公司簡介

| 光大證券 檢討摘要 | |

| 成立年份 | 1969 |

| 註冊國家/地區 | 香港 |

| 監管 | SFC, HKGX(未經證實) |

| 服務 | 財富管理、企業融資與資本市場、機構業務、資產管理和投資融資 |

| 交易平台 | 光大證券 GO!、MT4、eMO! 等 |

| 客戶支援 | 電話:+852 3920 2888;傳真:+852 3920 2789 |

| 電郵:cs@ebshk.com;enquiry@ebshkforex.com;corporatefinance@ebshk.com;insurance@ebshk.com;ecm@ebshk.com | |

| 總公司及接待處:香港灣仔告士打道108號光大中心33樓 | |

| 社交平台:WeChat、Facebook、Sinablog、LinkedIn | |

| 其他分行聯絡資訊:https://www.ebshk.com/contact.php?s=1 | |

光大證券 資訊

光大證券,全名為光大證券國際,最初於1969年成立為「新鴻基證券」,並於2021年成為光大證券股份有限公司的全資子公司。提供的金融服務包括財富管理、企業融資與資本市場、機構業務、資產管理和投資融資。其客戶群涵蓋個人、企業和機構。

2024年,該公司推出了自家的交易平台手機應用程式「光大證券 GO!」,讓交易者更輕鬆便利地執行交易。

該公司目前受SFC監管,這表明一定程度的可信度和客戶保護。但同時您也應該保持警惕,因為該公司聲稱的HKGX牌照尚未經過驗證。

優缺點

| 優點 | 缺點 |

| 受SFC監管 | 未經驗證的HKGX監管 |

| 廣泛的金融服務範疇 | |

| 多個交易平台 |

光大證券 是否合法?

光大證券目前受香港證券及期貨事務監察委員會(SFC)監管,牌照號碼為AAF237和ACI995。

然而,有一個關鍵要注意的地方是,HKGX(香港金融交易所)的牌照編號為044,尚未經當局核實,這暗示它可能從事超出HKGX法律允許範圍的金融活動。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| SFC | 受監管 | CES Commodities (HK) Limited | 從事期貨合約交易 | AAF237 |

| SFC | 受監管 | CES Forex (HK) Limited | 槓桿外匯交易 | ACI995 |

| HKGX | 未核實 | 新鴻基珠江三角洲投資有限公司 | E類牌照 | 044 |

服務

光大證券 在五個關鍵領域提供全方位的金融服務。

- 財富管理 為個人和公司提供基於目標的諮詢和投資解決方案。

- 企業融資與資本市場 支持客戶進行首次公開募股(IPO)、財務諮詢和籌資。

- 機構業務 為機構客戶提供量身定制的交易、研究和保險服務。

- 資產管理 提供包括共同基金和私人基金在內的多元化投資產品。

- 投資與融資 提供離岸融資和結構化解決方案,支持業務增長和資本需求。

交易平台

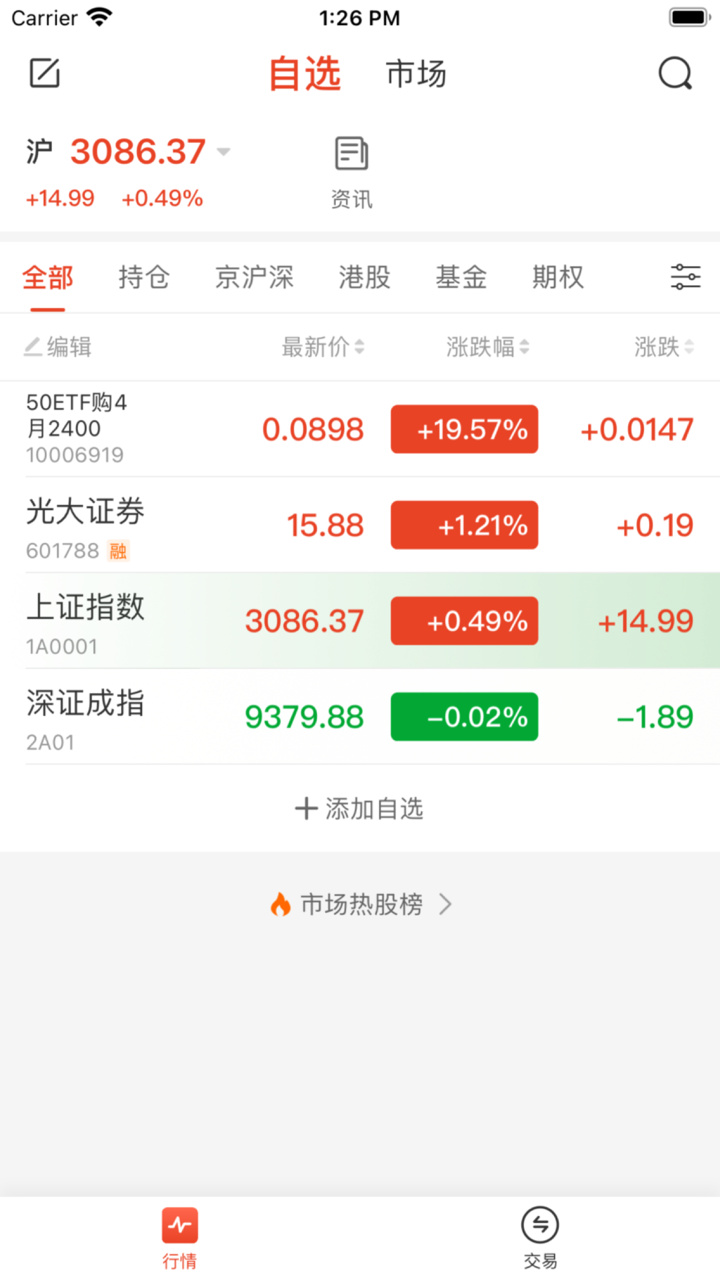

光大證券 宣稱使用世界知名的MetaTrader 4平台,以其先進的圖表工具和強大功能而廣受認可。

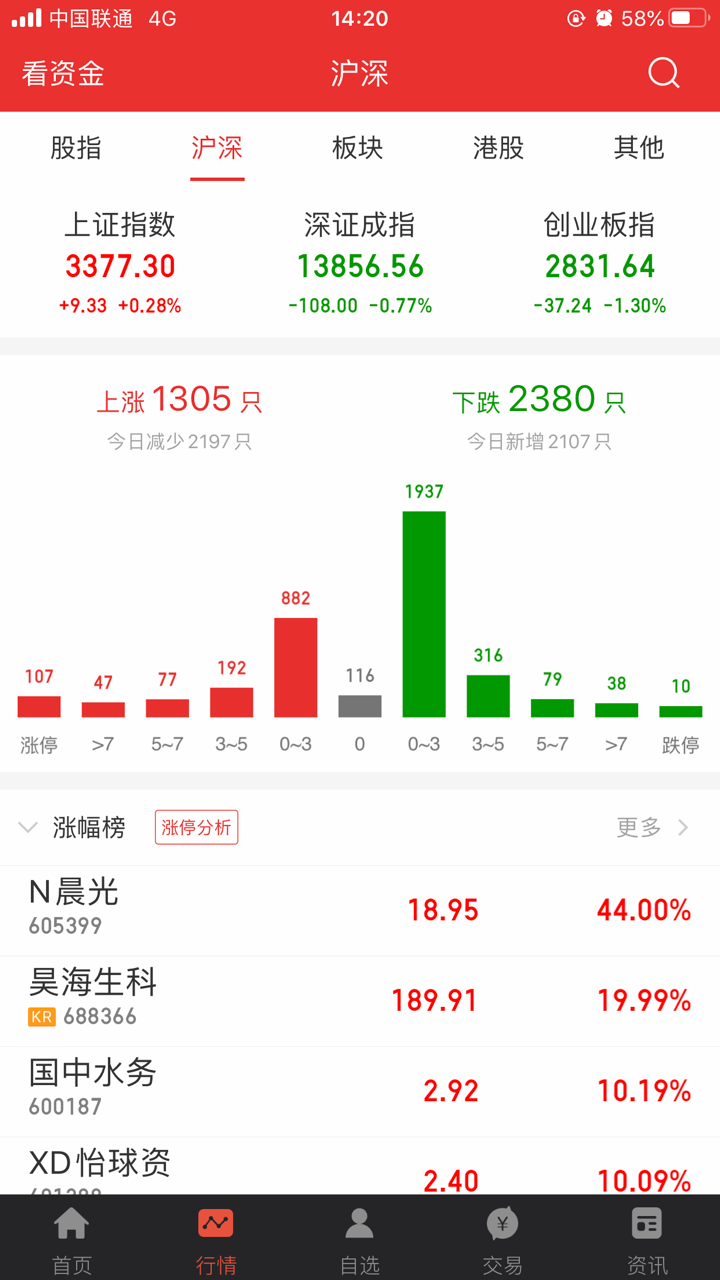

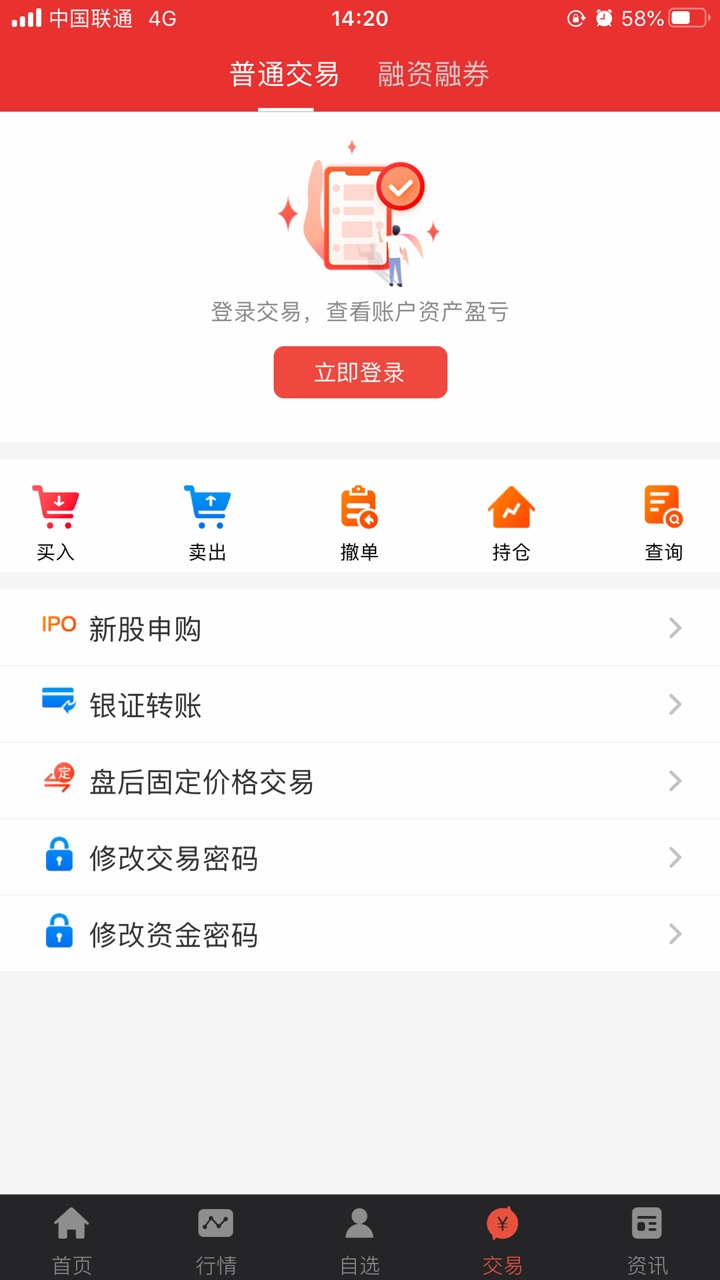

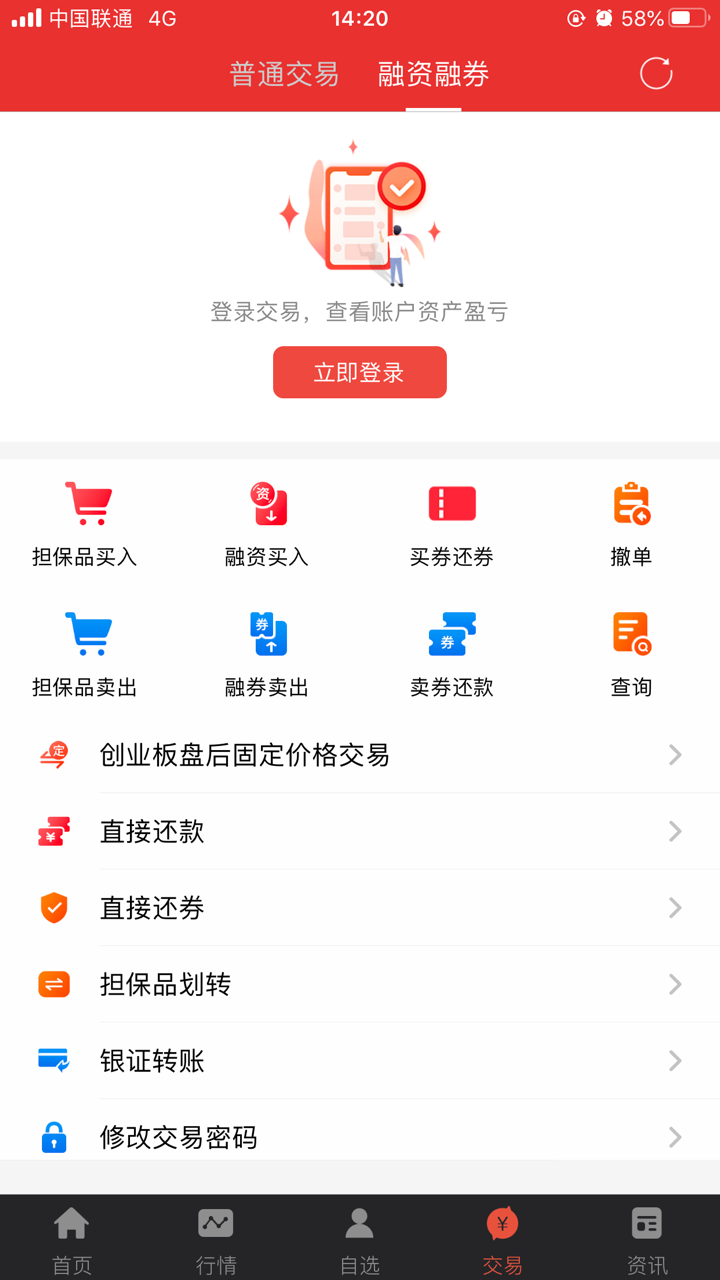

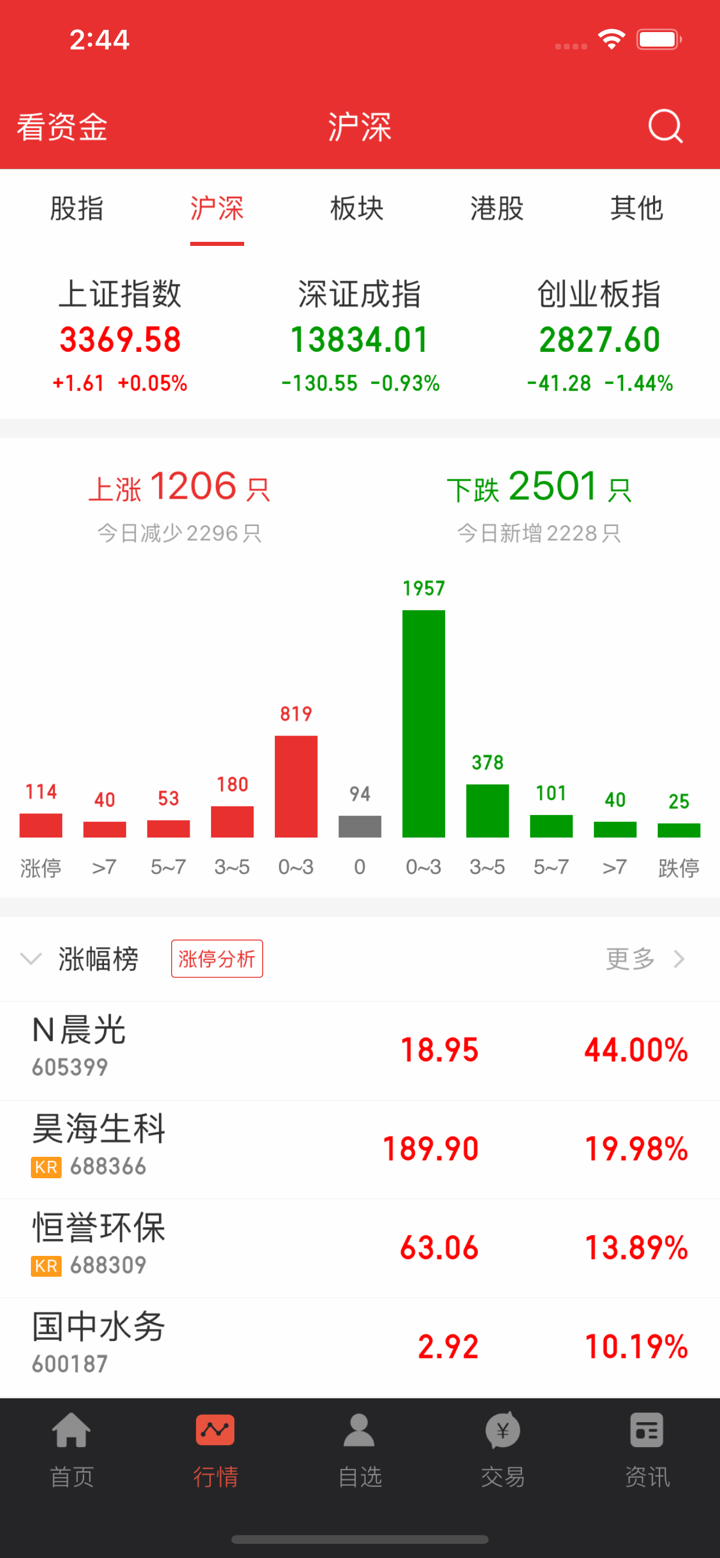

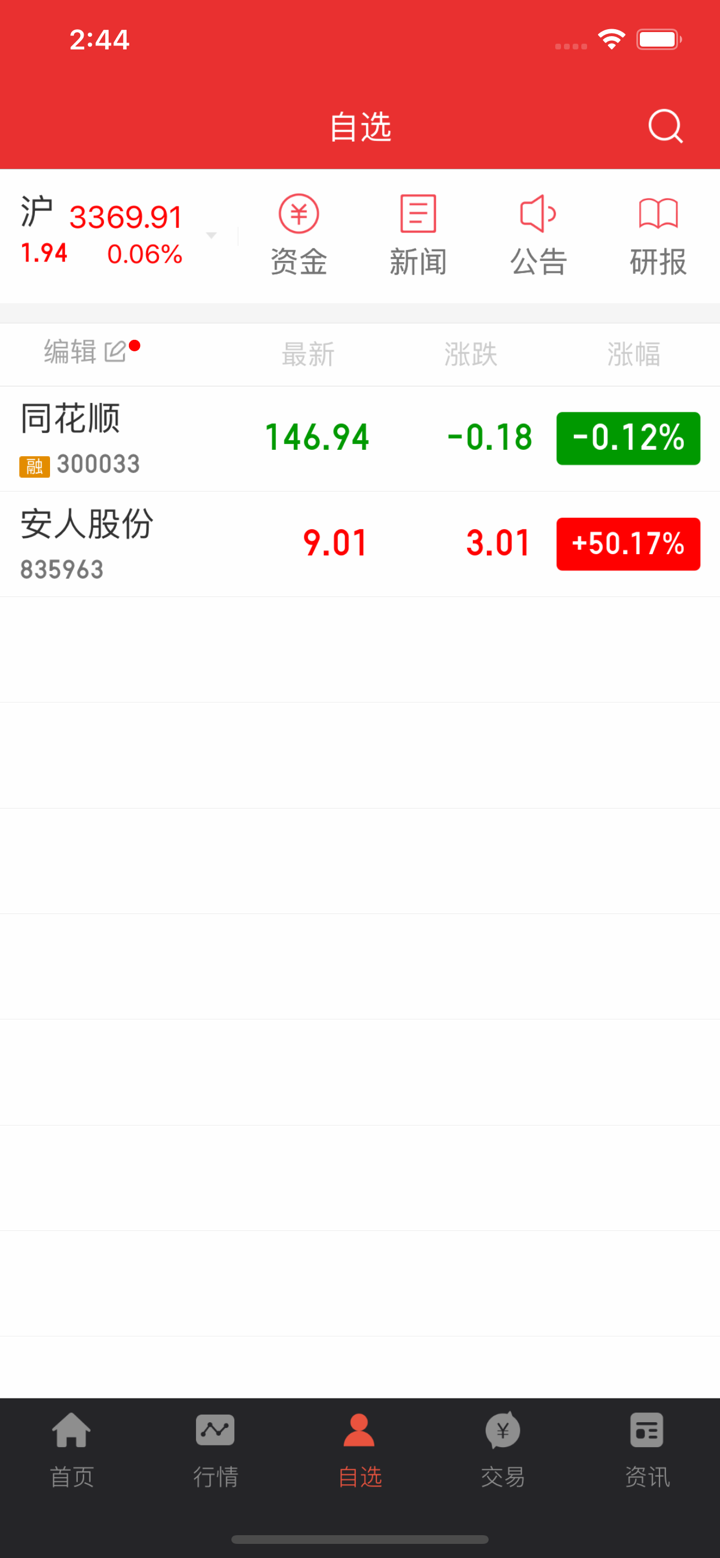

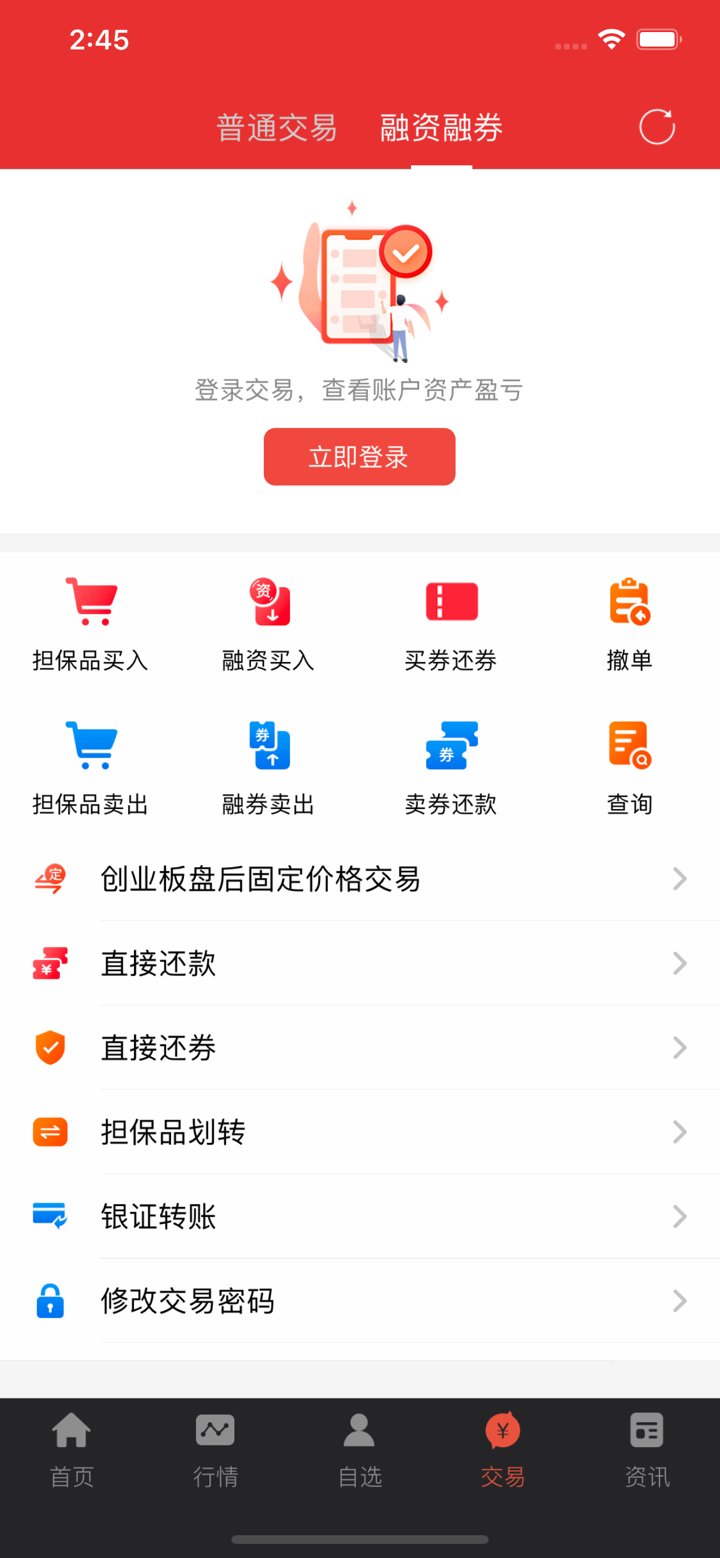

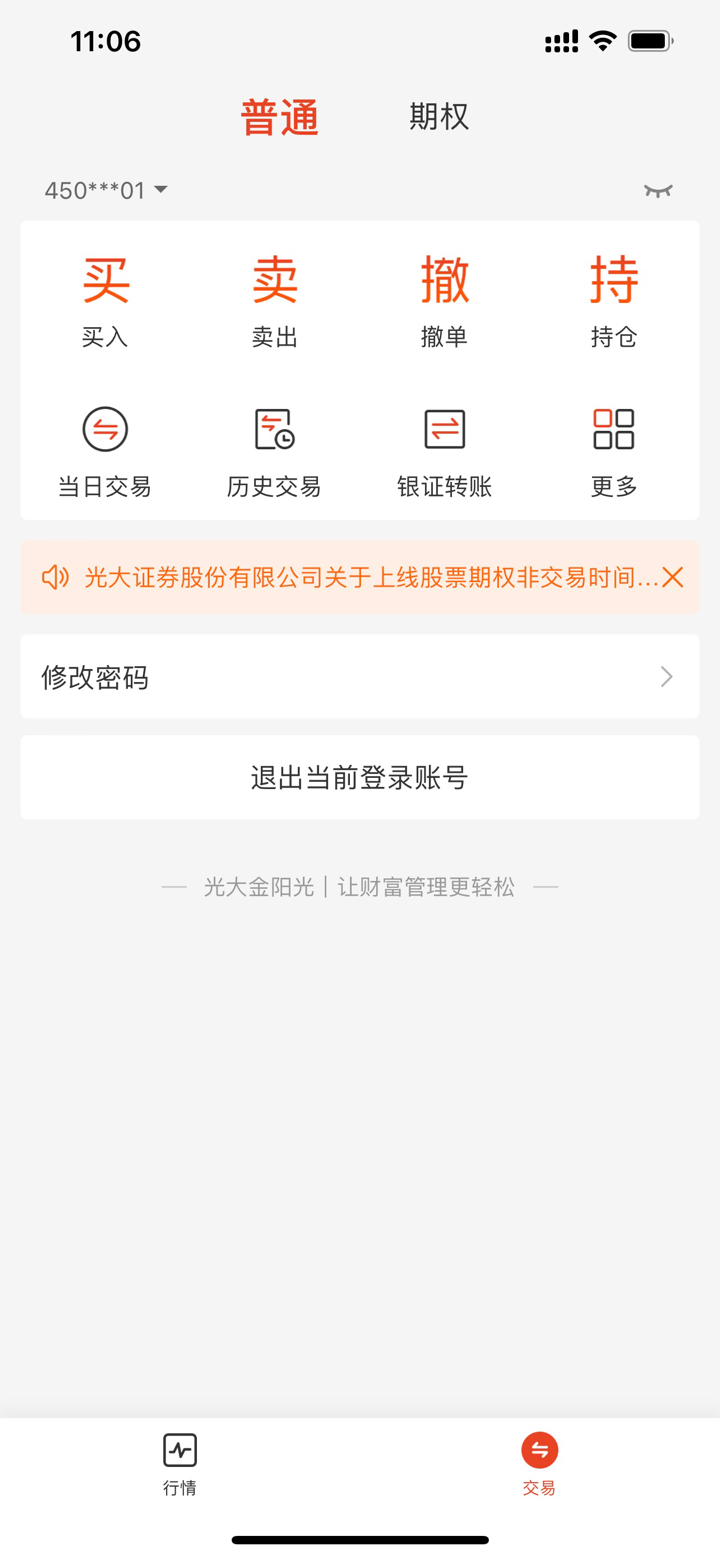

此外,光大證券 GO! 推出了自家開發的交易應用程式,可透過 iOS 和 Android 設備訪問。

除了以上兩者,該公司還提供各種其他交易系統,如 eMO!、HK Trader Pro、USstock Pro 等,讓投資者根據其交易習慣和經驗選擇最適合自己的系統。