Perfil de la compañía

| INVASTResumen de la reseña | |

| Establecido | 2004 |

| País/Región registrado | Japón |

| Regulación | FSA |

| Instrumentos de mercado | Forex, ETFs |

| Cuenta demo | / |

| Apalancamiento | Hasta 1:25 |

| Spread | Varios |

| Plataforma de trading | Click 365 |

| Depósito mínimo | / |

| Soporte al cliente | Teléfono: 0120-659-274 |

| Formulario de contacto | |

Información de INVAST

Invast, con sede en Tokio, Japón, es una destacada empresa de servicios financieros especializada en trading en línea. La compañía ofrece una variedad de servicios, incluyendo margen FX, CFDs y soluciones de trading automatizado. INVAST opera actualmente bajo la Agencia de Servicios Financieros (FSA).

Pros y contras

| Pros | Contras |

| Regulado por FSA | Instrumentos de mercado limitados |

| Cuenta demo no disponible | |

| Información limitada sobre condiciones de trading |

¿Es INVAST legítimo?

INVAST está regulado por la Agencia de Servicios Financieros (FSA), con una Licencia de Forex Minorista (No.26).

| País regulado | Autoridad reguladora | Estado regulatorio | Entidad regulada | Tipo de licencia | Número de licencia |

| Agencia de Servicios Financieros (FSA) | Regulado | INVAST Securities Co., Ltd | Licencia de Forex Minorista | 関東財務局長(金商)第26号 |

¿Qué puedo negociar en INVAST?

INVAST ofrece productos negociables que incluyen forex y ETFs.

| Activo de Trading | Disponible |

| forex | ✔ |

| ETFs | ✔ |

| productos básicos | ❌ |

| índices | ❌ |

| acciones | ❌ |

| criptomonedas | ❌ |

| bonos | ❌ |

| opciones | ❌ |

| fondos | ❌ |

Tipo de Cuenta

INVAST ofrece tanto cuentas personales como una cuenta corporativa.

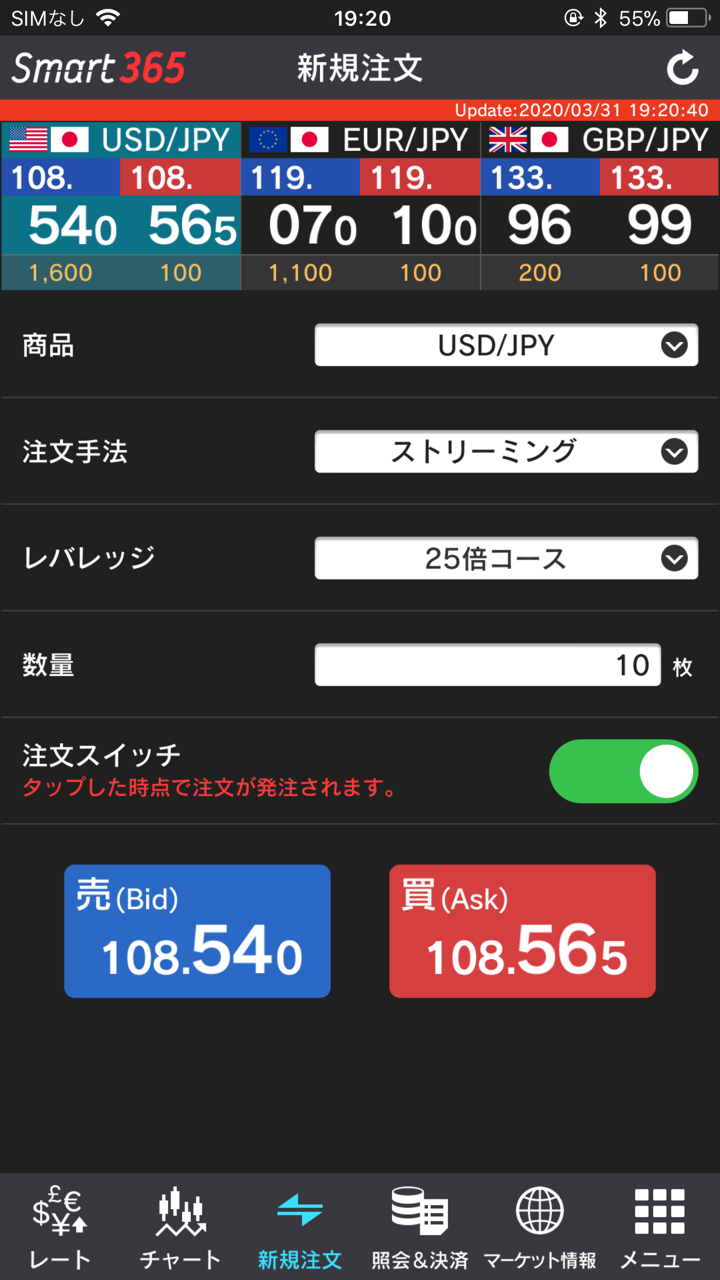

Apalancamiento

INVAST ofrece varias tasas de apalancamiento.

Apalancamiento de cuenta personal: curso de 25x, curso de 10x, curso de 5x y curso de 1x.

Solo hay una cuenta corporativa: curso de apalancamiento.

Tarifas

Los spreads son determinados por la Bolsa de Tokio.

Para más detalles, por favor visita el sitio web de la Bolsa de Tokio.

Las tarifas de trading suelen ser de JPY 330. Pero hay excepciones:

- Más de 1,000 hojas: Se aplica una tarifa reducida de JPY 88 si se negocian más de 1,000 hojas en un mes.

- Más de 3,000 hojas: Se aplica una tarifa aún más reducida (o sin tarifa) si se negocian más de 3,000 hojas en un mes.

| 1 hoja (impuestos incluidos) | usualmente | Descuento por Volumen (Medidor de Transacciones Mensual) | |||

| Más de 1,000 hojas | Más de 3,000 hojas | ||||

| Tarifa normal de un solo sentido | JPY 330 | JPY 88 | JPY 0 | ||

Además, la tarifa acumulada se deducirá del monto del depósito de margen al finalizar el trading el día 1.

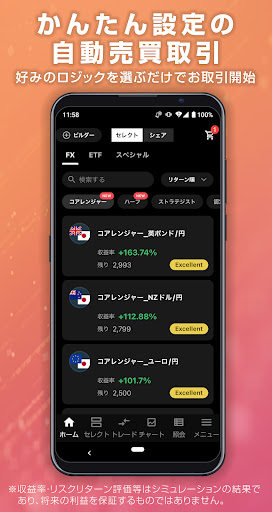

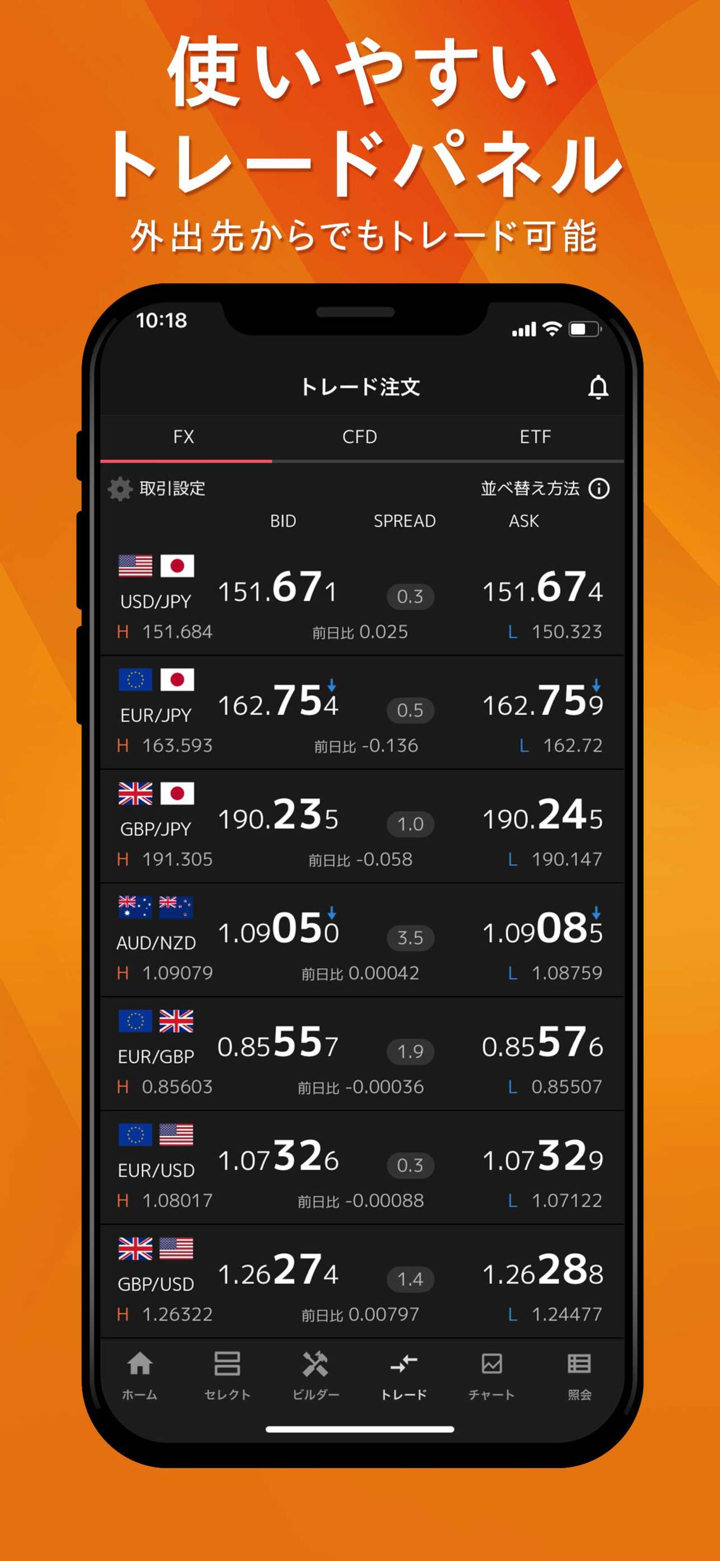

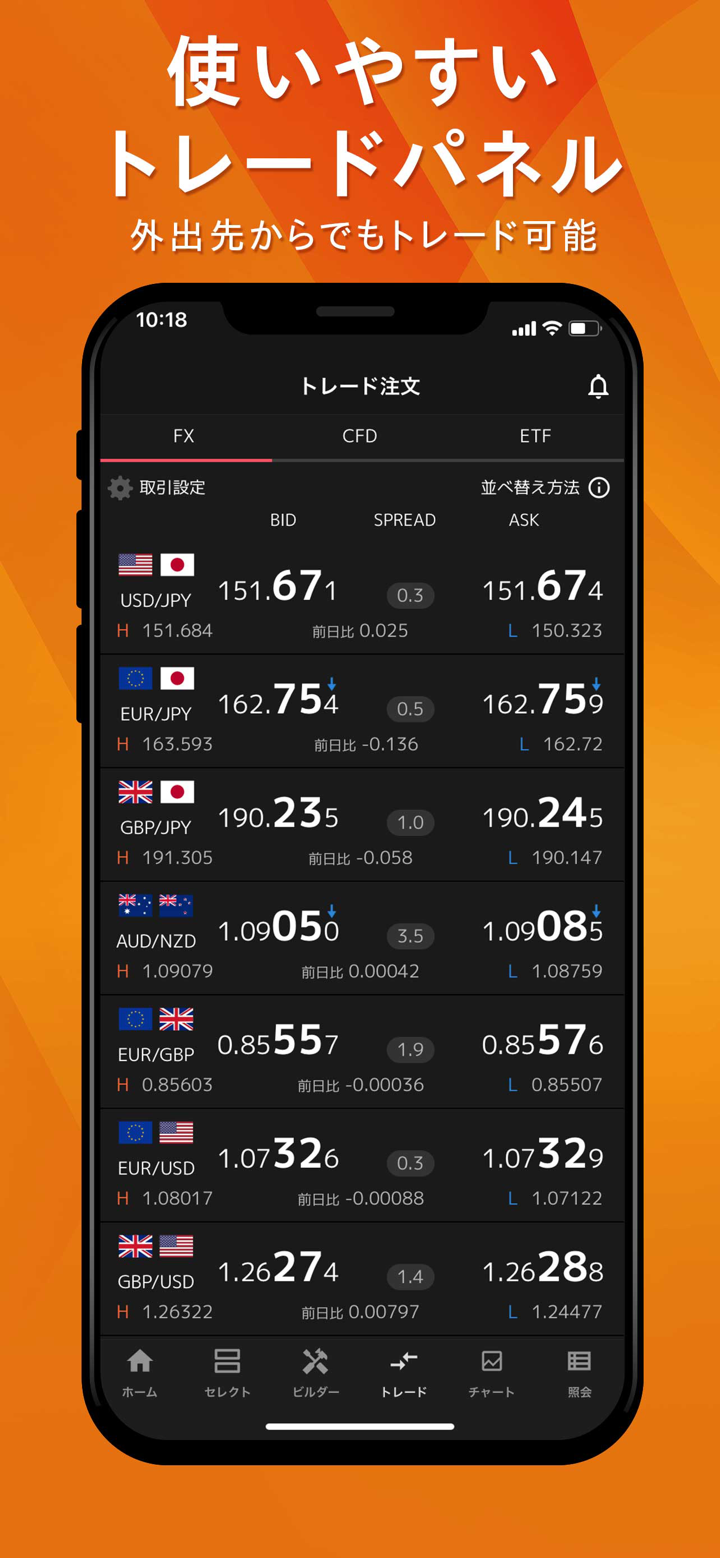

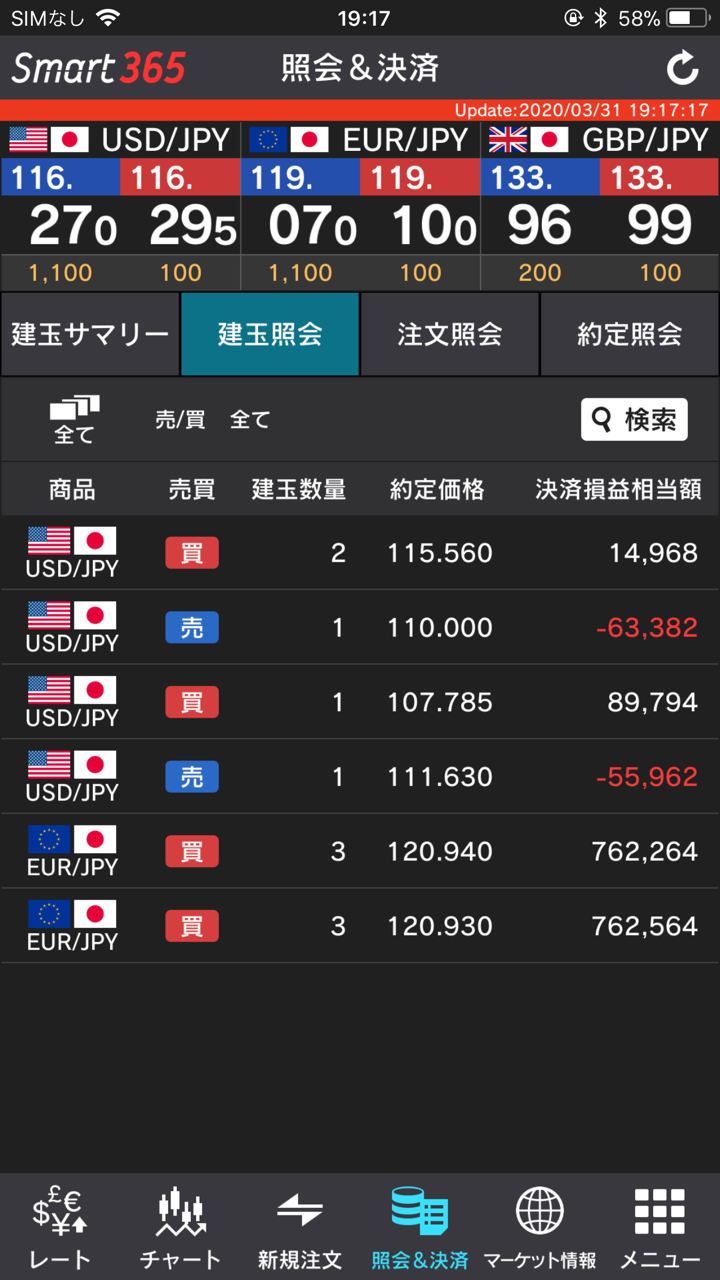

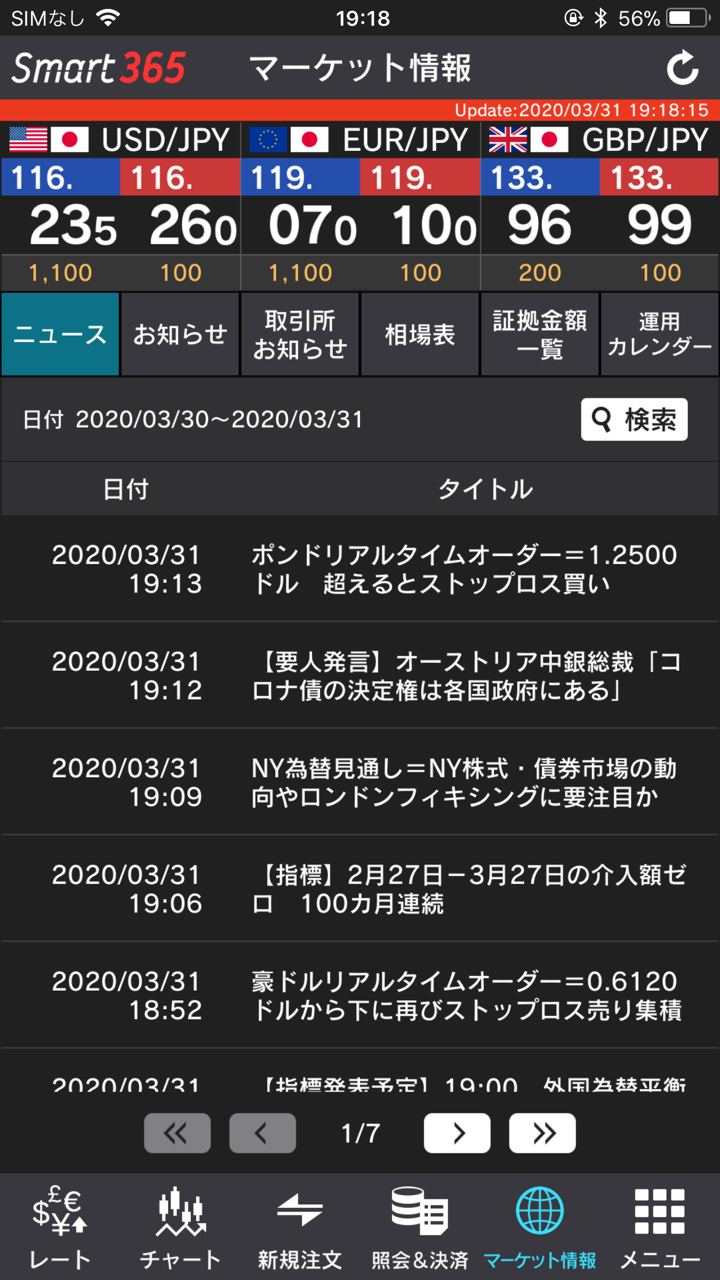

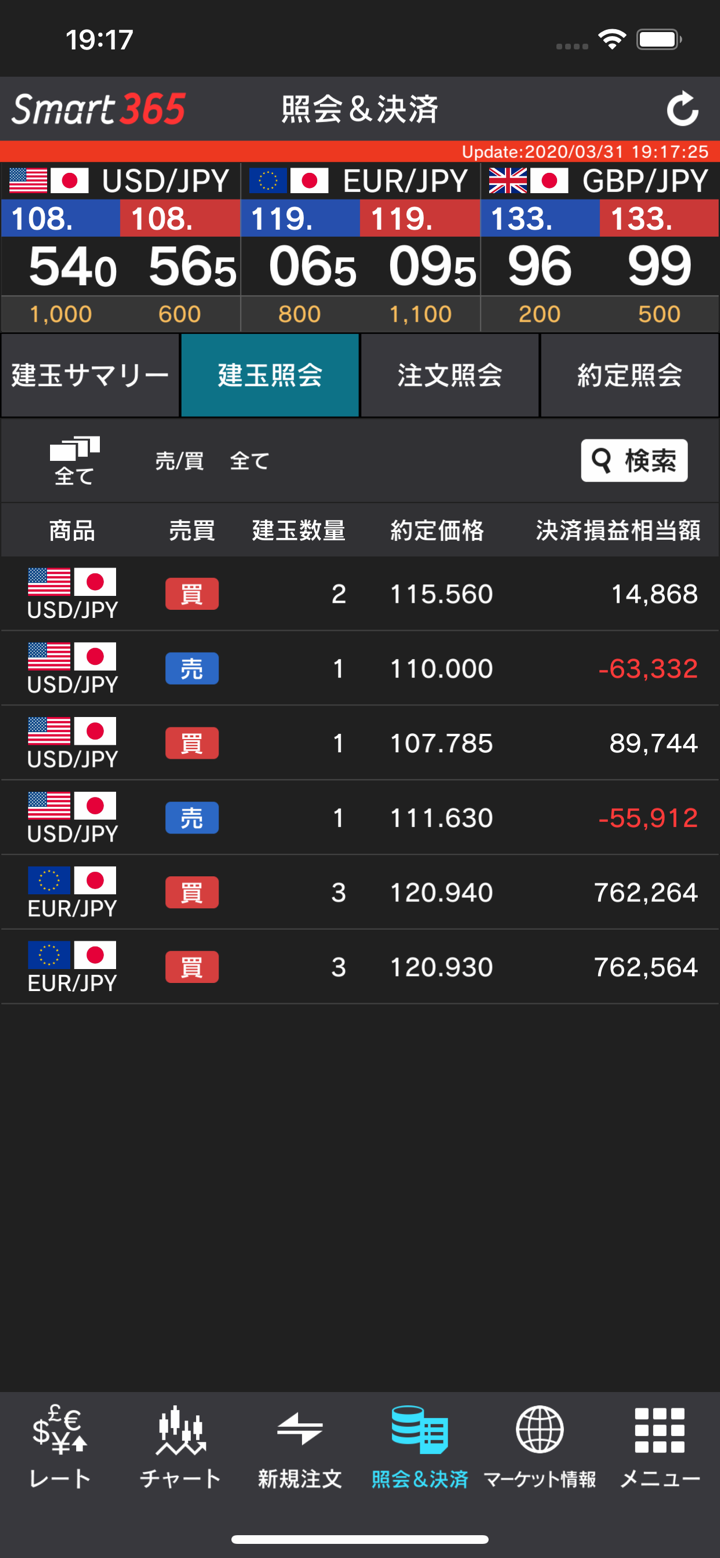

Plataforma de Trading

Click 365 es la plataforma de trading en línea exclusiva de Invast Securities diseñada para inversores minoristas japoneses.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Click 365 | ✔ | Escritorio, Móvil, Web | / |

| MT5 | ❌ | / | Traders experimentados |

| MT4 | ❌ | / | Principiantes |

Depósito y Retiro

Los traders pueden realizar un depósito a través de un mostrador bancario, cajero automático o banca en línea.

- Tarifas paraDepósitos Las tarifas por depositar dinero en tu cuenta de trading serán exentas si utilizas el servicio de depósito instantáneo.

Si no utilizas el servicio de depósito instantáneo y realizas una transferencia regular, serás responsable de la tarifa de transferencia de cada institución financiera.

- Tarifas para Retiros Las tarifas por retiros de tu cuenta de trading serán cubiertas por Invast Securities (sin cargo para ti).

FX3196354740

Hong Kong

Se siente bien, la velocidad de retiro es rápida, la apertura de cuenta es simple y rápida, la operación también es conveniente, solo que la actualización de datos es un poco lenta, la variedad es limitada, porque no es una plataforma local, la comunicación con el servicio al cliente no es tan conveniente, pero el servicio al cliente todavía es muy paciente y confiable.

Positivo

周红玉

Hong Kong

Le doy a este lugar 5 estrellas. Y también lo recomiendo a todos. Seguro que ganará mucho dinero si comienza a operar en este lugar. No hay otra plataforma como esta en el mercado actualmente. No tengo quejas sobre este lugar. He recibido apoyo cada vez que busqué del equipo de servicio al cliente aquí.

Positivo

FX1182046228

Hong Kong

El margen es súper estrecho, y la velocidad de depósito y retiro también es muy rápida. Aunque las opciones todavía son un poco menos, espero mantener la actual y seguir mejorando. ¡Sería aún mejor si pudiera soportar el pago electrónico, para que la transacción sea más conveniente!

Positivo

杰出青年

Hong Kong

Esta empresa japonesa se ve bien, pero lamentablemente no entiendo japonés y siento que sería mejor hacer negocios con una empresa local. ¿Existen empresas similares en Hong Kong? ¿Tienes algún amigo Hui para recomendar?

Positivo