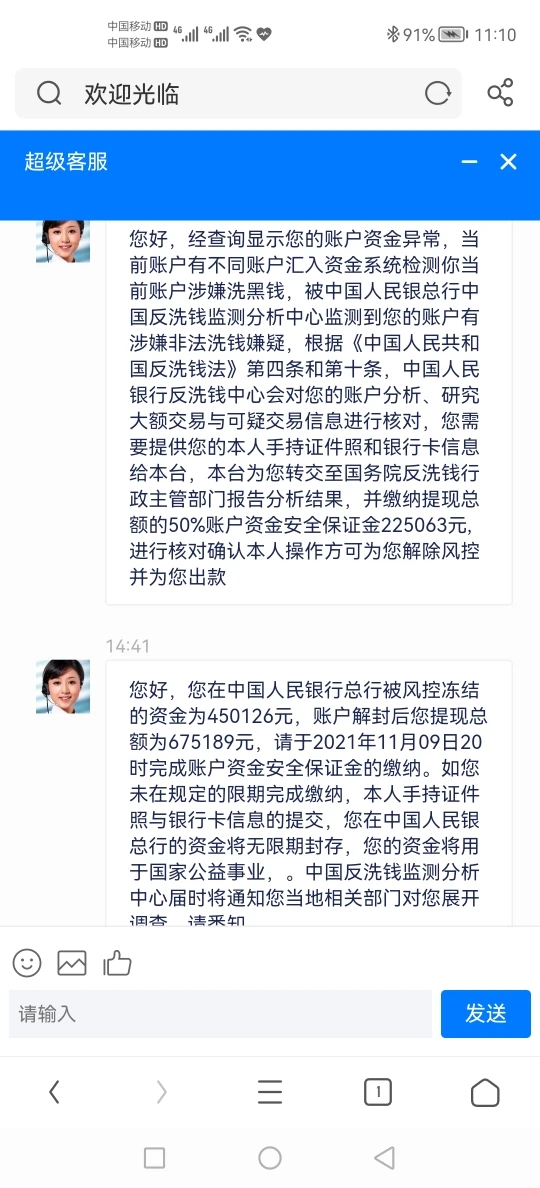

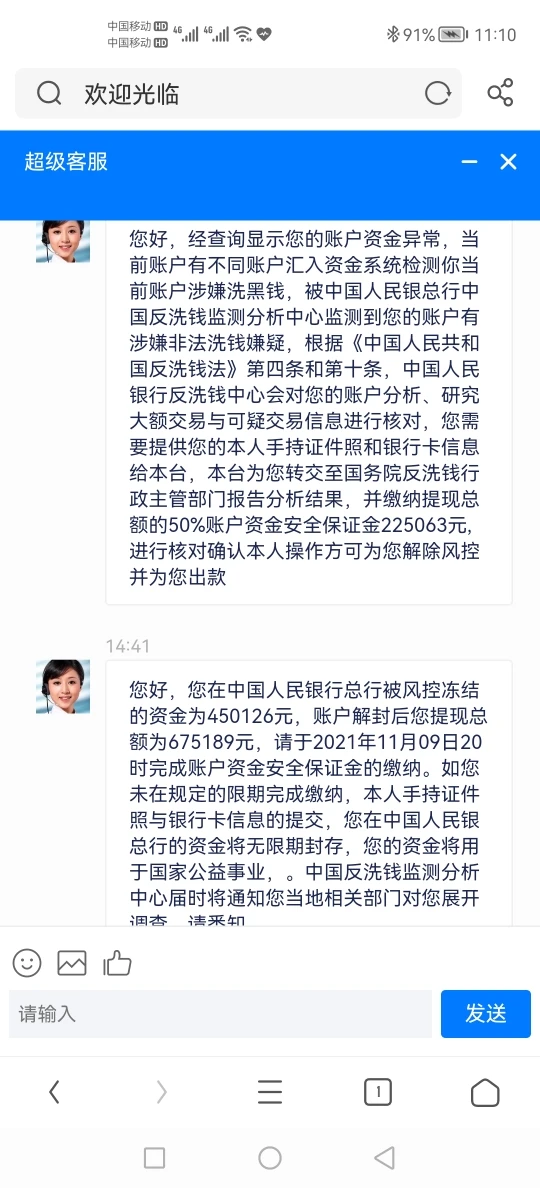

Présentation de l'entreprise

| Morgan StanleyRésumé de l'examen | |

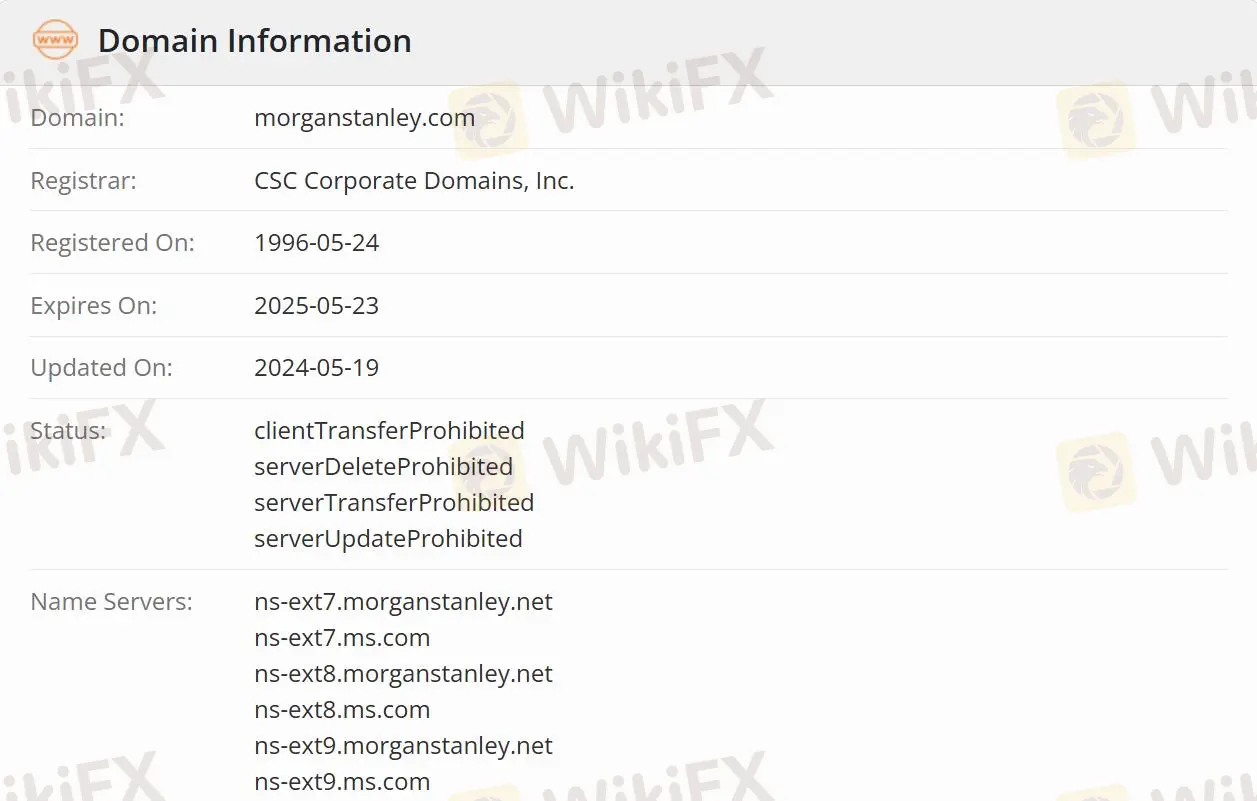

| Fondé | 1996-05-24 |

| Pays/Région enregistré(e) | États-Unis |

| Réglementation | Réglementé |

| Services | Gestion de patrimoine, Banque d'investissement et marchés de capitaux, Ventes et négociation, Recherche, Gestion d'investissement, Morgan Stanley au travail, Investissement durable et Groupe des entreprises inclusives |

| Assistance clientèle | Réseaux sociaux : LinkedIn, Instagram, Twitter, Facebook, YouTube |

Informations sur Morgan Stanley

Morgan Stanley est un courtier qui aide les particuliers, les familles, les institutions et les gouvernements à mobiliser, gérer et distribuer du capital.

Morgan Stanley est-il légitime ?

Morgan Stanley est autorisé et réglementé par l'Organisation de réglementation des investissements du Canada (ORIC), ce qui le rend plus sûr que les courtiers réglementés. Mais les risques ne peuvent pas être complètement évités.

Que fait Morgan Stanley ?

Le travail de l'entreprise comprend 8 aspects majeurs, notamment la gestion de patrimoine, la banque d'investissement et les marchés de capitaux, les ventes et la négociation, la recherche, la gestion d'investissement, Morgan Stanley au travail, l'investissement durable et le groupe des entreprises inclusives.

Gestion de patrimoine : Aider les personnes, les entreprises et les institutions à construire, préserver et gérer leur patrimoine.

Banque d'investissement et marchés de capitaux : Expertise en analyse de marché, services de conseil et de levée de capitaux pour les entreprises, les institutions et les gouvernements.

Ventes et négociation : Morgan Stanley pour les services de vente, de négociation et de création de marché.

Recherche : Offrir une analyse des entreprises, des secteurs, des marchés et des économies, aidant les clients dans leurs décisions.

Gestion d'investissement : Fournir des stratégies d'investissement dans différentes classes d'actifs, sur les marchés publics et privés.

Morgan Stanley au travail : Fournir des solutions financières en milieu de travail pour les organisations et leurs employés, en combinant des conseils.

Investissement durable : Offrir des produits d'investissement durables, favoriser des solutions innovantes et fournir des informations exploitables sur les questions de durabilité.

Options d'assistance clientèle

Les traders peuvent suivre Morgan Stanley sur différents réseaux sociaux, notamment LinkedIn, Instagram, Twitter, Facebook et YouTube.

| Options de contact | Détails |

| Réseaux sociaux | LinkedIn, Instagram, Twitter, Facebook, YouTube |

| Langue prise en charge | Anglais |

| Langue du site web | Anglais |

| Adresse physique | Morgan Stanley 1585 Broadway New York, NY 10036 |