公司簡介

風險提示

在線交易涉及重大風險,您可能會損失所有投資資金。它並不適合所有交易者或投資者。請確保您了解所涉及的風險,並註意本文中包含的信息僅供一般參考。

一般信息

| E-Global複習總結10分 | |

| 創立 | 2016年 |

| 註冊國家/地區 | 盧森堡 |

| 規定 | FSC(可疑克隆) |

| 市場工具 | 不適用 |

| 模擬賬戶 | 不適用 |

| 槓桿作用 | 不適用 |

| 歐元/美元價差 | 不適用 |

| 交易平台 | 不適用 |

| 最低存款 | 不適用 |

| 客戶支持 | 電話、電郵 |

什麼是 E-Global?

E-Globaltrade & finance luxembourg sa 於 2016 年獲得 psf 許可,作為客戶金融工具交易的經紀人。盧森堡實體是該集團業務向歐洲的合理延伸,產品包括 forex4you、trade4you 和 share4you。

在下面的文章中,我們將從各個方面分析該經紀人的特點,為您提供簡單而有條理的信息。如果您有興趣,請繼續閱讀。在文章的最後,我們也會做一個簡單的總結,讓您對經紀商的特點一目了然。

優點缺點

Global 提供範圍廣泛的市場工具,為投資者提供潛在機會。複製交易和移動交易的可用性可能會吸引那些尋求便利和替代交易選擇的人。

然而,有 關於 E-Global監管狀況,報告表明存在不受監管且可疑的克隆許可證。 網站信息有限進一步引發對公信力和可靠性的質疑 E-Global作為金融服務提供商。

| 優點 | 缺點 |

| • 複製交易和移動交易的可用性 | • 可疑的克隆 FSC 許可證 |

| • 對監管狀況和詐騙報告的擔憂 | |

| • 網站上的信息有限 |

E-Global替代經紀人

外匯俱樂部 - 提供全面的交易工具和教育資源,使其成為初學者和經驗豐富的交易者的合適選擇。

JFD- 提供透明和以客戶為中心的交易體驗,可以進入廣泛的市場和先進的交易平台。

電話交易 - 提供具有競爭力的點差和多種賬戶類型的用戶友好交易環境,使其成為各個級別交易者的良好選擇。

有許多替代經紀人 E-Global取決於交易者的具體需求和偏好。一些流行的選擇包括:

最終,個人交易者的最佳經紀商將取決於他們特定的交易風格、偏好和需求。

是 E-Global安全還是騙局?

根據提供的信息, E-Global的許可證 英屬維爾京群島金融服務委員會 (FSC, License No. SIBA/L/12/1027) 被懷疑是克隆人 或未經授權的實體。此外, 詐騙報告和缺乏足夠的信息 他們的網站上有危險信號。因此,建議謹慎行事並考慮 E-Global作為潛在的不安全。在與任何不受監管或可疑的金融實體合作以保護您的投資和個人信息之前,進行徹底的研究和盡職調查至關重要。

市場工具

E-Global將自己呈現為一個平台,提供 房地產和投資 在全球市場上。但是,沒有提供更具體的信息。

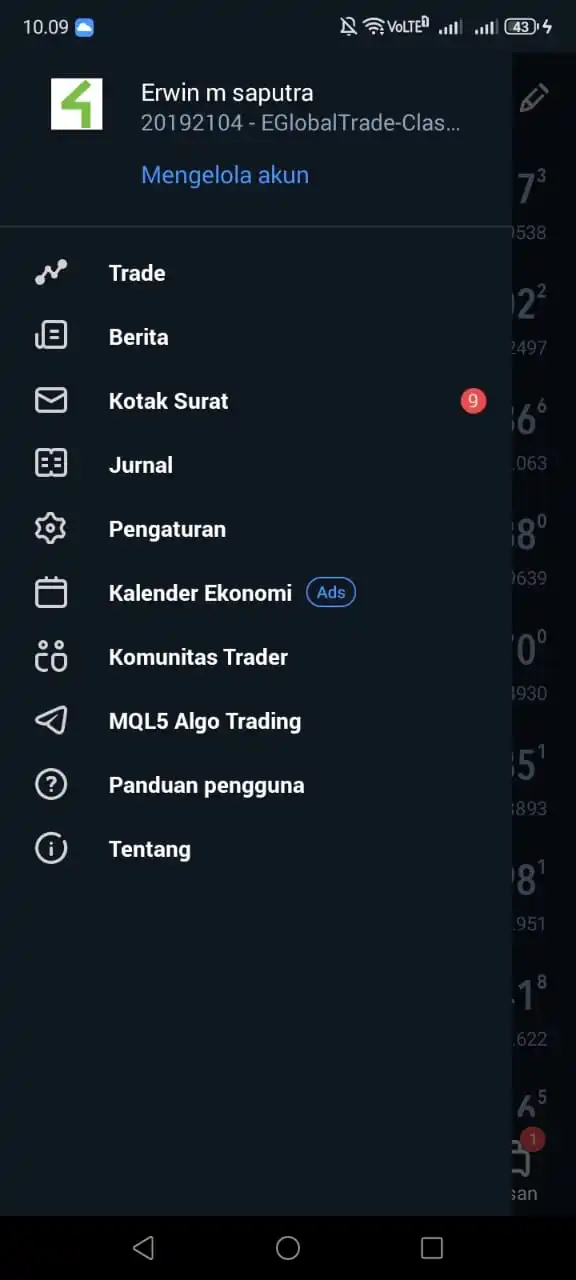

複製交易和移動交易

Global 在他們的網站上聲明他們為客戶提供複製交易和移動交易服務。複製交易通常允許投資者自動複製經驗豐富的交易者的交易和策略,使他們能夠從他們的專業知識中獲益。然而,因為 E-Global不提供有關其複制交易服務的更多詳細信息,潛在用戶直接從公司尋求更多信息很重要。

手機交易,另一方面,表明 E-Global提供一個平台或應用程序,允許客戶使用他們的移動設備訪問和管理他們的交易賬戶。這可以為喜歡隨時隨地監控和執行交易的交易者提供便利和靈活性。

客戶服務

E-Global通過提供客戶服務 電話:+352 26 374 964 和電子郵件:info@eglobal-group.com,允許客戶尋求幫助或查詢。此外, 公司地址:53 Boulevard Royal, 2449 Luxembourg – Eich, Luxembourg – Luxembourg在盧森堡列出的公司為客戶提供了一個物理位置,以便在需要時訪問或發送信件。

| 優點 | 缺點 |

| • 電話和電子郵件支持 | • 沒有 24/7 客戶支持 |

| • 不支持實時聊天 | |

| • 沒有社交媒體支持 | |

| • 支持時間不明確 |

注意:這些優點和缺點是主觀的,可能會因個人的經驗而異 E-Global的客服。

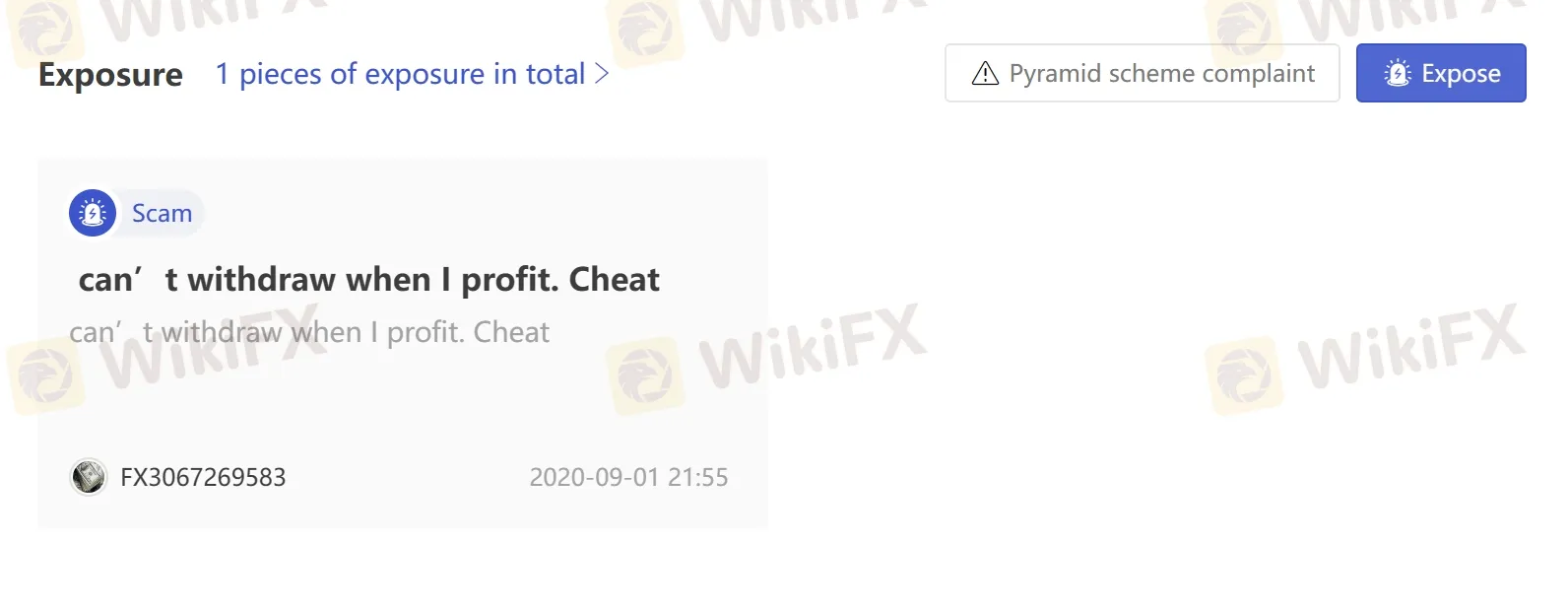

WikiFX用戶曝光

在我們的網站上,您可以看到 詐騙報告.鼓勵交易者仔細審查可用信息並考慮與在不受監管的平台上交易相關的風險。您可以在交易前查看我們的平台信息。如果您發現此類欺詐經紀人或曾經是其中的受害者,請在曝光部分告訴我們,我們將不勝感激,我們的專家團隊將盡一切可能為您解決問題。

結論

綜上所述, E-Global引起對其監管狀況的重大關注,有報告表明它使用不受監管且可疑的克隆許可證進行操作.這其網站上提供的信息有限,特別是在市場工具和交易平台方面,增加了透明度的缺乏,並引發了對公司信譽的懷疑。此外,缺乏複製交易和移動交易的明確細節進一步損害了其聲譽。建議交易者謹慎行事並探索市場上的替代受監管選項。

常見問題 (FAQ)

| 問 1: | 是 E-Global監管? |

| 一個 1: | 不。 E-Global英屬維爾京群島金融服務委員會(fsc,許可證號 siba/l/12/1027)的許可證是可疑的克隆。 |

| 問題 2: | 是 E-Global適合初學者的好經紀商? |

| A2: | 不,這對初學者來說不是一個好的選擇。不僅因為其不受監管的狀況,還因為缺乏透明度。 |

FX3067269583

越南

欺騙地板不要關閉訂單

爆料

erwinmsaputra

印尼

自從我開始使用這家經紀商以來,我就非常喜歡它。除了提供豐富的帳戶類型選擇外,它還提供低點差、快速的市場執行、友好且響應迅速的客戶服務以及各種誘人的促銷活動。 我推薦這家經紀商,它是交易者的最佳選擇之一。 MT 5 ID:20192104

好評

Iwan Corpsporations

印尼

喺呢間代理嘅體驗,每個月都有好多優惠同獎品,對於新手仲有交易教育課程,非常推薦。

好評

Iwan Corpsporations

印尼

呢間經紀公司有好多活動同優惠,每個月仲有獎勵,正呀

中評

Dyshmliy

英國

E-Global 的複制交易很糟糕。我以為這會節省我的精力和時間,但實際上我在跟單交易上損失了所有投資資金。他們非常不專業!

中評

FX1200822639

西班牙

e-global 是一家不受監管的公司。雖然我們可以打開您的網站並查看內容,但在我看來,在這裡投資是一個不明智的決定。

中評

FX1182125724

美國

不能提取我自己的錢。已嘗試提取資金,但一直停留在“待處理”狀態。發送給支持的任何電子郵件都將被忽略,我的客戶顧問或任何不回復電子郵件的人。

中評