Présentation de l'entreprise

| Résumé de l'examen d'Industrial Securities | |

| Fondé | 2010 |

| Pays/Région d'enregistrement | Chine |

| Régulation | CFFEX (réglementé) |

| Services | Fonds de private equity spécial, activités de gestion active basées sur des stratégies quantitatives, etc. |

| Compte de démonstration | ✅ |

| Plateforme de trading | Xingzheng Futures APP |

| Support client | Tél : 021-20370900, 0591-38117666 |

| Email : huangchen@xzfutures.com | |

| Adresse : 6e étage, Bâtiment des valeurs mobilières, n° 268, route Hudong, district de Gulou, Fuzhou | |

| Weibo, WeChat | |

Informations sur Industrial Securities

Industrial Securities est un prestataire de services réglementé en matière de courtage et de services financiers de premier plan, fondé en Chine en 2010. Il propose des produits et services pour les fonds de private equity spécial, les activités de gestion active basées sur des stratégies quantitatives, etc.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Comptes de démonstration | Manque de transparence |

| Temps d'opération long | |

| Divers canaux de contact | |

| Bien réglementé |

Industrial Securities est-il légitime ?

Oui. Industrial Securities est licencié par CFFEX pour offrir des services. Son numéro de licence est 0102. China Financial Futures Exchange Co. Ltd. (CFFEX), établie avec l'approbation du Conseil d'État de la République populaire de Chine et de la Commission de régulation des valeurs mobilières de Chine (CSRC), est une bourse incorporée spécialisée dans la fourniture de services de trading et de compensation pour les contrats à terme financiers, les options et autres dérivés.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| Bourse des contrats à terme financiers de Chine (CFFEX) | Réglementé | 兴证期货有限公司 | Licence de Contrats à Terme | 0102 |

Services d'Industrial Securities

| Services | Pris en Charge |

| Activité spéciale de FOF en capital-investissement | ✔ |

| Activité de gestion active basée sur des stratégies quantitatives | ✔ |

Frais d'Industrial Securities

Industrial Securities ne fournit aucune information sur ses frais.

Plateforme de Trading

| Plateforme de Trading | Pris en Charge | Appareils Disponibles |

| Application Xingzheng Futures | ✔ | Mobile |

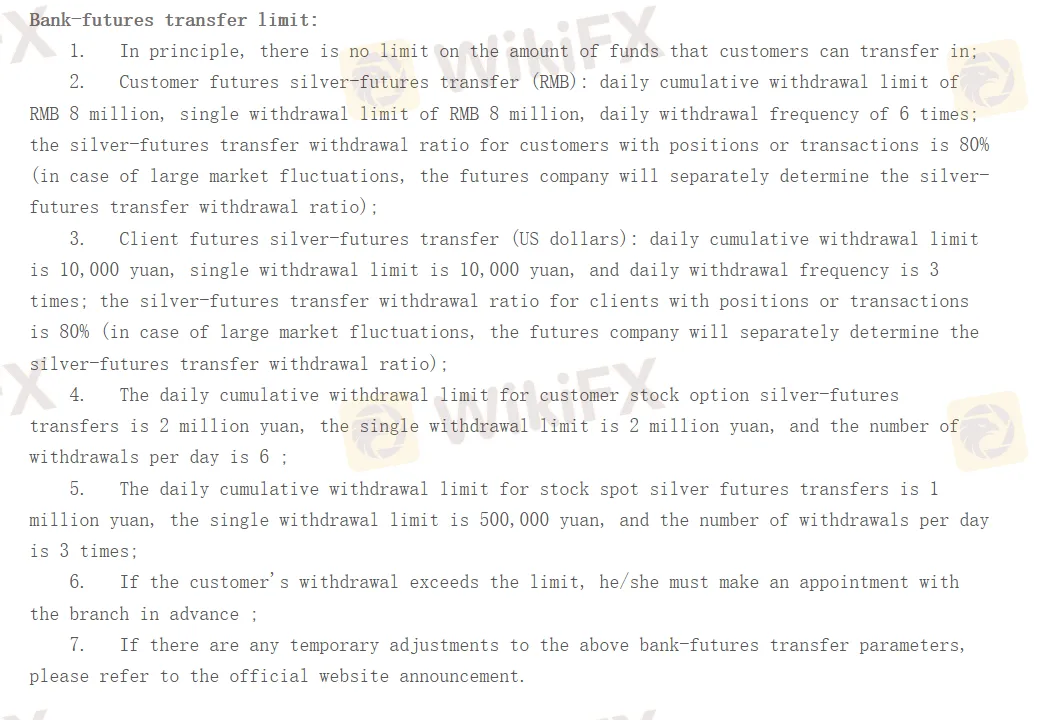

Dépôt et Retrait

Le montant maximum de retrait est défini mais aucun montant minimum de retrait/dépôt n'est défini et aucun frais n'est spécifié.