公司简介

| Dhan评论摘要 | |

| 注册国家/地区 | 印度 |

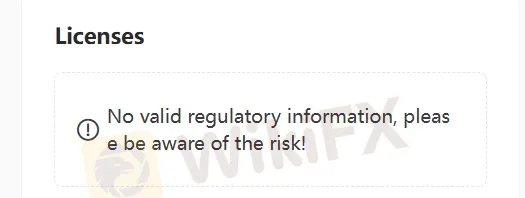

| 监管 | 无监管 |

| 市场工具 | 股票、期权、期货、大宗商品、货币、ETF、共同基金、IPO |

| 模拟账户 | 不可用 |

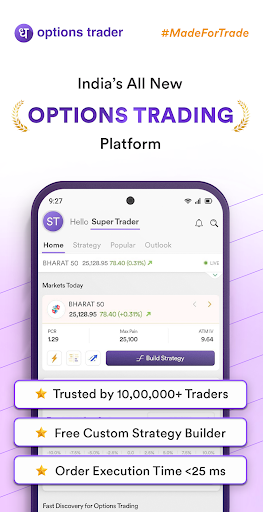

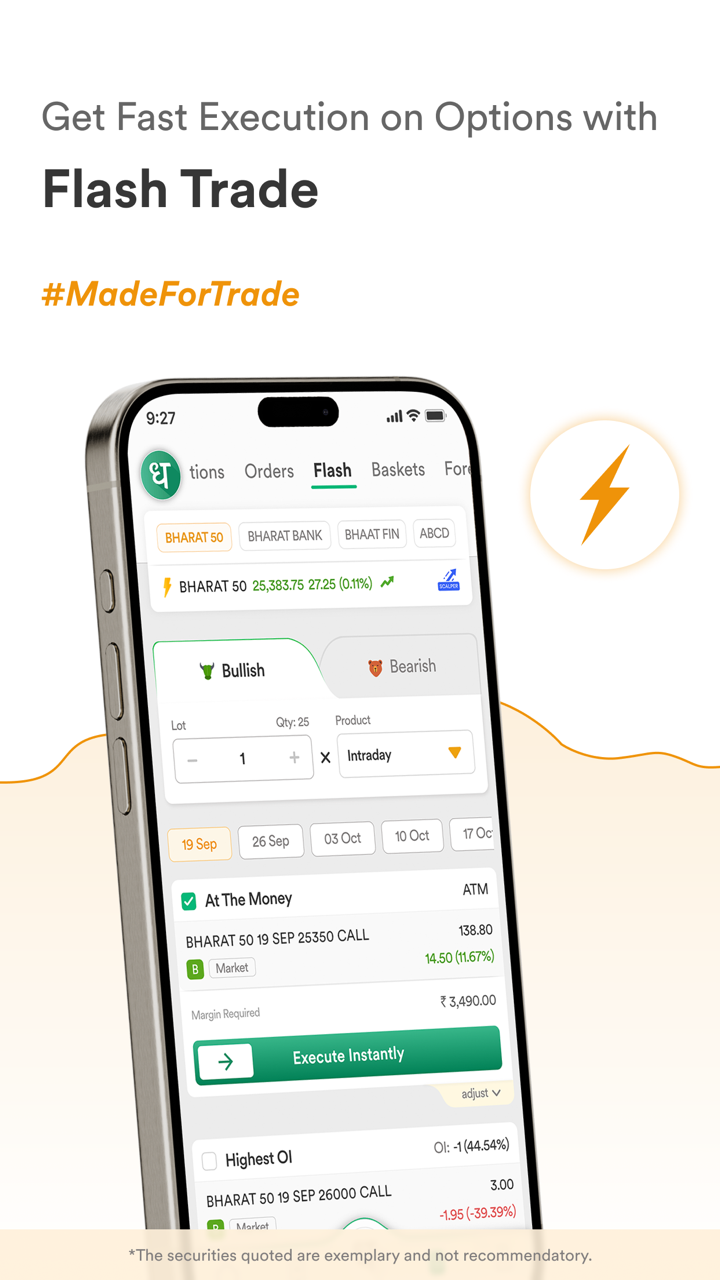

| 交易平台 | Dhan应用、Dhan网站、期权交易者应用、期权交易者网站、Dhan + TradingView、TradingView、DhanHQ |

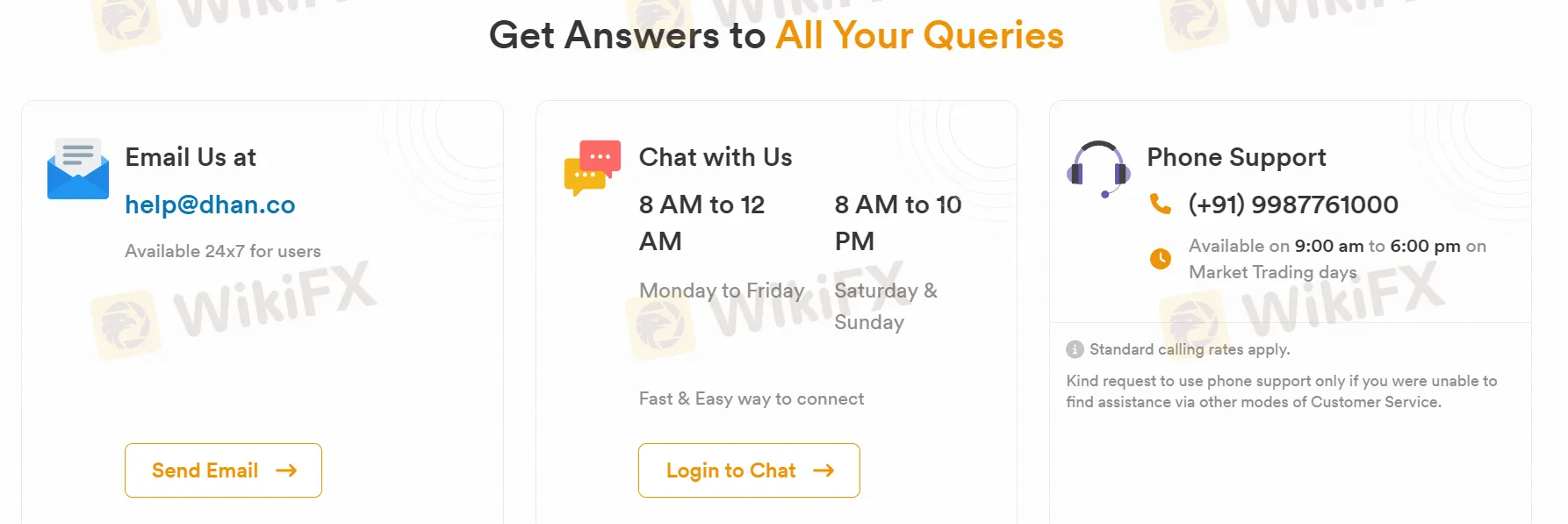

| 客户支持 | 电话号码:(+91)9987761000(市场交易日上午9:00至下午6:00可用) |

| 电子邮件:help@dhan.co | |

| 地址:印度马哈拉施特拉邦孟买Borivali East西部快车高速公路西边302号 | |

| Twitter:https://twitter.com/DhanCares | |

| 在线聊天(周一至周五上午8点至凌晨12点,周六和周日上午8点至晚上10点) | |

什么是Dhan?

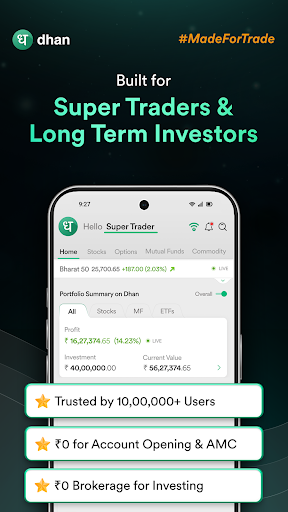

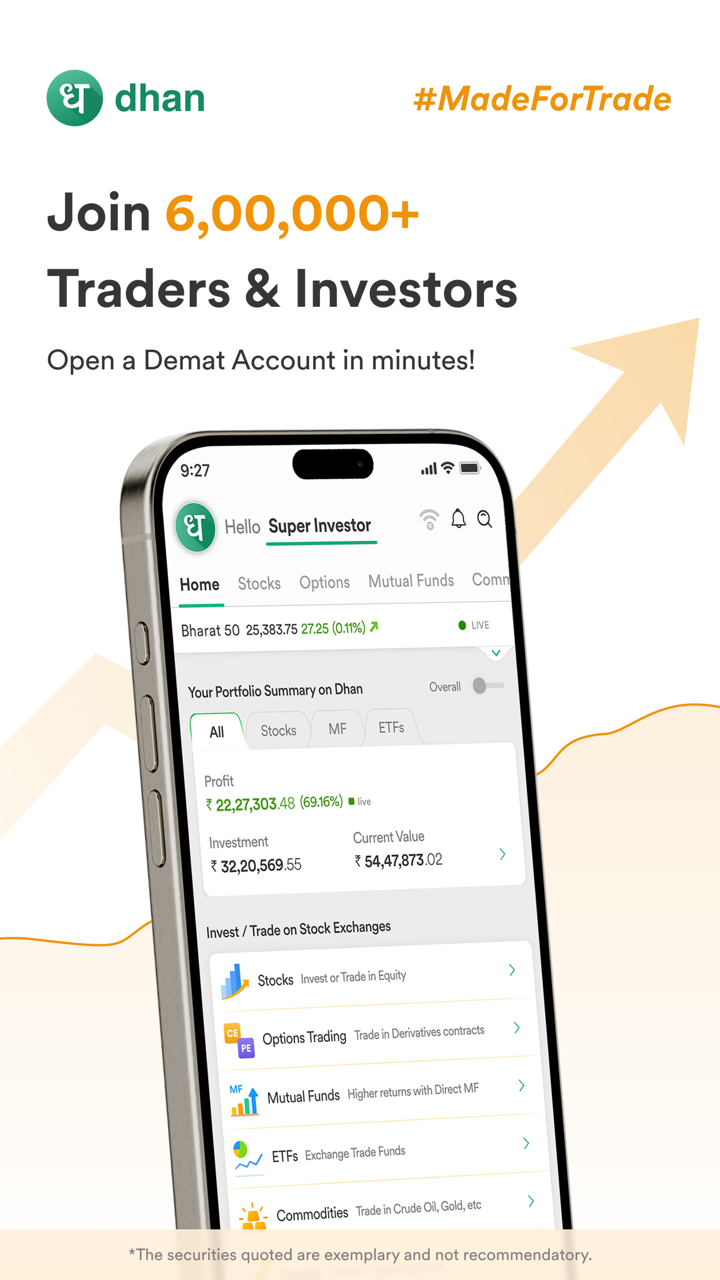

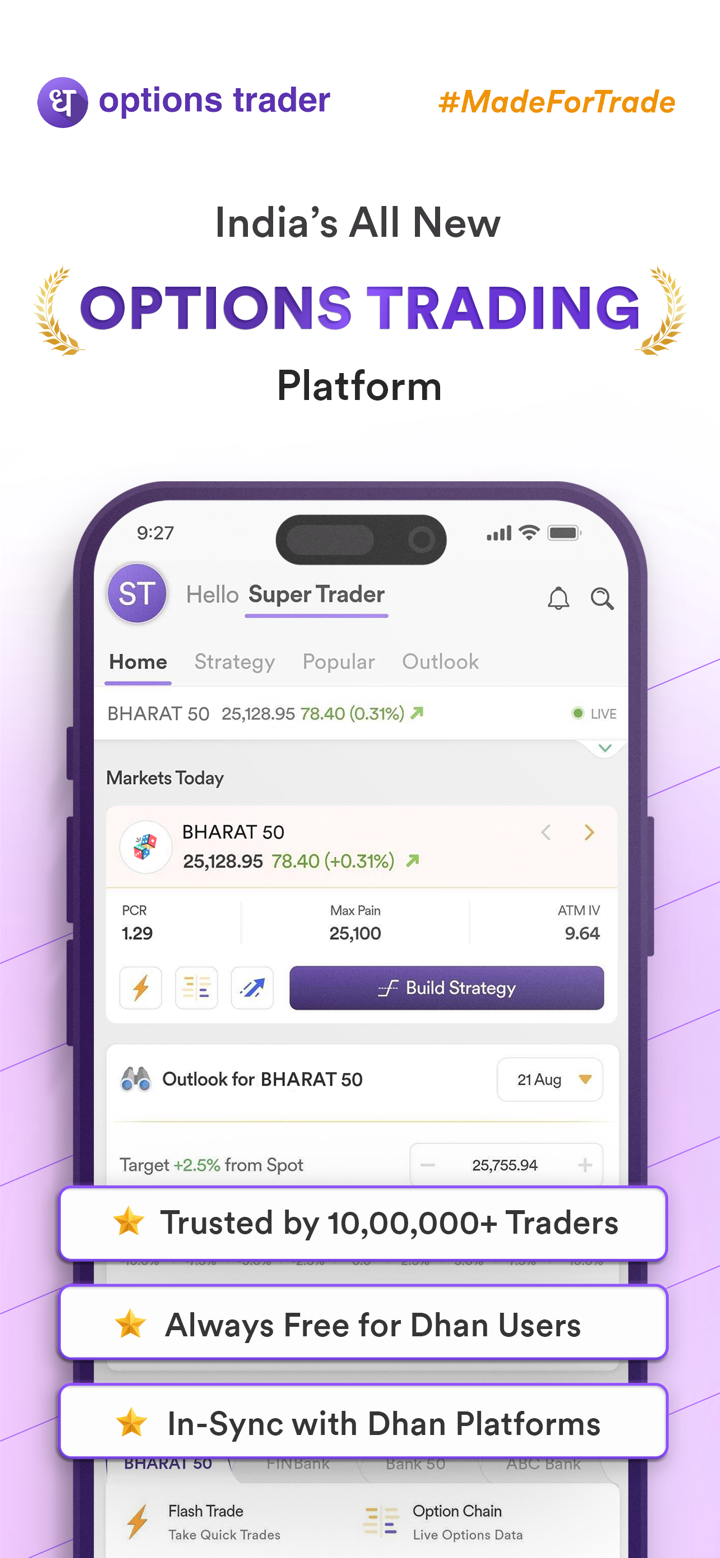

Dhan是一家总部位于印度的未受监管的金融服务平台,提供各种交易工具,涵盖不同资产类别,包括股票、期权、期货、大宗商品、货币、ETF(交易所交易基金)、共同基金和首次公开发行(IPO)。该平台为交易者和投资者提供参与多元化市场的机会。它以用户友好的交易平台而闻名,包括Dhan App & Web、Options Trader App & Web、Dhan + TradingView、TradingView和DhanHQ。

优缺点

| 优点 | 缺点 |

|

|

|

|

|

优点:

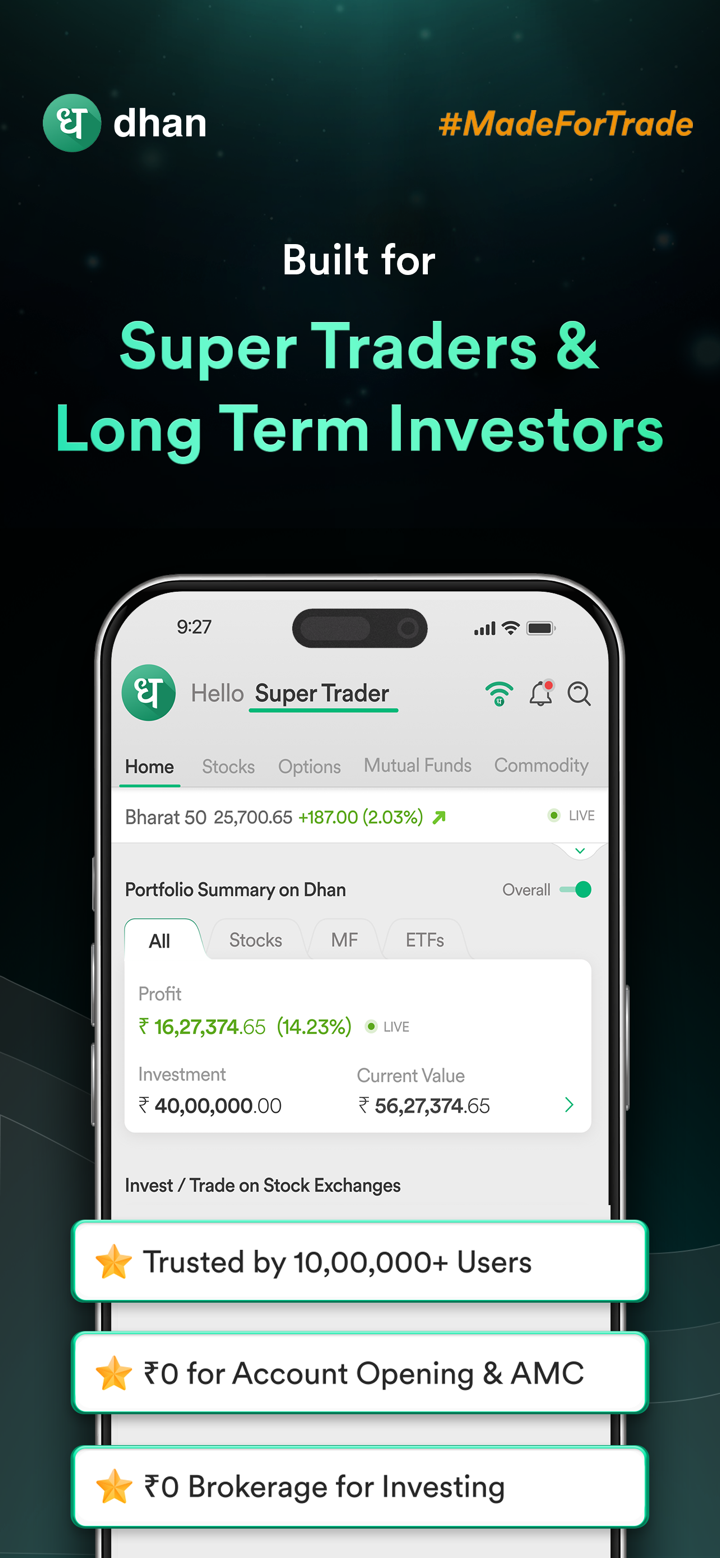

无开户费或年度维护费: ₹0开户费和₹0年度维护费。

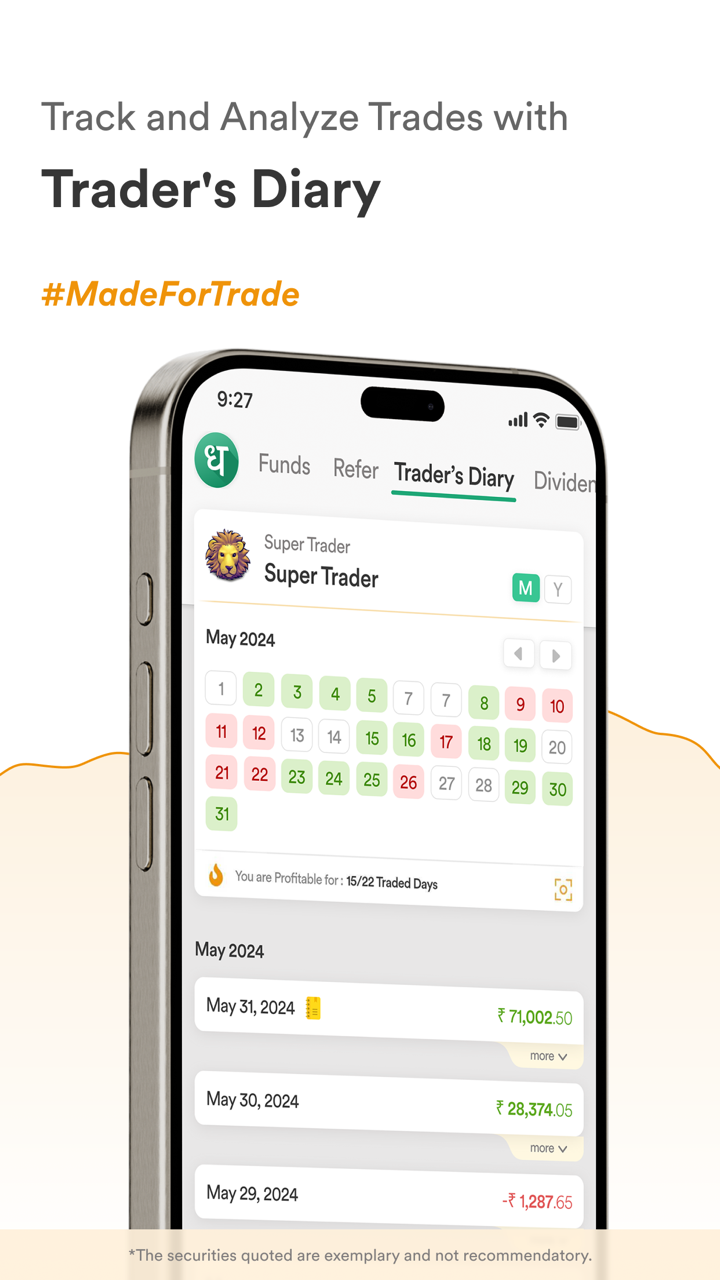

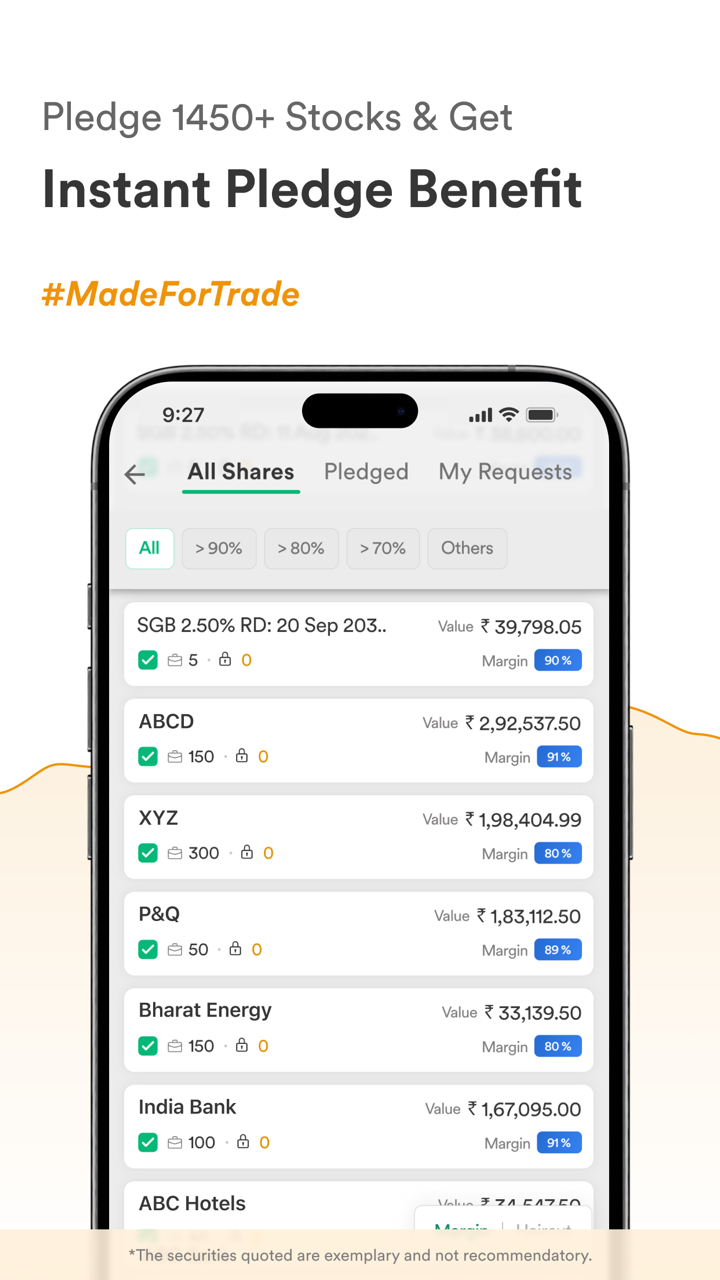

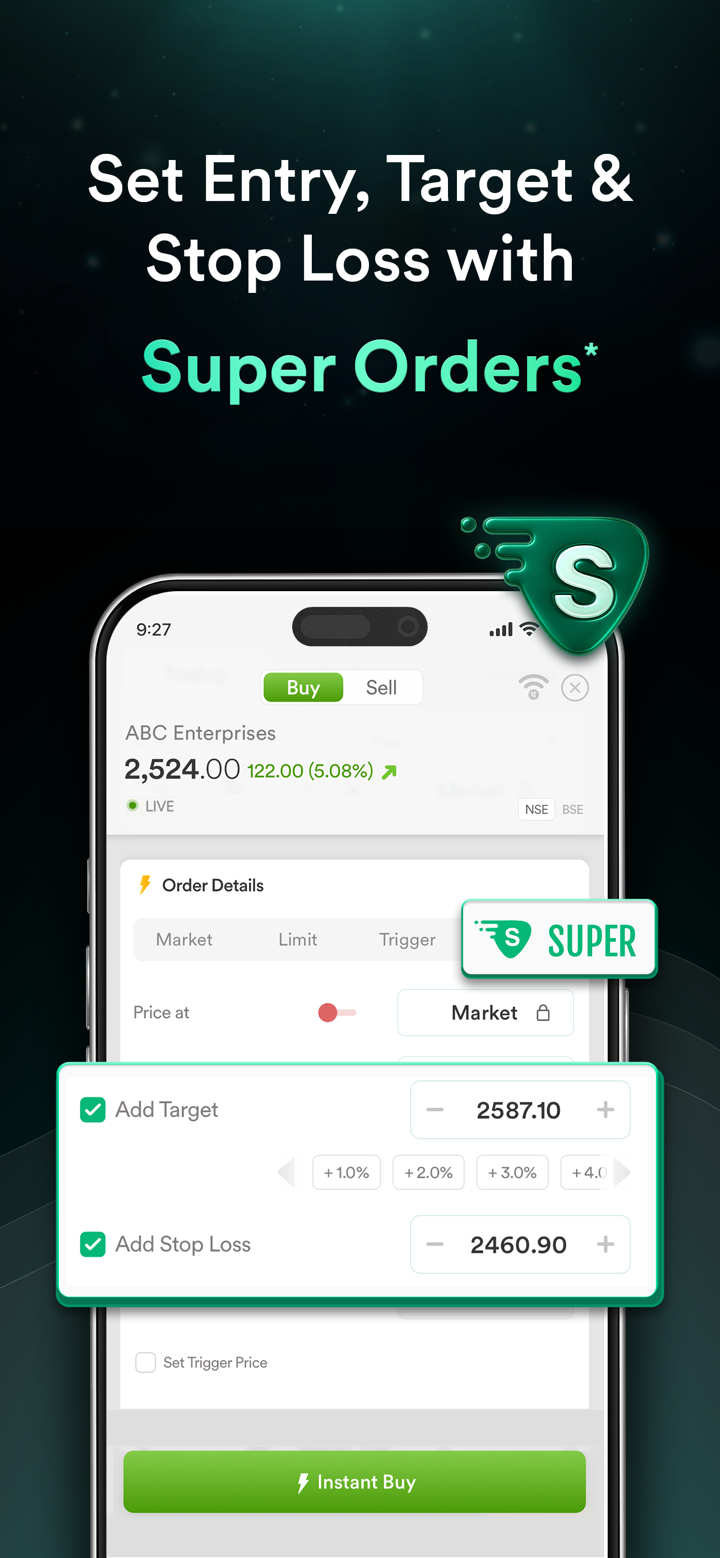

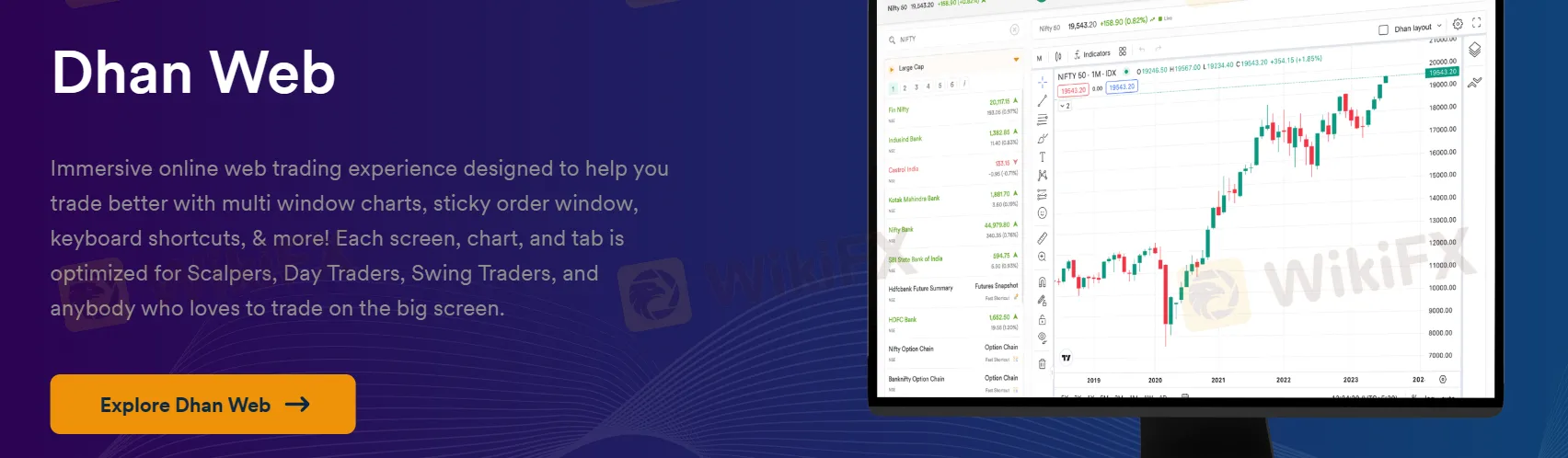

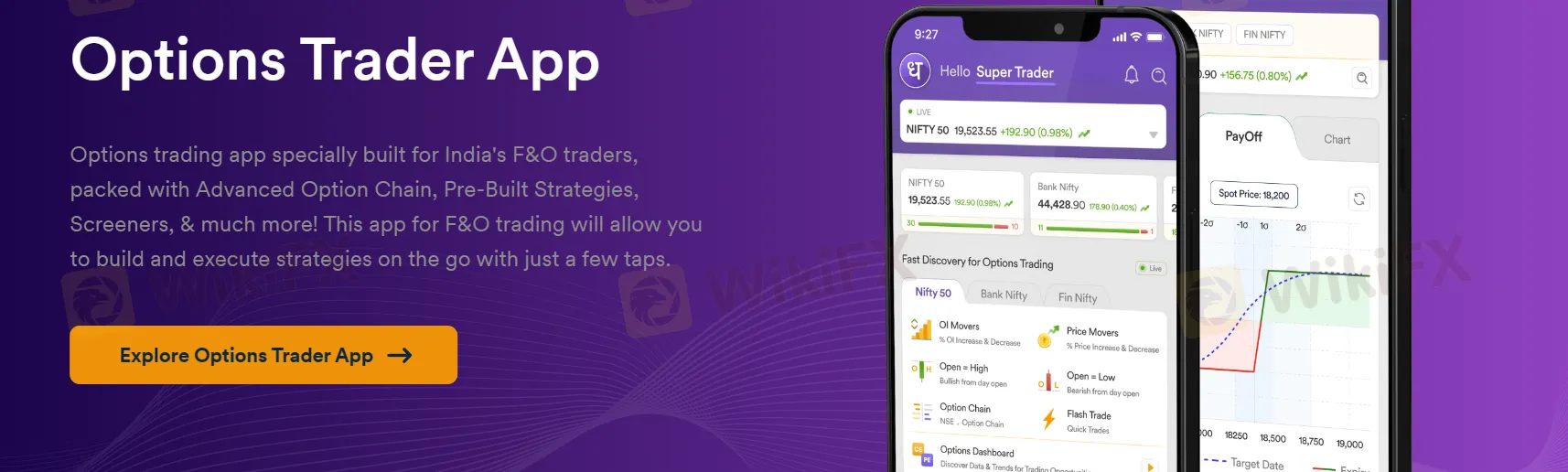

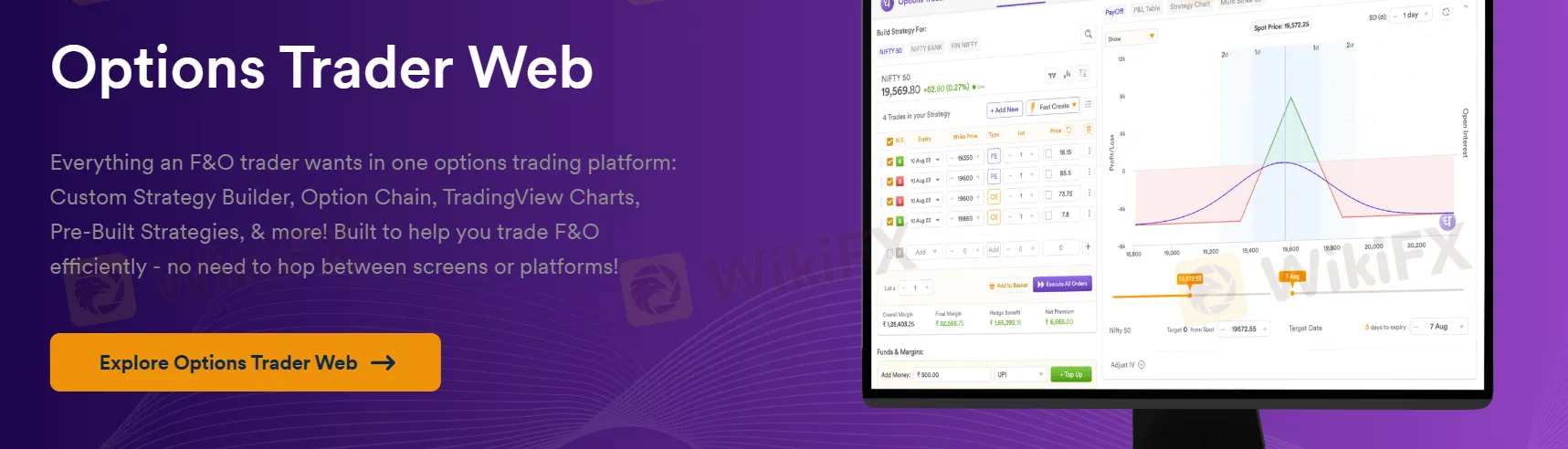

用户友好的交易平台:像Dhan App,Dhan Web,Options Trader和DhanHQ这样的平台满足各种交易需求。

多种客户支持渠道: Dhan提供多种客户支持渠道,包括电话、电子邮件和在线聊天(周一至周五上午8点至晚上12点,周六和周日上午8点至晚上10点),增强了客户的可访问性和帮助。

缺点:

无监管:缺乏有效监管引发了重大的安全和信任问题,监管监督对于确保客户保护和平台透明度至关重要。还有关于无法提取资金和诈骗的报道,增加了该平台的缺点。

Is Dhan Safe or Scam?

目前,Dhan缺乏有效监管,这引发了人们对其安全性和合法性的重大关注。监管监督对于确保金融服务提供商遵守既定标准并遵守旨在保护投资者和客户的特定规则和要求至关重要。没有适当的监管,存在欺诈活动、诈骗和消费者保护不足的风险。

市场工具

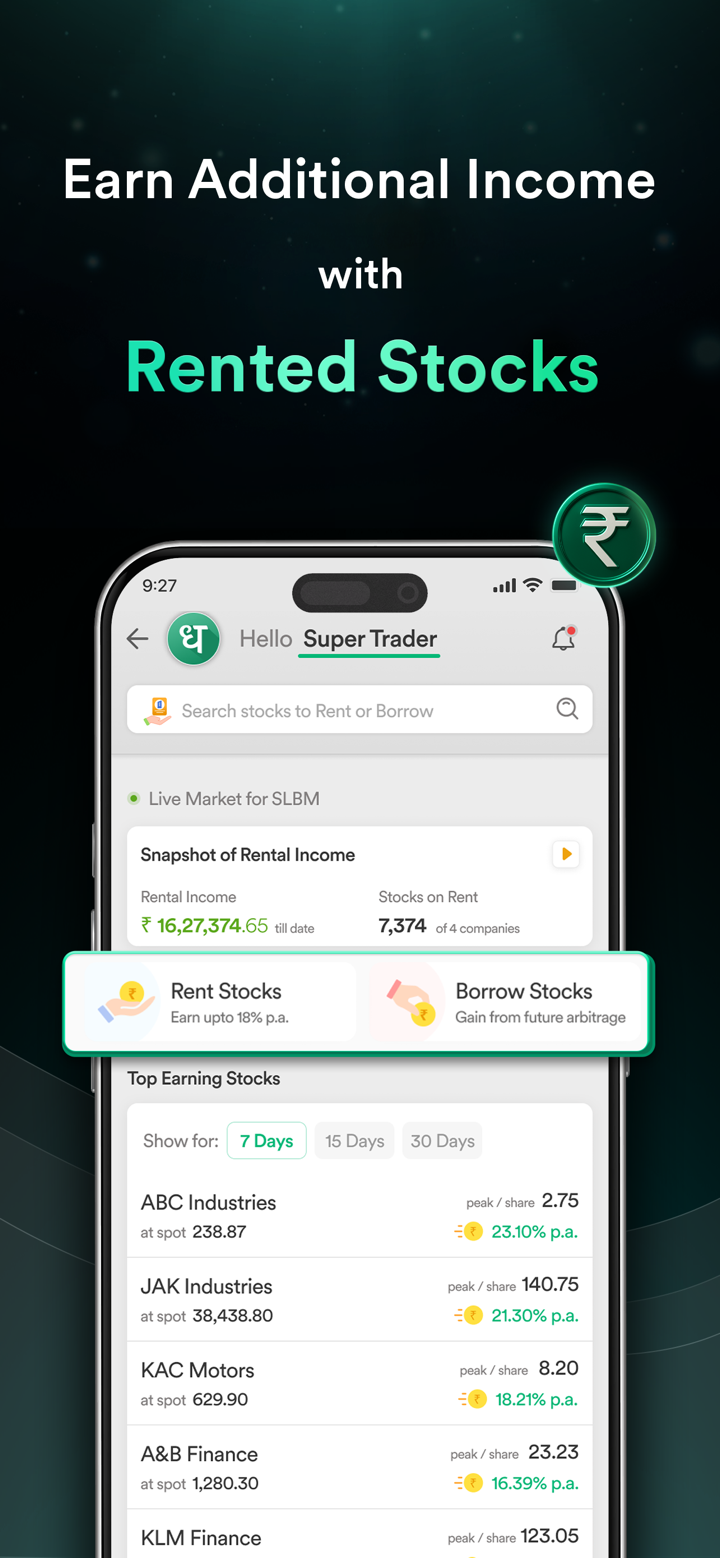

Dhan提供了涵盖多种资产类别的广泛交易工具。

股票:投资于上市公司的个别股票。

期权:根据股票等基础资产未来价值交易合同。

期货:在未来日期以特定价格买入或卖出资产的合同。

大宗商品:获得对黄金、石油或农产品等实物大宗商品的暴露。

货币:进行外汇交易以投机货币走势。

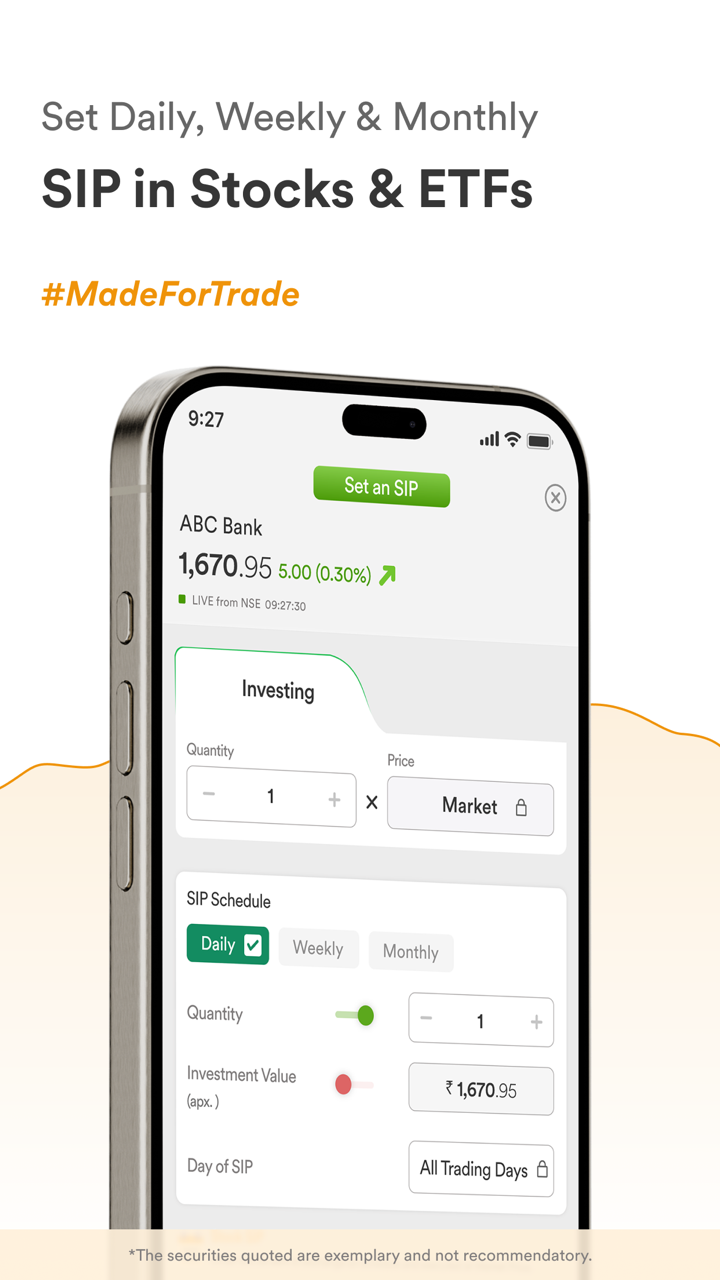

交易所交易基金(ETFs):投资于跟踪基础指数的一篮子证券。

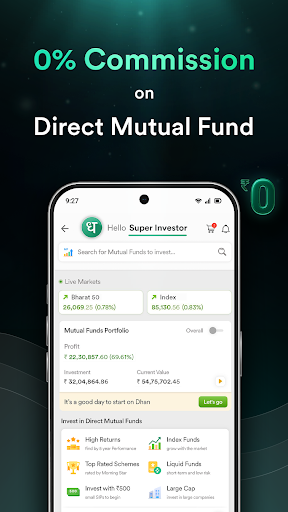

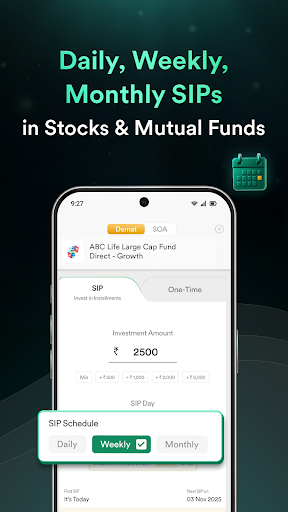

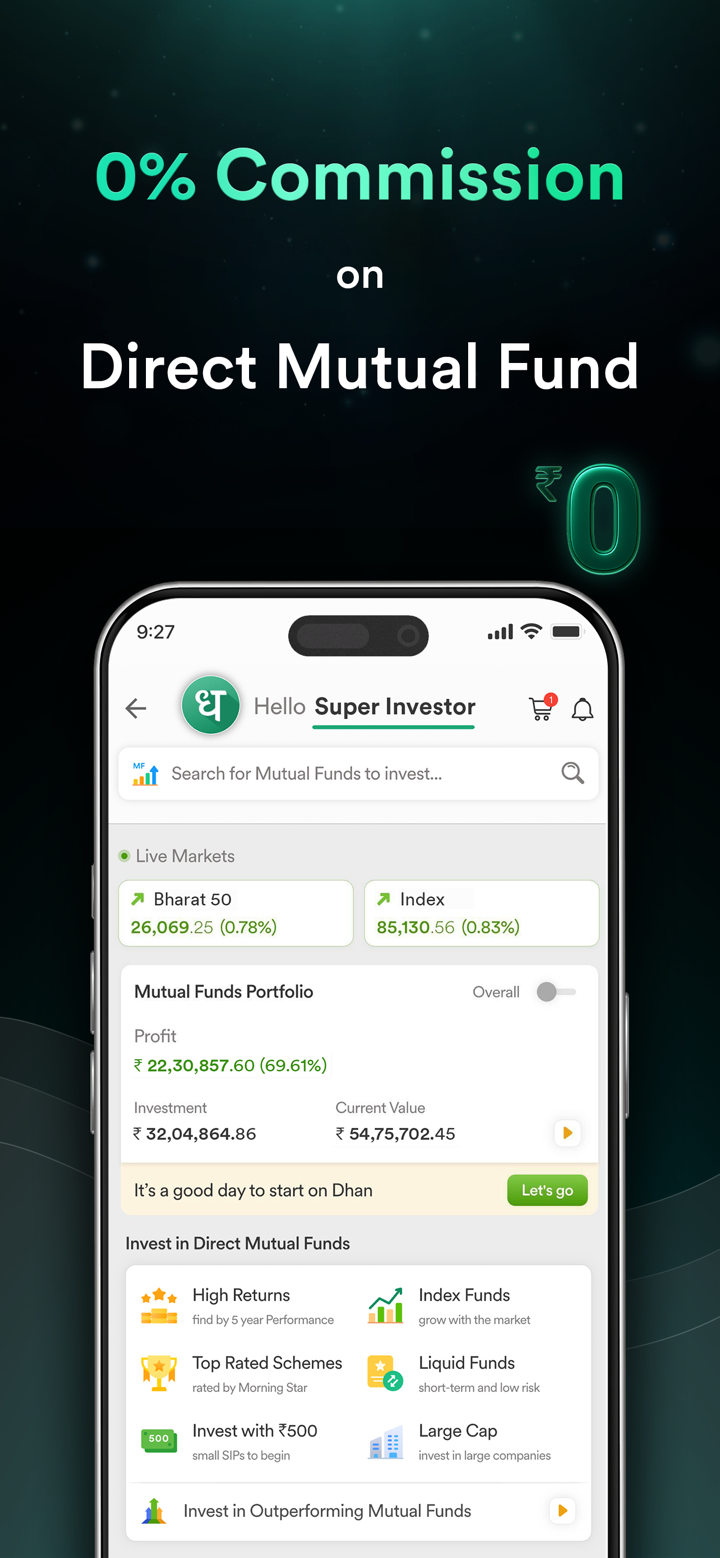

共同基金:投资于各种证券的专业管理组合。

IPOs(首次公开招股):获得新发行公司上市的股票。

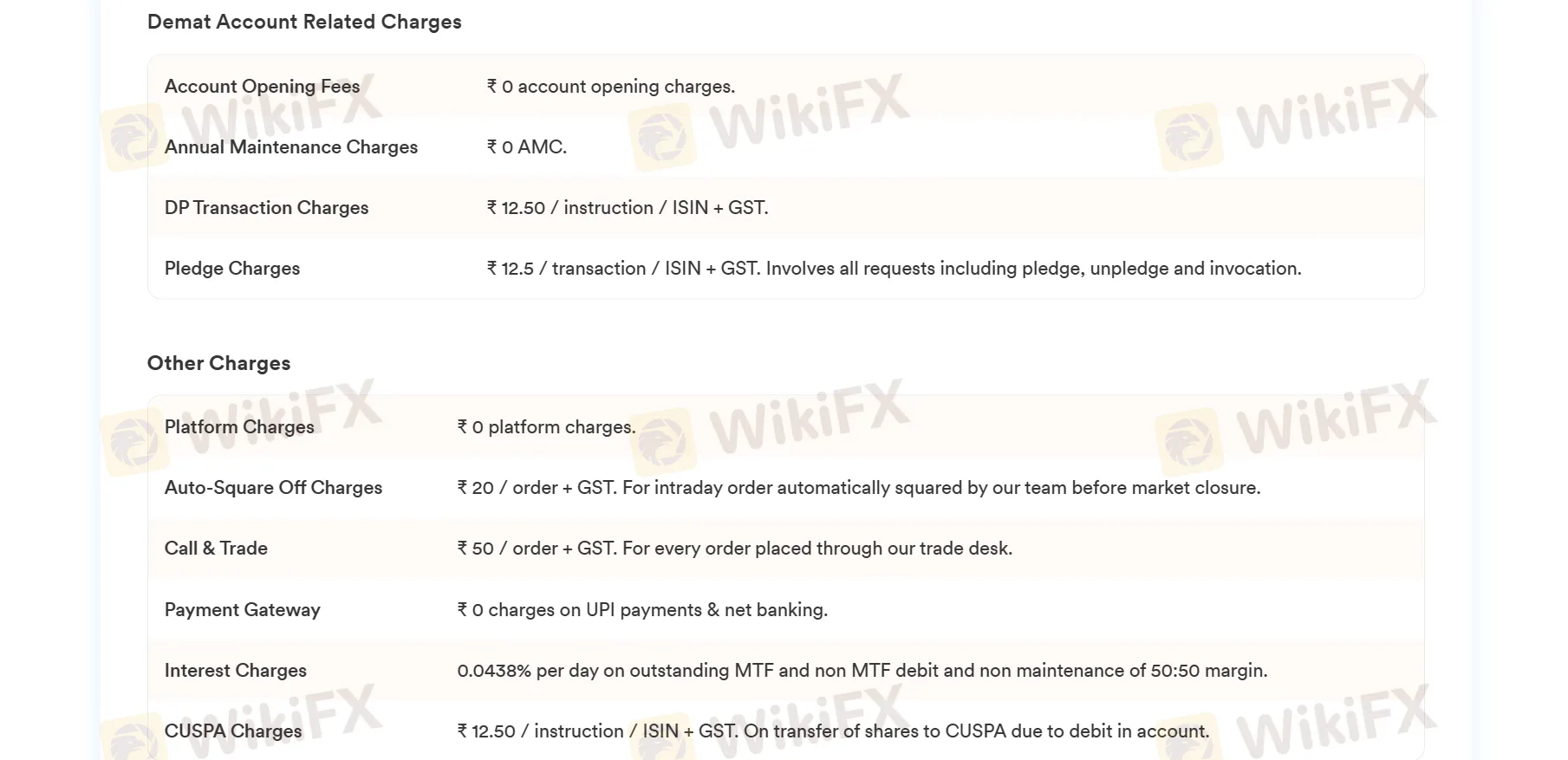

Demat Account

无开户或年度维护费用:

₹0开户费

₹0 年度维护费

交易费用:

每笔指令/ISIN ₹12.50 + GST:

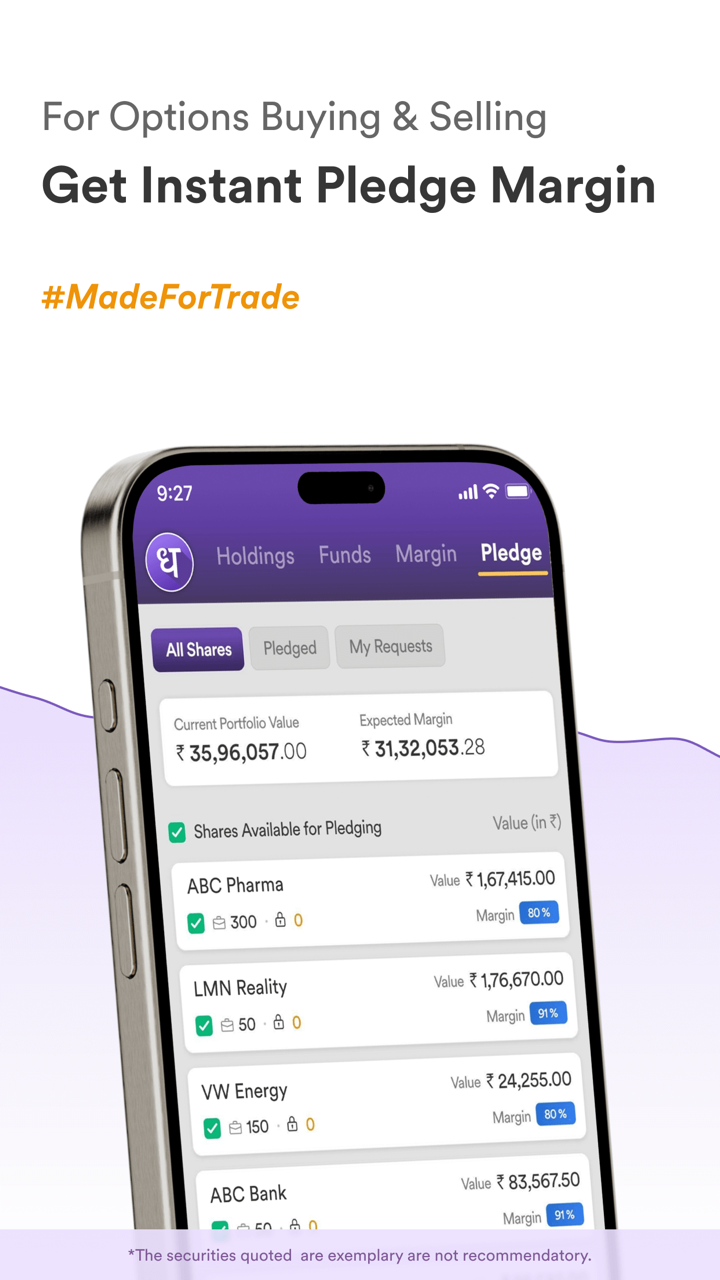

证券账户和质押交易(如买入、卖出、质押、解除质押、调用)

CUSPA费用(由于账户借记而转移股份)

每笔订单 ₹50 + GST:电话交易(通过他们的交易台下订单)

其他:

₹0平台费用

每笔订单 ₹20 + GST:自动平仓费用(在市场收盘前自动平仓的日内订单)

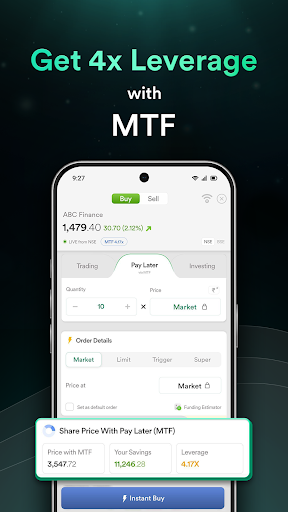

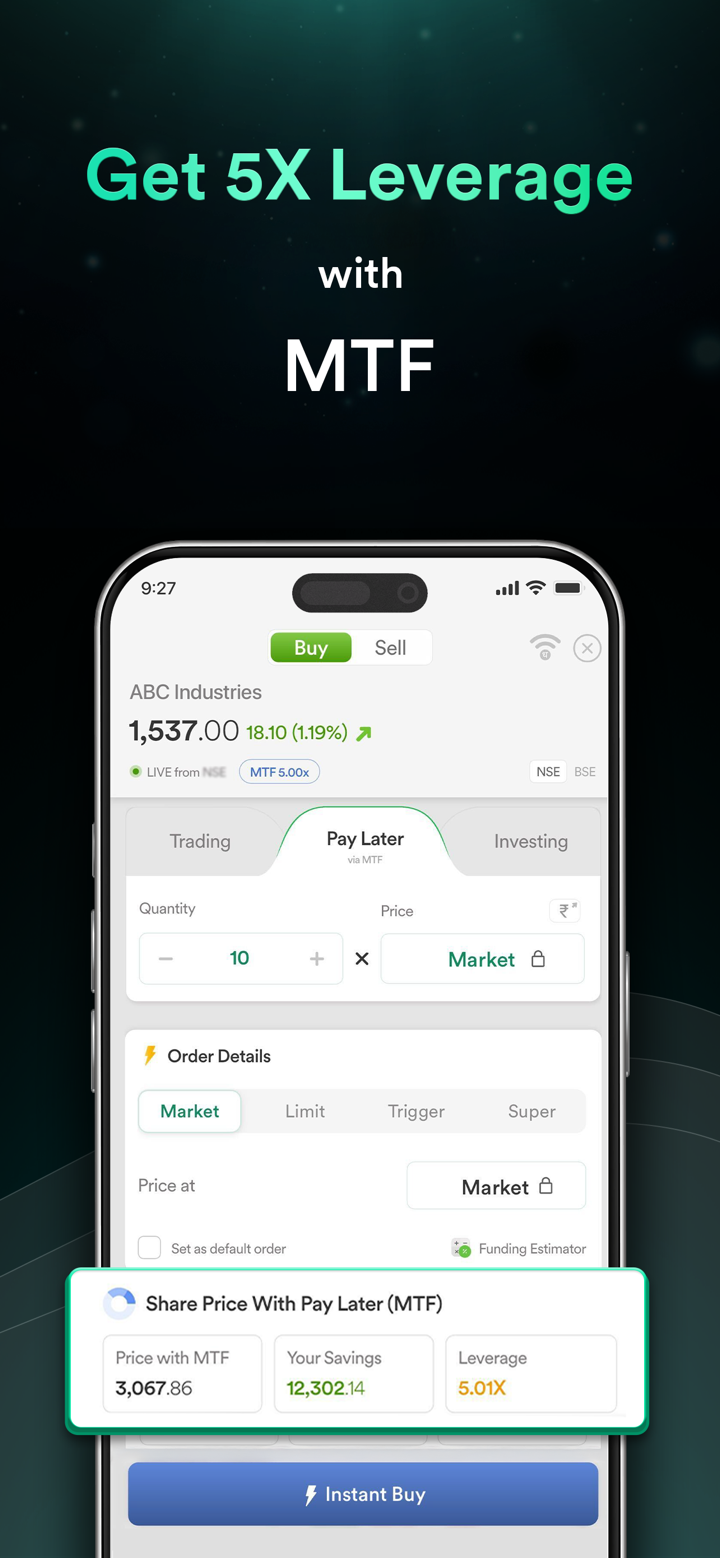

每日0.0438%利息:对于未结算的MTF和非MTF借款,未维持50:50保证金。

₹0费用: UPI支付和网银

如何开设账户?

步骤:

在首页点击“开户”按钮。

然后点击按钮''立即开始''。

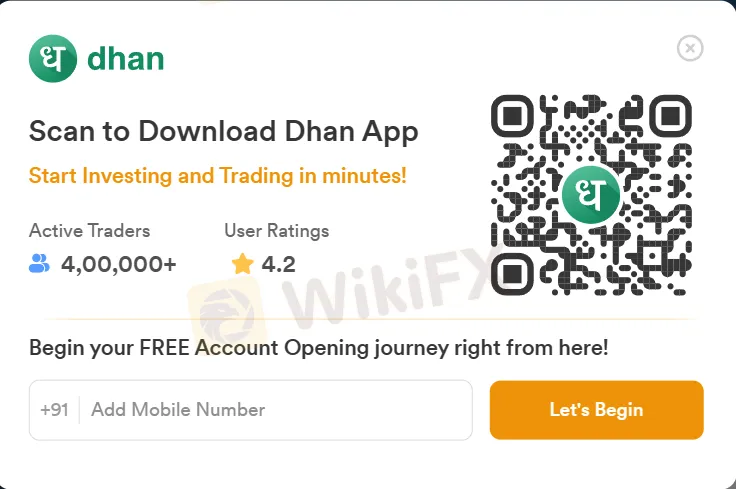

添加您的手机号码,并按照屏幕上的说明输入您的个人和联系信息。

为您的账户设置一个安全的密码。

阅读并同意所需的条款和条件以及任何其他政策。

点击“注册”选项完成您的账户创建。

通常会向您注册的电子邮件地址发送一封电子邮件,以验证您的账户。请确保检查您的收件箱和垃圾邮件文件夹。

点击收到的verification电子邮件中的链接以激活您的账户。

交易平台

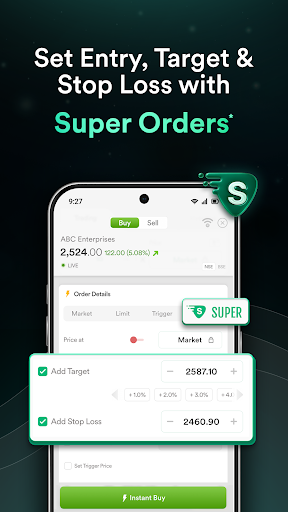

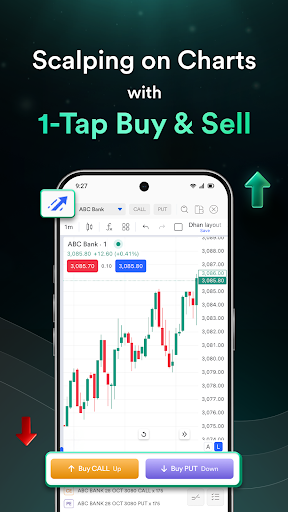

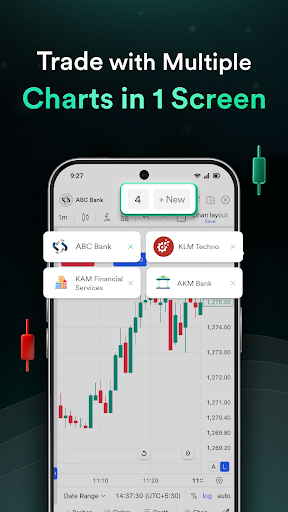

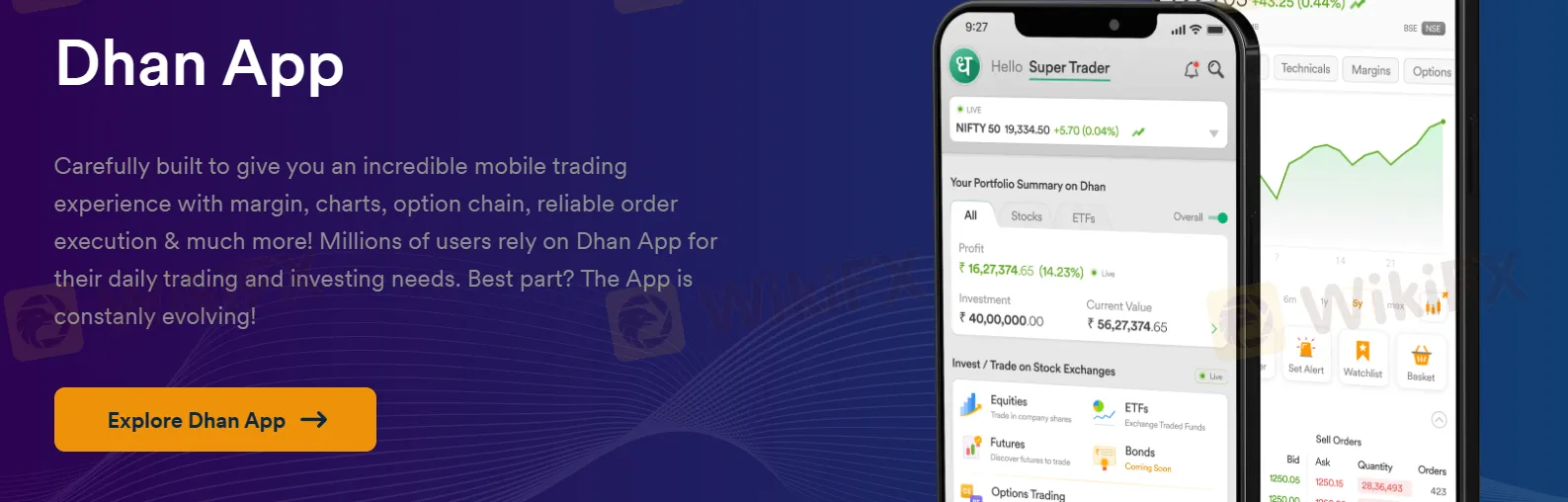

Dhan通过提供多个交易平台,满足各种交易风格。

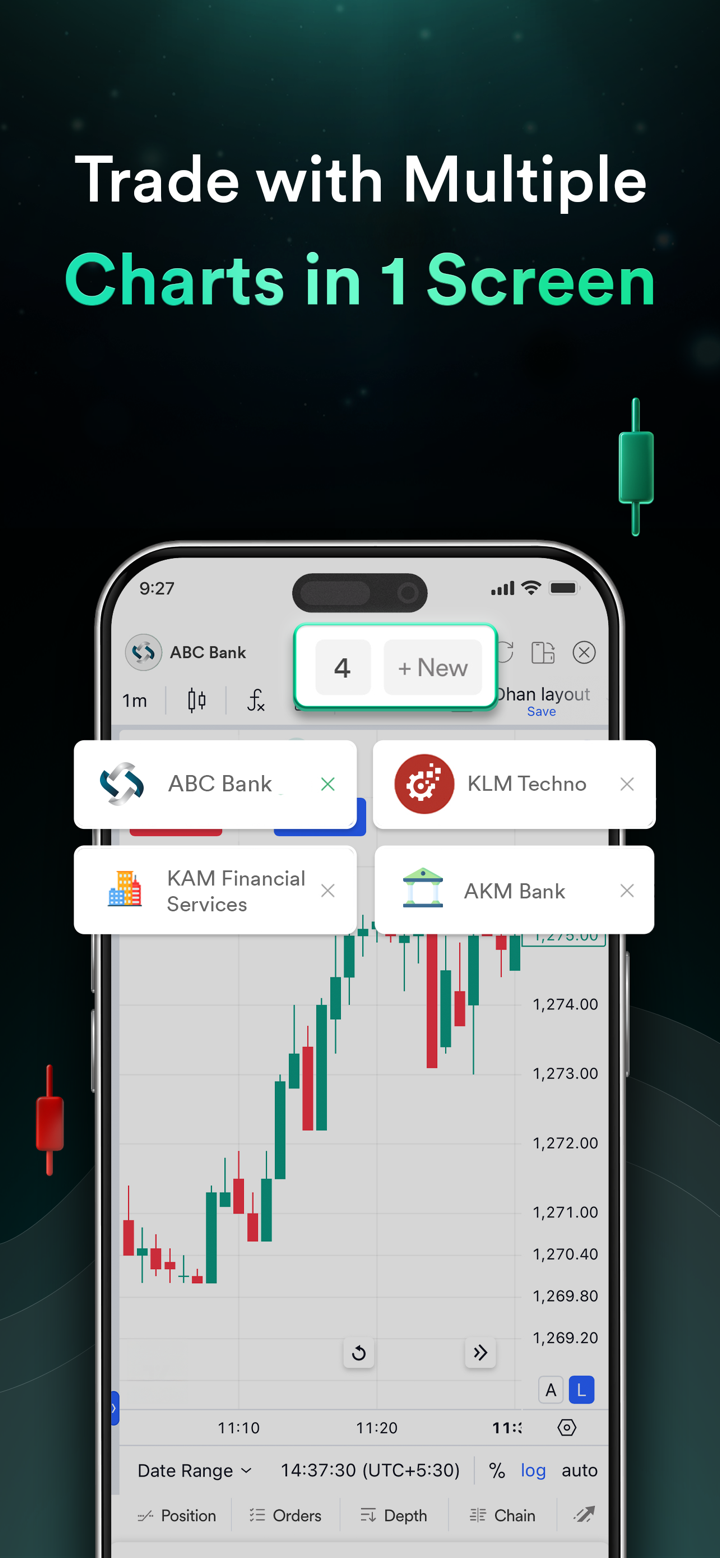

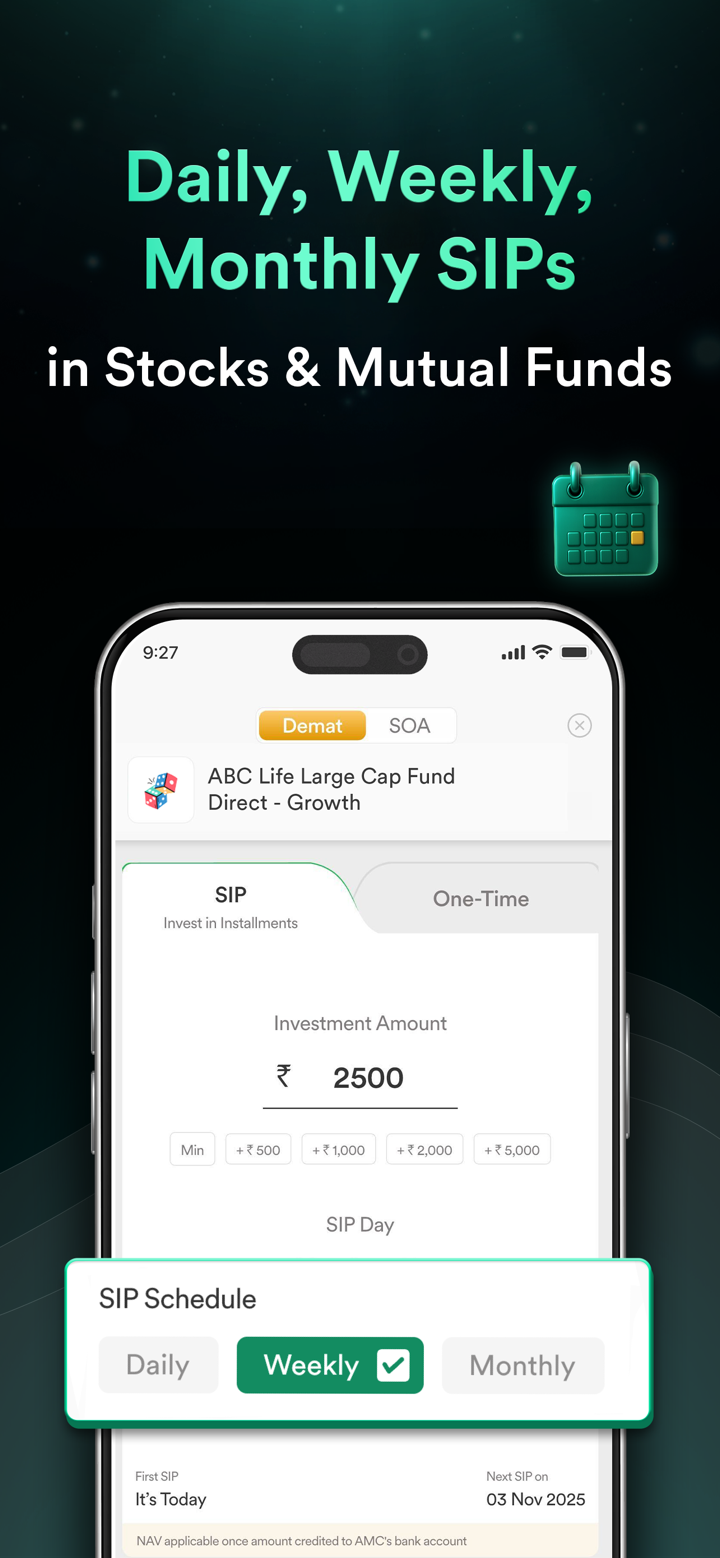

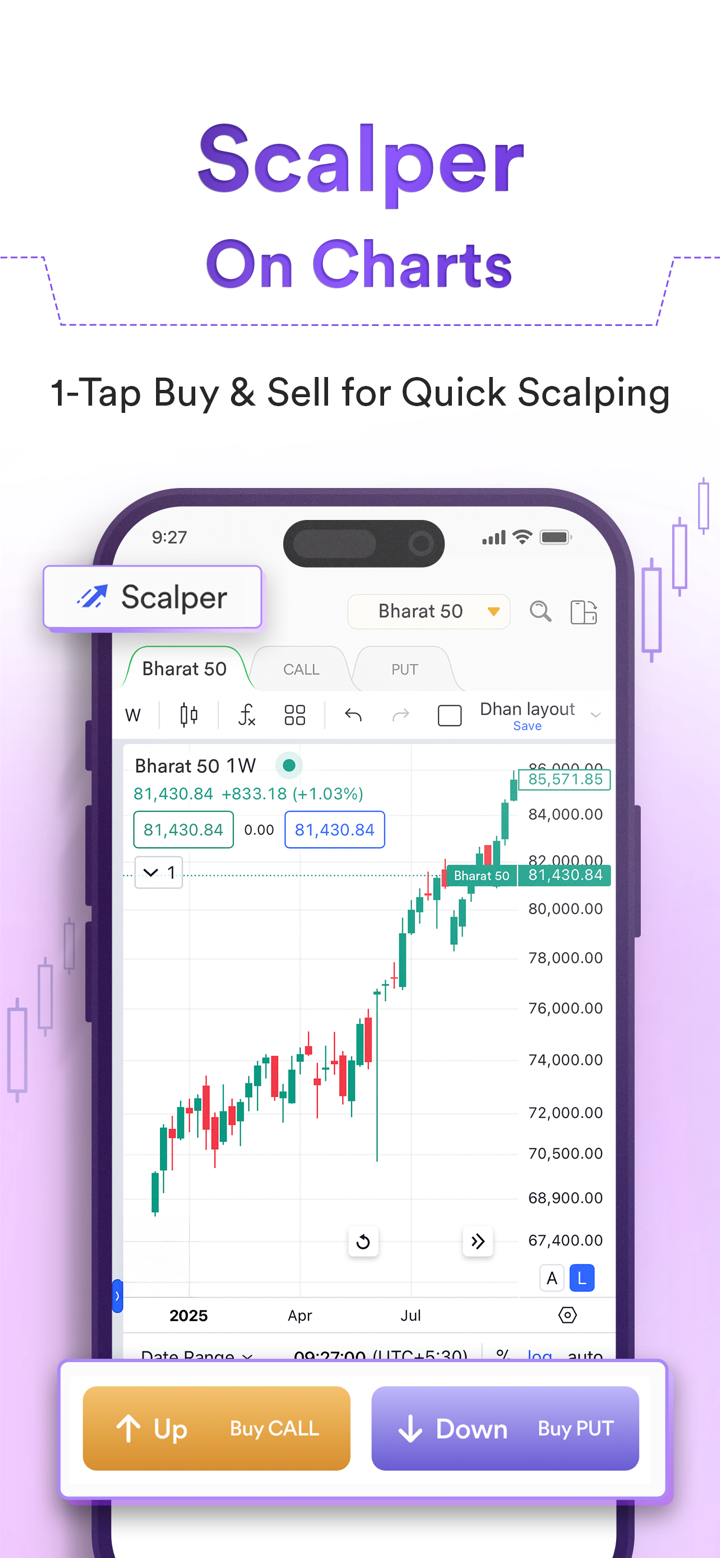

Dhan 应用程序和 Dhan 网站: 一体化平台,可随时随地或从您的桌面交易各种资产。

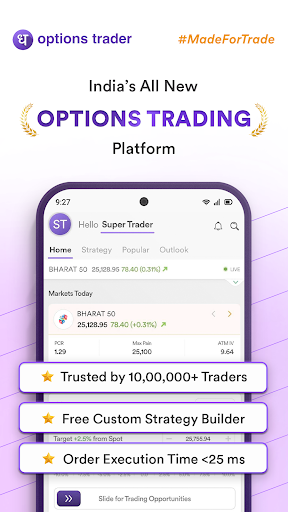

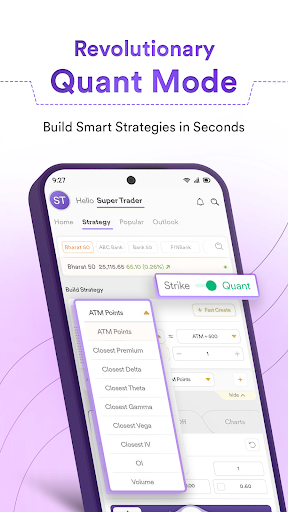

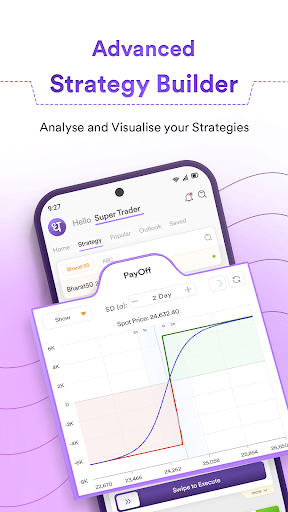

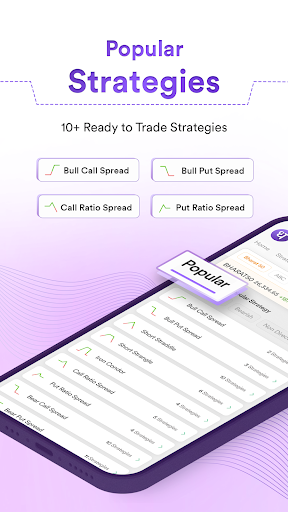

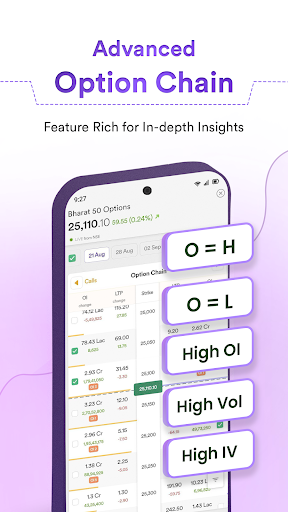

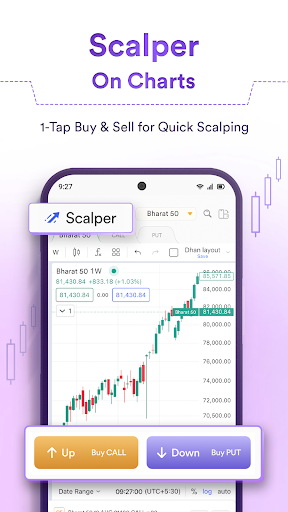

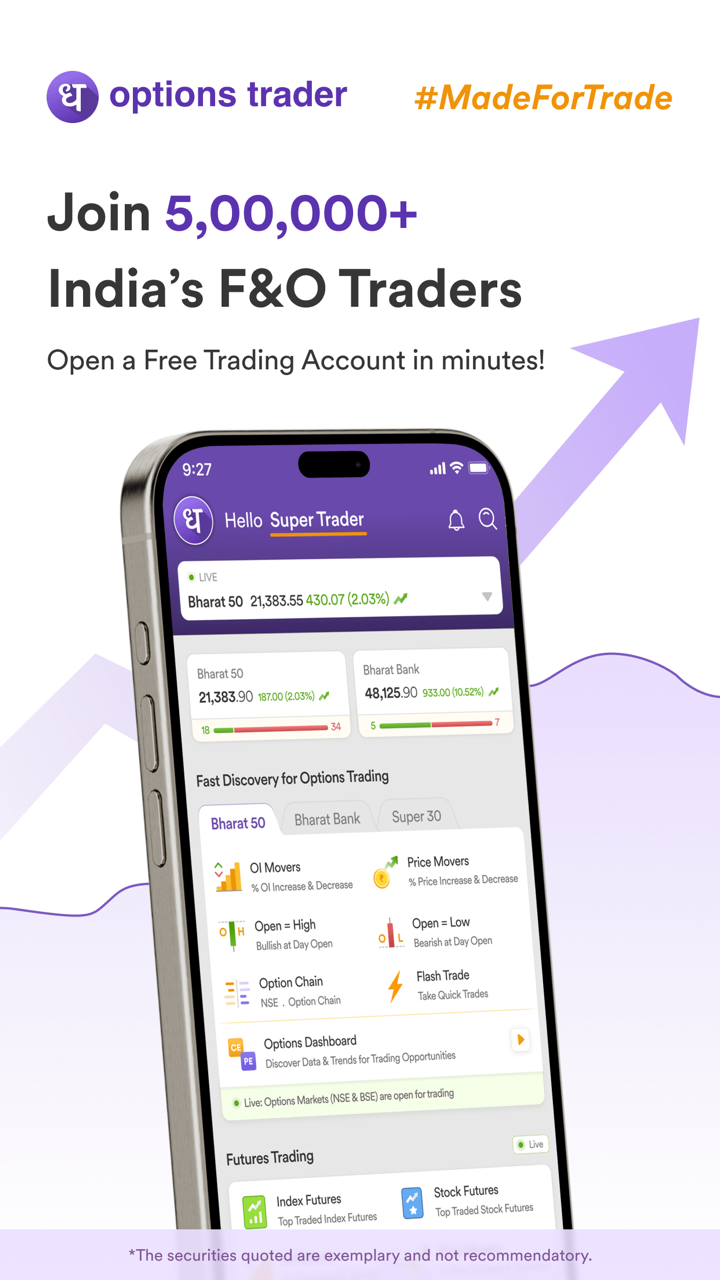

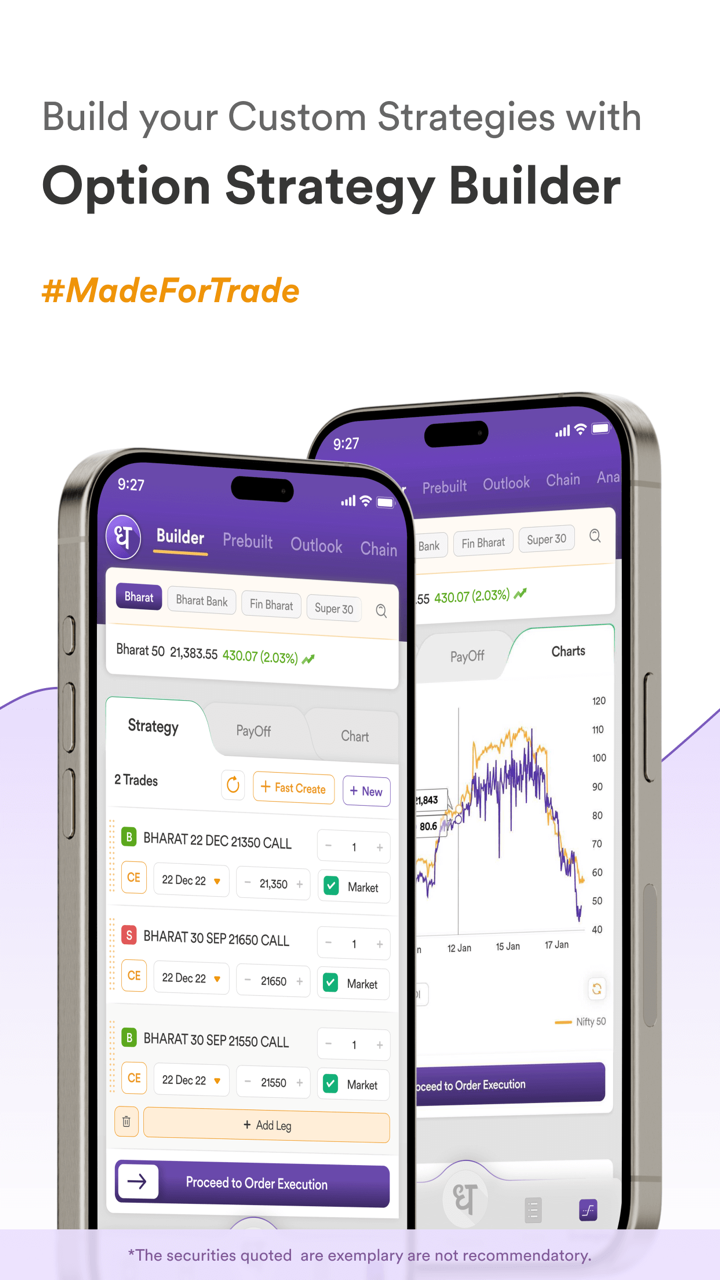

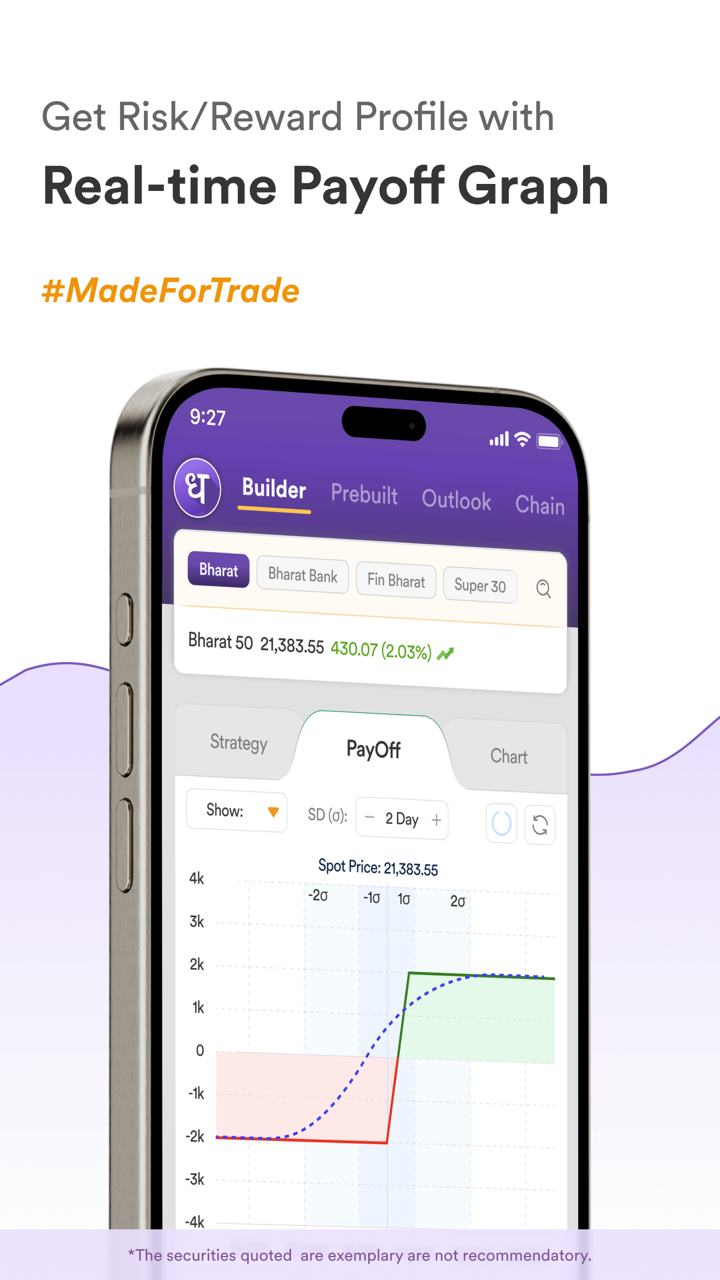

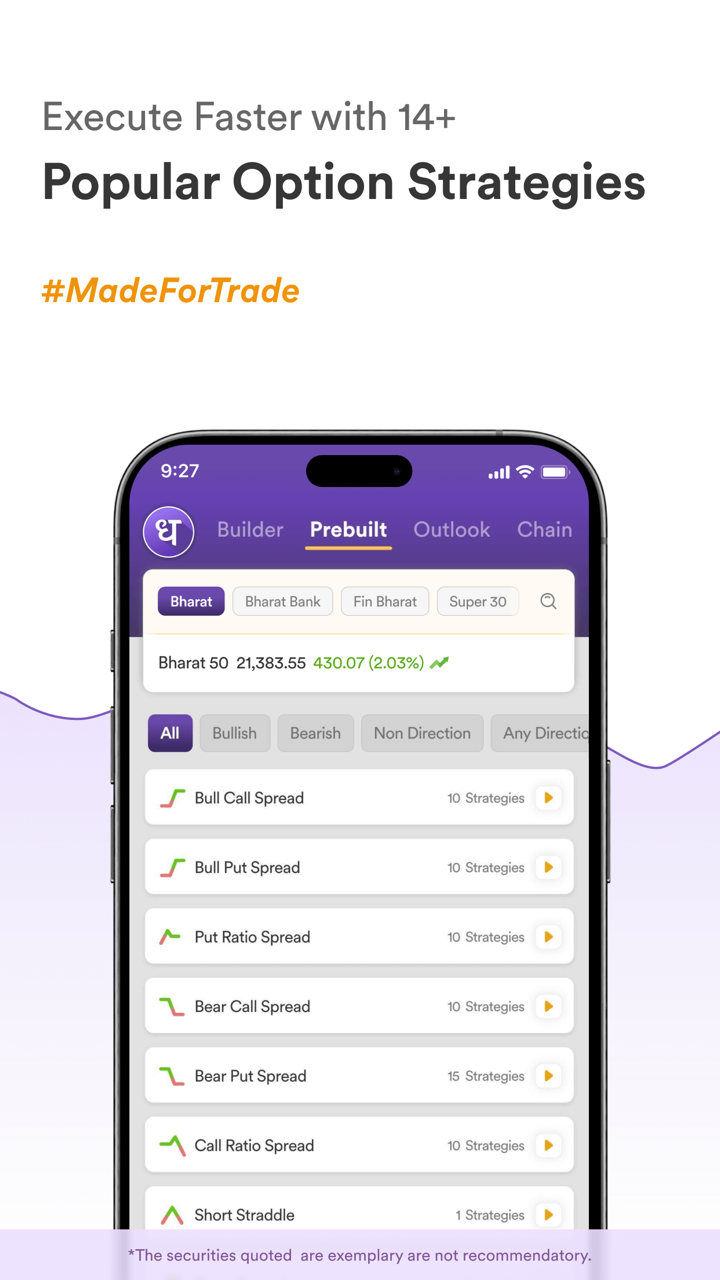

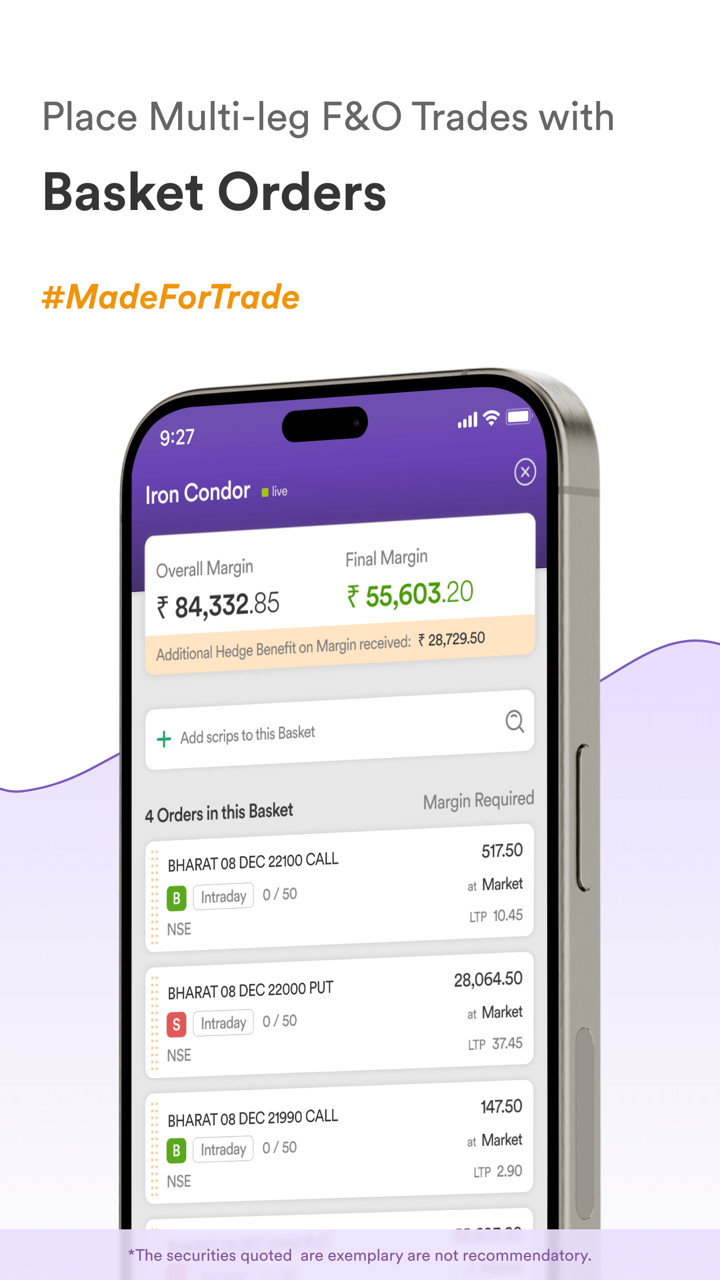

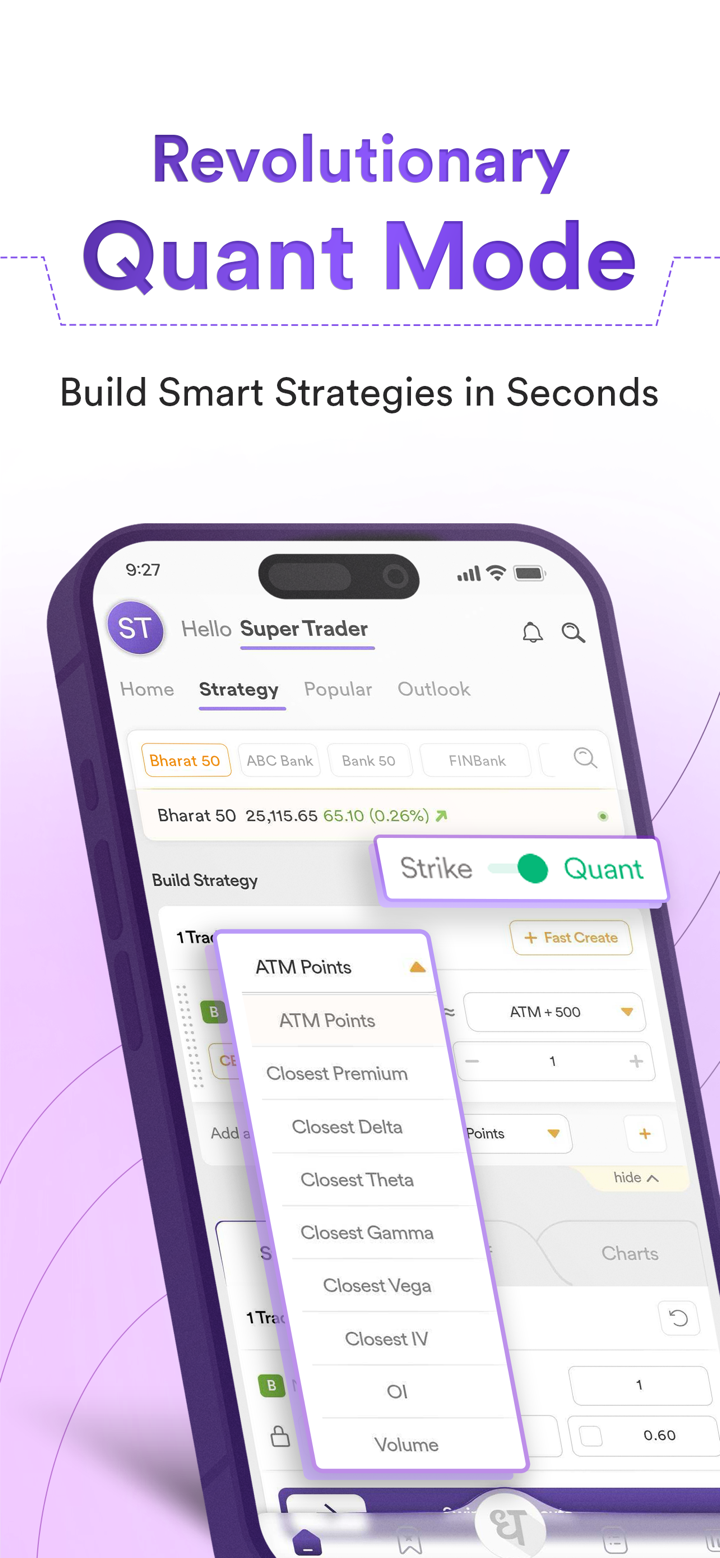

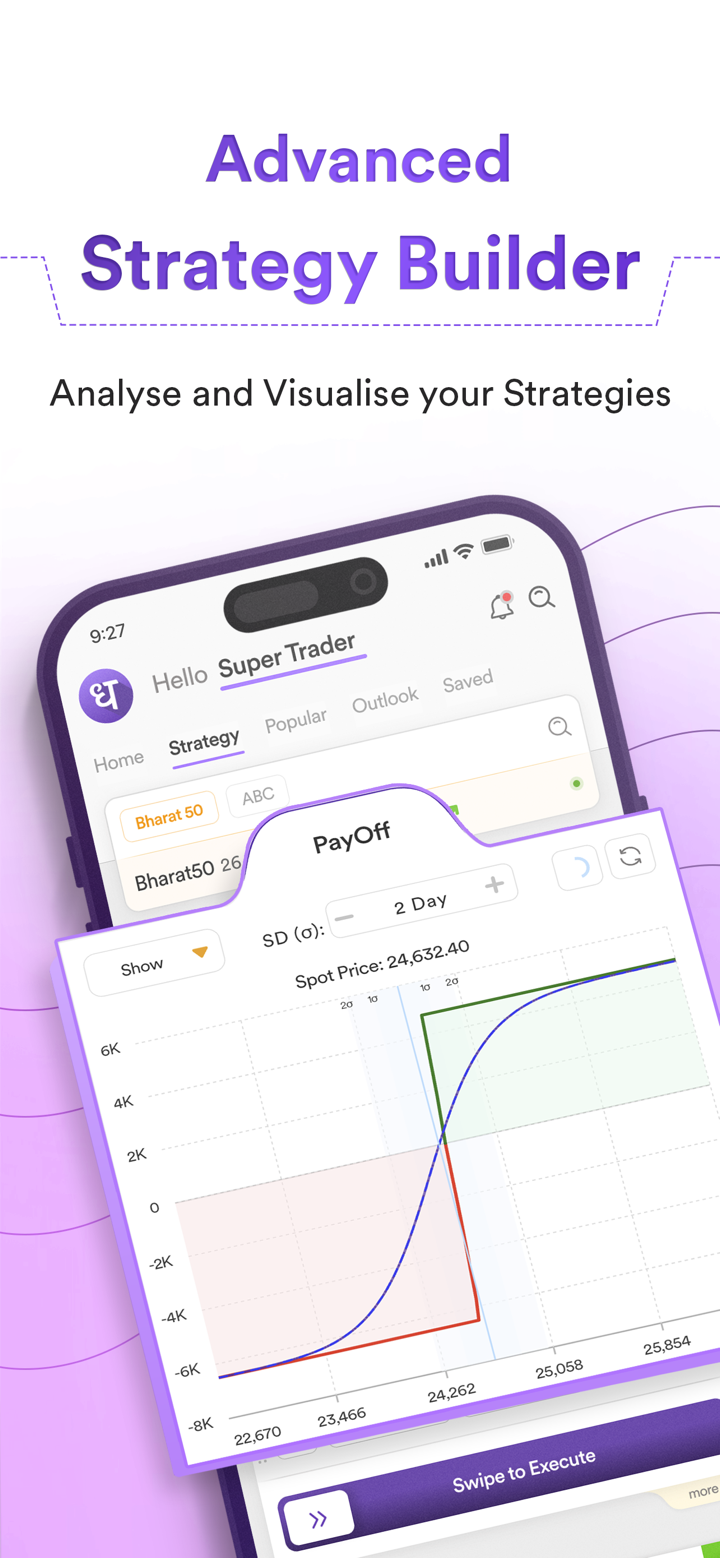

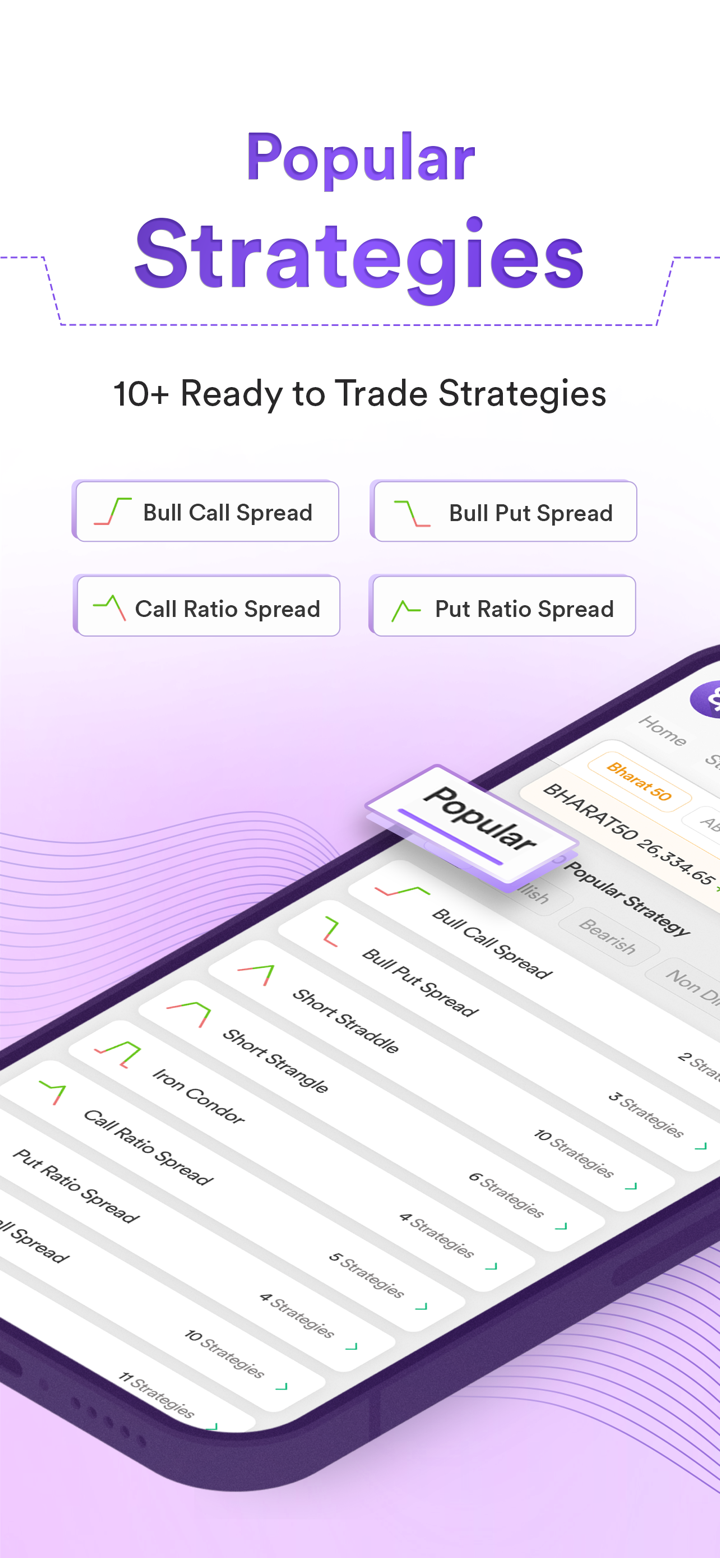

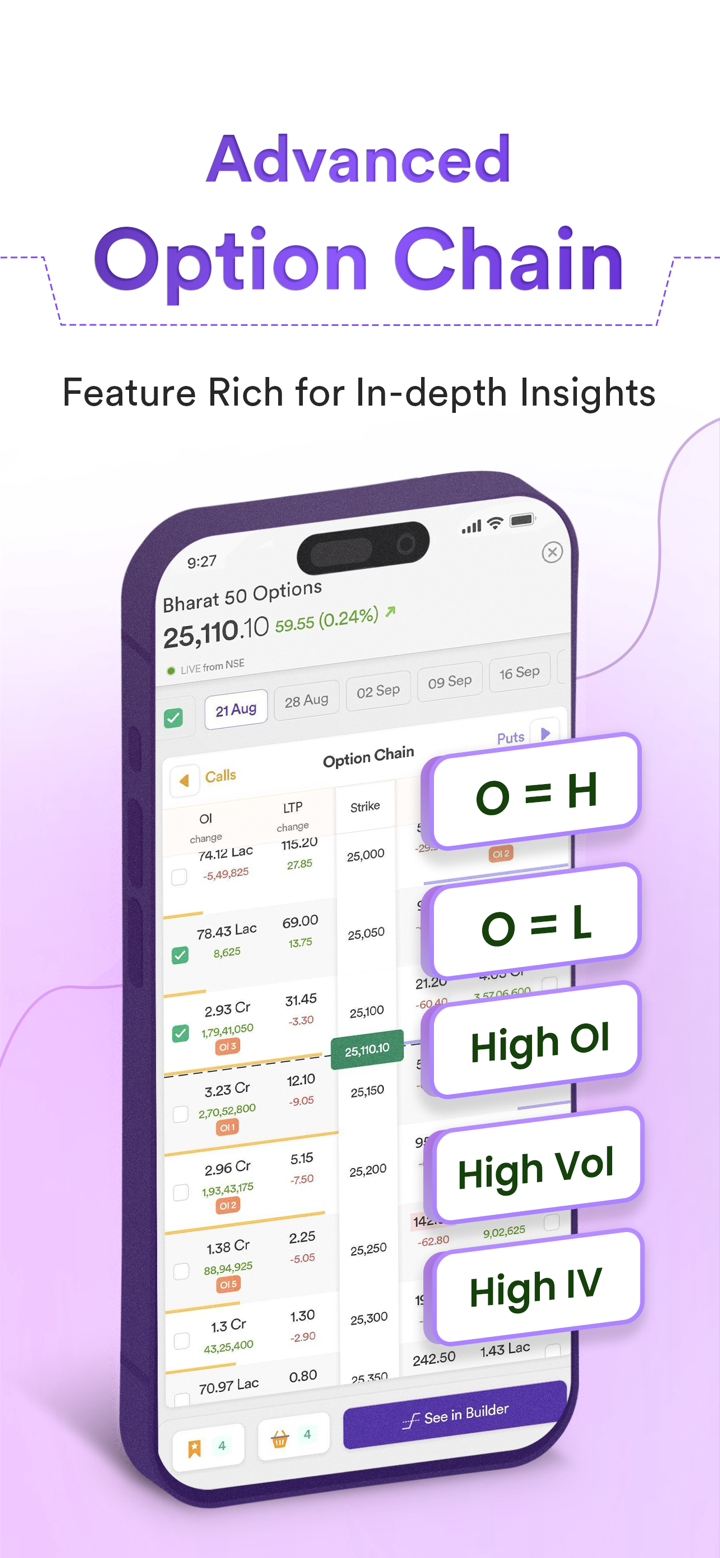

Options Trader App & Options Trader Web: 专为期权交易策略设计的专业平台。

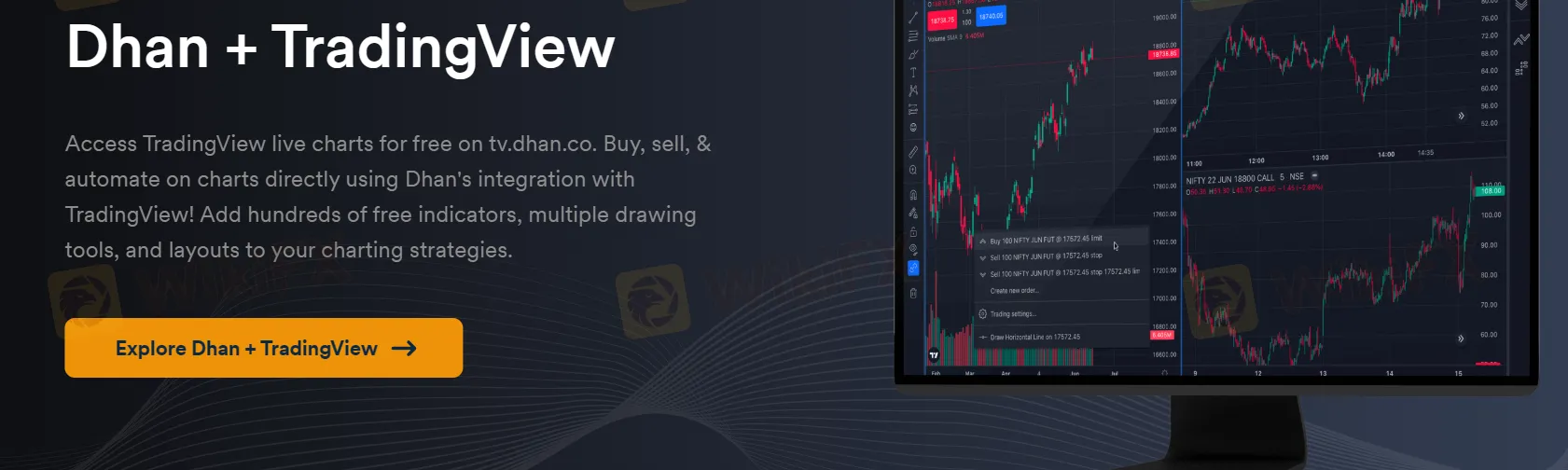

Dhan + TradingView: 将Dhan的交易功能与TradingView强大的图表和分析工具集成。

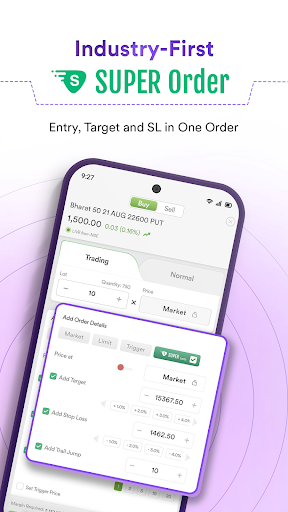

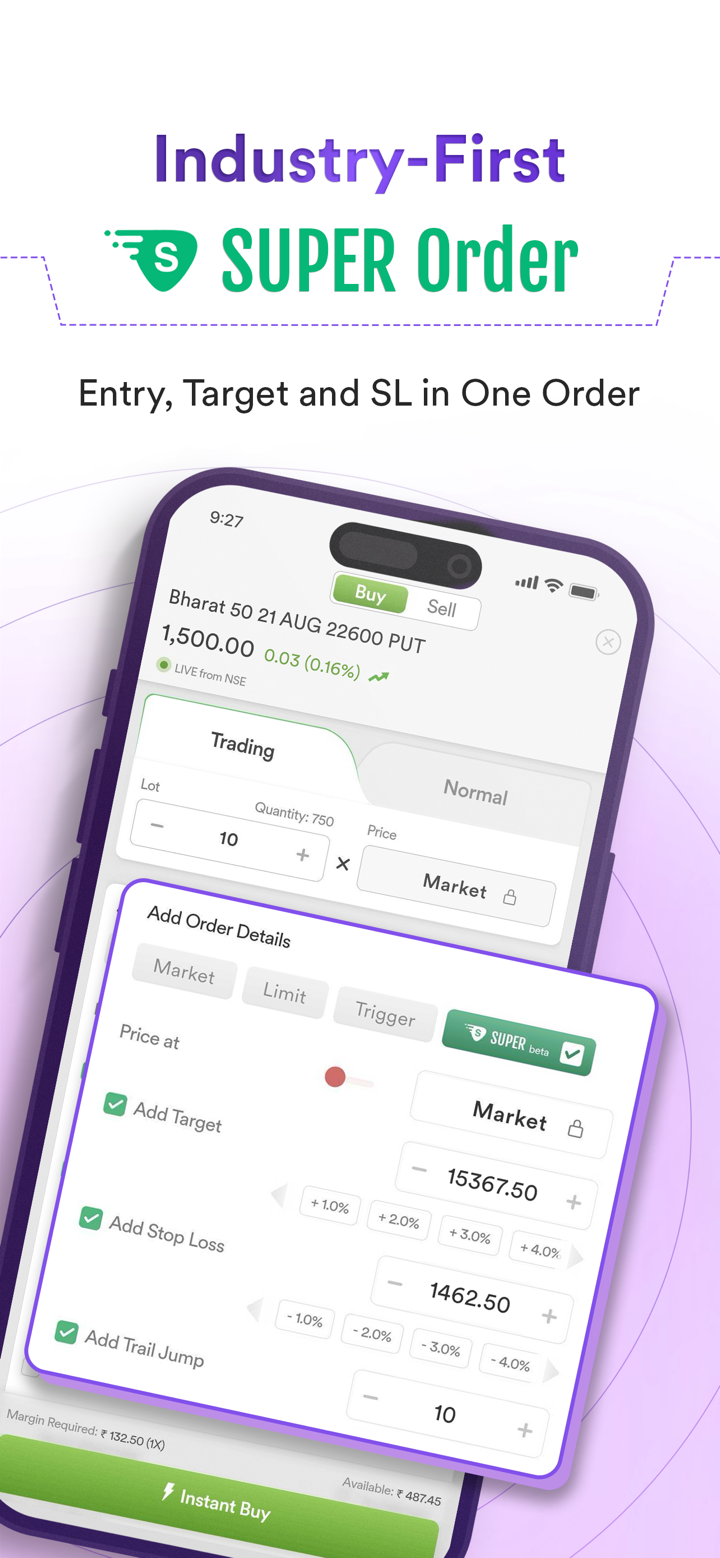

DhanHQ: 一家综合平台,为活跃交易者提供深入的市场数据、研究工具和高级订单类型。

客户服务

Dhan提供全面且便捷的客户支持网络。他们的支持团队可以通过不同渠道联系,以实现最大便利。

电话号码:(+91)9987761000(市场交易日上午9:00至下午6:00可用)

电子邮件:help@dhan.co

地址:印度马哈拉施特拉邦孟买东博里瓦利东部西部高速公路西边302号。

Twitter: https://twitter.com/DhanCares

在线聊天(周一至周五上午8点至晚上12点,周六和周日上午8点至晚上10点)

结论

总的来说,Dhan提供了广泛的交易工具、证券账户、多个交易平台和各种客户支持渠道,使其成为适合不同投资风格和目标的各种投资者的有利平台。然而,缺乏有效监管引发了对该平台安全性和可信度的重大关注。

常见问题(FAQs)

| 问题 1: | Dhan是否受监管? |

| 答案 1: | 否。已经确认该经纪人目前没有有效监管。 |

| 问题 2: | Dhan是否提供模拟交易? |

| 答案 2: | 否。 |

| 问题 3: | Dhan提供哪些交易平台? |

| 答案 3: | Dhan App, Dhan web, Options Trader App, Options Trader Web, Dhan + TradingView, TradingView, DhanHQ。 |

| 问题 4: | 我可以用Dhan交易哪些金融工具? |

| 答案 4: | 股票、期权、期货、商品、货币、ETF、共同基金、IPO。 |

风险警示

在线交易涉及重大风险,您可能会损失所有投资资本。这并不适合所有交易者或投资者。请确保您了解所涉风险,并注意本评论中提供的信息可能会因公司服务和政策的更新而发生变化。

此外,生成此评论的日期也可能是需要考虑的重要因素,因为信息可能自那时起已经发生变化。因此,建议读者在做出任何决定或采取任何行动之前,始终直接与公司核实更新的信息。对于本评论中提供的信息的使用责任完全由读者承担。