Buod ng kumpanya

| Fidelity Buod ng Pagsusuri | |

| Itinatag | 1969 |

| Rehistradong Bansa/Rehiyon | USA |

| Regulasyon | SFC |

| Mga Produkto at Serbisyo | Global na mutual funds, MPF & ORSO retirement schemes, thematic at multi-asset investment solutions |

| Demo Account | ❌ |

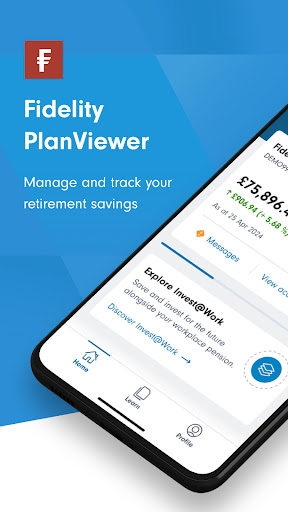

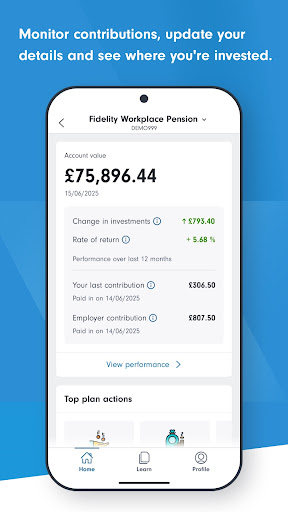

| Platform ng Pagtrade | Fidelity Online, Fidelity Mobile App |

| Minimum Deposit | HK$1,000/buwan (Monthly Investment Plan) |

| Suporta sa Customer | Telepono: (852) 2629 2629 |

| Email: hkenquiry@fil.com | |

Impormasyon Tungkol sa Fidelity

Itinatag noong 1969, ang Fidelity ay isang kumpanyang pinansiyal na nasa ilalim ng regulasyon ng SFC, na nag-aalok ng internasyonal na mga solusyon sa pamumuhunan. Hindi ito nagbibigay ng FX o CFDs, bagkus nakatuon sa mutual funds, retirement plans (MPF/ORSO), at thematic strategies.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Niregulate ng SFC | Walang demo o Islamic (swap-free) account |

| Malawak na pagpipilian ng mutual funds at retirement solutions | Relatibong mataas na bayad |

| Ang tiered fee structure ay nakakabenepisyo sa mga high-balance investors | |

| Mahabang oras ng operasyon | |

| Iba't ibang uri ng account |

Tunay ba ang Fidelity?

Oo, ang Fidelity ay niregulate. Ito ay awtorisado ng Securities and Futures Commission (SFC) ng Hong Kong na may lisensya sa Dealing in futures contracts. Ang numero ng lisensya ay AAG408.

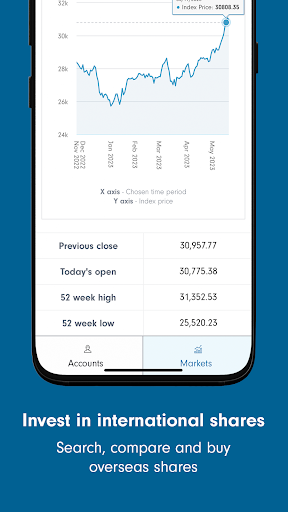

Mga Produkto at Serbisyo

Nag-aalok ang Fidelity ng pandaigdigang mutual funds, retirement schemes (MPF & ORSO), at mga tema ng pamumuhunan upang tugmaan sa mga layunin sa pinansyal ng mga mamumuhunan. Nag-aalok sila ng income creation, sustainable investing, at multi-asset strategies.

| Mga Produkto & Serbisyo | Tampok |

| Mutual Funds | Pandaigdigang pondo sa iba't ibang currencies at asset classes |

| Thematic Investing | Mga pamumuhunan sa pangmatagalang batayan sa pandaigdigang mga trend at tema ng innovasyon |

| Multi-Asset Solutions | Diversified portfolios na nagpapagsama ng iba't ibang uri ng asset |

| Sustainable Investing | Nakatuon sa ESG at responsable na mga pamamaraan ng pamumuhunan |

| MPF (Mandatory Provident Fund) | Mga pondo sa pagreretiro na naayon sa iba't ibang risk at income profiles |

| ORSO (Occupational Retirement Schemes Ordinance) | Mga plano ng pamumuhunan sa pagreretiro na itinataguyod ng employer |

| Income Strategies | Pandaigdigang mga pagpipilian sa pamumuhunan na nakatuon sa kita |

| Asia-Focused Investments | Mga pondo na tumutok sa mga pagkakataon sa paglago sa mga merkado sa Asya |

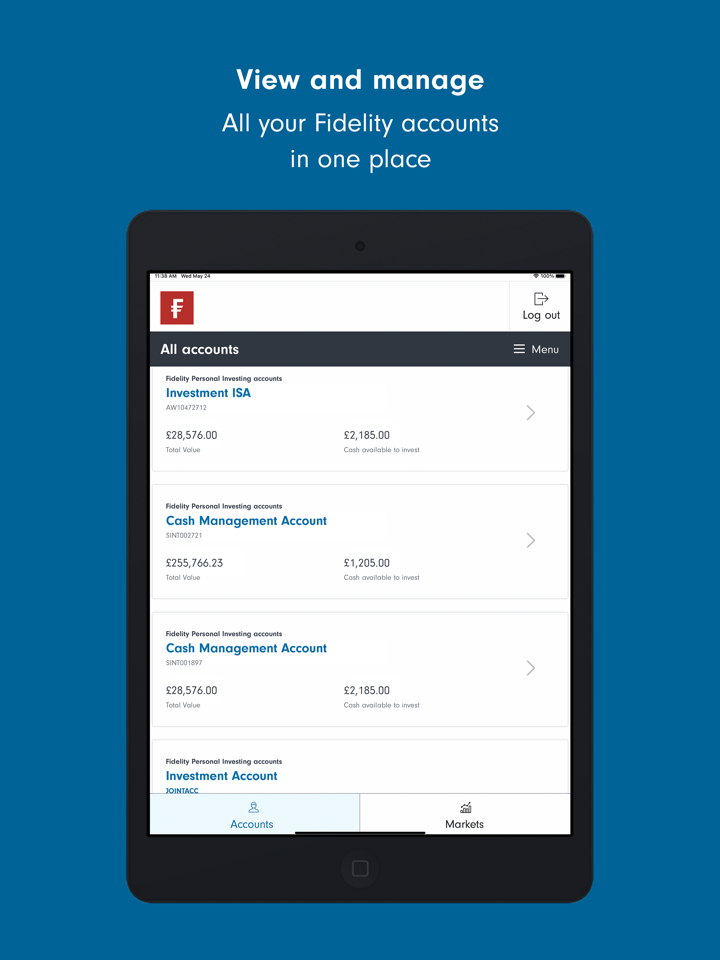

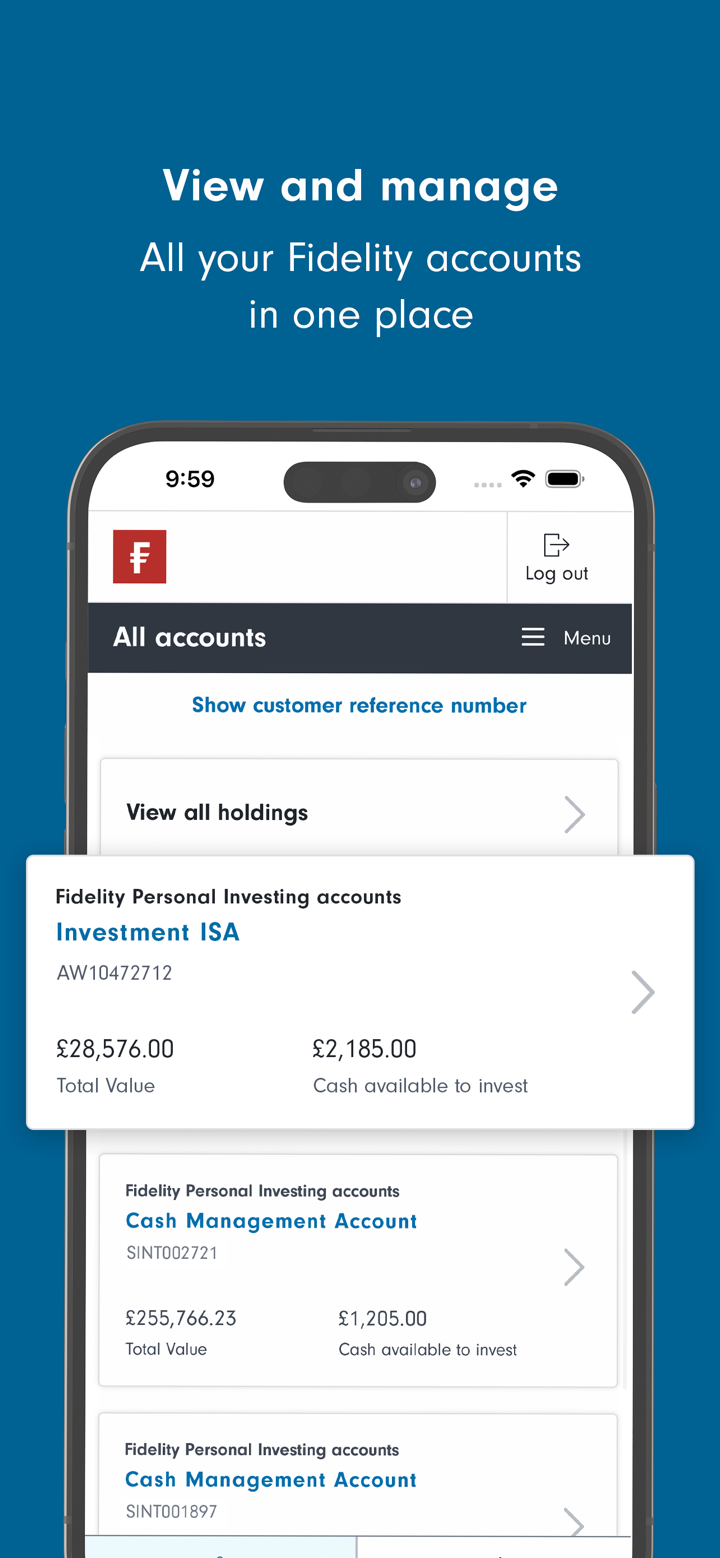

Uri ng Account

Fidelity nag-aalok ng apat na uri ng live accounts: Personal Investors, MPF/ORSO members, Intermediaries, at Institutional Investors. Walang demo o Islamic (swap-free) accounts na available.

| Uri ng Account | Angkop para sa |

| Personal Investors | Mga indibidwal na namamahala ng kanilang mga investment |

| MPF / ORSO Accounts | Mga empleyado at mga employer sa ilalim ng mga retirement schemes sa Hong Kong |

| Intermediaries | Mga tagapayo, taga-pamahala ng yaman, at mga financial consultant |

| Institutional Investors | Mga institusyon tulad ng mga pension, korporasyon, at family offices |

Mga Bayad ng Fidelity

Ang mga bayad ng Fidelity ay sumusunod sa isang tiered structure—ang mas malalaking halaga ng investment ay may mas mababang bayad, habang ang mas maliit na mga investment ay may mas mataas na bayad. Sa kabuuan, ang istraktura ng gastos nito ay katamtaman hanggang mataas ayon sa pamantayan ng industriya.

| Pamamaraan ng Investment | Uri ng Bayad | Investment Balance (USD) | Pondo sa Cash | Pondo sa Bond | Pondo sa Equity & Iba Pang Pondo |

| Lump Sum Investment | Sales Charge | >= 1,000,000 | 0.00% | 0.30% | 0.60% |

| 500,000 – <1,000,000 | 0.45% | 0.90% | |||

| 250,000 – <500,000 | 0.60% | 1.20% | |||

| 100,000 – <250,000 | 0.75% | 1.50% | |||

| 50,000 – <100,000 | 1.05% | 2.10% | |||

| <50,000 | 1.50% | 3.00% | |||

| Switching Fee | >= 1,000,000 | 0.10% | - | ||

| 500,000 – <1,000,000 | 0.15% | - | |||

| 250,000 – <500,000 | 0.20% | - | |||

| 100,000 – <250,000 | 0.25% | - | |||

| 50,000 – <100,000 | 0.35% | - | |||

| <50,000 | 0.50% | - | |||

| Buwang Investment Plan | Sales Charge | | 1.00% | - | - | |

| >=HK$20,000/buwan | 0.00% | - | - |

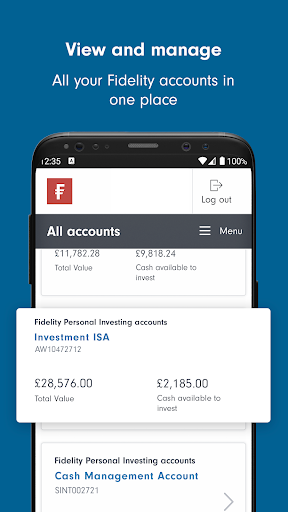

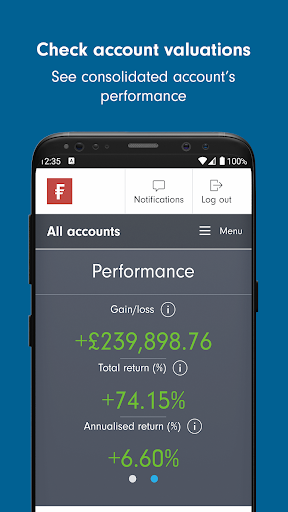

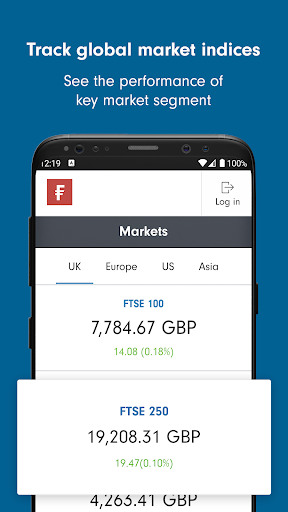

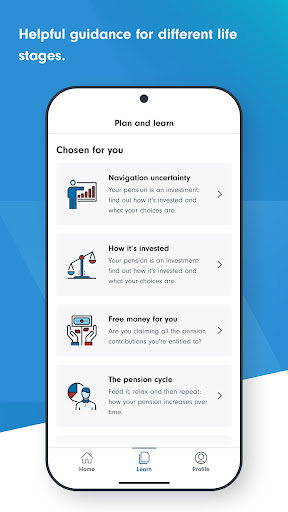

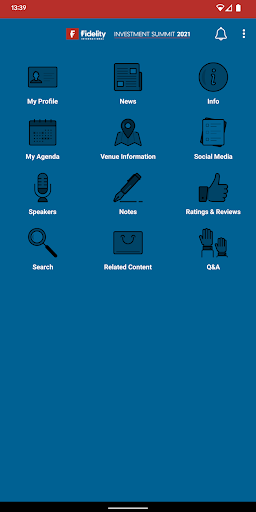

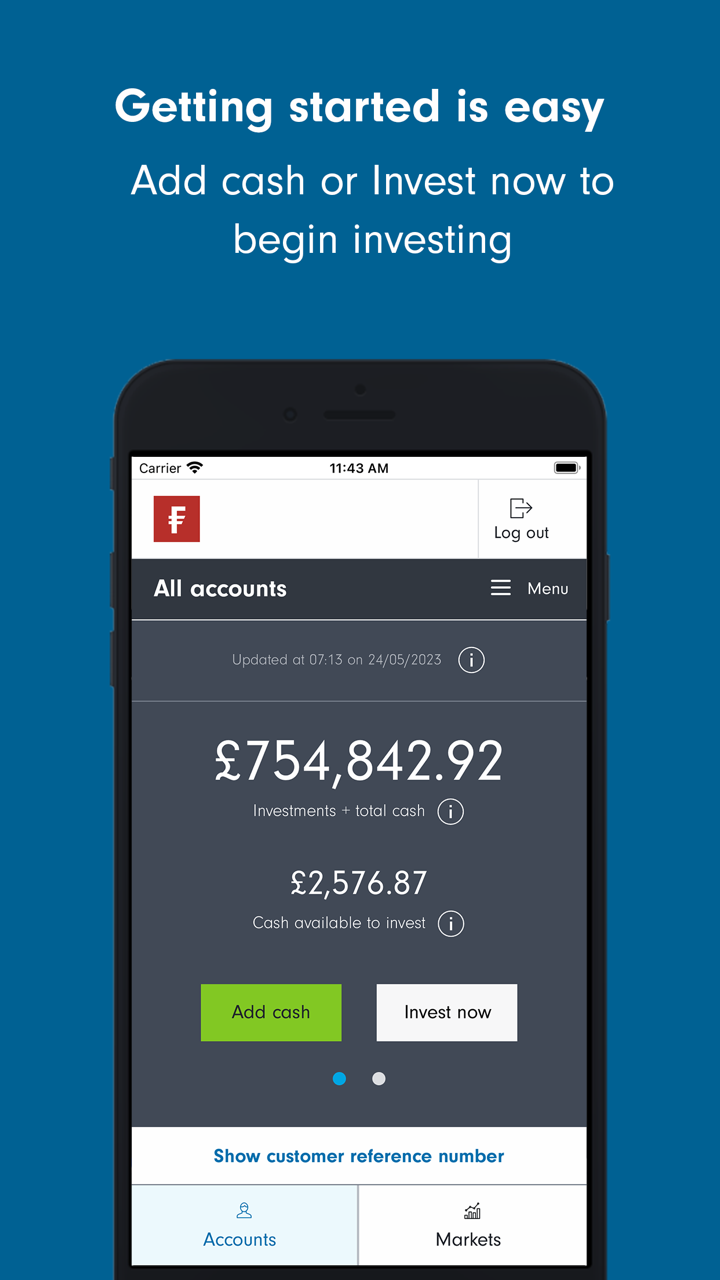

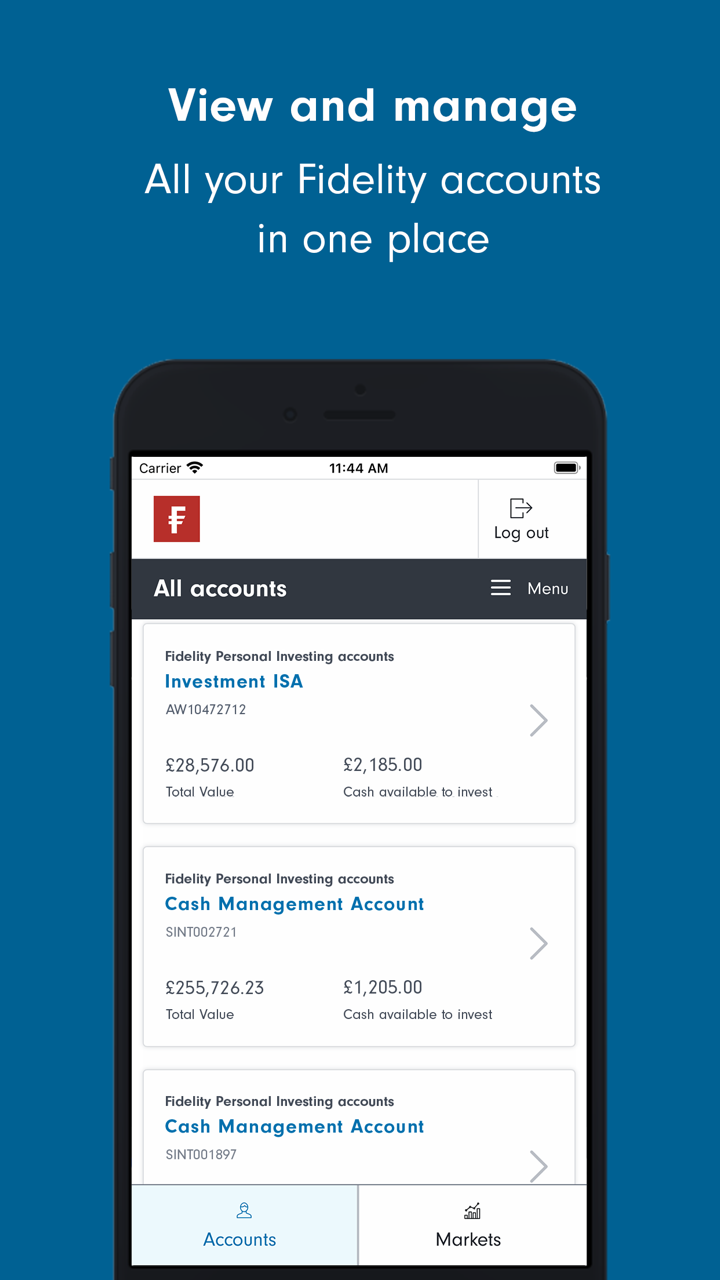

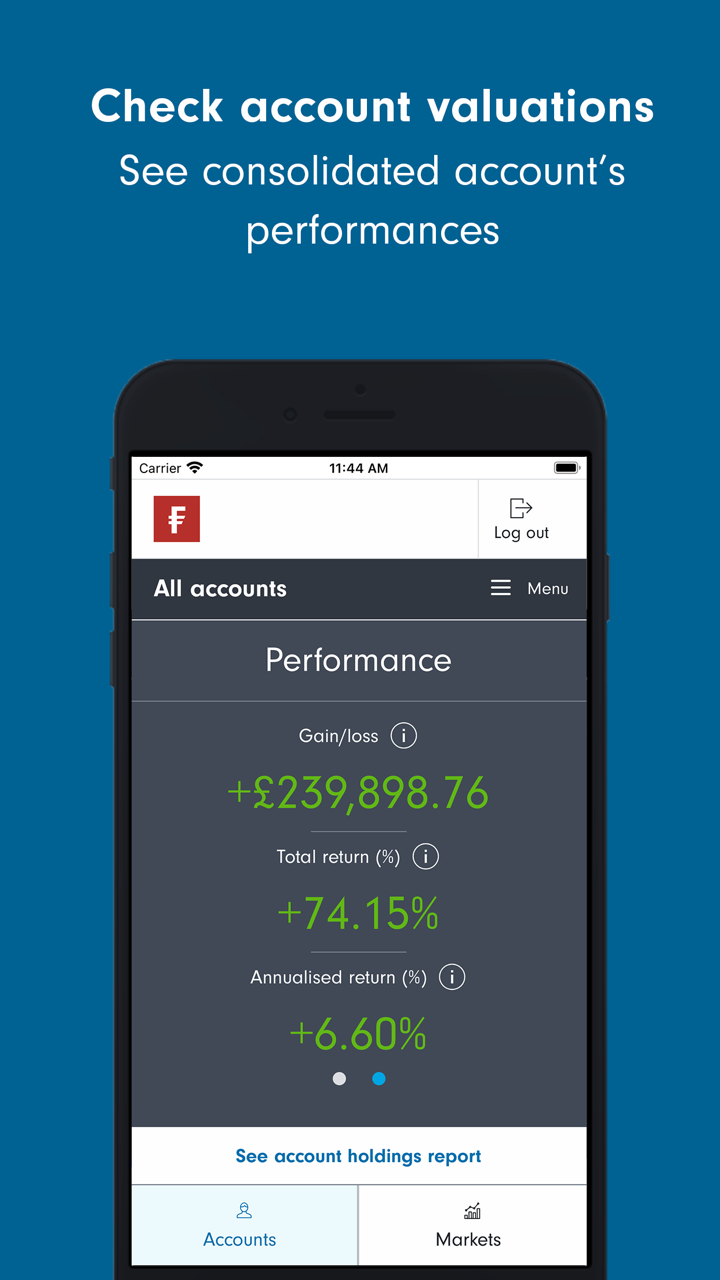

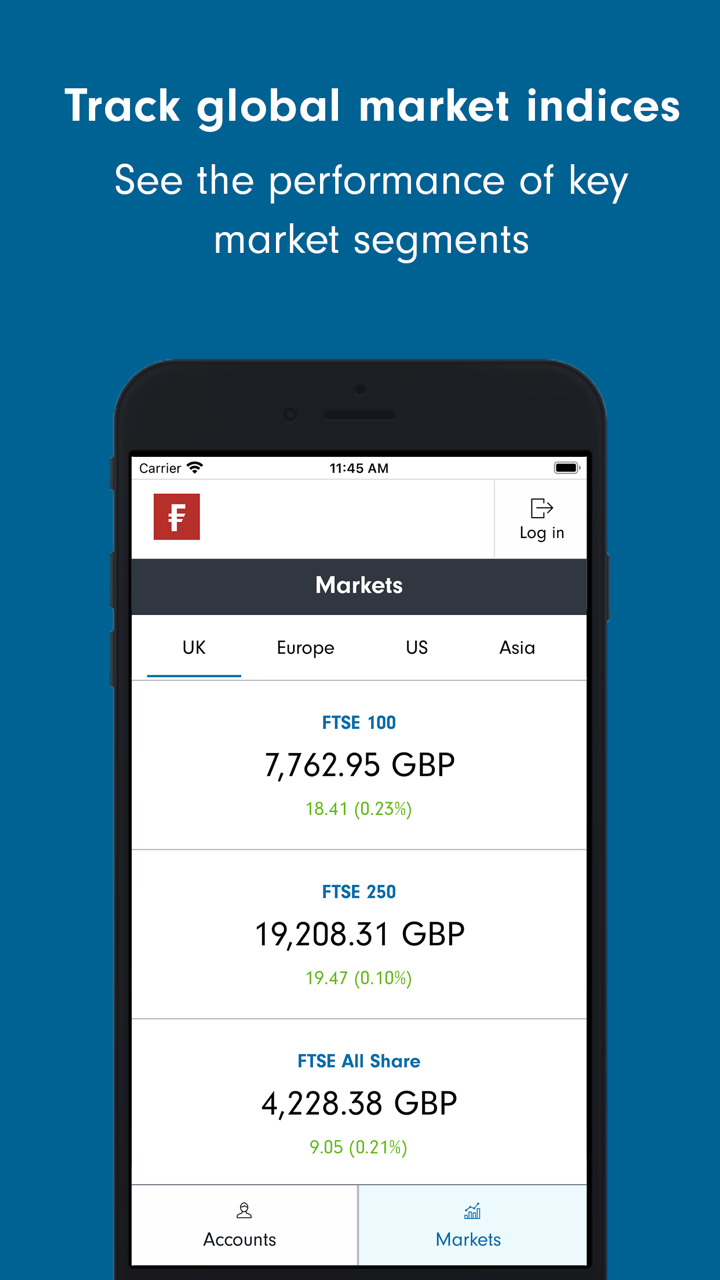

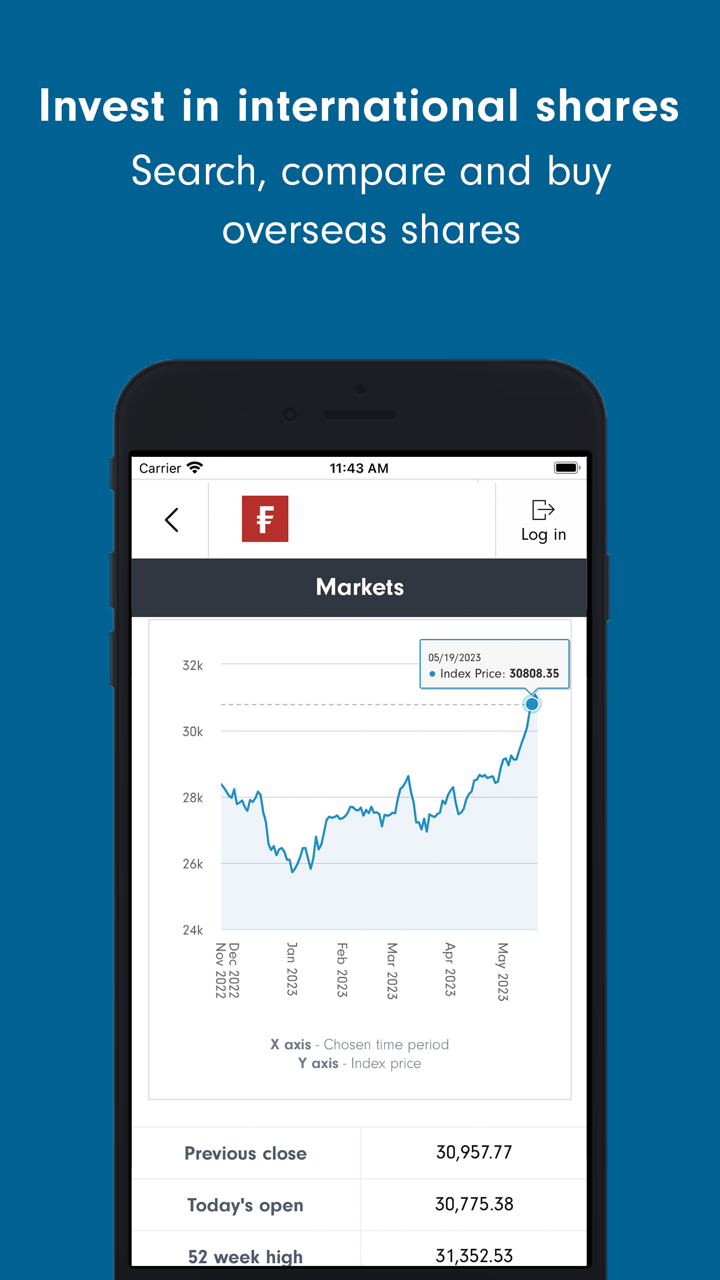

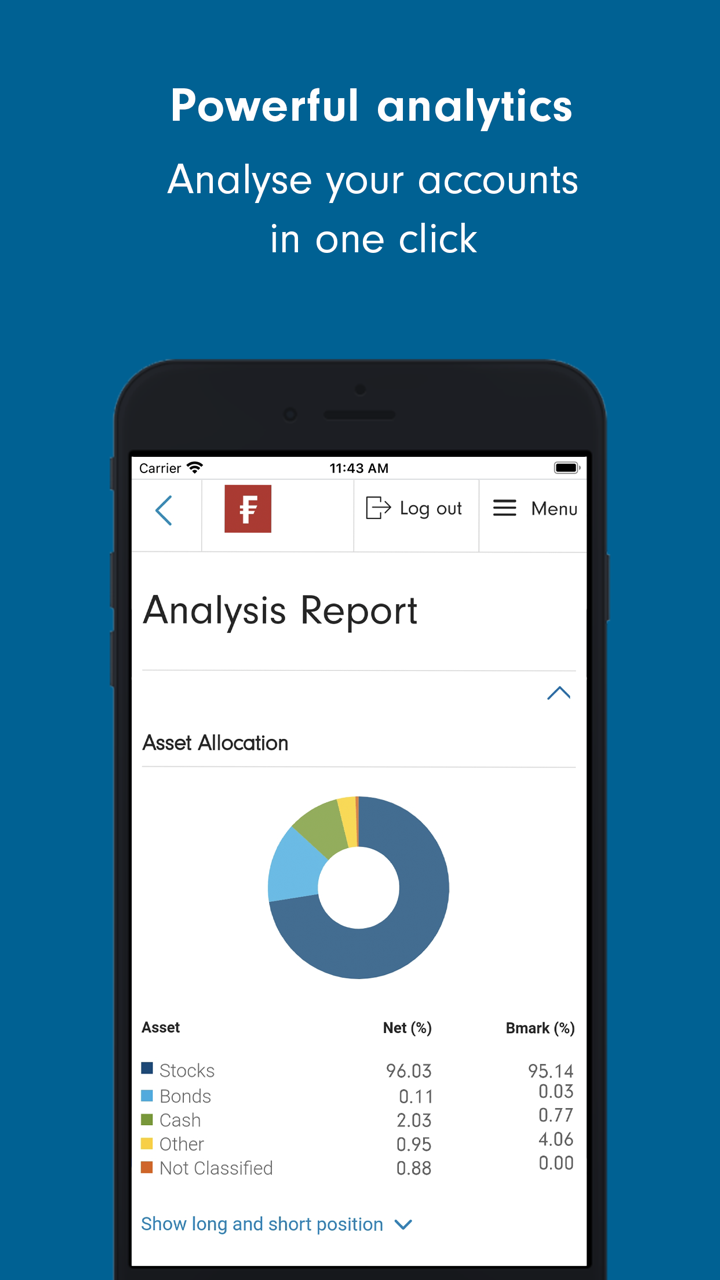

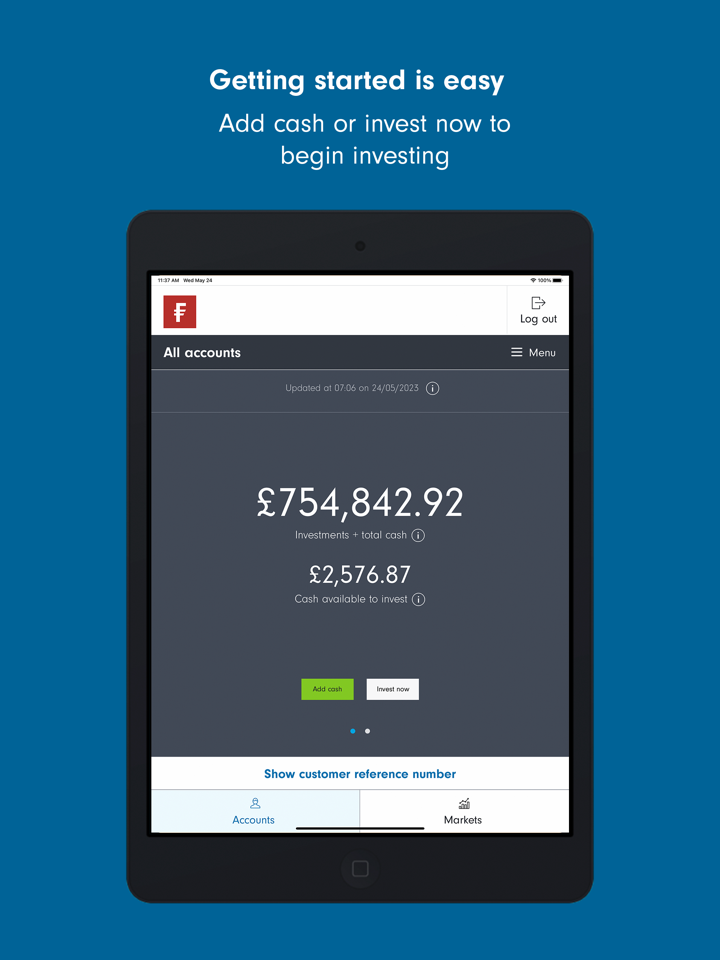

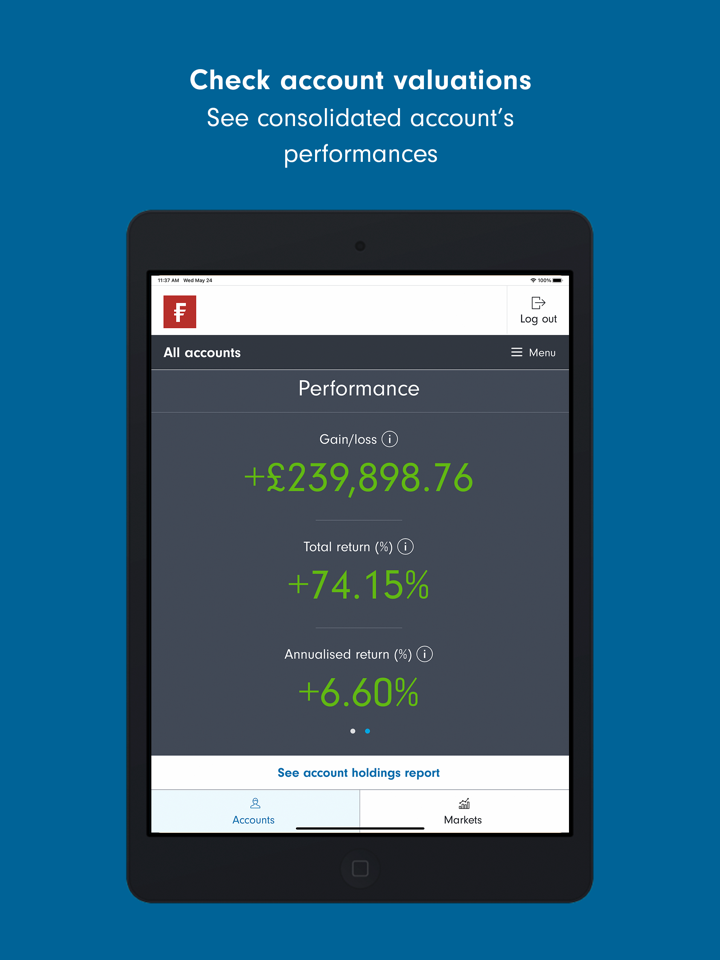

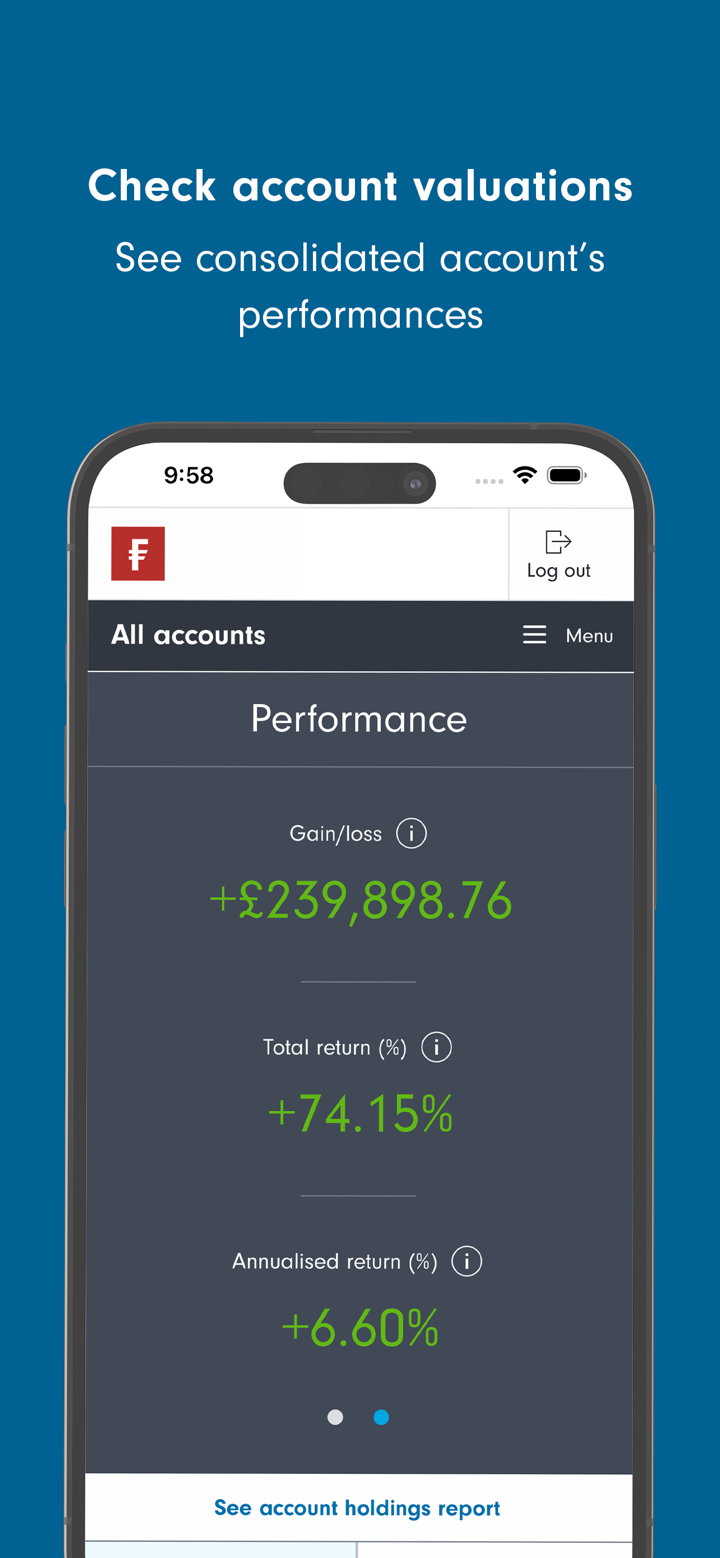

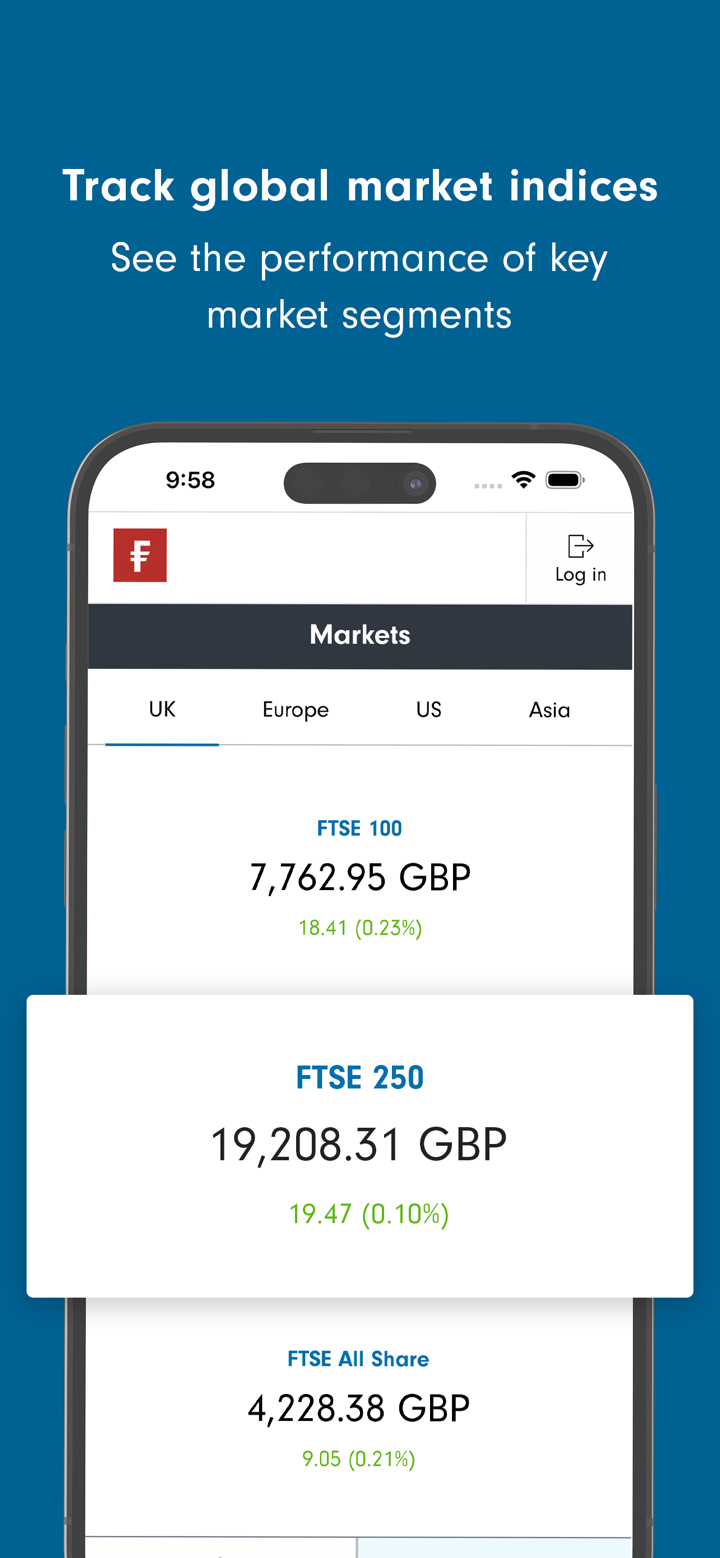

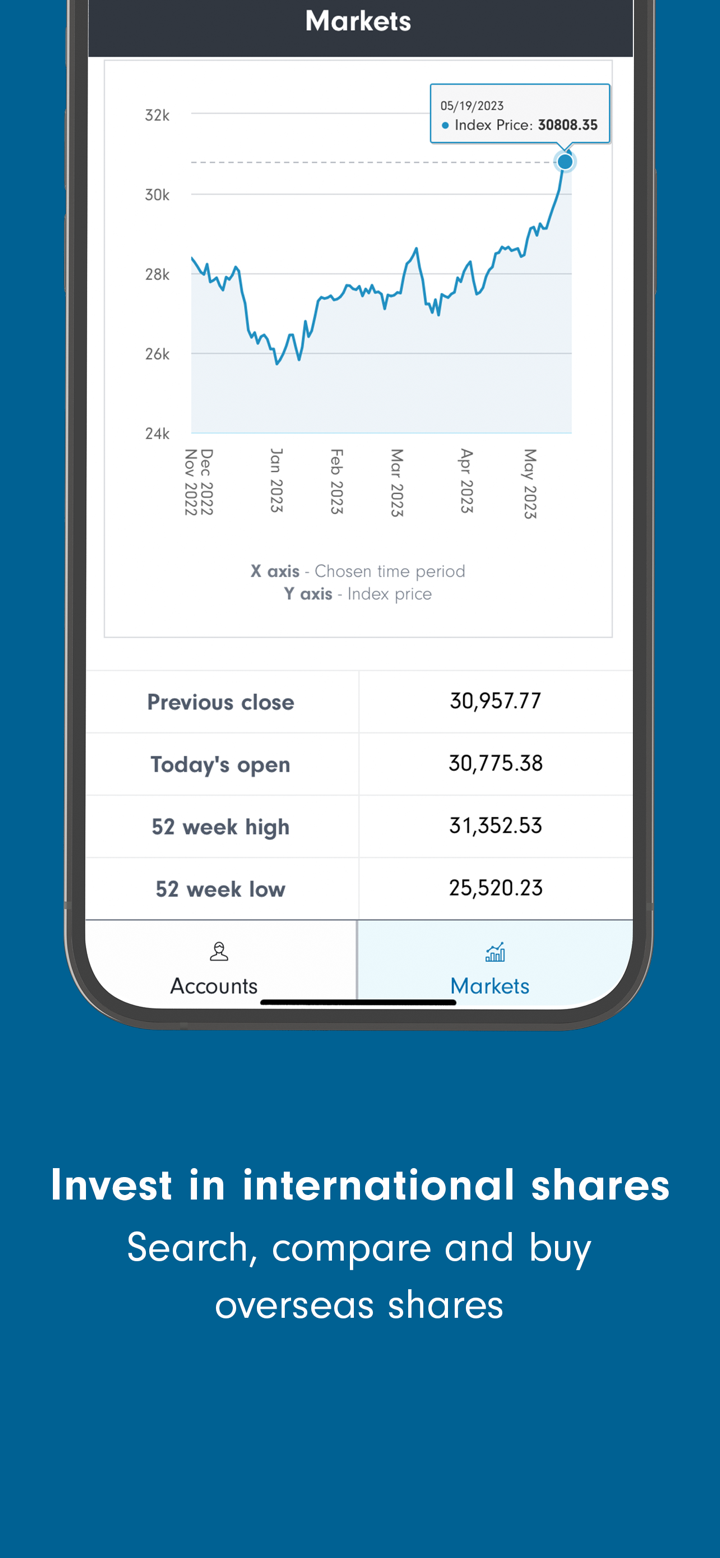

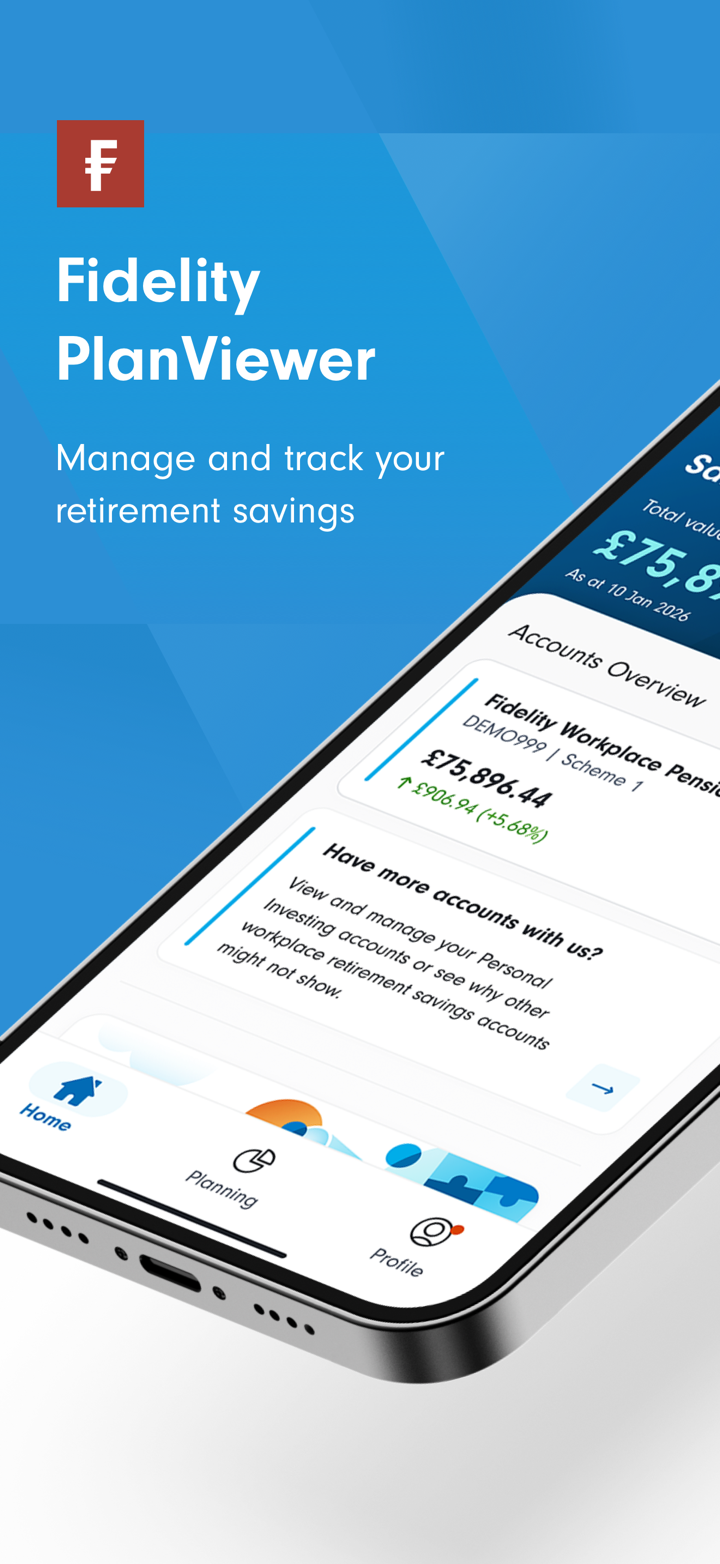

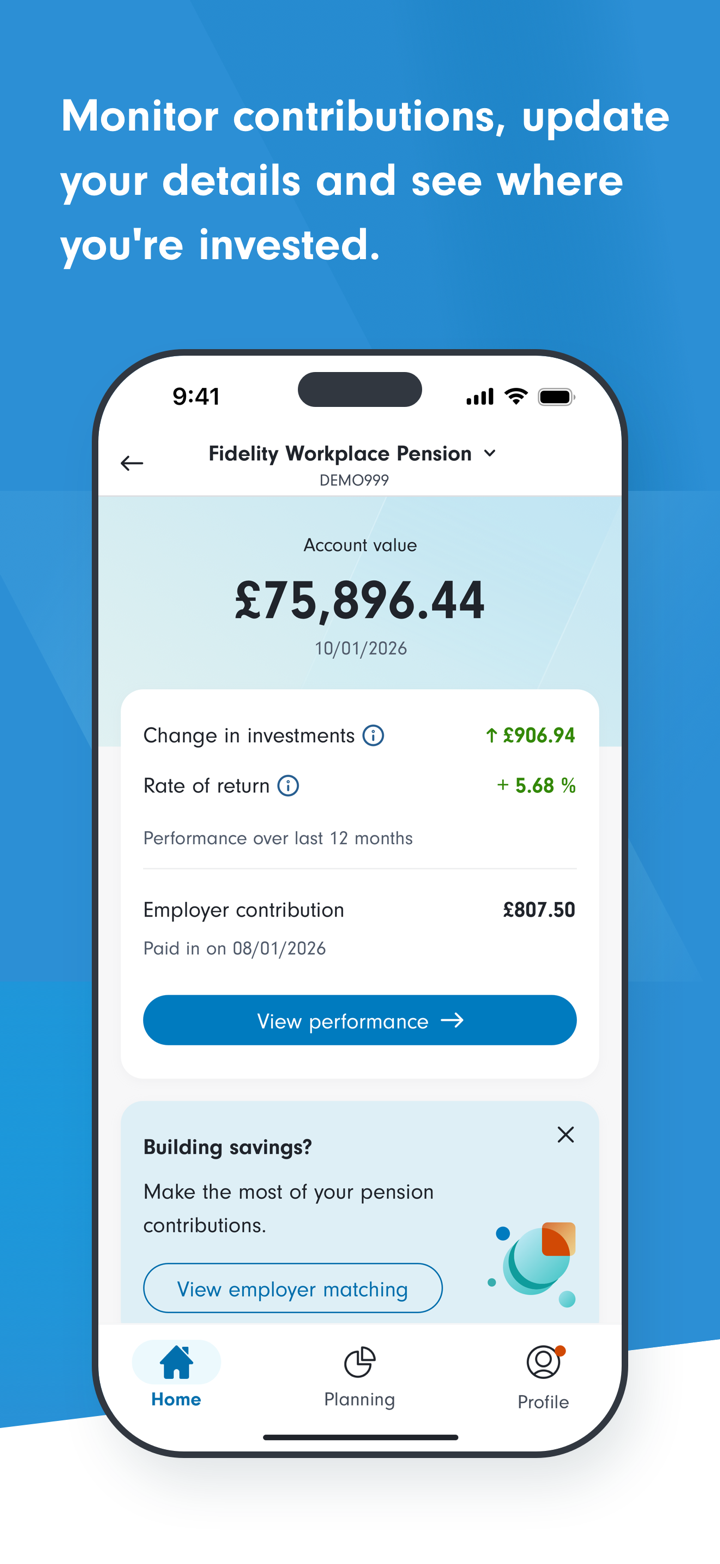

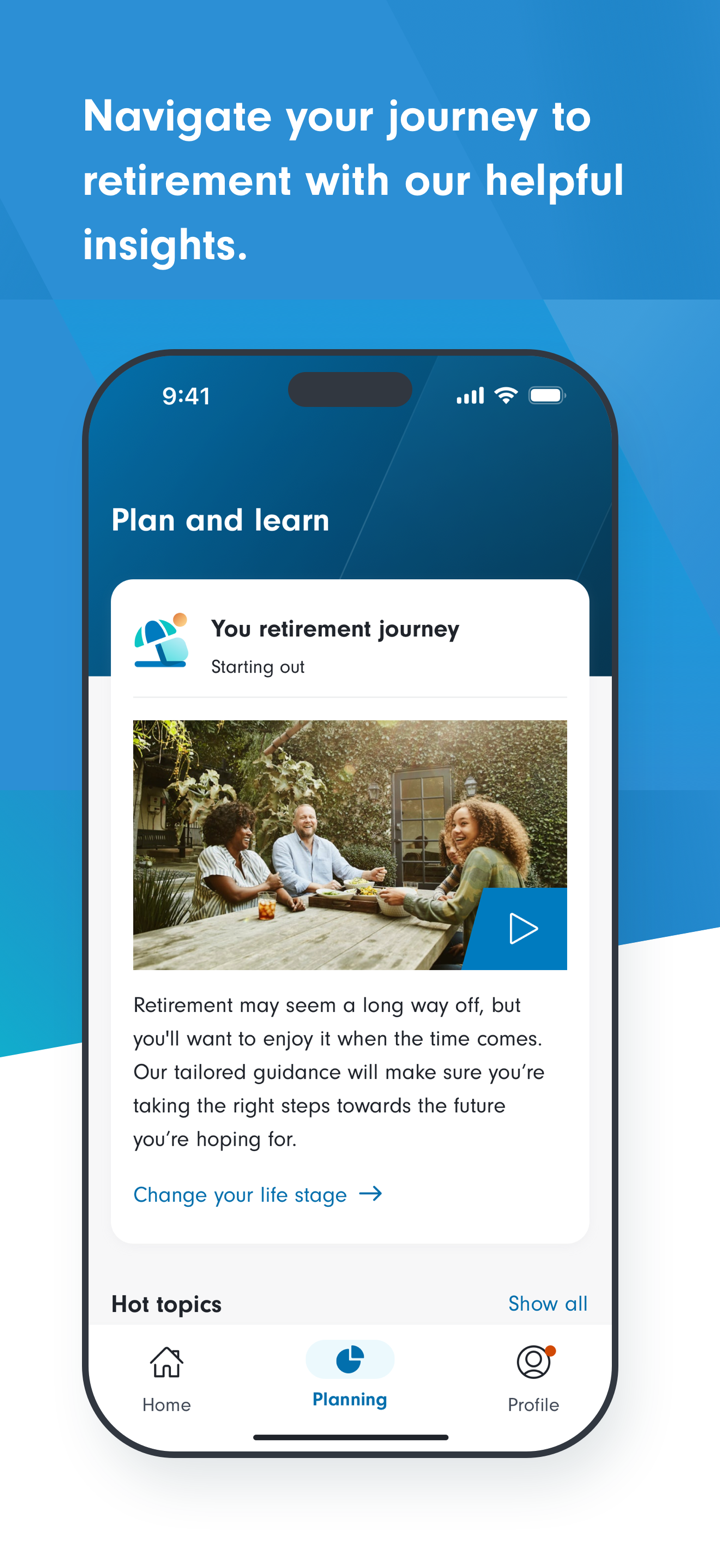

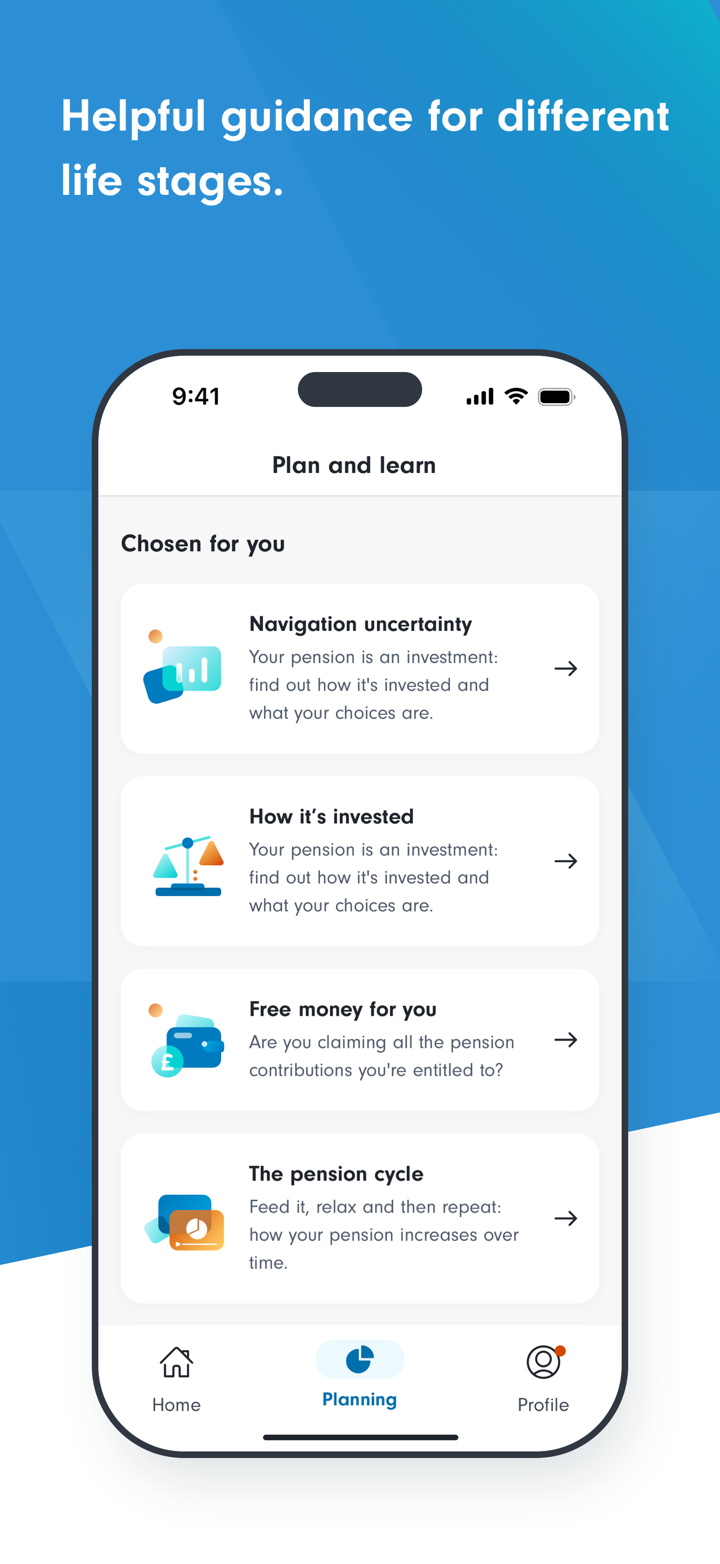

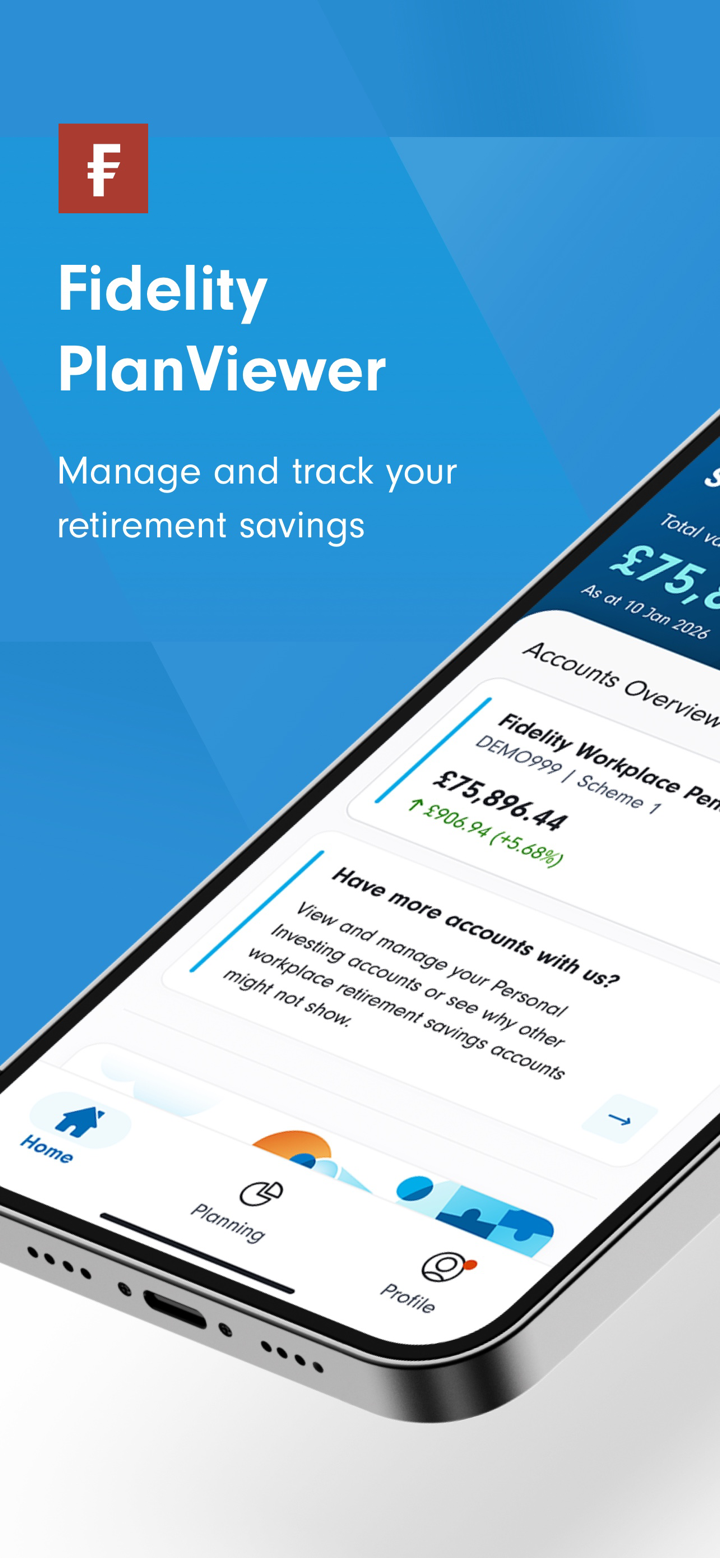

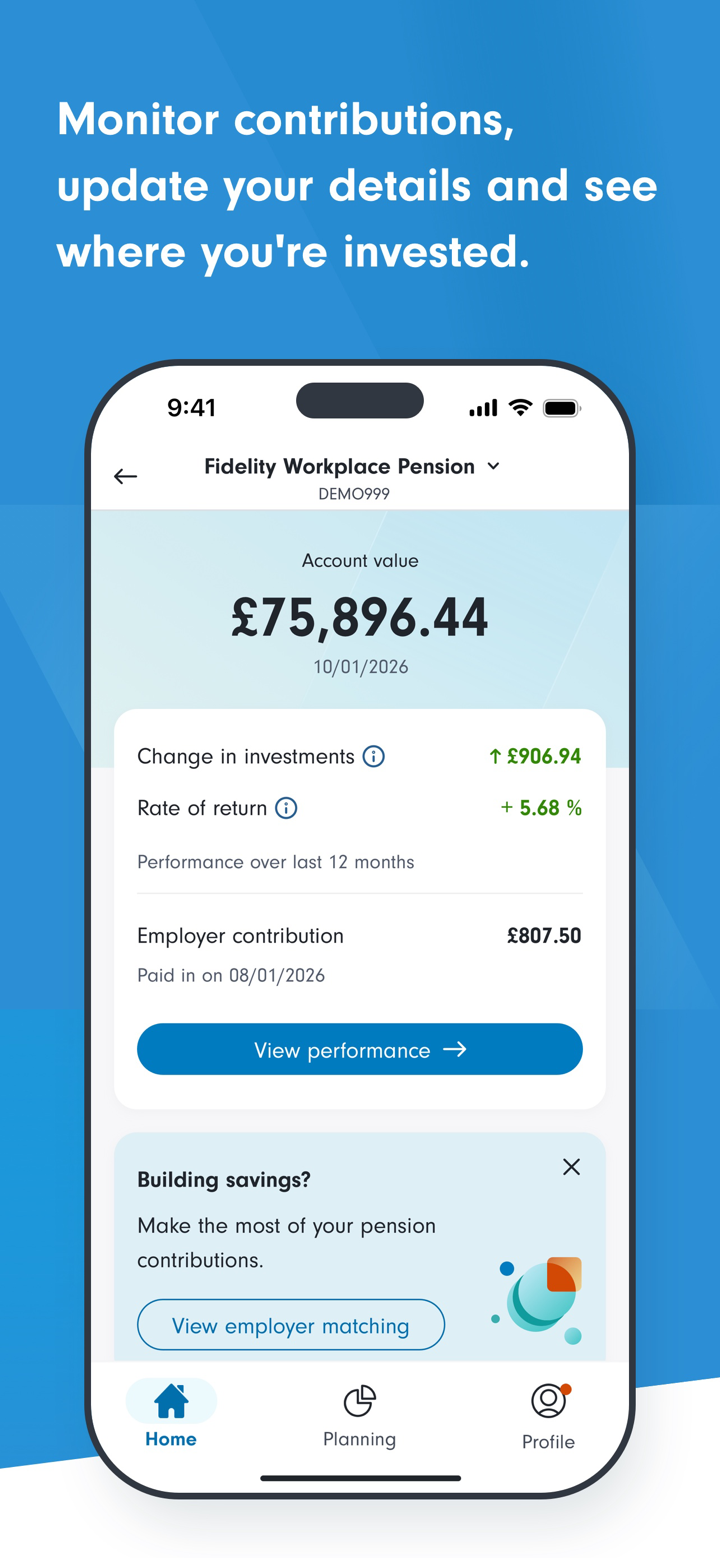

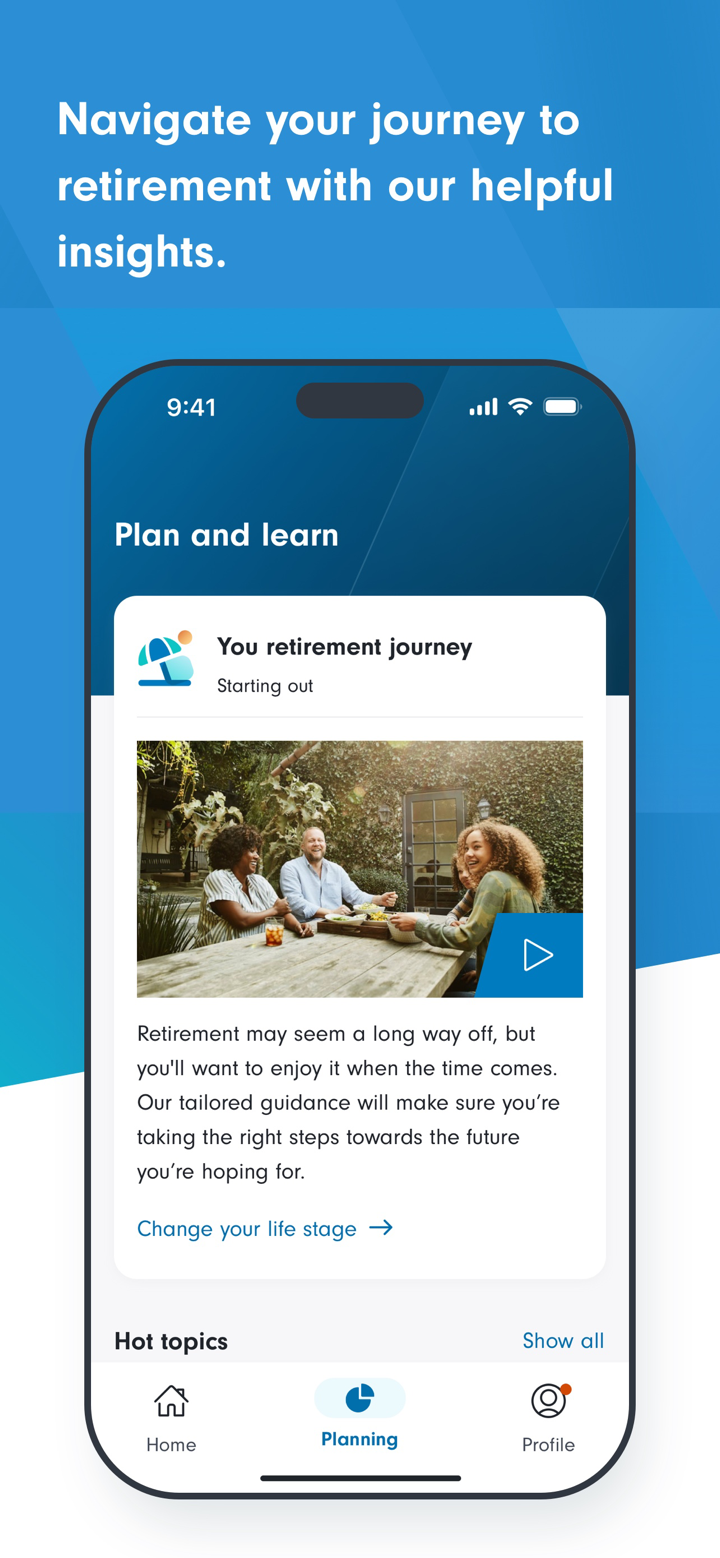

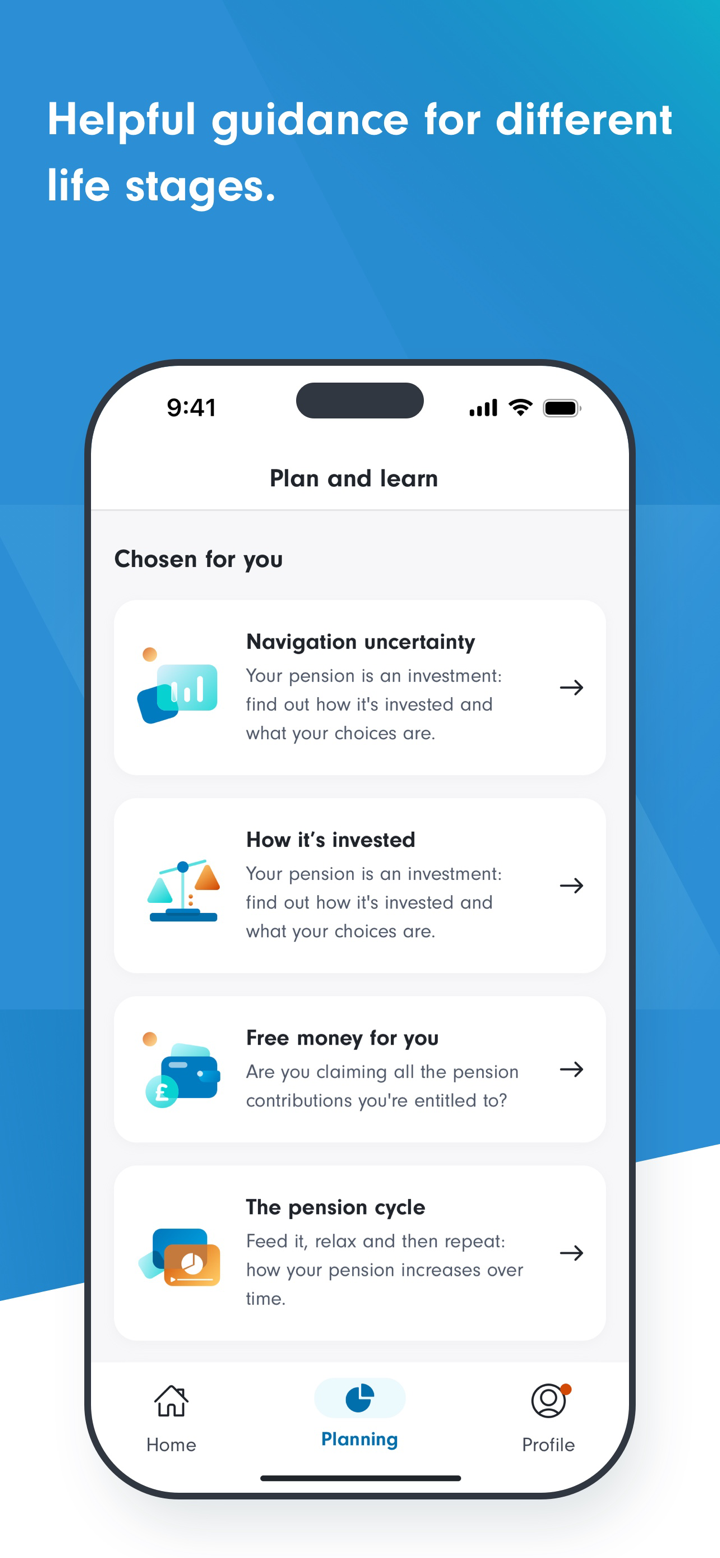

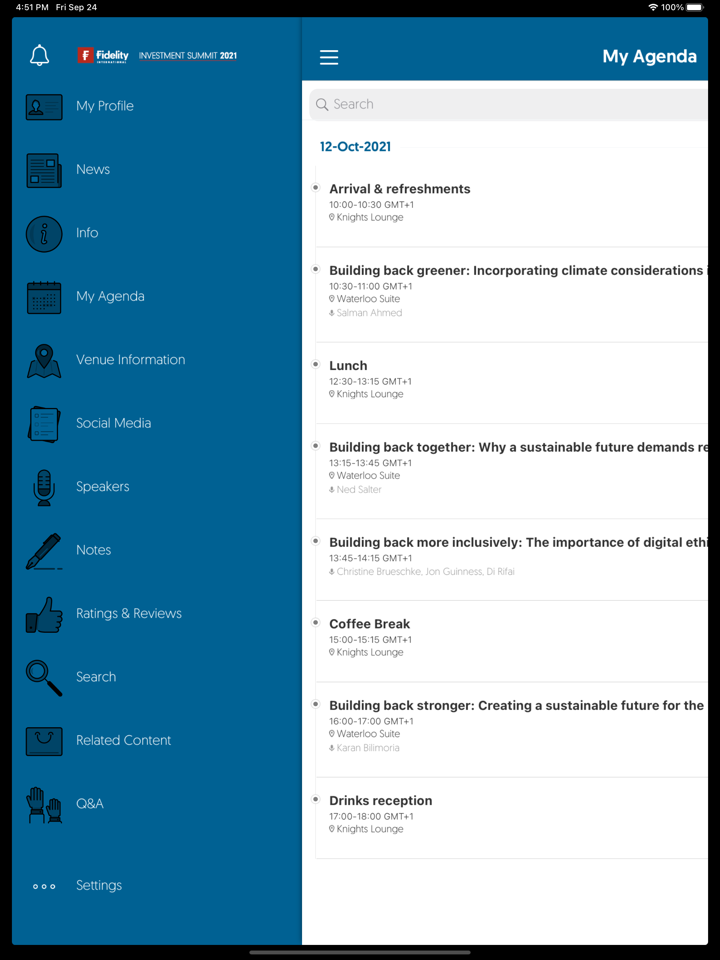

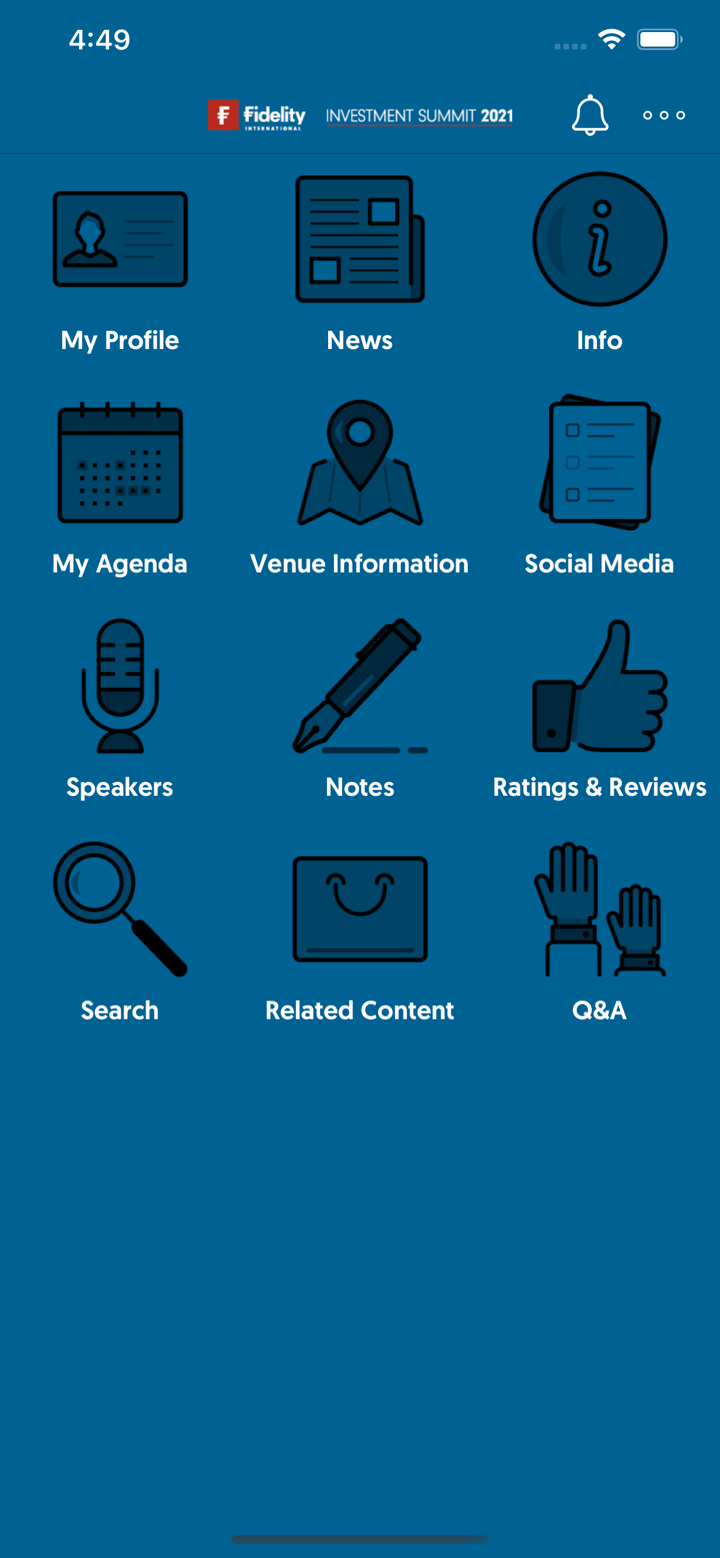

Platform ng Pagtetrade

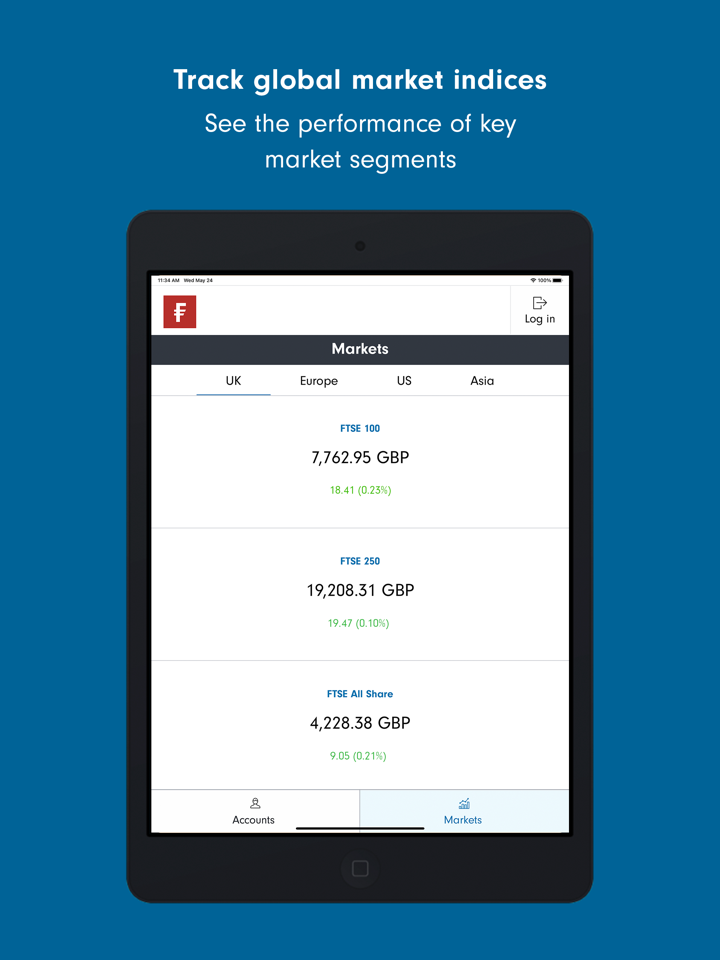

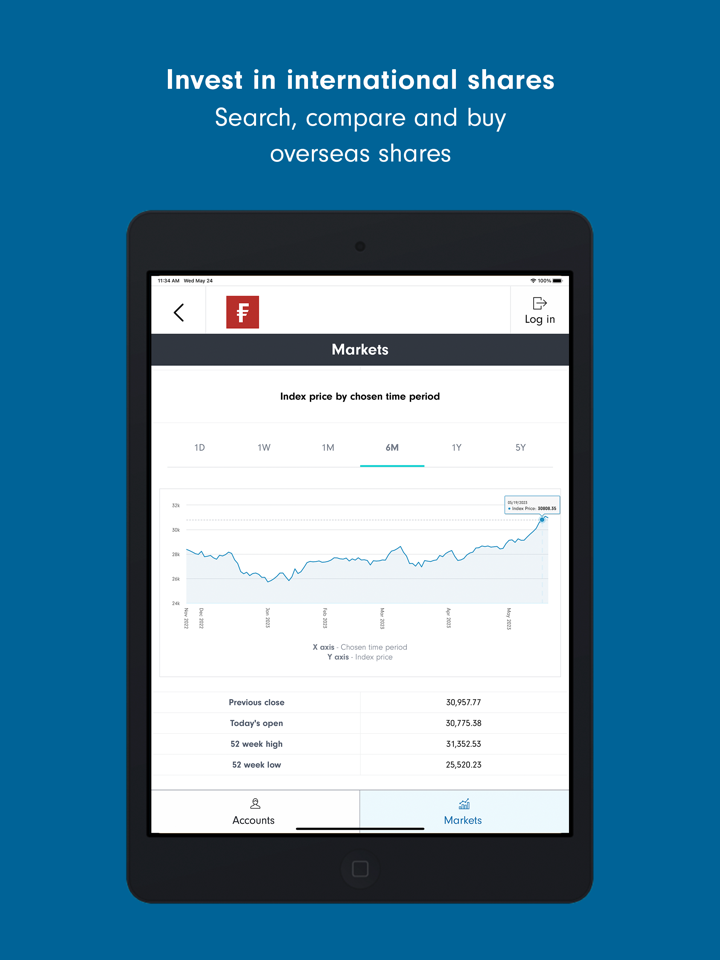

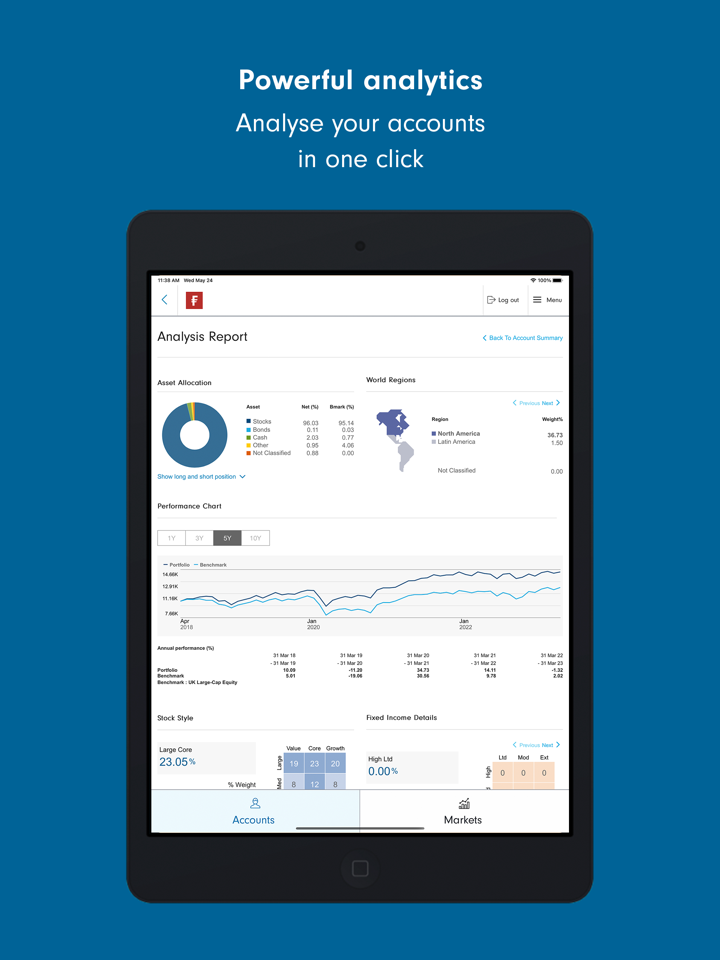

| Platform ng Pagtetrade | Supported | Available Devices | Angkop para sa |

| Fidelity Online | ✔ | Web (PC, Mac) | Long-term investors managing portfolios online |

| Fidelity Mobile App | ✔ | iOS, Android | Investors needing on-the-go portfolio access |

Deposito at Pagwiwithdraw

Fidelity ay hindi naniningil ng karagdagang bayad para sa mga pamantayang paraan ng pagdedeposito o pagwiwithdraw . Gayunpaman, maaaring magkaroon ng bayad mula sa bangko o intermediary depende sa ginamit na paraan. Ang minimum na deposito ay HK$1,000 bawat pondo bawat buwan para sa Monthly Investment Plans; walang partikular na minimum na nakasaad para sa lump sum investments.

| Pamamaraan ng Pagbabayad | Minimum Halaga | Mga Bayad | Oras ng Paghahandle |

| Telegraphic Transfer | / | Mga bayad mula sa bangko/intermediary | Sa pagtanggap ng malinaw na pondo |

| HSBC Bill Payment (Internet Banking) | / | ❌ (maliban sa bayad ng ahente) | Agad |

| Bank Draft / Cashier Order | / | Mga bayad mula sa ahente ng bangko | |

| HSBC / Hang Seng Same-Day Direct Debit | / | ❌ (ang kakulangan sa pondo ay maaaring magdulot ng bayad mula sa bangko) | |

| Personal Cheque (HK cleared) | HK$1,000,000 o mas mababa | ❌ | |

| Personal Cheque (non-HK cleared) | / | Maaaring magkaroon ng bayad sa koleksyon | Matapos ang paglilinaw |