公司简介

| 台新證券 评论摘要 | |

| 成立时间 | 2009 |

| 注册国家/地区 | 台湾 |

| 监管机构 | 台北证券交易所 |

| 市场工具 | 证券、期货、股票、ETF、债券、大宗商品、衍生品、债券 |

| 交易平台 | / |

| 客户支持 | 全天候在线聊天 |

| 电话:02-4050-9799(周一至周五,上午8点至下午5点) | |

| 电子邮件:ec@tssco.com.tw | |

台新證券 信息

台新證券成立于台湾,受台北证券交易所监管,是一家提供证券、期货、股票、ETF、债券、大宗商品、衍生品和债券交易的在线交易平台。

优点和缺点

| 优点 | 缺点 |

|

|

|

|

台新證券 是否合法?

台新證券在台湾受台北证券交易所监管,持有“证券交易”许可证。

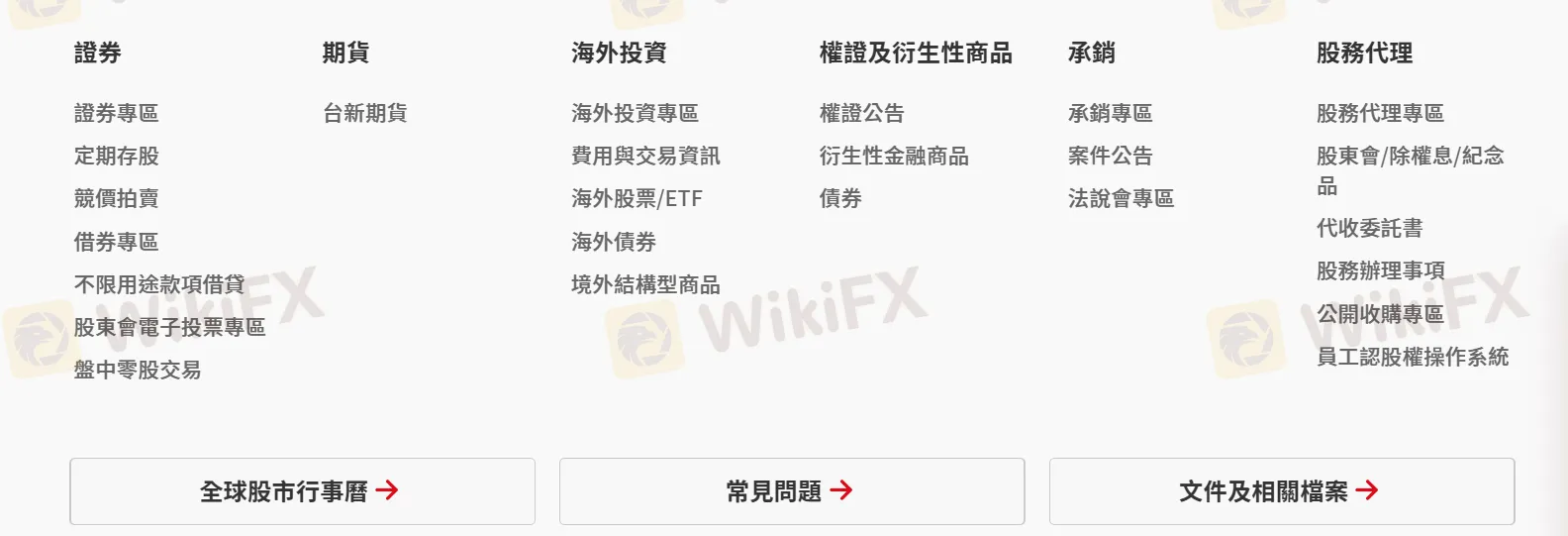

我可以在台新證券上交易什么?

通过台新證券平台,客户可以交易证券、期货、股票、ETF、债券、大宗商品、衍生品和债券。

| 可交易工具 | 支持 |

| 证券 | ✔ |

| 期货 | ✔ |

| 股票 | ✔ |

| ETF | ✔ |

| 债券 | ✔ |

| 大宗商品 | ✔ |

| 衍生品 | ✔ |

| 债券 | ✔ |

| 外汇 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 期权 | ❌ |

账户类型

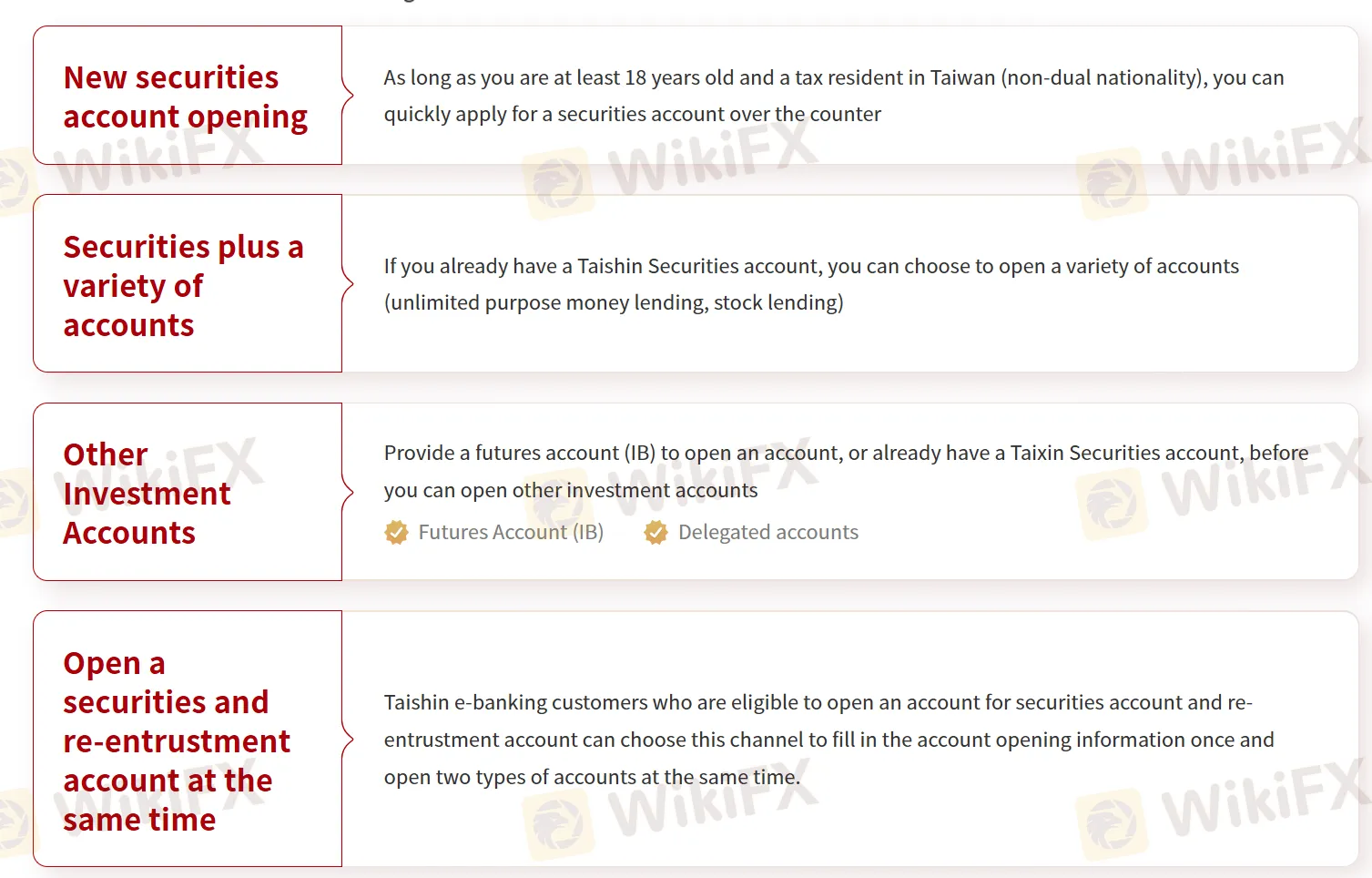

台新證券 提供四种账户类型:

- 新证券账户开户:适用于年满18岁且是台湾税收居民(非双重国籍)的个人,允许快速柜台申请证券账户。

- 证券加多种账户:适用于现有台新證券账户持有人,提供无限制的目的性贷款和股票借贷等选项。

- 其他投资账户:需要提供期货账户(IB)才能开立,或者已经拥有台新證券账户,然后可以开立其他投资账户,如期货账户(IB)和受托账户。

- 同时开立证券和再委托账户:允许符合条件的台新电子银行客户一次填写申请信息即可同时开立证券和再委托账户。

交易平台

| 交易平台 | 支持的应用 | 可用设备 | 适用对象 |

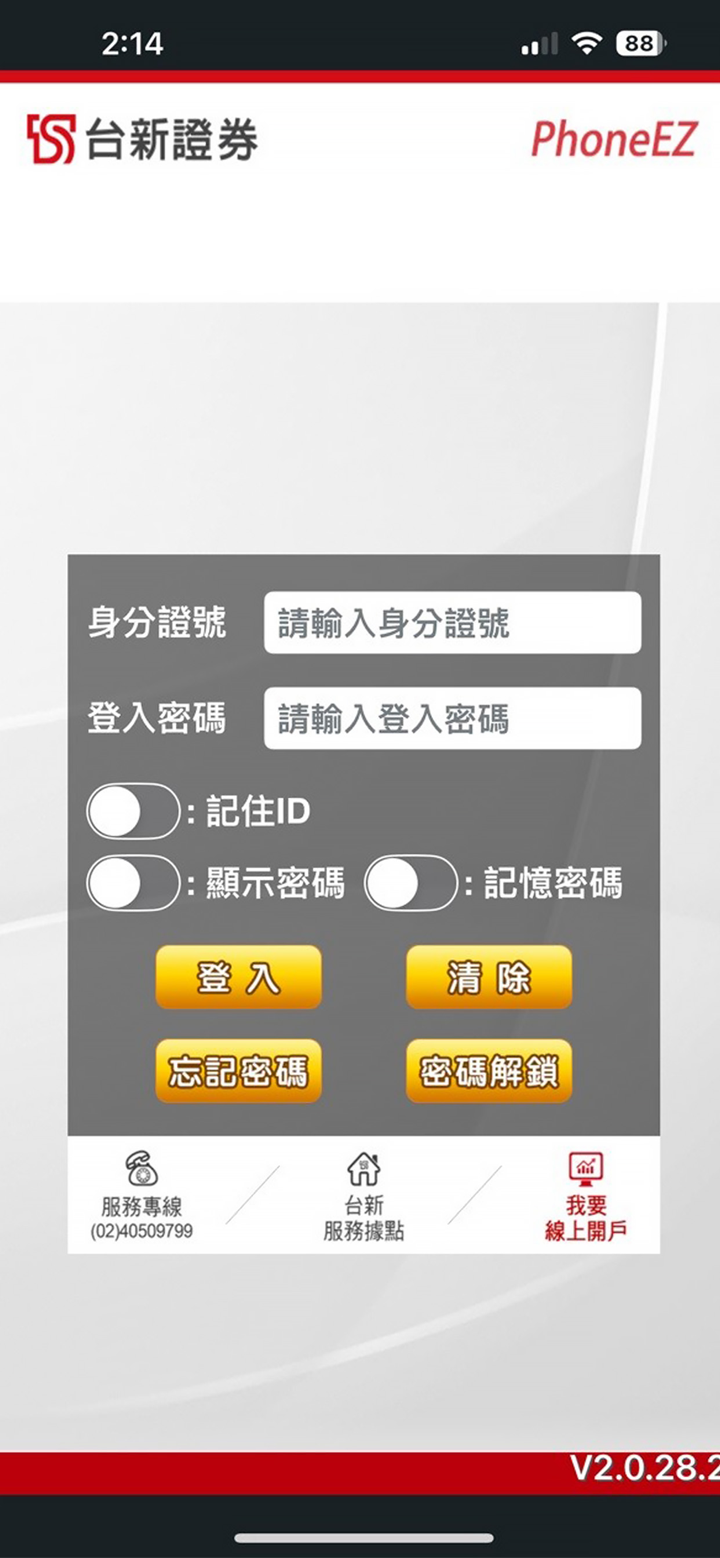

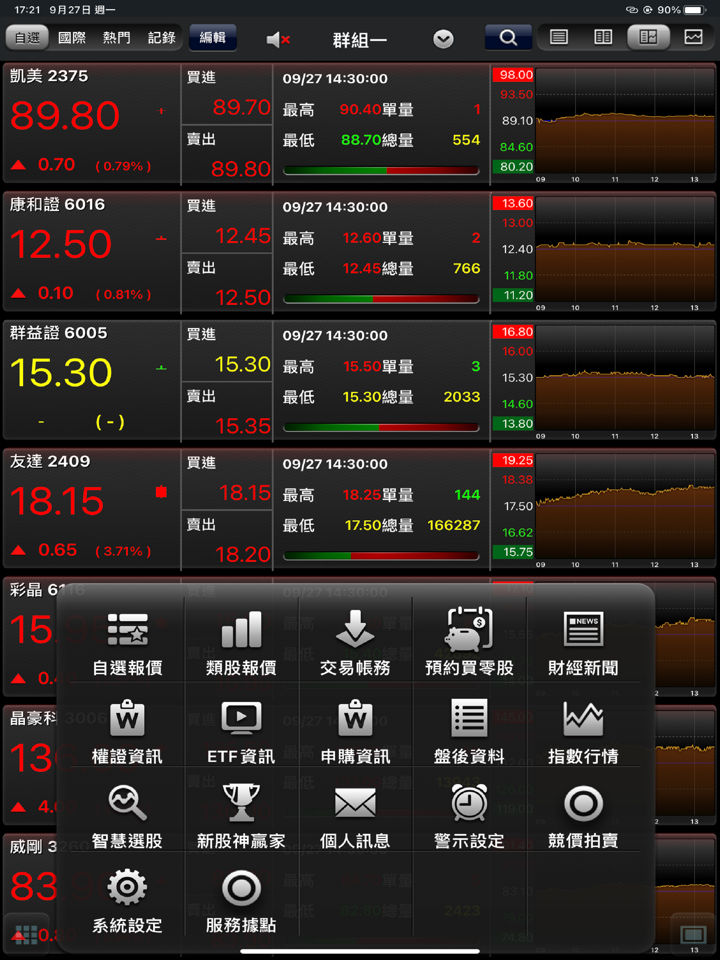

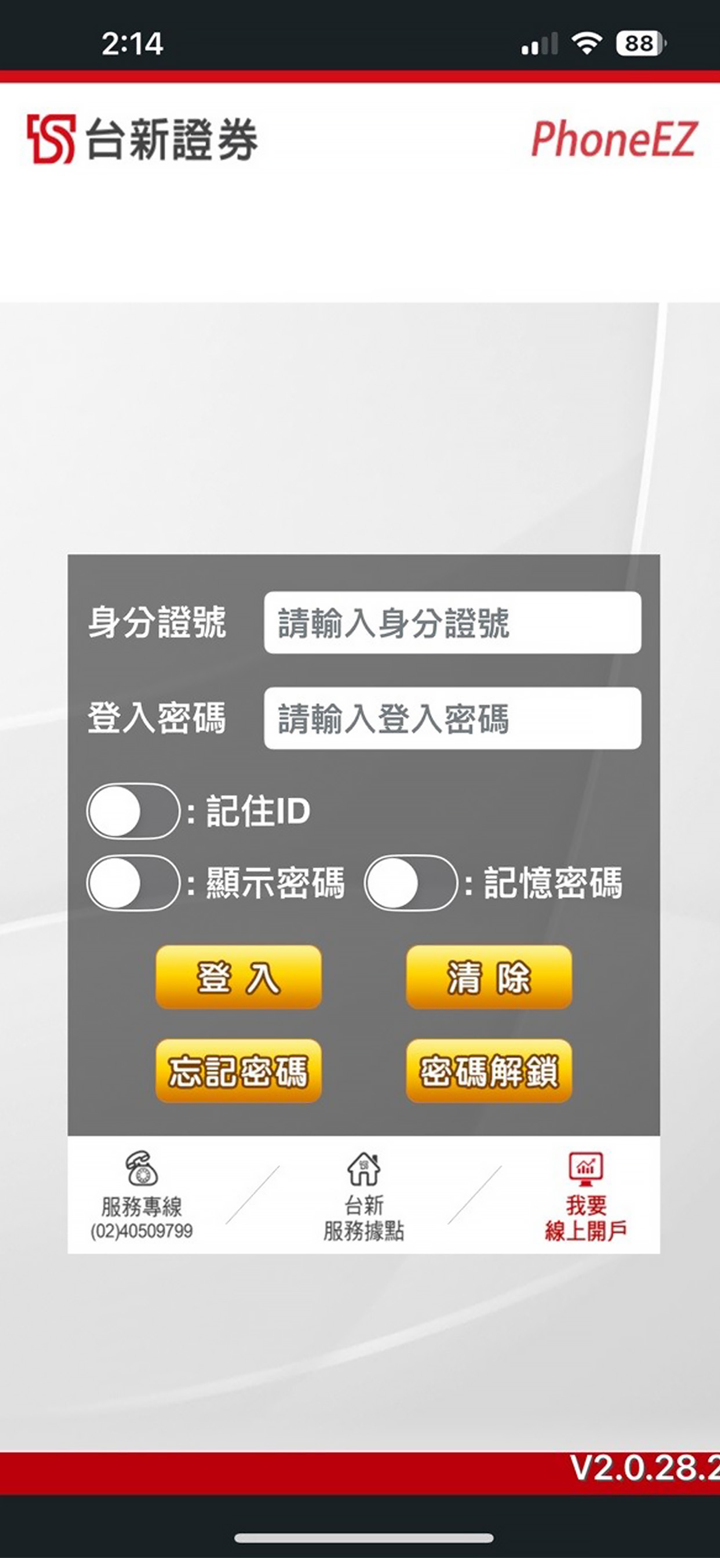

| APP交易 | Woojii, PhoneEZ | 移动应用 | 移动用户 |

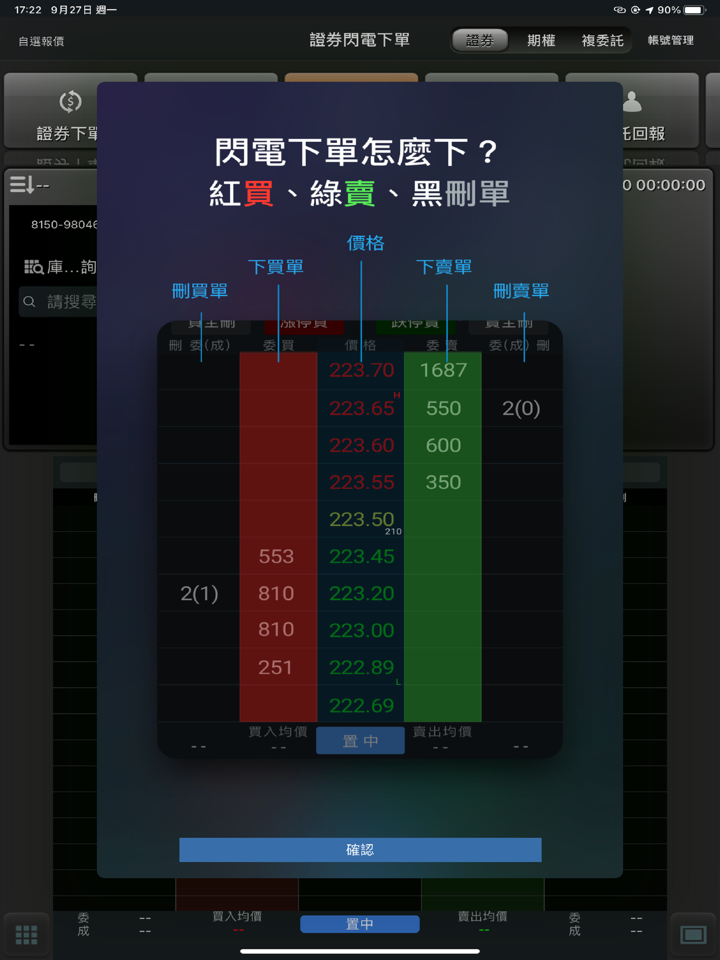

| 电脑交易 | 超级智星, 台新快速手, WEB交易, 应用程序接口交易, 全球期货之星 | 桌面, 网页浏览器, 应用程序接口 | 桌面用户, 算法交易 |

| 语音交易 | 语音交易 | 移动 | 基于语音的订单 |

| 证书区 | 证书区 | 未明确列出,可能是基于桌面的证书管理 | 证书管理 |