Company Summary

| GUOSEN FUTURES Review Summary | |

| Founded | 2008 |

| Registered Country/Region | China |

| Regulation | CFFEX (Regulated) |

| Market Instruments | Gold, Steel, Agricultural Products, Base Metals, Energy Products |

| Demo Account | ❌ |

| Trading Platform | Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 and so on |

| Min Deposit | / |

| Customer Support | Phone: 400-86-95536 / 0755-22941888 |

Guosen Futures Limited is a wholly-owned subsidiary of Guoxin Securities Company Limited. Headquartered in Shanghai, it offers tradable assets traded on their various trading platforms. Enjoying a position among the industry's top ten, Guosen Futures benefits from its extensive network covering major cities, facilitated by over 100 business departments of Guoxin Securities. It is under well regulated status by CFFEX.

Pros and Cons

| Pros | Cons |

| Regulated by CFFEX | Time-consuming account opening procedures |

| Various trading platforms across many devices | Limited contact channels |

| No demo accounts |

Is GUOSEN FUTURES Legit?

GUOSEN FUTURES is regulated by China Financial Futures Exchange Co. Ltd. (CFFEX). It holds Futures license with license No.0113.

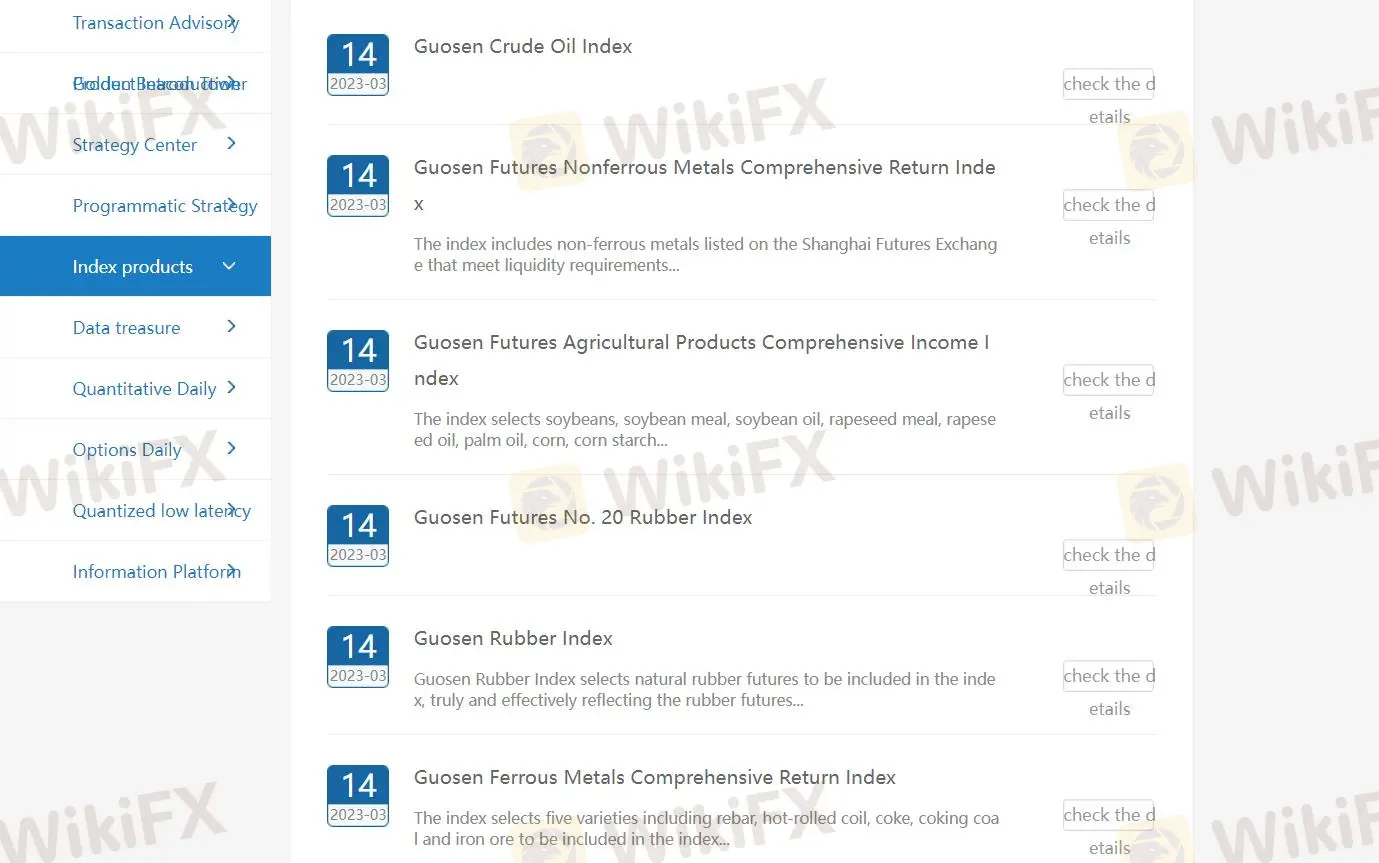

What Can I Trade on GUOSEN FUTURES?

GUOSEN FUTURES offers futures, gold, steel, agricultural products, base metals, and energy products.

Account Type

To open an account of GUOSEN FUTURES, you can register and log in to the futures internet account opening cloud system via mobile phone or computer, fill in your personal information, and select the type of account you want to open. Besides, you will also need to take an assessment, apply for the corresponding exchange, and sign relevant documents and so on. Therefore, the procedures are complex and time-consuming.

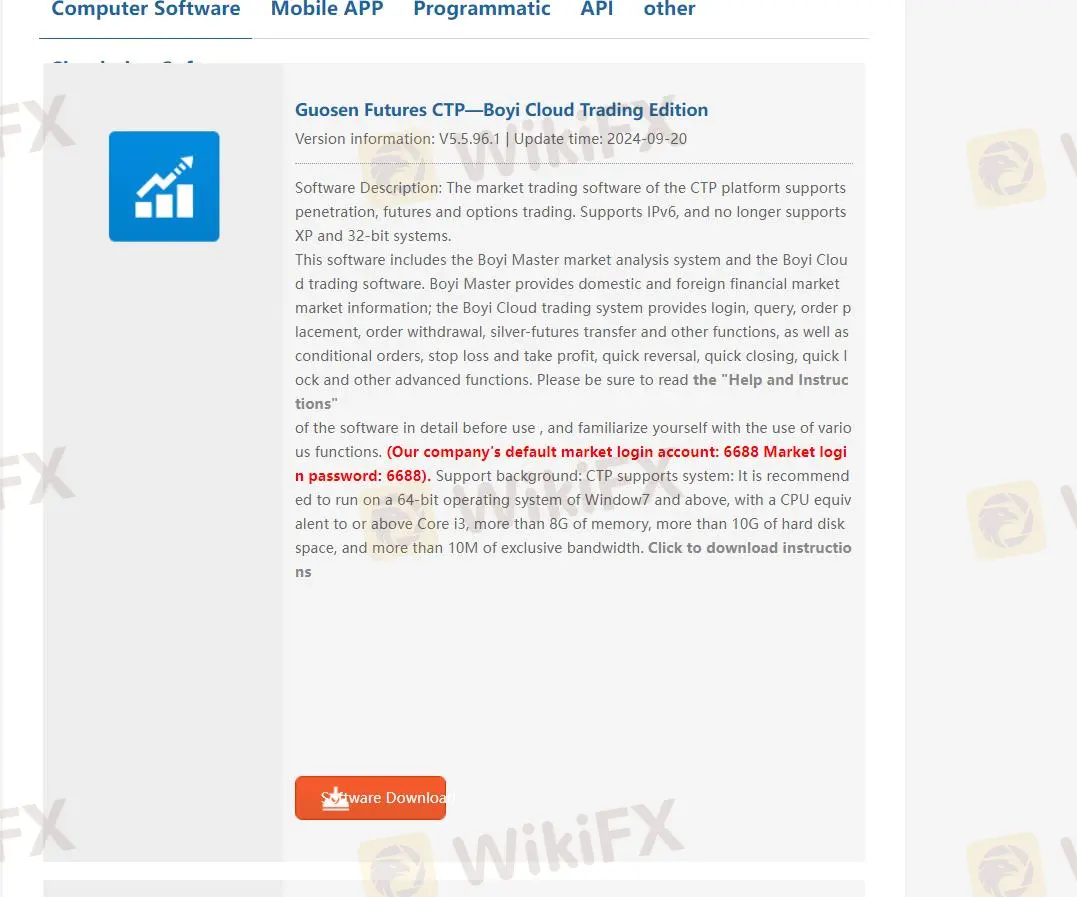

Trading Platform

GUOSEN FUTURES offers various trading platforms including desktop software, mobile App, Programmatic, API and others. The computer software includesGuosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 and so on.

Besides, their App are Guosen Futures, and Guosen Futures Premium Edition. You can choose different platforms according to your trading conditions. More details about trading platforms can learned through: https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

Deposit and Withdrawal

GUOSEN FUTURES supports bank-futures transfer, online banking transfer and over-the-counter transfer. The bank-futures transfers are opened to ICBC, ABC, BOC, CCB, BOC, SPDB, Minsheng, CMB, CITIC, Everbright, Ping An, Industrial Bank and Postal Savings Bank.

The maximum amount you can withdraw daily is RMB 10 million, and the maximum limit for a single transfer is also RMB 10 million. The RMB 100 guarantee fund cannot be withdrawn (if there are no transactions or positions on the day, you can apply for the withdrawal of the guarantee fund by phone).