Ahmed Harb

1-2年

Could you give a comprehensive overview of the fees charged by I-Access, covering both commissions and spreads?

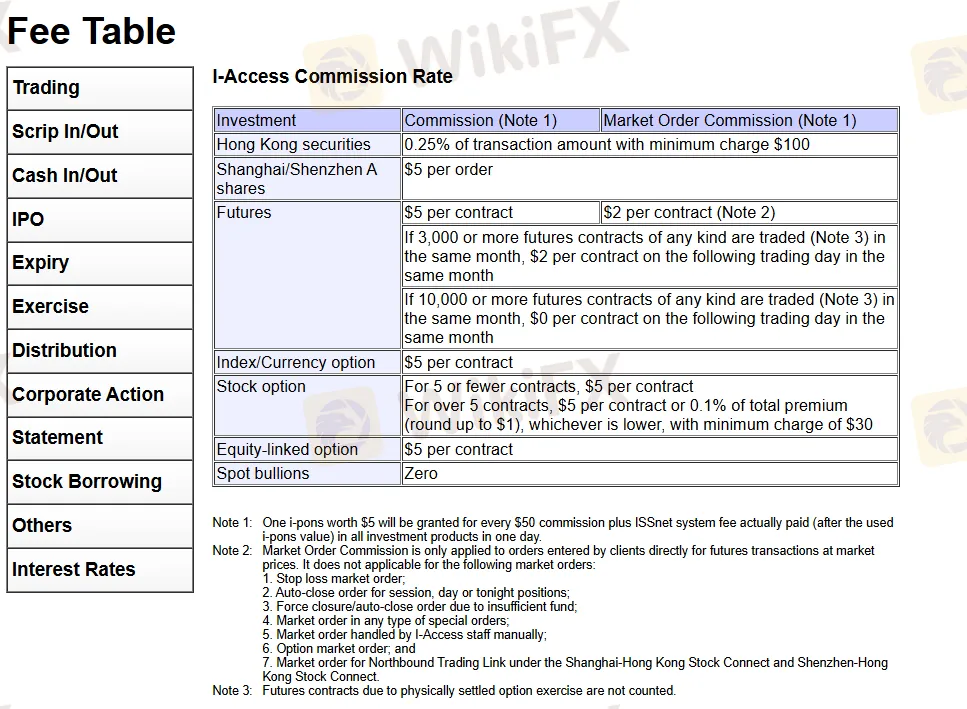

As an experienced trader, I always approach any broker’s fee structure with careful scrutiny, especially when transparency is a concern. With I-Access, what stands out immediately is their commission-based pricing model rather than spreads—in fact, forex and commodities trading aren’t even offered, so the familiar spread-based cost structure is not relevant here. Instead, I found that fees are clearly tied to commissions on securities, futures, and options transactions.

For trading Hong Kong securities, the broker charges a 0.25% commission per transaction, with a minimum of $100 per trade. Shanghai and Shenzhen A-shares incur a flat $5 commission per order. Futures contracts are charged $5 per contract, though if you trade more than 3,000 contracts in a month, the rate drops to $2 for subsequent contracts, and there are further reductions for exceptionally high volumes. Options, whether stock or index-linked, generally carry a $5 per contract fee, although for stock options over five contracts, a 0.1% of total premium (with a minimum of $30) may apply if that proves to be lower.

In my opinion, these commission levels are notably high, particularly the minimum charges. This structure may significantly impact smaller investors or those making frequent-but-small trades, as costs can quickly add up. I also couldn't find precise information regarding other incidental fees such as deposit or withdrawal charges, which leaves some uncertainty I personally find a bit unsettling. Ultimately, while their commission scheme is straightforward for the products offered, anyone considering I-Access should factor these sizeable charges and lack of regulatory clarity into their risk assessment.

Broker Issues

Fees and Spreads

J Forex Trader

1-2年

What are the key advantages and disadvantages of using I-Access for trading?

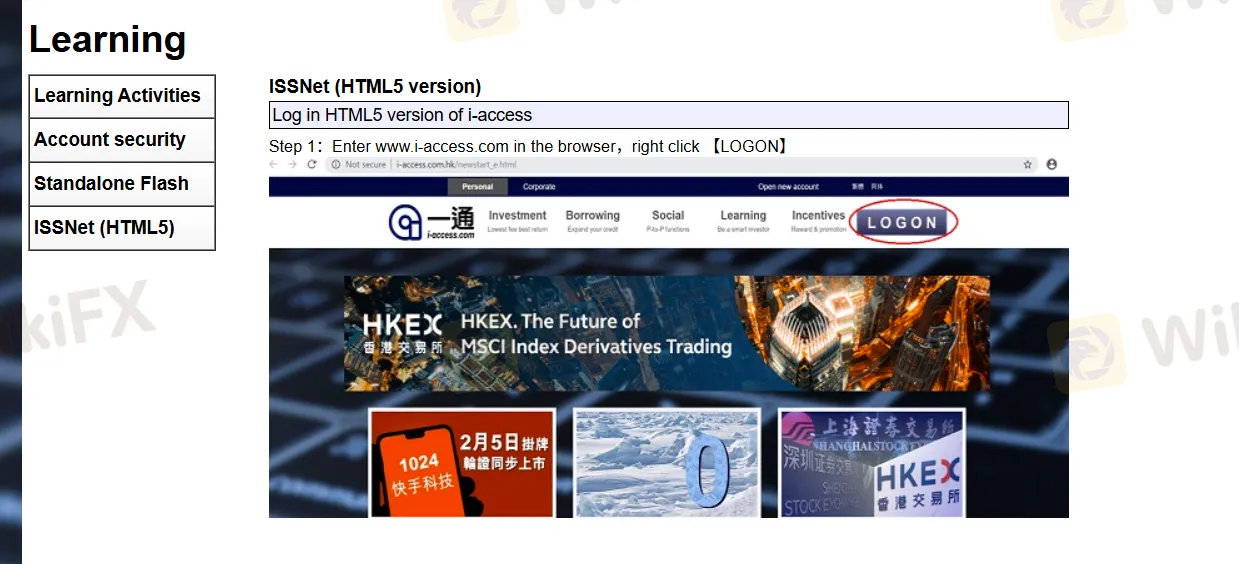

Reflecting on my experience as a trader, I always weigh a broker’s track record and regulatory standing above all else. With I-Access, I noticed the company has operated since 1999, which is a sign of longevity in an industry where many fade quickly. They offer a fairly wide spectrum of products—ranging from Hong Kong and China A shares to futures and options. The availability of a demo account is another positive point for those who want to familiarize themselves with the ISSNet trading platform.

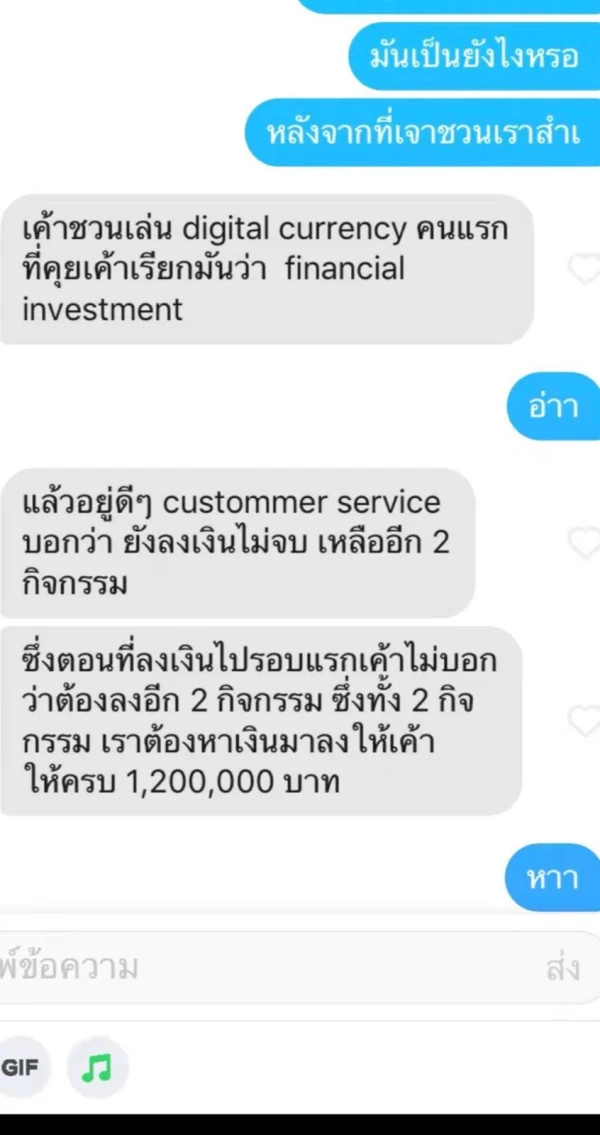

However, for me, the disadvantages stand out as particularly significant. I-Access operates without any valid regulation, and its previous Hong Kong SFC license has been revoked. This immediately raises questions about oversight and client protection—issues I cannot ignore, especially as an independent trader responsible for managing my own risk. I also noted the warnings about a suspicious regulatory license and business scope, along with the fact that there was no office found at the listed Hong Kong address during a field check. These are warning signals that I personally treat with utmost seriousness.

Additionally, fees seem on the higher side, with a minimum commission for Hong Kong securities and detailed charges for options and futures. While commission-based structures are common, the lack of transparency around deposits, withdrawals, and accepted currencies poses another layer of uncertainty for me.

As someone who values oversight and clear operational practices, I find these issues make I-Access a high-risk choice. For my own capital and peace of mind, I prefer brokers with transparent, up-to-date regulation and robust client safeguards.

mohdfazlan

1-2年

What documents do I need to provide in order to make my initial withdrawal through I-Access?

As an experienced trader, I’m always cautious when considering the withdrawal process, especially with brokers lacking clear regulatory status. In the case of I-Access, I found that their WikiFX profile provides very limited transparency about their withdrawal requirements and process in general. There isn’t any specific, detailed guidance available regarding what documents are necessary for an initial withdrawal.

Typically, any legitimate broker would require standard verification documents—such as proof of identity (like a passport or government ID) and proof of address (such as a recent utility bill or bank statement)—to comply with anti-money laundering and KYC policies. However, the absence of published details from I-Access about their process and the lack of regulatory oversight deeply concern me. Without such clarity, the risk of delays, denials, or additional, unexpected requirements increases.

To be prudent, I would recommend preparing the usual documents I mentioned, but I would also exercise extra caution: I would reach out directly to I-Access via their official contact methods and request written confirmation of the exact documentation and procedure before making any deposit or attempting a withdrawal. Personally, the lack of clear, regulated procedures would be a significant red flag for me, and I would be very hesitant to proceed without explicit information and guarantees in writing. In these situations, protecting my funds and personal data is always my paramount concern.

Broker Issues

Deposit

Withdrawal

mohdfazlan

1-2年

Are there any payment methods with I-Access that allow for instant withdrawals?

As an experienced trader, I approach every broker with a healthy amount of caution, particularly when it comes to deposits and withdrawals. With I-Access, my concerns are heightened due to several key issues. Based on my research, I-Access does not provide any clear information regarding their payment methods or withdrawal processing times. They don’t specify which options they support, what currencies are accepted, or how quickly withdrawals are handled. For me, this lack of transparency immediately signals a red flag and makes it impossible to confidently say if any instant withdrawal method exists with this broker.

In addition, I-Access operates without any valid regulatory oversight and has had its key license revoked in Hong Kong. In my experience, brokers with regulatory issues often struggle to maintain trust and operational stability, which can result in unreliable or delayed handling of funds. When I cannot verify essential details like payment processes or withdrawal speeds with a broker, I simply do not risk my capital with them. My conservative approach stems from years of trading, having seen how often unclear processes can result in unnecessary complications or, worse, loss of funds.

Given these uncertainties, I personally would not proceed with any deposits to I-Access until they publish clear, verifiable information about payment methods and withdrawal timings. Without such transparency and the presence of legitimate oversight, the risks are simply too high for me.

Broker Issues

Deposit

Withdrawal