公司简介

| 财富财富评论摘要 | |

| 成立时间 | 2006 |

| 注册国家/地区 | 印度 |

| 监管 | 无监管 |

| 市场工具 | 股票、衍生品 |

| 模拟账户 | ❌ |

| 交易平台 | NSE Mobile App,NOW(NSE的在线交易平台) |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:+91-422-4334333 | |

| 电子邮件:pms@fortunewmc.com,info@fortunewmc.com | |

| 社交媒体:Facebook,Instagram,Twitter | |

财富财富信息

财富财富是一家无监管经纪商,提供股票和衍生品交易,使用NSE Mobile App和NOW(NSE的在线交易平台)交易平台。

优缺点

| 优点 | 缺点 |

| 操作时间长 | 无监管 |

| 多种联系渠道 | 无演示账户 |

| 支付选项有限 |

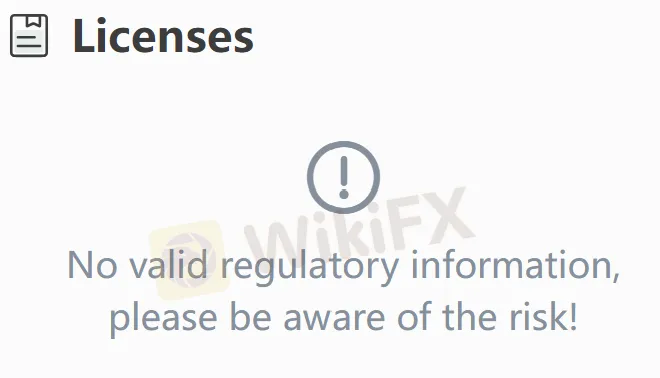

财富财富是否合法?

不。财富财富目前没有有效监管。请注意风险!

我可以在财富财富上交易什么?

Fortune Wealth提供股票和衍生品交易。

| 交易工具 | 支持 |

| 股票 | ✔ |

| 衍生品 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

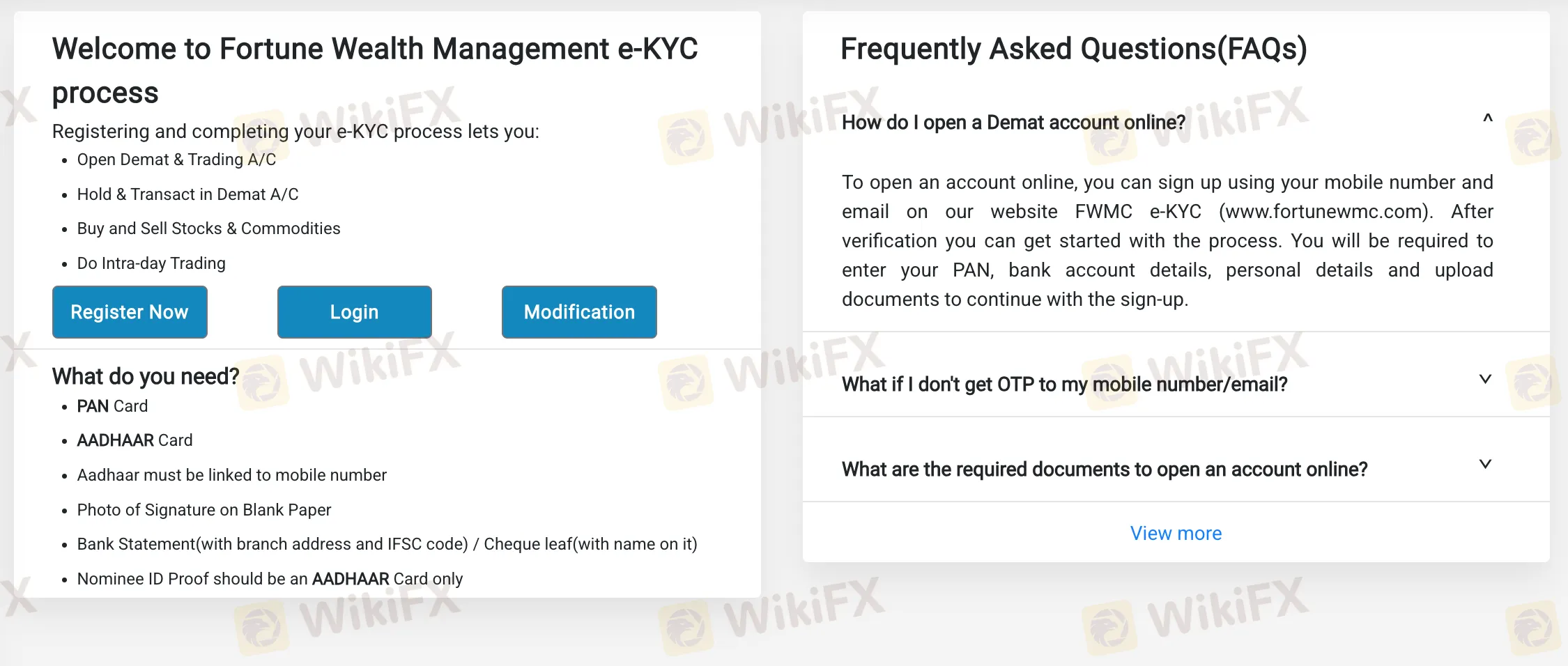

账户类型

该经纪商提供Demat 账户。但是,它没有提供账户的详细信息。

Fortune Wealth费用

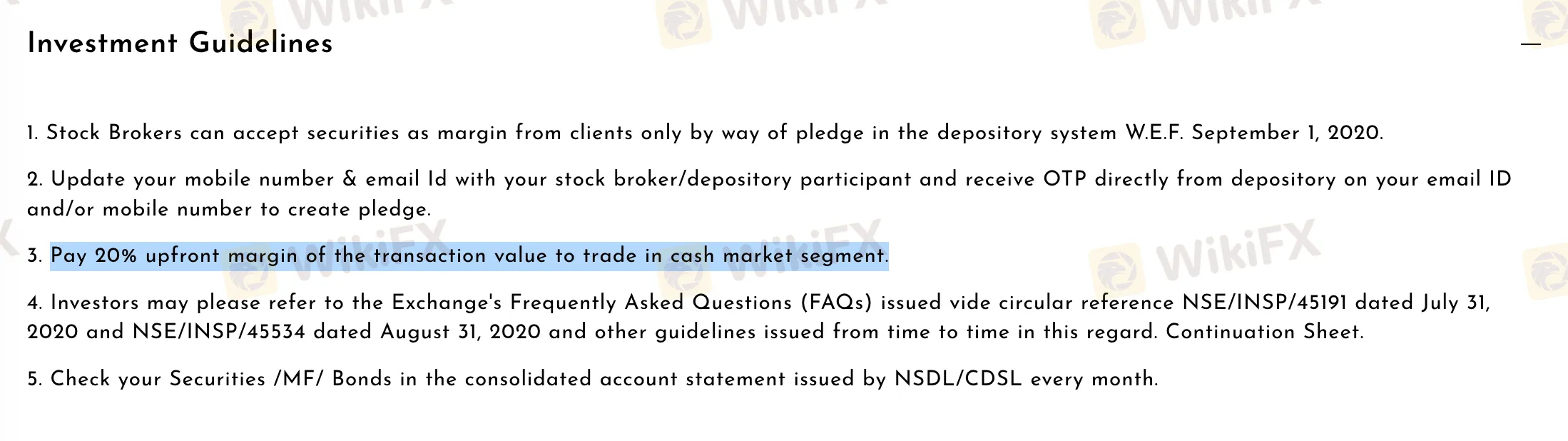

客户应支付交易价值的20%作为现金市场段交易的预付保证金。

与经纪商开设交易账户时,有一次性费用为Rs 116。

交易平台

| 交易平台 | 支持 | 可用设备 |

| NSE移动应用 | ✔ | 移动设备 |

| NOW(NSE在线交易平台) | ✔ | Web |

存款和取款

该经纪商接受通过银行电汇进行的付款。没有规定最低存款或取款金额,也没有指定手续费或收费。