Company Summary

| Banco de la PampaReview Summary | |

| Founded | 2000 |

| Registered Country/Region | Argentina |

| Regulation | No regulation |

| Services | Loan, insurance |

| Promotion | ✅ |

| Customer Support | Contact form |

| Tel: 0810-222-2257 (Monday - Friday from 8 a.m. to 8 p.m) | |

Banco de la Pampa was registered in 2000 in Argentina, which mainly focuses on different types of loan and insurance services. Besides, it offers bonus and promoting activities for clients to choose. However, it should be noted that Banco de la Pampa is not regulated, and potential risks may exist.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| Bonus and promotions offered | Limited types of services |

| Free monthly maintenance | Annual maintenance fees charged |

Is Banco de la Pampa Legit?

No, Banco de la Pampa is not regulated by financial regulatory authorities in Argentina, which means this company lacks regulation from its registration site. Therefore, please be aware of the potential risks!

Banco de la Pampa Services

Banco de la Pampa provides loan and insurance programs, and the most popular one is Mastercard Debit, where clients can make a loan through MasterCard.

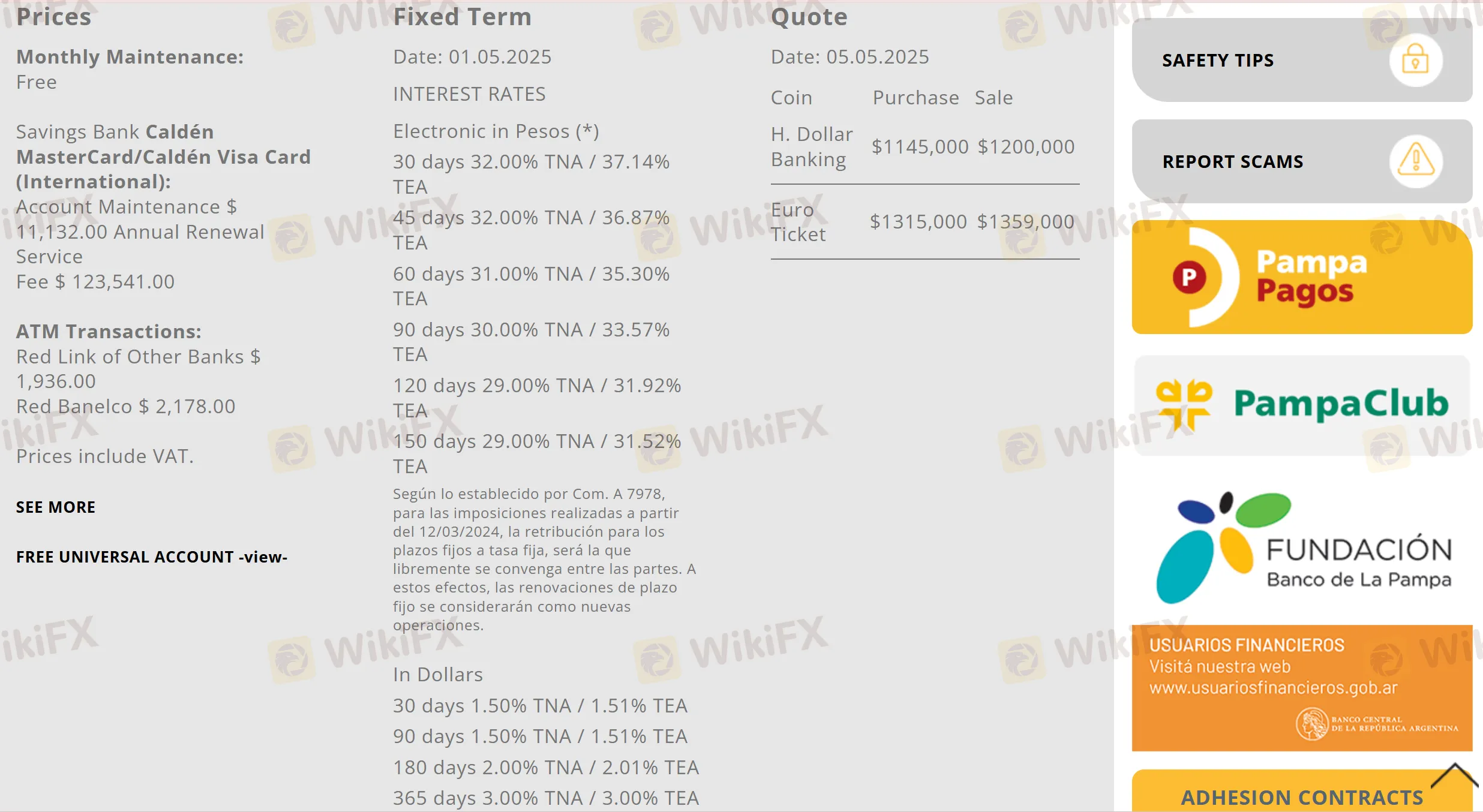

Banco de la Pampa Fees

Banco de la Pampa charges certain amounts of fees for account maintenance and annual renewal services. Despite that, monthly maintenance is free.

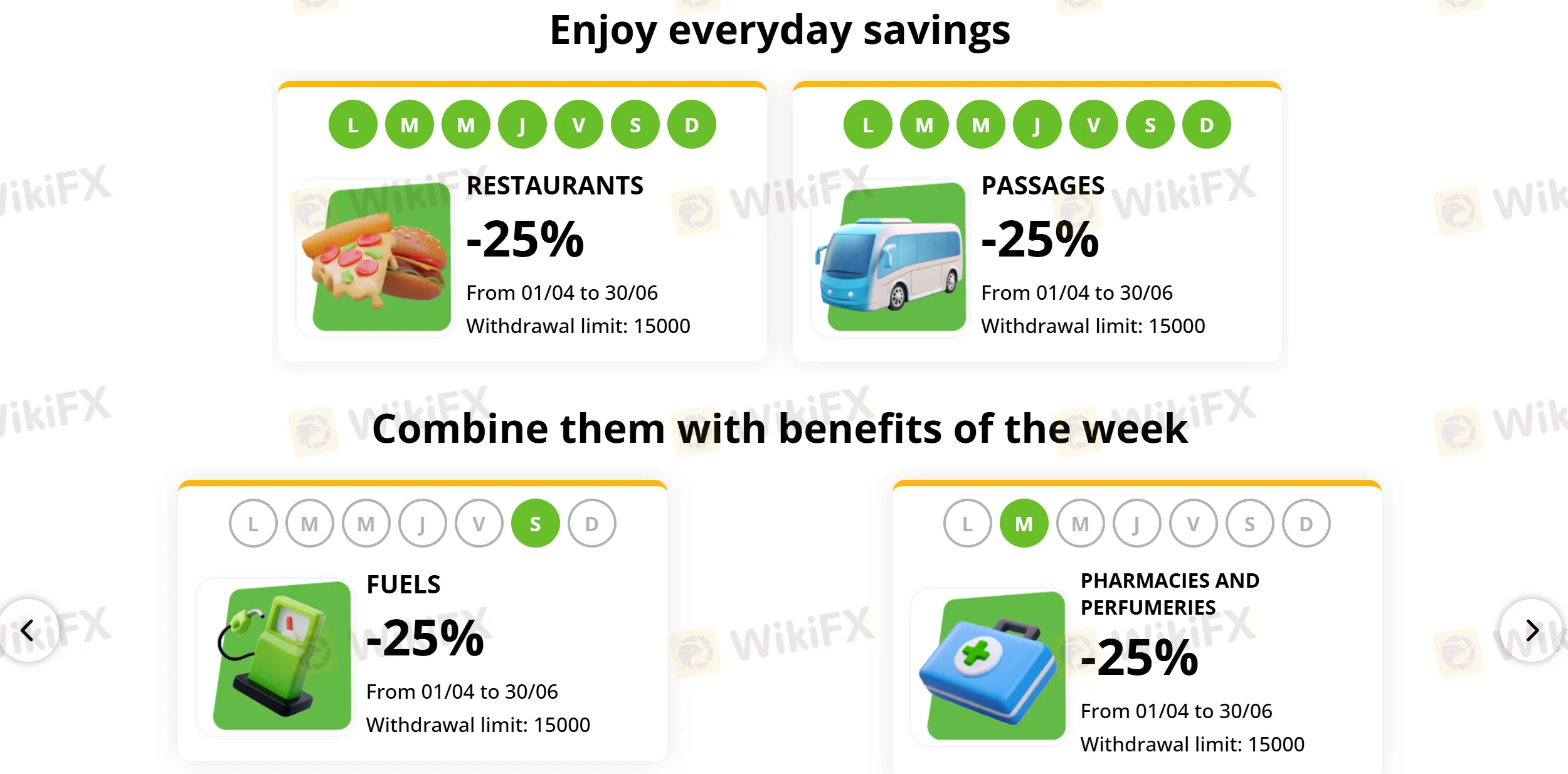

Promotion

Banco de la Pampa provides different types of promotions, such as card loan benefits, food and shopping benefits, from all of which clients can enjoy around 25% discount.