Unternehmensprofil

| au Kabucom SecuritiesÜberblick über die Bewertung | |

| Gegründet | 1997 |

| Registriertes Land/Region | Japan |

| Regulierung | FSA |

| Produkte & Dienstleistungen | Aktien, Margin, Transaktion (System/Allgemein), Initial Public Offering (IPO)/Öffentlicher Verkauf (PO), ETF/ETN/REIT, Kostenlose ETF (Provisionsfreier börsengehandelter Fonds), Petit Shares (Aktien mit weniger als einer Einheit), Tender Offer (TOB), Investment Trust, FX (Forex Margin Trading), Futures/Options Trading, Anleihen (Ausländische Anleihen), Fremdwährungsdenominierte MMF, CFD (Aktie 365) |

| Demokonto | / |

| Hebelwirkung | / |

| Spread | / |

| Handelsplattform | Au Kabucom FX App |

| Mindesteinzahlung | / |

| Kundensupport | Live-Chat |

| Tel: 0120 390 390, 05003-6688-8888 | |

| E-Mail: cs@kabu.com | |

| Soziale Medien: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities ist ein Online-Brokerage-Unternehmen und das Kernunternehmen der Online-Finanzdienstleistungen der Mitsubishi UFJ Financial Group (MUFG Group). Das Unternehmen ist im Wertpapierhandel, Brokerage, Angebot und Verkauf tätig. Neben anderen Finanzdienstleistungen bietet es Bankagentur und Devisen-Margin-Handel an.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch die FSA | Begrenzte Informationen zu Handelsbedingungen |

| Etabliertes Unternehmen mit einem renommierten Mutterunternehmen | |

| Verschiedene Handelsprodukte und -dienstleistungen | |

| Live-Chat-Support |

au Kabucom Securities ist legitim?

Ja, Au Kabucom wird derzeit von der Financial Services Agency (FSA) reguliert und besitzt eine Einzelhandels-Forex-Lizenz (Nr. 61).

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| Financial Services Agency (FSA) | Reguliert | au Kabucom Securities株式会社 | Einzelhandels-Forex-Lizenz | 関東財務局長(金商)第61号 |

Produkte und Dienstleistungen

| Produkte & Dienstleistungen | Verfügbar |

| Aktien | ✔ |

| Margin-Transaktion (System/Allgemein) | ✔ |

| Erstplatzierung (IPO)/Öffentlicher Verkauf (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| Kostenloser ETF (Provisionsfreier börsengehandelter Fonds) | ✔ |

| Petit-Aktien (Aktien mit weniger als einer Einheit) | ✔ |

| Übernahmeangebot (TOB) | ✔ |

| Investmentfonds | ✔ |

| FX (Forex-Margin-Handel) | ✔ |

| Futures/Optionen-Handel | ✔ |

| Anleihen (Ausländische Anleihen) | ✔ |

| In Fremdwährung denominierte MMF | ✔ |

| CFD (Share 365) | ✔ |

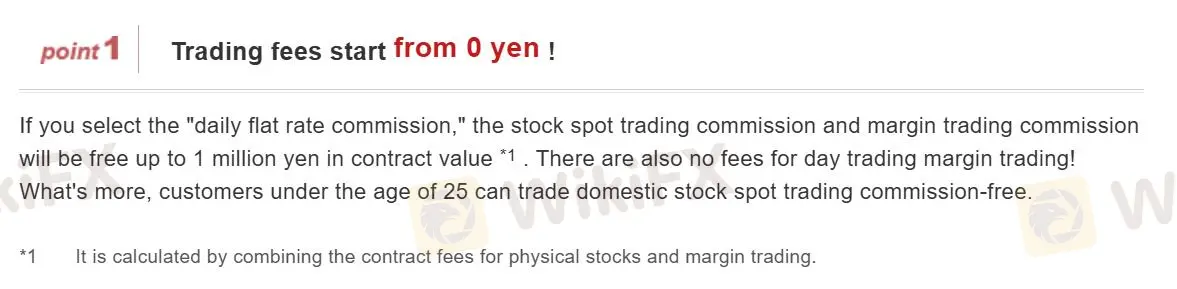

Gebühren

au Kabucom Securities bietet den Handel mit provisionsfreiem Forex an, bei dem die Handelskosten in die Spreads eingerechnet sind.

Au Kabucom erhebt jedoch Gebühren für Transaktionen mit anderen Produkten. Hier ist beispielsweise die Aktienhandelsprovision.

Aktienhandelsprovision (ohne Petit (Kabu®) und Premium-Akkumulation (Petit (Kabu® )))

| Vertragspreis (JPY) | Physische Gebühr (inkl. Steuern) | Plan für Großvolumen |

| 0 Yen bis 50.000 Yen oder weniger | 55 Yen | ❌ |

| Über 50.000 Yen bis unter 100.000 Yen | 99 Yen | |

| Über 100.000 Yen bis unter 200.000 Yen | 115 Yen | |

| Über 200.000 Yen bis unter 500.000 Yen | 275 Yen | |

| Über 500.000 Yen bis unter 1.000.000 Yen | 535 Yen | |

| Über 1 Million Yen | Vertragsbetrag × 0,099% (inkl. Steuern) + 99 Yen [Maximal: 4.059 Yen] |

Hinweis:

- Die oben genannten Gebühren gelten unabhängig von den Ausführungsbedingungen (Marktauftrag, Limitauftrag, automatisierter Handel usw.).

- Wenn eine Berechnung (Gebührenberechnung oder Verbrauchssteuerberechnung) zu einem Bruchteil führt, wird dieser abgerundet.

- Für Telefontransaktionen wird eine Betreibergebühr von 2.200 Yen (inklusive Steuern) separat hinzugefügt.

- Die Gebühren für den Kauf und Verkauf von Aktienbezugsrechten entsprechen den oben genannten Gebühren für den Kauf und Verkauf physischer Aktien.

- Es fallen keine Gebühren für Transaktionen innerhalb eines NISA (steuerfreies Kleinanlagekonto) an.

- Wenn sich die Obergrenze des Preisbereichs (Stop High) aufgrund einer zeitlich festgelegten Order ändert und der verfügbare Betrag nicht ausreicht, wird die Order zwangsweise storniert.

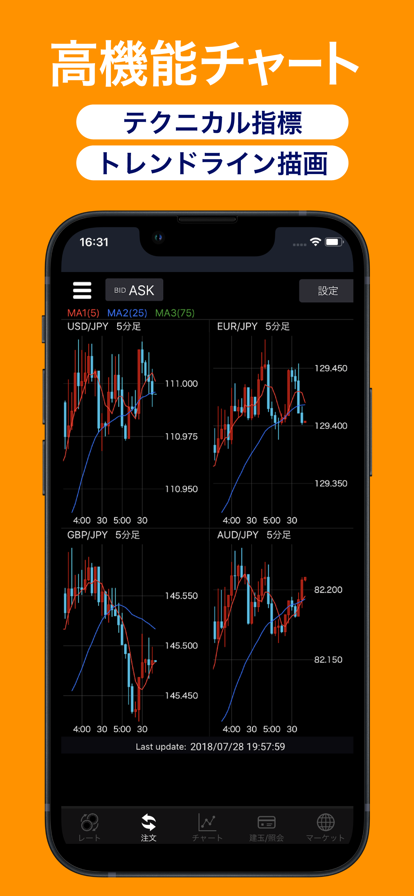

Handelsplattform

Au Kabucom Securities bietet eine Au Kabucom-App an, die sowohl auf dem PC als auch auf der mobilen Plattform verfügbar ist.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Au Kabucom FX-App | ✔ | Desktop, Mobil | / |

| MT5 | ❌ | / | Erfahrene Trader |

| MT4 | ❌ | / | Anfänger |