Shoofar

1-2年

What are the pros and cons of trading with First Securities?

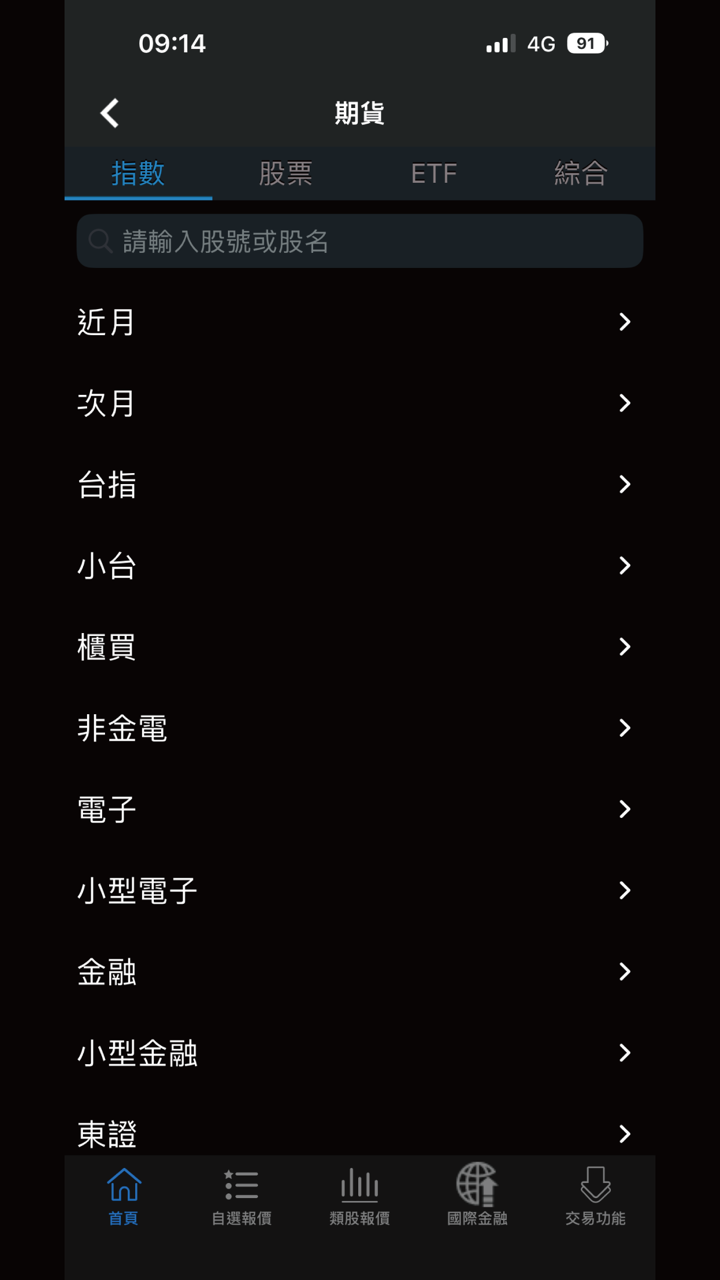

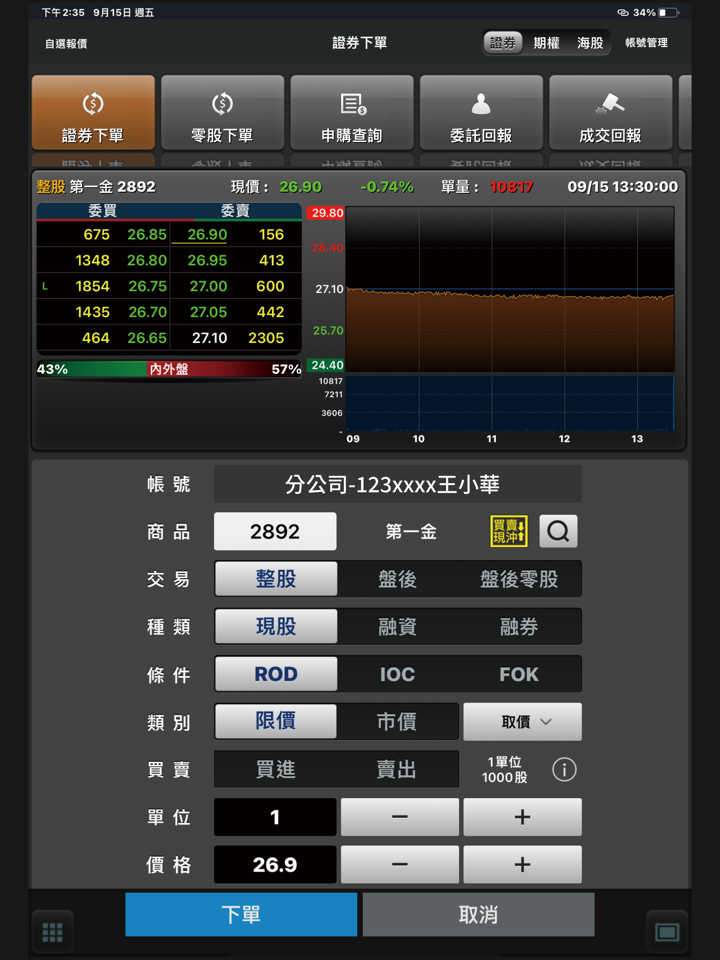

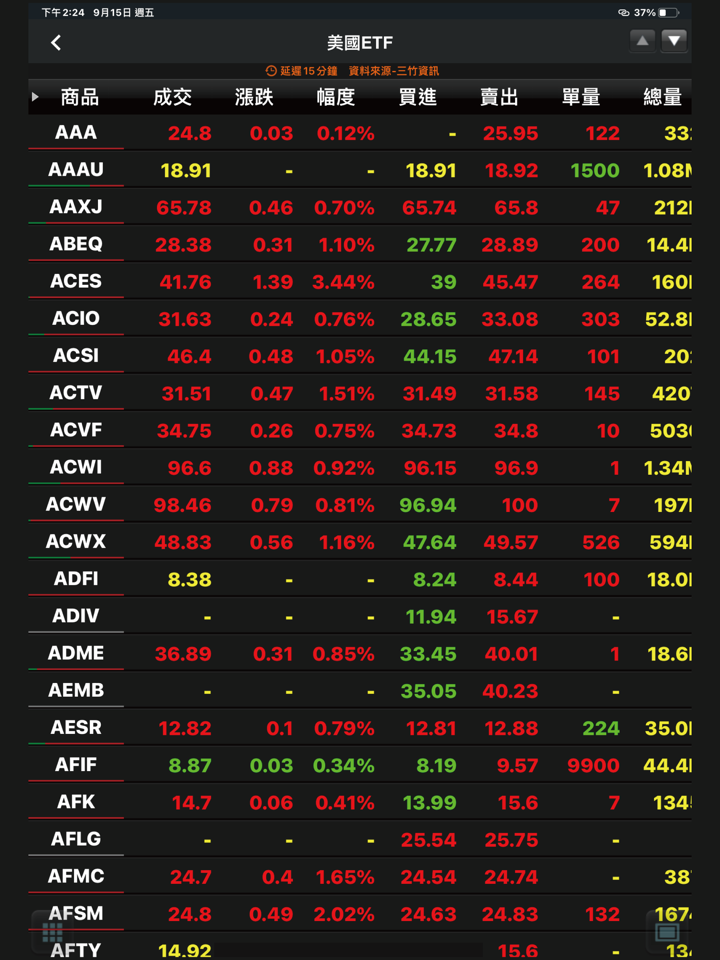

The pros of trading with First Securities include its wide range of financial products, such as equities, derivatives, and fixed-income securities, making it suitable for diverse investment strategies. The platform is regulated by TPEX, which provides some level of security for local traders. However, the cons include the lack of global regulation and transparency, especially with the "Unreleased" regulatory license number. The platform’s fee structure is also not entirely clear, which could make it difficult for traders to assess costs upfront. Furthermore, its limited international presence may not appeal to global traders.

tabawan_dreamer

1-2年

What are the commission fees for trading stocks with First Securities?

First Securities applies a tiered commission structure for stock trading. For domestic stocks, if the agreed consideration is less than 1 million yen, the commission fee is 1.210% of the agreed consideration, with a minimum charge of 2,750 yen. For trades exceeding 1 million yen but less than 3 million yen, the fee is reduced to 0.880% of the agreed consideration, plus an additional 3,300 yen. Foreign stock trading incurs a higher commission of 2.20% (including tax), with a minimum of 5,500 yen. These rates can add up, especially for larger transactions, so traders should consider them before making trades.

Broker Issues

Fees and Spreads

ryad22

1-2年

Is First Securities a safe and legitimate broker?

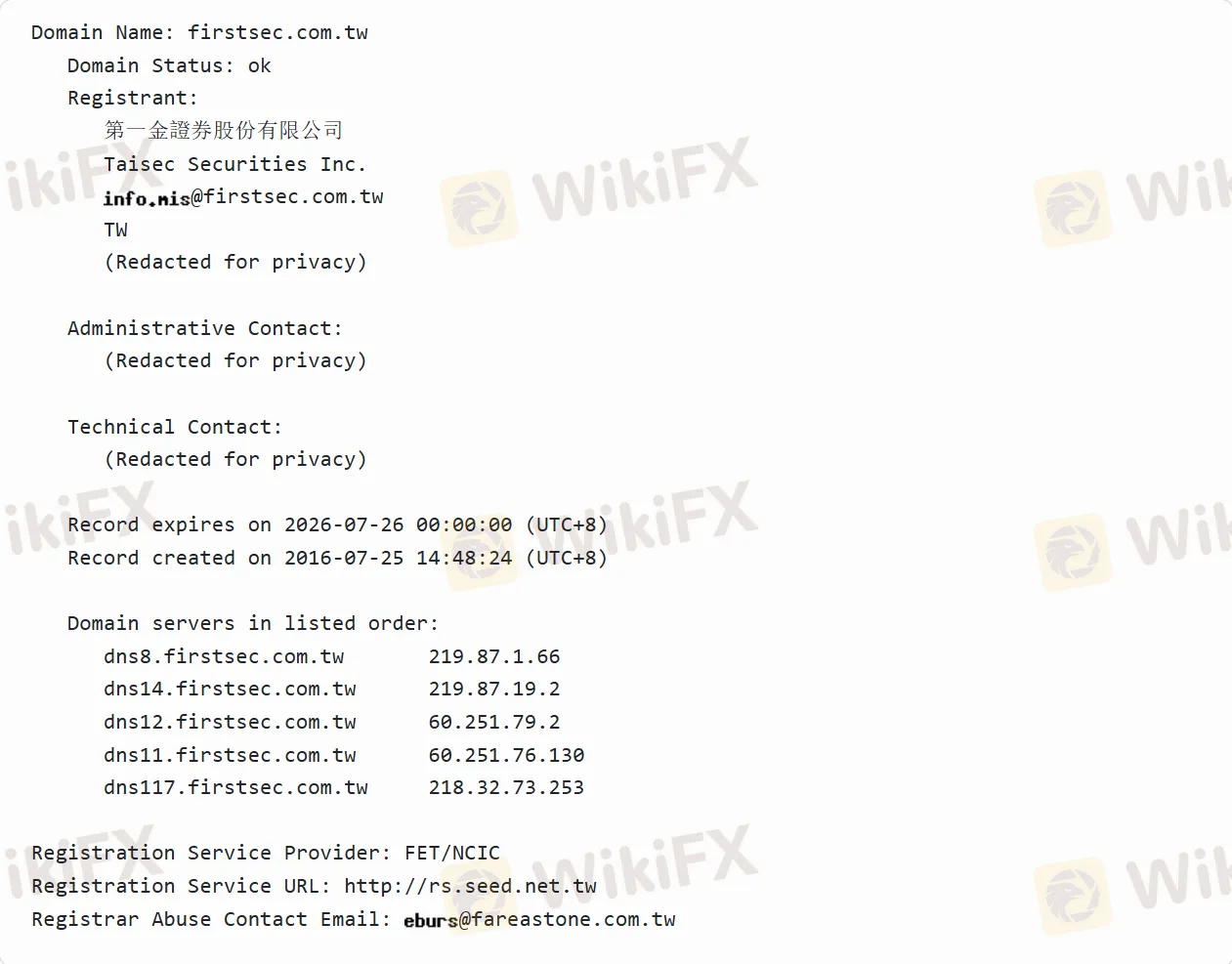

First Securities is a legitimate broker operating under the regulation of the Taipei Exchange (TPEX), ensuring it follows the legal requirements for financial services in Taiwan. However, its "Unreleased" regulatory license number may raise concerns regarding the level of detail and transparency around its official registration. While it is a registered entity in Taiwan, traders should understand that the broker’s international regulatory standing is limited. Despite this, for those focused on the Taiwan market, First Securities provides a regulated and secure environment for trading.