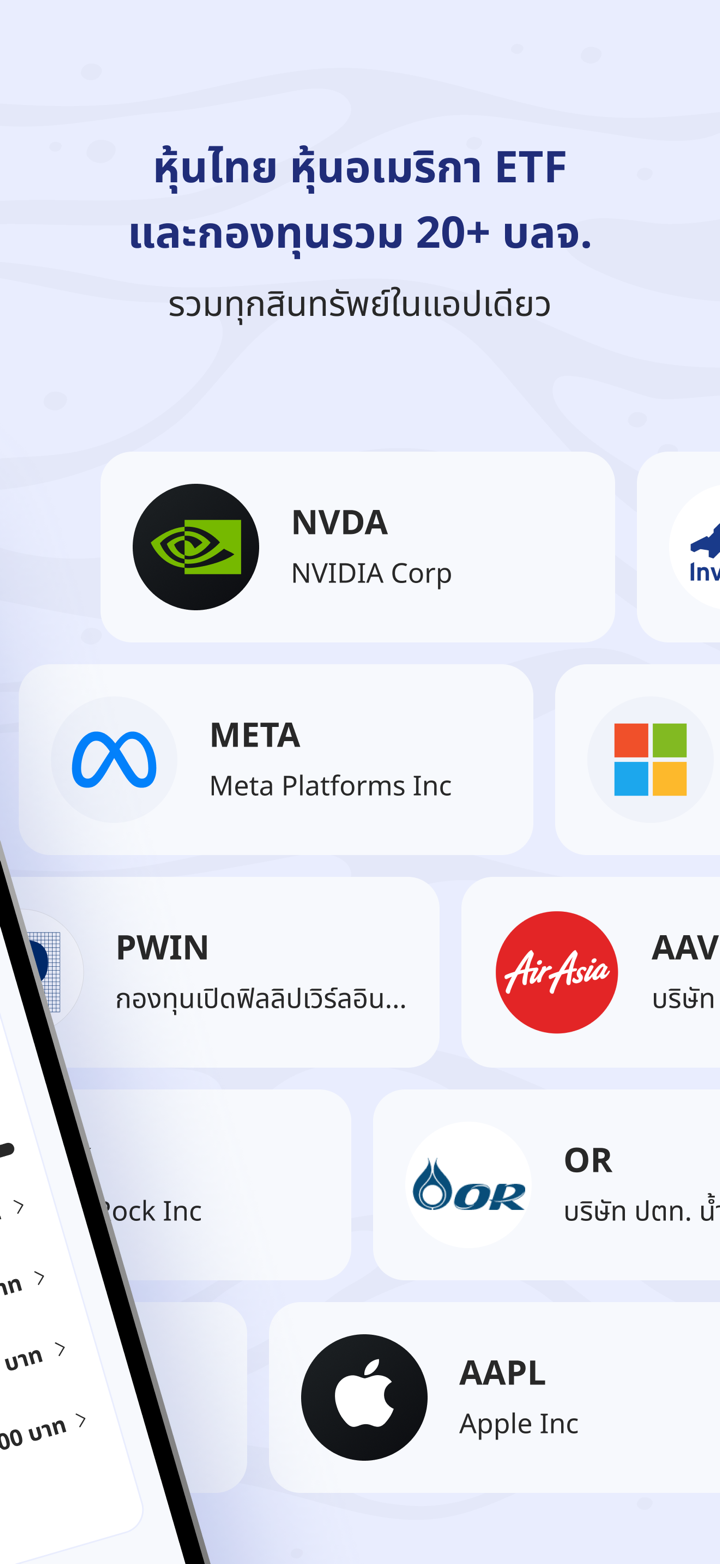

| Instrumentos de mercado | Valores, ETFs |

| Cuenta demo | ❌ |

| Apalancamiento | / |

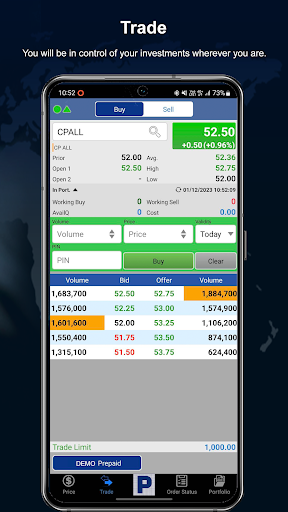

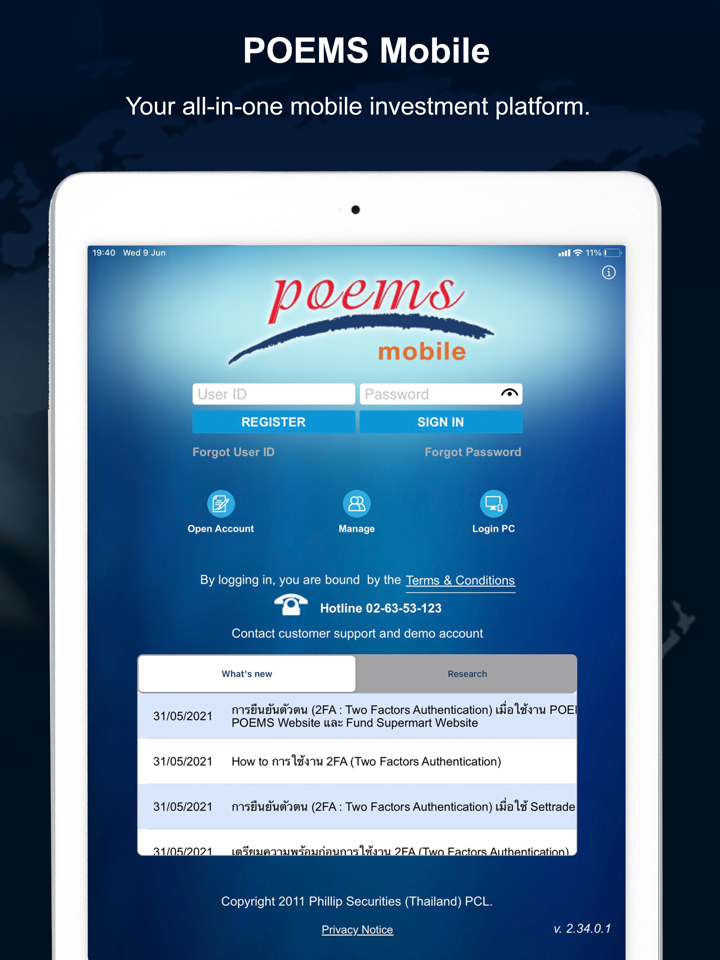

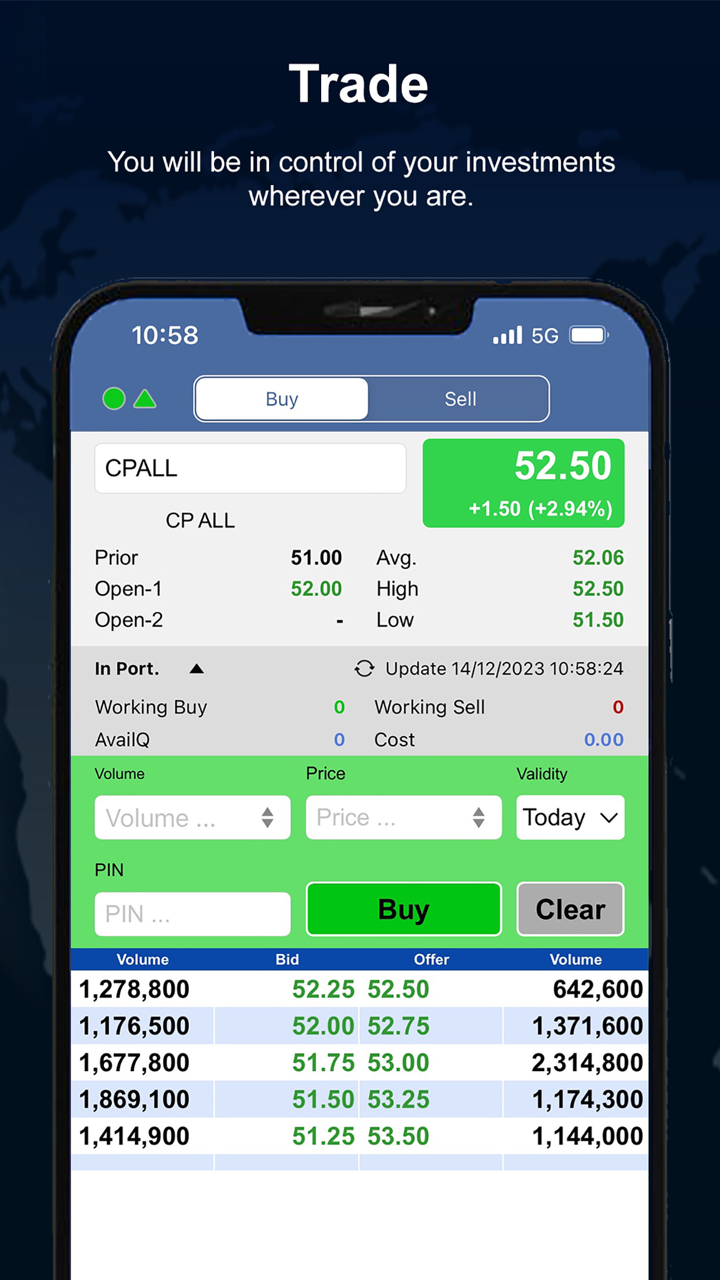

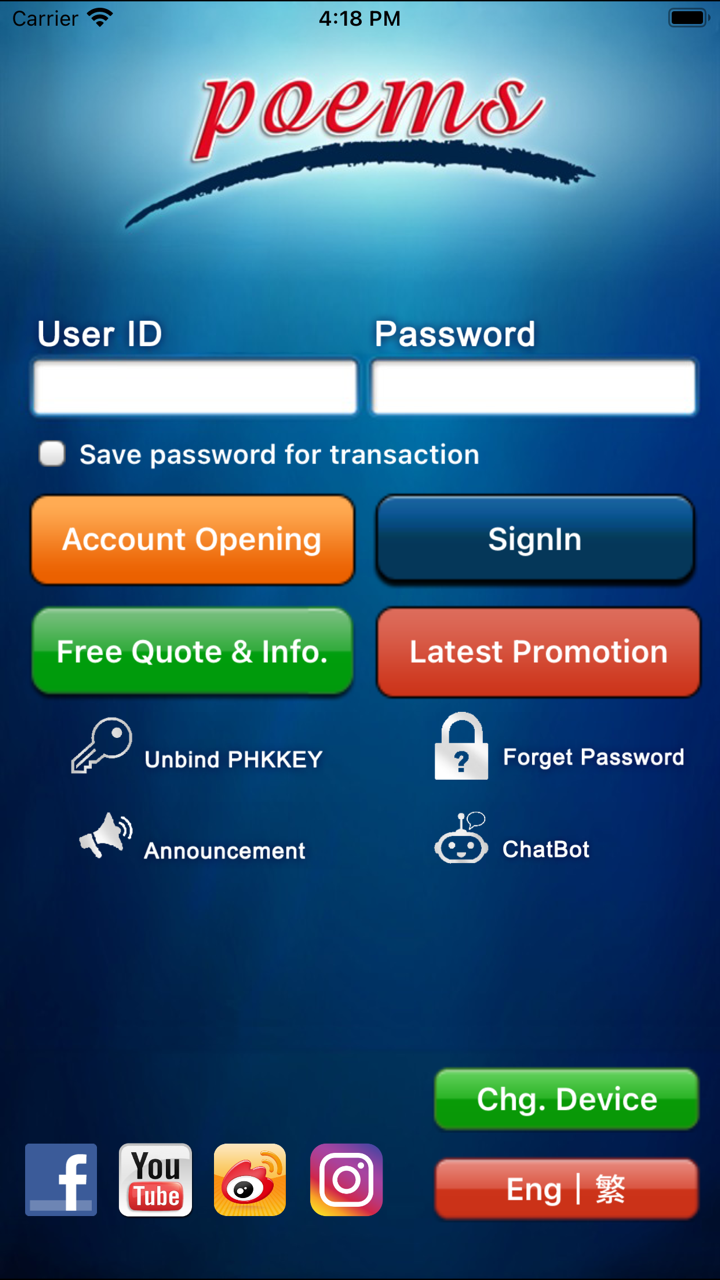

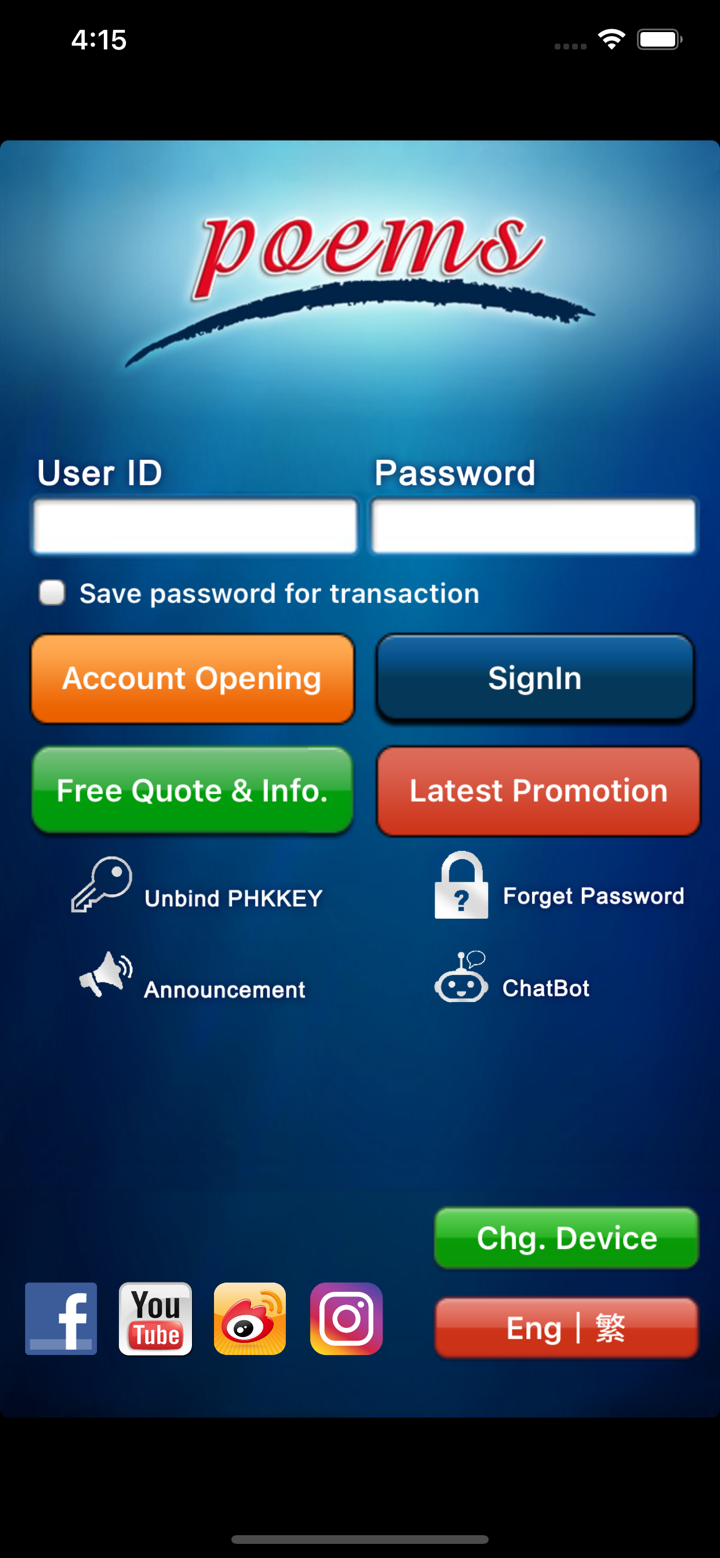

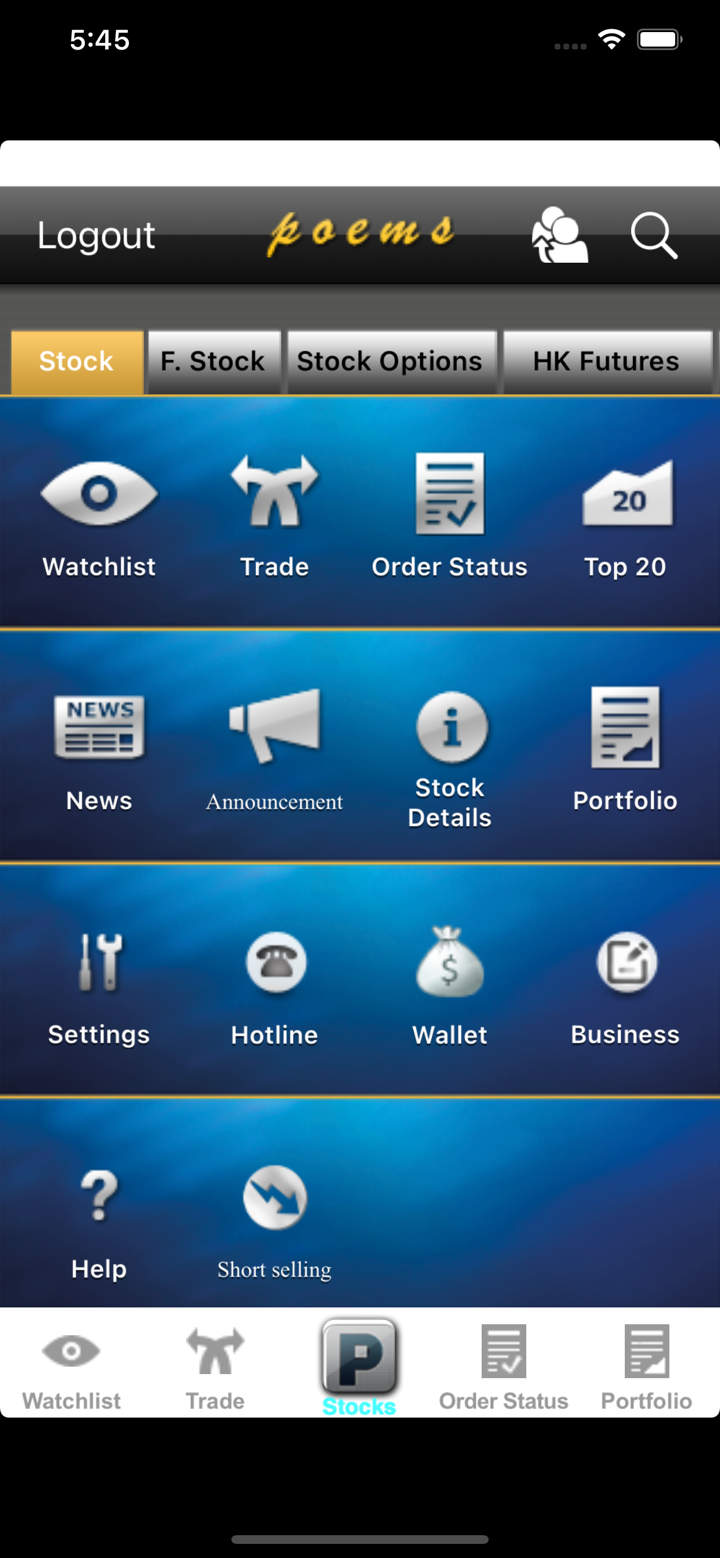

| Plataforma de trading | / |

| Depósito mínimo | / |

| Soporte al cliente | Formulario de contacto |

| Tel: +81-3-4589-3303 | |

| Dirección: 4-3, Nihonbashi Kabuto-cho, Chuo-ku, Tokyo,103-0026 Japón | |

Phillip Securities, operando bajo el paraguas del Grupo Phillip Capital, tiene una rica historia que se remonta a 1920. La casa de corretaje de valores se convirtió en parte del Grupo Phillip Capital en 2002. Está regulado por la FSA de Japón. Sus ofertas de productos permiten a los clientes operar en tres bolsas nacionales: TSE, OSE y TOCOM.

Pros y contras

| Pros | Contras |

| Operación de larga historia | Sin cuentas demo |

| Presencia global con tres oficinas | Falta de transparencia |

| Regulado por la FSA |

¿Es Phillip Securities legítimo?

Sí, Phillip Securities está regulado por la Agencia de Servicios Financieros (FSA). Tiene una licencia de Forex minorista con el número 関東財務局長(金商)第127号.

| Estado regulatorio | Regulado |

| Regulado por | Agencia de Servicios Financieros (FSA) |

| Institución con licencia | Phillip Securities証券株式会社 |

| Tipo de licencia | Licencia de Forex minorista |

| Número de licencia | 関東財務局長(金商)第127号 |

Productos y servicios

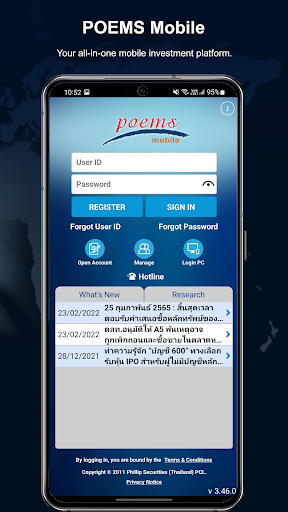

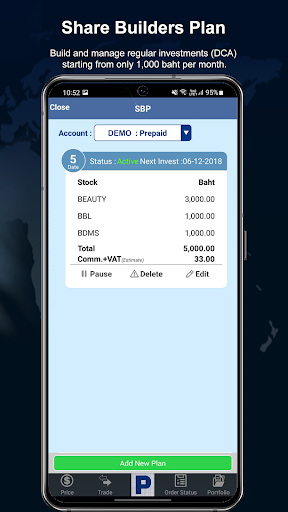

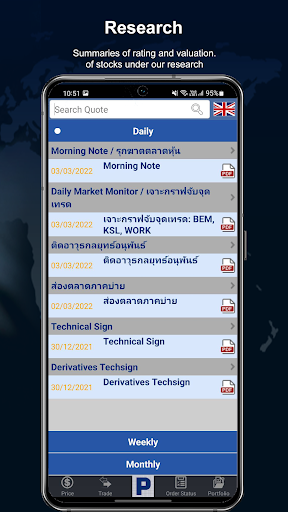

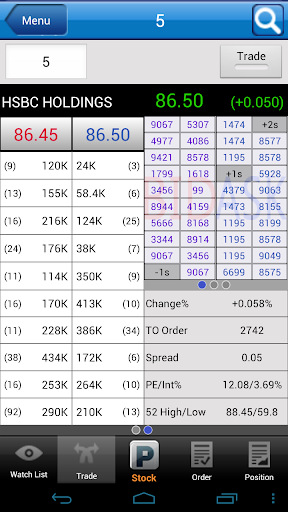

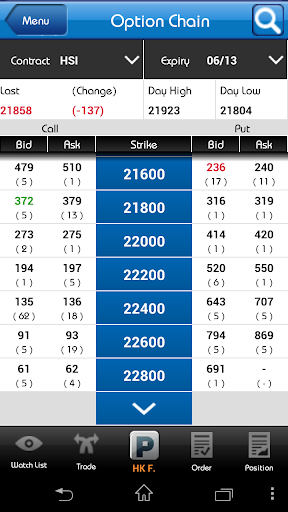

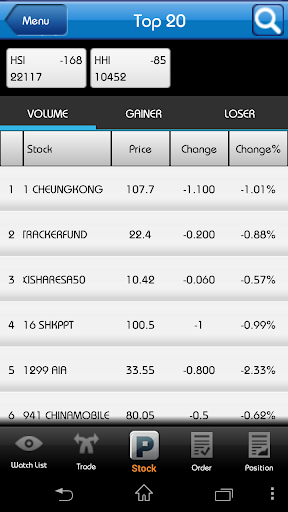

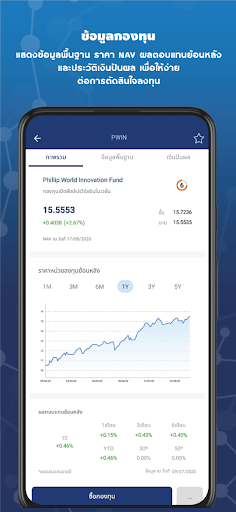

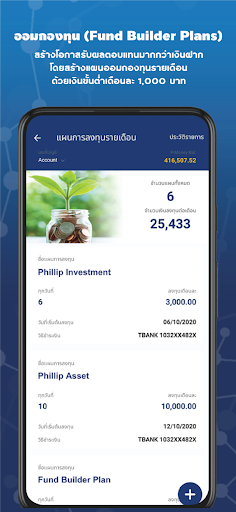

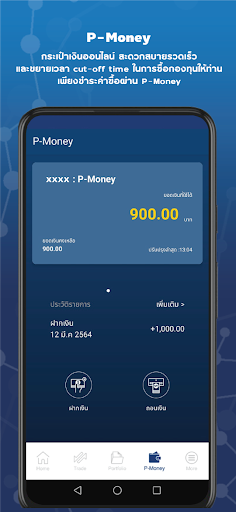

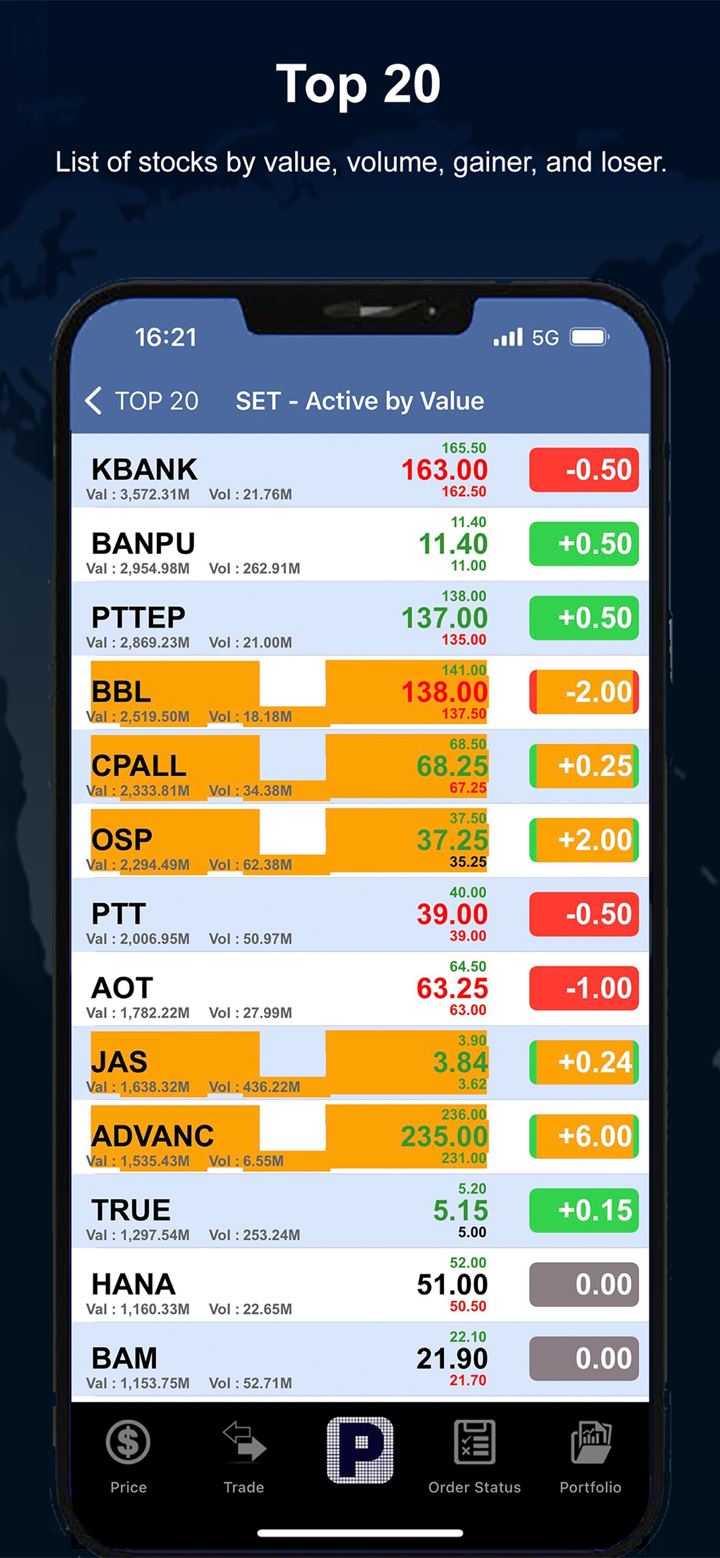

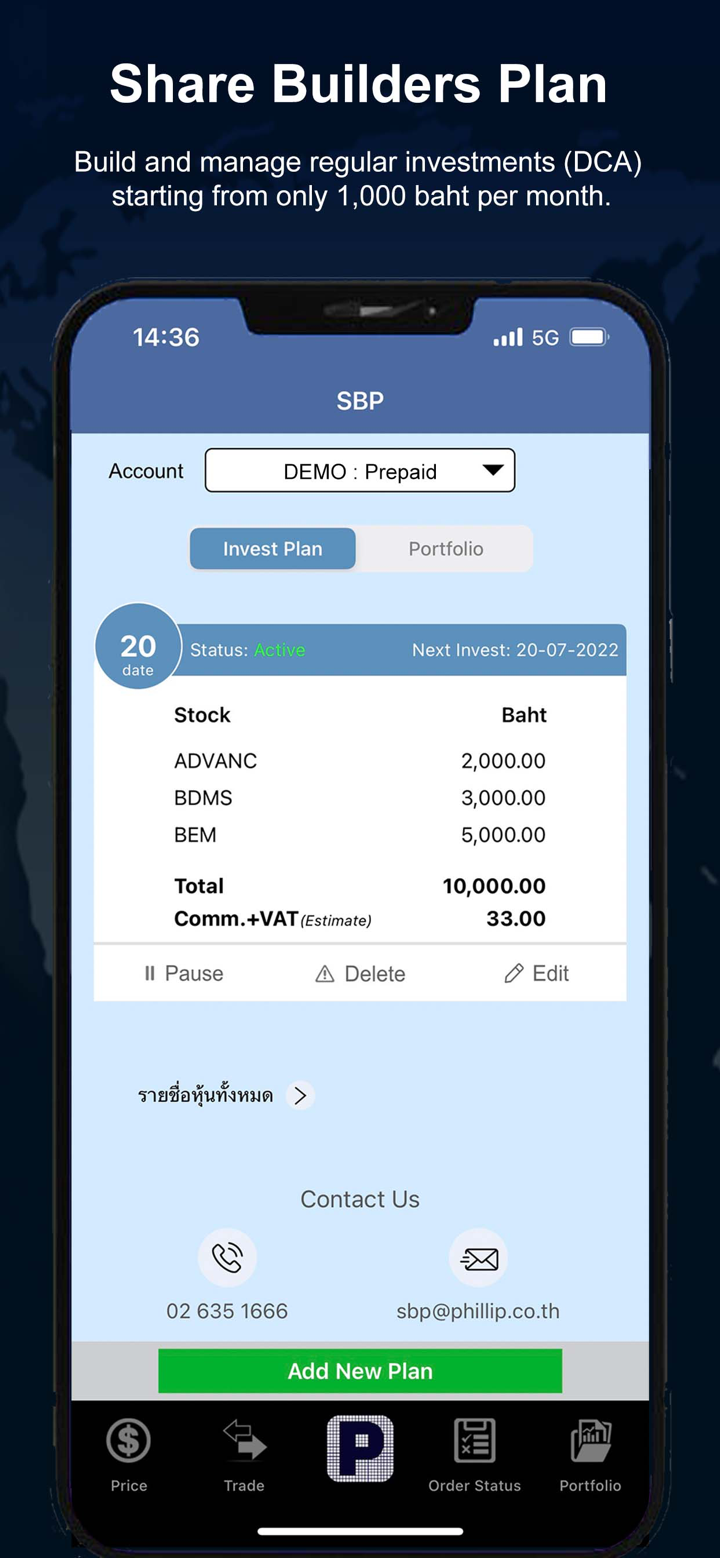

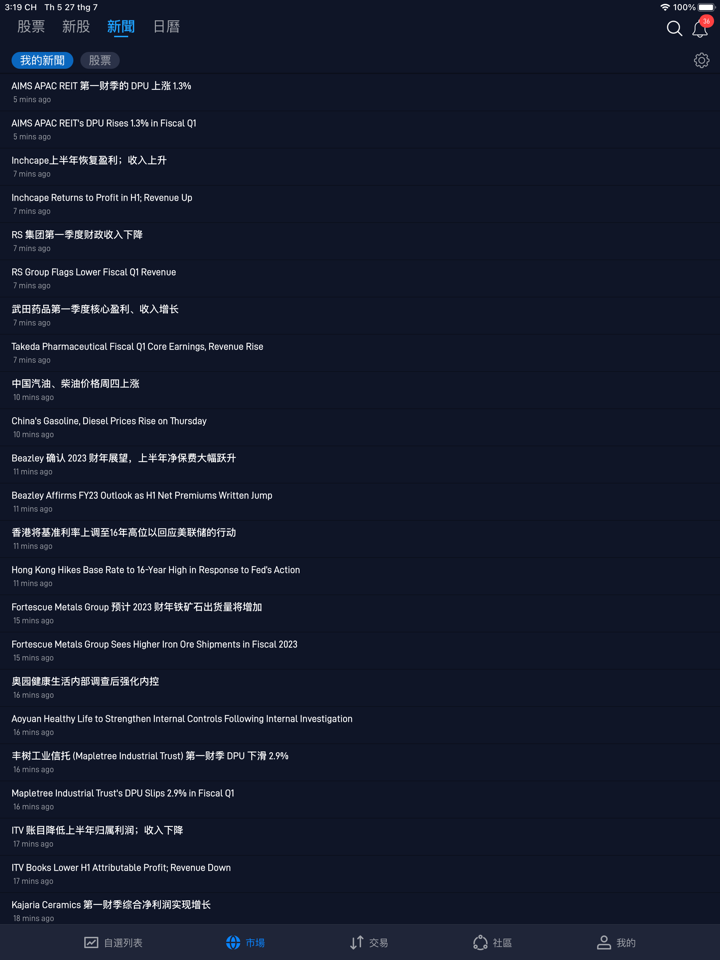

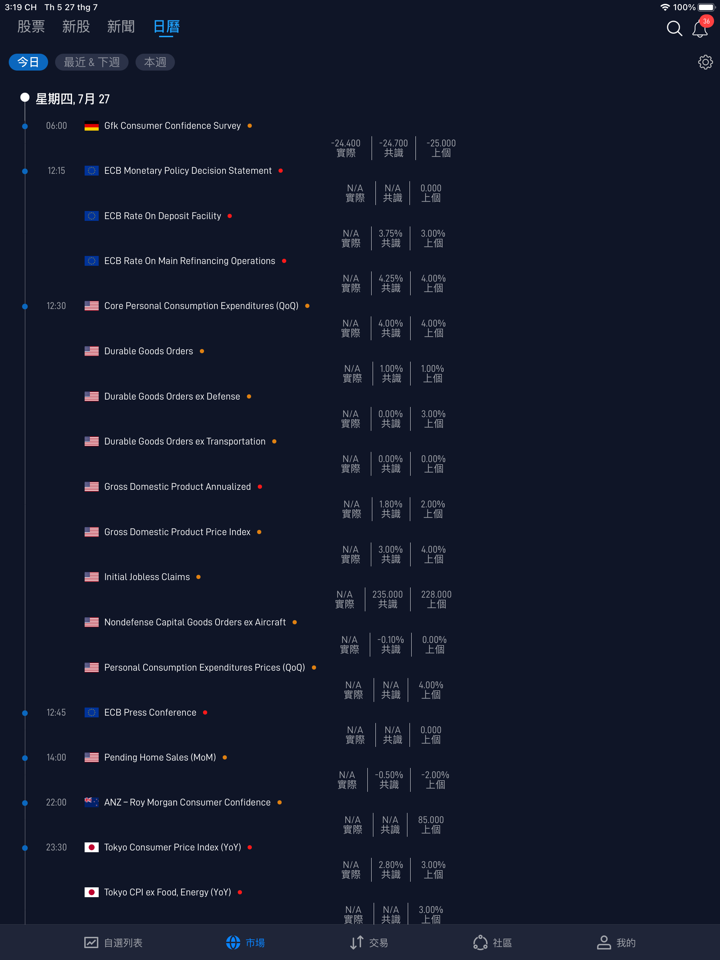

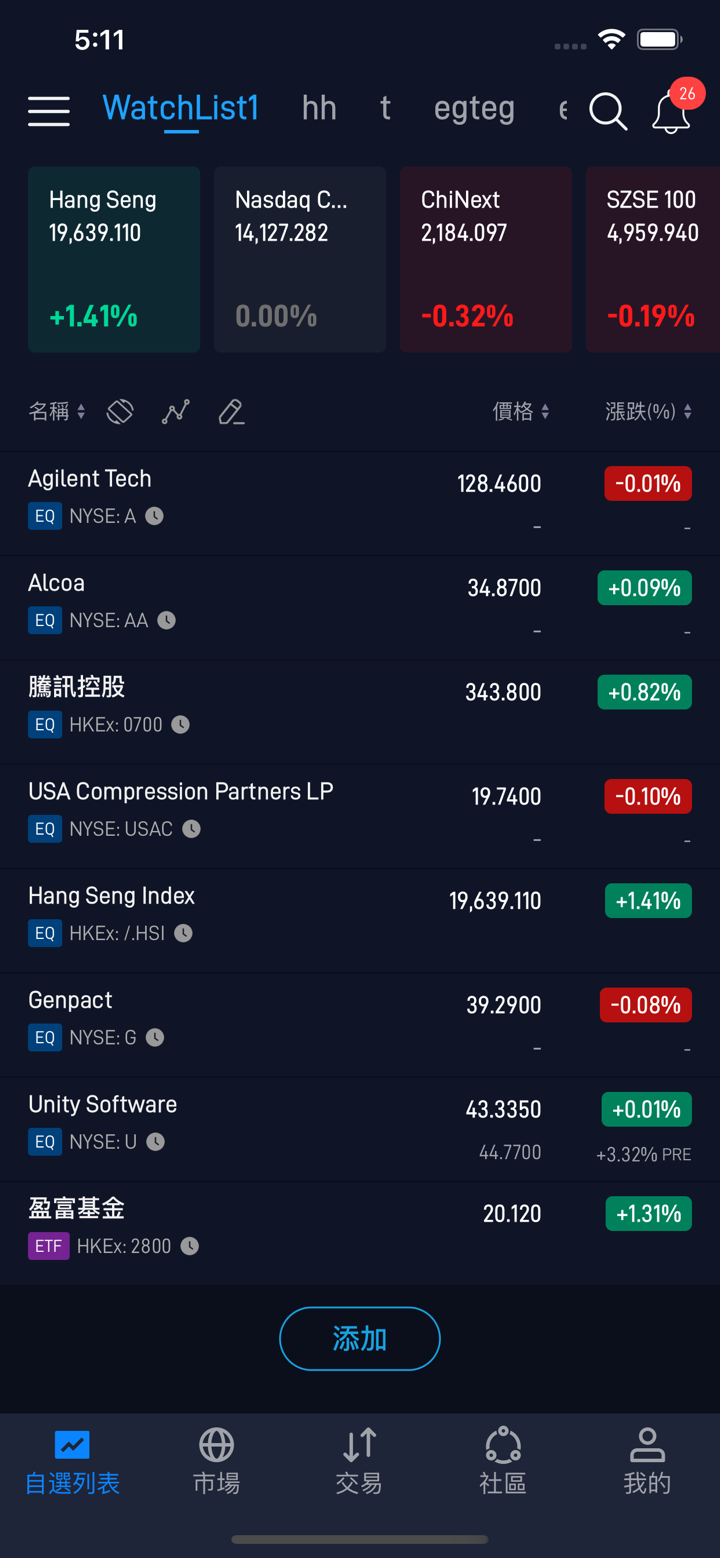

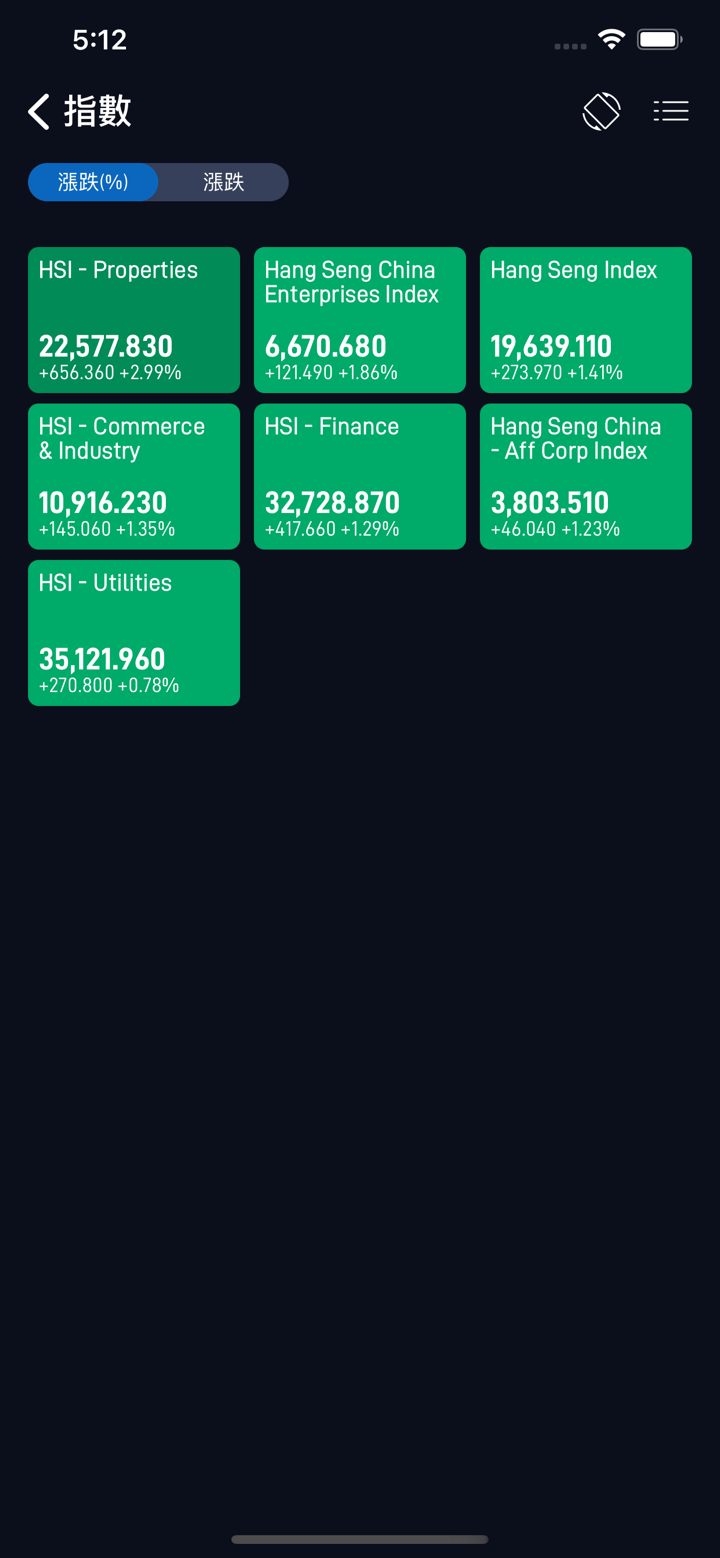

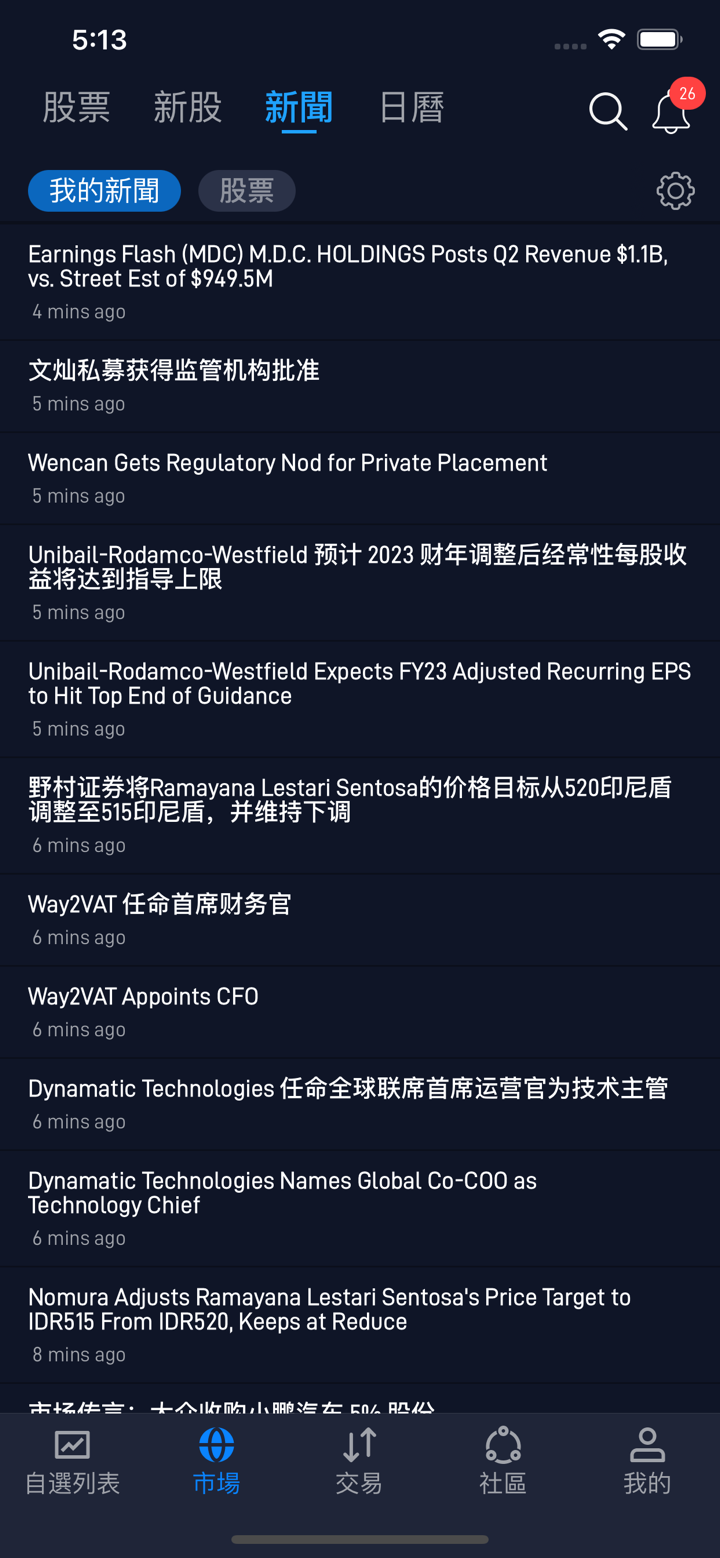

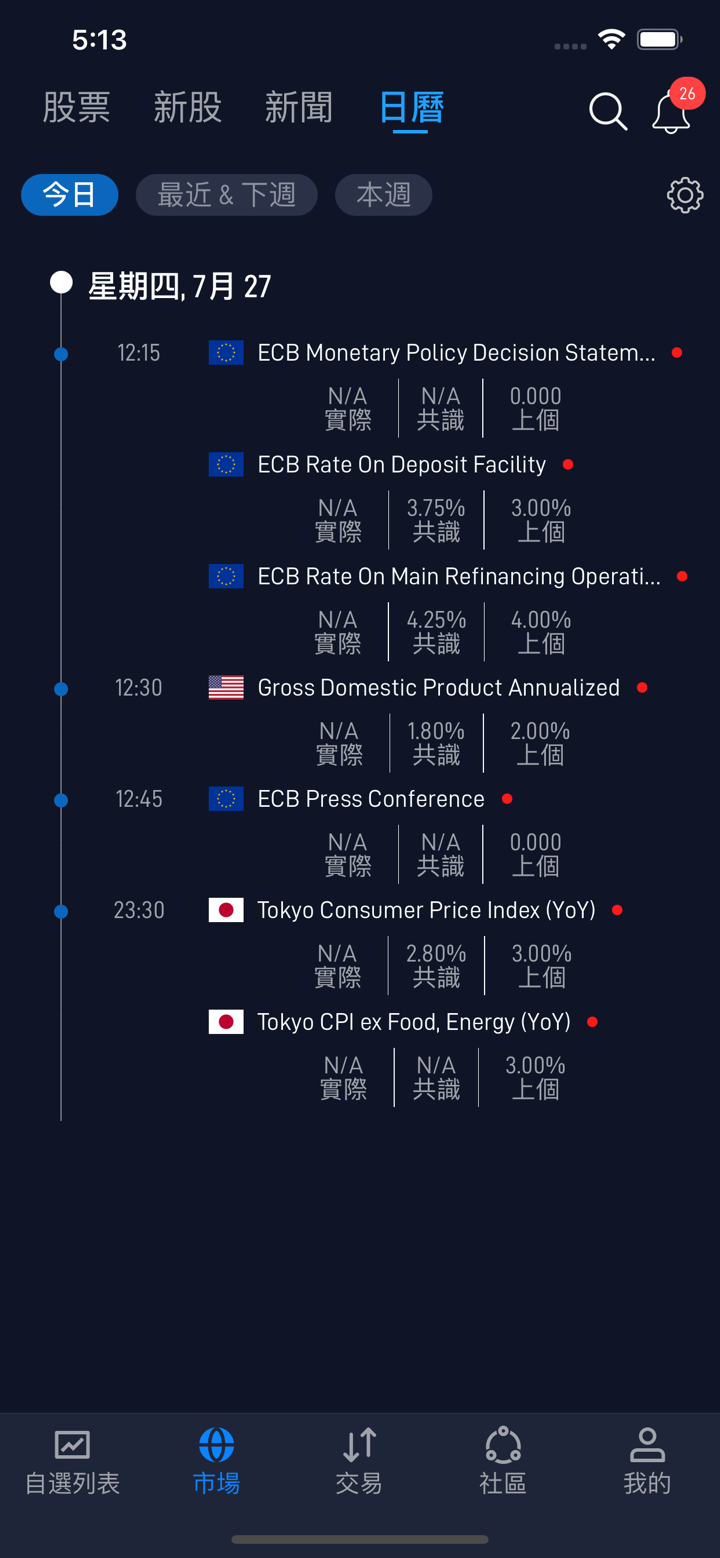

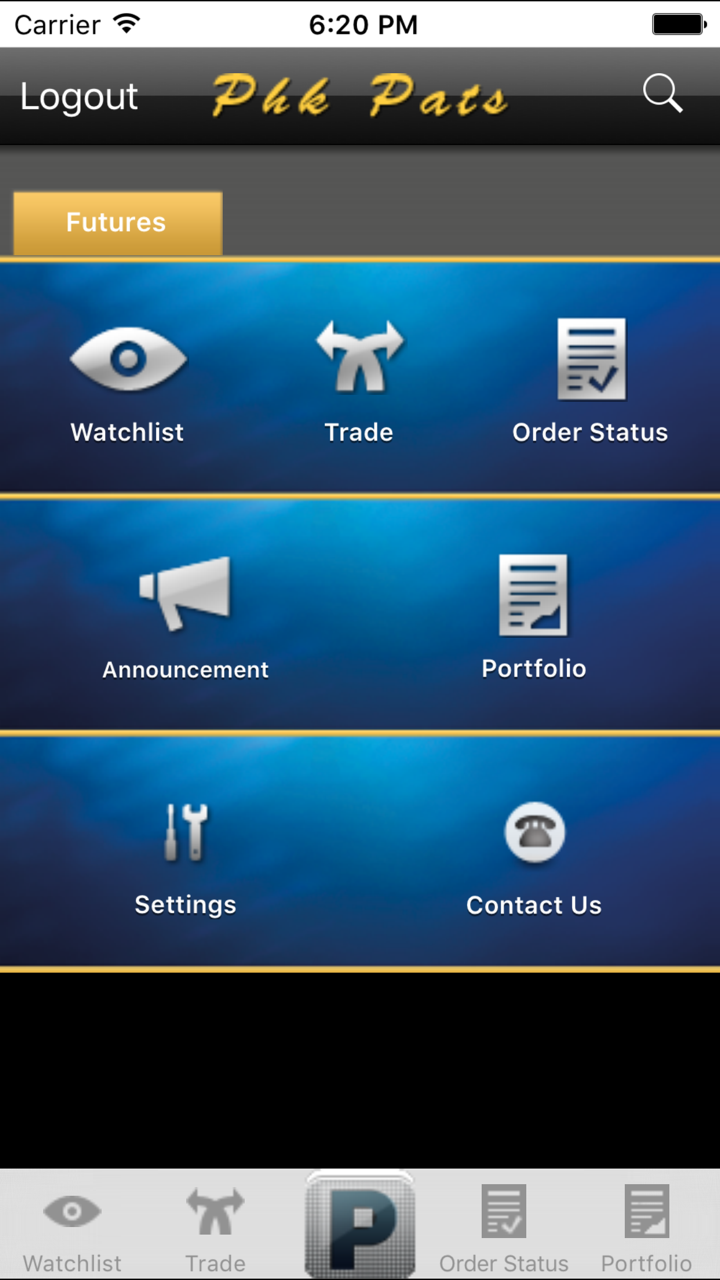

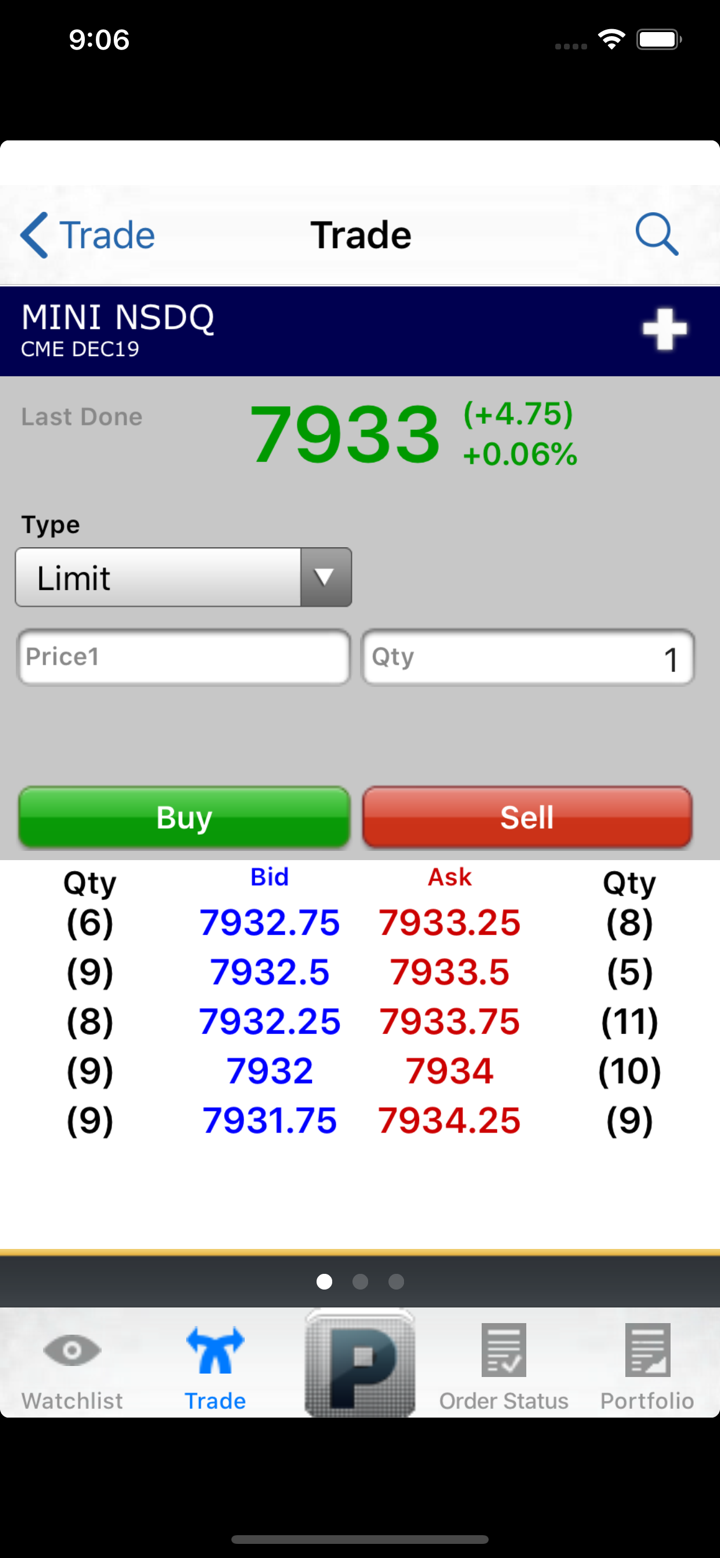

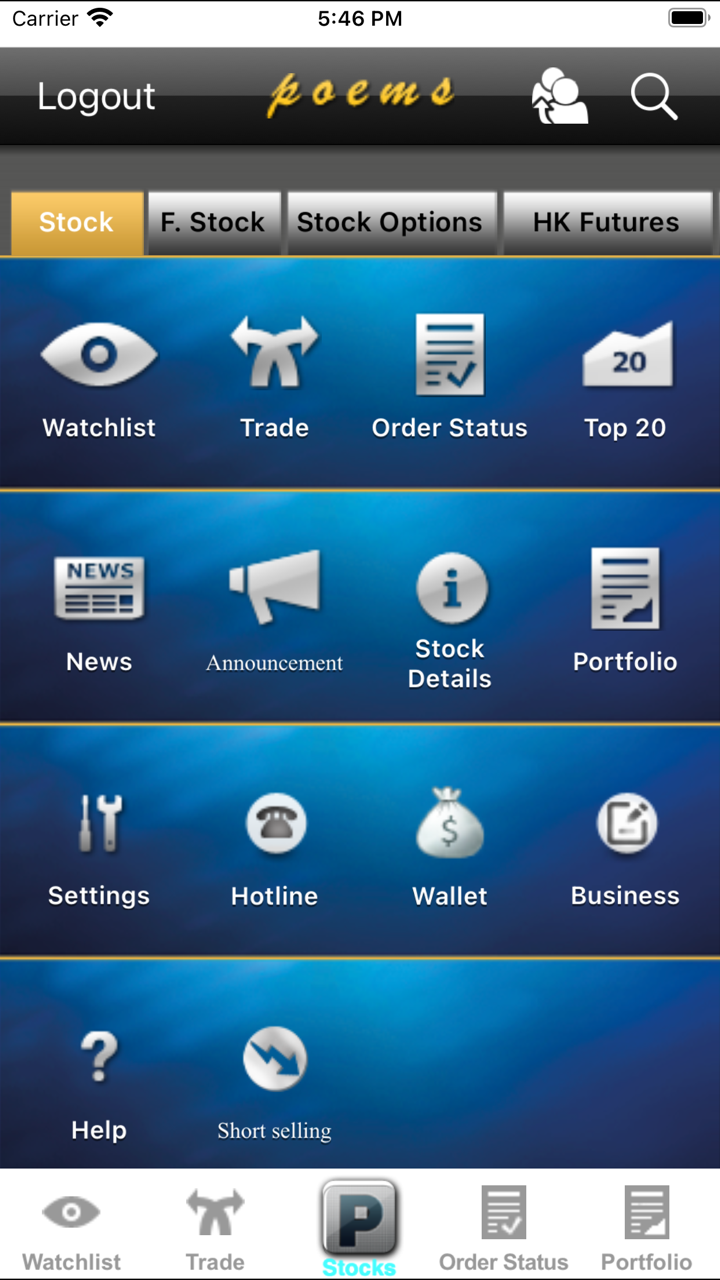

Phillip Securities ofrece tres bolsas nacionales (TSE, OSE y TOCOM) y bolsas extranjeras (CME, ICE y SGX), ETF y operaciones con margen.

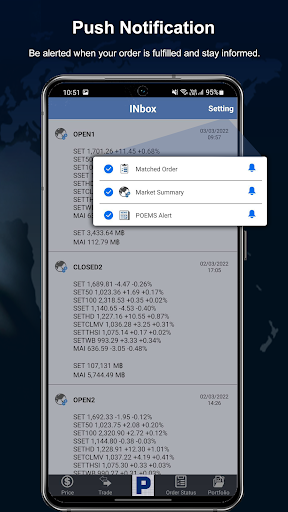

Además, también ofrece servicios relacionados que incluyen asesoramiento de inversión, servicios de custodia, opciones de conectividad externa, opciones de baja latencia y opciones de liquidación.

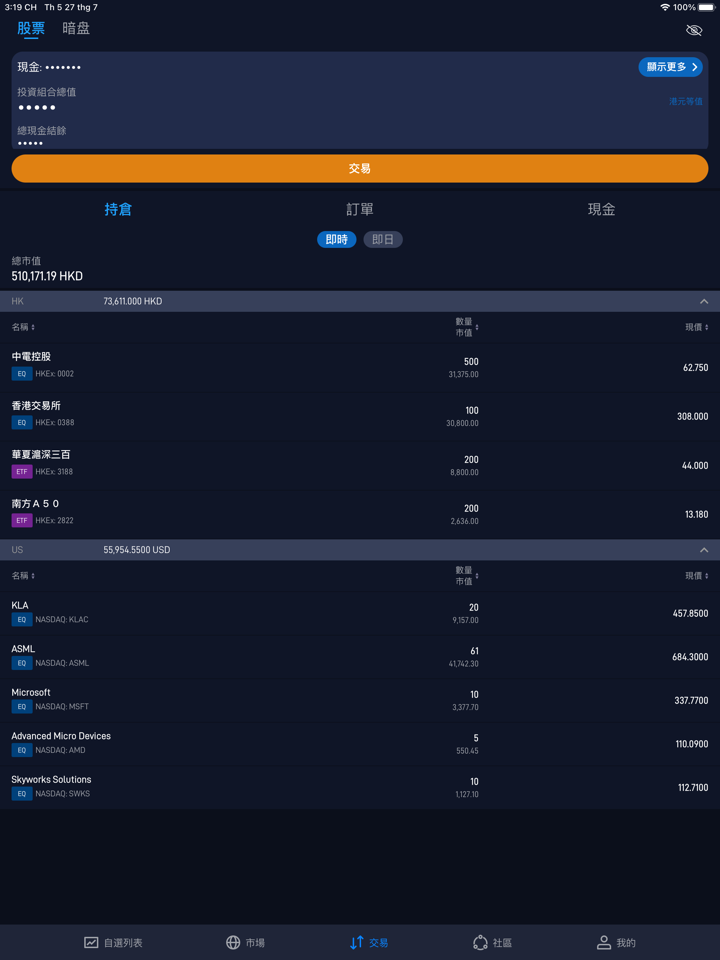

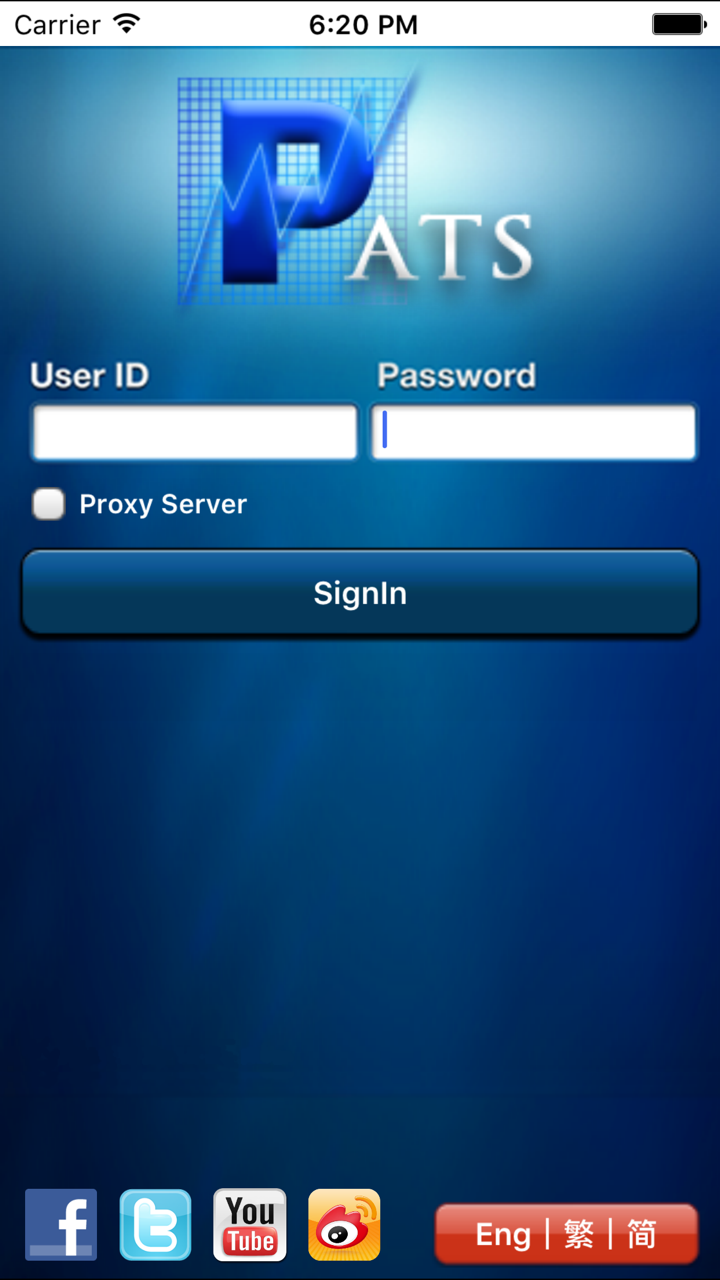

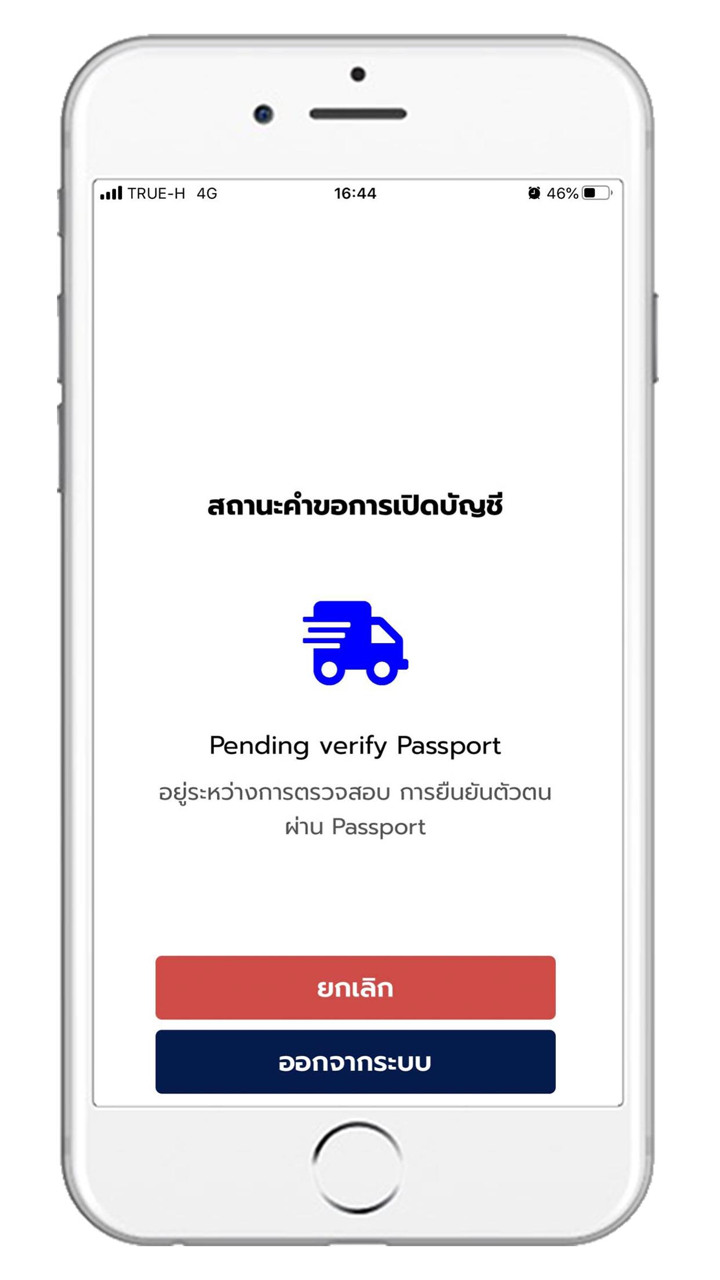

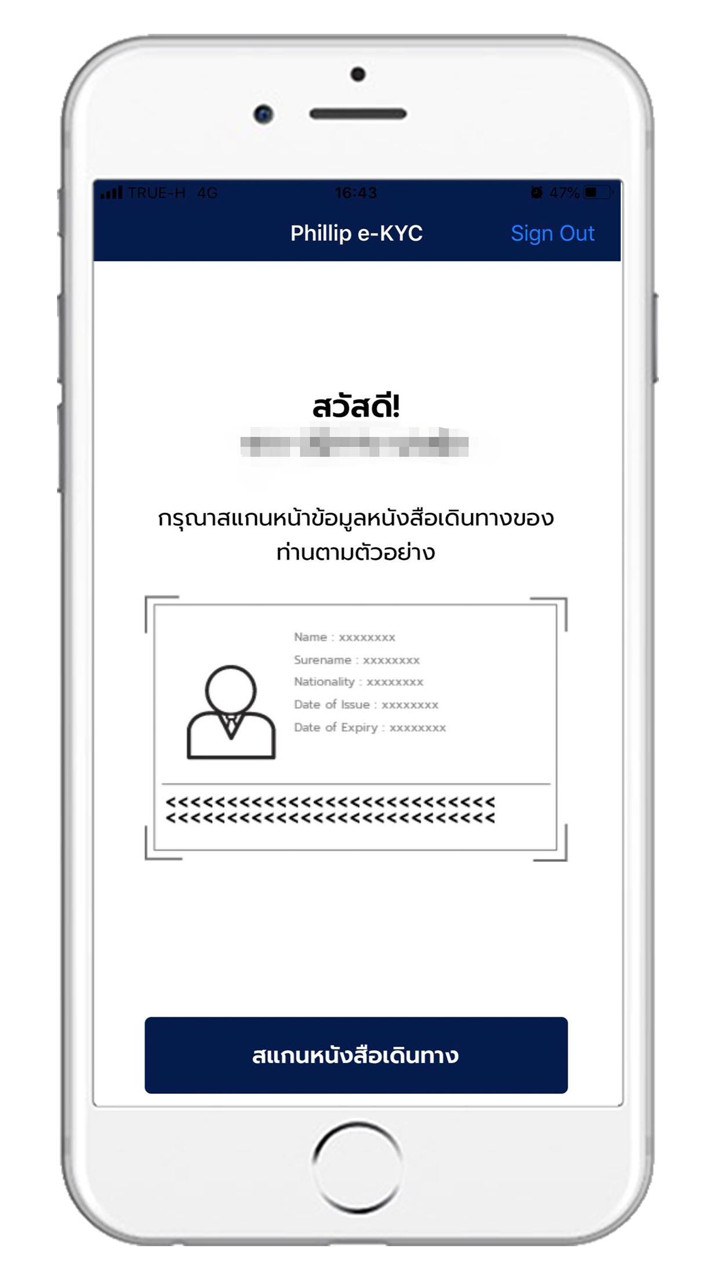

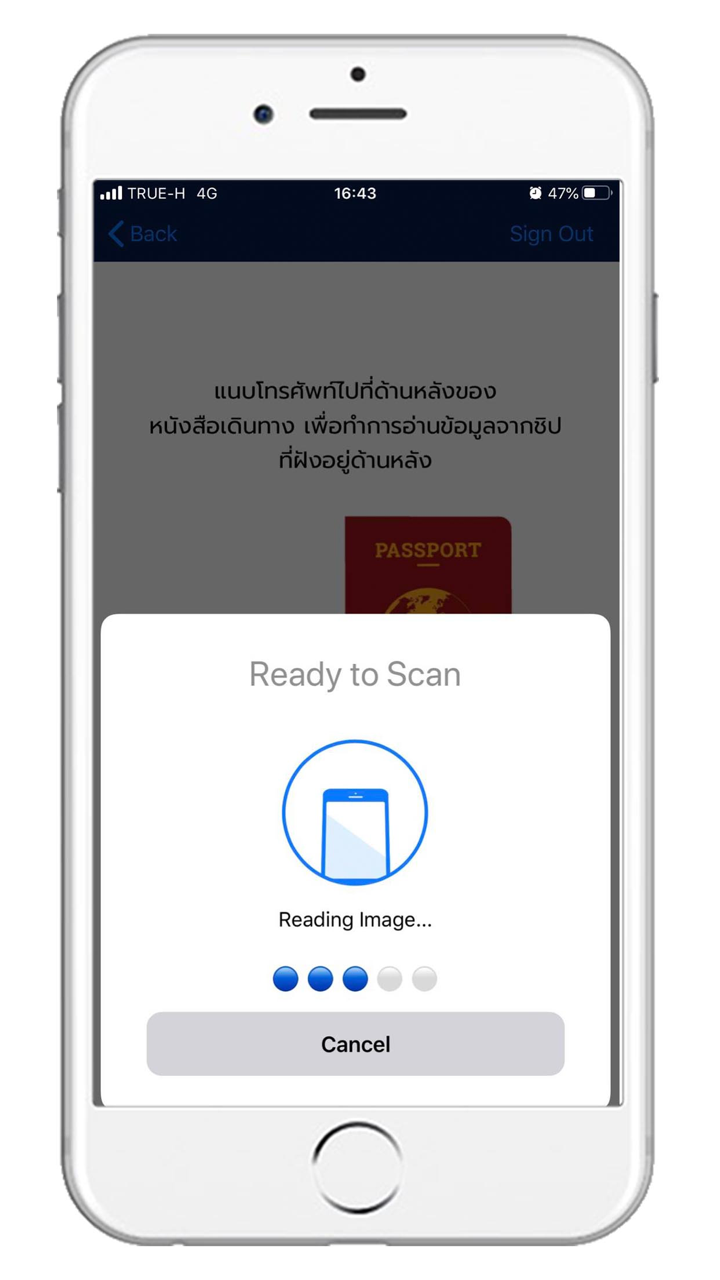

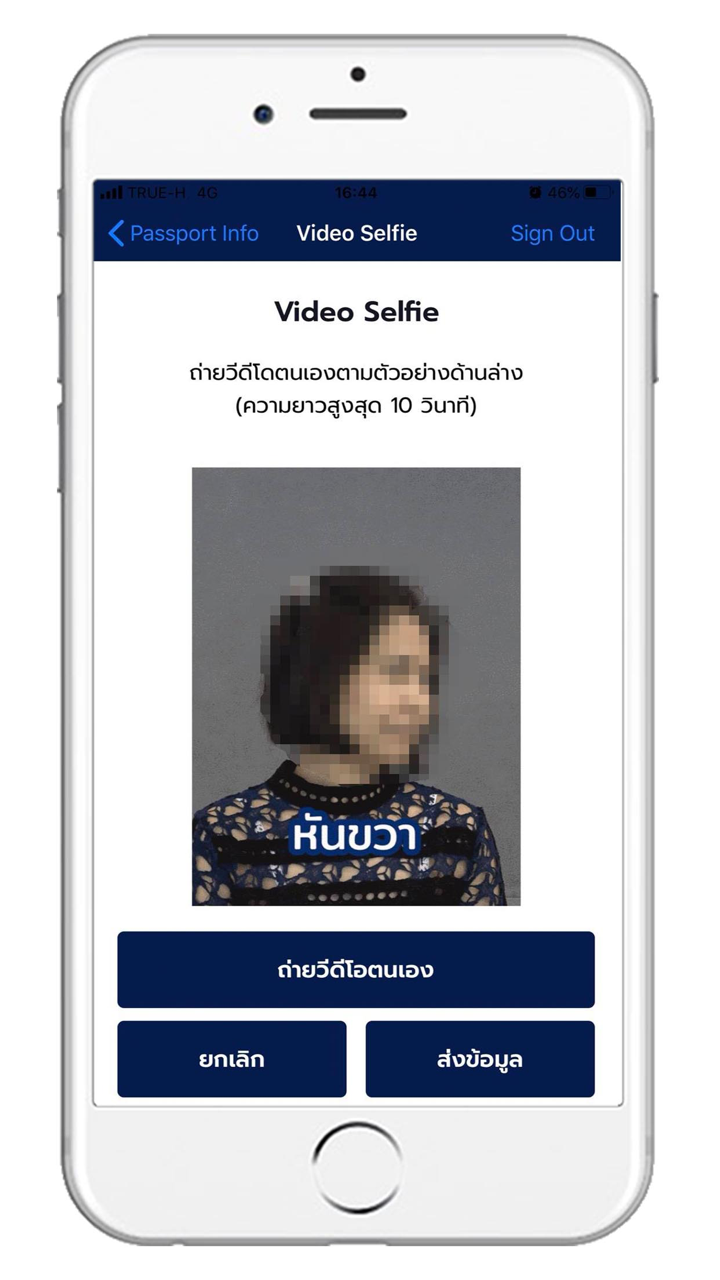

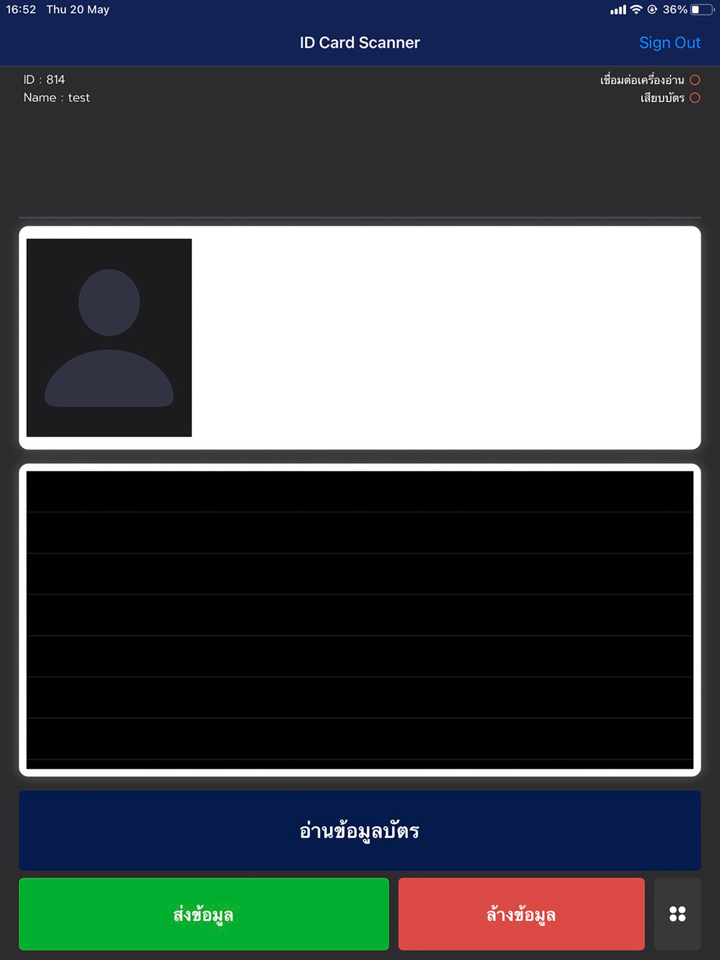

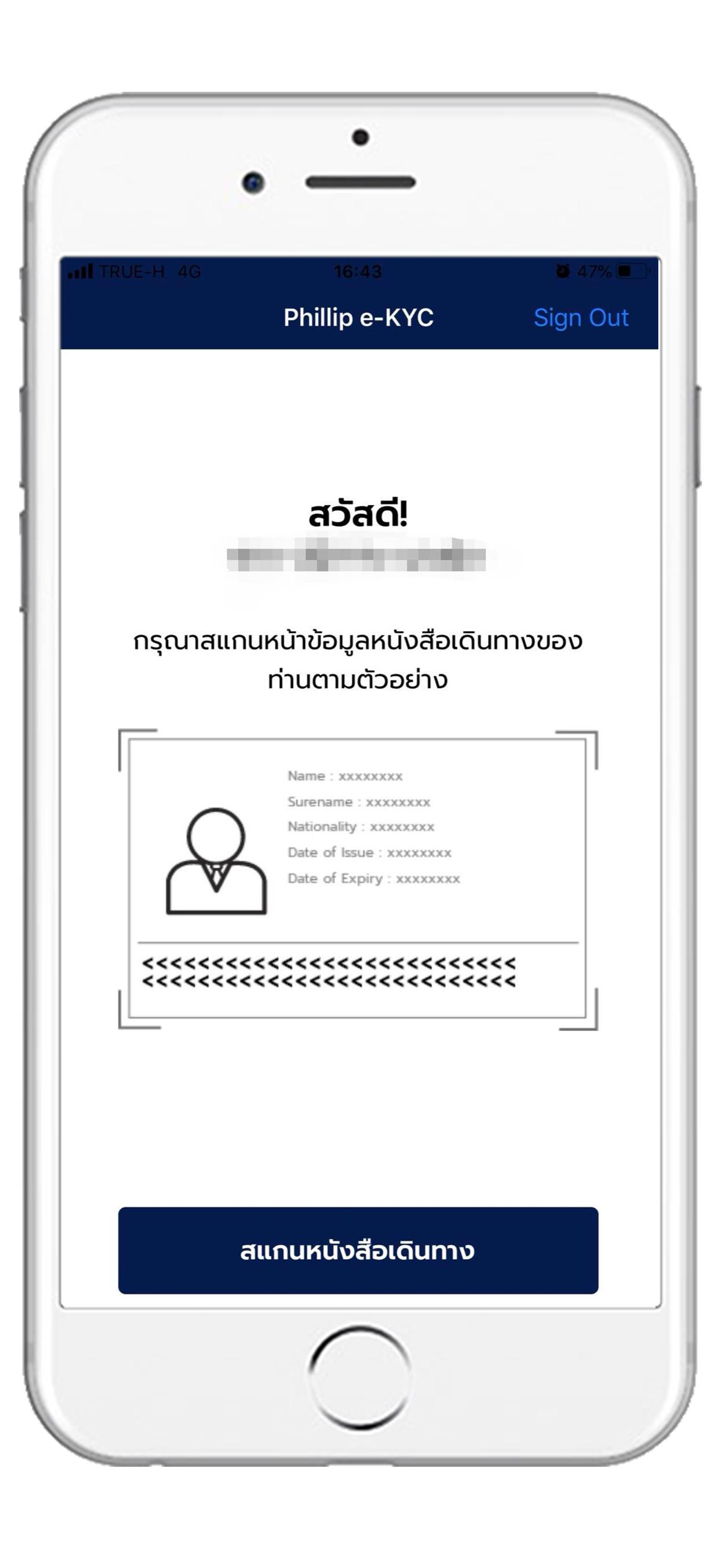

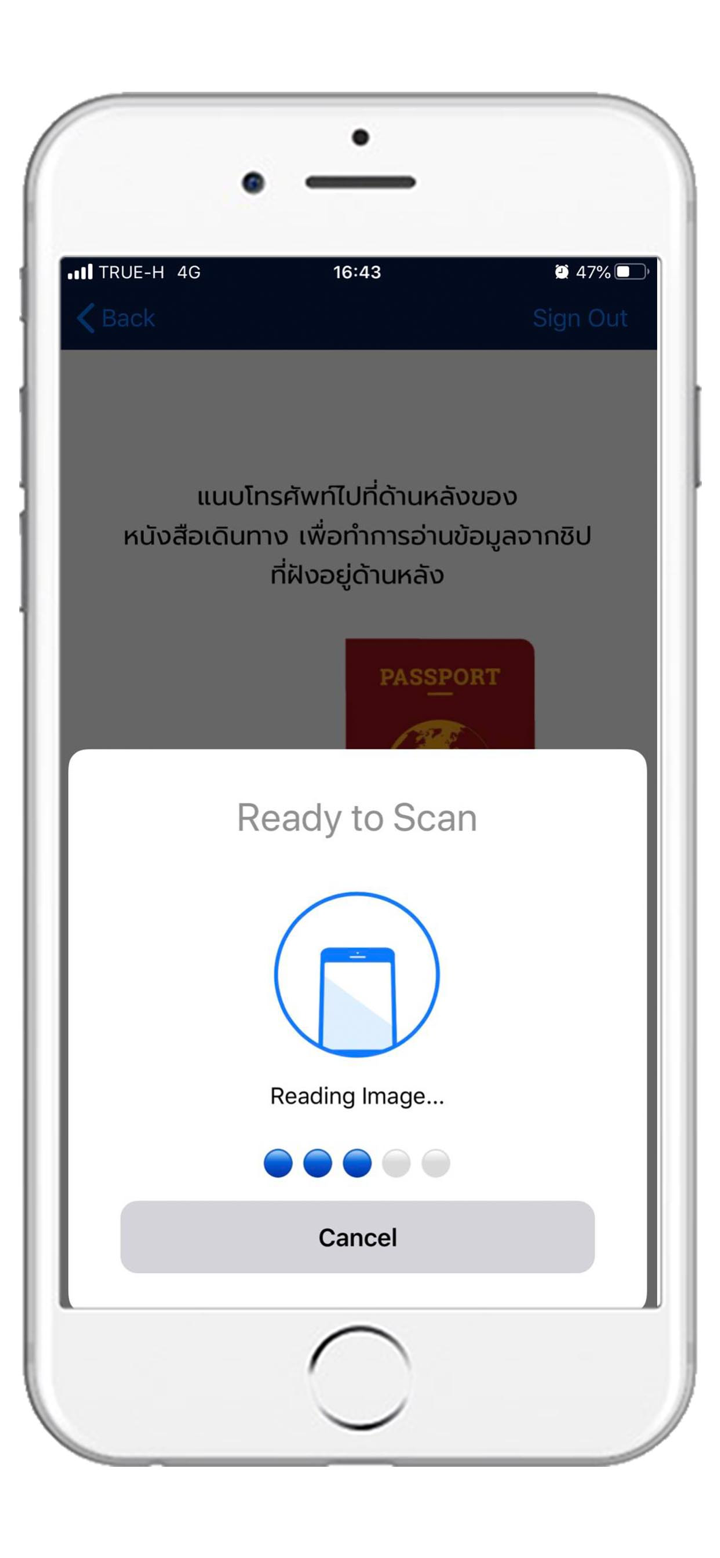

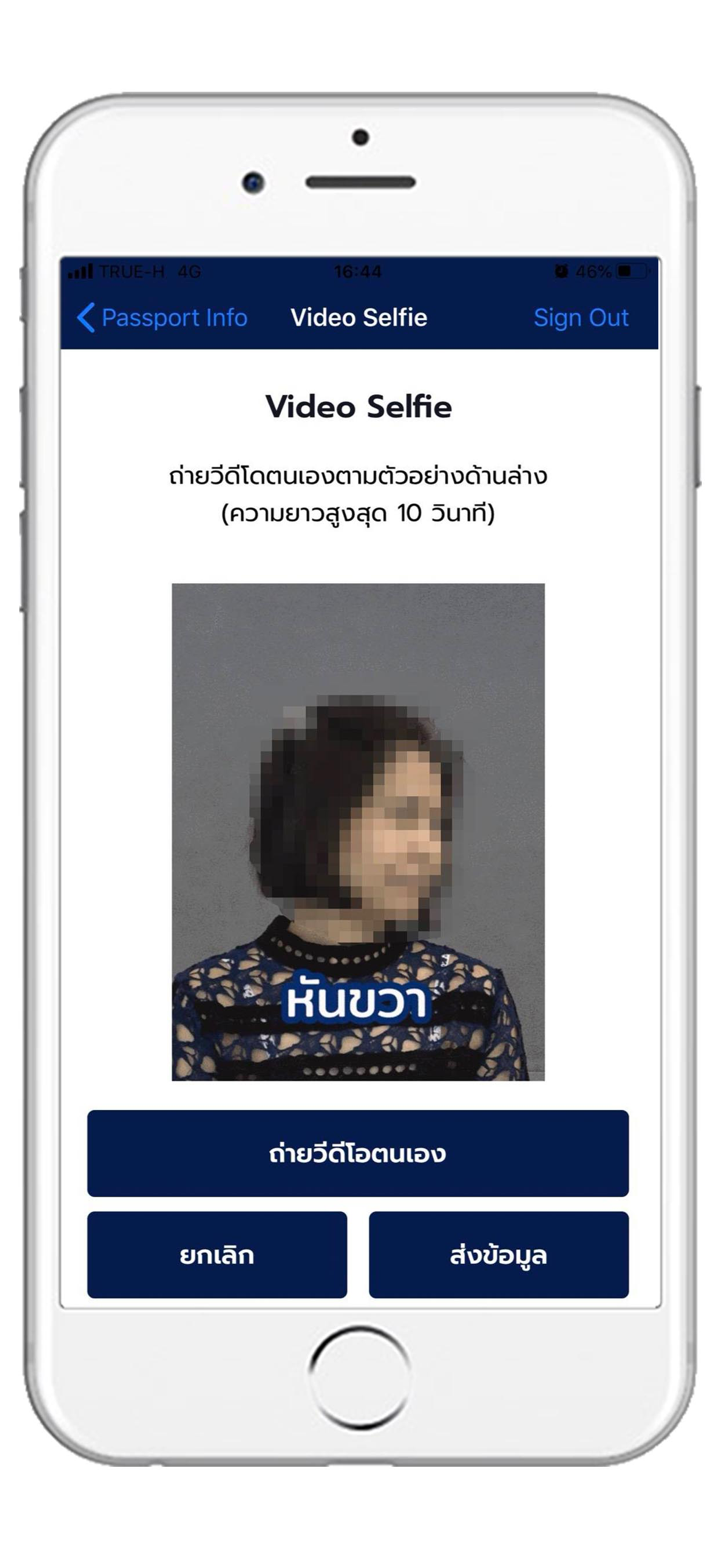

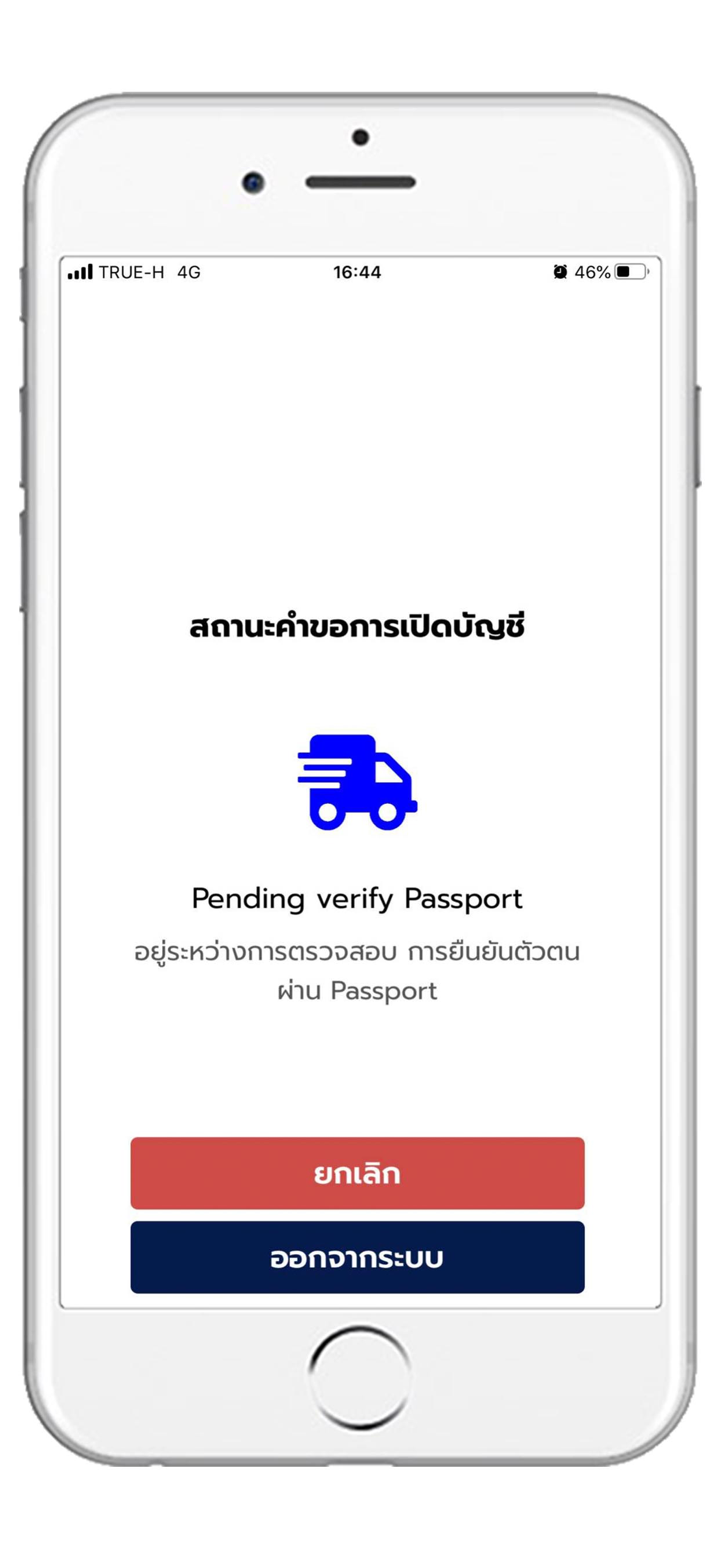

Cuenta

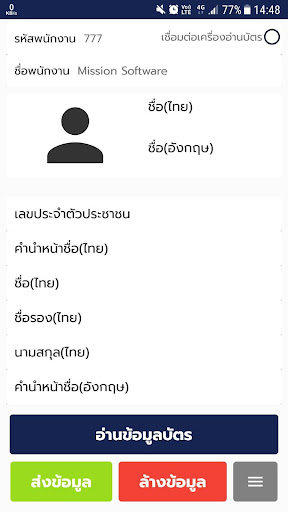

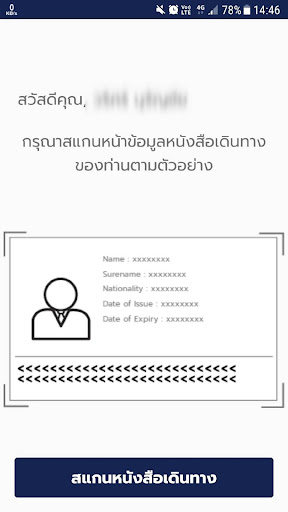

Para abrir una cuenta de Phillip Securities, puedes completar los formularios de solicitud de cuenta. Ellos afirman que aceptan solicitudes de apertura de cuenta de la mayoría de las jurisdicciones de todo el mundo, incluyendo Singapur, Hong Kong, Australia, Estados Unidos, Reino Unido e Islas Caimán.

FX2478212096

Japón

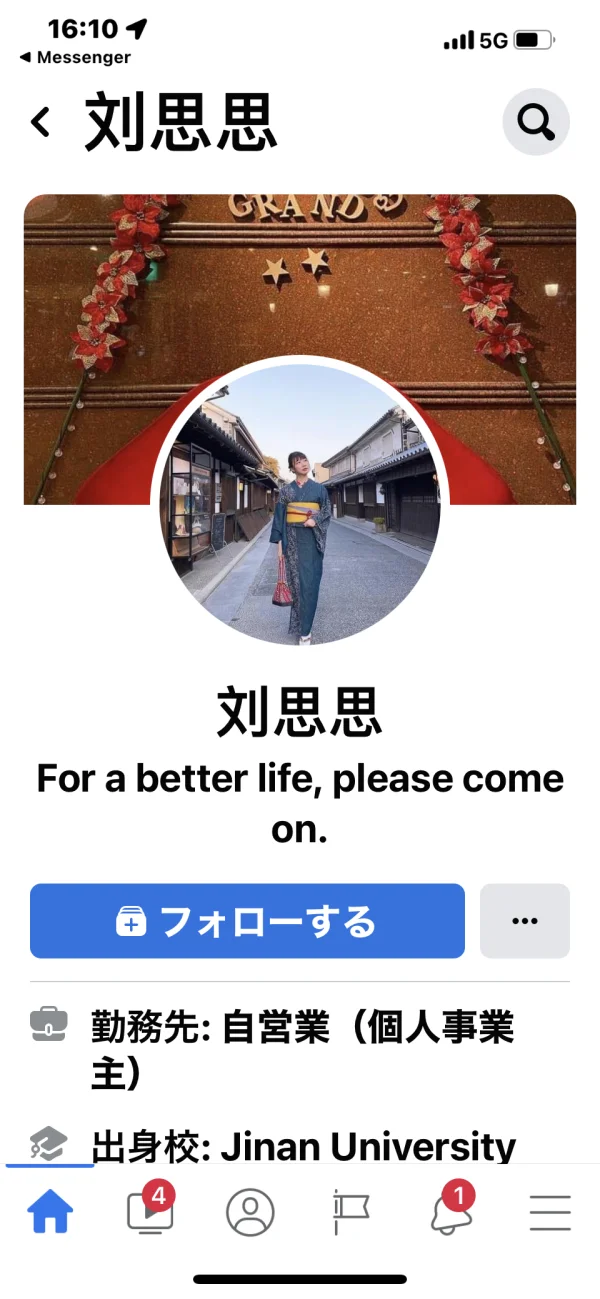

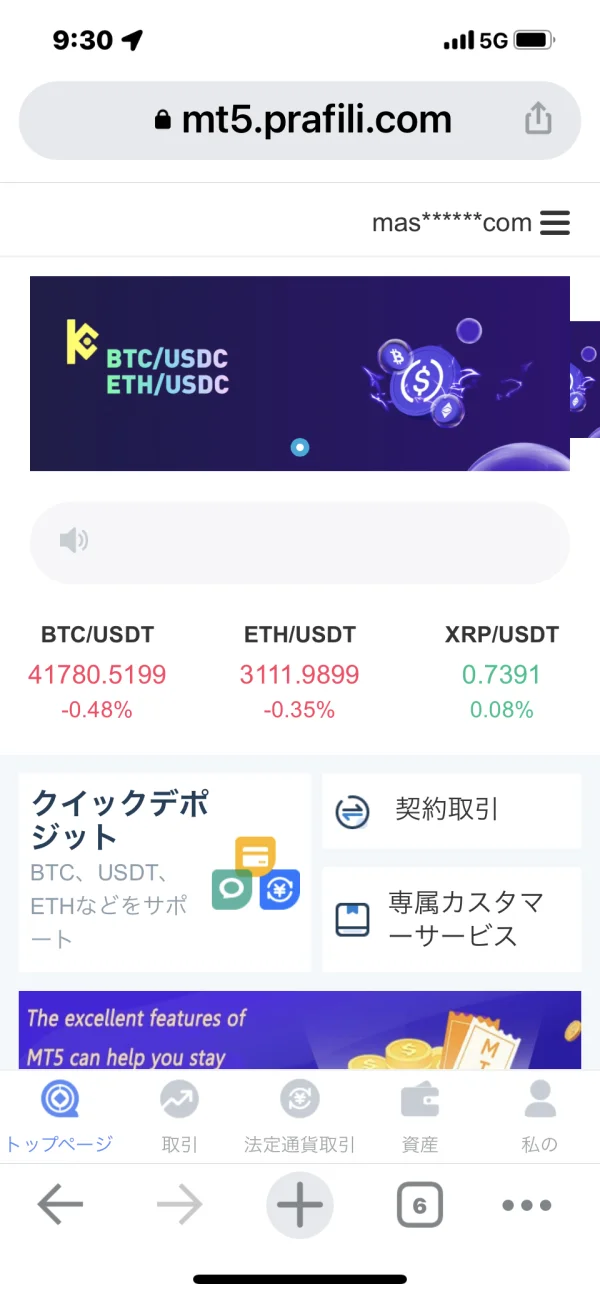

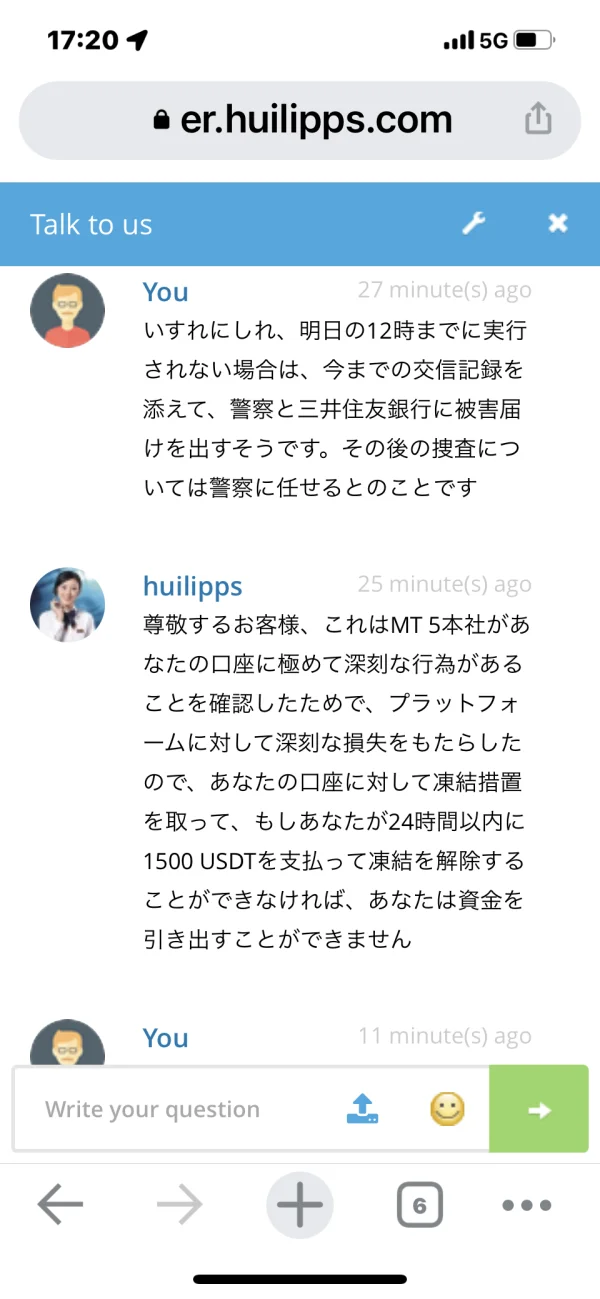

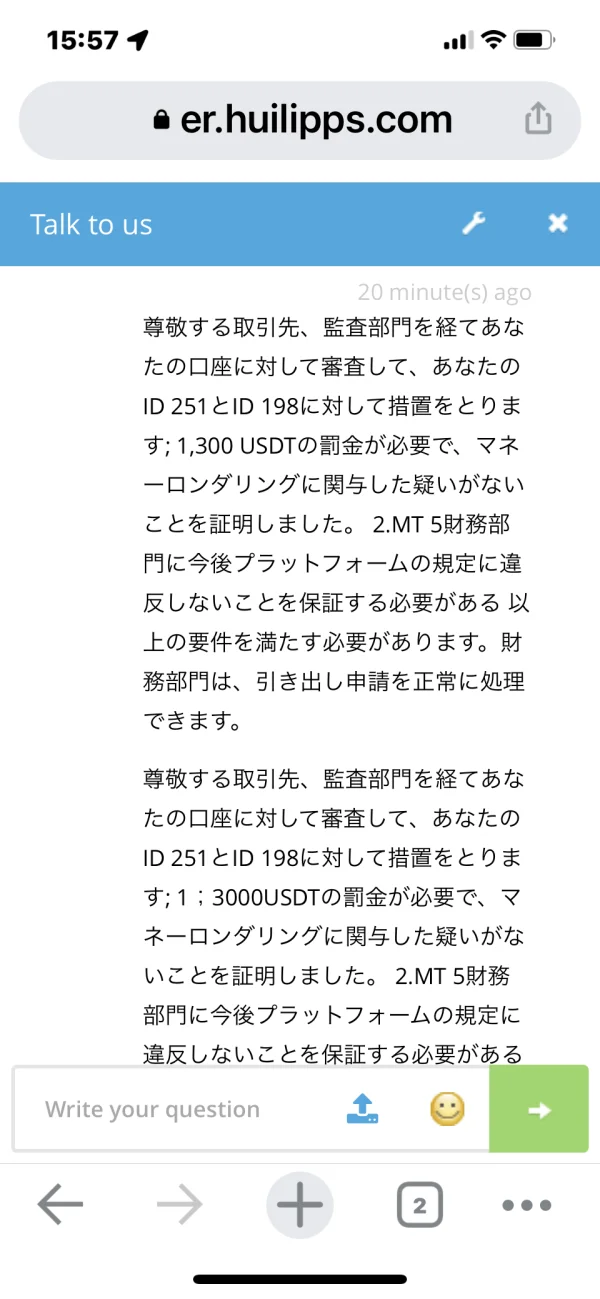

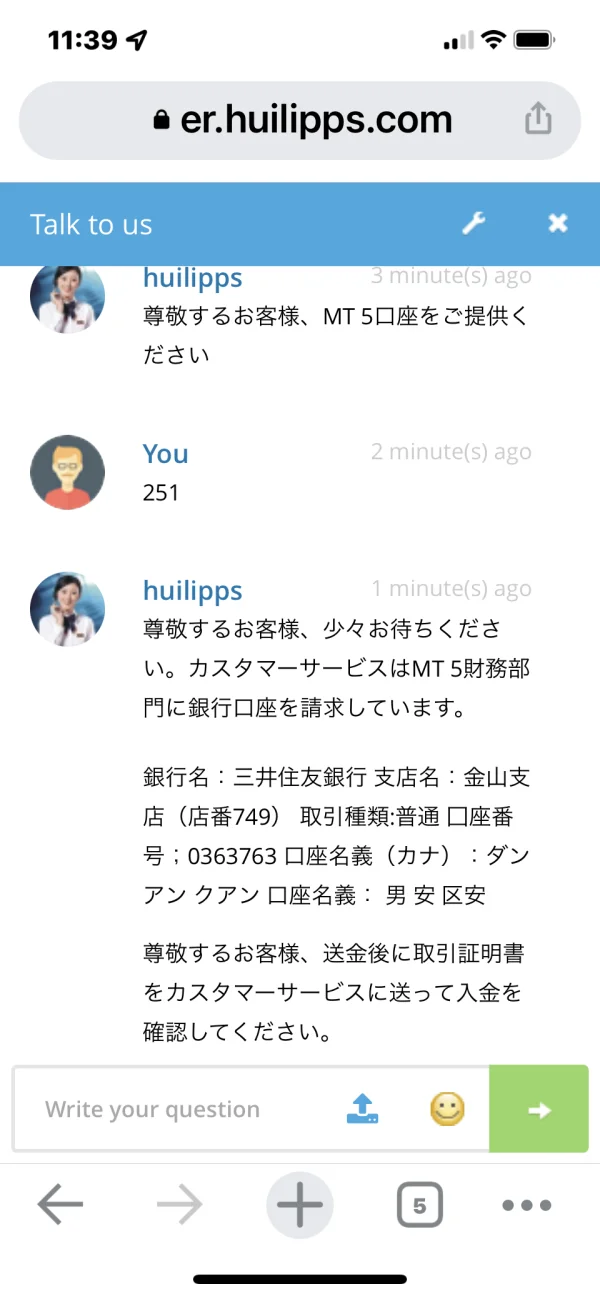

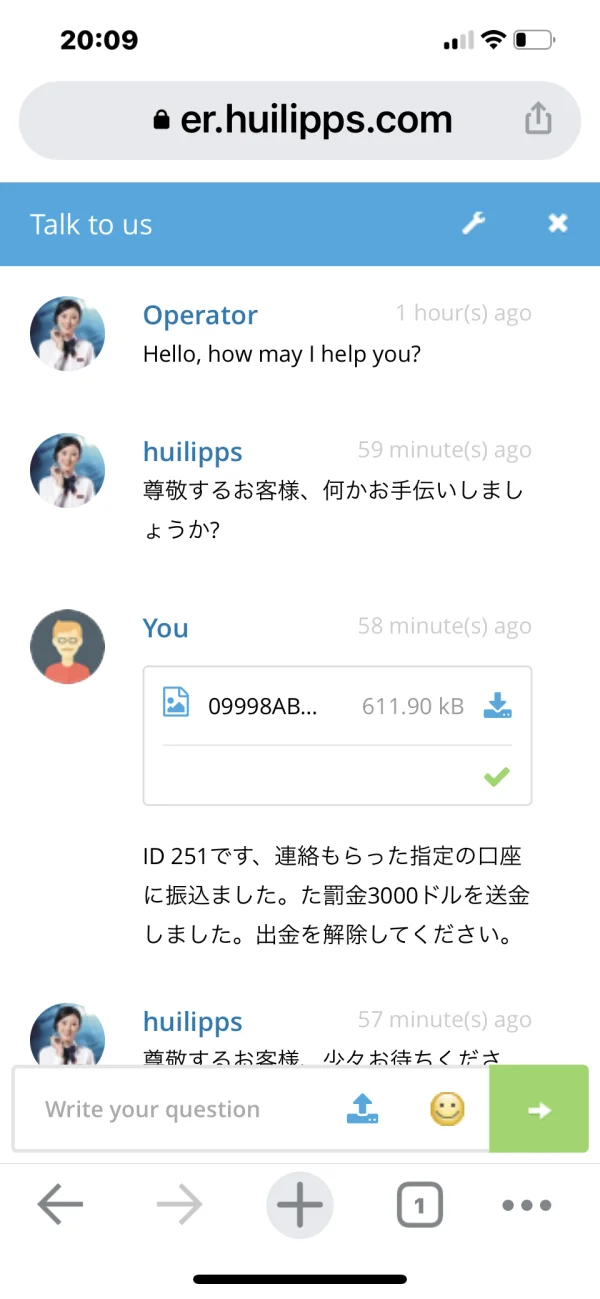

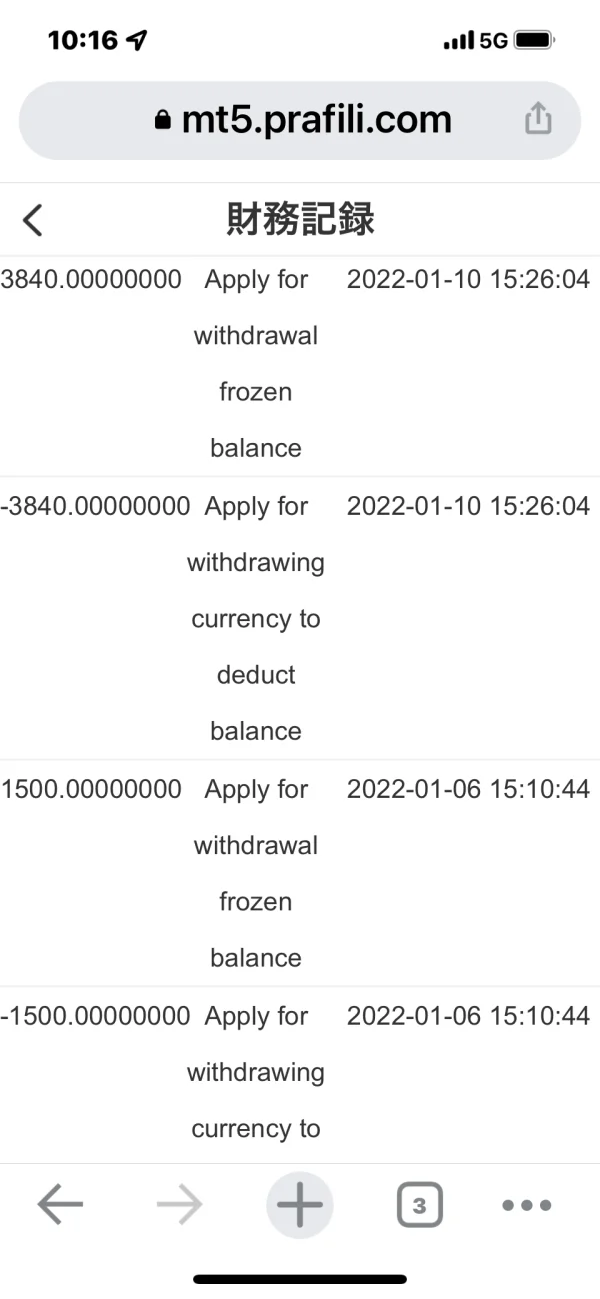

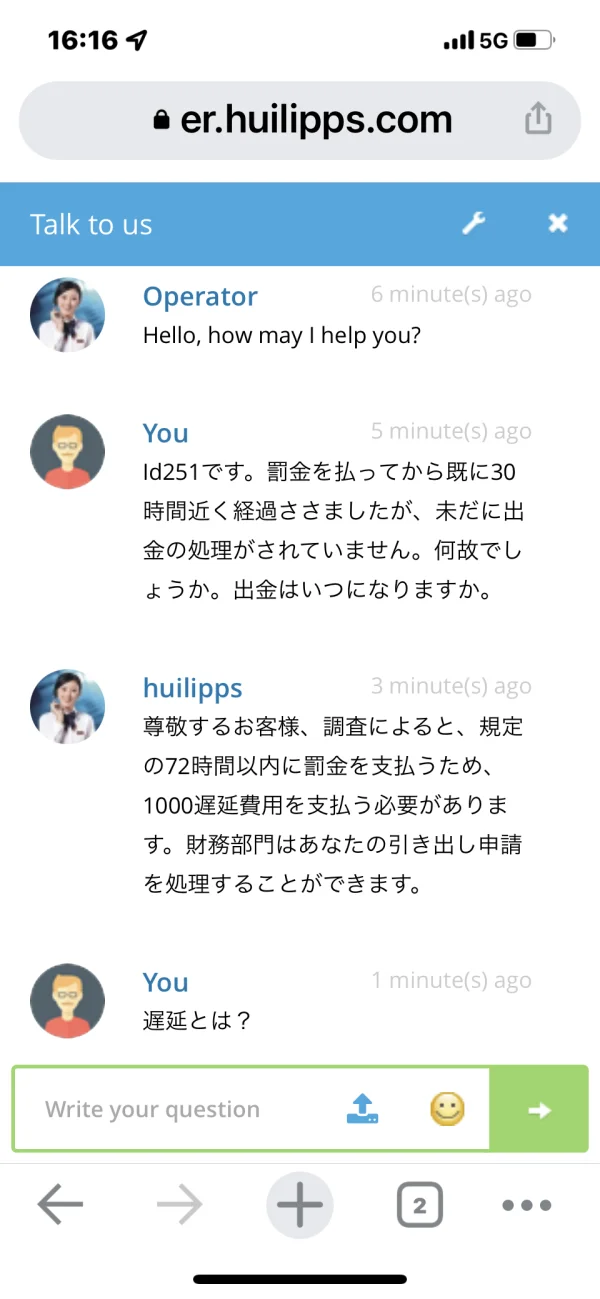

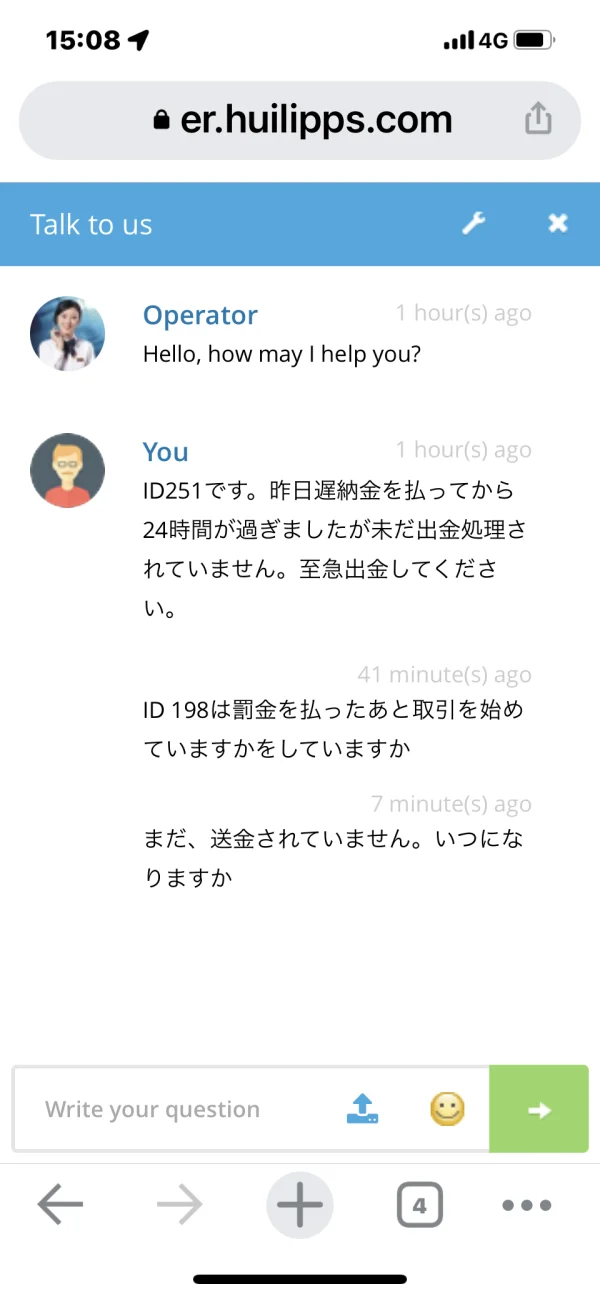

Una mujer que conocí en Facebook me llevó a LINE y solicitó una transacción financiera. La plataforma de negociación es mt5.prafili.com. El ID251 fue emitido para uso privado y la mujer (ID198) puso $2000 en mi cuenta y me dijo que pusiera la misma cantidad de dinero en su lugar. Entonces, primero envié 30,000 yenes para abrir una cuenta, luego 70,000 yenes, luego 100,000 yenes a la cuenta personal designada de Sumitomo Bank, y la transacción comenzó con una transacción, por lo que fueron 5340 dólares, así que retiro Cuando solicité, se sospechaba de mí de lavado de dinero y pagué una multa de $ 3000. Después de eso, solicité pagar $ 1000 porque hubo un retraso en mi solicitud de retiro y pagué cada vez. Todavía no pagué y me pidieron $ 1500. Todavía no he recibido ningún dinero.

Exposición

79699

Japón

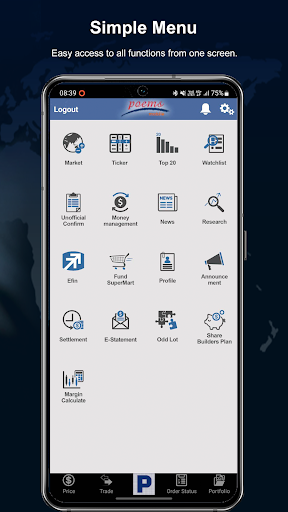

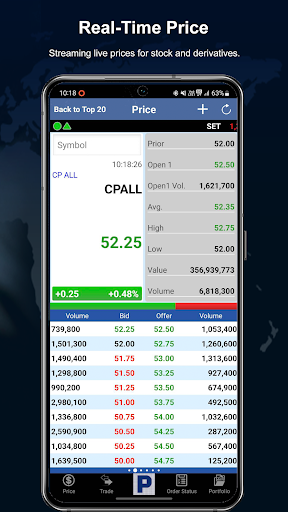

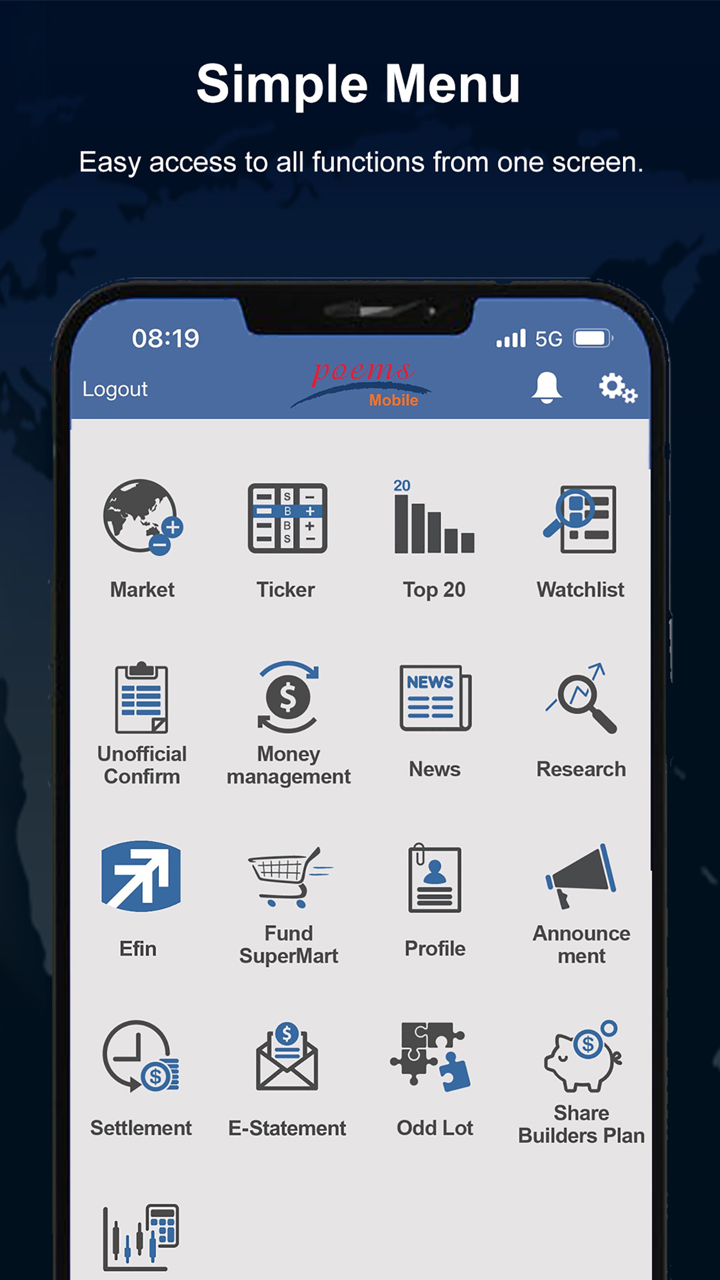

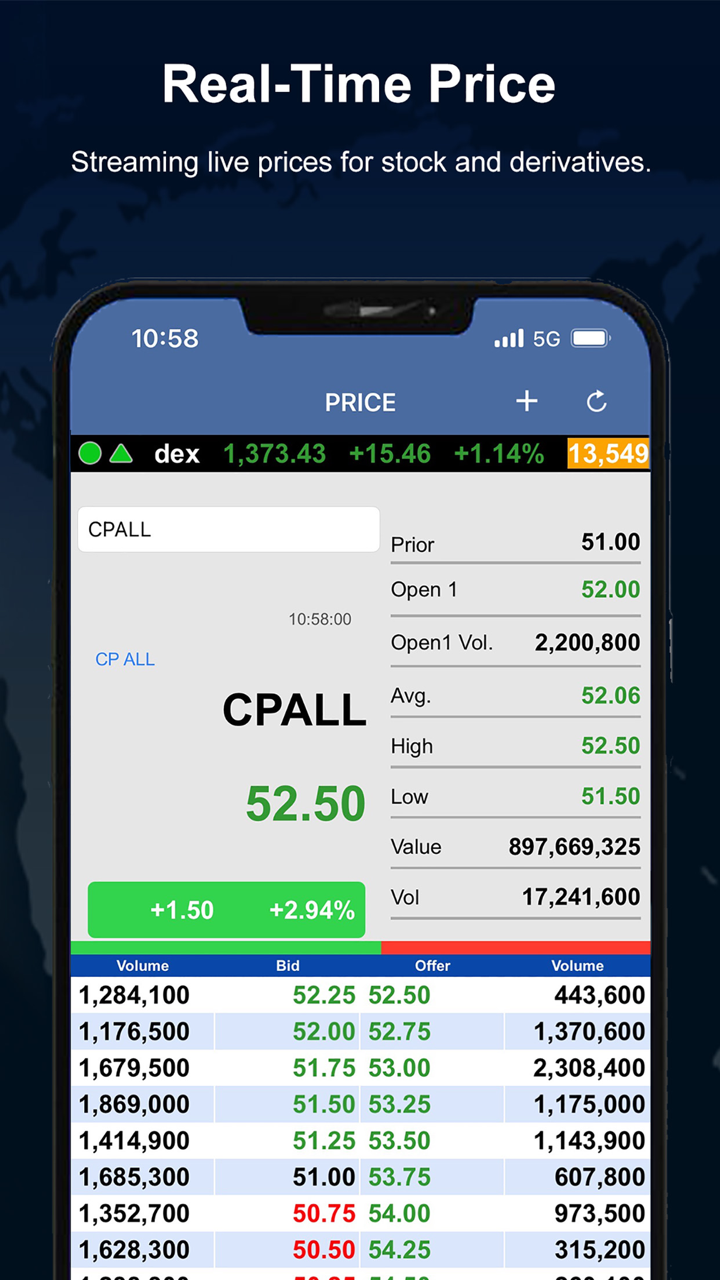

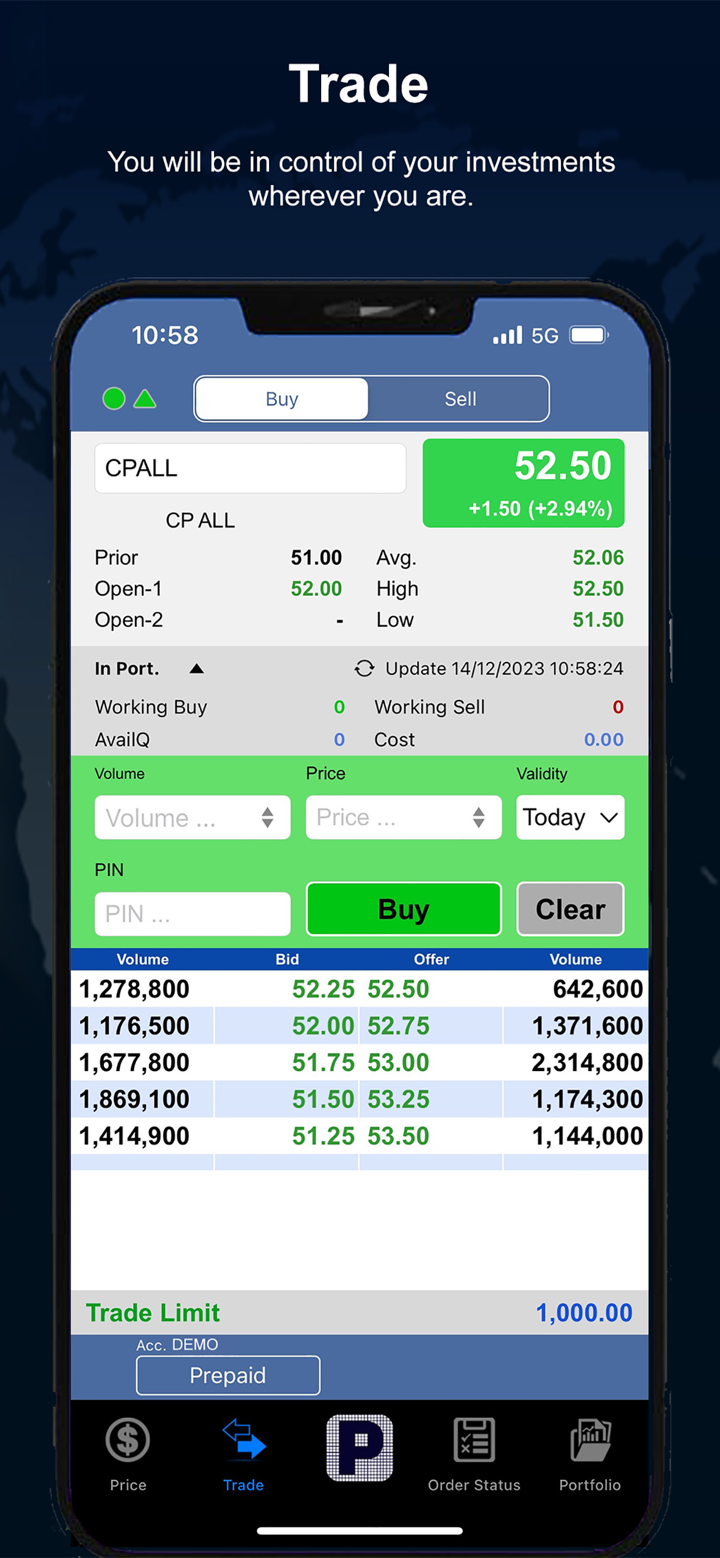

Estoy impresionado con la infraestructura tecnológica. Sus sistemas de trading electrónicos son confiables y ofrecen características avanzadas que me ayudan a gestionar mis operaciones de manera efectiva.

Positivo

Abel Gert

Países Bajos

¡Después de 3 meses de experiencia con Phillip Securities, estoy completamente impresionado! Tienen retiros rápidos, comisiones bajas y la mejor parte: un servicio al cliente de 5 estrellas.👍👍👍

Positivo

FX1383707667

Colombia

Es un corredor confiable, ¿qué más hay que decir? Me las arreglé para trabajar con diferentes corredores durante 3 años de negociación. Pero a juzgar por los términos y beneficios para los comerciantes, Phillip Securities es excelente. De hecho, el dinero se retira en 48 horas desde el momento en que lo solicitó, pero es mejor esperar que encontrarse con estafadores por el bien de la seguridad del dinero.

Positivo