公司简介

| MAHFAZA评论摘要 | |

| 成立时间 | / |

| 注册国家/地区 | 约旦 |

| 监管 | 无监管 |

| 市场工具 | 外汇、交叉盘、指数、商品 |

| 模拟账户 | ✅ |

| 杠杆 | / |

| 欧元/美元点差 | 从0.5点 |

| 交易平台 | MT5 |

| 最低存款 | / |

| 客户支持 | 联系表格 |

| 电话:+962 6 560 9000 | |

| 传真:+962 6 560 9001 | |

| 电子邮件:mahfaza@mahfaza.com.jo | |

MAHFAZA 信息

MAHFAZA 是一家在约旦注册的无监管经纪商,通过MT5交易平台提供外汇、交叉盘、指数和商品交易,点差从0.5点起。

优点和缺点

| 优点 | 缺点 |

| 多样化的交易资产 | 无监管 |

| 模拟账户账户 | 杠杆不明确 |

| 多种账户类型 | 没有关于存款和提款的信息 |

| 无佣金 | |

| MT5平台 |

MAHFAZA 是否合法?

不是。MAHFAZA 目前没有有效的监管。请注意风险!

我可以在 MAHFAZA 上交易什么?

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 交叉盘 | ✔ |

| 指数 | ✔ |

| 商品 | ✔ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

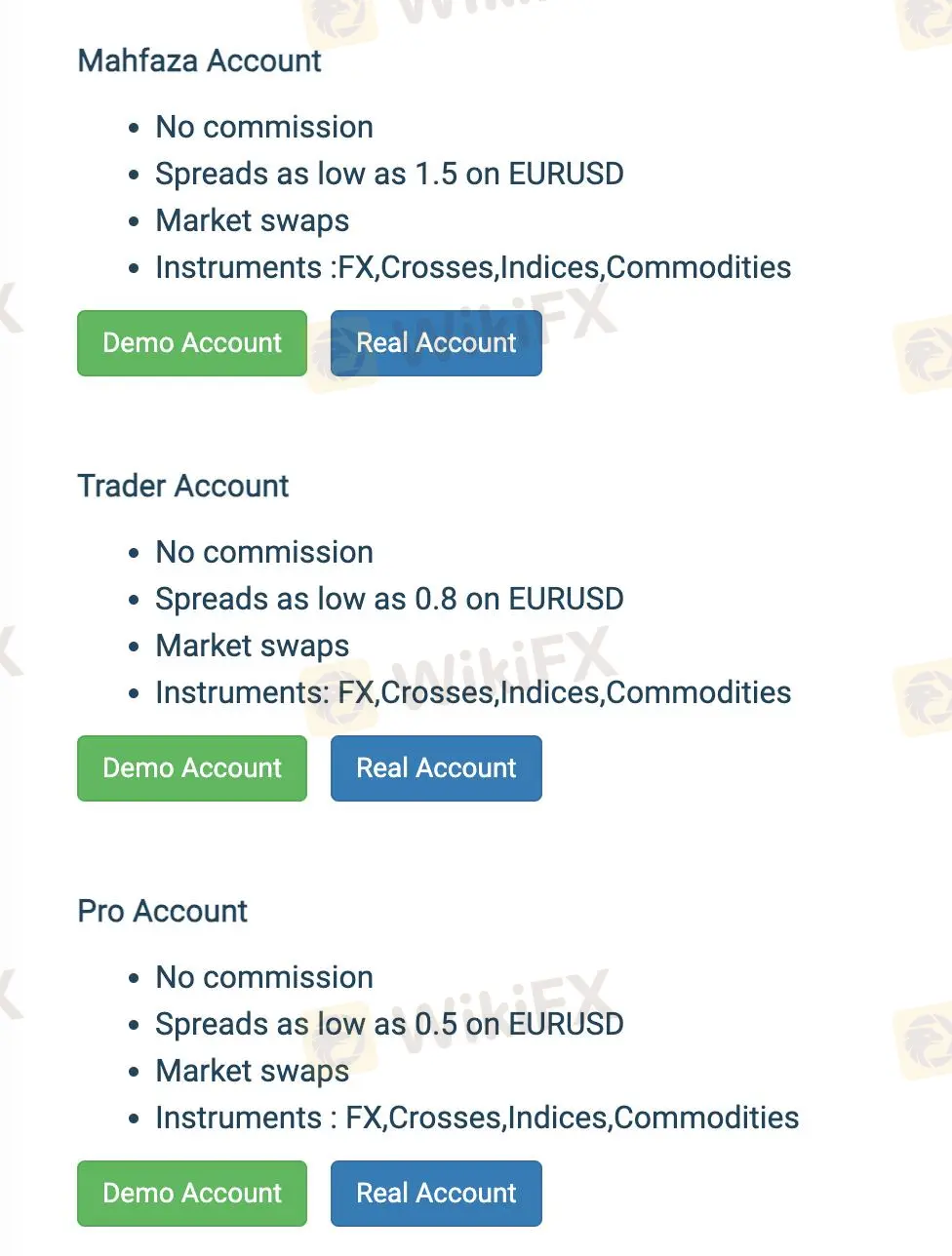

账户类型/费用

Mahfaza提供三种账户类型:Mahfaza账户、交易者账户和专业账户。

| 账户类型 | EUR/USD点差 | 佣金 |

| Mahfaza | 从1.5点差 | ❌ |

| 交易者 | 从0.8点差 | ❌ |

| 专业 | 从0.5点差 | ❌ |

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| MT5 | ✔ | / | 经验丰富的交易者 |

| MT4 | ❌ | 初学者 |