公司简介

| Connexar Capital评论摘要 | |

| 成立时间 | 2022 |

| 注册国家/地区 | 科摩罗 |

| 监管 | 未受监管 |

| 市场工具 | 外汇、贵金属、指数、差价合约、加密货币 |

| 模拟账户 | ✔ |

| 杠杆 | 最高1:400 |

| 点差 | 从0.2点 |

| 交易平台 | MT5(Windows、Mac、Android、iOS) |

| 最低存款 | $50(Ultra账户) |

| 客户支持 | 电话:+44 7308642365 |

| 电子邮件:support@connexarcapital.com | |

| 24/7在线聊天:可用 | |

Connexar Capital信息

Connexar Capital成立于2022年。它提供了外汇、差价合约、指数和加密货币等多种交易可能性。他们的MT5系统支持多种设备,并提供三种不同类型的账户以满足交易者的不同偏好。最低存款要求为$50。

优点和缺点

| 优点 | 缺点 |

| 包括外汇和差价合约在内的多种工具 | 未受监管 |

| 低至$50的最低存款 | 只提供一种交易平台:MT5 |

| 提供3种不同类型的账户 | |

| 提供最高1:400的杠杆 | |

| 提供奖金计划 |

Connexar Capital是否合法?

Connexar Capital作为一个未受监管的平台运营。

我可以在Connexar Capital上交易什么?

Connexar Capital提供许多交易工具,包括主要货币对、次要货币对、异国情调的货币对、贵金属、指数和差价合约。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 贵金属 | ✔ |

| 指数 | ✔ |

| 差价合约 | ✔ |

| 加密货币 | ✔ |

| 股票 | ❌ |

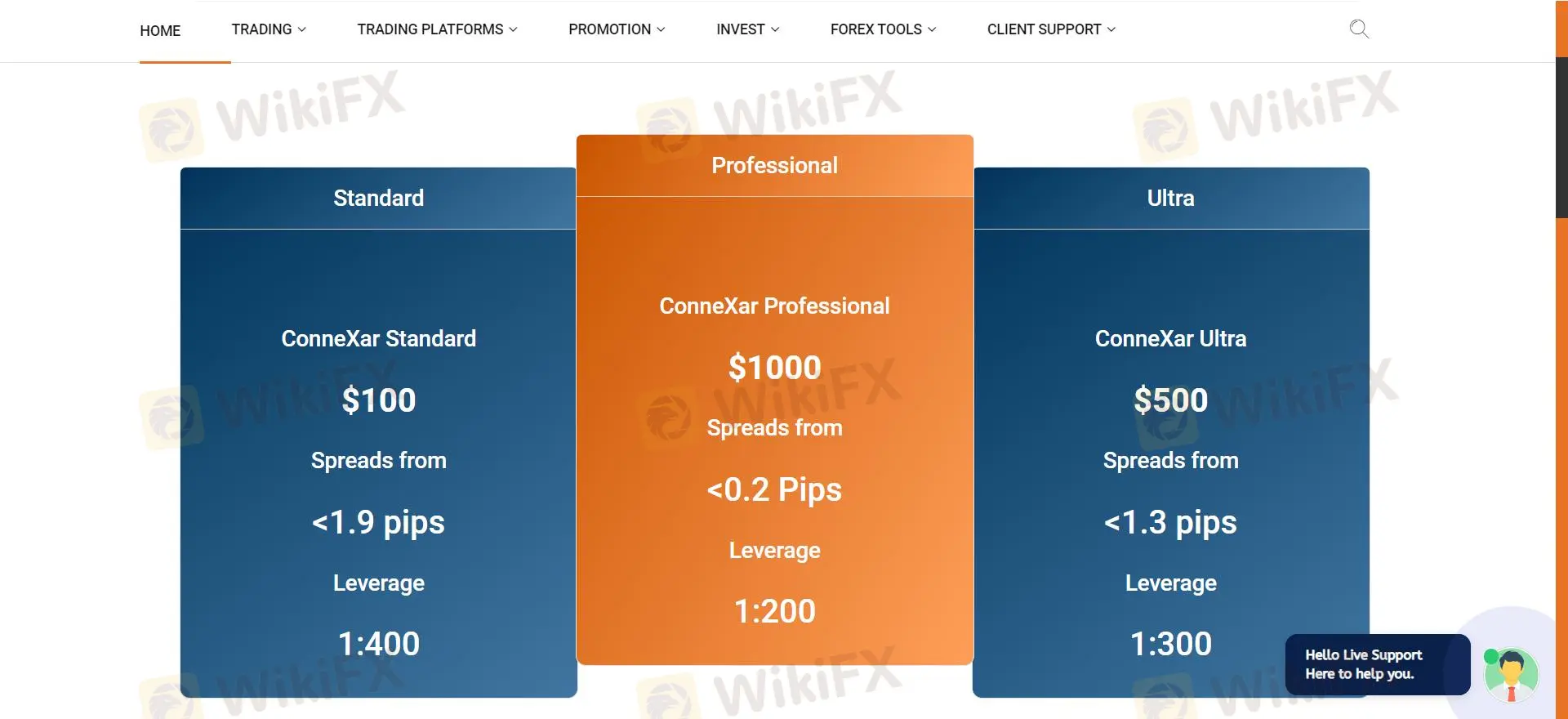

账户类型

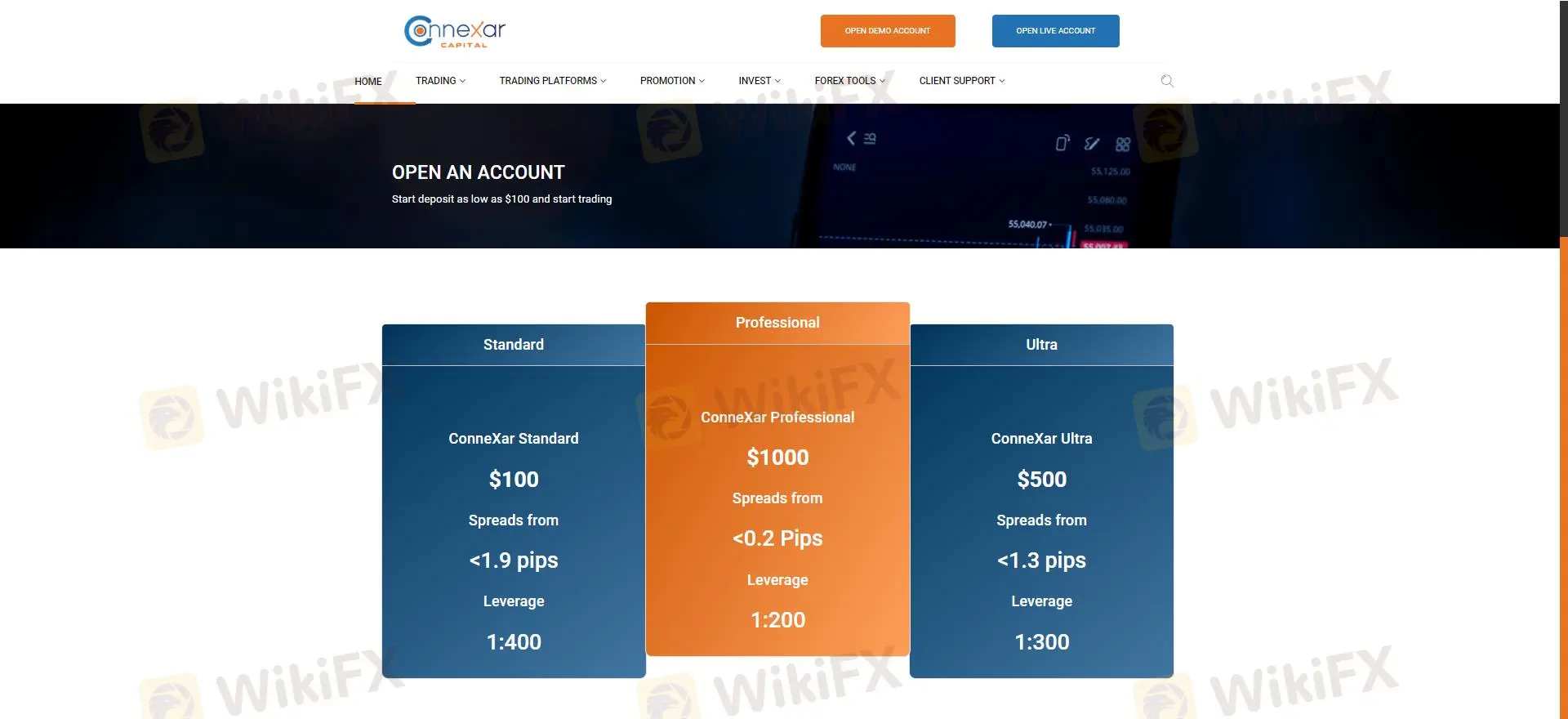

Connexar Capital提供3种账户类型,专为不同级别的交易者设计。

| 账户类型 | 最低存款 | 点差 | 杠杆 | 附加功能 |

| 标准账户 | $100 | 从1.9点 | 最高1:400 | 无掉期费用,MT5 |

| 专业账户 | $1,000 | 从0.2点 | 最高1:200 | ECN执行,MT5 |

| 超级账户 | $500 | 从1.3点 | 最高1:300 | PAMM/MAM支持 |

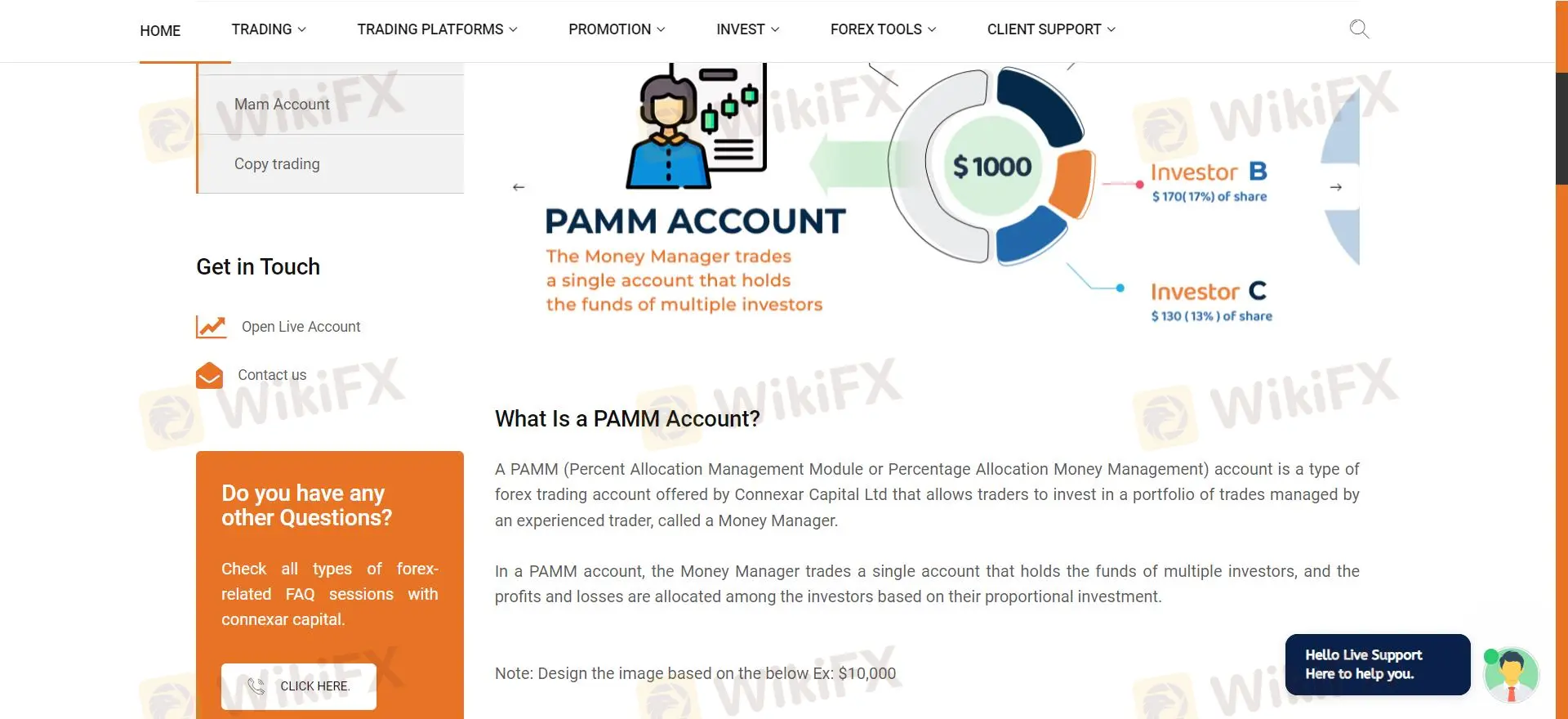

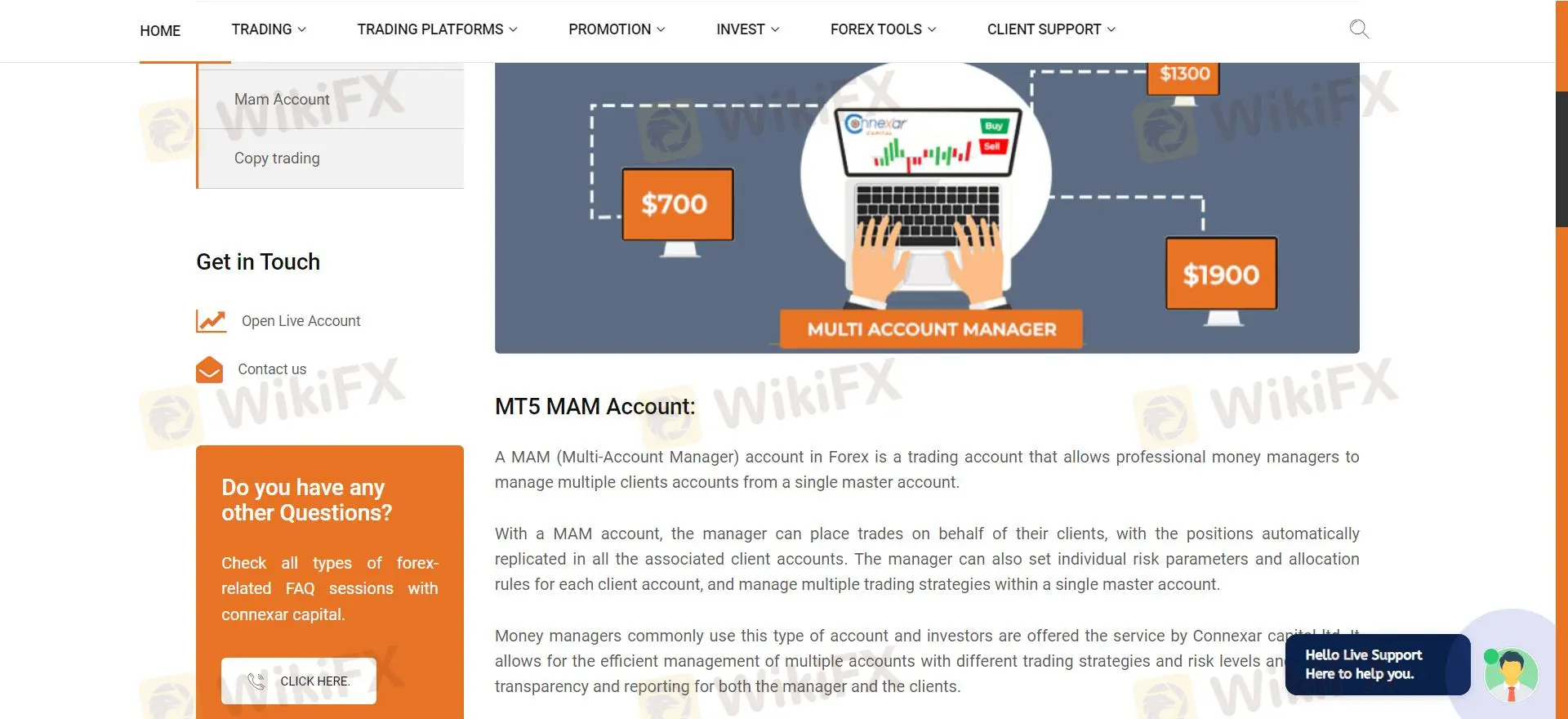

同时,它还提供PAMM账户和MAM账户。

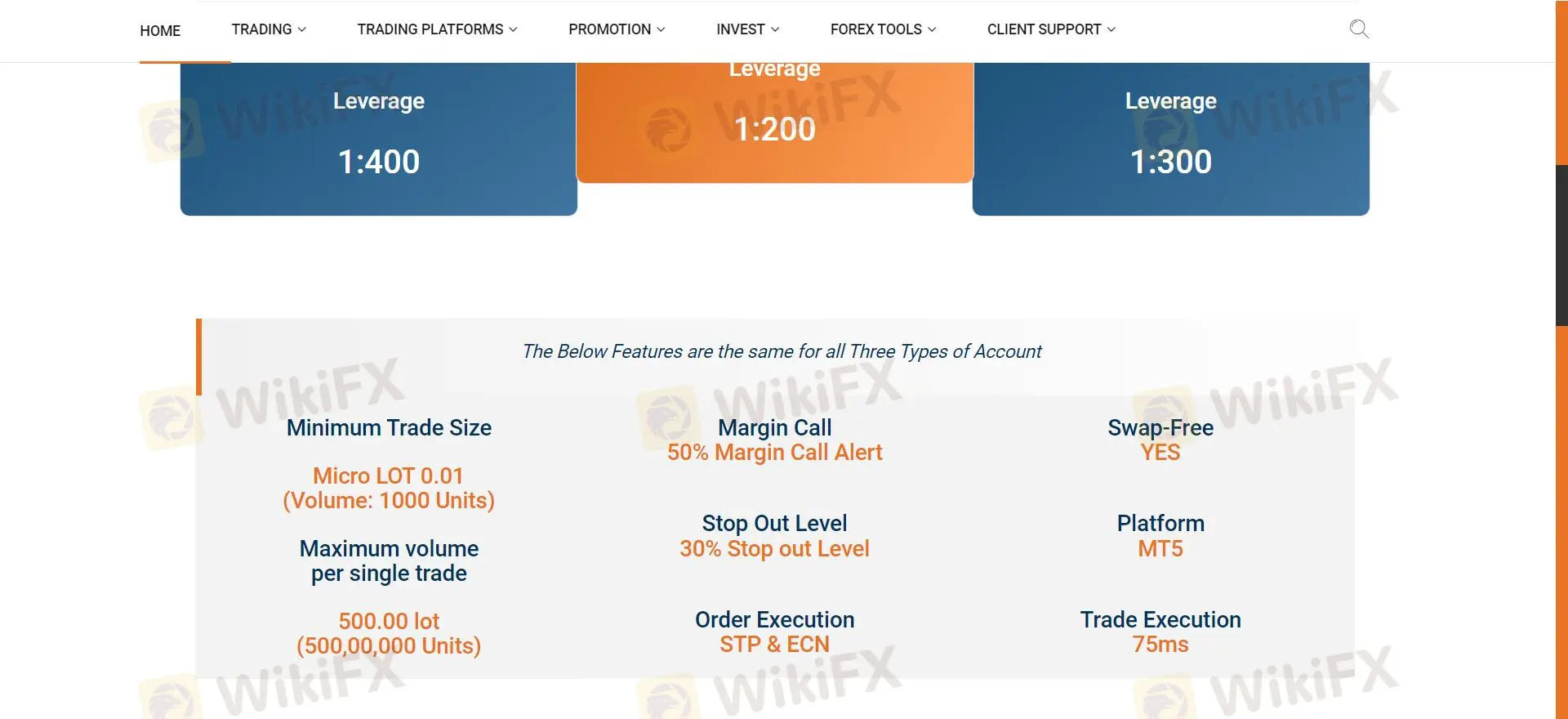

杠杆

Connexar Capital提供1:200到1:400的杠杆。

| 账户类型 | 最大杠杆 |

| Connexar STD | 1:400 |

| Connexar ECN | 1:200 |

| Connexar PRO | 1:300 |

Connexar Capital费用

Connexar Capital有三种不同点差、佣金和掉期成本的账户选择。以下是详细说明:

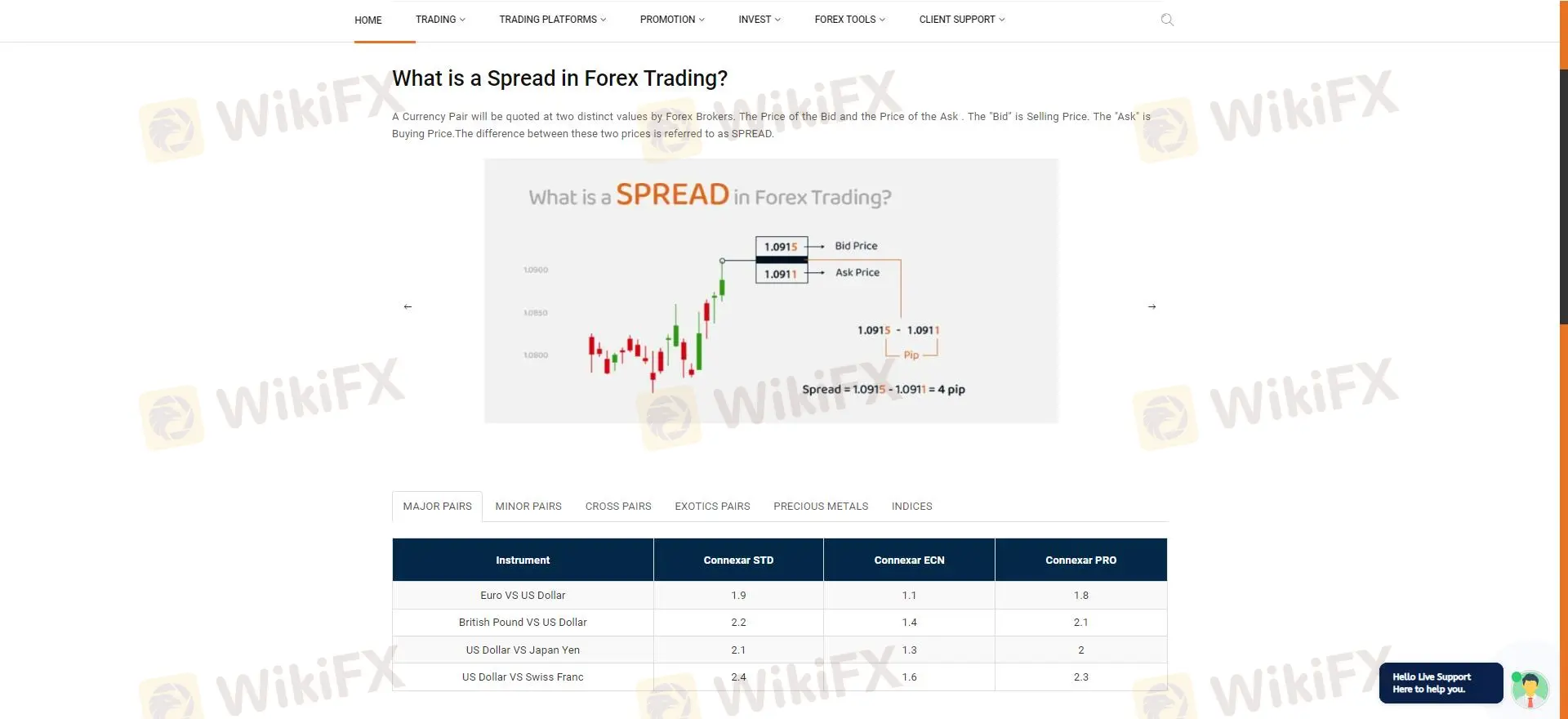

点差

点差根据账户类型而不同:

- Connexar STD:点差从1.9点起。

- Connexar ECN:点差从1.1点起。

- Connexar PRO:点差从1.8点起。

以下是常见交易工具的具体示例:

| 工具 | Connexar STD | Connexar ECN | Connexar PRO |

| EUR/USD | 1.9点 | 1.1点 | 1.8点 |

| GBP/USD | 2.2点 | 1.4点 | 2.1点 |

| 黄金/美元 | 2.1点 | 1.2点 | 1.9点 |

| 日经225指数 | 65.5点 | 55.5点 | 60.5点 |

| 美国道琼斯30指数 | 81.5点 | 71.5点 | 76.5点 |

佣金

Connexar Capitals的佣金根据账户类型而定,每手从0美元到6美元不等:

| 账户类型 | 佣金 |

| Connexar STD | 无佣金;成本包含在点差中。 |

| Connexar ECN | 每手6美元(双向)。 |

| Connexar PRO | 无佣金;成本包含在点差中。 |

掉期退款

Commexar是免掉期费的。对于满足特定交易量标准的交易者,有一个掉期退款计划:

| 达到交易量 | 退款百分比 |

| 存款的0.1% | 掉期退款的20%手续费 |

| 存款的0.2% | 掉期退款的50%手续费 |

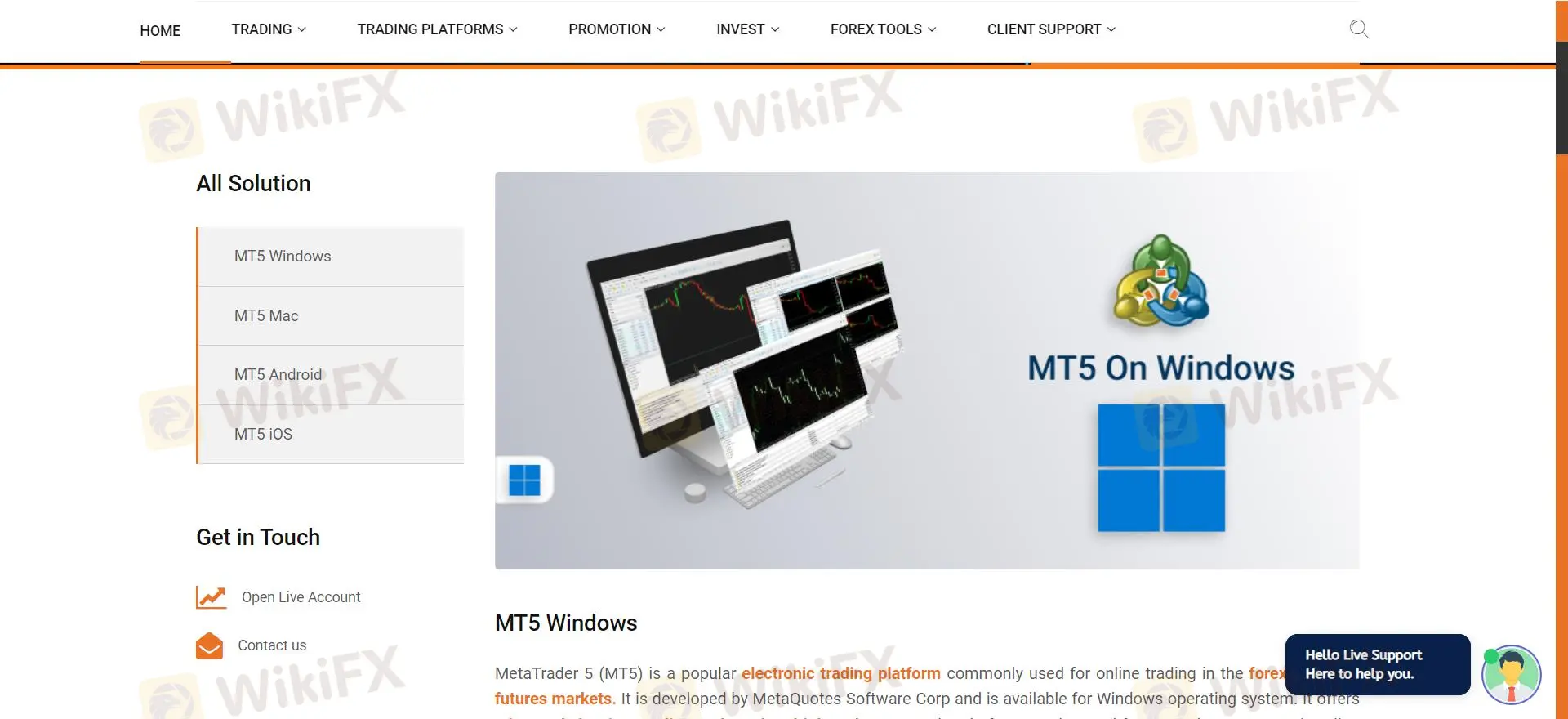

交易平台

Connexar只提供MT5作为其交易平台。

| 交易平台 | 支持设备 | 适用于 |

| MT5 | Windows、Mac、Android、iOS | 高级交易者和专业人士 |

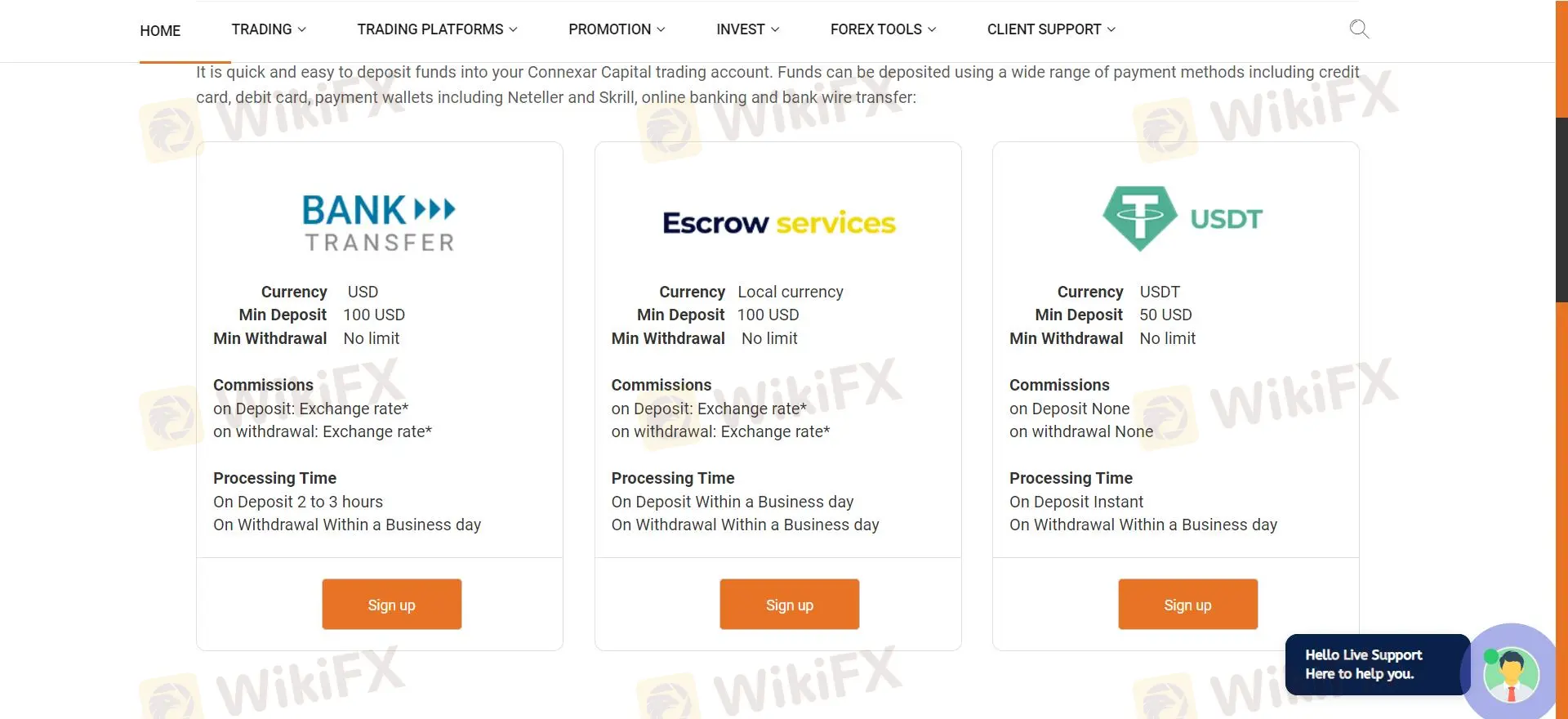

存款和取款

Connexar Capital提供3种免费存款和取款选项。

| 存款选项 | 最低入金 | 费用 | 处理时间 |

| 银行转账 | $100 | 无 | 2-3小时 |

| 电子钱包 | $100 | 无 | 即时 |

| 加密货币 | $50 | 无 | 即时 |

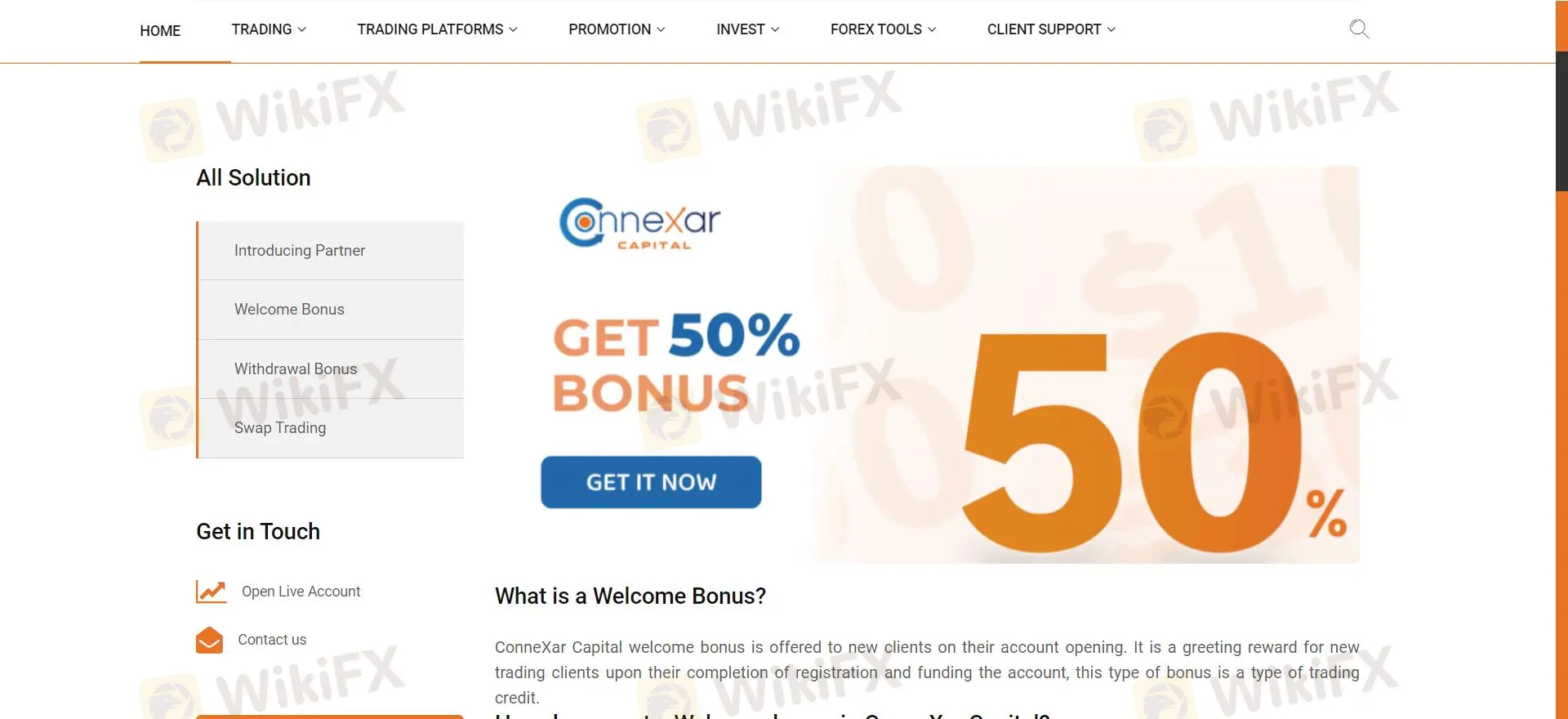

奖励计划

Connexar Capital提供首次存款高达50%的欢迎奖金,以及后续充值的30%奖金,总额上限为$5000。