公司簡介

| 道通期貨 評論摘要 | |

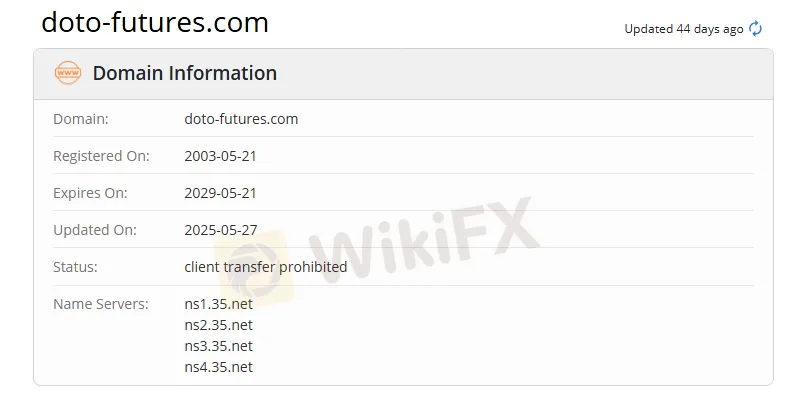

| 成立年份 | 2003 |

| 註冊國家/地區 | 中國 |

| 監管 | CFFEX |

| 交易產品 | 期貨、宏觀股指、黑色品種、有色金屬、能源和化工、農產品和期權 |

| 模擬交易 | ✅ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | 自家平台 |

| 最低存款 | / |

| 客戶支援 | 電話:025-83276920 |

| 傳真:025-83276908 | |

| 電郵:service@doto-futures.com | |

| 地址:江蘇省南京市廣州路188號蘇寧環球大廈5樓502室 | |

道通期貨 資訊

道通期貨 成立於2003年,註冊於中國,並受CFFEX監管,持有期貨牌照(牌照號碼:0239)。該公司提供多種交易產品,包括期貨、宏觀股指、黑色金屬、有色金屬、能源和化工、農產品和期權,並支援模擬交易。

優缺點

| 優點 | 缺點 |

| 悠久的運營歷史 | 收費結構不清晰 |

| 受CFFEX監管 | 沒有存取款資訊 |

| 多樣的金融產品 | |

| 提供模擬交易 |

道通期貨 是否合法?

| 監管國家 | 監管機構 | 監管狀態 | 監管實體 | 牌照類型 | 牌照號碼 |

| 中國金融期貨交易所 (CFFEX) | 受監管 | 道通期貨經紀有限公司 | 期貨牌照 | 0239 |

我可以在道通期貨上交易什麼?

道通期貨 為交易者提供多種可交易資產選擇: 宏觀股指、黑色品種、有色金屬、能源和化工、農產品以及期權。

| 交易產品 | 可用 |

| 期貨 | ✔ |

| 宏觀股指 | ✔ |

| 黑色品種 | ✔ |

| 有色金屬 | ✔ |

| 能源和化工 | ✔ |

| 農產品 | ✔ |

| 期權 | ✔ |

| 外匯 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 交易所交易基金 | ❌ |

費用

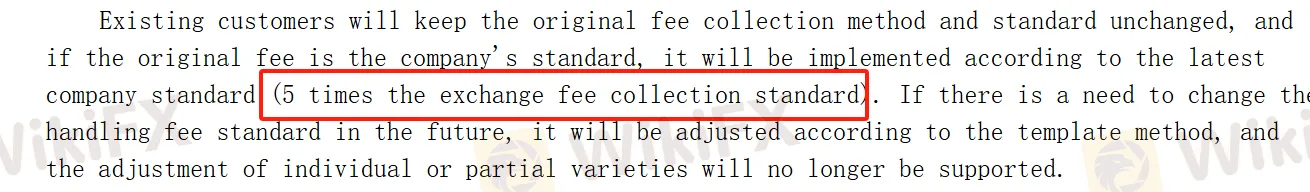

在交易時,道通期貨 將收取五倍標準交易所費用作為交易費用。

交易平台

| 交易平台 | 支援 | 可用設備 |

| 專有平台 | ✔ | 手機 |