Présentation de l'entreprise

| Shikoku Résumé de l'examen | |

| Fondé | 2002 |

| Pays/Région Enregistré | Japon |

| Régulation | Réglementé par la FSA (Japon) |

| Instruments de Marché | Fonds d'investissement, Actions, Obligations, Forex, Matières premières |

| Compte de Démo | / |

| Spread EUR/USD | de 10 à 75 sen |

| Plateforme de Trading | Web Trader |

| Support Client | Tél : 089-921-5200 |

| Adresse : Préfecture d'Ehime, Ville de Matsuyama, Sanbancho 5-10-1 | |

Informations sur Shikoku

Shikoku est un courtier basé au Japon fondé en 2002, réglementé par la FSA. Il propose une gamme diversifiée d'instruments de marché, tels que : Fonds d'investissement, Actions, Obligations, Forex et Matières premières.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la FSA | Canaux de contact limités |

| Divers actifs de trading | Pas de support MT4 et MT5 cTrader |

| Longue durée d'exploitation | Pas de comptes de démonstration disponibles |

| Divers frais facturés |

Shikoku est-il légitime ?

Shikoku est réglementé par l'Agence des services financiers (FSA), sous Shikoku, avec le numéro de licence 四国財務局長(金商)第21号.

| Statut Réglementaire | Réglementé Par | Institution Agréée | Type de Licence | Numéro de Licence |

| Réglementé | Agence des services financiers (FSA) | Shikoku | Licence de Forex au détail | 四国財務局長(金商)第21号 |

Enquête sur le terrain WikiFX

L'équipe d'enquête sur le terrain de WikiFX a visité l'adresse de Shikoku au Japon et nous avons trouvé son bureau sur place, ce qui signifie que la société opère avec un bureau physique.

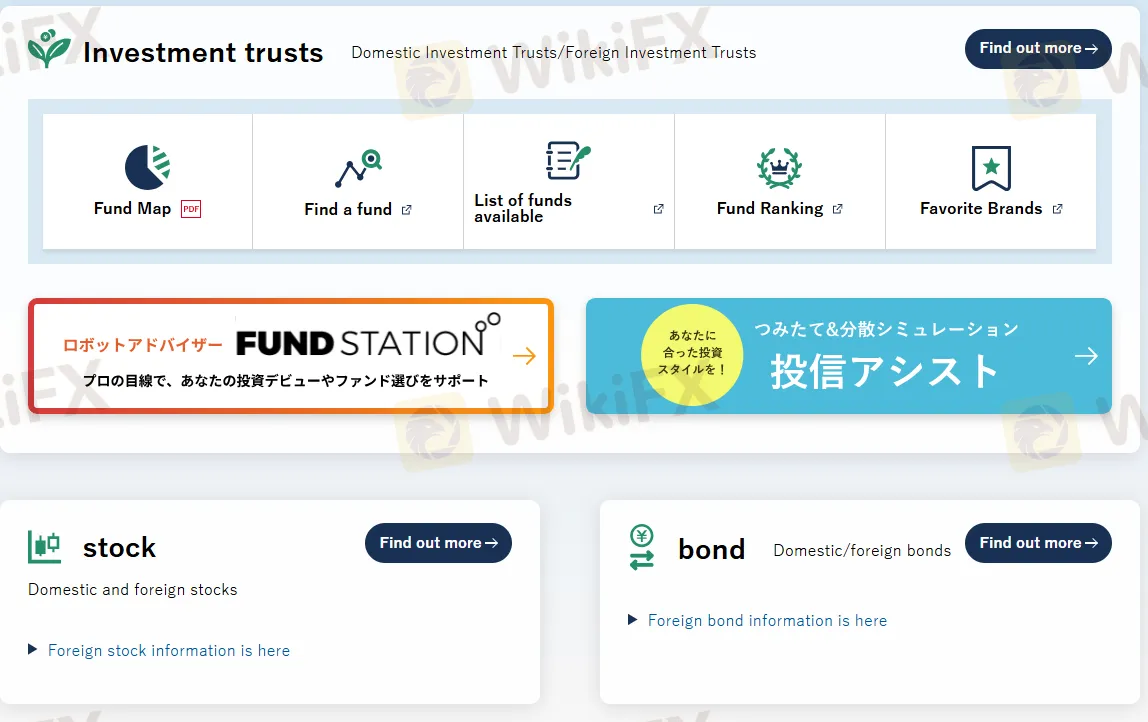

Que puis-je trader sur Shikoku ?

| Instruments de trading | Pris en charge |

| Fonds d'investissement | ✔ |

| Actions | ✔ |

| Obligations | ✔ |

| Forex | ✔ |

| Matières premières | ✔ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

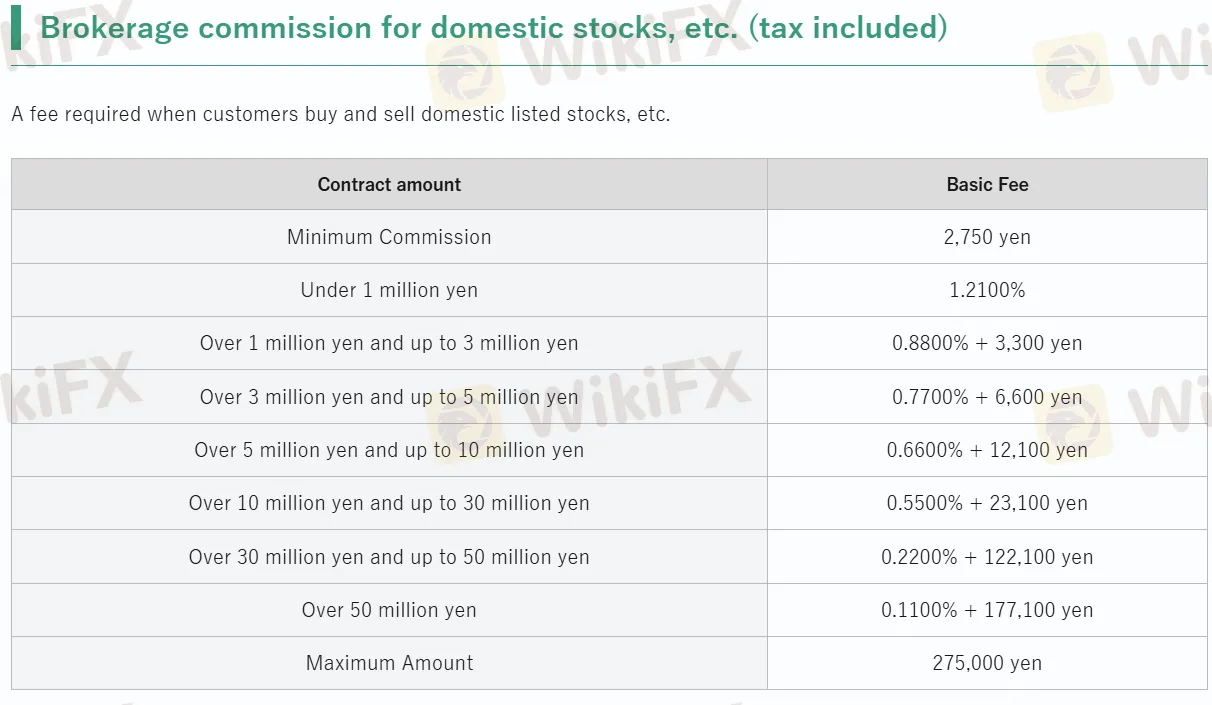

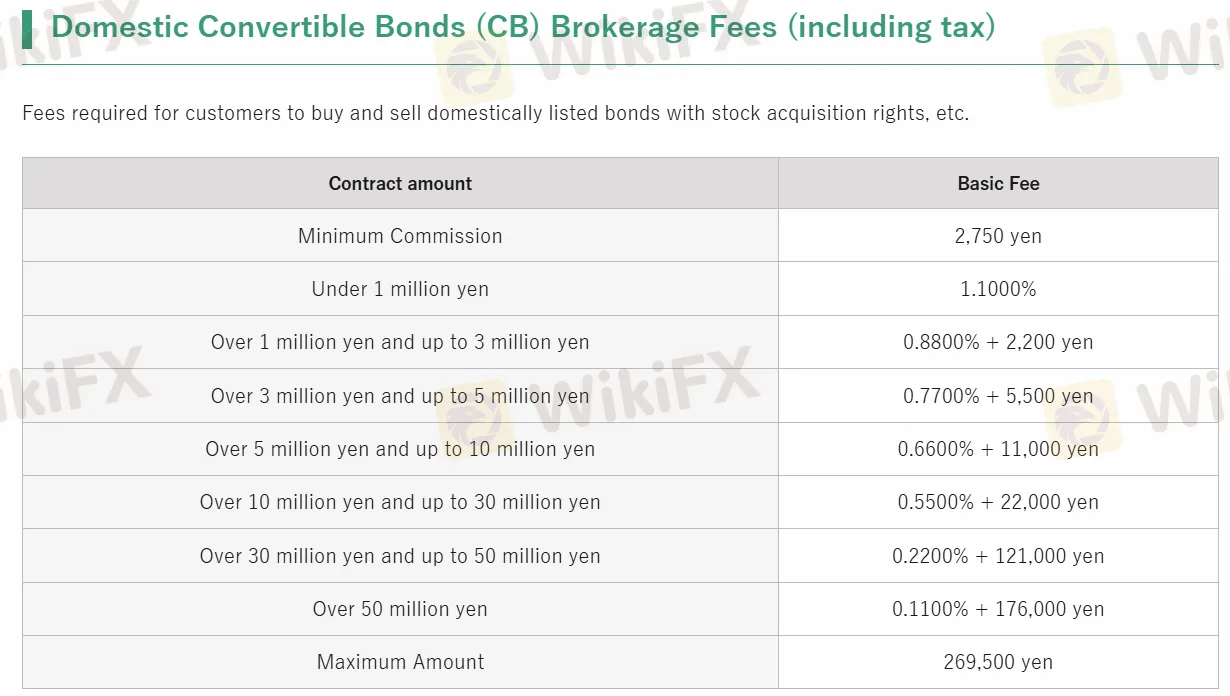

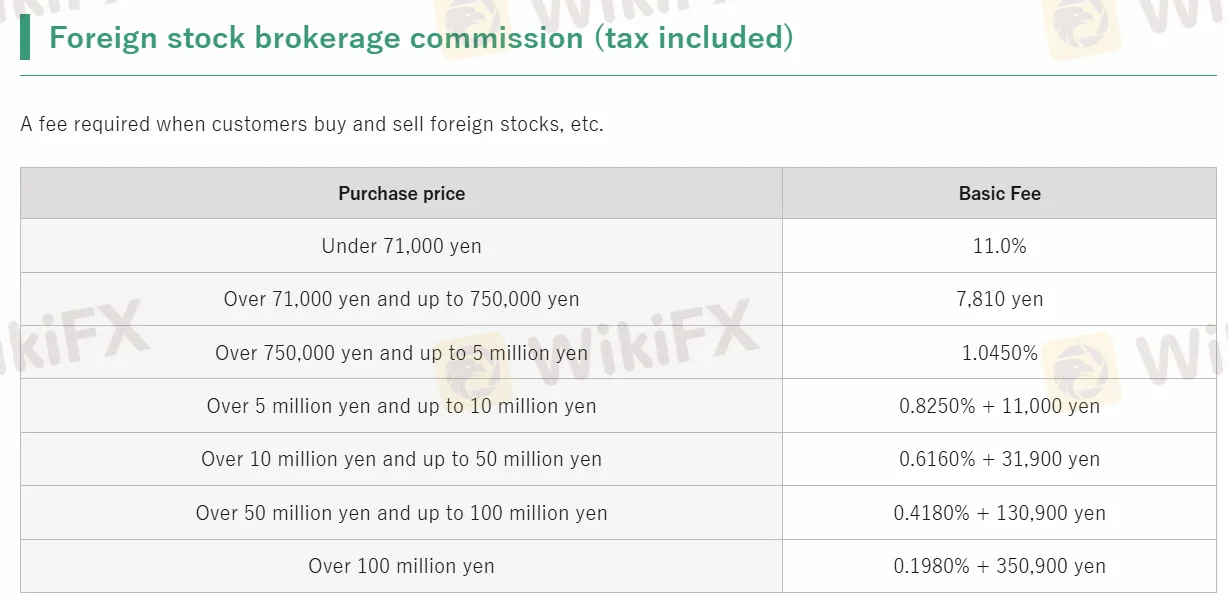

Frais de Shikoku

| Type de services | Frais de base |

| Courtage d'actions domestiques | JPY 2,750 - 275,000 |

| Courtage de titres convertibles domestiques | JPY 2,750 - 269,500 |

| Courtage d'actions étrangères | 0,1980% - 11% |

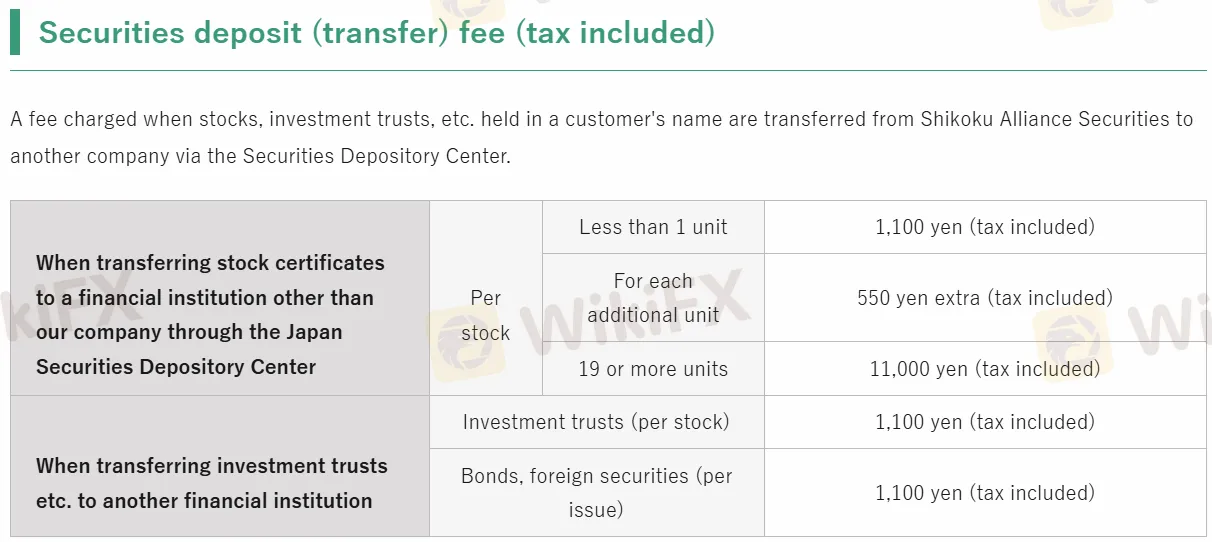

| Dépôts de titres | JPY 550 - 11,000 |

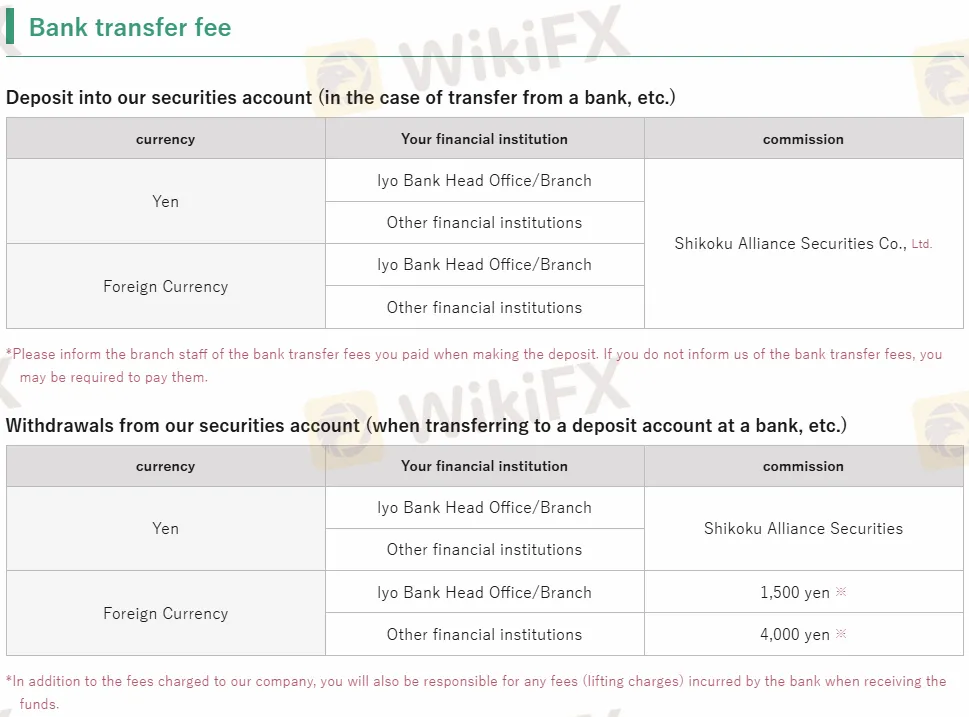

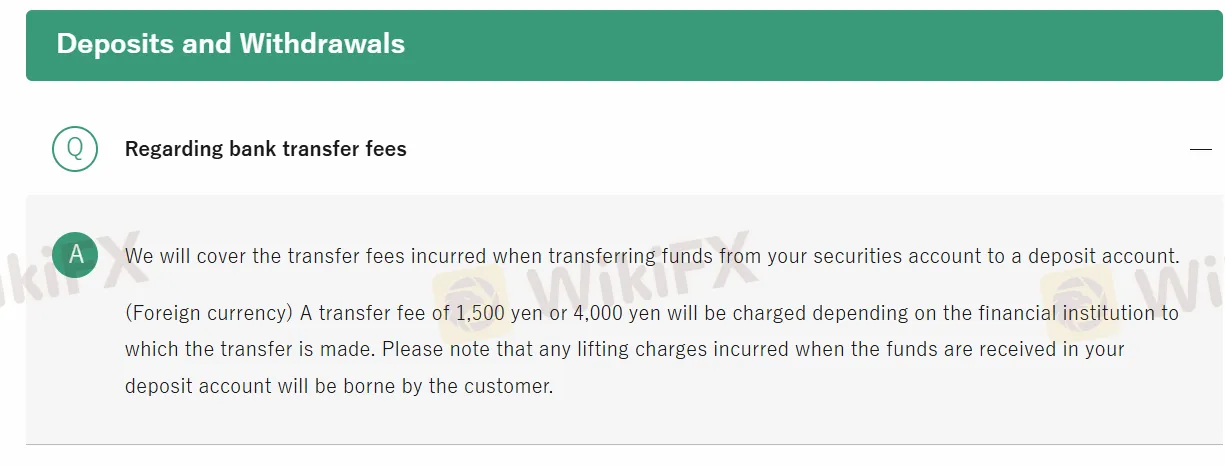

| Frais de virement bancaire | JPY 0 - 4,000 |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Trader Web | ✔ | Web | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |

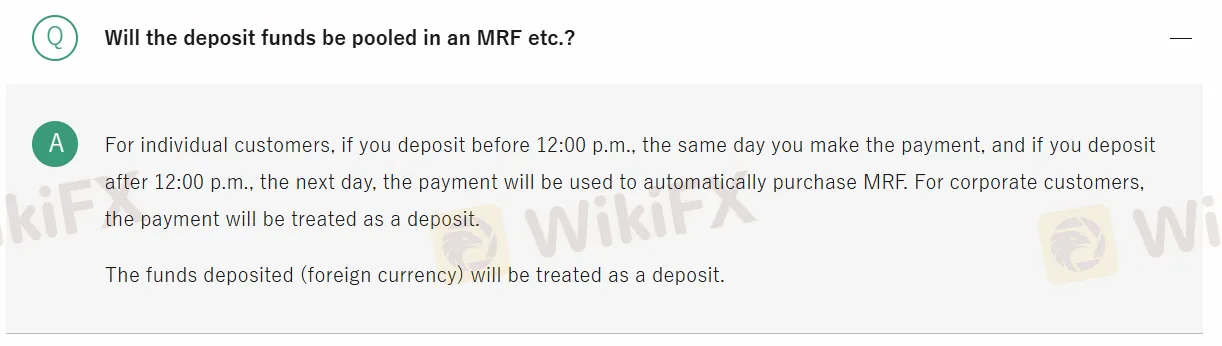

Dépôt et retrait

| Montant minimum | Frais de virement bancaire | Délai de traitement | |

| Dépôt | / | JPY 0 - 4,000 | Moins de 24 heures |

| Retrait | / | / |

within

La colombie

Jusqu'à présent, je pense que shikoku est une entreprise qualifiée, si vous en avez besoin, je pense que cela peut être votre choix ! Diverses conditions commerciales sont raisonnables, et le plus important est qu'il ne s'agit pas d'une entreprise illégale, elle ne trompera pas votre argent.

Positifs

文章

Hong Kong

J'ai l'habitude d'investir la confiance chez Shikoku, mon expérience est formidable ! Bien que tant de nouveaux courtiers apparaissent, dans tous les cas, je préfère choisir celui qui a de l'expérience.

Positifs

FX1015868943

Hong Kong

Quelqu'un a dit que Shikoku était une bonne plate-forme pour investir dans diverses opérations sur actions. Quelqu'un est-il prêt à me dire quels sont ses frais facturés ? J'ai envoyé une demande, mais personne ne me répond...

Neutre

FX1022619685

Hong Kong

Sa conception de site Web n'est pas ce que je préfère, et il est difficile de trouver sur quoi vous voulez vous concentrer. Est-ce que quelqu'un a trouvé ça ? Il peut être plus adapté aux investisseurs japonais. Pour moi, je trouverais des courtiers pour me mettre à l'aise…

Neutre