Resumo da empresa

| Tasman FX Resumo da Revisão | |

| Fundação | 2009-03-05 |

| País/Região Registrada | Austrália |

| Regulação | Regulamentado |

| Serviços | Produtos de FX, Remessa de Entrada, Gestão de Riscos, Ordens de Mercado e Pagamentos Globais |

| Suporte ao Cliente | Sydney: (02) 8011 1846Melbourne: (03) 9111 0310Brisbane: (07) 3733 1913Perth: (08) 9468 2705Adelaide: (08) 7111 0807 |

| (02) 9098 8217 | |

| Facebook, LinkedIn, Instagram, Twitter | |

| The Commons, Level 1, 285a Crown St, Surry Hills, NSW 2010, Austrália | |

Tasman FX Informações

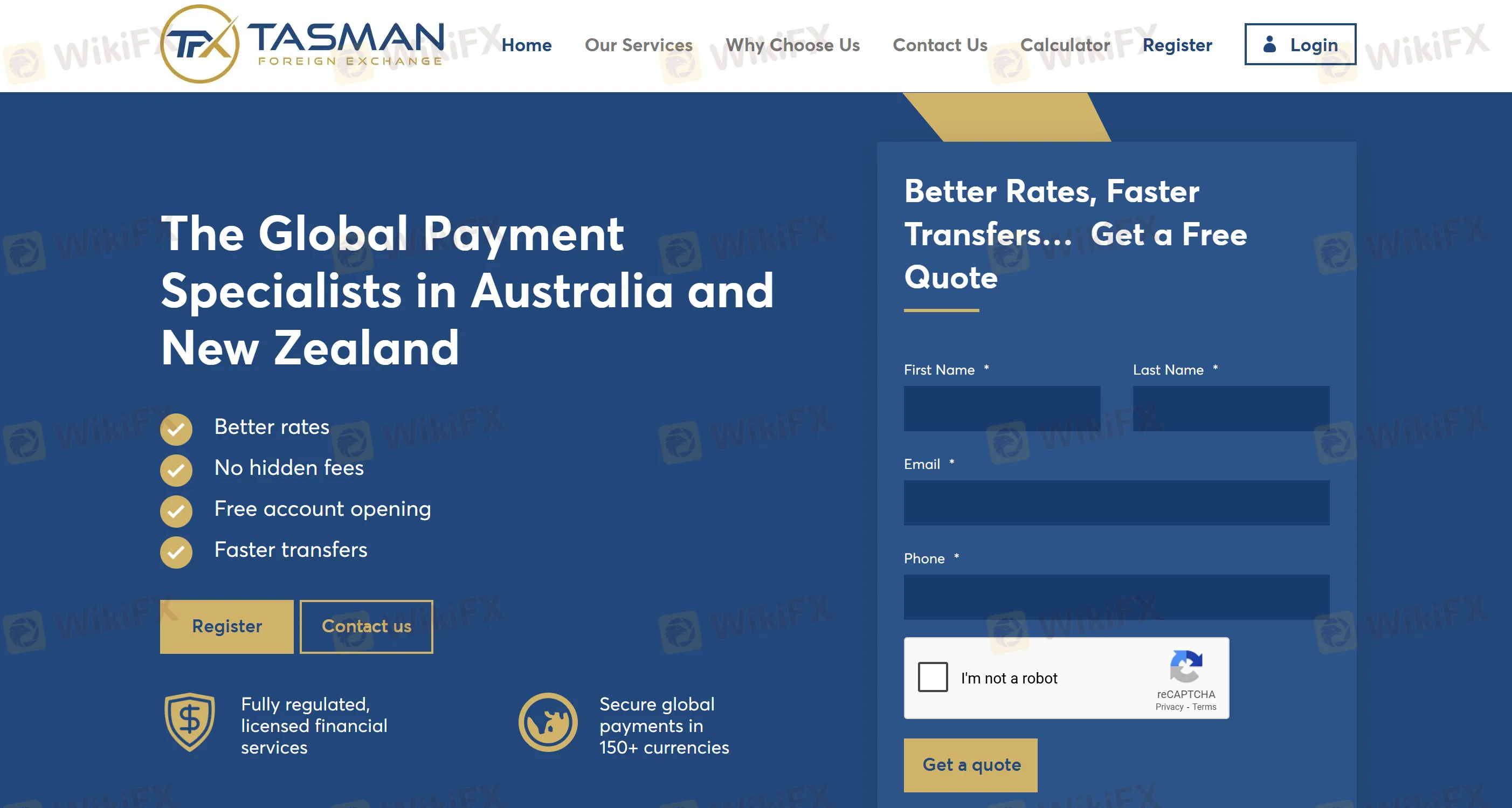

Fundada em 2009, Tasman FX é uma das principais fornecedoras de serviços de câmbio estrangeiro licenciada na Austrália e na Nova Zelândia. Tasman FX oferece soluções de fundos transfronteiriços para indivíduos e empresas, suportando pagamentos seguros em mais de 150 moedas em mais de 50 países e regiões em todo o mundo.

Prós e Contras

| Prós | Contras |

| Regulamentado | Escopo de serviço limitado (centrado nos mercados da Austrália e Nova Zelândia) |

| Múltiplos serviços | Único tipo de produto |

| Pagamentos globais em 150+ moedas | Falta de serviços de alavancagem |

É Tasman FX Legítimo?

Sim. Tasman FX possui uma Licença de Serviços Financeiros Australiana (AFSL) e está legalmente registrada e regulamentada na Nova Zelândia. Seu número de licença ASIC é 000337970.

Quais Serviços Tasman FX Oferece?

Tasman FX oferece produtos de câmbio estrangeiro, como negociação de câmbio à vista e Contratos de Câmbio a Prazo (FEC). Os investidores podem escolher vários métodos de transferência de fundos, incluindo transferência telegráfica, ACH e SEPA, abrangendo mais de 50 moedas.

Tipo de Conta

Tasman FX oferece contas individuais e corporativas, com abertura de conta gratuita. Suporta serviços como remessas transfronteiriças, conversão de câmbio e soluções personalizadas de gestão de riscos.

小芯

Taiwan

A plataforma permite que você abra uma conta e invista diretamente e gratuitamente. É muito adequado para iniciantes. Mais importante ainda, a taxa de manuseio é baixa e a velocidade de retirada é rápida. A atitude do serviço é muito boa.

Positivos

FX3660481217

Hong Kong

Entrei nesta plataforma com apreensão. Depois de usá-lo por um tempo, descobri que é uma plataforma muito boa. Ganhei uma renda extra aqui e continuarei a usá-los.

Positivos

FX1349771962

Nova Zelândia

Achei o processo de registro de uma conta gratuita na Tasman FX muito demorado e tedioso. Além disso, o tempo de resposta do atendimento ao cliente era extremamente lento, dificultando a obtenção de respostas para questões importantes. No geral, tive uma experiência ruim com esta empresa e não consideraria usar seus serviços no futuro.

Neutro

FX1299232315

Austrália

Sou cliente da TASMAN há muitos anos e devo dizer que eles são os melhores do ramo. O atendimento ao cliente é incomparável; sua plataforma torna o investimento tão simples!

Positivos