Resumo da empresa

| MasterLink SecuritiesResumo da Revisão | |

| Fundado | 1989 |

| País/Região Registrado | Taiwan |

| Regulação | Regulado pela Taipei Exchange |

| Instrumentos de Mercado | Corretagem, Gestão de Patrimônio, Subscrição, Registro e Transferência de Ações, Negociação Proprietária, Negociação Proprietária de Futuros, Renda Fixa, Derivativos, Consultoria de Investimentos MasterLink Securities, MasterLink Futures, MasterLink Insurance Agency, MasterLink Venture Capital&MasterLink Venture Mana |

| Conta Demonstração | Não mencionado |

| Alavancagem | Até 1:600 |

| Spread | A partir de 0.5 pips |

| Plataforma de Negociação | MetaTrader 4 |

| Depósito Mínimo | $100 |

| Suporte ao Cliente | Telefone: +886-2-27313888 |

| Email: sylvia0704@masterlink.com.tw | |

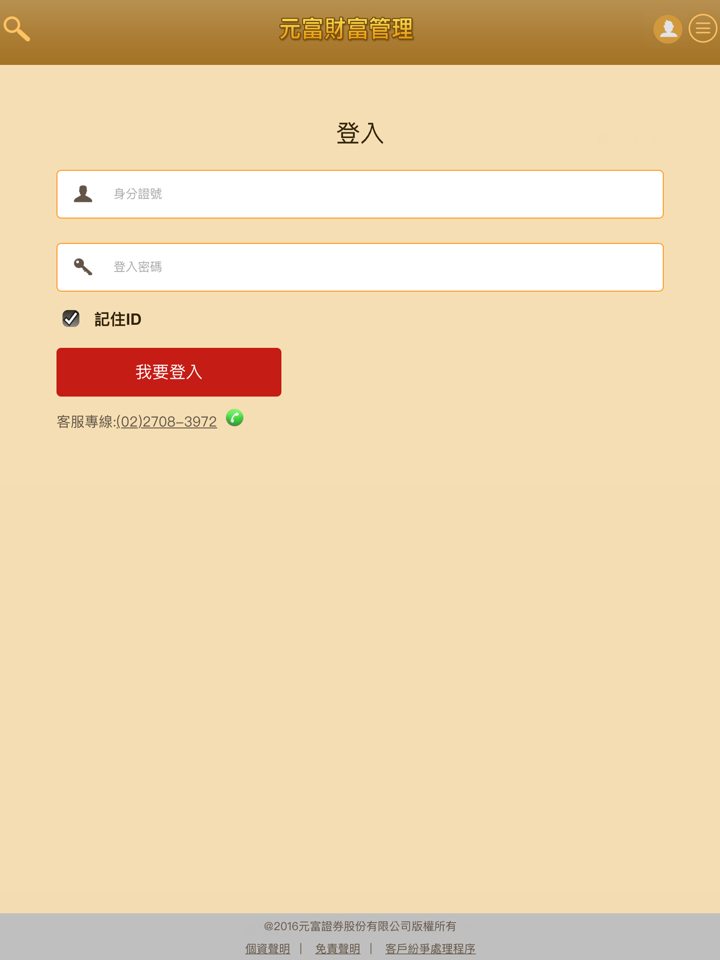

Informações MasterLink Securities

MasterLink Securities está sediado em Taiwan e foi fundado em 1989. Este corretor oferece Forex, CFDs, commodities e índices. Ele também oferece alavancagem de até 1:600, spreads variando de 0.5 pips a 1.5 pips e três tipos de contas para escolher.

Prós e Contras

| Prós | Contras |

| Oferece vários ativos de negociação | Falta de suporte de chat ao vivo |

| Fornece tipos de contas | |

| Regulado pela Taipei Exchange | |

| Oferece uma alavancagem competitiva de 1:600 | |

| Fornece plataforma de negociação MetaTrader 4 |

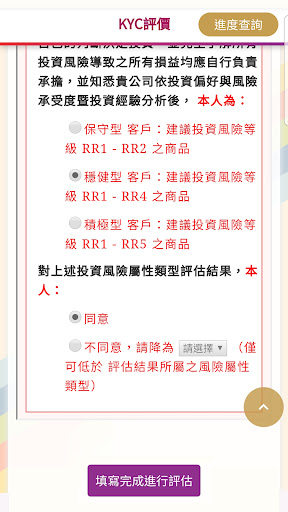

MasterLink Securities é Legítimo?

MasterLink Securities é regulado pela Taipei Exchange. Seu tipo de licença é No Sharing.

O que posso negociar na MasterLink Securities?

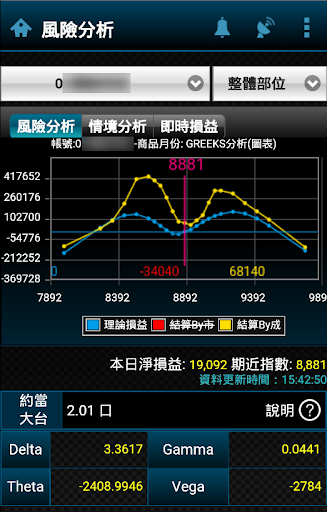

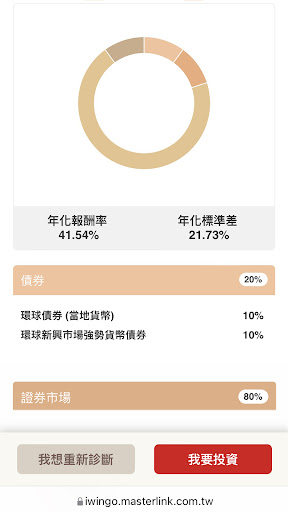

MasterLink Securities oferece Corretagem, Gestão de Patrimônio, Subscrição, Registro e Transferência de Ações, Negociação Proprietária, Negociação Proprietária de Futuros, Renda Fixa, Derivativos, Consultoria de Investimentos MasterLink Securities, MasterLink Futures, MasterLink Insurance Agency, MasterLink Venture Capital&MasterLink Venture Mana, incluindo forex, CFDs em índices e commodities, commodities e negociação de índices.

| Instrumentos Negociáveis | Suportado |

| Forex | ✔ |

| Commodities | ✔ |

| Crypto | ❌ |

| CFD | ✔ |

| Futuros | ✔ |

| Ações | ✔ |

| Índice | ✔ |

| Opções | ❌ |

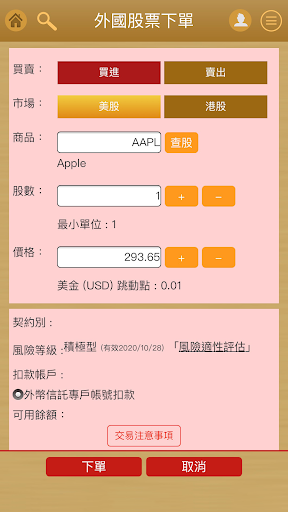

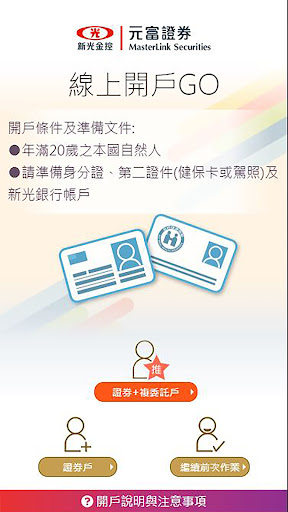

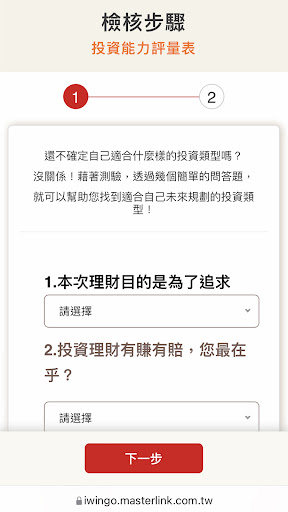

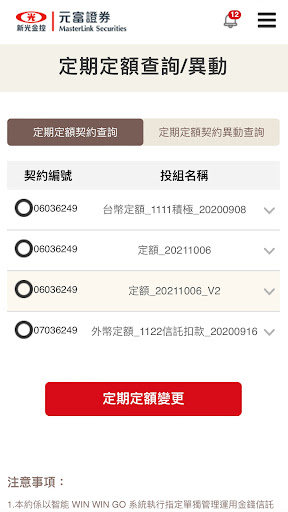

Tipos de Conta

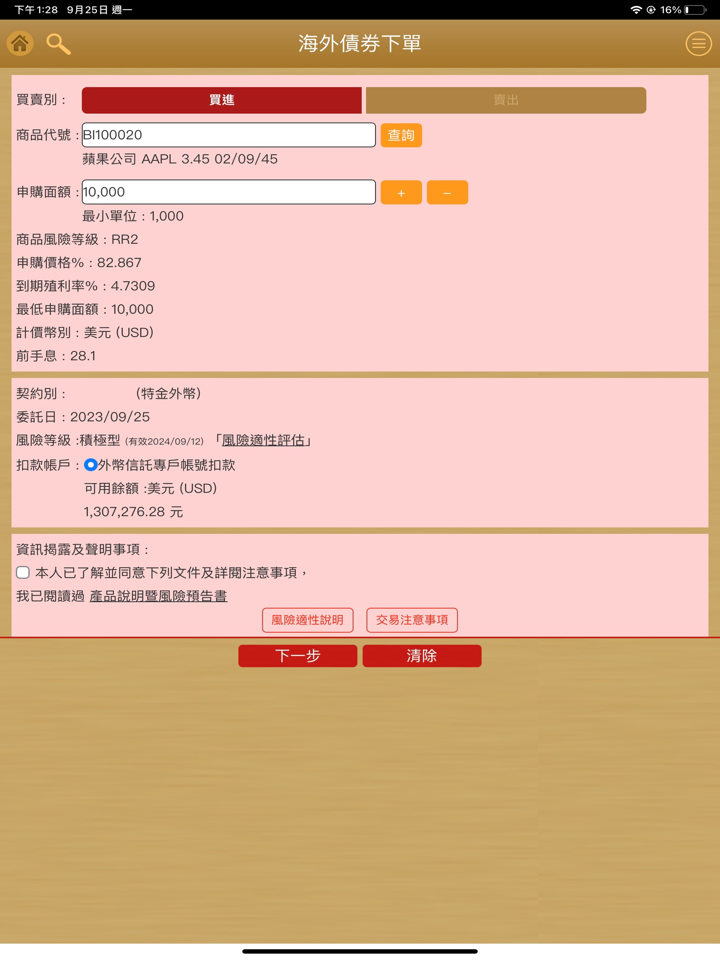

MasterLink Securities oferece três tipos de contas, incluindo contas Standard, Gold e Platinum.

Conta Standard:

A conta Standard oferece um depósito mínimo de $100, também oferece spreads de 1.5 pips e zero comissões. Além disso, oferece alavancagem de até 1:600.

Conta Gold:

A conta Gold requer um depósito mínimo de $500 e oferece spreads mais baixos de 1.0 pips sem comissões. E também oferece alavancagem de até 1:600.

Conta Platinum:

A conta Platinum oferece um depósito mínimo de $1,000, e seus spreads começam a partir de 0.5 pips. Assim como os outros tipos de conta, oferece alavancagem de até 1:600.

| Característica | Standard | Gold | Platinum |

| Alavancagem | Até 1:600 | Até 1:600 | Até 1:600 |

| Spreads | A partir de 1.5 pips | A partir de 1.0 pips | A partir de 0.5 pips |

| Comissões | Nenhuma | Nenhuma | Nenhuma |

| Depósito Mínimo | $100 | $500 | $1,000 |

| Ferramentas de Negociação | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

Alavancagem

A alavancagem máxima oferecida por MasterLink Securities é de até 1:600. Isso significa que os traders podem controlar posições no mercado até 600 vezes o valor do seu capital de negociação.

MasterLink Securities Taxas

Em uma conta Standard, os traders podem se beneficiar de spreads de pares de moedas principais tão baixos quanto 1.5 pontos.

Nas contas Gold, o spread começa a partir de 1.0 pips.

Na conta Platinum, o spread de pares de moedas principais começa a partir de 0.5 pips.

E todas as contas não requerem comissão.

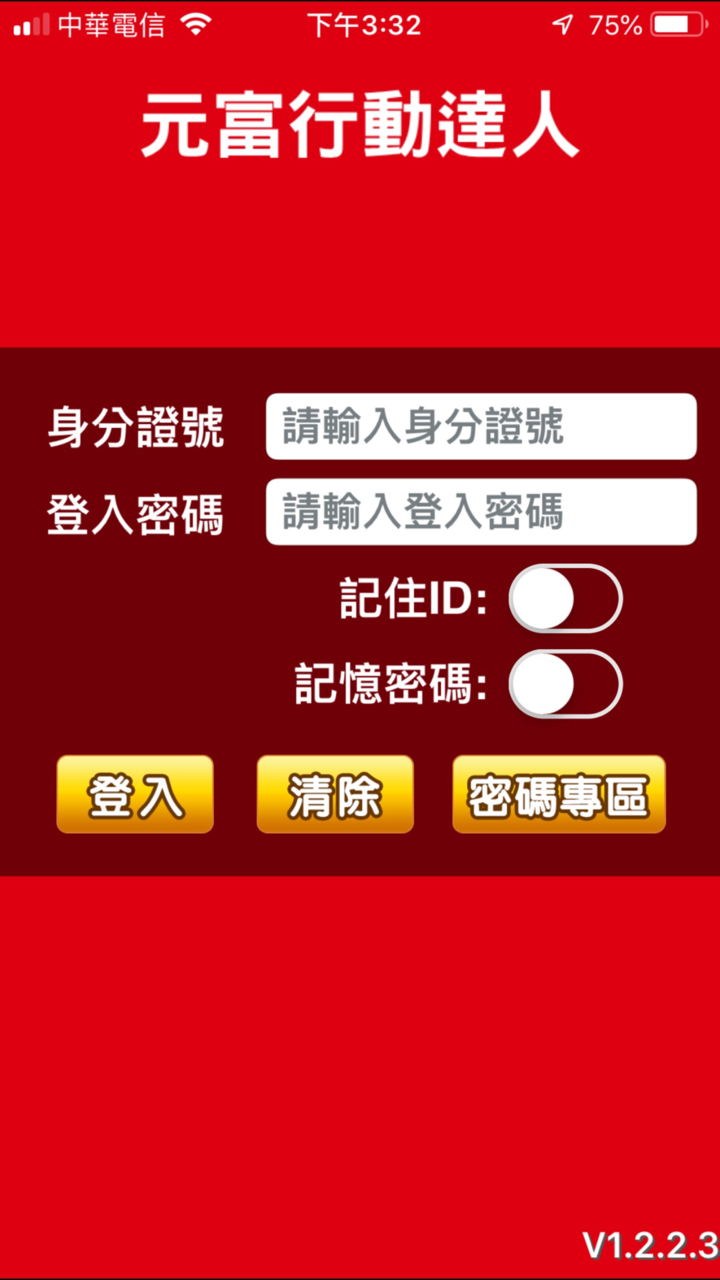

Plataforma de Negociação

| Plataforma de Negociação | Suportada | Dispositivos Disponíveis | Adequado para qual investidor |

| MetaTrader 4 | ✔ | Windows, MAC, IOS e Android | Investidores de todos os níveis de experiência |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

Depósito e Retirada

O valor mínimo de depósito necessário para abrir uma conta de negociação com MasterLink Securities é de $100 para contas Standard, $500 para contas Gold e $1,000 para contas Platinum.