公司簡介

| Okigin評論摘要 | |

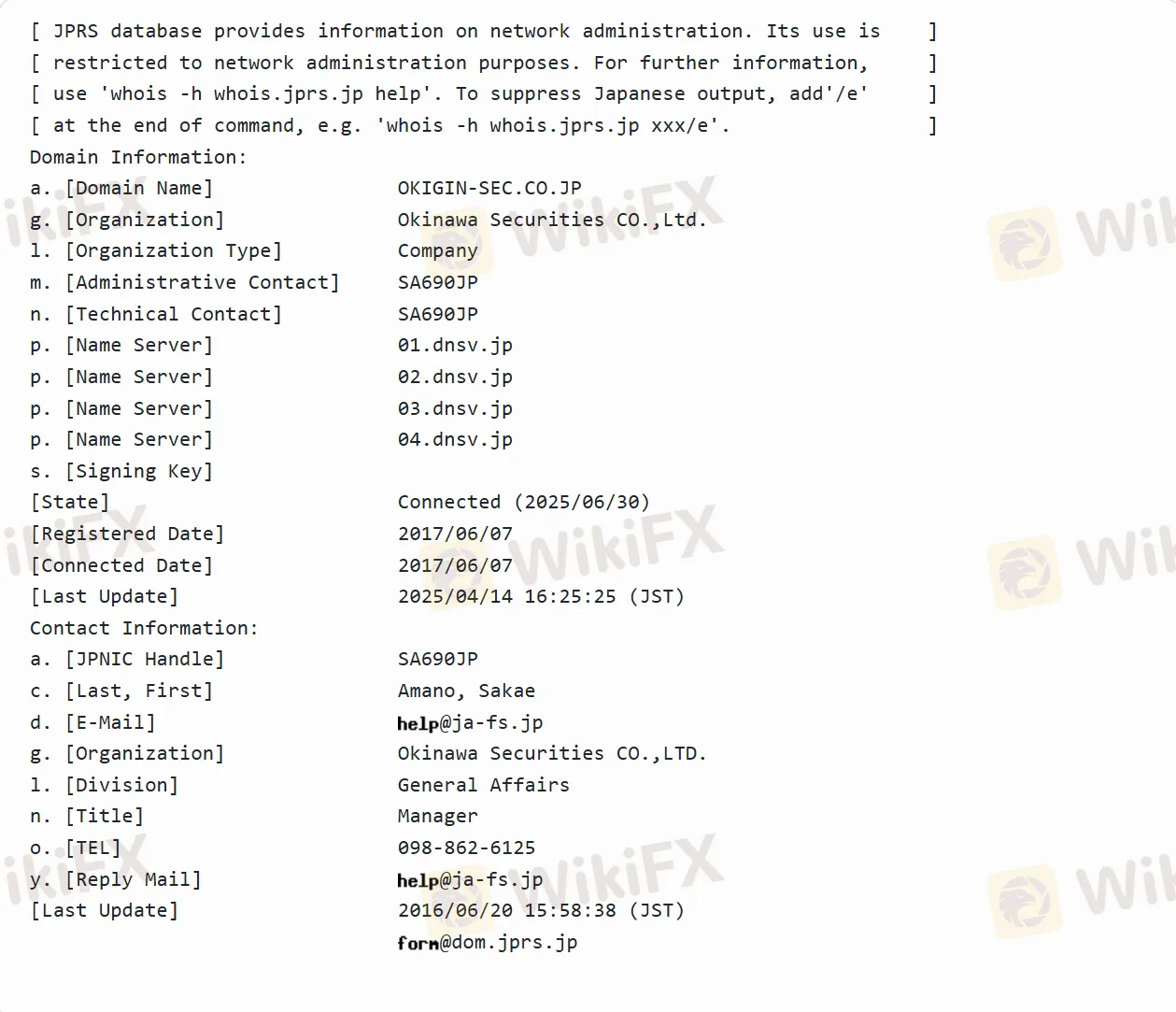

| 成立日期 | 2017-06-07 |

| 註冊國家/地區 | 日本 |

| 監管 | 受監管 |

| 市場工具 | 股票、債券和投資信託 |

| 客戶支援 | / |

Okigin 資訊

Okigin 是一家日本金融服務提供商,其母公司為沖繩銀行,在當地金融領域具有一定影響力。該平台致力於為投資者提供多元化的金融投資服務,涵蓋各種金融產品,如股票、債券和投資信託。該平台制定了一系列法律相關指南,如招攬金融產品指南、個人信息保護聲明和處理指南等,以維護客戶權益,規範業務運作。

優缺點

| 優點 | 缺點 |

| 受監管 | 語言限制(日語) |

| 多樣的金融產品 | 投資者在國際業務上的限制 |

| 清晰的風險警告 | 複雜的費用標準 |

| 多元化服務渠道(場外交易、電話接待、線上服務) | |

| 由沖繩銀行支持 |

Okigin 是否合法?

Okigin 是一個合法且合規的金融服務平台。其母公司沖繩銀行在日本金融市場具有合法經營資格。該平台本身也受金融廳監管,其監管許可證編號為由沖繩總務局(金融商人)主任發出的第1號。

Okigin 可以交易什麼?

在 Okigin 平台上,投資者可以交易各種金融產品,包括股票(國內和國外股票)、債券和投資信託。

| 可交易工具 | 支援 |

| 股票 | ✔ |

| 債券 | ✔ |

| 投資信託 | ✔ |

Okigin 費用

股票交易費用分為國內股票和外國股票。

對於國內股票,如果約定金額低於100萬日圓,手續費率為約定金額的1.210%(最低為2,750日圓);如果超過100萬日圓但低於或等於300萬日圓,手續費率為約定金額的0.880%加上3,300日圓,依此類推。

對於外國股票,在委託買賣時,將收取約定金額的2.20%的國內代理手續費(含稅,最低為5,500日圓);對於場外國內交易,只需支付購買金額,外幣兌換按公司確定的匯率進行。

此外,對於債券交易費用,如果約定金額少於100萬日圓,手續費率為約定金額的1.045%(最低為2,750日圓);如果超過100萬日圓但不超過500萬日圓,手續費率為約定金額的0.935%加上1,100日圓,依此類推。通過籌款和出售等相關交易購買債券時,只需支付購買金額。