Perfil de la compañía

| Mega SecuritiesResumen de la revisión | |

| Fundado | / |

| País/Región Registrado | China (Taiwán) |

| Regulación | TPEx |

| Productos y Servicios | Acciones, futuros, gestión financiera, fideicomisos |

| Soporte al Cliente | Chat de IA |

| Tel: (02)2351-7017; (02)4055-3355 | |

| Dirección: 台北市中正區忠孝東路二段95號 | |

Mega Securities se registró en Taiwán. Esta empresa se especializa en acciones, futuros, gestión financiera y fideicomisos. Además, está regulada por TPEx en Taiwán.

Pros y Contras

| Pros | Contras |

| Regulado por TPEx | Estructura de tarifas poco clara |

| Múltiples plataformas de negociación |

¿Es Mega Securities legítimo?

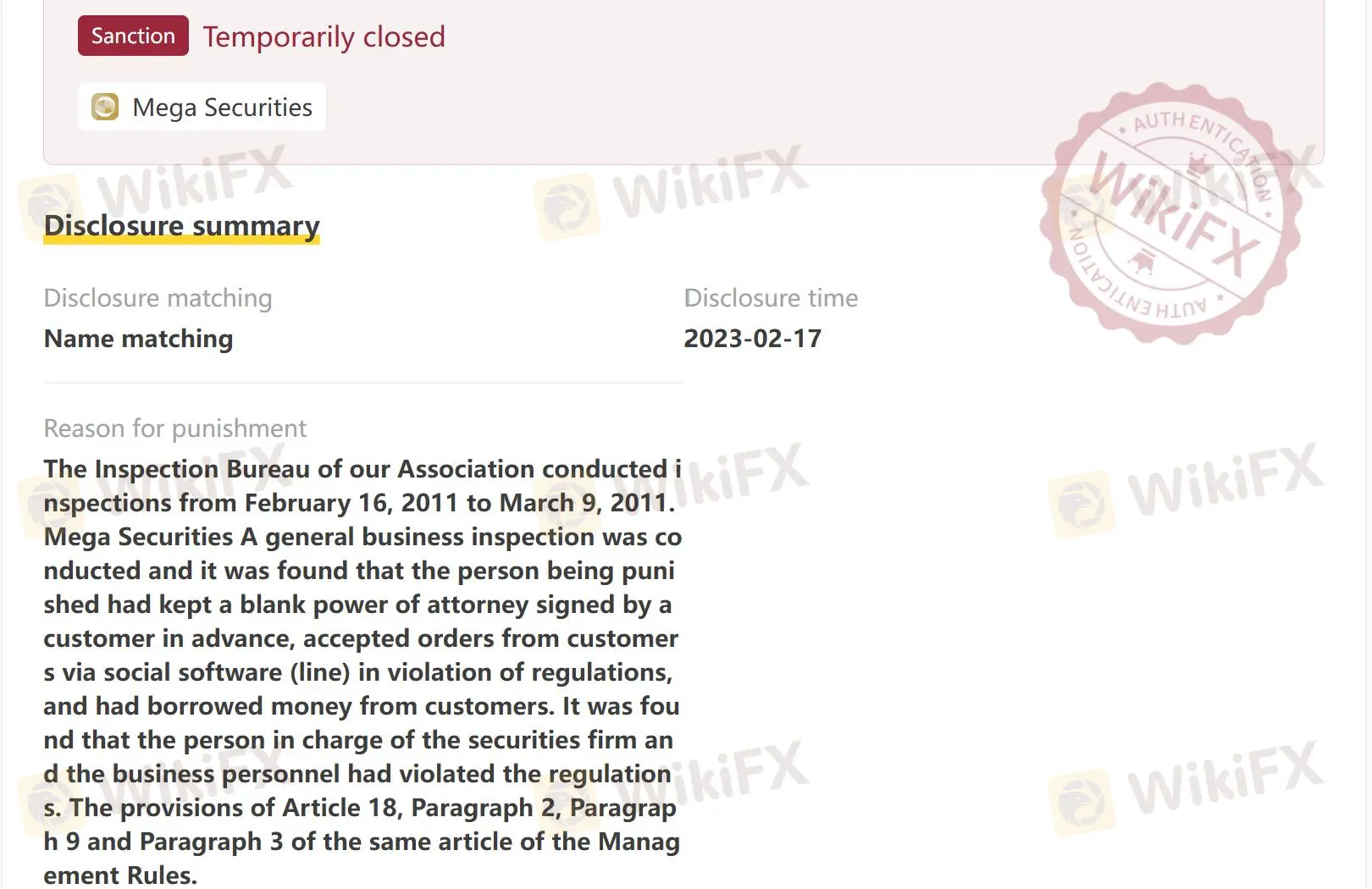

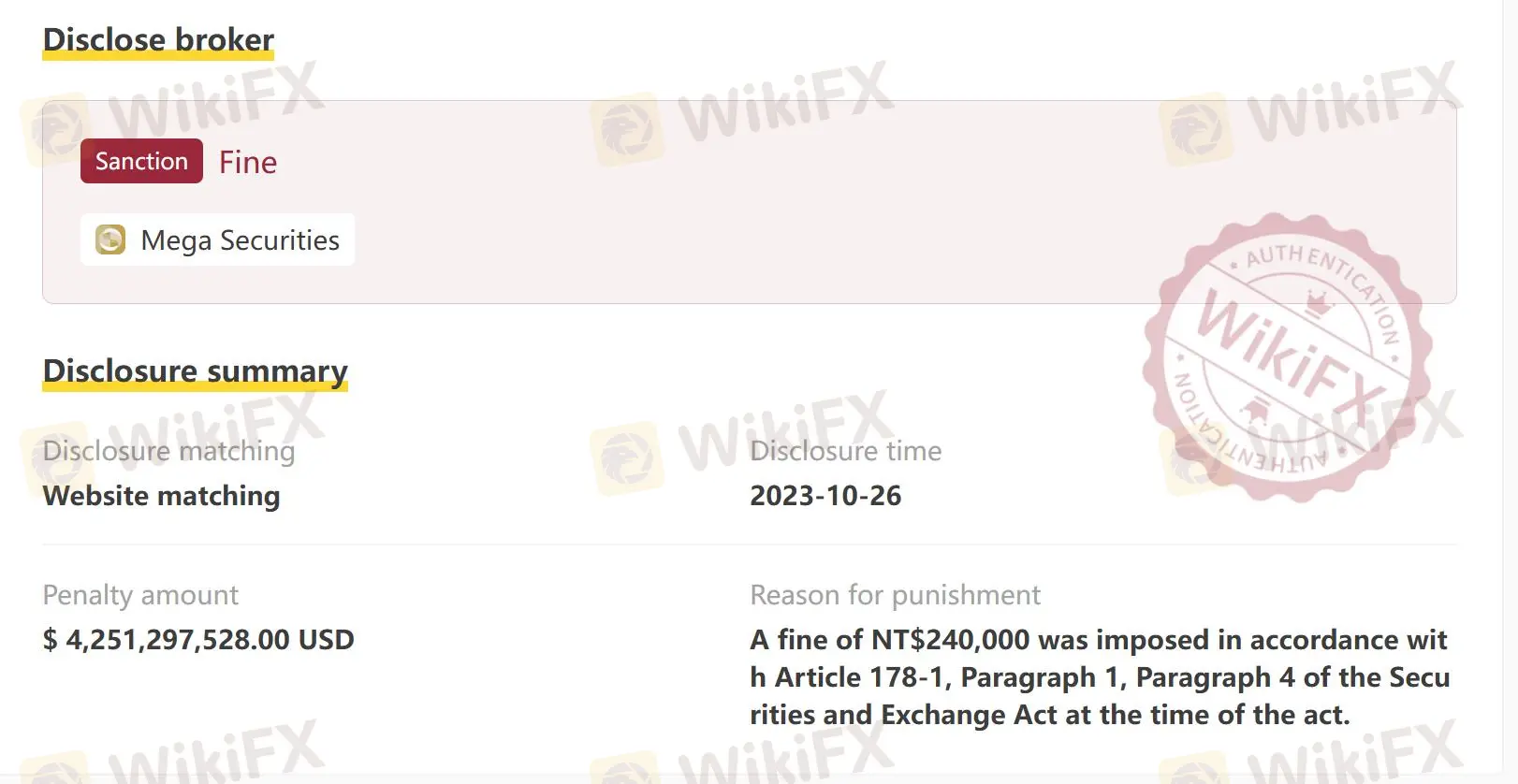

Sí, Mega Securities está regulado por la Bolsa de Valores de Taipei (TPEx). Sin embargo, la Oficina de Valores y Futuros emitió sanciones a Mega Securities en dos ocasiones. ¡Tenga en cuenta los posibles riesgos!

| Autoridad Reguladora | Estado Actual | País Regulado | Tipo de Licencia | Número de Licencia |

| Bolsa de Valores de Taipei (TPEx) | Regulado | China (Taiwán) | Negociación de valores | No publicado |

Investigación de Campo de WikiFX

El equipo de investigación de campo de WikiFX visitó la dirección regulatoria de Mega Securities en Taiwán y encontró su dirección física.

¿Qué puedo negociar en Mega Securities?

Mega Securities ofrece negociación en acciones, futuros y fideicomisos.

| Instrumentos Negociables | Soportado |

| Acciones | ✔ |

| Futuros | ✔ |

| Fideicomisos | ✔ |

Plataforma de Negociación

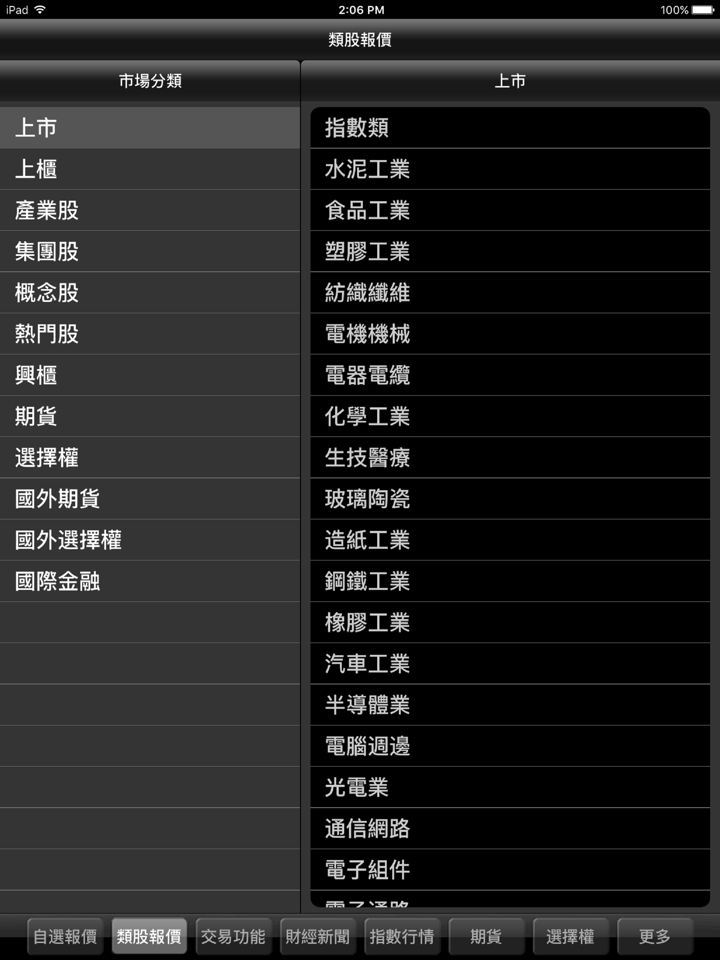

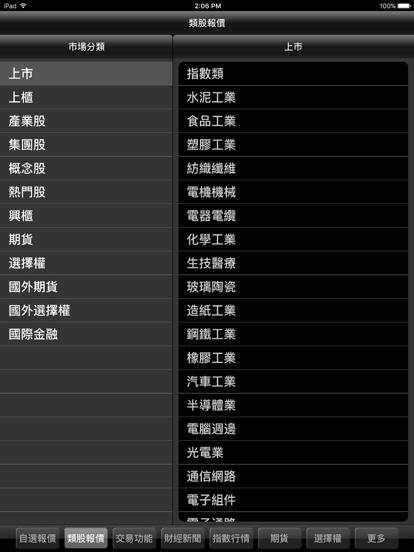

Mega Securities proporciona varios tipos de plataformas, incluyendo Mega Fortune Securities, Global Finance, Trillion Wins, Mega HTS y Credentials.

| Plataforma de Trading | Soportada | Dispositivos Disponibles | Adecuada para |

| Mega Fortune Securities | ✔ | Móvil | / |

| Global Finance | ✔ | PC | |

| Trillion Wins | ✔ | ||

| Mega HTS | ✔ | ||

| Credentials | ✔ |