Resumo da empresa

| GEX Resumo da Revisão | |

| Nome da Empresa | GEX Ventures Pte Ltd. |

| País/Região Registrado(a) | Singapura |

| Regulação | Sem Regulação |

| Serviços | aconselhamento em negócios corporativos, captação de recursos, investimentos financeiros |

| Suporte ao Cliente | Formulário de Contato, Tel: +65 6559 8888 |

| Endereço da Empresa | 238A Thomson Road Novena Square Office Tower A |

O que é GEX?

GEX Ventures Pte Ltd., sediado em Singapura, opera principalmente como uma empresa financeira que oferece aconselhamento. A empresa não possui regulamentação atualmente.

Prós e Contras

| Prós | Contras |

| N/A |

|

|

Contras:

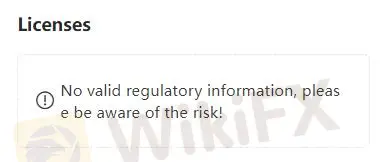

Sem Regulação: GEX não possui regulamentação, o que preocupa os usuários em relação à sua responsabilidade e transparência.

Falta de Informações em seu Website: Apenas informações limitadas podem ser encontradas em seu website oficial, o que dificulta que potenciais clientes tomem decisões informadas.

GEX é Legítimo ou uma Fraude?

Visão Regulatória: GEX está atualmente sem supervisão regulatória e sem licenças que permitam a condução de seus padrões operacionais no mercado financeiro. Essa falta de regulamentação apresenta inúmeros riscos para os investidores, como falta de transparência, preocupações com segurança e nenhuma garantia de adesão aos padrões e práticas do setor.

Feedback dos Usuários: Os usuários devem verificar as avaliações e feedback de outros clientes para obter uma visão mais abrangente do corretor, ou procurar avaliações em sites e fóruns confiáveis.

Medidas de Segurança: Até o momento, não encontramos nenhuma informação sobre as medidas de segurança deste corretor.

Serviços

GEX oferece serviços de aconselhamento abrangendo muitos aspectos de negócios corporativos, incluindo captação de recursos e investimentos financeiros. Sua expertise se estende a oferecer orientação estratégica em assuntos corporativos, auxiliando os clientes na navegação de paisagens financeiras complexas e facilitando iniciativas de captação de recursos.

Suporte ao Cliente

GEX oferece suporte ao cliente por meio de vários canais, incluindo um formulário de contato em seu website e uma linha telefônica no +65 6559 8888. GEX também fornece seu endereço físico, que é em 238A Thomson Road Novena Square Office Tower A, para que os clientes possam escolher assistência presencial, se necessário.

Conclusão

Como uma empresa financeira, GEX fornece principalmente serviços de consultoria. Há apenas informações limitadas em seu site oficial e também não possui regulamentações.

Perguntas Frequentes (FAQs)

Pergunta: GEX é regulamentado ou não?

Resposta: Não, não é regulamentado.

Pergunta: GEX também fornece consultoria para indivíduos?

Resposta: Sim.

Pergunta: GEX é uma boa escolha ou não?

Resposta: Não. Ele carece de transparência de informações e regulamentações.

Aviso de Risco

A negociação online envolve riscos significativos e você pode perder todo o seu capital investido. Não é adequado para todos os traders ou investidores. Certifique-se de entender os riscos envolvidos e observe que as informações fornecidas nesta análise podem estar sujeitas a alterações devido à atualização constante dos serviços e políticas da empresa.