Présentation de l'entreprise

| Travelex Résumé de l'examen | |

| Fondé | 1976 |

| Pays/Région Enregistré | Australie |

| Régulation | ASIC |

| Produits & Services | Devises, carte de voyage, assurance voyage |

| Compte de Démo | ❌ |

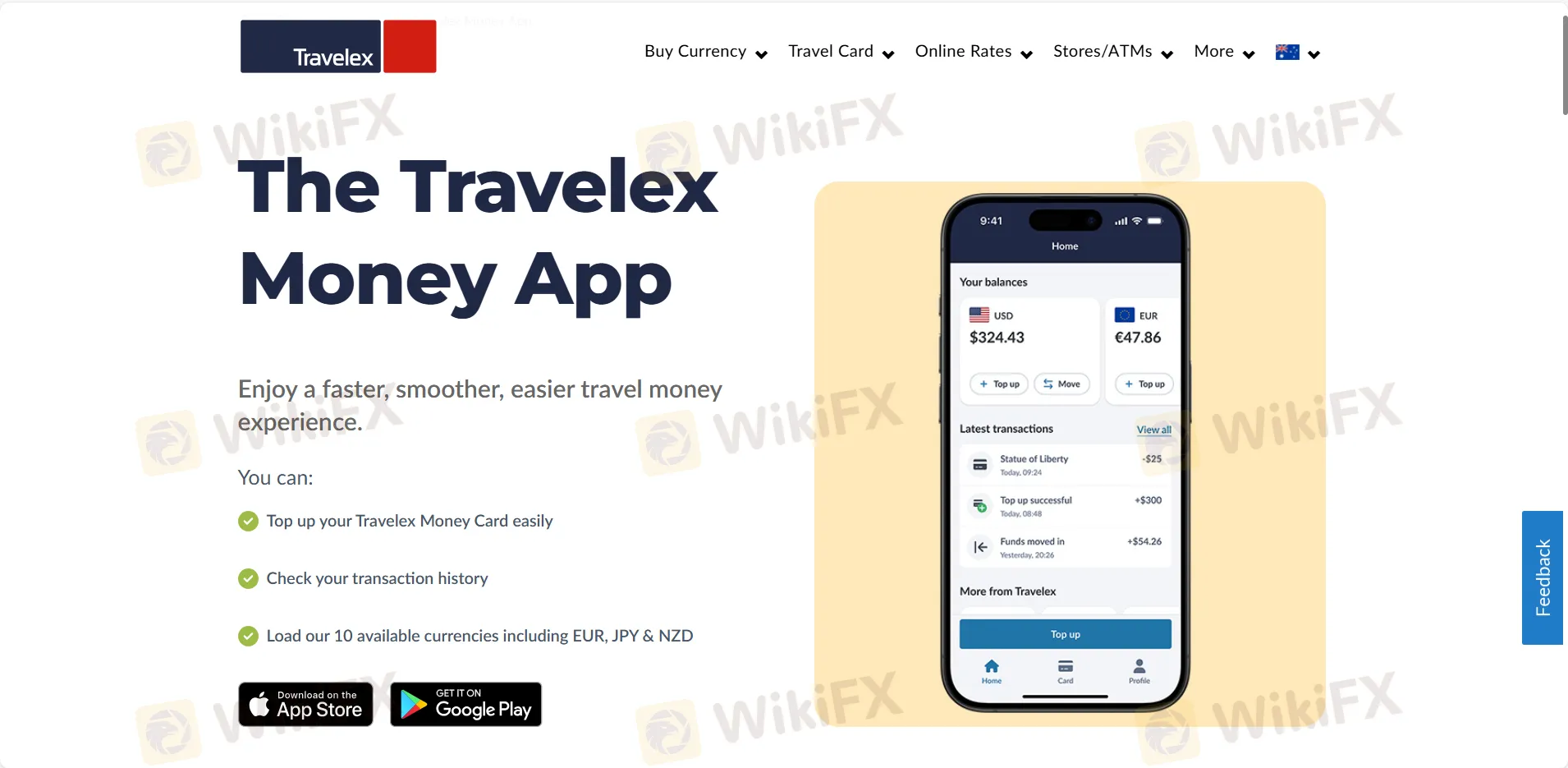

| Plateforme de Trading | Travelex Money APP, Travelex web |

| Dépôt Minimum | AUD 100 |

| Support Client | Support 24/7 |

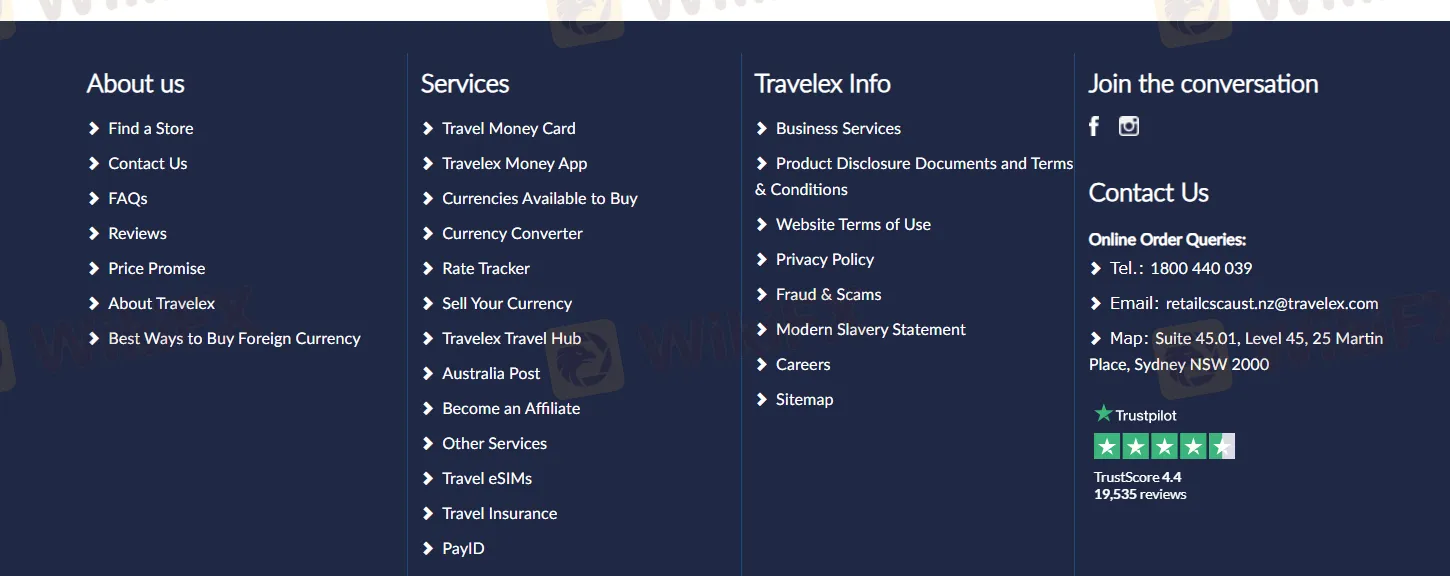

| Tél : 1800 440 039 | |

| Email : retailcscaust.nz@travelex.com | |

| Adresse : Suite 45.01, Niveau 45, 25 Martin Place, Sydney NSW 2000 | |

| Facebook, Instagram | |

Informations sur Travelex

Travelex est un fournisseur de services réglementé de premier plan en courtage et services financiers, fondé en Australie en 1976. Il propose des produits et services pour les devises, les cartes de voyage et l'assurance voyage.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Temps d'opération long | Frais de commission facturés |

| Divers canaux de contact | |

| Bien réglementé | |

| Diverses options de paiement |

Travelex est-il Légitime ?

Oui. Travelex est agréé par la Commission australienne des valeurs mobilières et des investissements pour offrir des services. Son numéro de licence est 000222444. La Commission australienne des valeurs mobilières et des investissements (ASIC) est un organisme gouvernemental australien indépendant qui agit en tant que régulateur des sociétés australiennes, créé le 1er juillet 1998 suite aux recommandations de l'enquête Wallis.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| Commission australienne des valeurs mobilières et des investissements (ASIC) | Régulé | Travelex Limited | Teneur de Marché (MM) | 000222444 |

Produits et Services

| Produits & Services | Pris en Charge |

| Devises | ✔ |

| Carte de Voyage | ✔ |

| Assurance Voyage | ✔ |

Frais Travelex

| Type de Frais | Montant |

| Frais de Carte Initiale (facturés au moment de l'achat) | En Ligne : GRATUIT via travelex.com.au ou l'Application Travelex Money |

| En Magasin : GRATUIT pour les chargements de devises étrangères (les chargements en AUD entraînent des frais de 1,1 % du montant ou 15 $, le montant le plus élevé étant retenu) | |

| Frais de Recharge | En Ligne : GRATUIT via travelex.com.au ou l'Application Travelex Money |

| En Magasin : GRATUIT pour les recharges de devises étrangères (les recharges en AUD entraînent des frais de 1,1 % du montant ou 15 $, le montant le plus élevé étant retenu) | |

| BPAY : Les recharges effectuées en dehors de travelex.com.au ou de l'Application Travelex Money entraînent des frais de 1 % du montant | |

| Frais de Remplacement de Carte | ❌ |

| Frais de Retrait et de Paiement par Carte Internationale (hors Australie) | GRATUIT (Remarque : certains opérateurs de distributeurs automatiques de billets peuvent facturer leurs propres frais ou fixer leurs propres limites) |

| Frais de Retrait et de Paiement par Carte Domestique - lorsque vous utilisez votre carte pour effectuer un retrait ou un achat en Australie et que vous avez de l'argent en AU$ sur votre carte (pour plus de détails, reportez-vous à la clause 9.4 des Conditions Générales) | |

| Frais de Retrait au Comptoir (lorsque de l'argent est retiré au guichet) | ❌ |

| Frais d'Inactivité Mensuels : Facturés au début de chaque mois si vous n'avez effectué aucune transaction sur la carte au cours des 12 derniers mois, sauf si votre carte est réutilisée ou rechargée. Ces frais s'appliquent chaque mois jusqu'à ce que la carte soit fermée ou que le solde restant soit inférieur aux frais d'inactivité. | AU$4.00 par mois |

| Assistance d'Urgence Globale 24/7 | ❌ |

| Frais de Fermeture/Retrait : Facturés lorsque vous fermez votre carte ou retirez des fonds de votre Fonds de Carte. Ces frais sont fixés et facturés par Mastercard Prépayé. | AU$10.00 |

| Taux de Change de Devises : Appliqué lorsque vous transférez vos fonds d'une devise à une autre. | Au taux de change de détail applicable déterminé par nous. Le courtier vous informera du taux qui s'appliquera au moment où vous allouez vos fonds d'une devise à une autre. |

| Frais de Conversion de Devises : Appliqués lorsqu'un achat ou un retrait au distributeur automatique est effectué dans une devise non chargée ou insuffisante pour effectuer la transaction et le coût est imputé à la devise utilisée pour financer la transaction. | GRATUIT (Le Taux de Dépense s'appliquera aux transactions de change conformément aux Conditions Générales) |

Plateforme de Trading

| Plateforme de Trading | Pris en Charge | Appareils Disponibles |

| L'Application Travelex Money | ✔ | Mobile |

| Travelex web | ✔ | PC, ordinateur portable, tablette |

Dépôt et Retrait

Travelex accepte les paiements effectués via Mastercard, VISA, BPAY, Pay ID, GPay et ApplePay.

| Montant minimum | AU$350 ou équivalent en devise, en ligne et via l'application |

| AU$100 ou équivalent en devise en magasin | |

| Montant maximum | AU$50.000 ou équivalent en devise |