Présentation de l'entreprise

| Oriental Securities Corporation Résumé de l'examen | |

| Fondé | 1979 |

| Pays/Région Enregistré | Taïwan |

| Régulation | Bourse de Taipei |

| Instruments de Marché | Titres, Contrats à terme, Obligations |

| Plateforme de Trading | Oriental Securities Corporation-亞東e指賺 |

| Support Client | Tél : 02-7753-1899;0800-088-567;02-405-0218 |

| Email : service@osc.com.tw | |

Informations sur Oriental Securities Corporation

Oriental Securities Corporation, fondé à Taïwan en 1979 et régulé par la Bourse de Taipei, est une plateforme de trading en ligne qui propose le trading de divers actifs financiers et fournit une plateforme de trading mobile.

Avantages et Inconvénients

| Avantages | Inconvénients |

|

|

| |

|

Oriental Securities Corporation Est-il Légitime ?

Oriental Securities Corporation détient une licence de "Négociation de titres" régulée par la Bourse de Taipei à Taïwan.

Que Puis-je Trader sur Oriental Securities Corporation ?

La plateforme Oriental Securities Corporation propose des actifs financiers à trader, y compris des titres, des contrats à terme et des obligations.

| Instruments Échangeables | Pris en Charge |

| Titres | ✔ |

| Contrats à Terme | ✔ |

| Obligations | ✔ |

| Forex | ❌ |

| Matières Premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Principales Activités

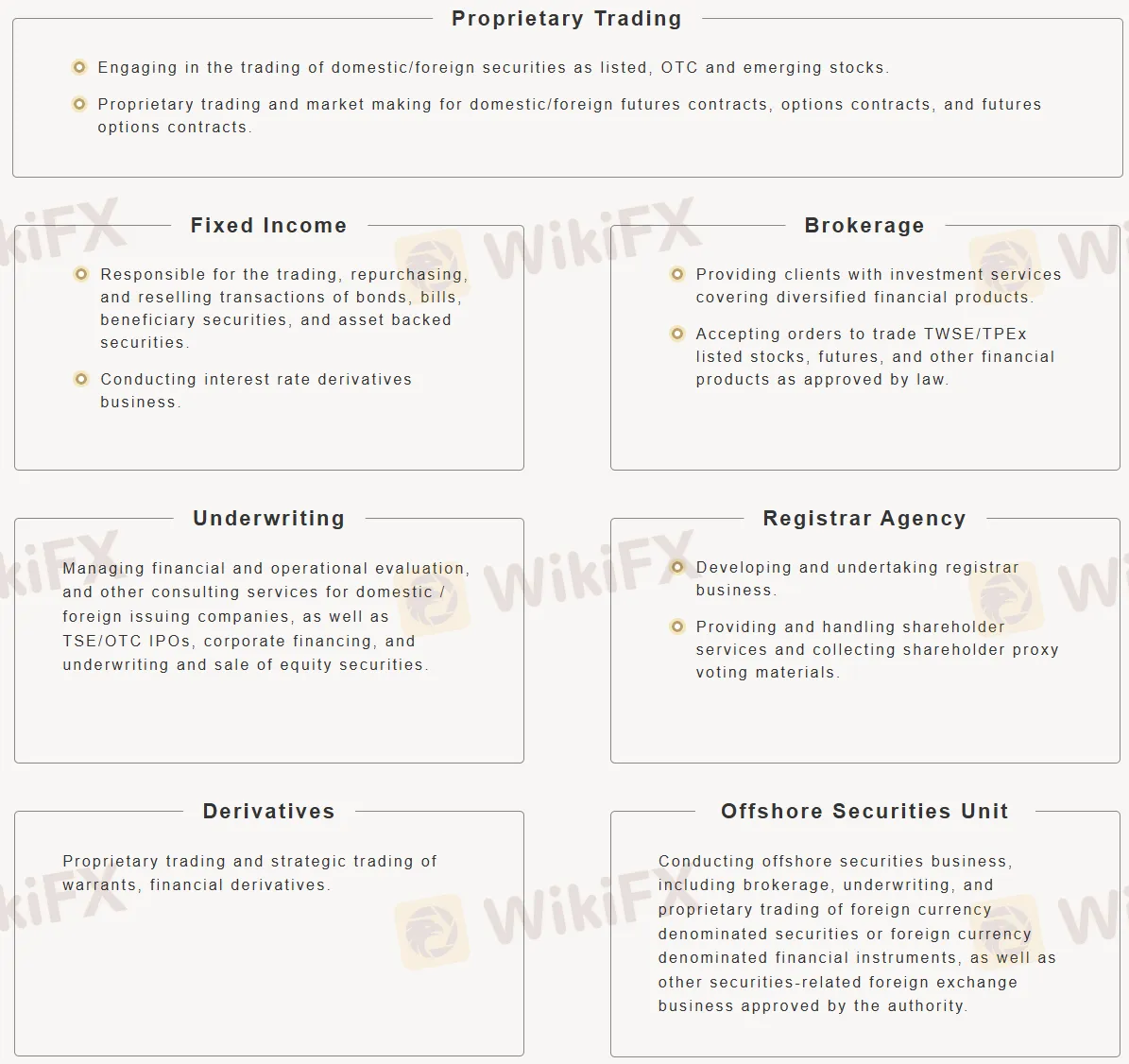

Voici les principales activités de Oriental Securities Corporation :

- Trading Propriétaire : Commerce des actions et divers contrats à terme/options.

- Revenu Fixe : Traite des obligations et des produits dérivés de taux d'intérêt.

- Courtage : Offre des services d'investissement et exécute des transactions pour les clients (actions, contrats à terme, etc.).

- Souscription : Gère les introductions en bourse, le financement d'entreprise et les ventes d'actions.

- Agence de Registre : Gère les services aux actionnaires et les votes par procuration.

- Dérivés : Commerce des bons de souscription et des produits dérivés financiers.

- Unité de Valeurs Offshore : Effectue des opérations de titres internationaux (courtage, souscription, trading propriétaire en devises étrangères).

Plateforme de Trading

| Plateforme de Trading | Pris en charge | Appareils Disponibles |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |