Şirket özeti

| GUOSEN FUTURES İnceleme Özeti | |

| Kuruluş Yılı | 2008 |

| Kayıtlı Ülke/Bölge | Çin |

| Düzenleme | CFFEX (Düzenlenmiş) |

| Piyasa Araçları | Altın, Çelik, Tarım Ürünleri, Baz Metaller, Enerji Ürünleri |

| Demo Hesabı | ❌ |

| İşlem Platformu | Guosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 ve diğerleri |

| Minimum Yatırım | / |

| Müşteri Desteği | Telefon: 400-86-95536 / 0755-22941888 |

Guosen Futures Limited, Guoxin Securities Company Limited'ın tamamen sahip olduğu bir yan kuruluştur. Şanghay merkezli olarak çeşitli işlem platformlarında işlem gören ticari varlıklar sunmaktadır. Sektörün en iyi onu arasında yer alan Guosen Futures, Guoxin Securities'ın 100'den fazla iş departmanı tarafından desteklenen büyük şehirleri kapsayan geniş bir ağdan faydalanmaktadır. CFFEX tarafından iyi düzenlenmiş bir statüdedir.

Artıları ve Eksileri

| Artıları | Eksileri |

| CFFEX tarafından düzenlenir | Zaman alıcı hesap açma prosedürleri |

| Birçok cihazda çeşitli işlem platformları | Sınırlı iletişim kanalları |

| Demo hesapları yok |

GUOSEN FUTURES Güvenilir mi?

GUOSEN FUTURES, China Financial Futures Exchange Co. Ltd. (CFFEX) tarafından düzenlenmektedir. 0113 lisans numarasıyla Vadeli İşlemler lisansına sahiptir.

GUOSEN FUTURES üzerinde ne işlem yapabilirim?

GUOSEN FUTURES, vadeli işlemler, altın, çelik, tarım ürünleri, baz metaller ve enerji ürünleri gibi çeşitli işlem yapma imkanı sunmaktadır.

Hesap Türü

GUOSEN FUTURES hesabı açmak için, mobil telefon veya bilgisayar aracılığıyla vadeli işlemler internet hesap açma bulut sistemine kaydolmanız ve giriş yapmanız gerekmektedir. Kişisel bilgilerinizi doldurmanız ve açmak istediğiniz hesap türünü seçmeniz gerekmektedir. Ayrıca, bir değerlendirme yapmanız, ilgili borsaya başvurmanız ve ilgili belgeleri imzalamanız gerekecektir. Bu nedenle, prosedürler karmaşık ve zaman alıcıdır.

İşlem Platformu

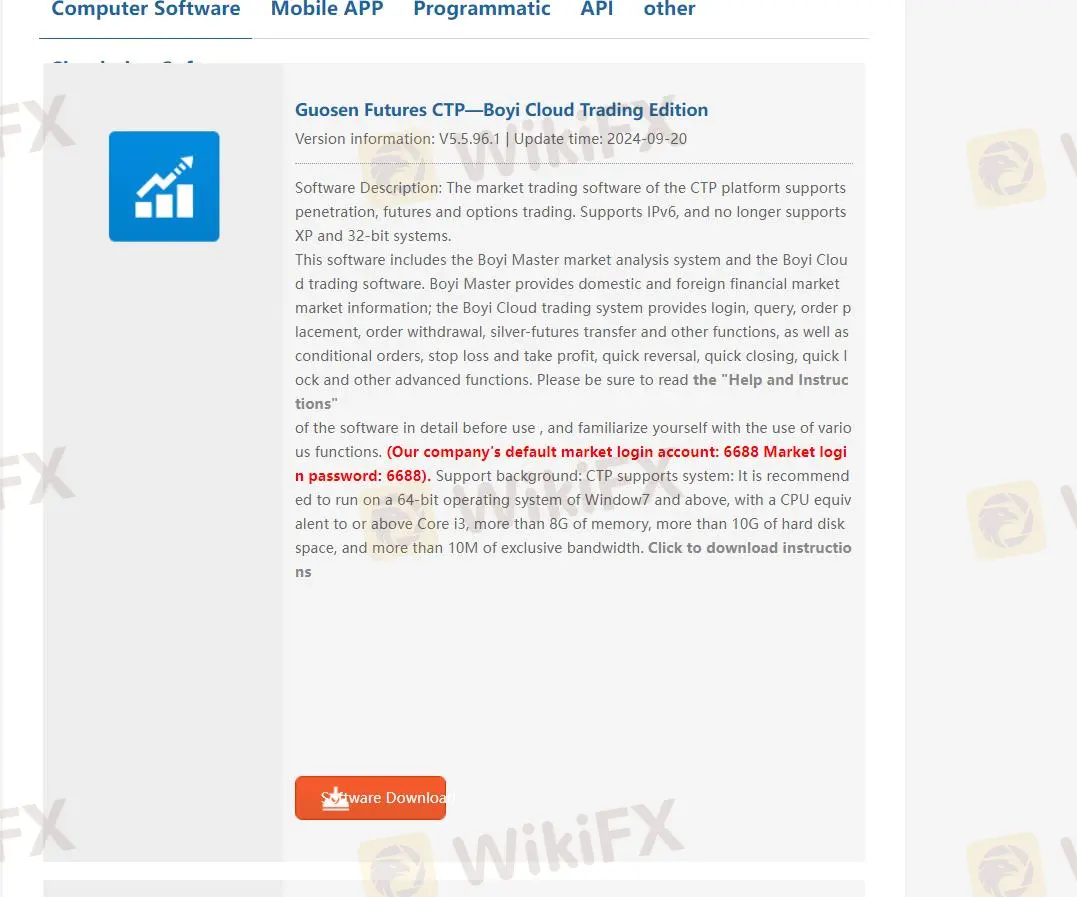

GUOSEN FUTURES, masaüstü yazılım, mobil uygulama, Programatik, API ve diğerleri dahil olmak üzere çeşitli işlem platformları sunmaktadır. Bilgisayar yazılımı arasındaGuosen Futures CTP—Boyi Cloud Trading Edition, EasyStar 9.5 macOS, Guoxin Futures CTP- Quick Futures V3 Client, Wenhua Winshun WH6 ve diğerleri bulunmaktadır.

Ayrıca, uygulamaları Guosen Futures ve Guosen Futures Premium Sürümü'dür. Ticaret koşullarınıza göre farklı platformlar seçebilirsiniz. Ticaret platformları hakkında daha fazla bilgi için şu adresten öğrenebilirsiniz: https://www.guosenqh.com.cn/main/kfzx/xjzq/dnrj/index.shtml

Para Yatırma ve Çekme

GUOSEN FUTURES banka-vadeli işlem transferi, online bankacılık transferi ve tezgah üstü transferi desteklemektedir. Banka-vadeli işlem transferleri ICBC, ABC, BOC, CCB, BOC, SPDB, Minsheng, CMB, CITIC, Everbright, Ping An, Industrial Bank ve Postal Savings Bank için açıktır.

Günlük olarak çekebileceğiniz maksimum miktar 10 milyon RMB'dir ve tek bir transfer için maksimum limit de 10 milyon RMB'dir. 100 RMB'lik garanti fonu çekilemez (gün içinde işlem veya pozisyon yoksa, garanti fonunun çekilmesi için telefonla başvurabilirsiniz).