公司簡介

| Forex Sport 評論摘要 | |

| 成立年份 | 2011 |

| 註冊國家/地區 | 澳洲 |

| 監管機構 | ASIC |

| 服務 | 資產買賣、外匯風險管理、國際供應商支付、全球員工支付、國際收款、稅務 |

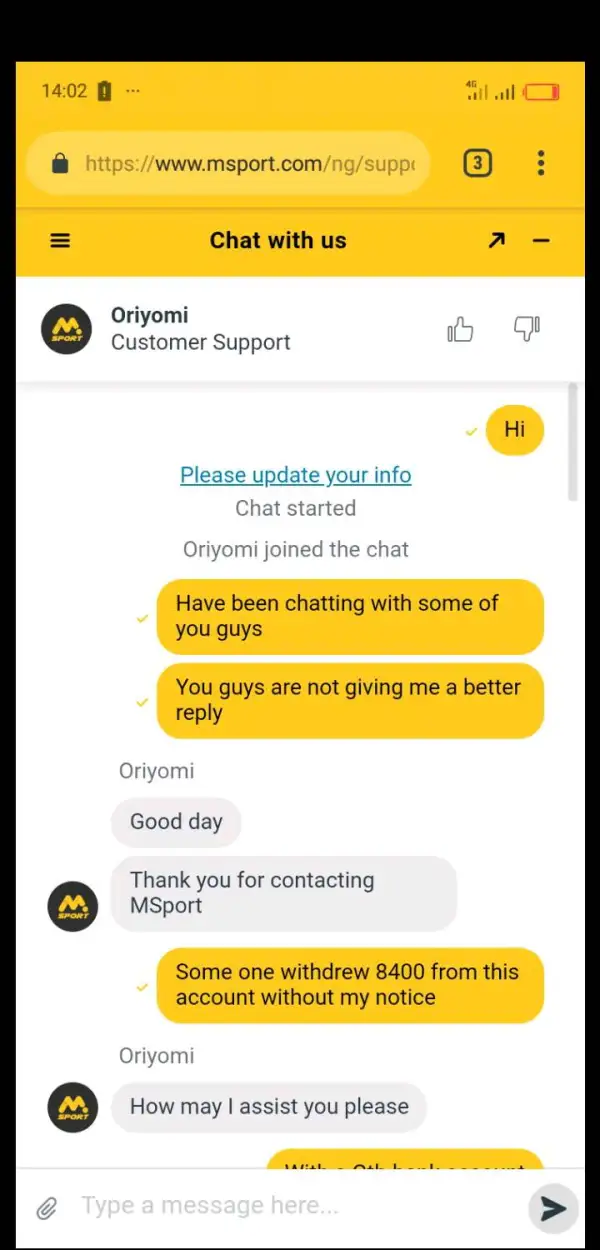

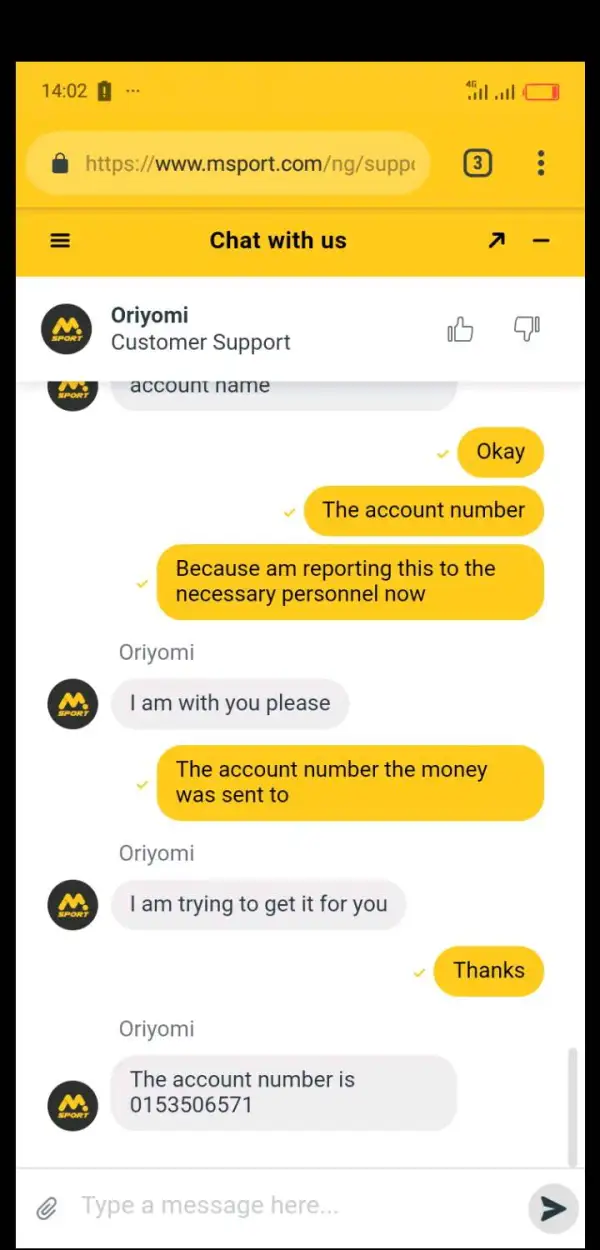

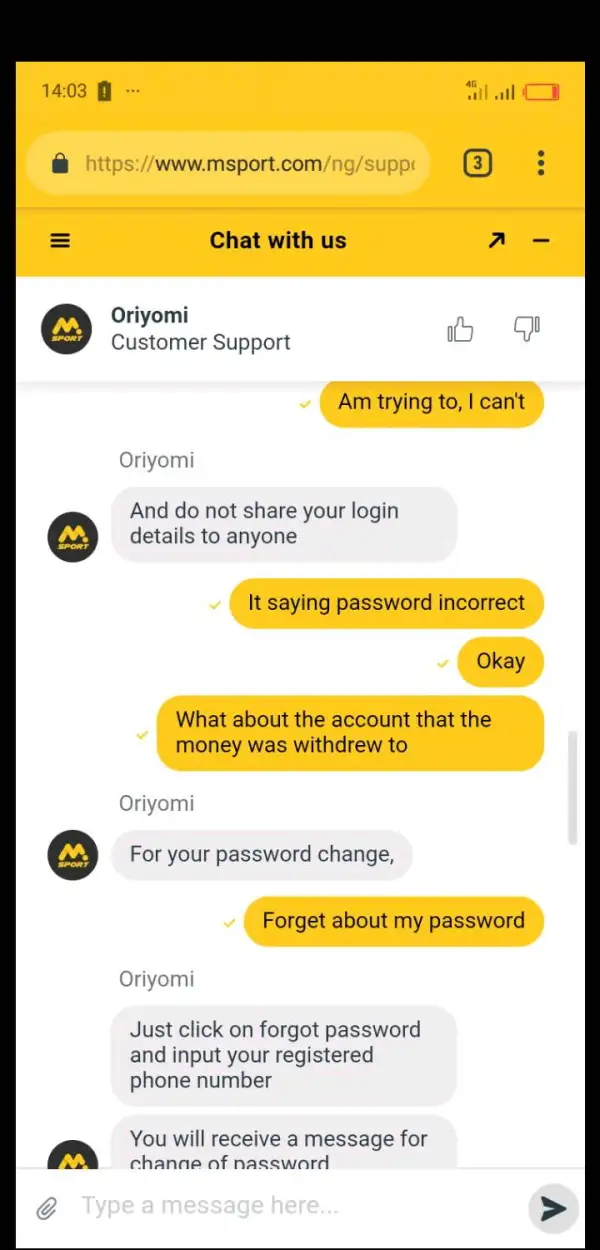

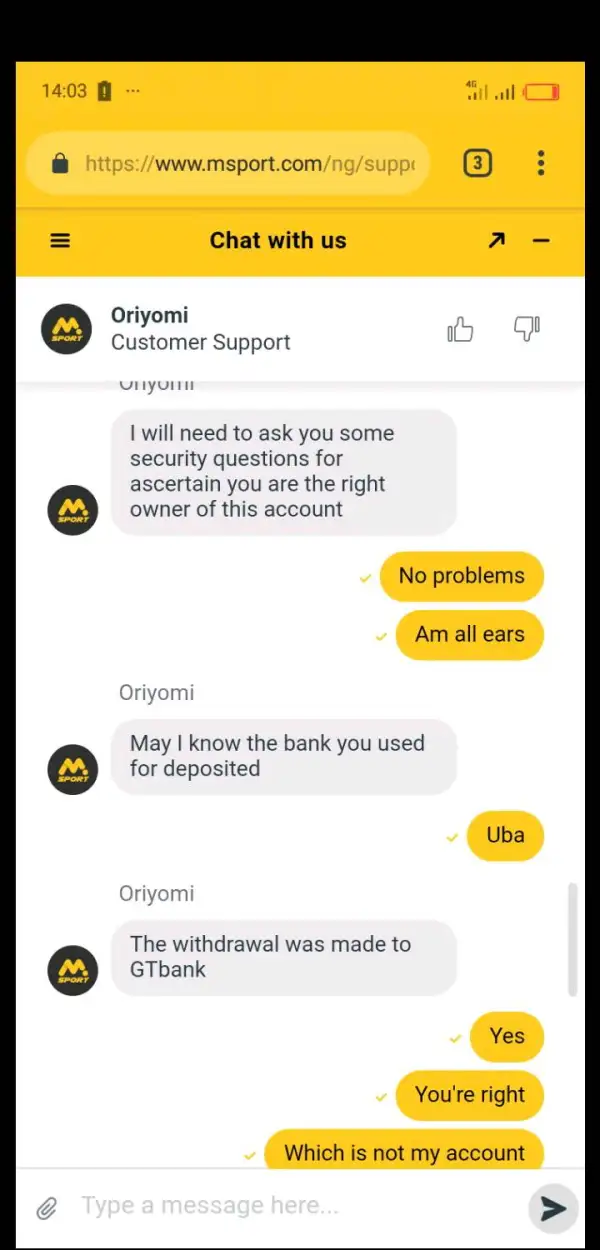

| 客戶支援 | 在線聊天、聯繫表單 |

| 電話:+61 03 9008 1880 | |

| 電子郵件:admin@forexsport.com | |

| 地址:墨爾本維多利亞州柯林斯街100號4樓 | |

| LinkedIn、YouTube、Facebook | |

Forex Sport 於2011年在澳洲註冊,並受ASIC監管。該公司聲稱提供一種更便宜更好的全球匯款方式。

優點和缺點

| 優點 | 缺點 |

| 受ASIC監管 | 無 |

| 多種金融服務 | |

| 超過1000美元的交易免費 | |

| 在線聊天支援 |

Forex Sport 是否合法?

是的。Forex Sport 受澳洲證券投資委員會(ASIC)監管。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 許可證類型 | 許可證號碼 |

|---|---|---|---|---|---|

| 澳洲證券投資委員會(ASIC) | 受監管 | FOREX SPORT PTY. LTD. | 市場做市商(MM) | 401379 |

服務

| 服務 | 支援 |

| 資產買賣 | ✔ |

| 外匯風險管理 | ✔ |

| 國際供應商支付 | ✔ |

| 全球員工支付 | ✔ |

| 國際收款 | ✔ |

| 稅務 | ✔ |

Forex Sport 費用

處理Forex Sport時沒有隱藏費用,交易金額超過1000美元時也不收取任何費用。