Profil perusahaan

| uSMART Group Ringkasan Ulasan | |

| Didirikan | 2021 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | MAS |

| Instrumen Pasar | Saham, saham, opsi, ETF, REIT, dan ADR, futures dan forex |

| Akun Demo | ❌ |

| Leverage | 1:3 |

| Spread | / |

| Platform Trading | Aplikasi uSMART |

| Deposit Minimum | 0 |

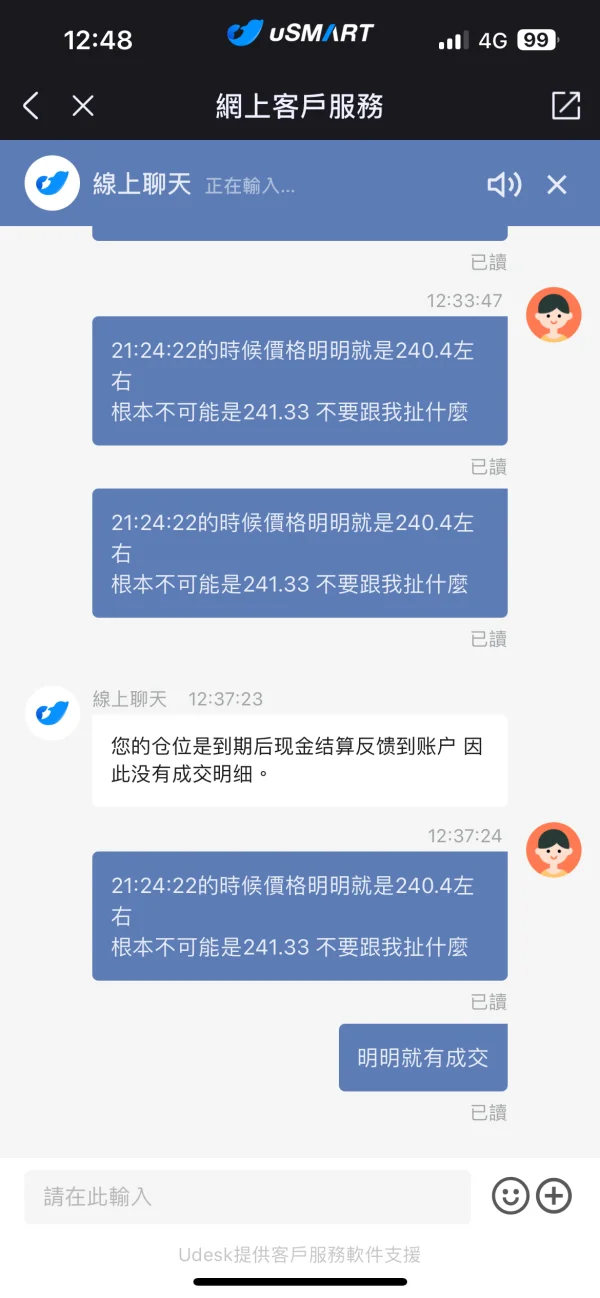

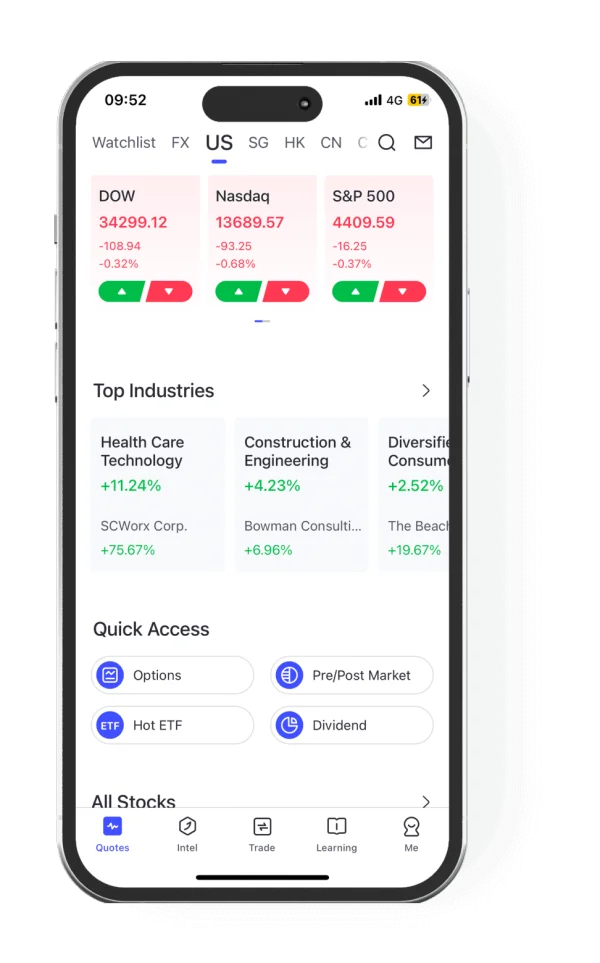

| Dukungan Pelanggan | Dukungan 24/5 |

| Tel: +65 6303 0663; +65 3135 1599 (Singapura)/ +852 9520 4758 (Hong Kong) | |

| Email: support@usmart.sg (Singapura)/cs@usmarthk.com (Hong Kong) | |

| Alamat: 3 Phillip St, #12-04, Royal Group Building, Singapura 048693 | |

| Room 2606-07, Lantai 26, FWD Financial Centre, 308 Des Voeux Road Central, Sheung Wan, Hong Kong | |

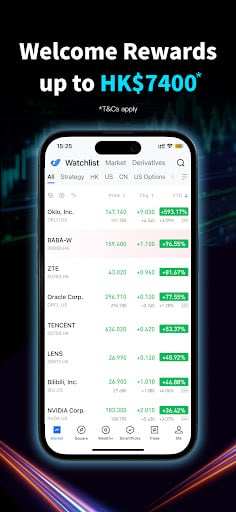

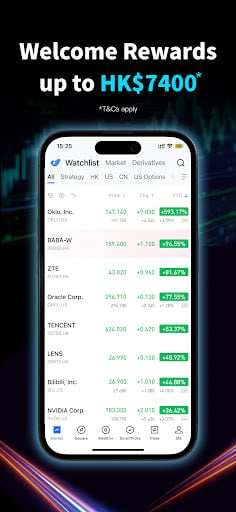

uSMART Group, secara resmi terdaftar sebagai uSmart Holding Ltd., beroperasi sebagai broker terdaftar berbasis Hong Kong sejak tahun 2021. uSMART Group menyediakan berbagai pilihan perdagangan termasuk saham AS, Singapura, dan Hong Kong, saham pecahan, berbagai opsi AS, forex, dan perdagangan grid. Broker ini menggunakan platform uSmart miliknya sendiri, kompatibel dengan iOS, Android, Mac, Windows, dan OpenAPI. Saat ini diatur dengan baik oleh MAS.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh MAS | Tidak ada akun demo |

| Tindakan keamanan disediakan | Struktur biaya yang kompleks |

| Prosedur pembukaan akun yang sederhana | Tidak ada MT4/5 |

| Tidak ada persyaratan deposit minimum | Kurangnya metode pembayaran populer |

Apakah uSMART Group Legal?

uSMART Group telah membuktikan keabsahan dan kredibilitasnya dengan mengamankan regulasi dari Otoritas Moneter Singapura (MAS), sebuah otoritas regulasi terkenal karena pengawasan keuangan yang komprehensif dan ketat. Broker ini memegang Lisensi Forex Ritel.

| Status Regulasi | Diatur |

| Diatur oleh | Otoritas Moneter Singapura (MAS) |

| Institusi Berlisensi | USMART SECURITIES (SINGAPORE) PTE. LTD. |

| Jenis Lisensi | Lisensi Forex Ritel |

| Nomor Lisensi | CMS101161 |

Selain itu, uSMART Group juga memberikan perlindungan lebih lanjut. Untuk memastikan keamanan aset klien, dana dan surat berharga disimpan dalam rekening kustodian terpisah, yang mencegah mereka bercampur dengan rekening lain.

Apa yang Bisa Saya Perdagangkan di uSMART Group?

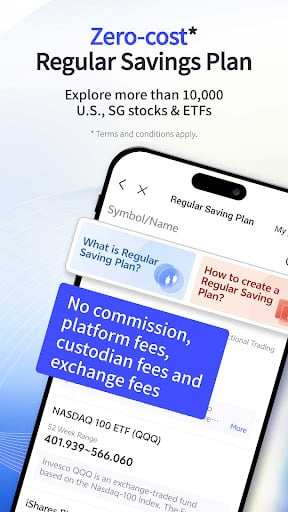

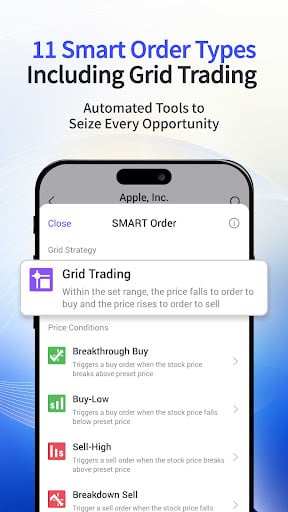

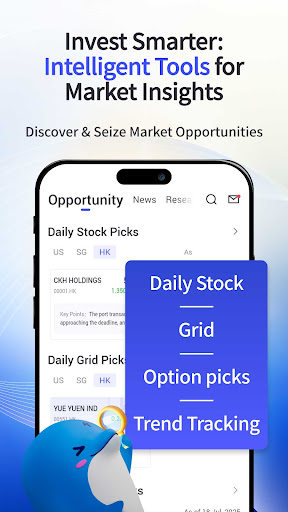

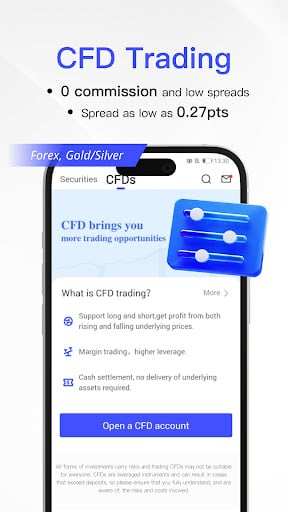

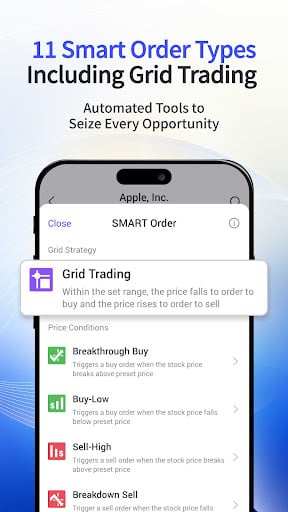

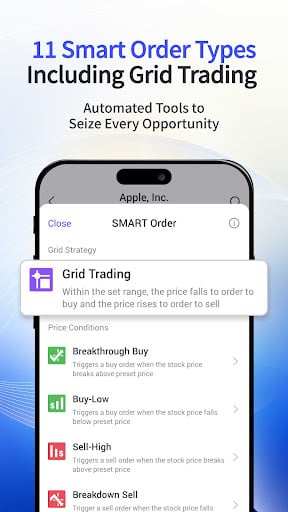

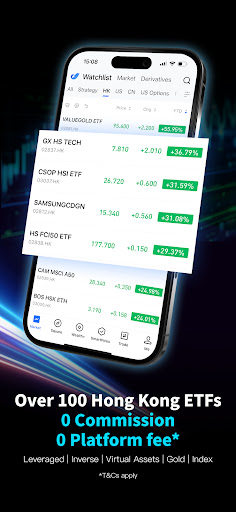

uSMART Group menyediakan perdagangan saham di pasar Amerika Serikat, Singapura, dan Hong Kong, serta perdagangan bagian pecahan, opsi Amerika Serikat dengan berbagai strategi opsi, penjualan pendek, dan pesanan perdagangan grid, ETF, REIT, dan ADR, serta berbagai produk futures dan forex.

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Opsi | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| ADR | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptocurrency | ❌ |

| Obligasi | ❌ |

Jenis Akun

uSMART Group menawarkan dua jenis akun: akun Tunai dan akun Margin. Mereka mengklaim bahwa akun ini tidak memerlukan deposit minimum.

| Jenis Akun | Fitur | Produk yang Tersedia untuk Perdagangan |

| Tunai | Akun dasar untuk perdagangan dengan uang tunai. Daya beli melalui deposit tunai. | Ekuitas, Bagian Pecahan |

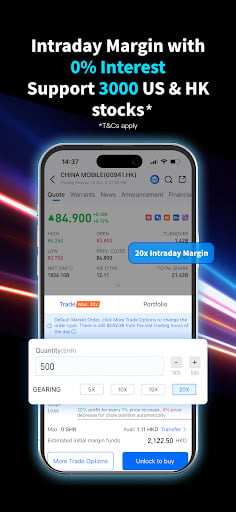

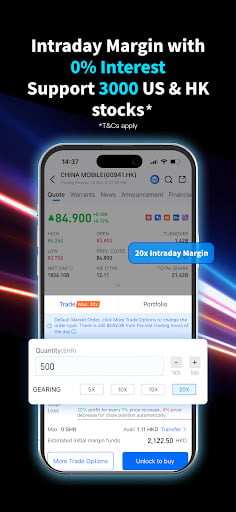

| Margin | Akun fleksibel dengan leverage (hingga 3 kali). Daya beli melalui uang tunai atau saham sebagai jaminan. | Ekuitas, Bagian Pecahan, Opsi, Penjualan Pendek |

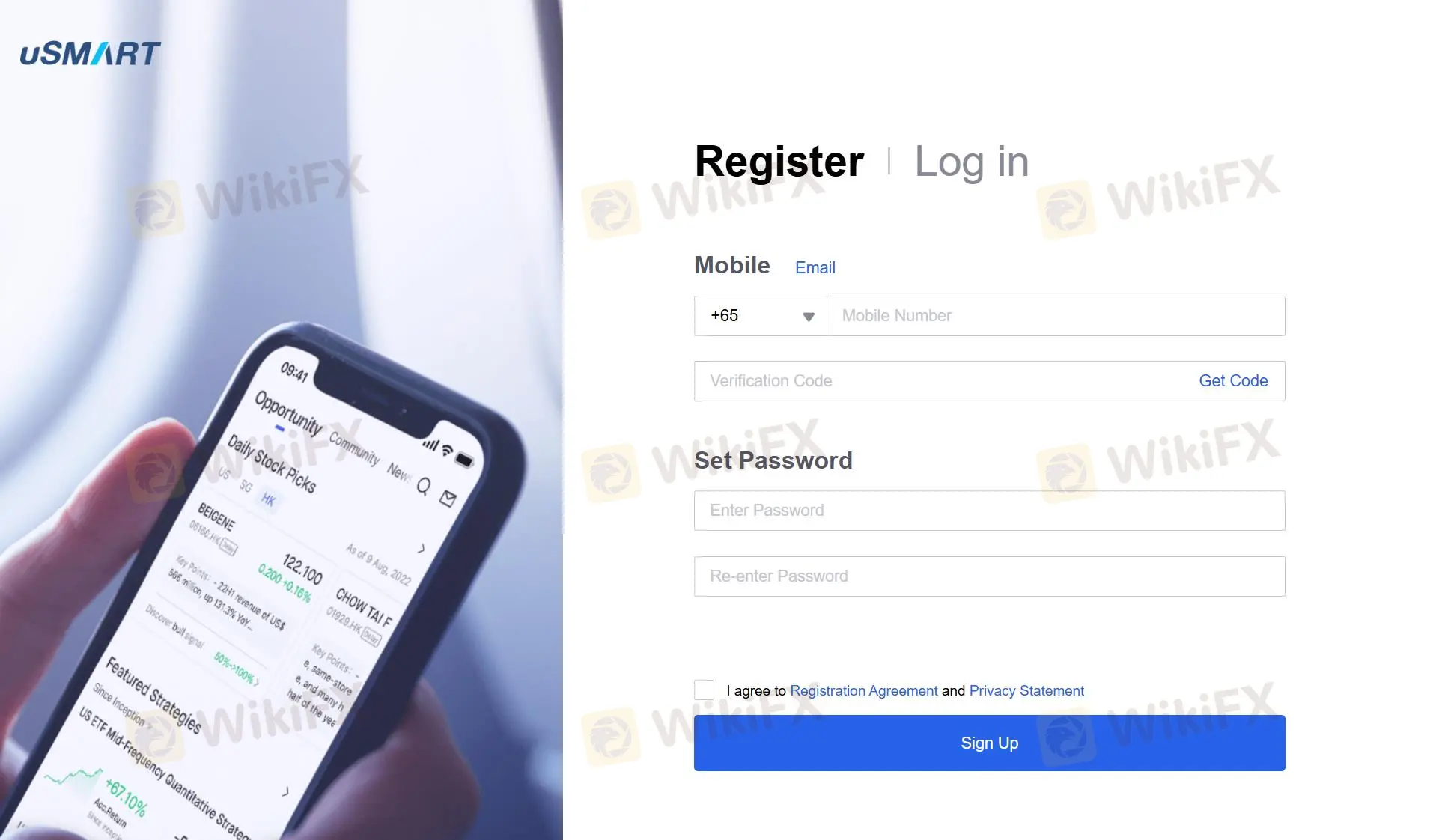

Untuk membuka akun di uSMART Group, Anda dapat klik "Daftar/Masuk", dan isi nomor ponsel atau email Anda, atur kata sandi, dan klik "Daftar". Prosedurnya sederhana dan mudah.

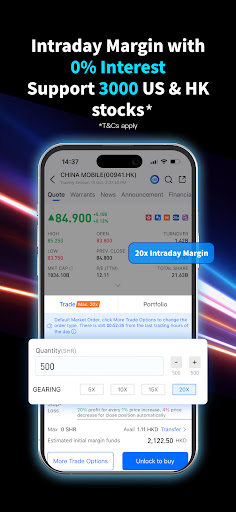

Leverage

uSMART Group menawarkan leverage hingga 1:3. Penting untuk diingat bahwa semakin besar leverage, semakin besar risiko kehilangan modal yang Anda depositkan. Penggunaan leverage dapat bekerja untuk keuntungan dan kerugian Anda.

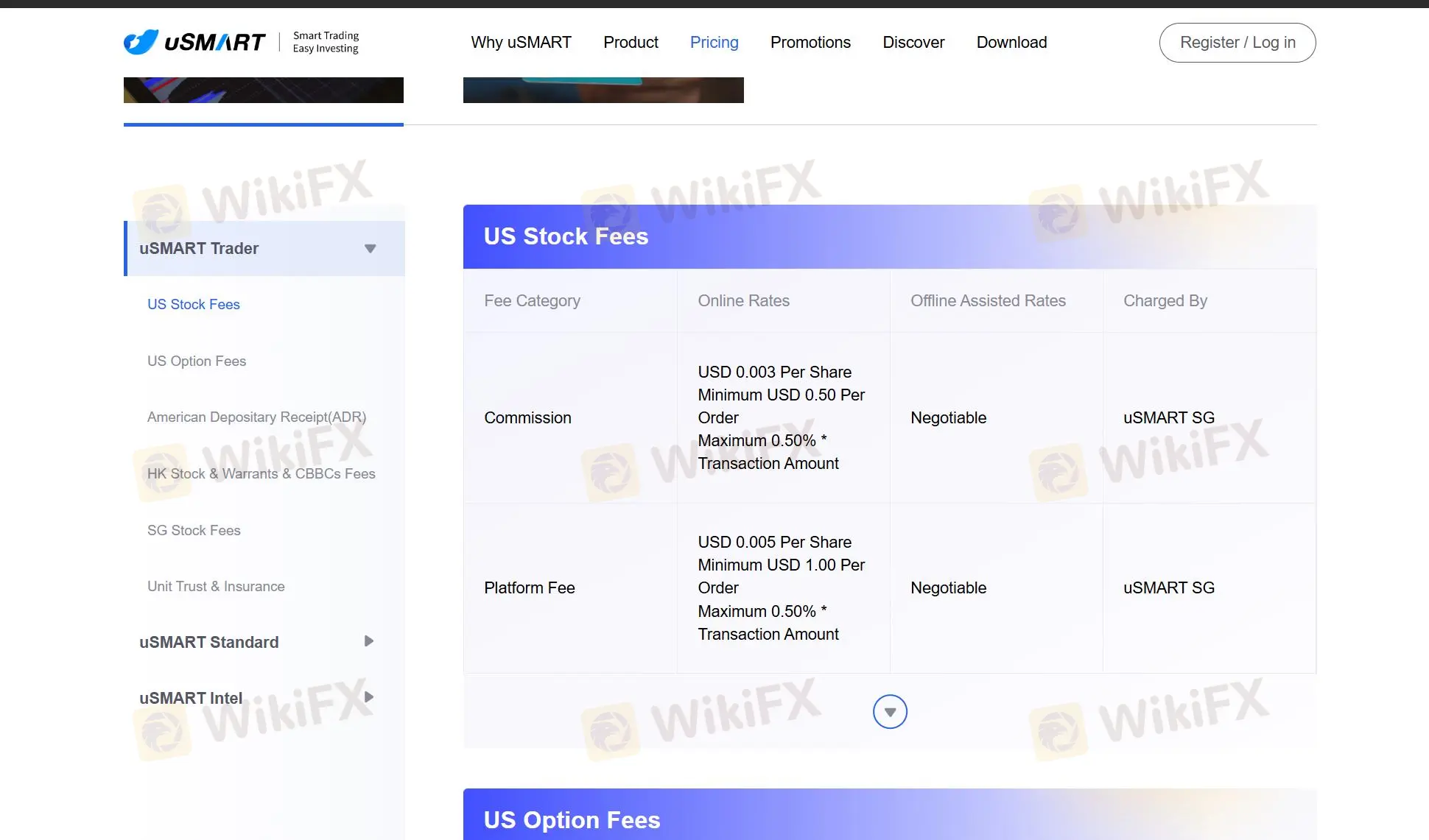

Biaya uSMART Group

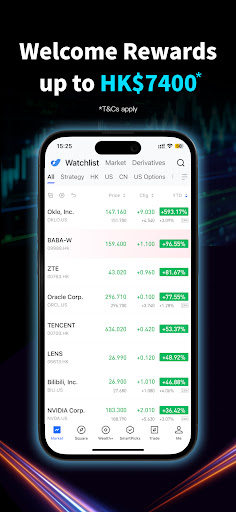

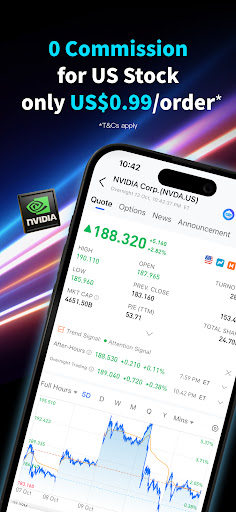

uSMART Group mengenakan biaya sesuai dengan produk dan layanan yang berbeda. Untuk trader uSMART, mereka mengenakan biaya saham AS, opsi AS, ADR, saham HK & Warrant & CBBCs, biaya saham SG, dan Unit Trust & Asuransi.

| Jenis Produk | Jenis Biaya | Tarif/Jumlah | Minimum | Maksimum | GST yang Berlaku (9%) |

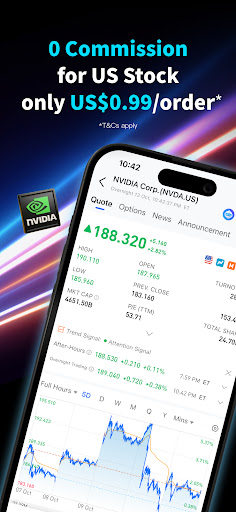

| Saham AS | Komisi | $0,003 per saham | $0,50 per pesanan | 0,50% dari jumlah transaksi | ✔ |

| Biaya Platform | $0,005 per saham | $1,00 per pesanan | ✔ | ||

| Perdagangan Saham Pecahan | Komisi | $0,00 (untuk < 1 saham) | / | / | ❌ |

| Biaya Platform | $1,00 per pesanan | / | / | ❌ | |

| Perdagangan Saham OTC | Komisi | ❌ | / | / | ❌ |

| Biaya Platform | $0,019 per saham | $6 per transaksi | 2% dari jumlah transaksi | ✔ |

Informasi lebih lanjut dapat dipelajari melalui klik: https://www.usmartglobal.com/pricing

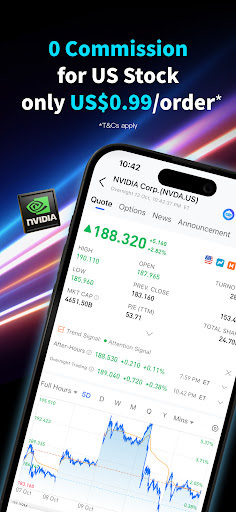

Platform Perdagangan

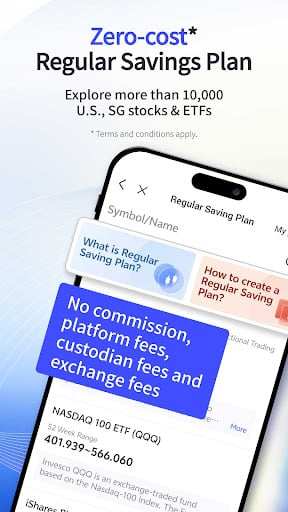

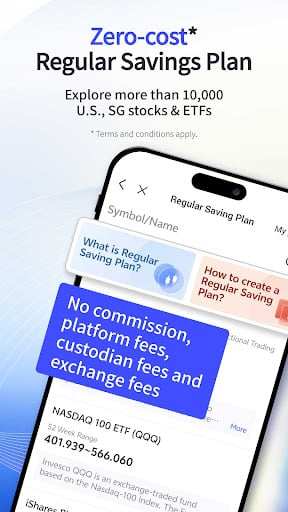

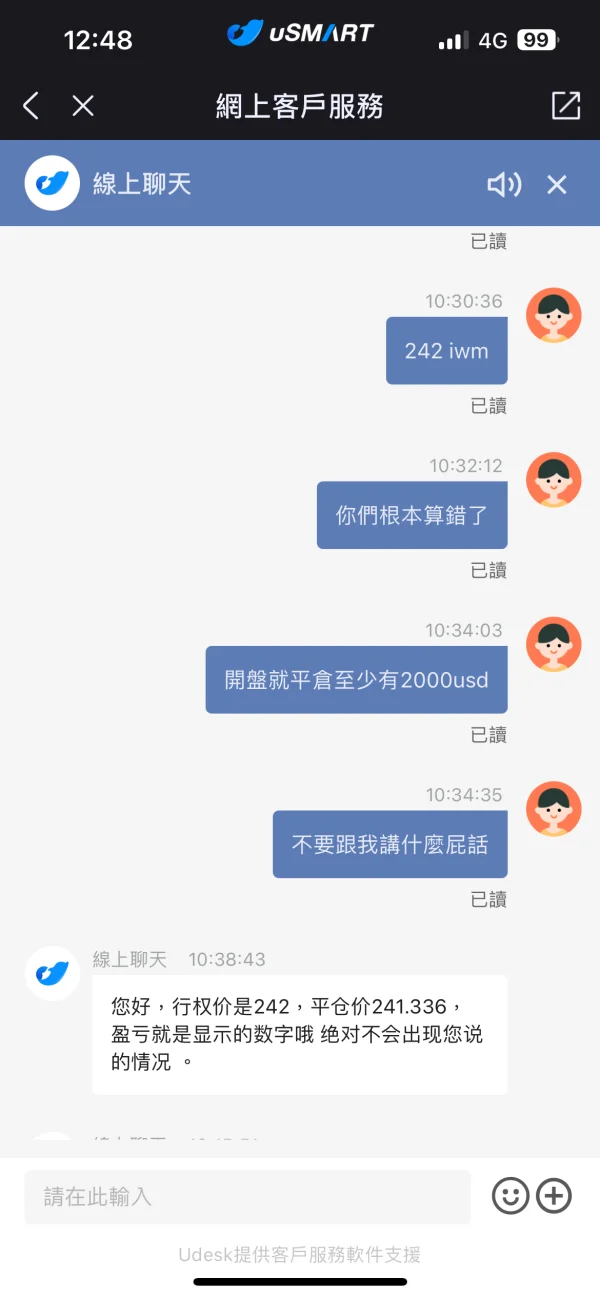

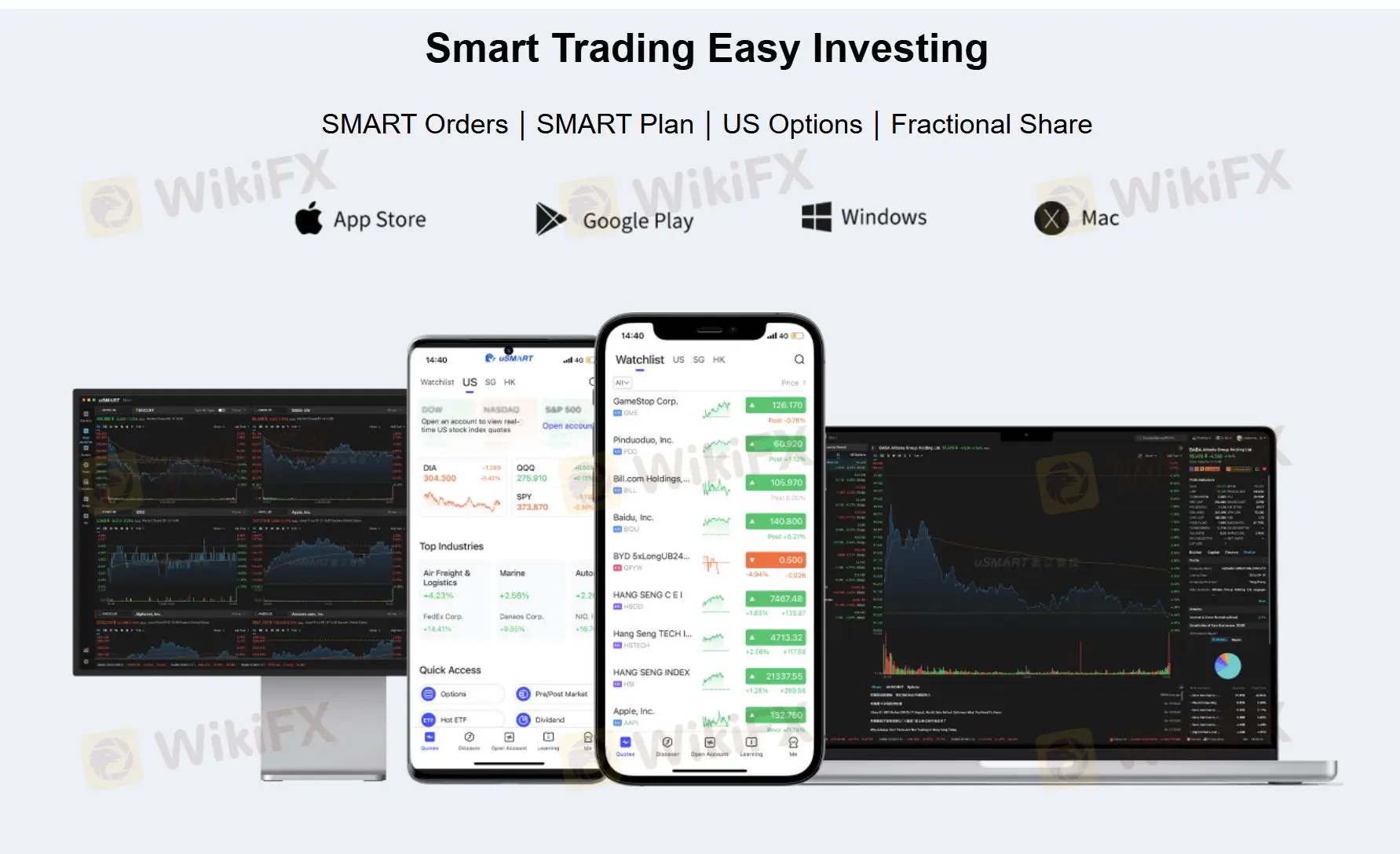

uSMART Group menawarkan uSMART App. Aplikasi ini mendukung perdagangan di iOS, Android, Mac, Windows, dan OpenAPI. Pesanan TWAP, VWAP didukung untuk trader profesional.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| uSMART App | ✔ | iOS, Android, Windows, Mac | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | Windows, Android, WebTrader, iOS | Trader berpengalaman |

Deposit dan Penarikan

Untuk Dolar Singapura (SGD), uSMART Group menerima eGIRO, Paynow, FAST, transfer telegrafis, dan BigPay untuk melakukan deposit.

Untuk mata uang asing (USD dan HKD), mereka menawarkan transfer telegrafis dan BigPay.

Selain itu, mereka mendukung penarikan dana tetapi membutuhkan jumlah penarikan minimum:

| Penarikan Minimum | |

| HKD ke bank di negara/daerah lain | 400 |

| HKD ke bank Hong Kong | 10 |

| USD | 50 |