公司简介

| 海通期货评论摘要 | |

| 成立时间 | 2007 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX |

| 市场工具 | 宏观金融、能源和化工、金属、农产品和航运 |

| 模拟账户 | ✅ |

| 杠杆 | \ |

| 点差 | \ |

| 交易平台 | \ |

| 最低存款 | \ |

| 客户支持 | 电子邮件:services@htfutures.com |

| 电话:400-820-9133;021-61871678;021-38917383;021-38917385 | |

| 社交媒体:微信 | |

| 地址:中国(上海)自由贸易试验区杨高南路799号5楼02-04室,11楼,12楼 | |

| 区域限制 | 美国、日本、加拿大、澳大利亚、朝鲜、英国、伊朗、叙利亚、苏丹和古巴。 |

海通期货 信息

海通期货成立于2007年11月28日,总部位于中国上海自由贸易试验区。它是一家受中国金融期货交易所(CFFEX)监管的持牌期货公司,持有期货牌照(牌照号码0133)。该公司提供多种交易产品,涵盖宏观金融、能源和化工、有色金属、黑色金属、农产品和航运等领域,并支持股票期权、商品期货、金融期货等账户类型。其业务严格遵守中国法律法规,致力于维护市场秩序和投资者权益,并提供模拟账户、应用程序接口访问以及多银行资金存取款服务,满足客户多样化需求。

优点与缺点

| 优点 | 缺点 |

| 提供模拟账户 | 支付选项有限 |

| 受监管 | 区域限制 |

| 五种账户 | |

| 多样的交易产品 | |

| 悠久的运营历史 |

海通期货 是否合法?

海通期货有限公司是中国金融期货交易所的受监管实体,持有期货许可证,许可证号码为0133。该公司在中国金融市场的运营受到严格监管,以确保其业务活动符合相关法律法规的要求。这种监管机制有助于维护市场秩序和投资者的权益。

| 受监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 中国金融期货交易所 | 受监管 | 海通期货有限公司 | 期货许可证 | 0133 |

在海通期货上可以交易什么?

海通期货的交易产品涵盖宏观金融、能源化工、黑色金属、有色金属、农产品和航运等各个领域。

账户类型

海通期货提供5种实时账户:股票期权账户、商品期货账户、金融期货账户、互联网账户、特定品种和期货期权账户。

股票期权账户: 专用于交易股票期权的账户,允许投资者买入和卖出或认购期权。

商品期货账户: 用于交易大宗商品期货合约(如黄金、原油、农产品等),帮助投资者参与实物大宗商品衍生品市场。

金融期货账户: 用于交易金融期货合约(如股指期货、利率期货等),主要服务于与金融市场相关的投资需求。

互联网账户: 通过在线平台开设的期货账户,支持投资者通过互联网开户、交易和管理资金,方便快捷。

特定品种和期货期权账户: 设计用于特定品种(如国际期货品种)和期货期权交易,满足跨境交易或特殊品种的投资需求。

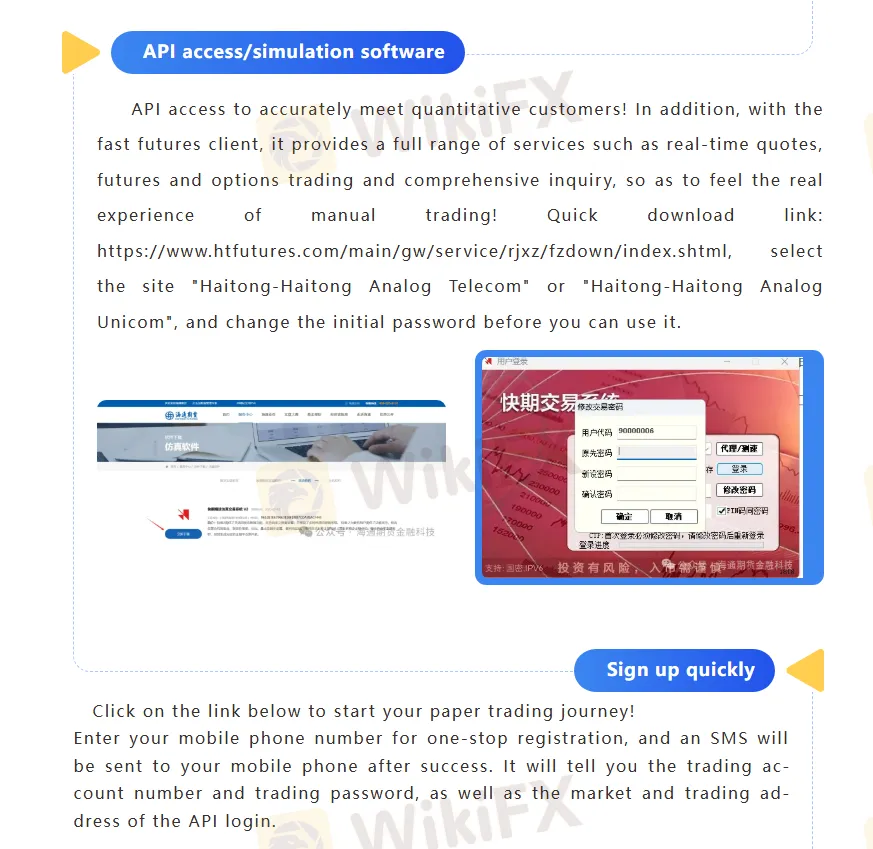

海通期货提供模拟账户服务,帮助客户体验真实交易环境。用户可以通过官方网站链接下载模拟软件,通过手机号码快速注册,成功注册后会收到包含交易账号和密码的短信通知。此外,公司还支持应用程序接口接入,满足量化客户的个性化需求,提供实时行情、期货期权交易和综合查询等全面功能,帮助用户熟悉手动交易流程。

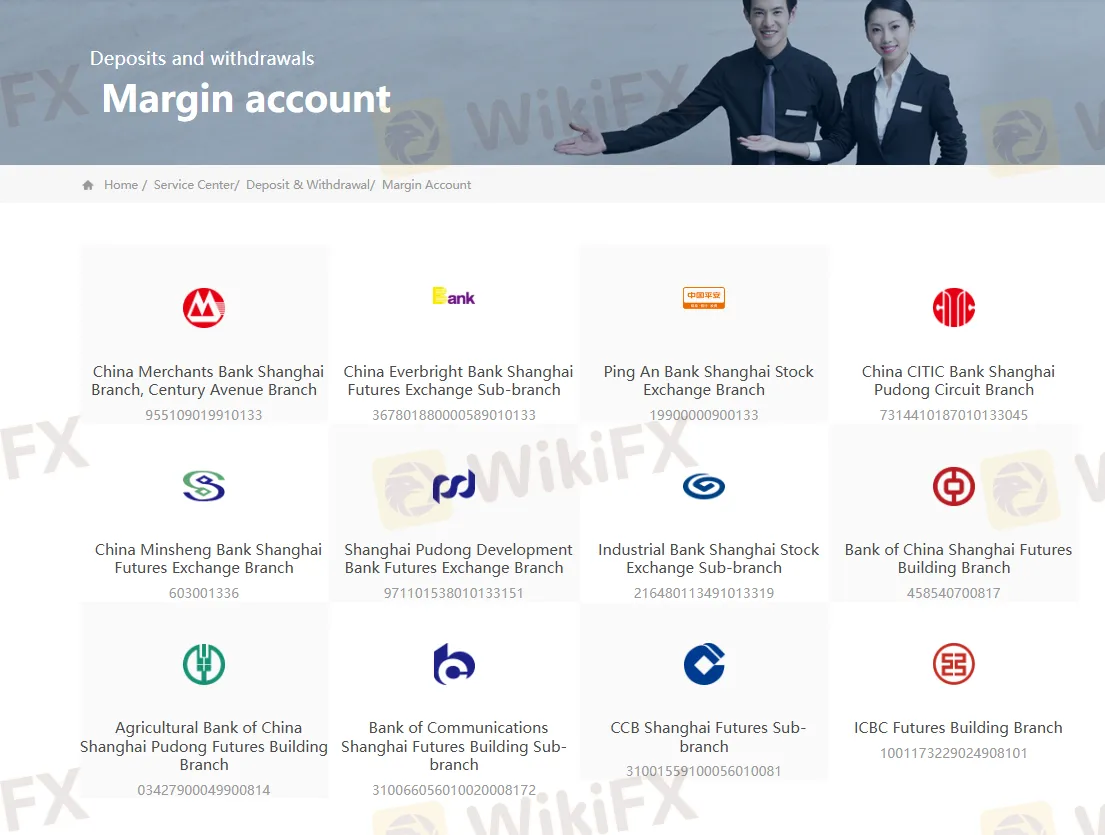

存取款

目前,海通期货客户可以通过银期转账和银行转账进行存取款。通过网银、手机银行和期货软件进行的银期转账客户的存取款已经处理,通过银行汇款进行的银期转账客户的存取款尚未处理。

海通期货的存取款操作主要通过其保证金账户进行,支持与多家银行合作,包括招商银行、光大银行、平安银行、中信银行、民生银行、上海浦东发展银行、兴业银行、中国银行、中国农业银行、交通银行和中国建设银行。每家合作银行均为期货交易所或期货大厦分支机构提供了专用账户,用于客户资金的存取款,以确保交易资金的安全和便利。