Profil perusahaan

| au Kabucom SecuritiesRingkasan Ulasan | |

| Didirikan | 1997 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Produk & Layanan | Saham, Margin, Transaksi (Sistem/Umum), Penawaran Umum Perdana (IPO)/Penjualan Penawaran Umum (PO), ETF/ETN/REIT, ETF Gratis (Dana Indeks yang Diperdagangkan Bebas Komisi), Saham Kecil (Saham Kurang dari Satu Unit), Tender Offer (TOB), Reksa Dana Investasi, FX (Perdagangan Margin Forex), Perdagangan Futures/Options, Obligasi (Obligasi Asing), MMF Berdenominasi Mata Uang Asing, CFD (saham 365) |

| Akun Demo | / |

| Leverage | / |

| Spread | / |

| Platform Perdagangan | Aplikasi Au Kabucom FX |

| Deposit Minimum | / |

| Dukungan Pelanggan | Obrolan langsung |

| Tel: 0120 390 390, 05003-6688-8888 | |

| Email: cs@kabu.com | |

| Media Sosial: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities adalah perusahaan pialang online dan merupakan perusahaan inti dari layanan keuangan online Mitsubishi UFJ Financial Group (MUFG Group). Bisnis ini terlibat dalam perdagangan sekuritas, pialang, penawaran, dan penjualan. Bersama dengan layanan keuangan lainnya, perusahaan ini menawarkan agensi perbankan dan perdagangan margin valuta asing.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA | Informasi terbatas tentang kondisi perdagangan |

| Perusahaan yang mapan dengan perusahaan induk yang terpercaya | |

| Berbagai produk dan layanan perdagangan | |

| Dukungan obrolan langsung |

au Kabucom Securities Legal?

Ya, Au Kabucom saat ini diatur oleh Otoritas Jasa Keuangan (FSA), memegang lisensi forex ritel (No.61).

| Negara yang Diatur | Otoritas yang Diatur | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| Otoritas Jasa Keuangan (FSA) | Diatur | au Kabucom Securities株式会社 | Lisensi Forex Ritel | 関東財務局長(金商)第61号 |

Produk dan Layanan

| Produk & Layanan | Tersedia |

| Saham | ✔ |

| Transaksi Margin (Sistem/Umum) | ✔ |

| Penawaran Saham Perdana (IPO)/Penjualan Penawaran Umum (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| ETF Gratis (Dana Indeks yang Diperdagangkan Bebas Komisi) | ✔ |

| Saham Kecil (Saham Kurang dari Satu Unit) | ✔ |

| Penawaran Tender (TOB) | ✔ |

| Investasi Amanah | ✔ |

| FX (Perdagangan Margin Forex) | ✔ |

| Perdagangan Futures/Opsi | ✔ |

| Obligasi (Obligasi Asing) | ✔ |

| MMF dengan Mata Uang Asing | ✔ |

| CFD (Share 365) | ✔ |

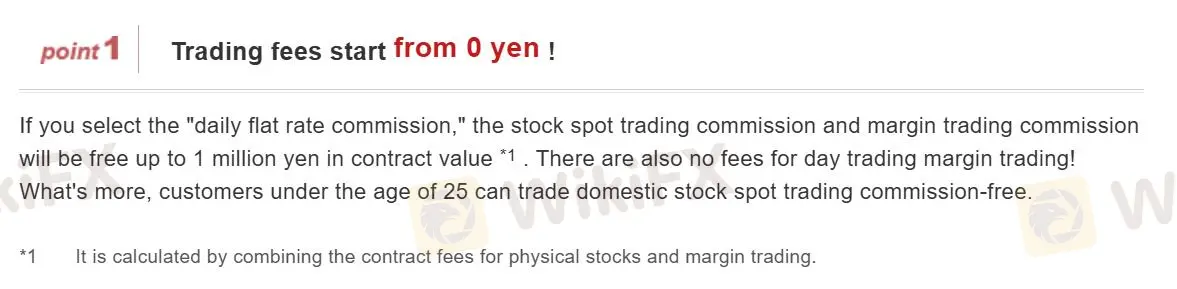

Biaya

au Kabucom Securities menawarkan perdagangan forex bebas komisi, di mana biaya perdagangan dimasukkan ke dalam spread.

Namun, Au Kabucom mengenakan biaya untuk transaksi yang melibatkan produk lain. Berikut adalah komisi perdagangan saham, misalnya.

Komisi perdagangan saham (tidak termasuk Petit (Kabu®) dan Akumulasi Premium (Petit (Kabu® )))

| Harga Kontrak (JPY) | Biaya Fisik (termasuk pajak) | Rencana Preferensial Volume Besar |

| 0 yen hingga 50.000 yen atau kurang | 55 yen | ❌ |

| Lebih dari 50.000 yen hingga kurang dari 100.000 yen | 99 yen | |

| Lebih dari 100.000 yen hingga kurang dari 200.000 yen | 115 yen | |

| Lebih dari 200.000 yen hingga kurang dari 500.000 yen | 275 yen | |

| Lebih dari 500.000 yen hingga kurang dari 1.000.000 yen | 535 yen | |

| Lebih dari 1 juta yen | Jumlah kontrak × 0,099% (termasuk pajak) + 99 yen [Maksimum: 4.059 yen] |

Catatan:

- Biaya di atas akan diterapkan tanpa memperhatikan kondisi eksekusi (order pasar, order limit, perdagangan otomatis, dll.).

- Jika hasil perhitungan (perhitungan biaya atau perhitungan pajak konsumsi) menghasilkan bagian pecahan, maka akan dibulatkan ke bawah.

- Untuk transaksi melalui telepon, akan dikenakan biaya operator sebesar 2.200 yen (termasuk pajak) secara terpisah.

- Biaya untuk membeli dan menjual hak perolehan saham sama dengan biaya untuk membeli dan menjual saham fisik yang disebutkan di atas.

- Tidak ada biaya untuk transaksi dalam akun NISA (investasi skala kecil bebas pajak).

- Jika batas atas rentang harga (stop high) berubah karena order dengan periode tertentu dan jumlah yang tersedia tidak mencukupi, maka order akan dibatalkan secara paksa.

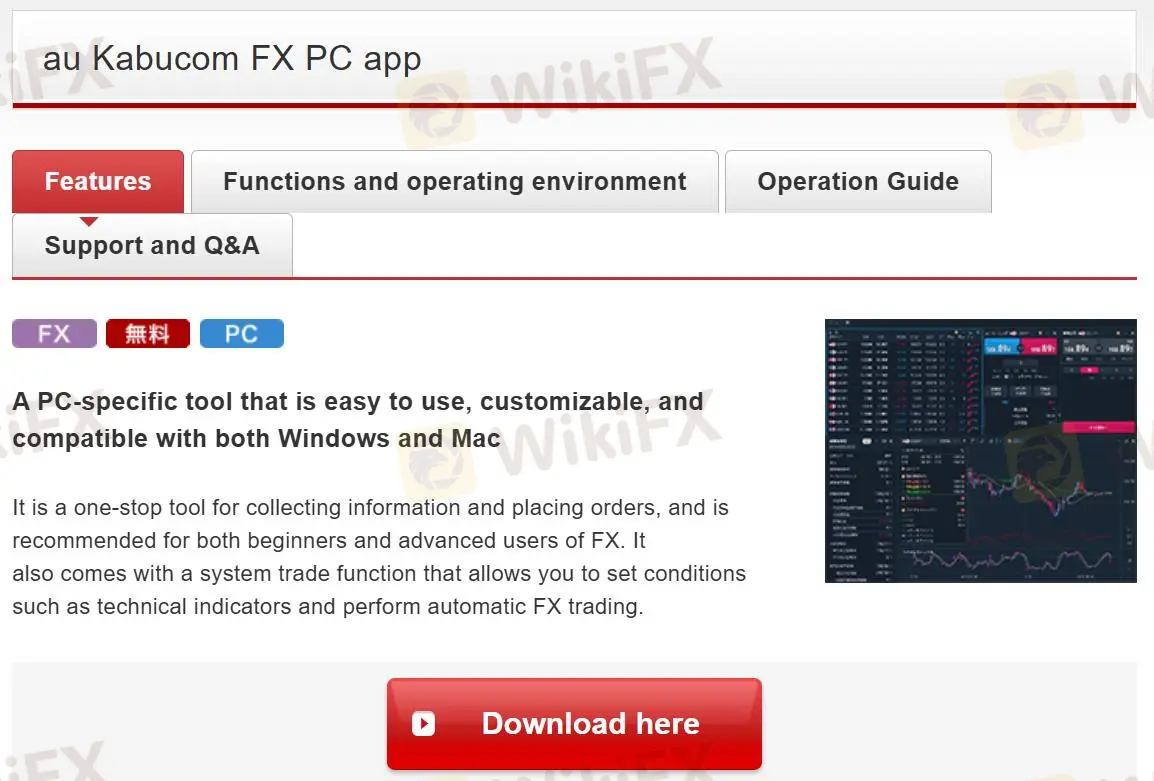

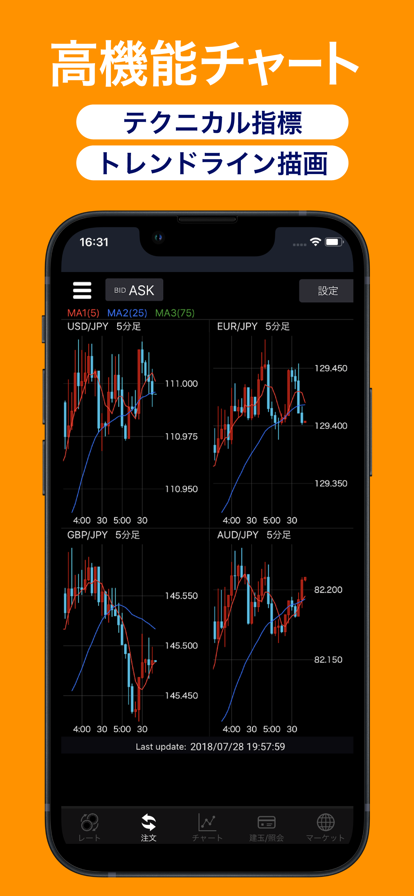

Platform Perdagangan

Au Kabucom Securities menawarkan aplikasi Au Kabucom yang tersedia baik di PC maupun platform mobile.

| Platform Perdagangan | Didukung | Perangkat yang Tersedia | Cocok untuk |

| Aplikasi Au Kabucom FX | ✔ | Desktop, Mobile | / |

| MT5 | ❌ | / | Trader berpengalaman |

| MT4 | ❌ | / | Pemula |