Resumo da empresa

| C&SResumo da Revisão | |

| Fundado | 2008 |

| País/Região Registrado | Argentina |

| Regulação | Sem regulação |

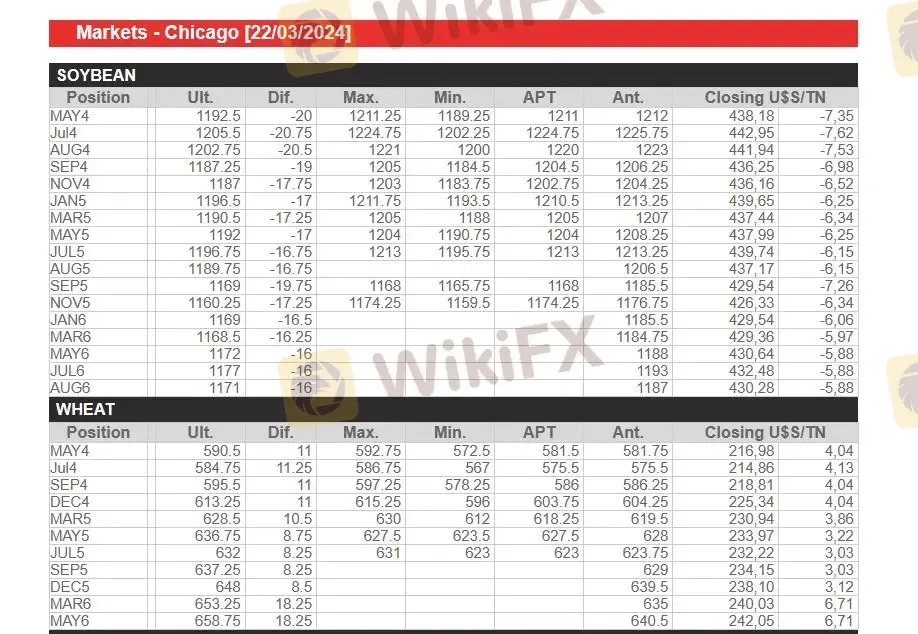

| Instrumentos de Mercado | Commodities |

| Conta Demonstração | ❌ |

| Plataforma de Negociação | / |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: (+54.341) 426-0226 / 426-7201 |

| Email: contacto@cysargentina.com | |

| Endereço: Entre Rios 729 - P.11 - Rosario, Santa Fe, Argentina | |

| Twitter: https://twitter.com/cysargentina | |

| Facebook: https://www.facebook.com/home.php?#!/profile.php?id=100001769530055 | |

Informações C&S

Fundada em 2008, a C&S é uma provedora de serviços financeiros não regulamentada registrada na Argentina, oferecendo negociação de commodities.

Prós e Contras

| Prós | Contras |

| Múltiplos canais de contato | Sem regulação |

| Sem contas de demonstração | |

| Produtos de negociação limitados |

A C&S é Legítima?

Não. A C&S está registrada na Argentina. Atualmente, não possui regulamentações válidas.

O que Posso Negociar na C&S?

| Instrumentos Negociáveis | Suportados |

| Commodities | ✔ |

| Forex | ❌ |

| Ações | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |