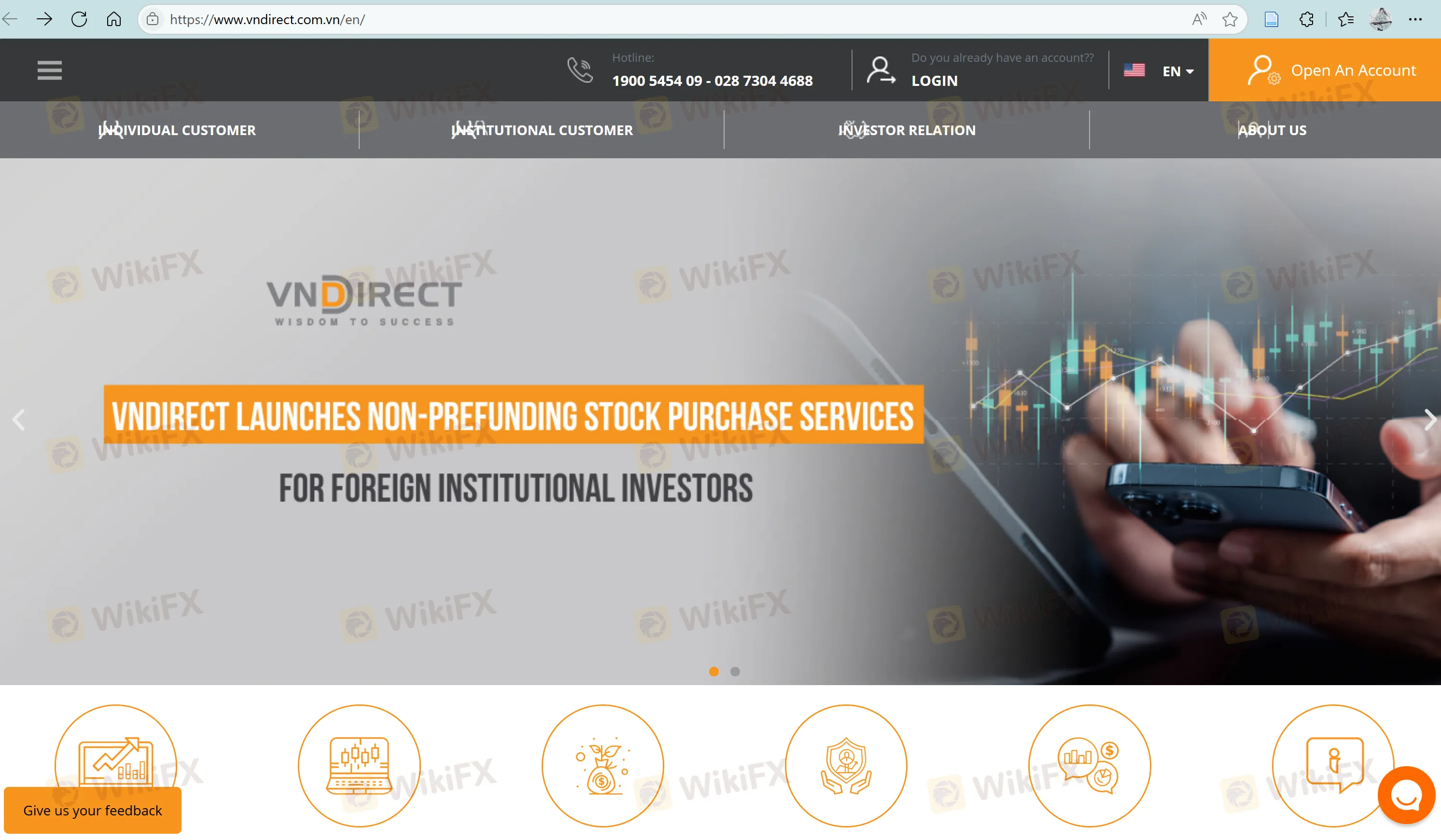

회사 소개

| VNDIRECT 리뷰 요약 | |

| 설립 연도 | 2018 |

| 등록 국가/지역 | 베트남 |

| 규제 | 규제 없음 |

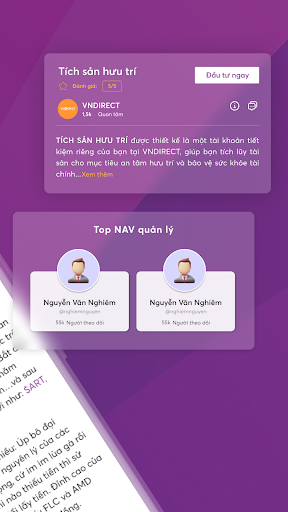

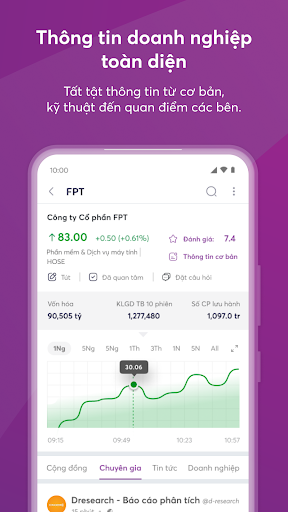

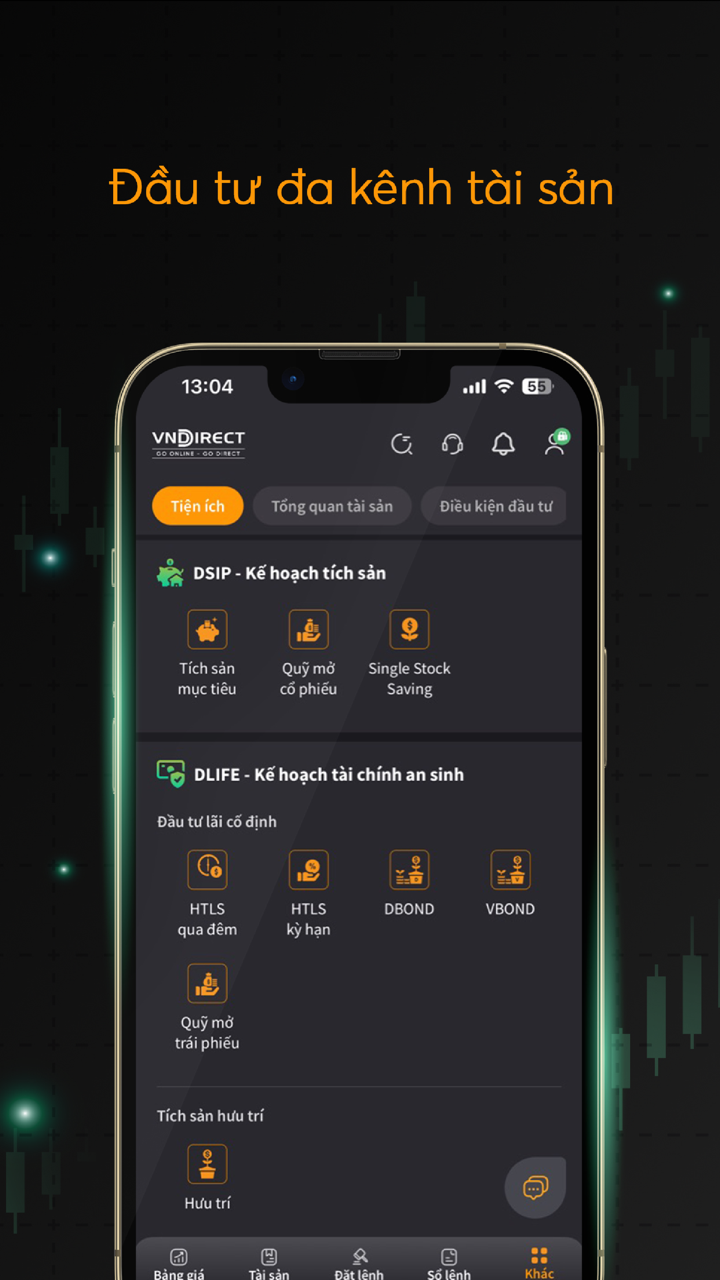

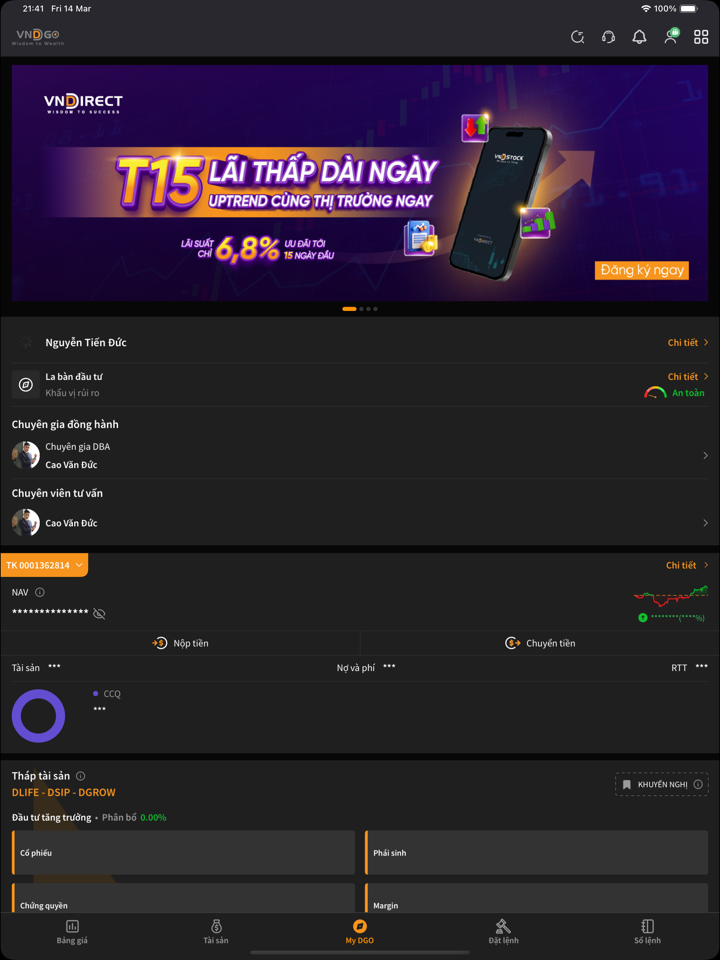

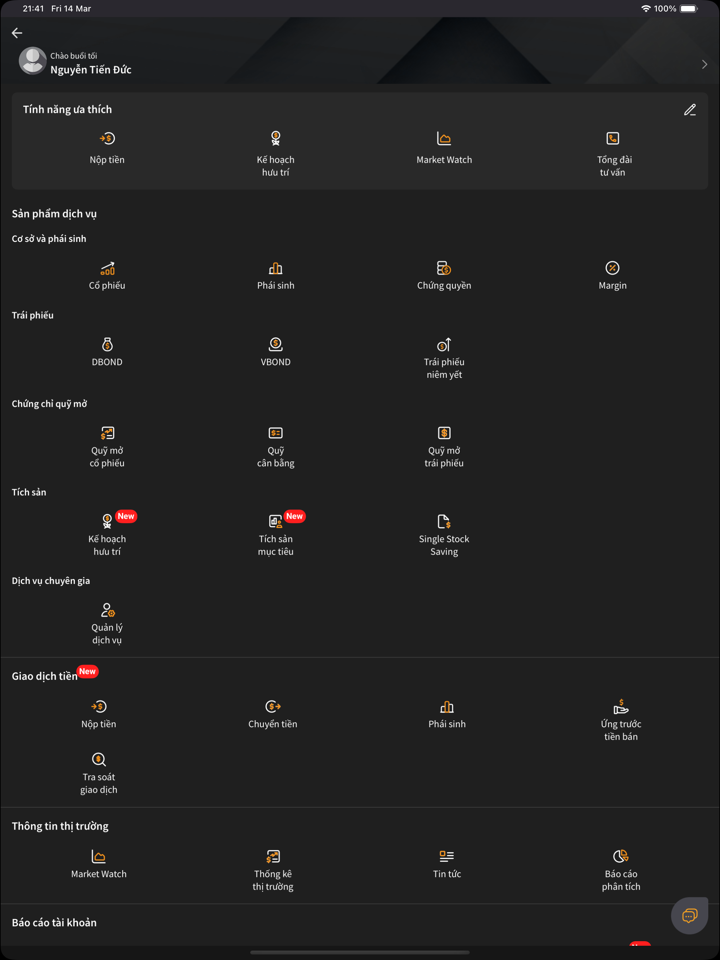

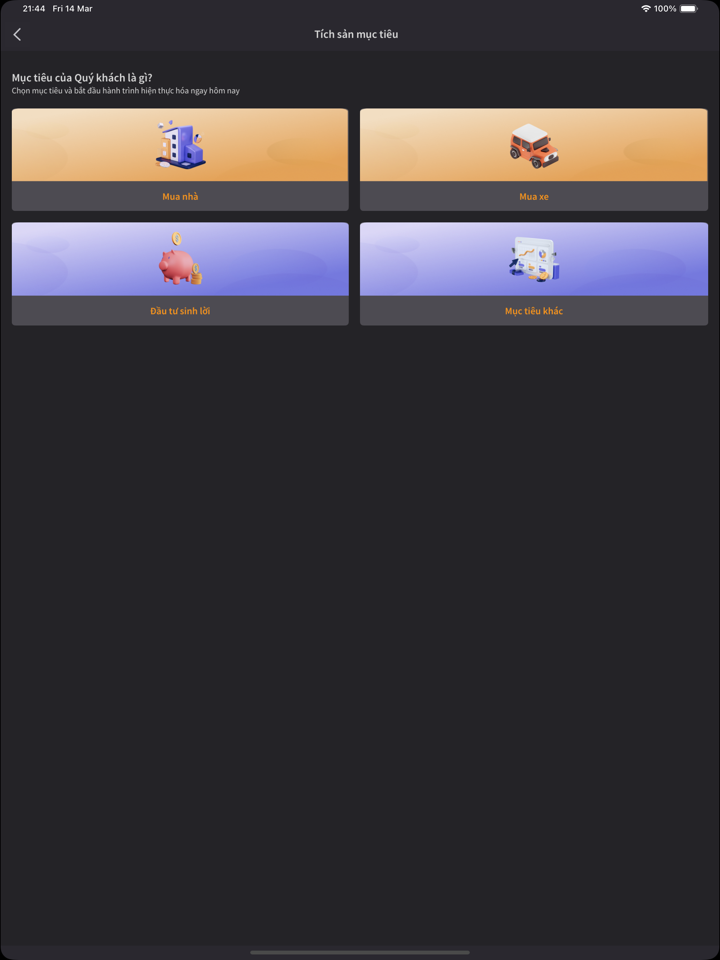

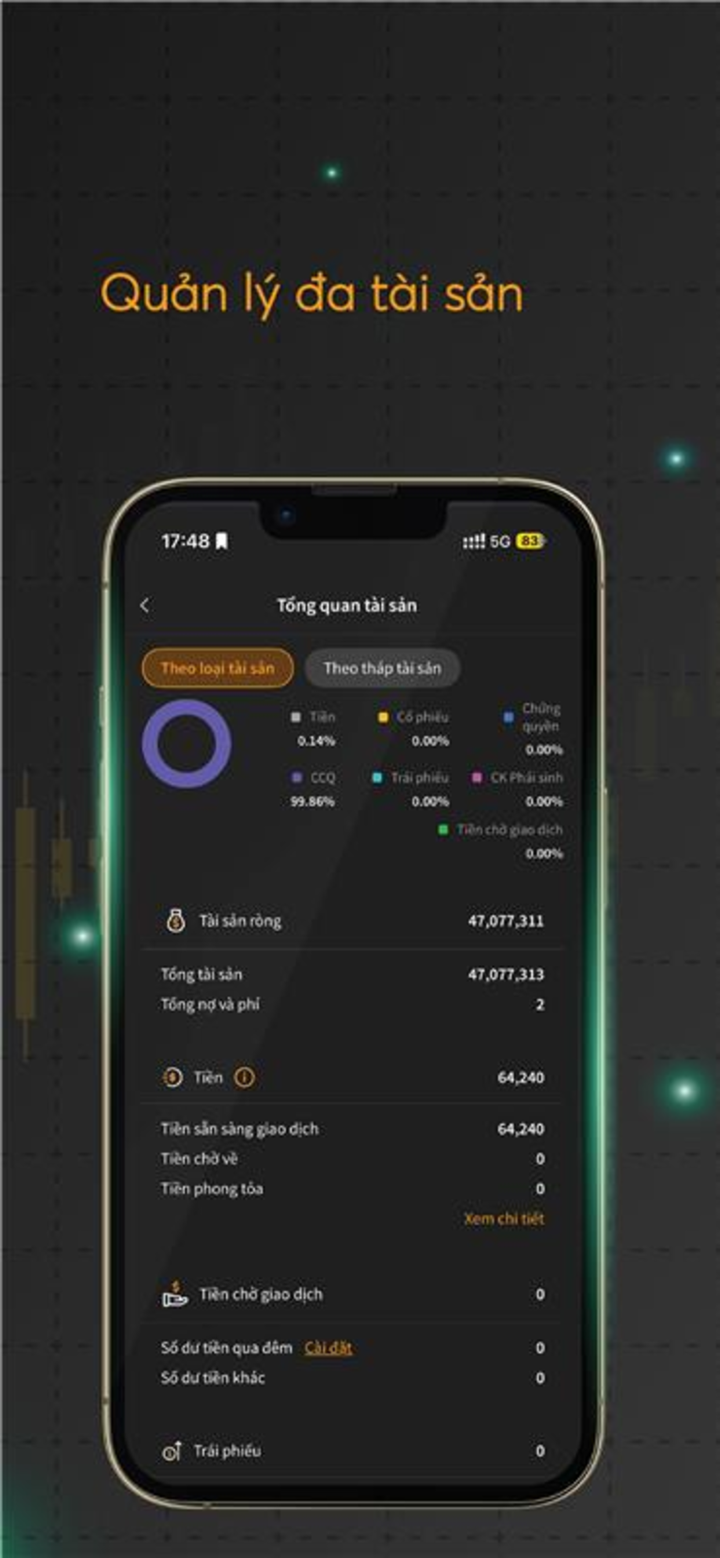

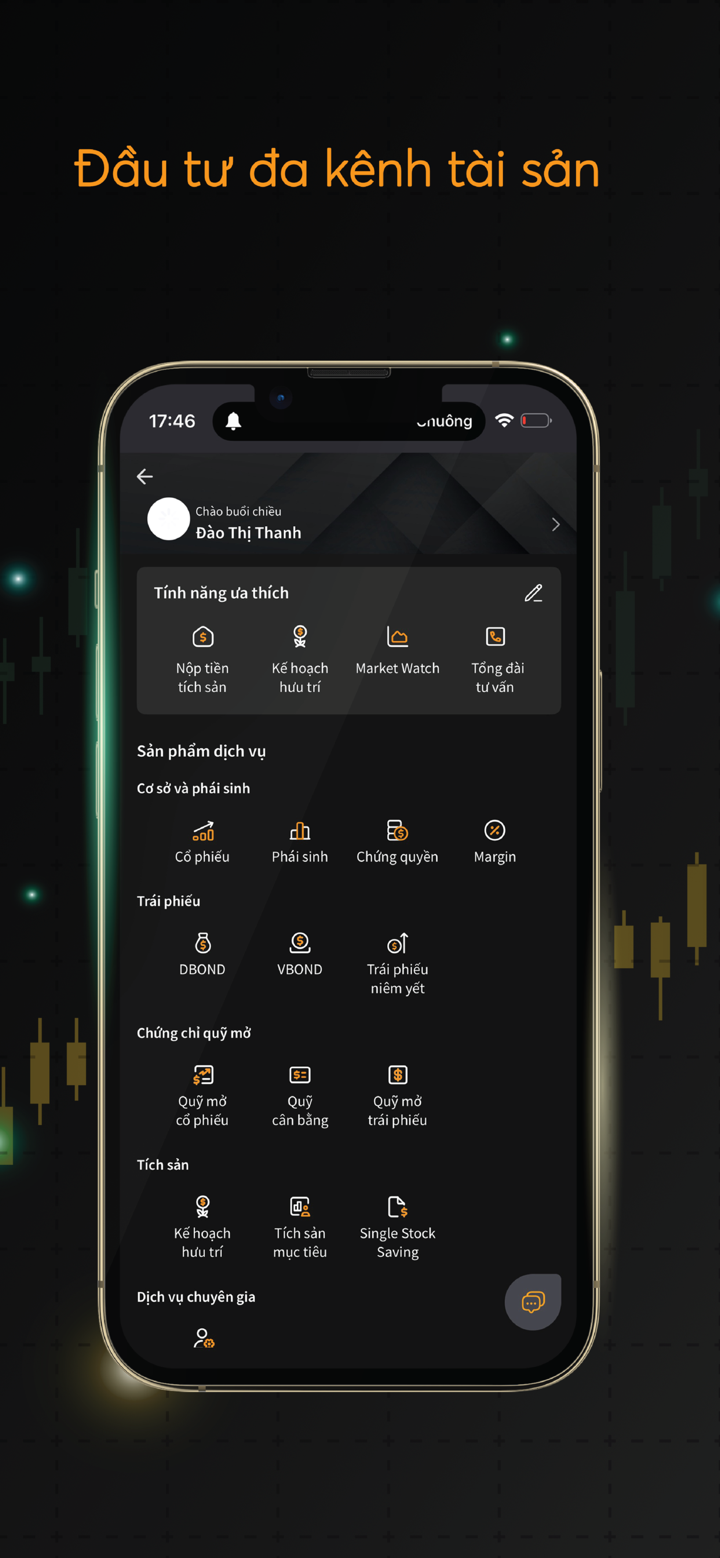

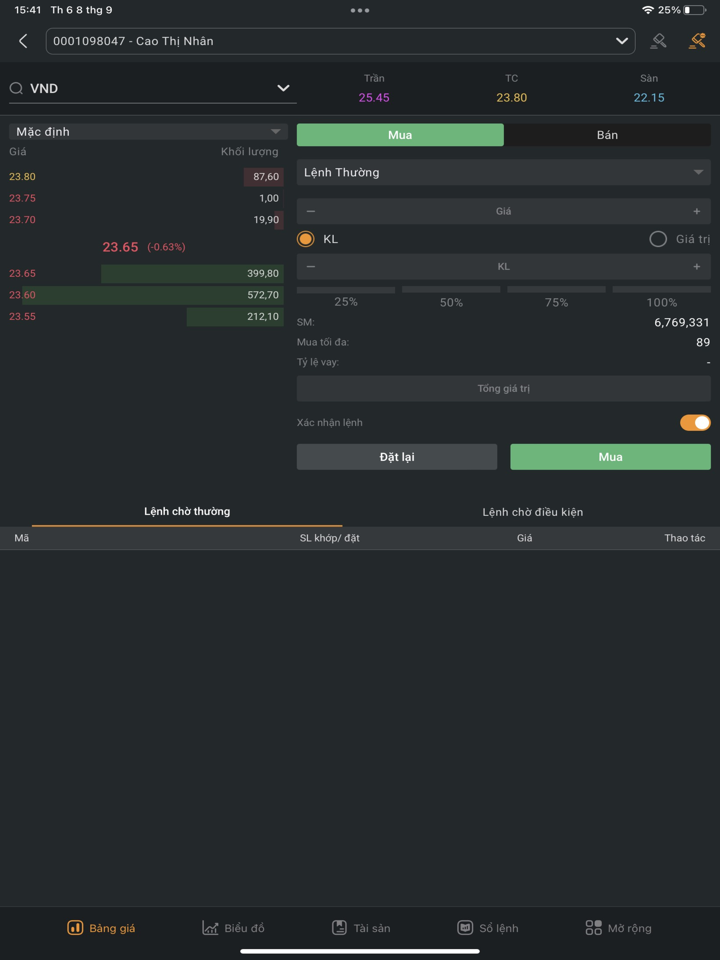

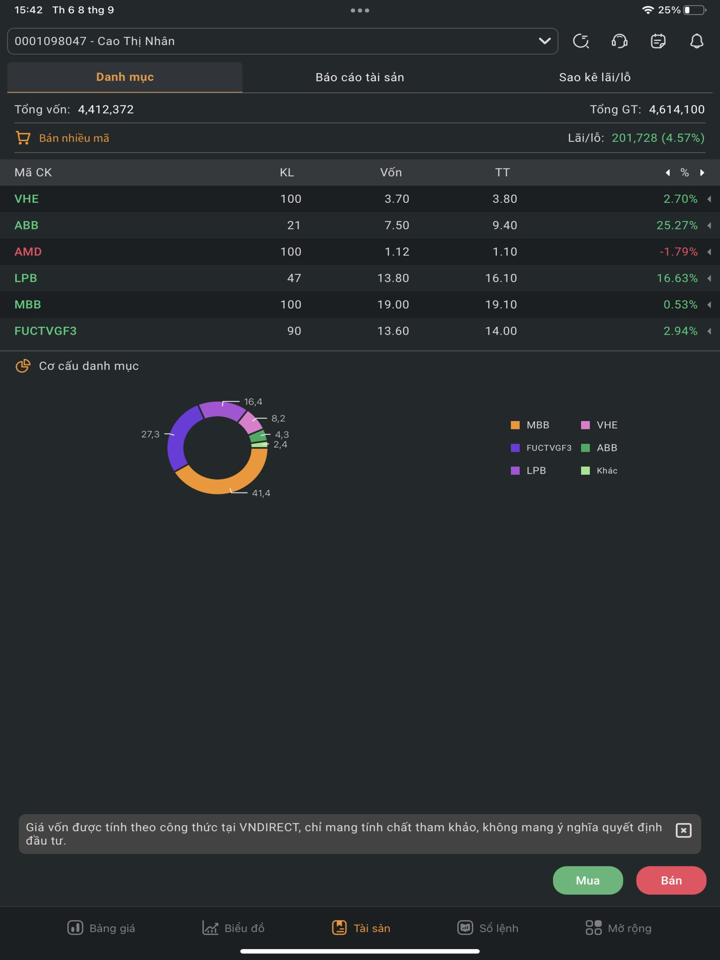

| 투자 서비스 | 자산 관리 및 투자 자문 서비스 DGO, 증권 거래 서비스, 증권 중개 서비스 |

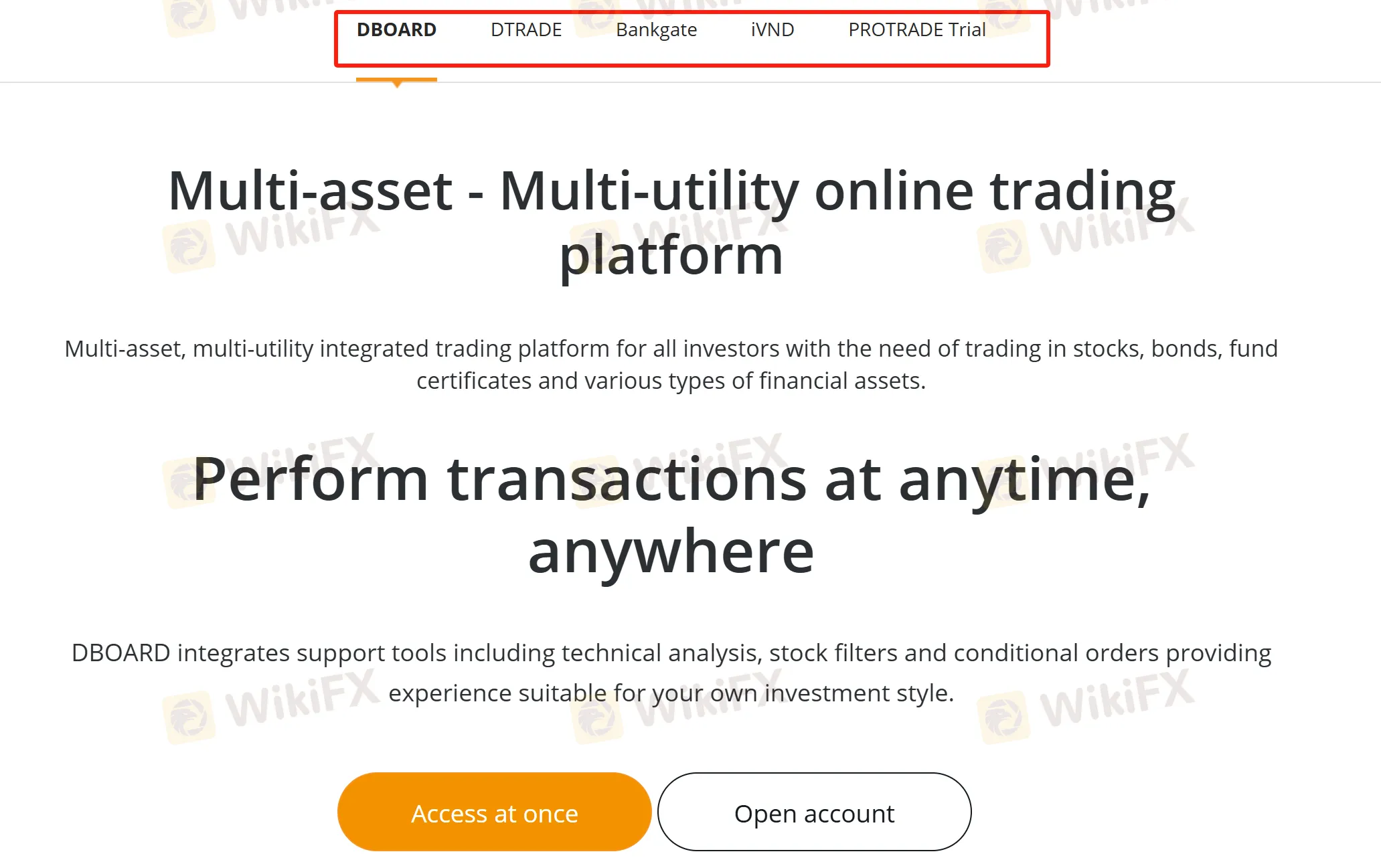

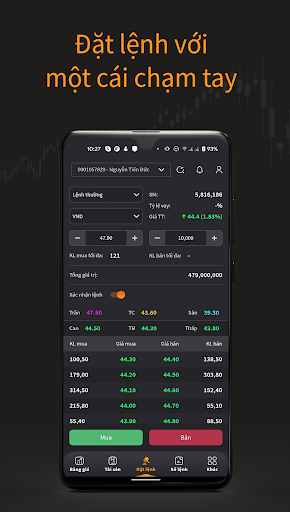

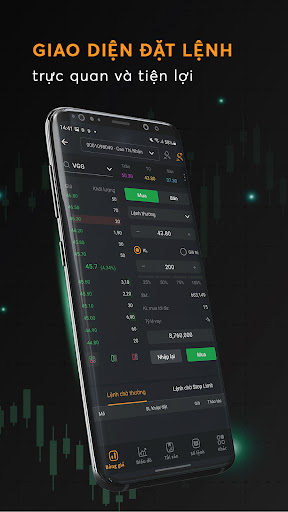

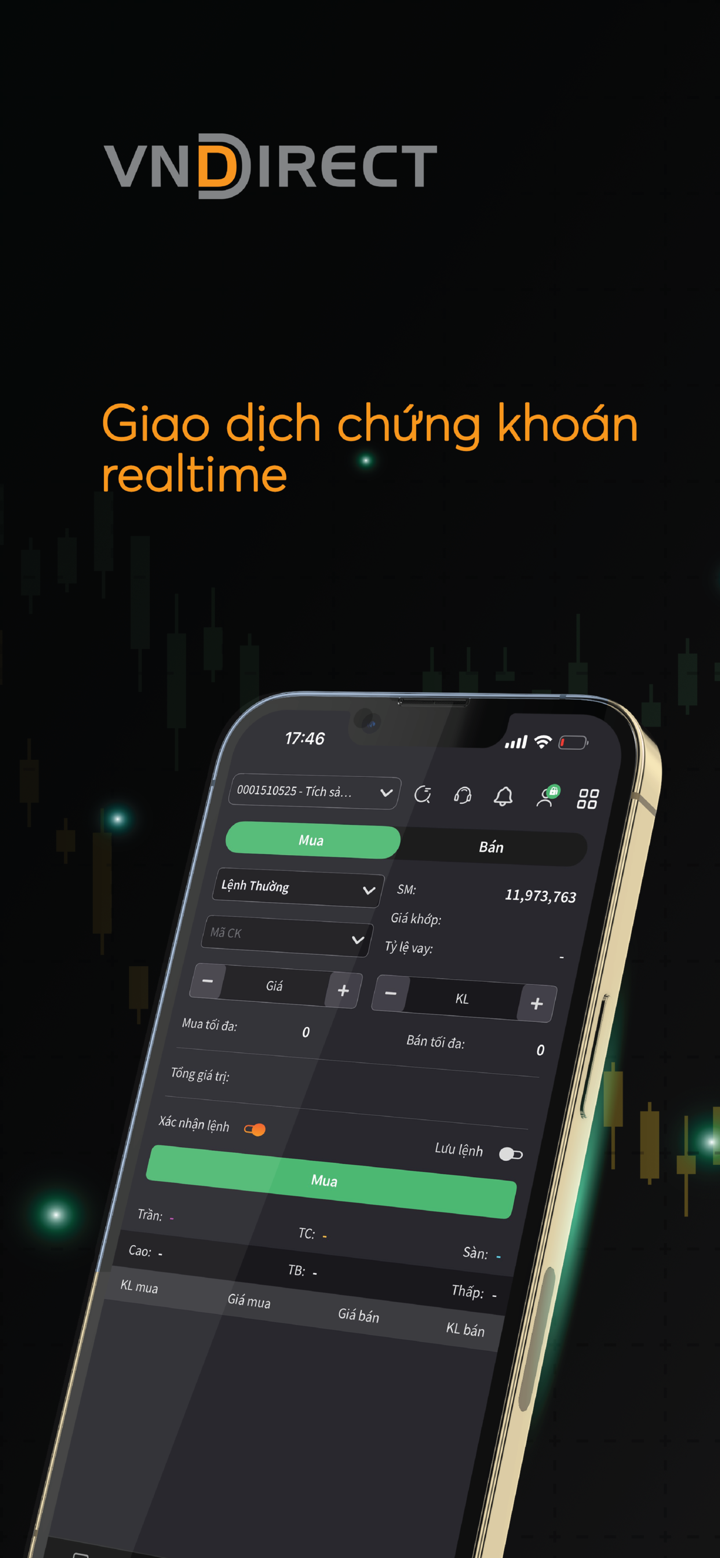

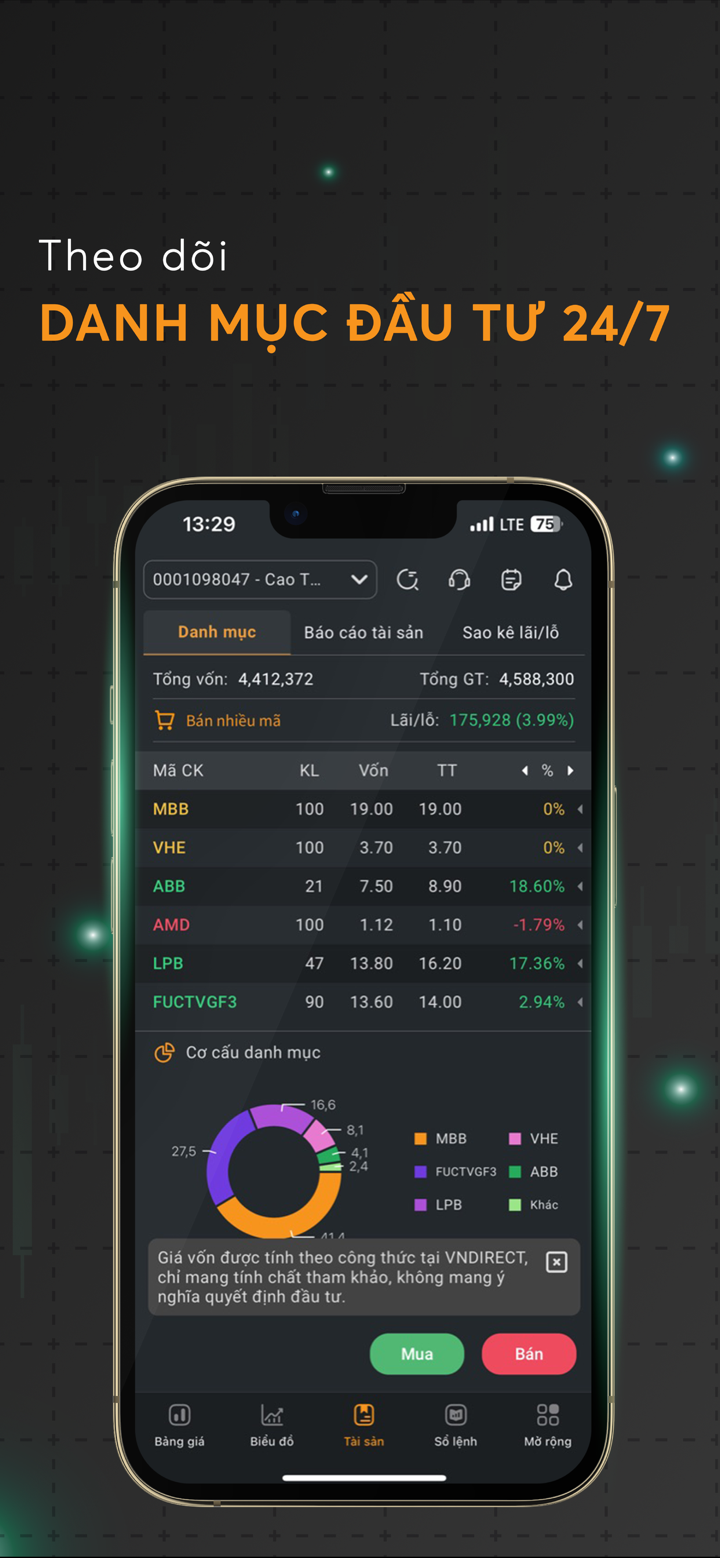

| 거래 플랫폼 | DBOARD, iVND, Protrade, Bankgate |

| 최소 입금액 | / |

| 고객 지원 | 24/7 지원 |

| 문의 양식 | |

| 전화: (+84) 1900 5454 09, 028 7304 4688 | |

| 이메일: ICG@vndirect.com.vn, support@vndirect.com.vn | |

| 주소: Securities Joint Stock Company No. 1 Nguyen Thuong Hien, Hai Ba Trung, Hanoi 100000 | |

| Facebook, LinkedIn, YouTube | |

VNDIRECT은 2018년에 설립된 베트남을 기반으로 하는 규제되지 않은 금융 회사입니다. 자산 관리 및 투자 자문 서비스 DGO, 증권 거래 서비스, 증권 중개 서비스 등 다양한 서비스를 제공합니다. 또한, 회사는 DBOARD, iVND, Protrade, Bankgate와 같은 여러 거래 플랫폼을 활용합니다.

장단점

| 장점 | 단점 |

| 다양한 금융 서비스 | 규제 없음 |

| 다양한 거래 플랫폼 | 계정에 대한 정보 제한 |

| 거래 수수료에 대한 정보 제한 | |

| 데모 계정 없음 |

VNDIRECT이 신뢰할 만한가요?

현재 VNDIRECT은 유효한 규제가 없습니다. 해당 도메인은 유효하지 않거나 지원되지 않는 도메인으로 보입니다. 규제를 받는 다른 회사를 찾는 것이 좋습니다.

투자 서비스

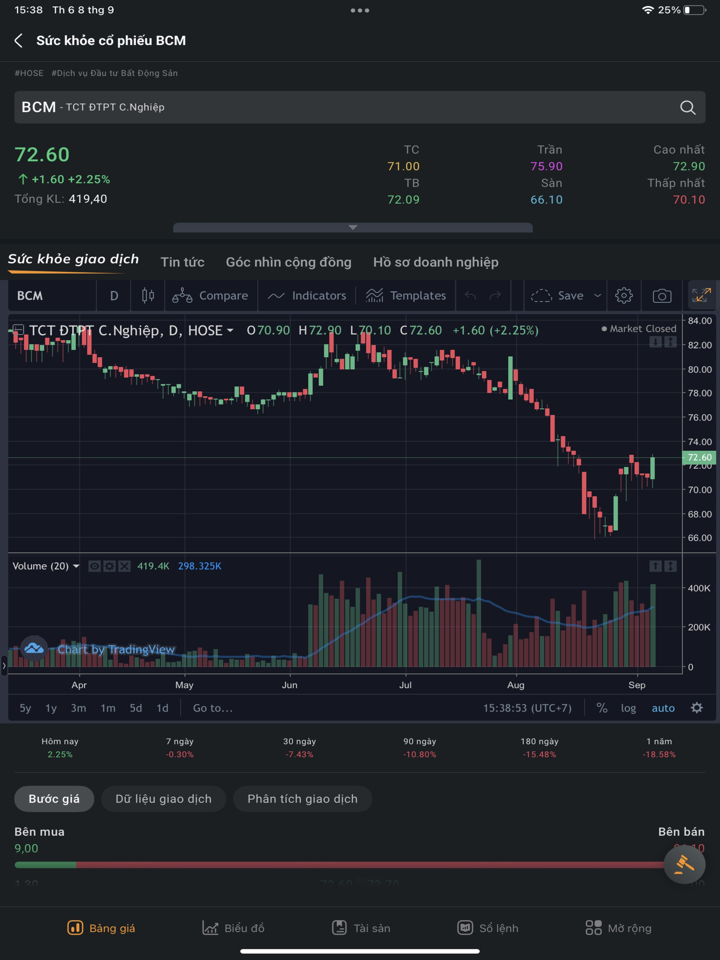

VNDIRECT 고객에게 자산 관리 및 투자 자문 서비스 DGO, 증권 거래 서비스 및 증권 중개 서비스를 제공합니다.

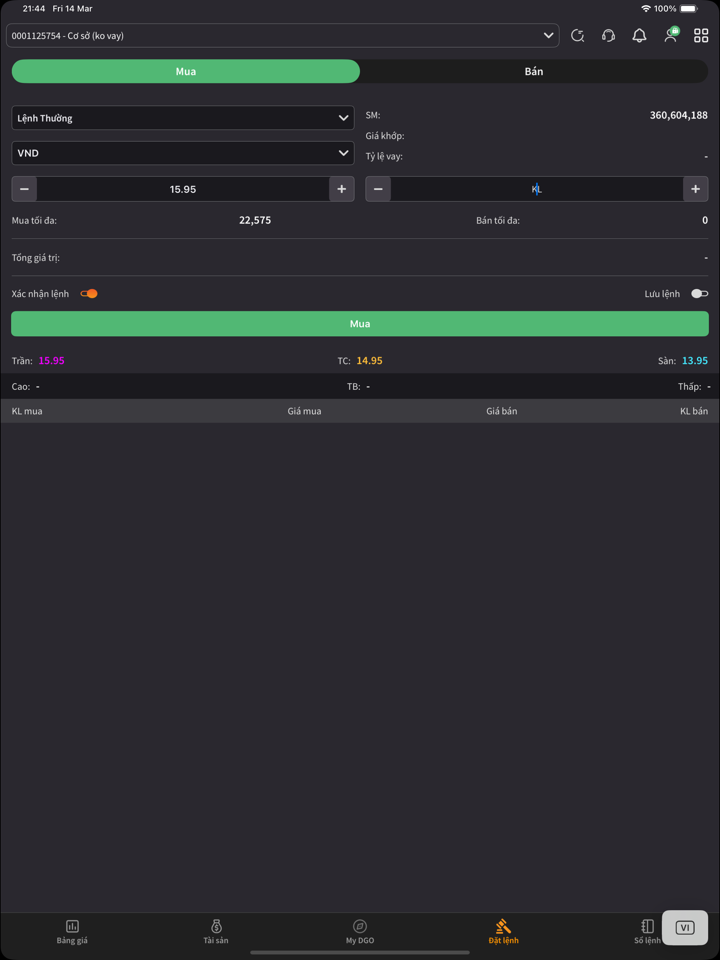

거래 플랫폼

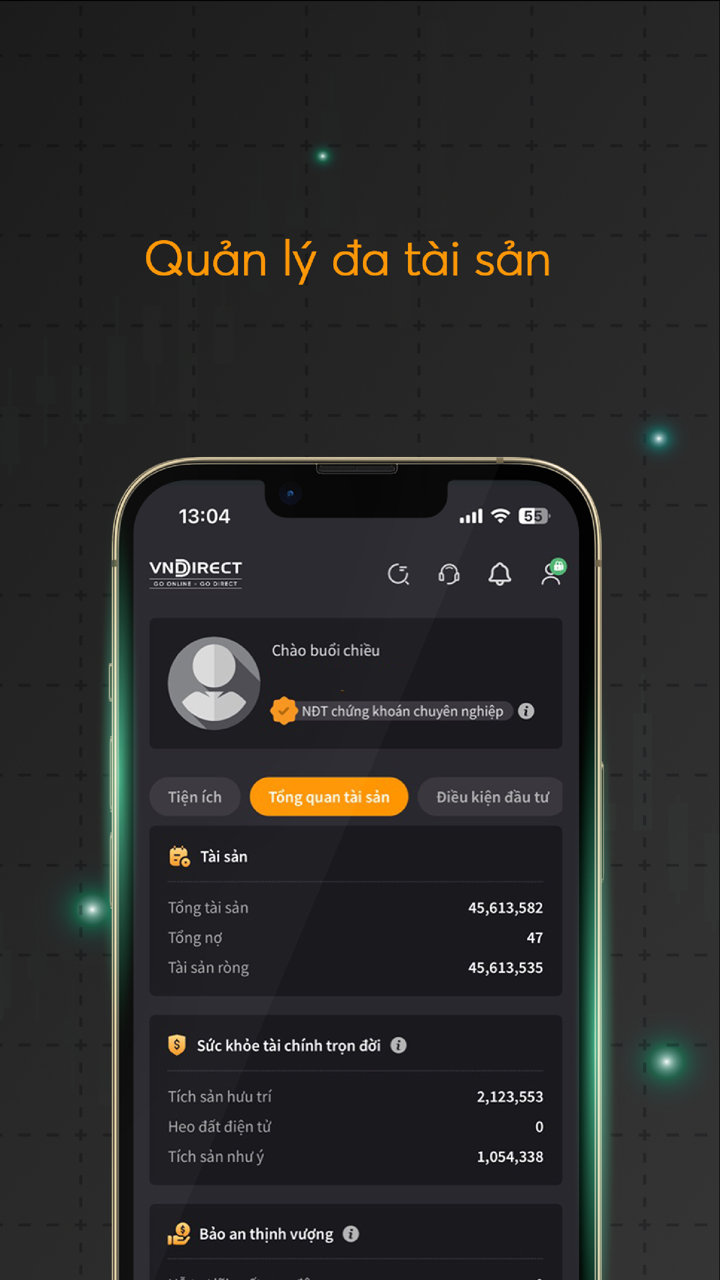

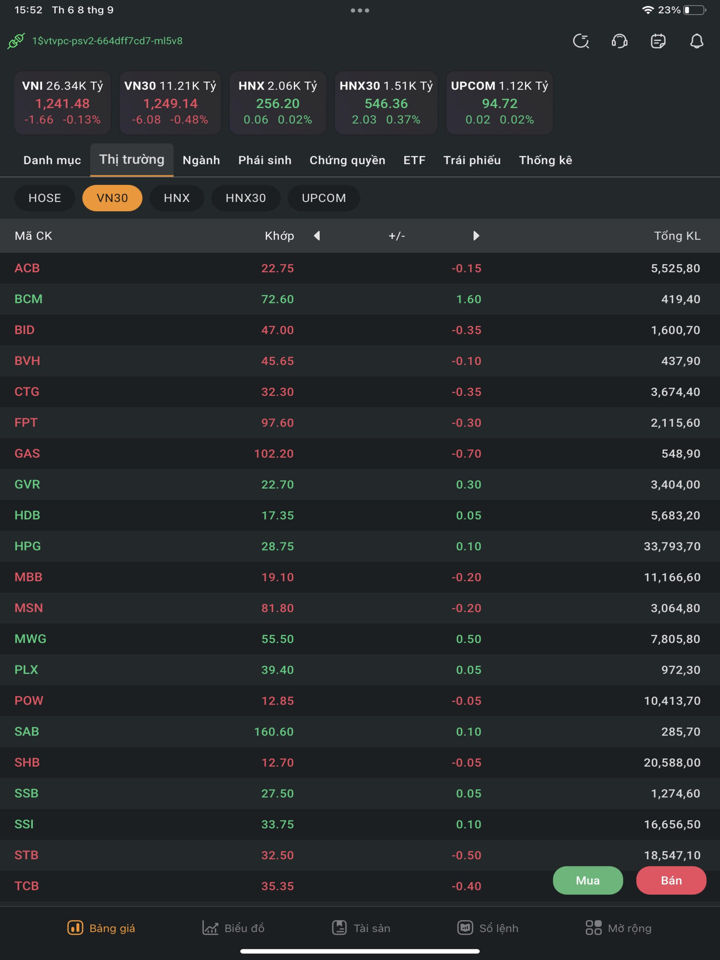

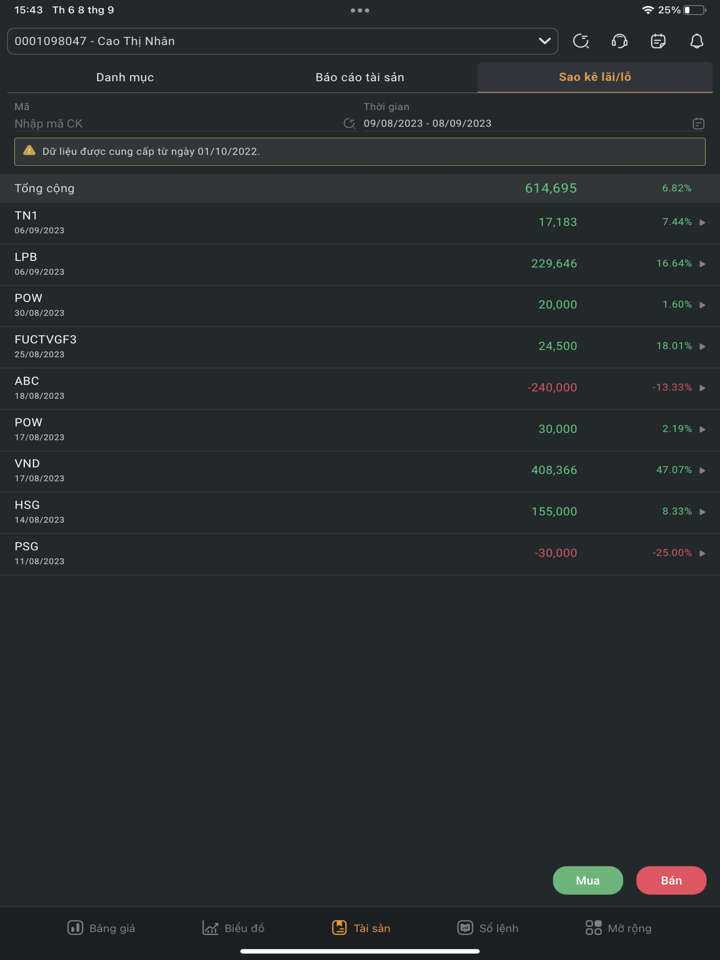

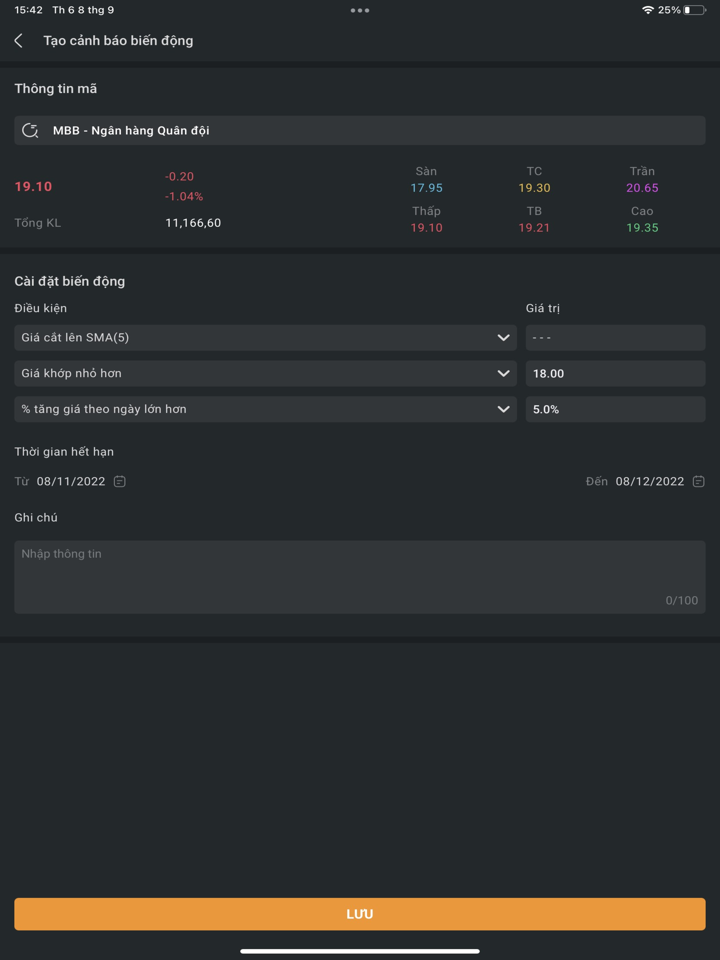

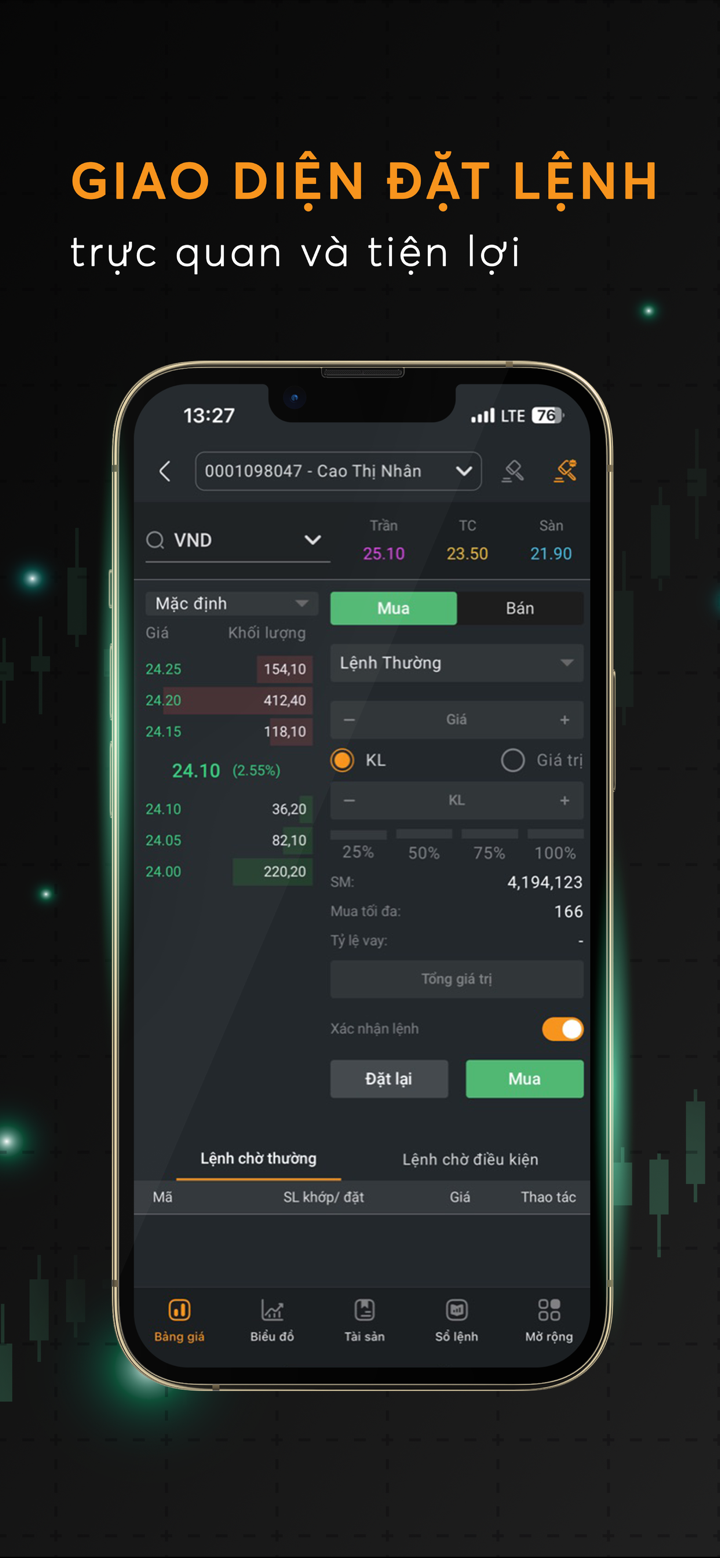

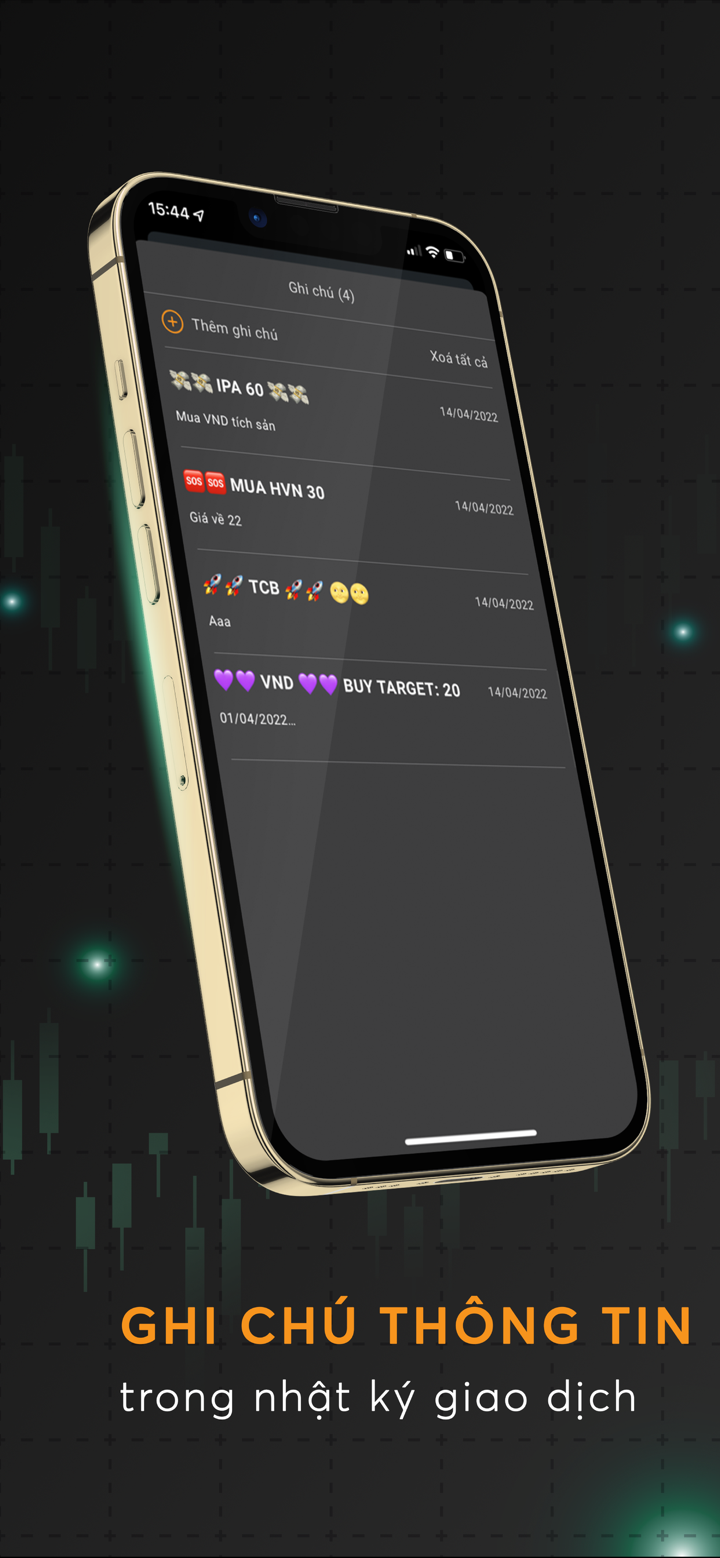

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| DBOARD | ✔ | 웹, iOS, 안드로이드 |

| iVND | ✔ | 웹 |

| Protrade | ✔ | 데스크톱, 모바일, 웹 |

| Bankgate | ✔ | 웹 |