公司简介

RK Global 的一般信息和法规

RK Global 于 1995 年在印度新德里成立,并于 2000 年开设了自己的零售经纪服务。RK Global 为印度 24 个州的 150 多个城市提供一系列金融服务,旨在赢得客户信任并创造高效透明的交易环境,通过电子邮件、电汇、网络表格和聊天为客户提供 24/7 全天候客户服务。 RK Global 网站上没有可用的监管信息。

安全分析

RK Global 目前不作为股票经纪人受到监管,这意味着投资者的交易活动和资金不受任何保护。

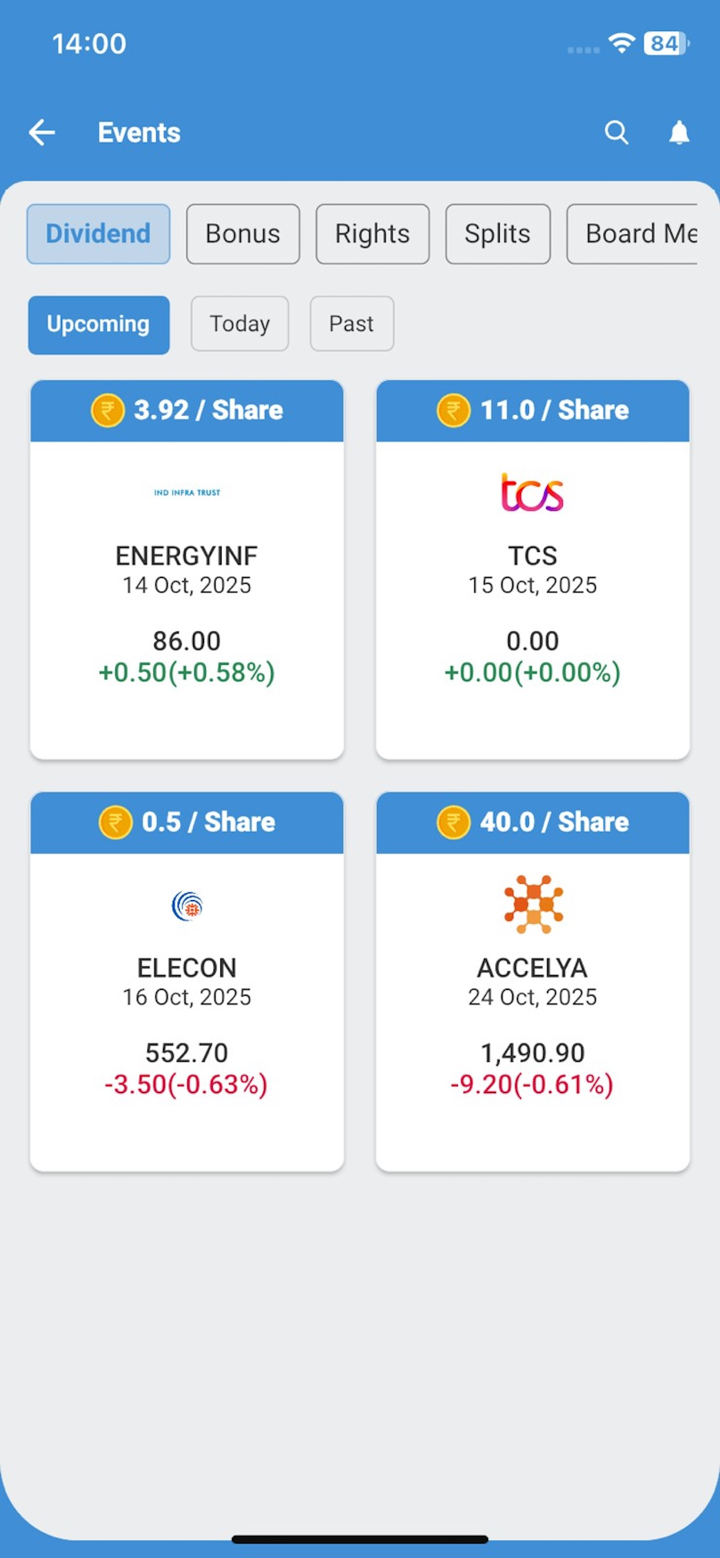

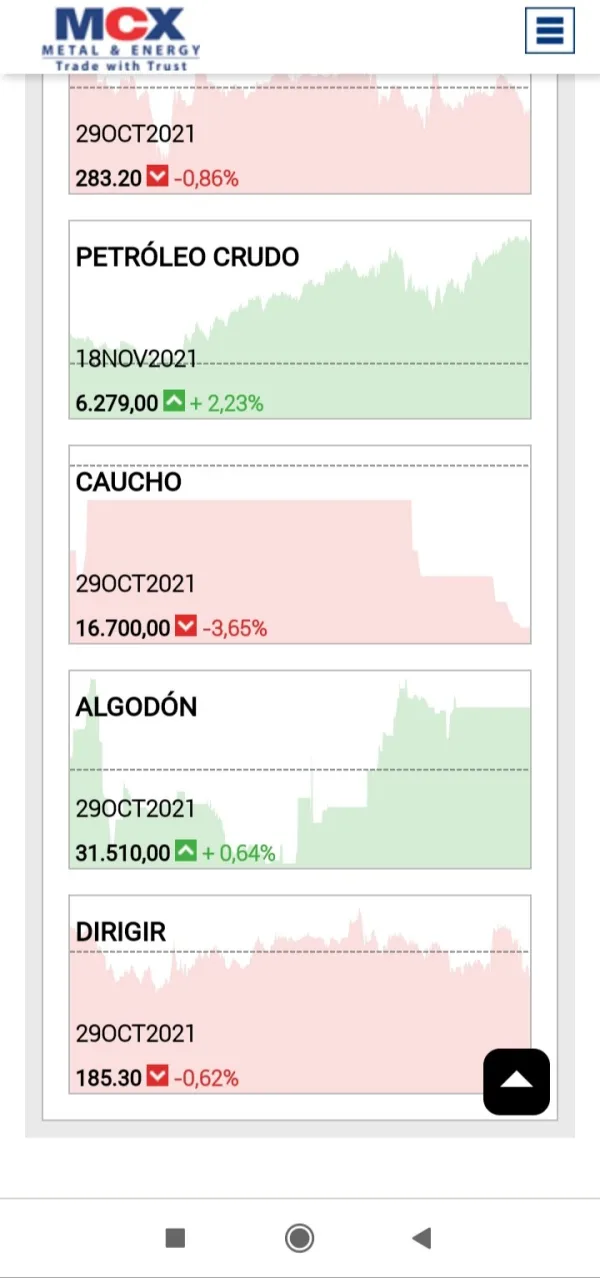

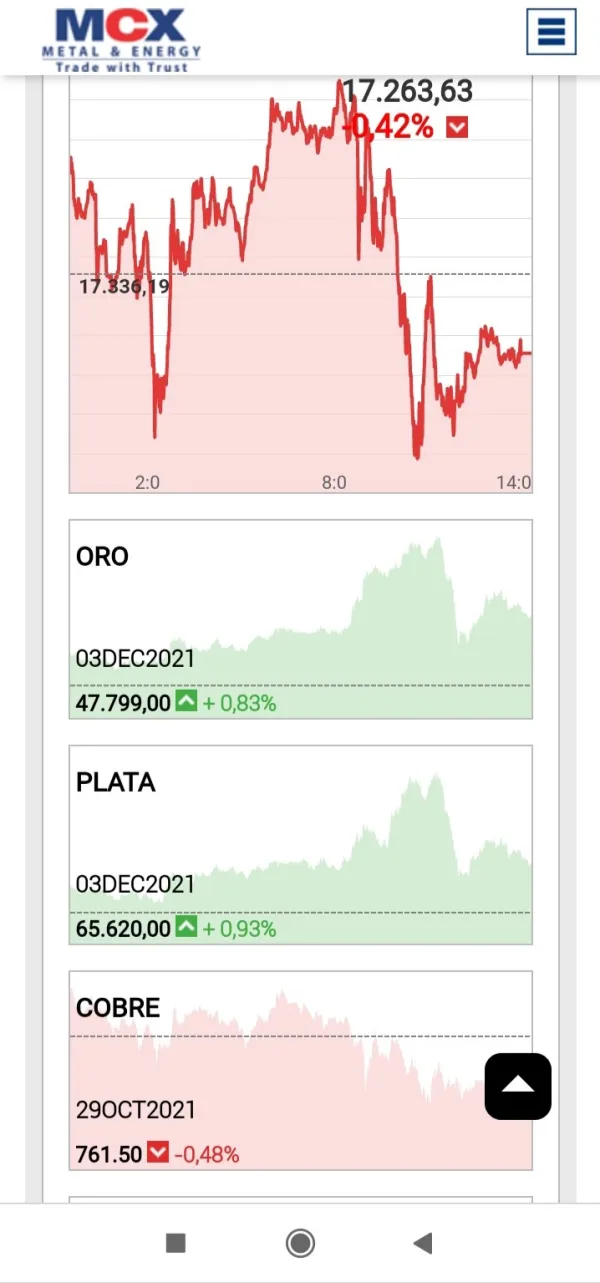

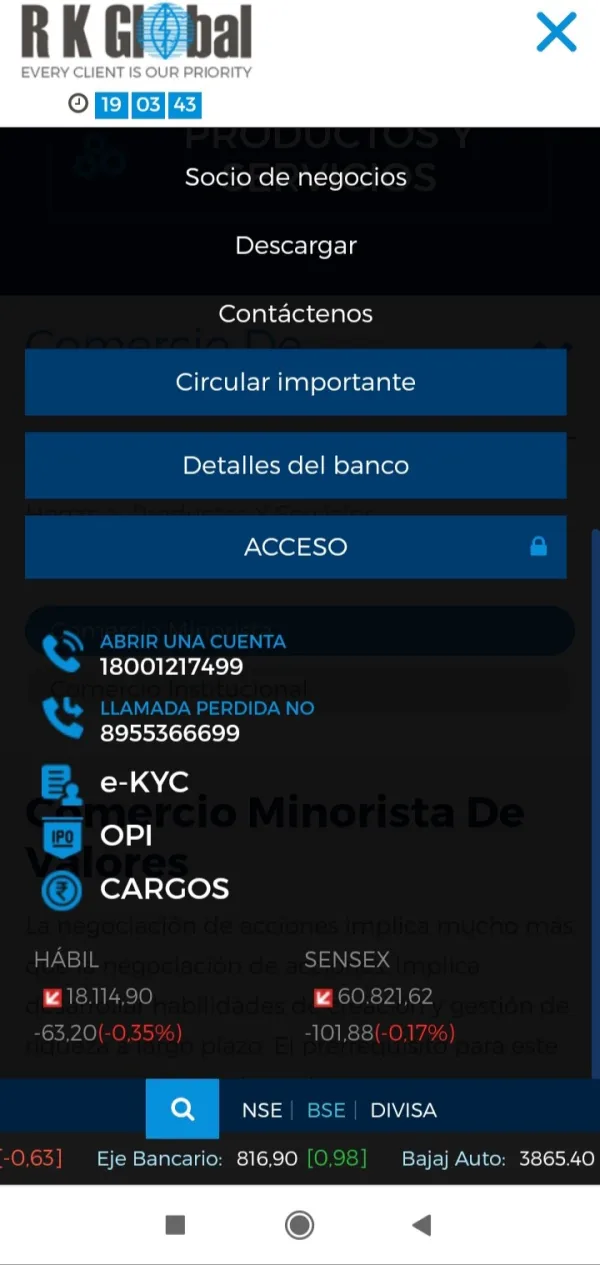

主营业务

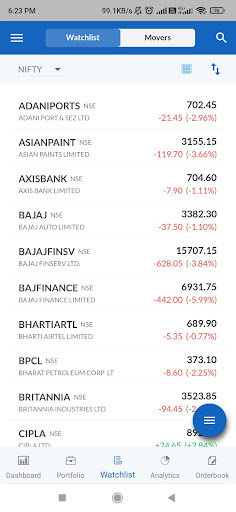

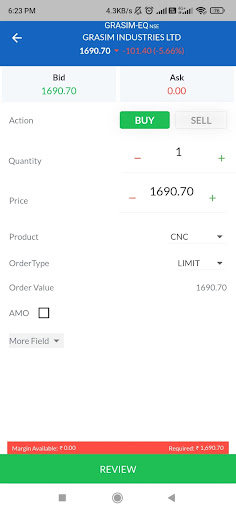

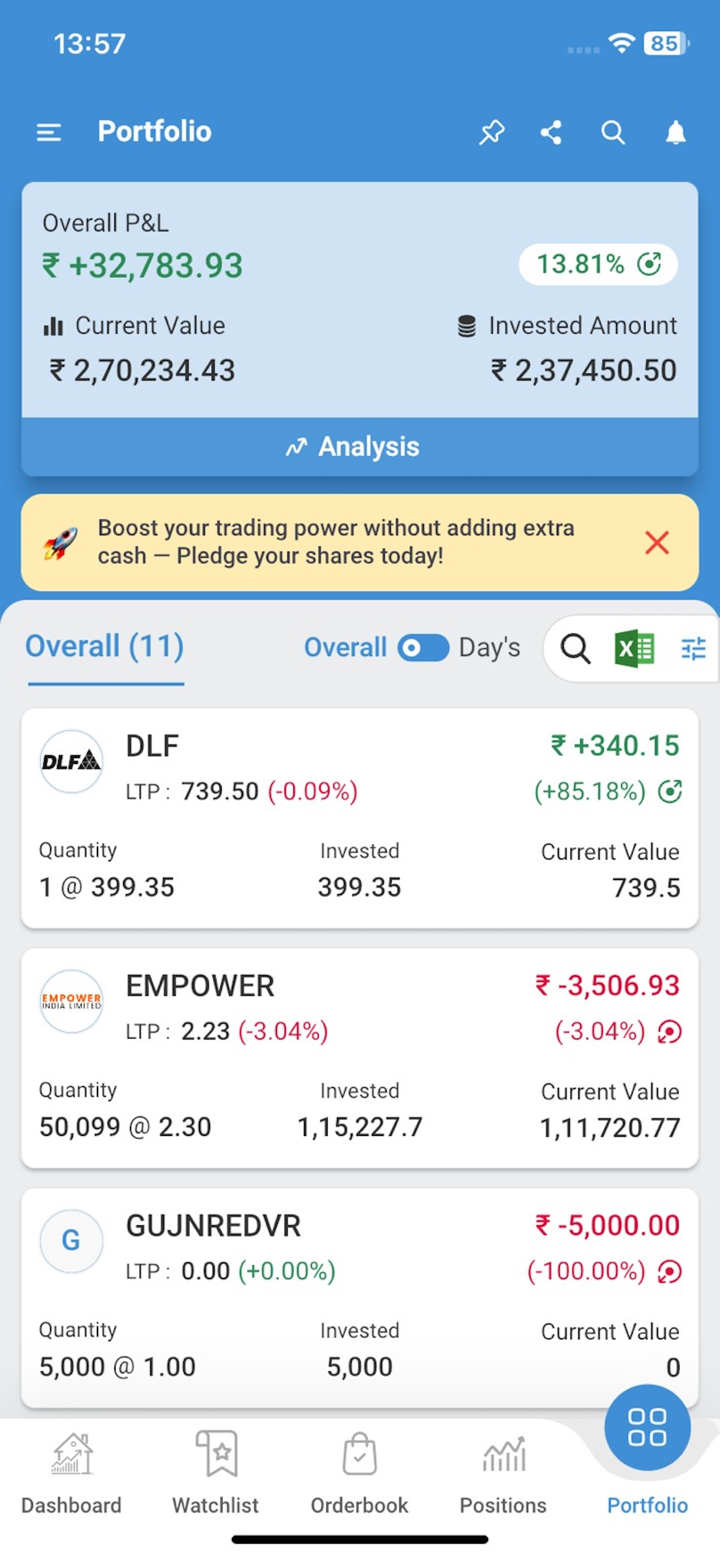

RK Global 提供股票、IPO/IPO、衍生品、商品、共同基金和货币方面的服务。

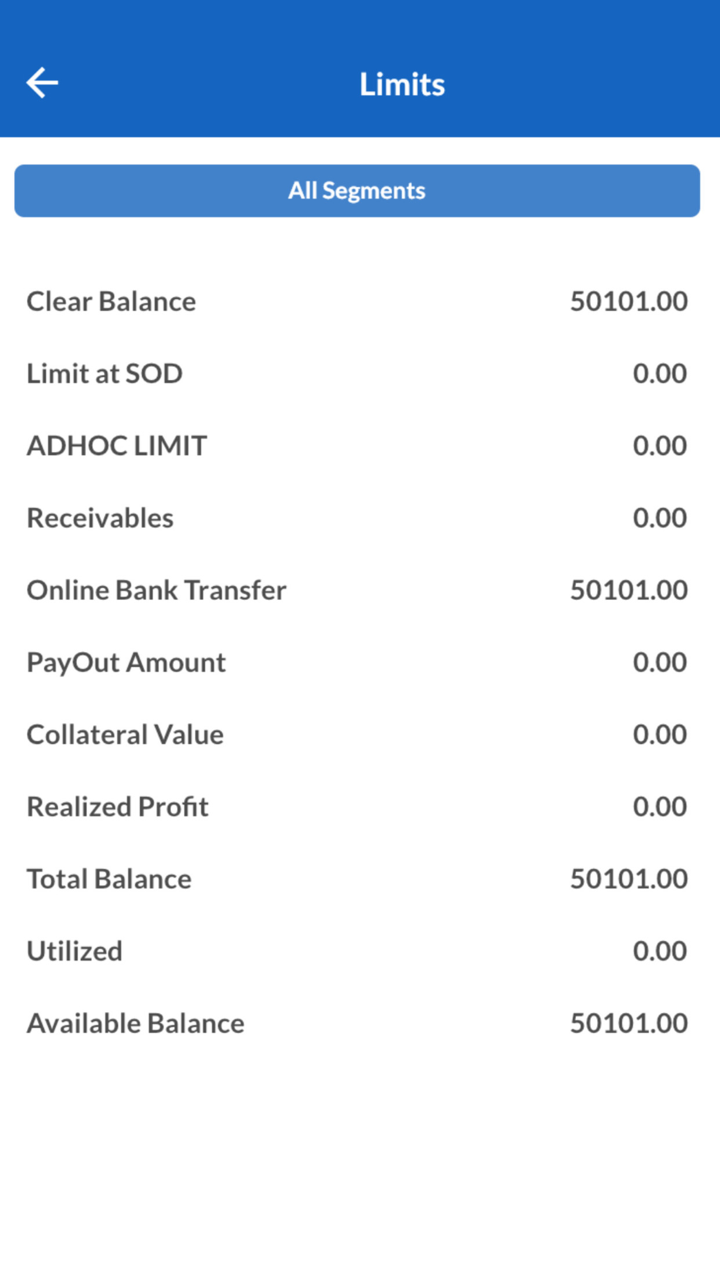

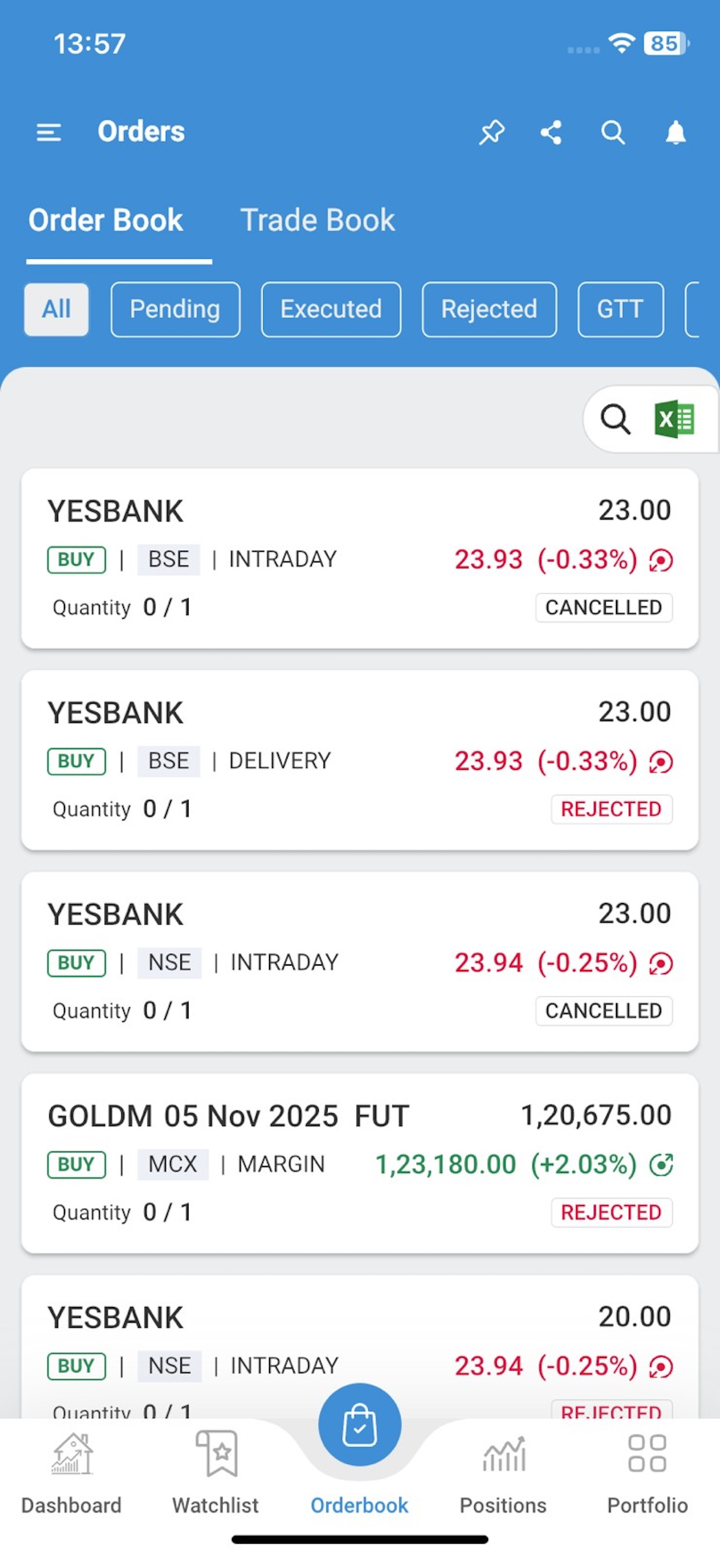

RK Global的费用

RK Global 为 NSE/BSE 资本市场领域的零售经纪商提供股票市场和衍生品无限交易两种方案。资本市场以外的零售客户的交易佣金为卢比。每批 9 个。其他费用包括仅基于卖方的基于交易的股权出售的 DP 费用 - 卢比。每笔交易 12.5 卢比的额外费用。 25 用于电话交易,通过电子邮件发送数字合同需要额外支付 Rs。订购快速合同的实物副本每份合同 30;卢比的 Demat 开户费(一次性)。 50。

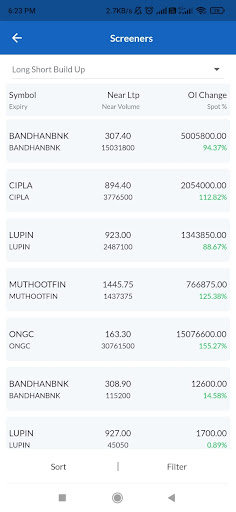

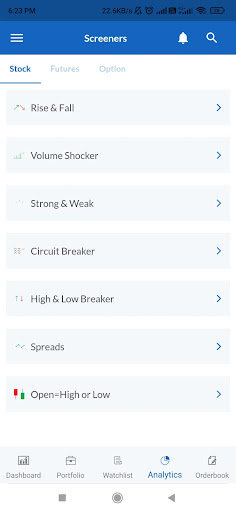

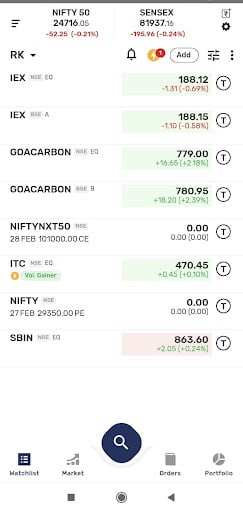

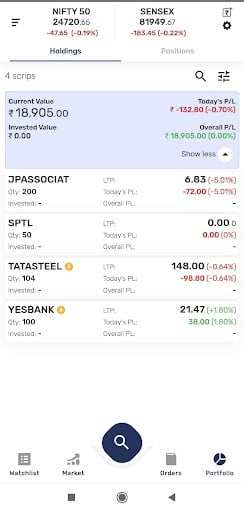

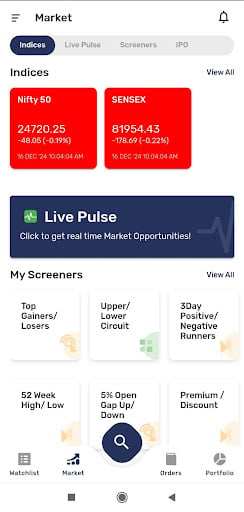

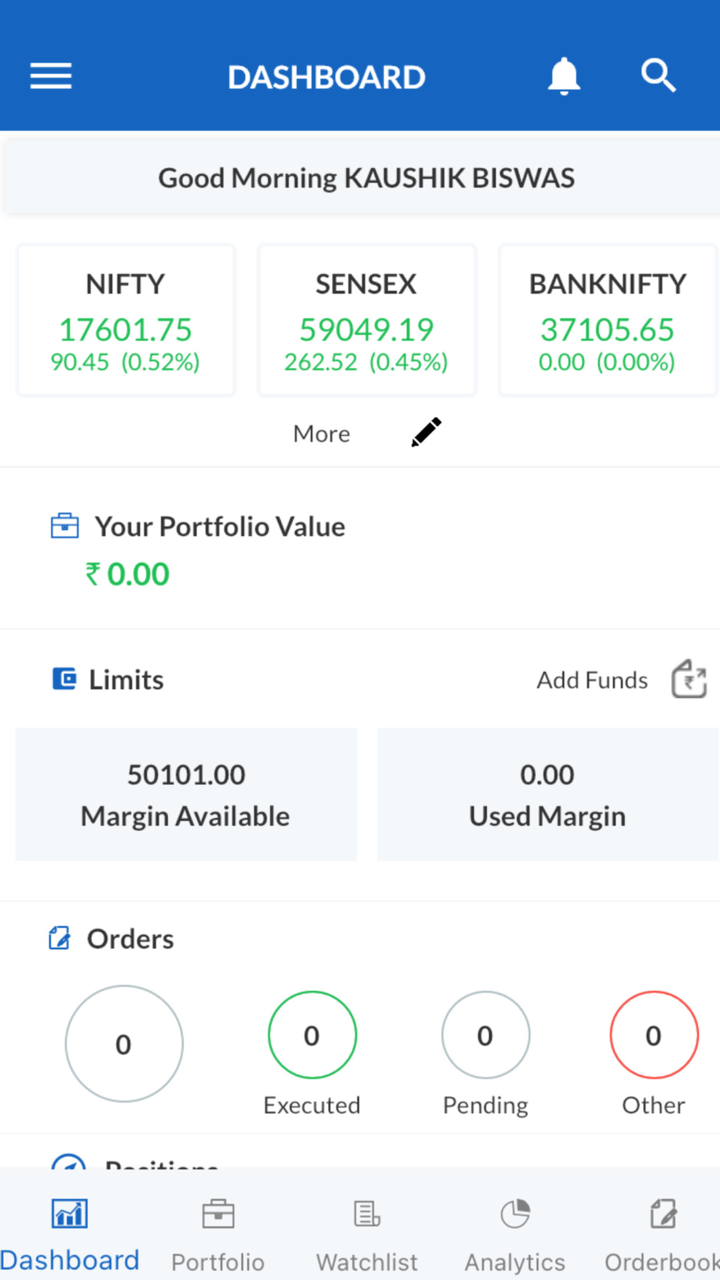

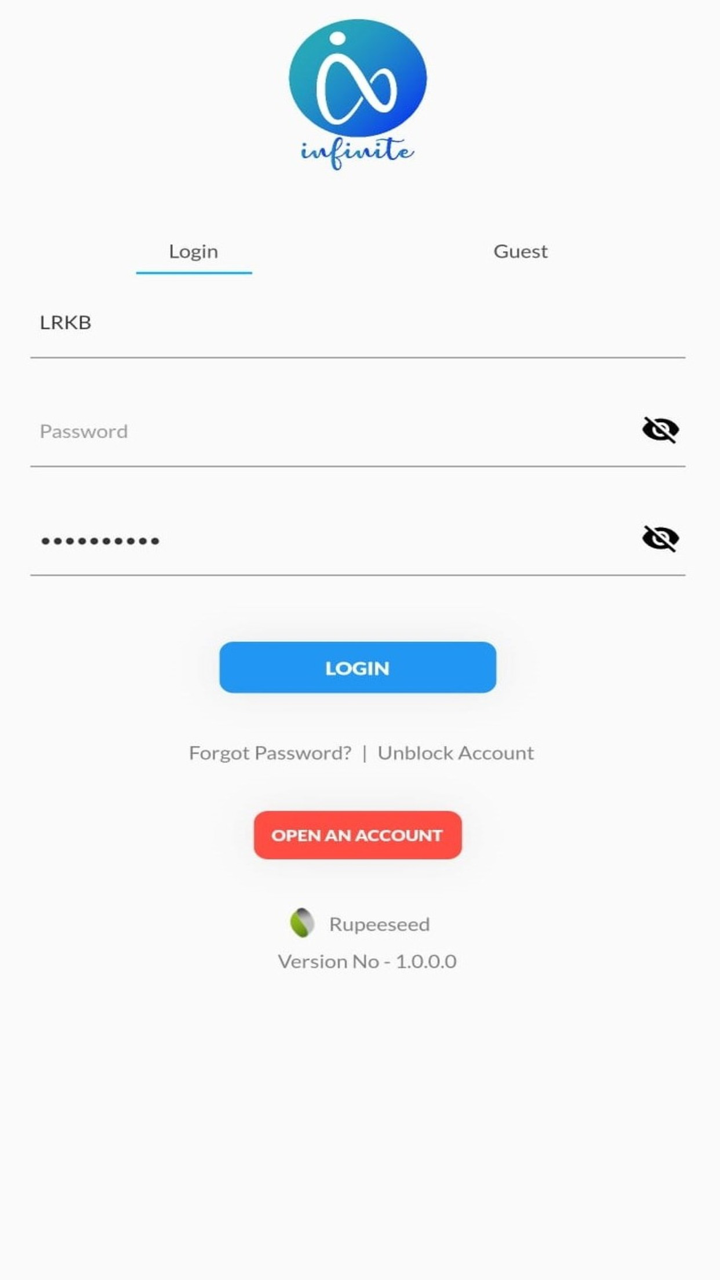

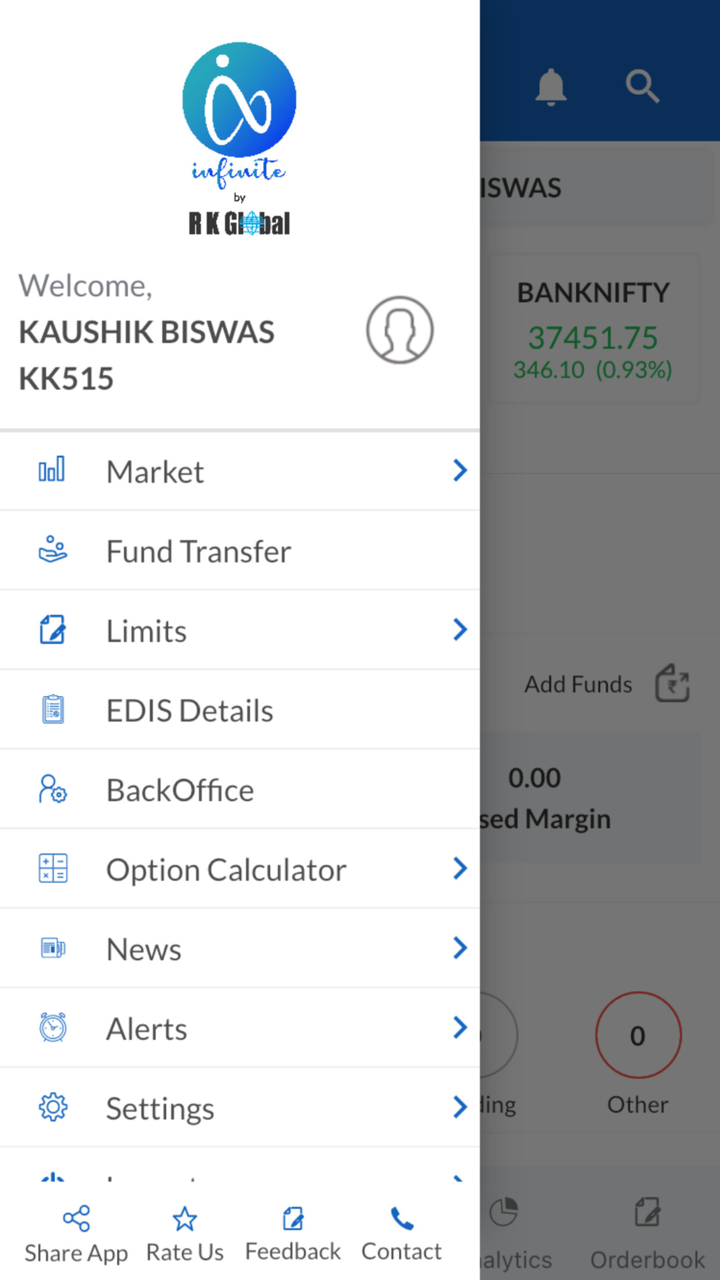

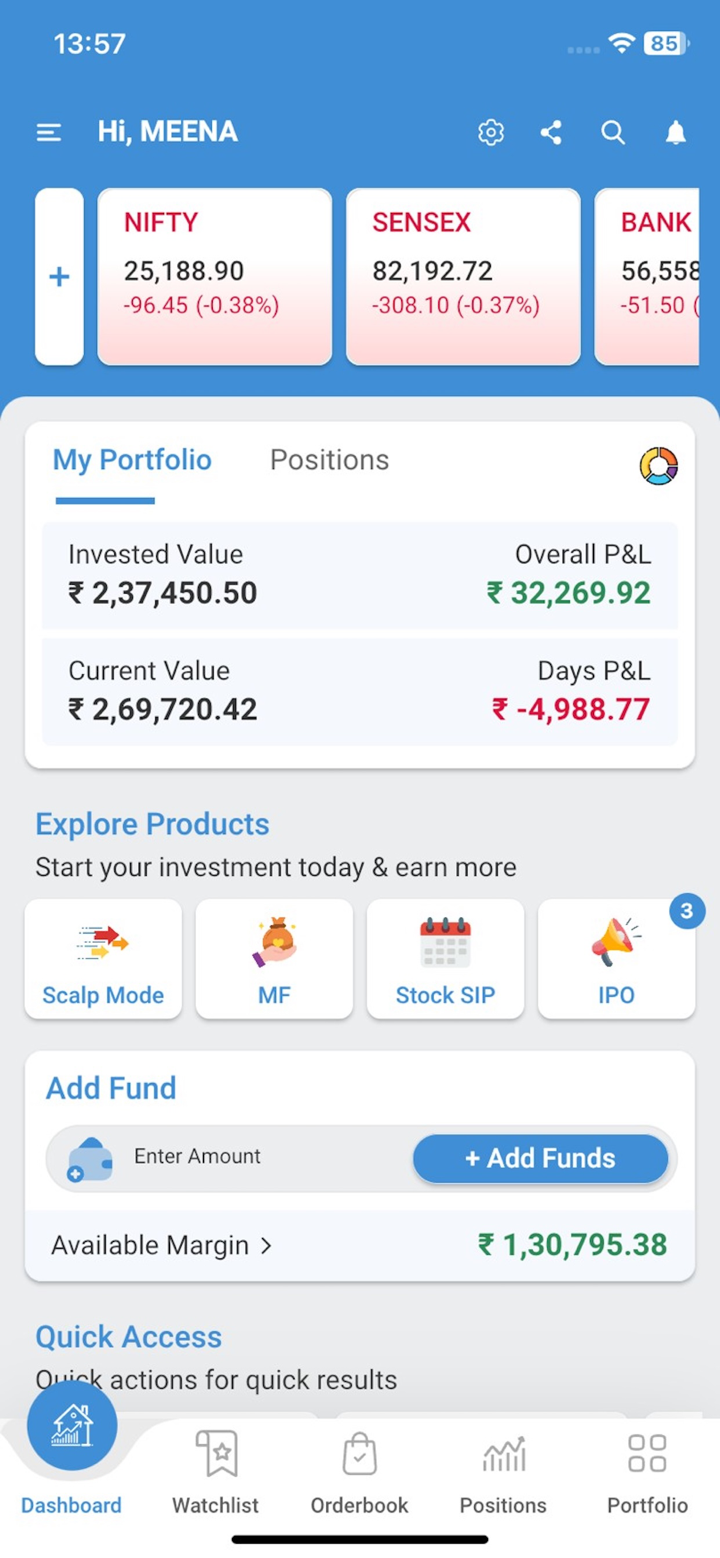

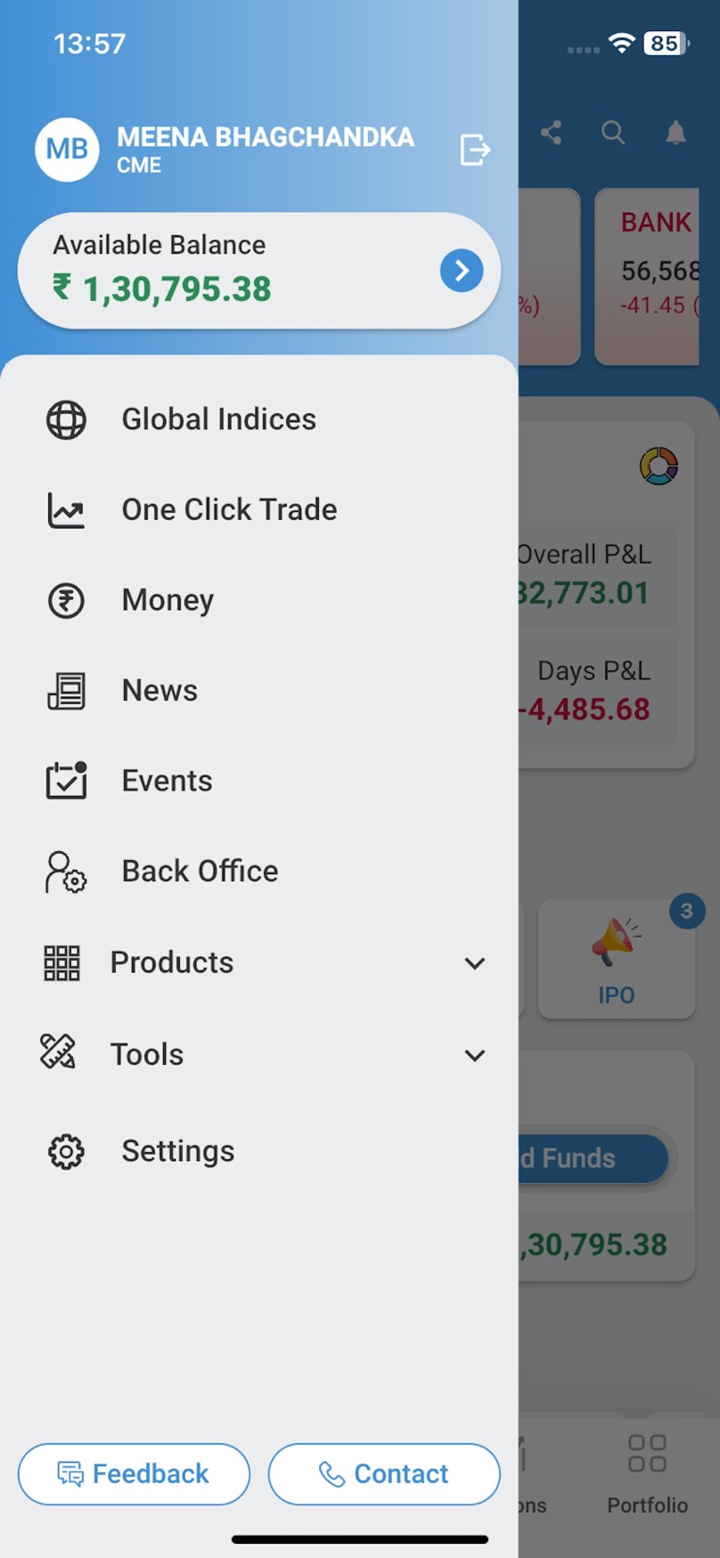

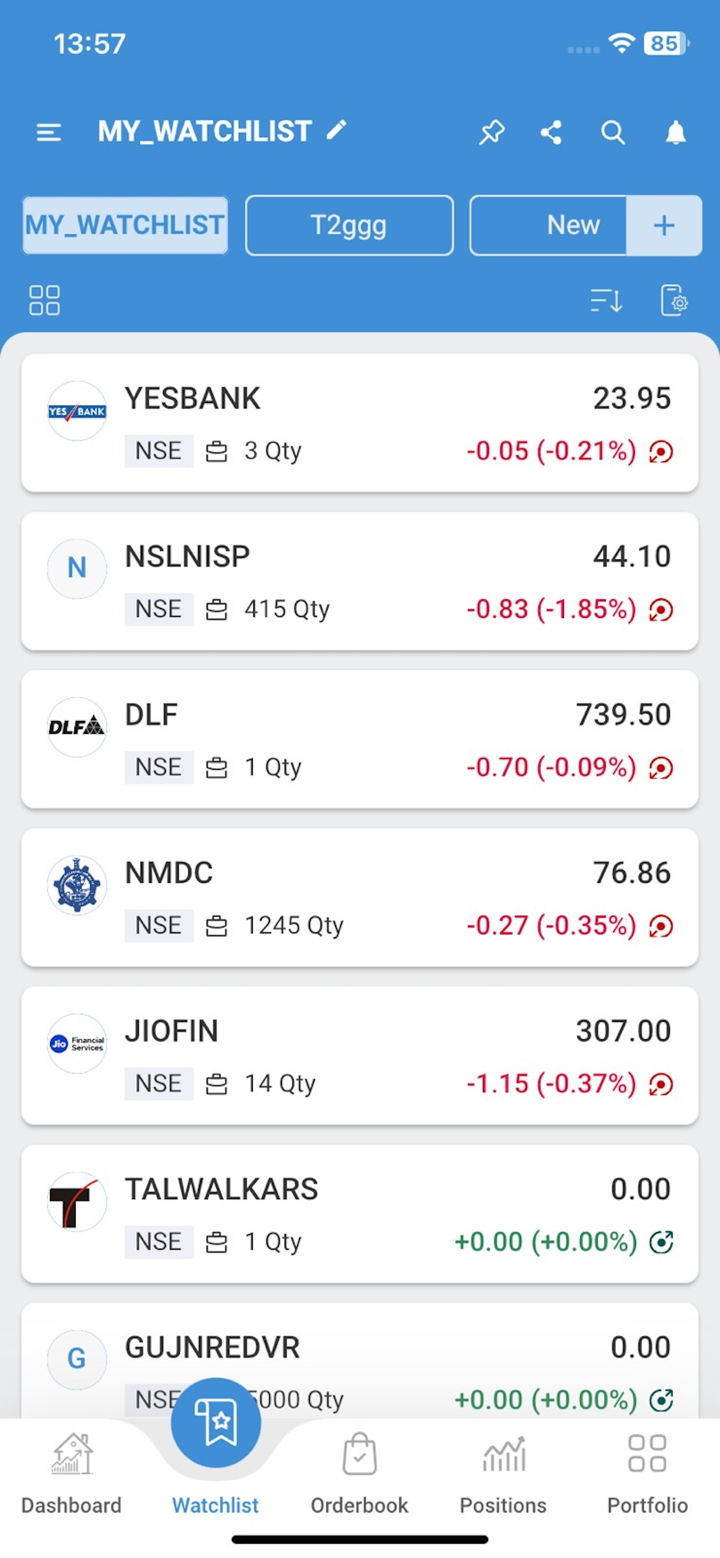

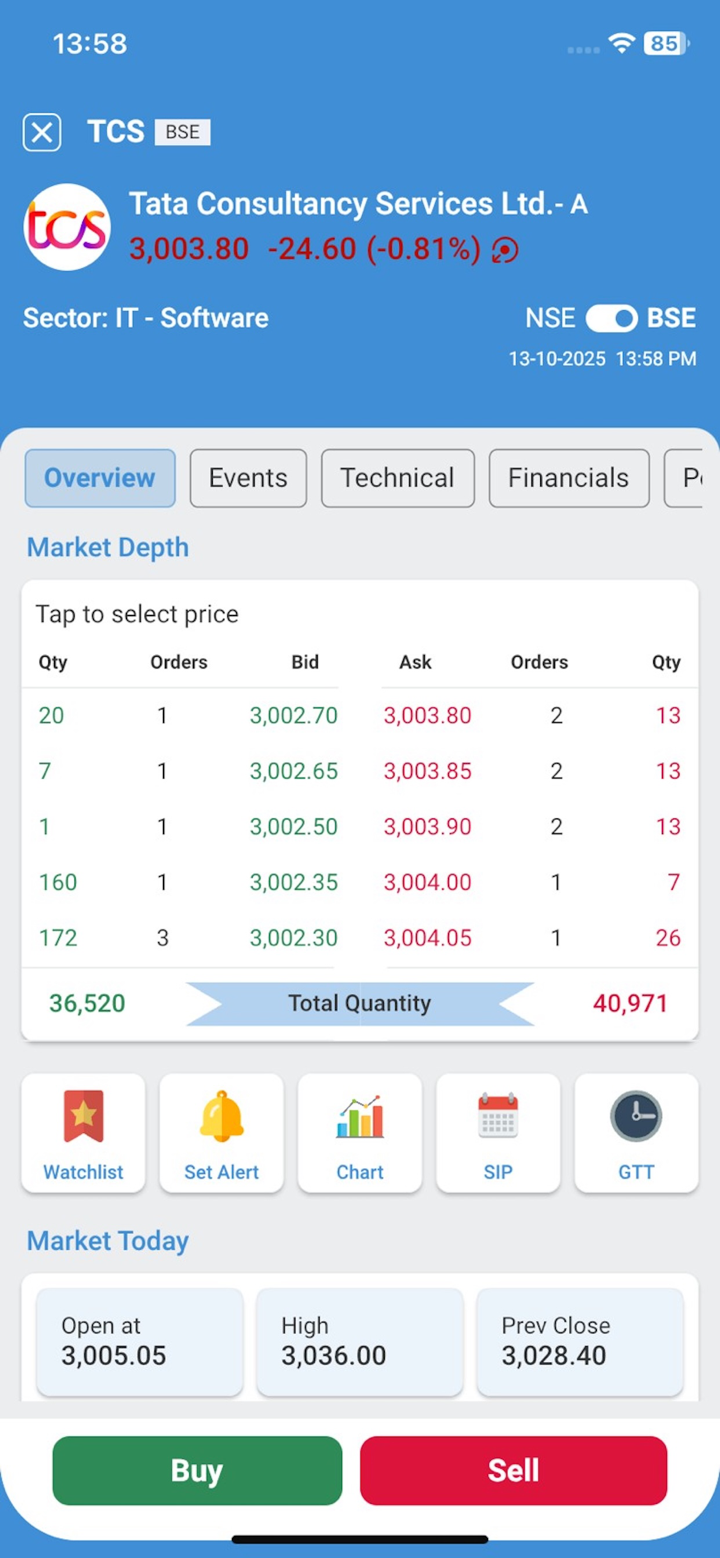

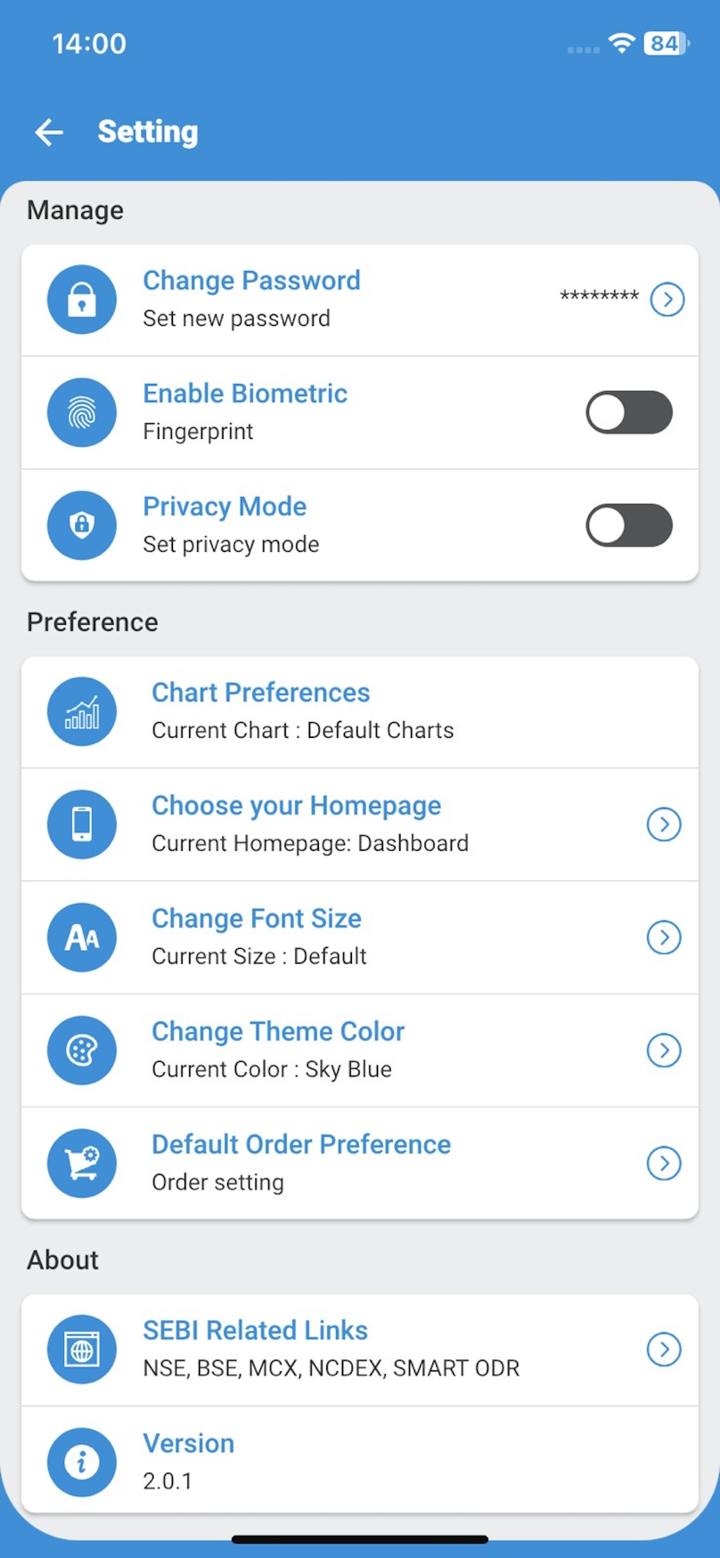

RK Global可用的交易平台

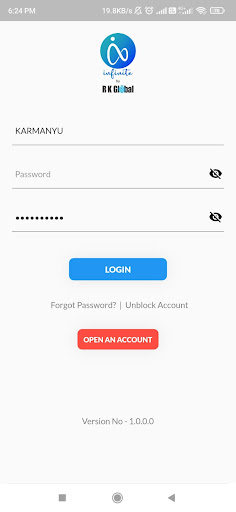

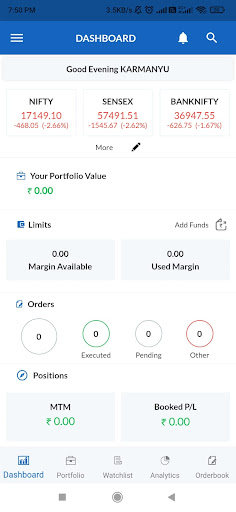

RKG Diet ODIN-Diet ODIN 10x Setup 是一款桌面高速交易终端,支持多笔交易和多段交易,为客户提供实时访问以太币报价的快捷方式。它支持高级订单类型,例如括号订单和覆盖订单。RKG Net。 Net-RKG Net.Net是一个快速、方便、易访问的在线交易交易网站,具有与交易终端相同的功能,提供无需安装或下载即可快速、轻松访问的在线交易工具。

RK Global 的优缺点

RK Global的主要优势是:

1. 24/7 客户服务

2. 创新的交易平台

RK Global 的主要缺点是:

1、监管信息不明确

2. 多重收费

3. 未提供账户及存取款方式