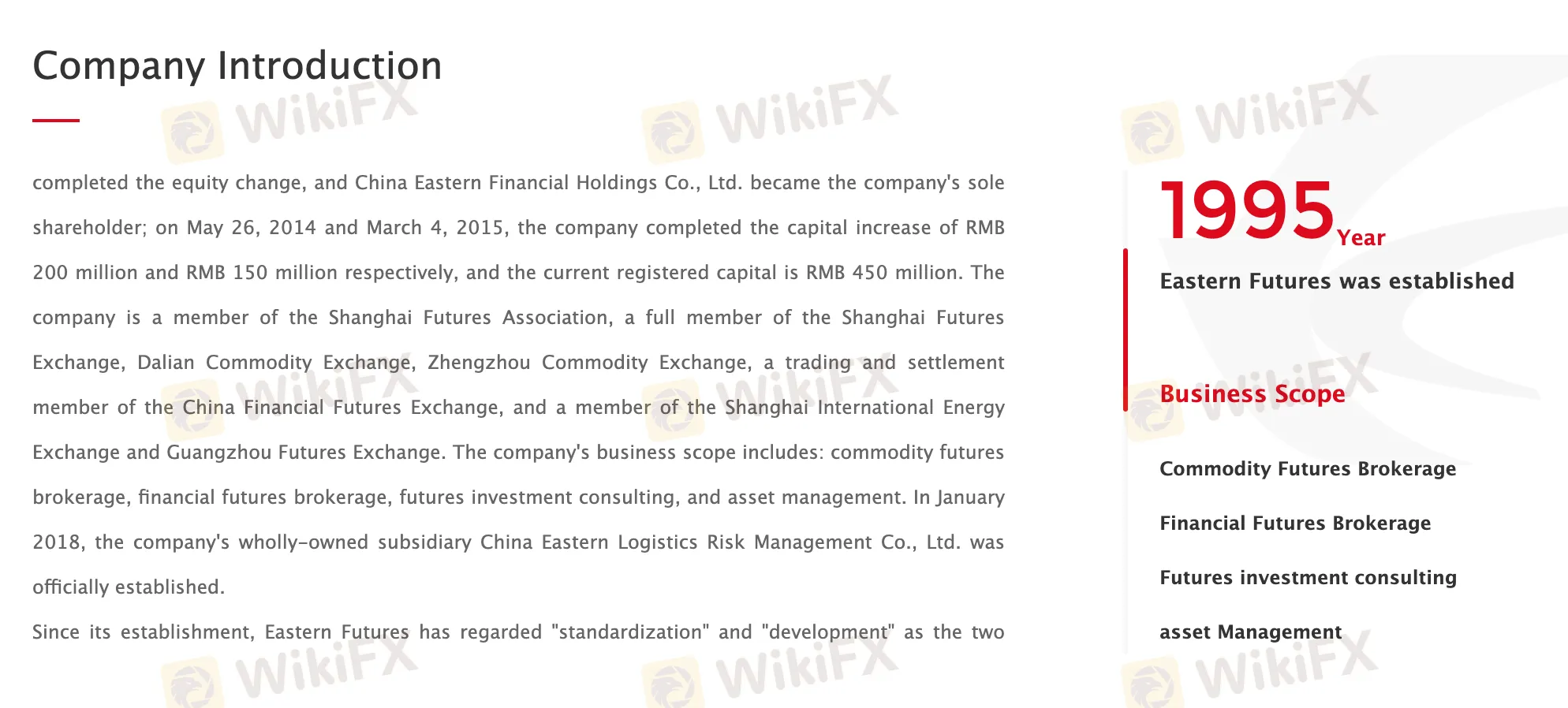

회사 소개

| Ces Futures 리뷰 요약 | |

| 설립 연도 | 2010 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFE (규제됨) |

| 시장 상품 | 선물 |

| 데모 계정 | ✅ |

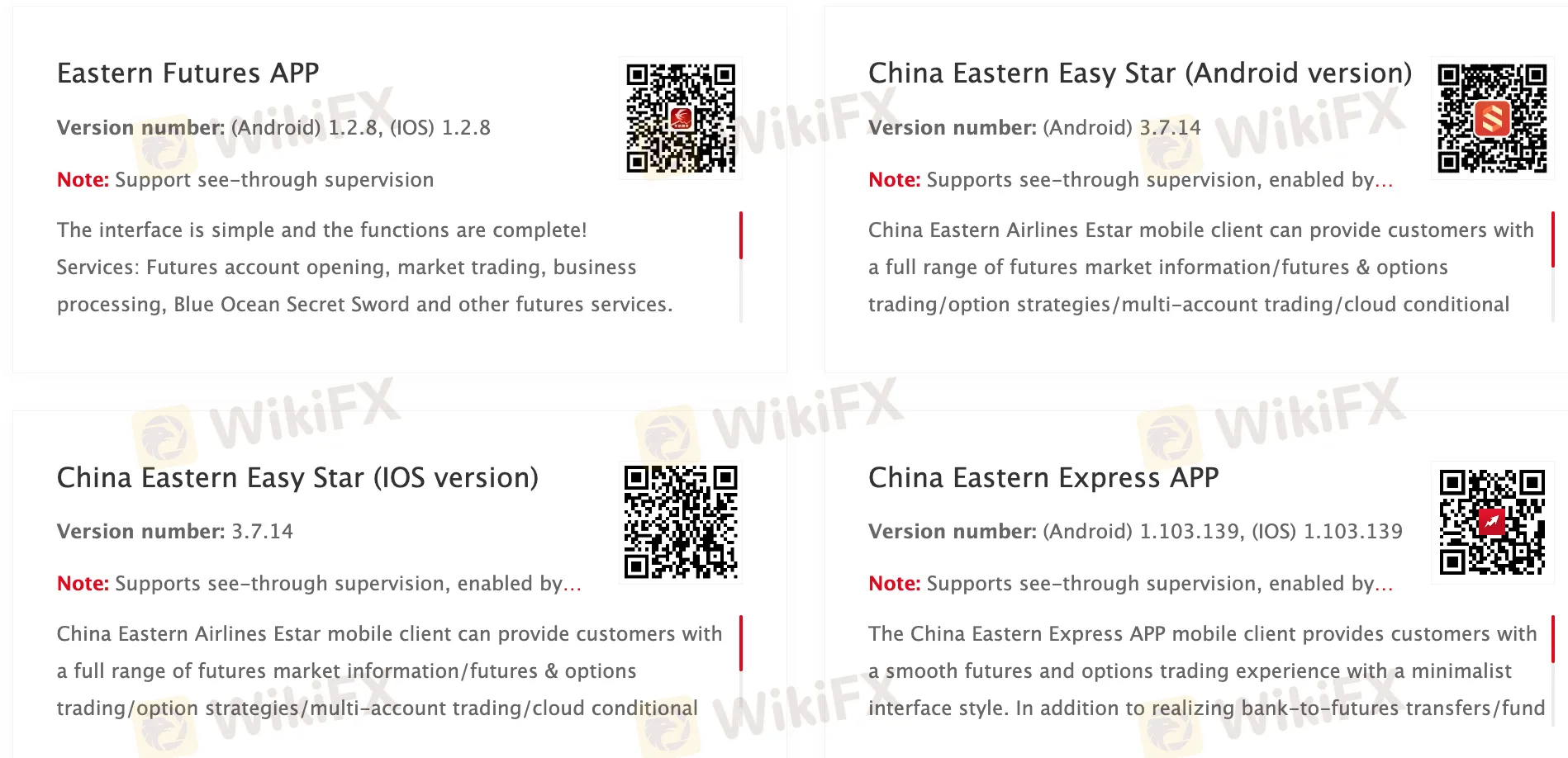

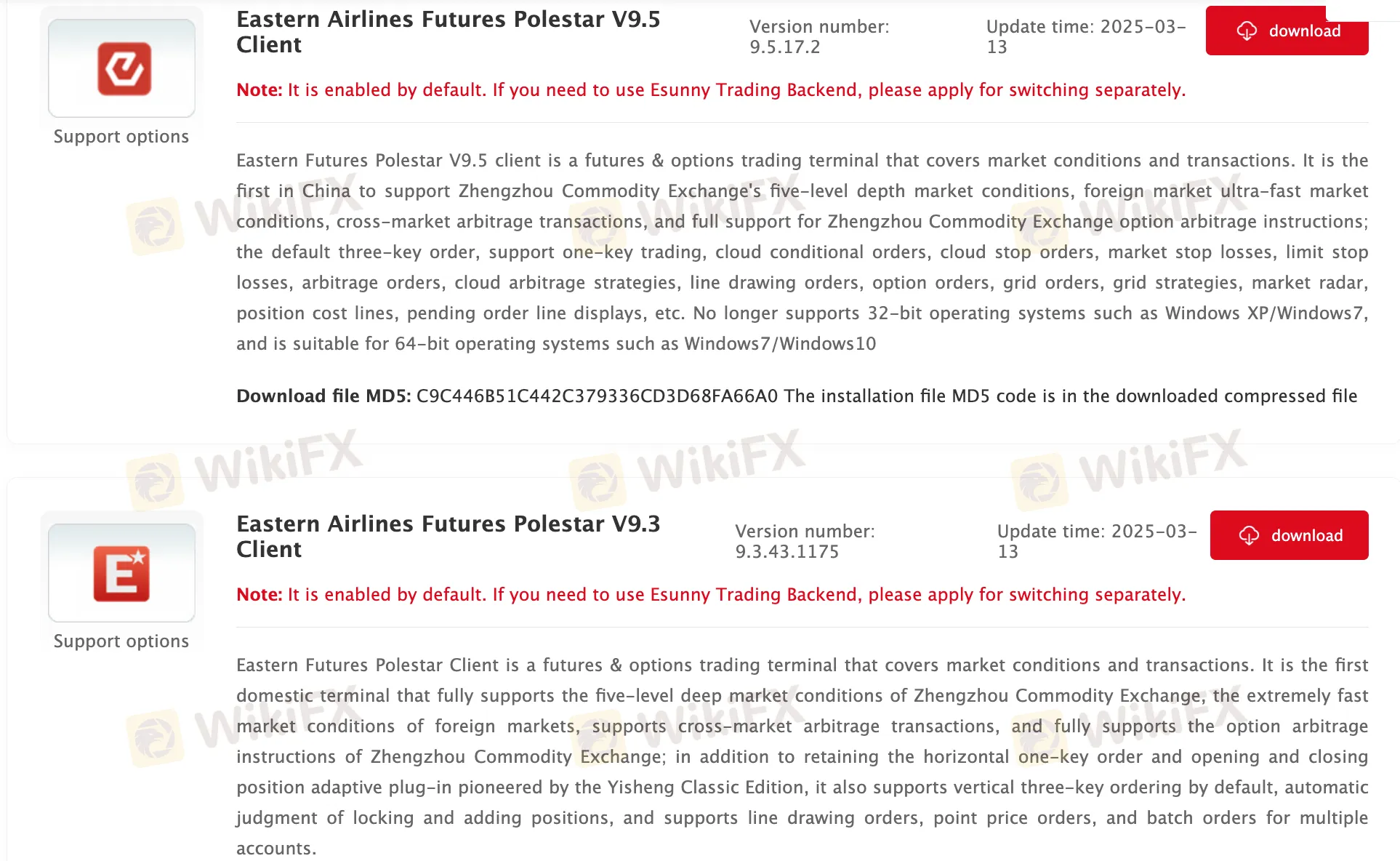

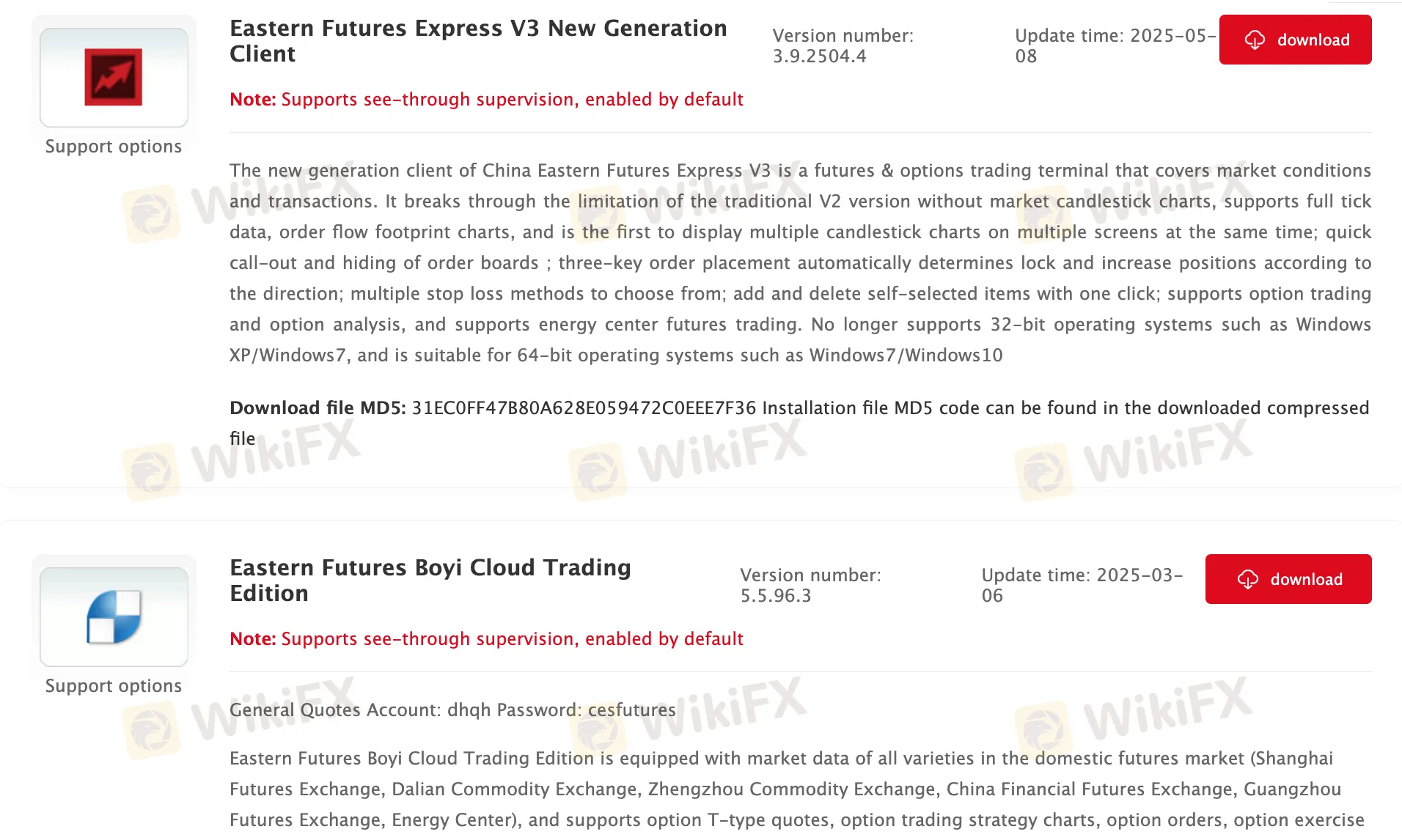

| 거래 플랫폼 | Eastern Futures APP, China Eastern Easy Star (Android 버전), China Eastern Easy Star (IOS 버전), China Eastern Express APP, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (국가 비밀 버전), Eastern Airlines Futures Boyi Cloud (국가 기밀 버전), 등 |

| 고객 지원 | 실시간 채팅 |

| 전화: 4008-889-889 | |

| Wechat, tiktok | |

| 이메일: service@kiiik.com | |

Ces Futures 정보

Ces Futures는 다양한 거래 플랫폼에서 선물 거래를 제공하는 규제된 브로커입니다.

장단점

| 장점 | 단점 |

| 다양한 거래 플랫폼 | 한정된 거래 상품 유형 |

| 데모 계정 | 거래 및 마진 수수료 부과 |

| 잘 규제됨 | |

| 실시간 채팅 지원 | |

| 운영 시간이 길다 |

Ces Futures 합법인가요?

네. Ces Futures은 CFFEX에 의해 라이선스를 받아 서비스를 제공합니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 중국 금융 선물 거래소 | 규제됨 | Ces Futures有限责任公司 | 선물 라이선스 | 0153 |

Ces Futures에서 무엇을 거래할 수 있나요?

Ces Futures 선물 거래를 제공합니다.

| 거래 가능한 상품 | 지원 |

| 선물 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

계정 유형

브로커는 제공하는 계정 유형을 명확히 제시하지 않았습니다. 고객은 데모 계정을 열어 선물 거래를 시작할 수 있습니다.

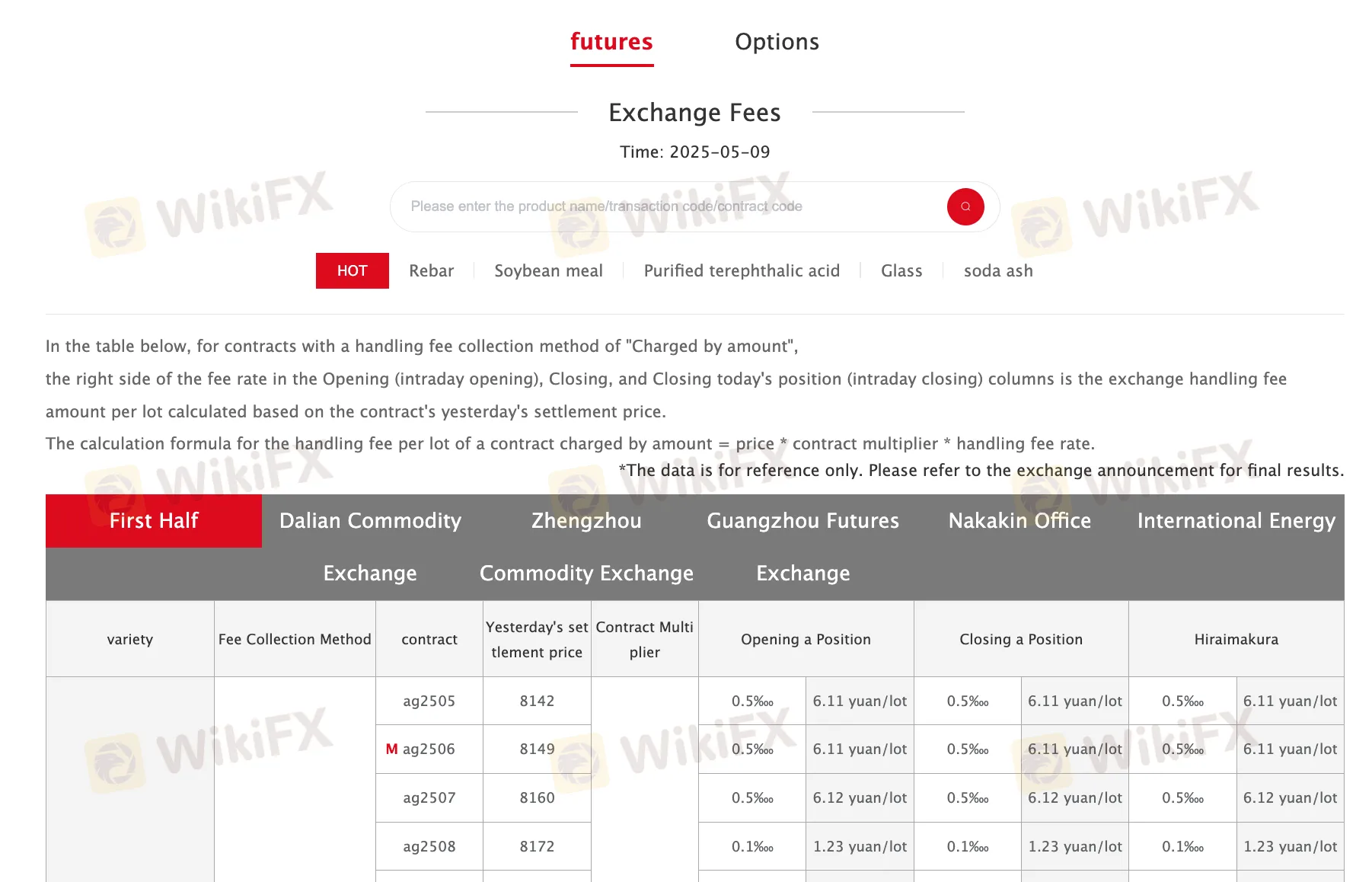

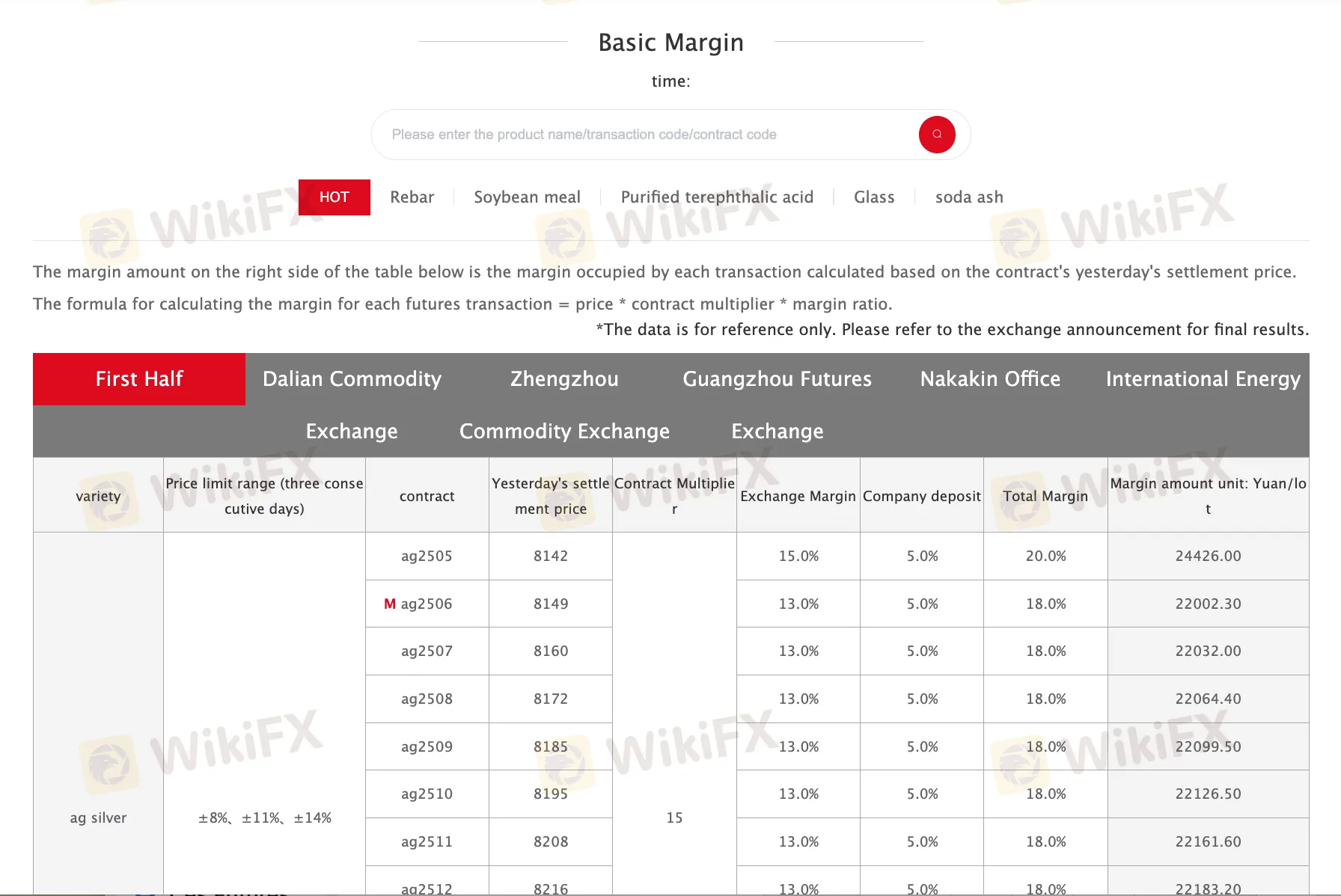

Ces Futures 수수료

브로커는 다양한 유형의 거래 상품에 대해 교환 수수료와 마진 수수료를 요구합니다.

거래 플랫폼

브로커는 Eastern Futures APP, China Eastern Easy Star (Android 버전), China Eastern Easy Star (IOS 버전), China Eastern Express APP, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (국가 기밀 버전) 및 Eastern Airlines Futures Boyi Cloud (국가 기밀 버전)을 포함한 다양한 거래 플랫폼을 제공합니다.

사용 가능한 장치: 데스크톱 및 모바일 (IOS, Android).

입출금

최소 입금 또는 인출 금액이 정의되지 않았으며 수수료나 요금이 명시되지 않았습니다. 웹 사이트에는 입금 및 인출 시간만 표시됩니다.