gnsrael

1-2年

What are the advantages of trading with a regulated broker like Imamura Securities?

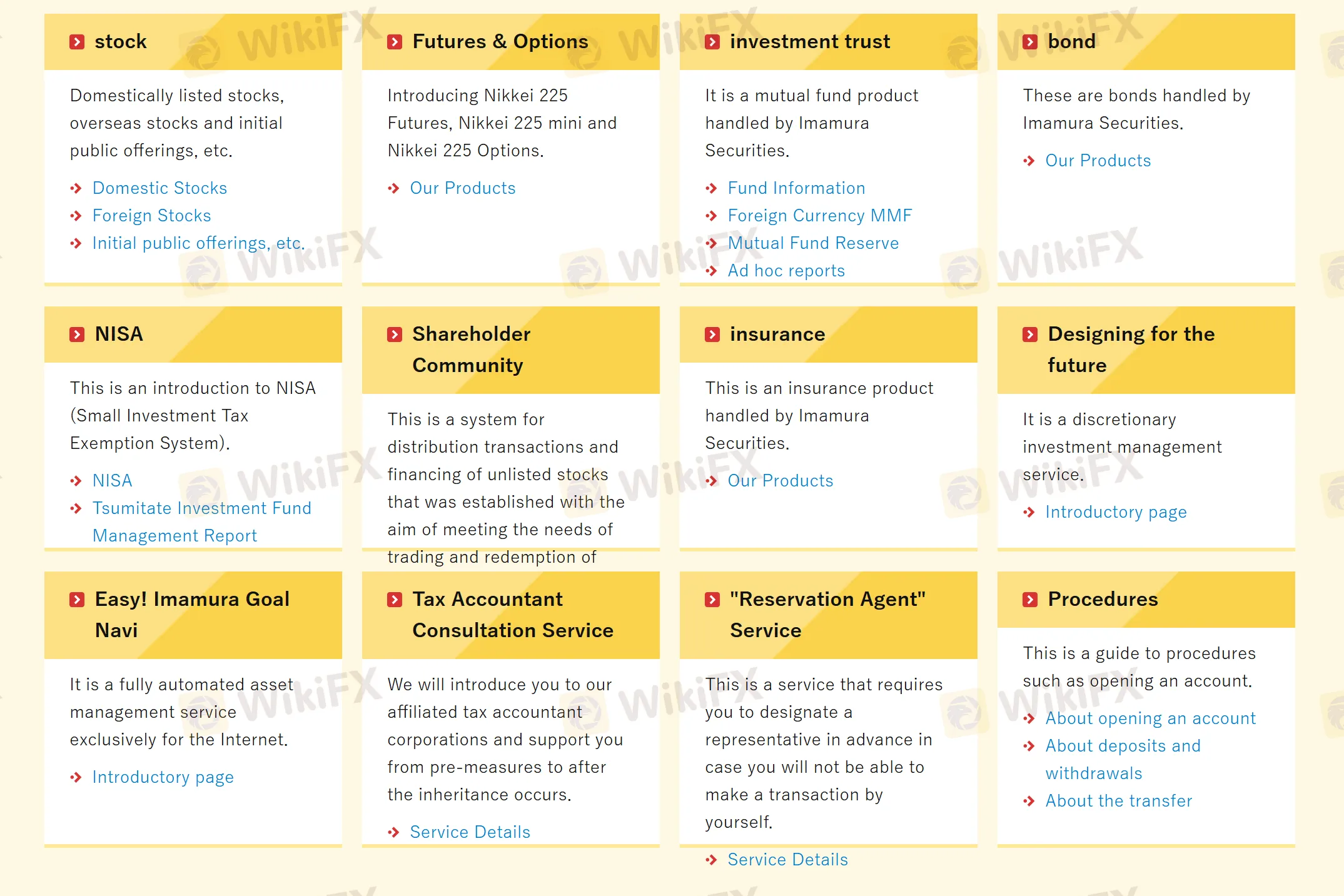

The main advantage of trading with Imamura Securities, a broker regulated by the Financial Services Agency (FSA), is the added security and reliability that comes with such regulation. FSA regulation ensures that Imamura follows strict compliance procedures, offering protection for investors. This oversight can help traders feel more secure knowing that the company’s financial activities are being monitored. Additionally, Imamura’s wide range of tradable products, including stocks, bonds, and futures, gives traders plenty of investment options.

zack18

1-2年

What are the trading fees at Imamura Securities?

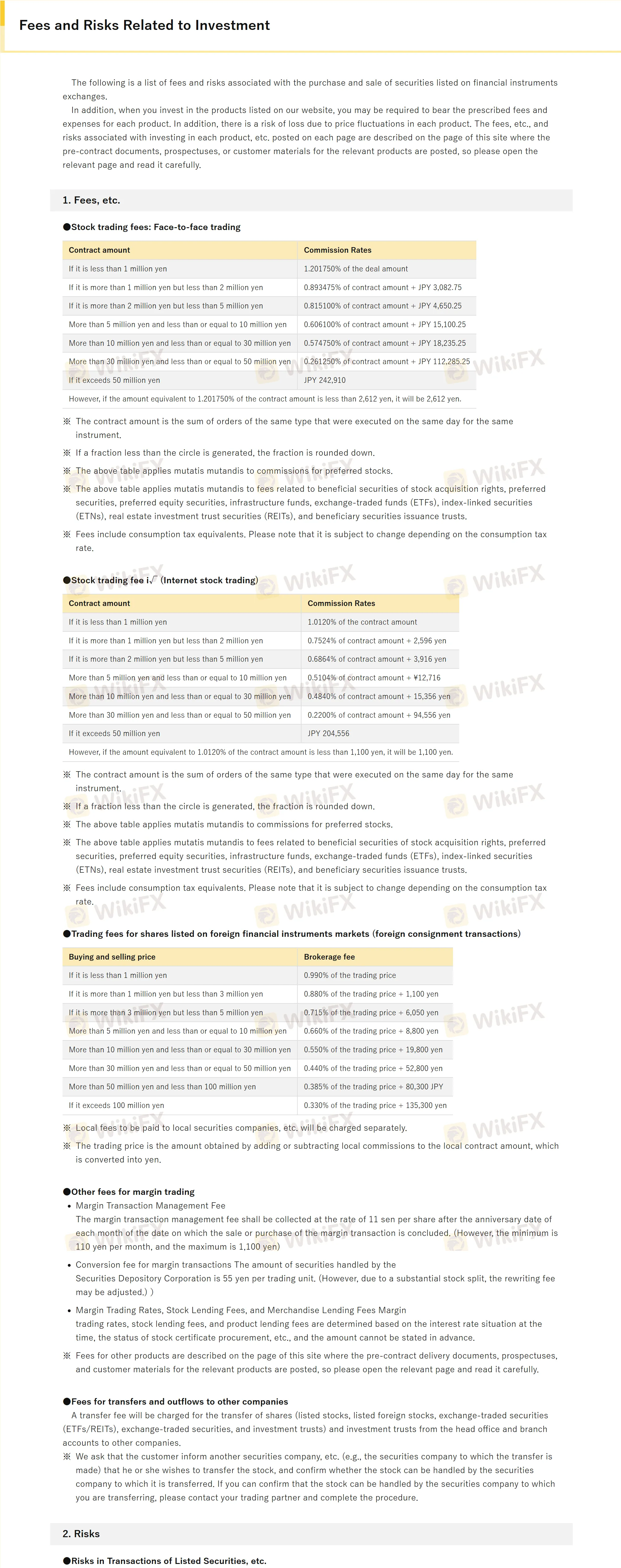

Imamura Securities has a detailed fee structure based on the transaction amount. For domestic stock trades, fees are calculated as a percentage of the transaction, with rates decreasing as the trade volume increases. For example, trades up to 1,000,000 JPY are charged 1.20175%, with a minimum fee of 2,612 JPY. As trade volumes increase, the rates decrease, but minimum fees still apply. It’s essential for traders to fully understand these fees before committing to trades, as they could significantly impact small traders.

Broker Issues

Fees and Spreads