Company Summary

| Taishin Securities Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Taiwan |

| Regulation | Taipei Exchange |

| Market Instruments | Securities, futures, stocks, ETFs, bonds, commodities, derivatives, bonds |

| Trading Platform | / |

| Customer Support | 24/7 live chat |

| Tel: 02-4050-9799 (Monday to Friday, 8 a.m. to 5 p.m.) | |

| Email: ec@tssco.com.tw | |

Taishin Securities Information

Taishin Securities, founded in Taiwan and regulated by the Taipei Exchange, is an online trading platform that offers trading in securities, futures, stocks, ETFs, bonds, commodities, derivatives, and bonds.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Taishin Securities Legit?

Taishin Securities has a “Dealing in securities” license regulated by the Taipei Exchange in Taiwan.

What Can I Trade on Taishin Securities?

Through the Taishin Securities platform, clients can trade securities, futures, stocks, ETFs, bonds, commodities, derivatives, and bonds.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Commodities | ✔ |

| Derivatives | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

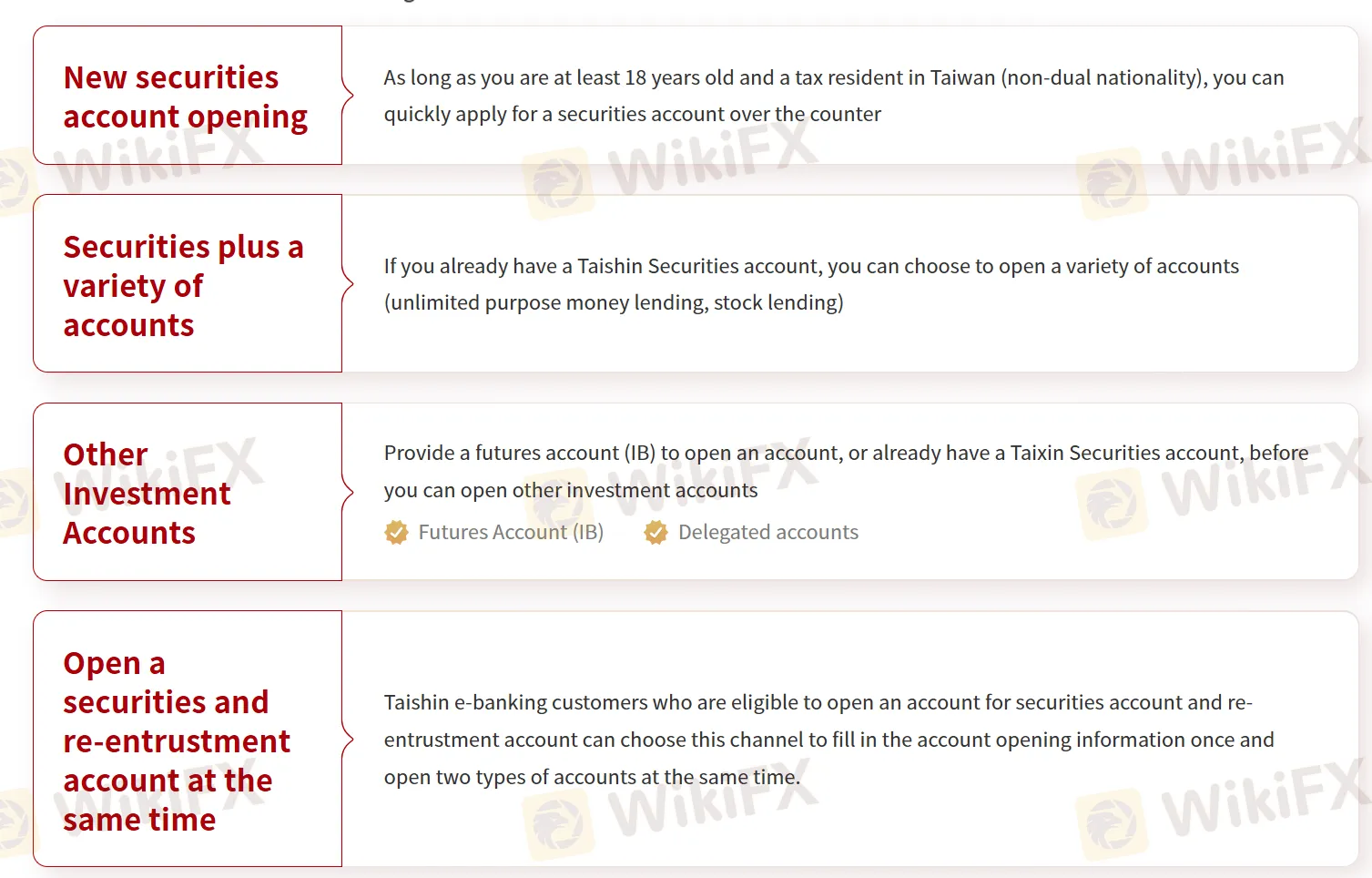

Account Type

Taishin Securities offers four account types:

- New securities account opening: For individuals at least 18 years old and tax residents in Taiwan (non-dual nationality), allowing quick over-the-counter application for a securities account.

- Securities plus a variety of accounts: Available for existing Taishin Securities account holders, offering options like unlimited purpose money lending and stock lending.

- Other Investment Accounts: Requires providing a futures account (IB) to open, or already having a Taishin Securities account, to then open other investment accounts such as Futures Account (IB) and Delegated accounts.

- Open a securities and re-entrustment account at the same time: Allows eligible Taishin e-banking customers to open both a securities and a re-entrustment account simultaneously by filling out the application information once.

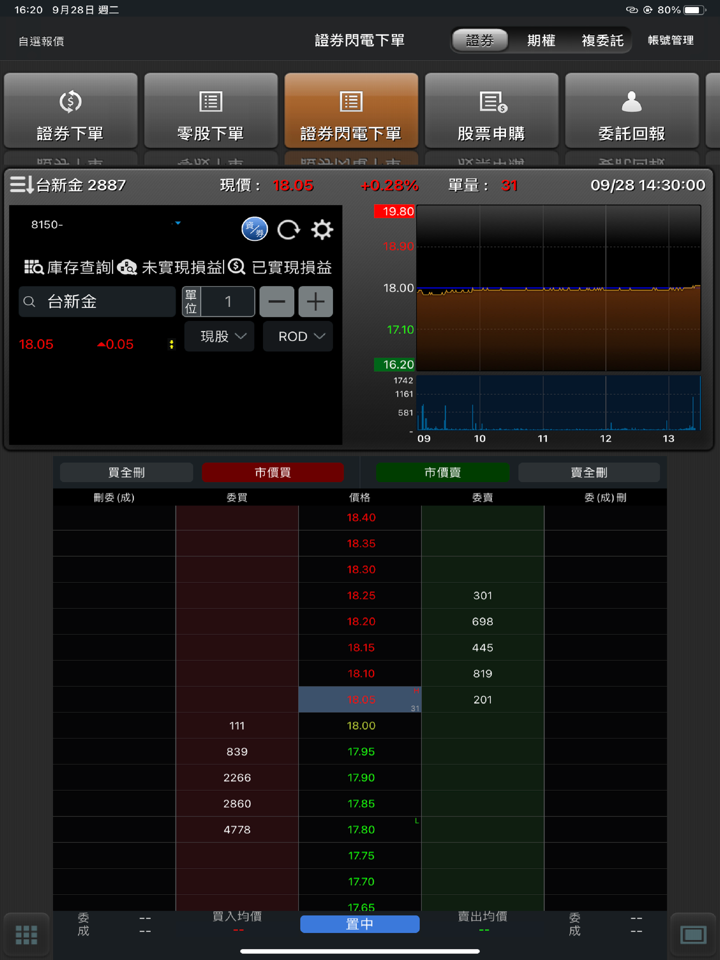

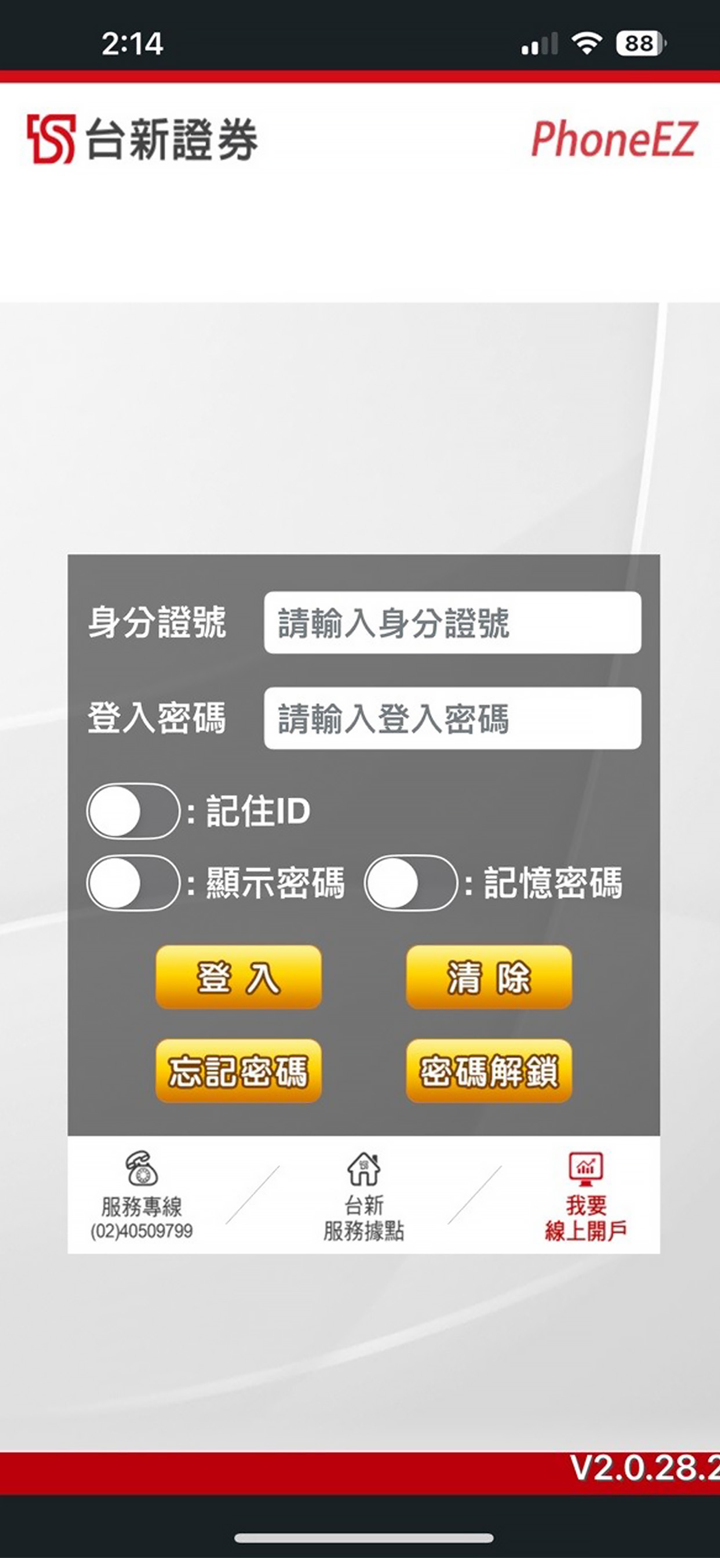

Trading Platform

| Trading Platform | Supported Apps | Available Devices | Suitable for |

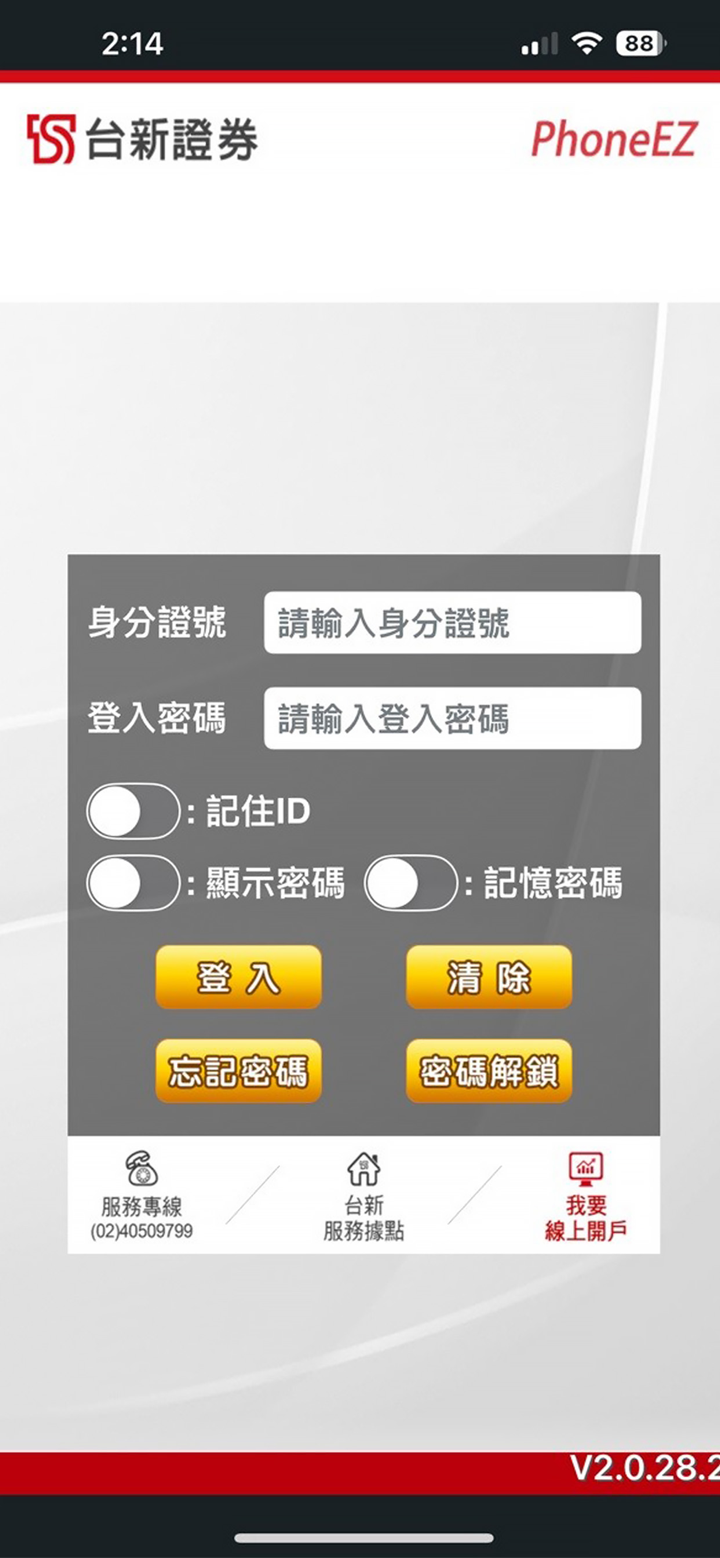

| APP Trading | Woojii, PhoneEZ | Mobile App | Mobile Users |

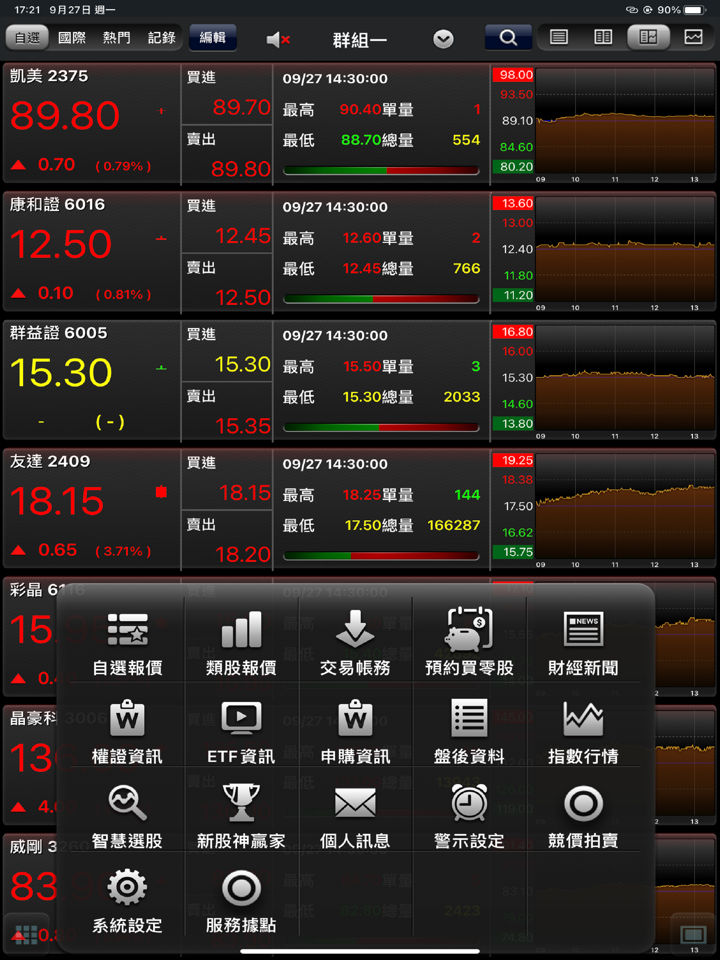

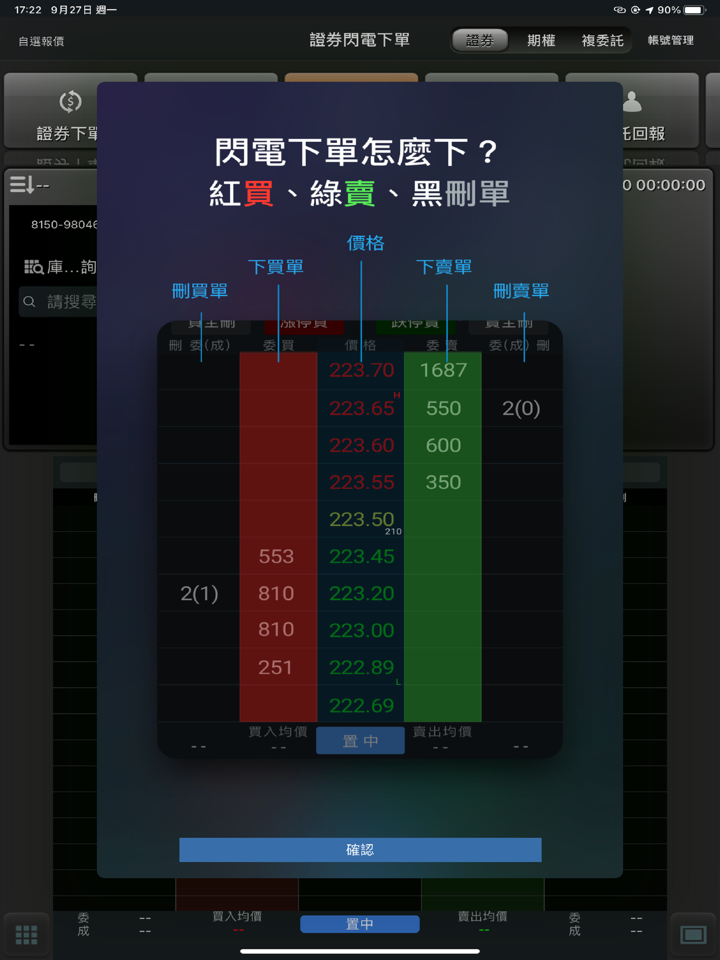

| Computer Trading | Super Smart Star, Taishin Express Hand, WEB Trading, API Trading, Global Futures Star | Desktop, Web Browser, API | Desktop Users, Algorithmic Trading |

| Voice Trading | Voice Trading | Mobile | Voice-Based Orders |

| Certificate Area | Certificate Area | Not explicitly listed, likely desktop-based for certificate management | Certificate Management |