Abstract:Think your broker is safe? Think again. Behind polished websites and bold promises, many brokers hide fake licences, offshore registrations, and regulatory warnings that could put your money at risk. WikiFX exposes the secrets they don’t want you to see.

Every year, countless traders wake up to find their trading accounts frozen, their funds inaccessible, and their brokers unresponsive. The promises of quick withdrawals, seamless platforms, and high leverage often turn out to be smoke and mirrors, luring traders into a trap they never saw coming. What makes this danger even more chilling is that many of these brokers appeared trustworthy on the surface. They had slick websites, professional support teams, and glowing reviews plastered across forums.

But here lies the uncomfortable truth: the broker you trust with your hard-earned money may not be what it claims to be.

In an industry fraught with shadow players and questionable operators, vigilance is no longer optional, but it is essential. And this is where WikiFX, the global broker regulatory query platform, becomes not just helpful, but vital. By revealing what others cannot (or will not), WikiFX empowers traders to see past the glossy facades and into the realities of the brokers they entrust with their money.

Here are five secrets that only WikiFX can uncover. These are secrets that could make the difference between protecting your funds and losing them to the abyss.

1. The Truth Behind a Brokers Licence

One of the most insidious practices in the trading industry is the misuse or outright fabrication of regulatory licences. Countless brokers claim to be licensed by respected authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Their websites may even feature convincing-looking licence numbers and certificates.

But the truth? Many of these “licences” are cloned, outdated, or completely falsified. For an unsuspecting trader, the difference is almost impossible to spot.

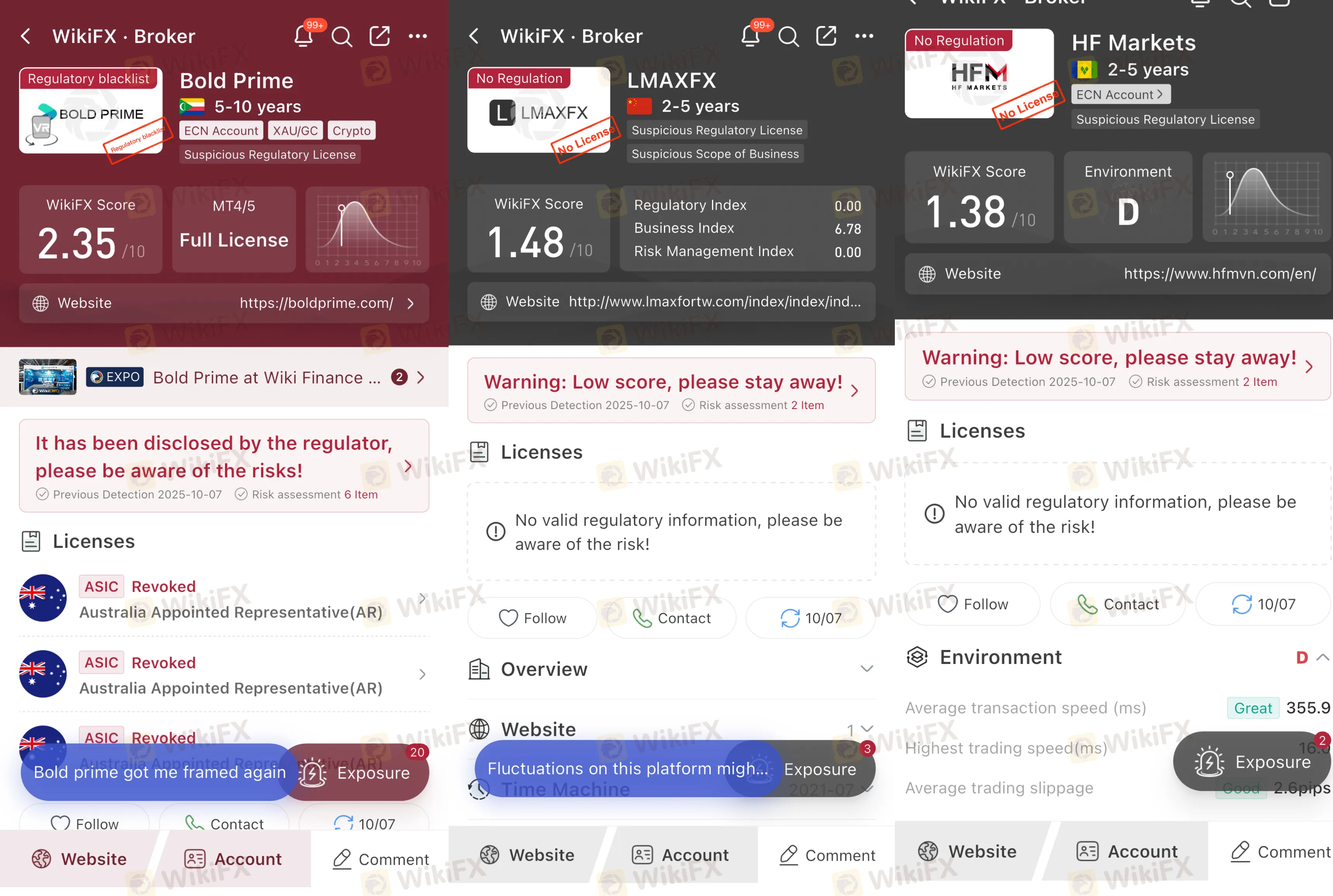

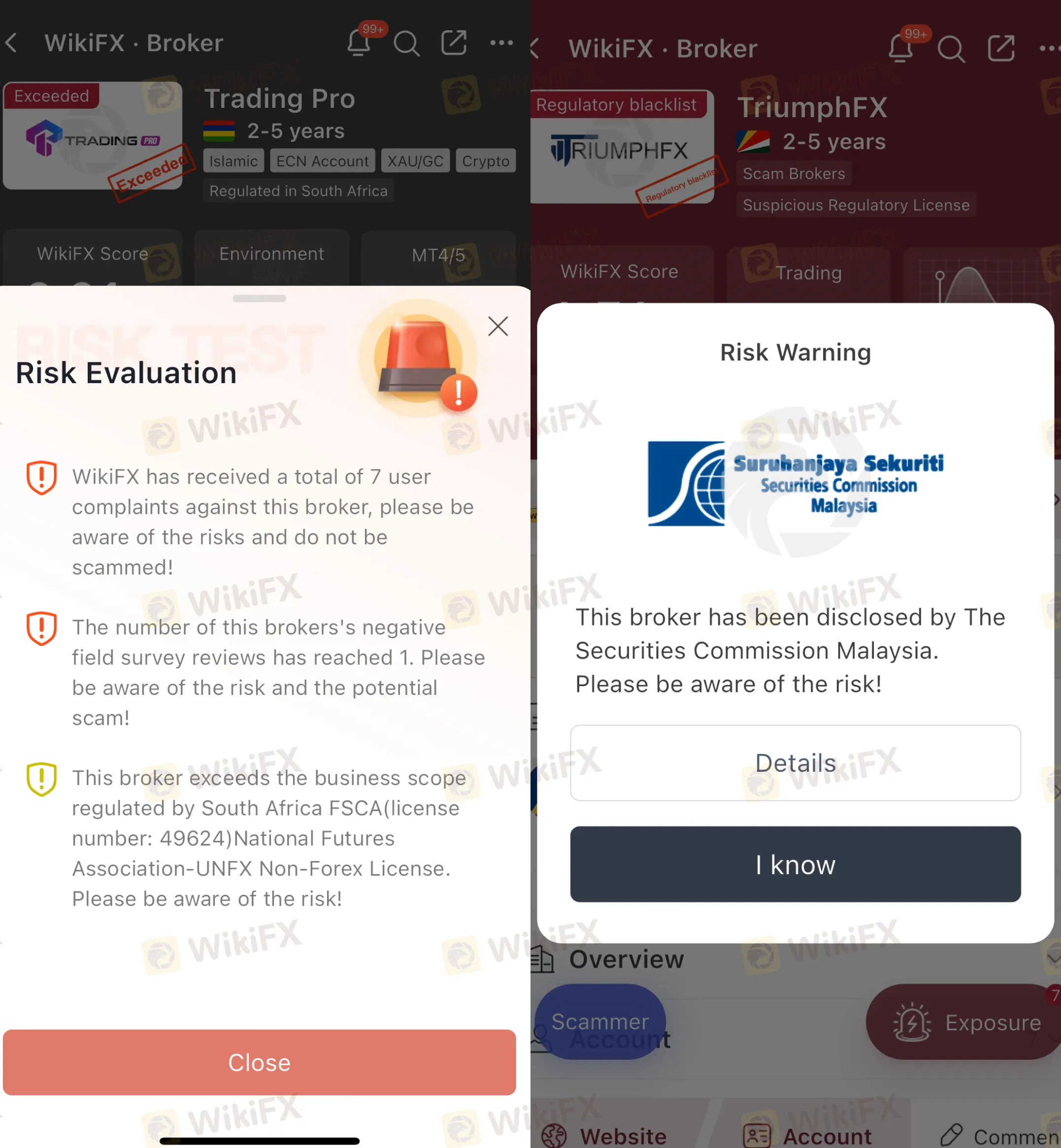

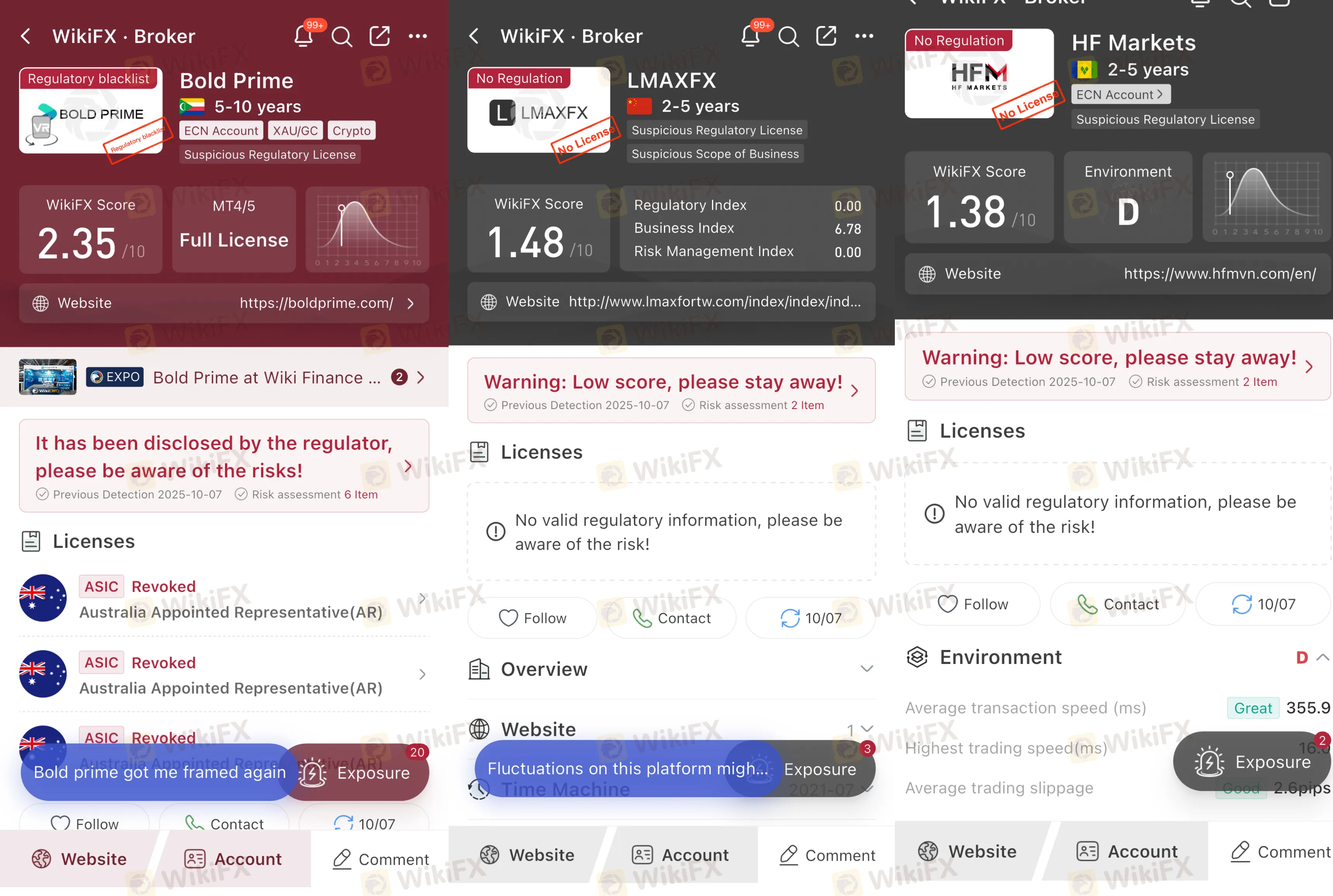

WikiFX, however, directly cross-verifies broker claims with global regulatory databases. Within seconds, traders can uncover whether a broker is genuinely regulated or merely hiding behind forged credentials. Imagine how many traders could have avoided disaster had they been able to verify the licence before signing up.

2. The Jurisdiction Trap

Where a broker is registered says more about its trustworthiness than any advertisement ever could. Onshore brokers, governed by strong financial watchdogs, are bound by strict compliance measures. Offshore brokers, meanwhile, often operate from jurisdictions notorious for a lack of regulatory oversight. These are the places where regulators provide licences with little scrutiny, and investors have virtually no recourse when things go wrong.

Many traders, enticed by high leverage or low deposit requirements, fail to ask a simple but crucial question: where is my broker actually based?

WikiFX reveals not only a broker‘s official registered address but also whether that jurisdiction is known for strong investor protections, or, conversely, whether it is a hotbed for unregulated activity. This knowledge alone can save traders from entering what amounts to a regulatory no-man ’s-land.

Read this article to learn how WikiFX takes an extra step to verify brokers office locations: https://www.wikifx.com/en/newsdetail/202509115854924517.html

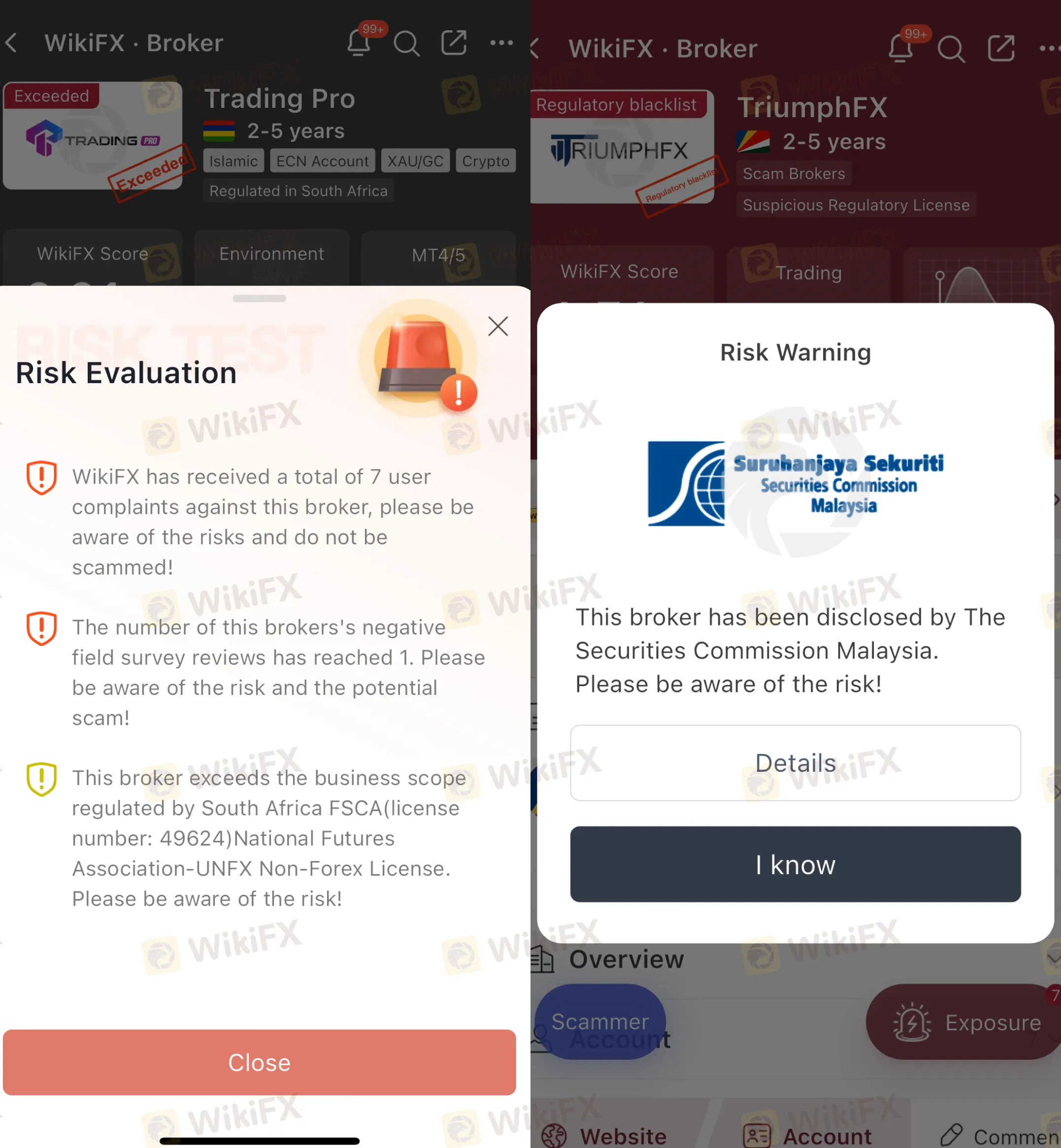

3. Hidden Warnings and Blacklists

Most traders never see the issued warnings by regulators against fraudulent brokers. These notices, often buried deep within regulatory websites, can be difficult to find unless you know where to look.

WikiFX aggregates such alerts and flags brokers who have been blacklisted, sanctioned, or issued cease-and-desist orders. This means that even if a broker appears legitimate on its own website, traders using WikiFX can instantly check if regulators elsewhere have already raised concerns.

Consider the cost of ignoring these warnings: accounts suddenly frozen, funds irretrievable, and legal recourse a distant dream. Knowing whether a broker has already been blacklisted can spell the difference between trading safely and walking into a carefully laid trap.

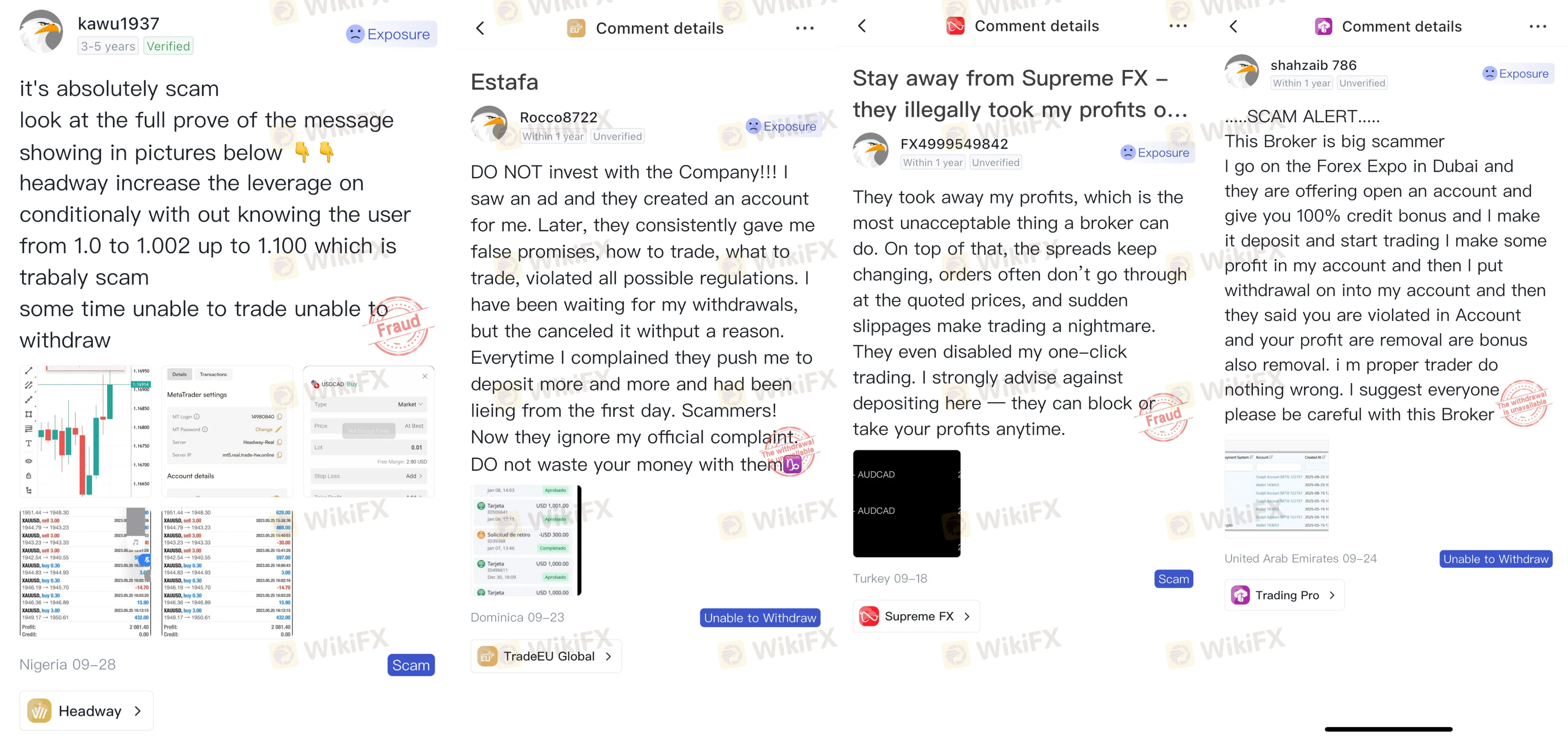

4. The Hidden Stories from Other Traders

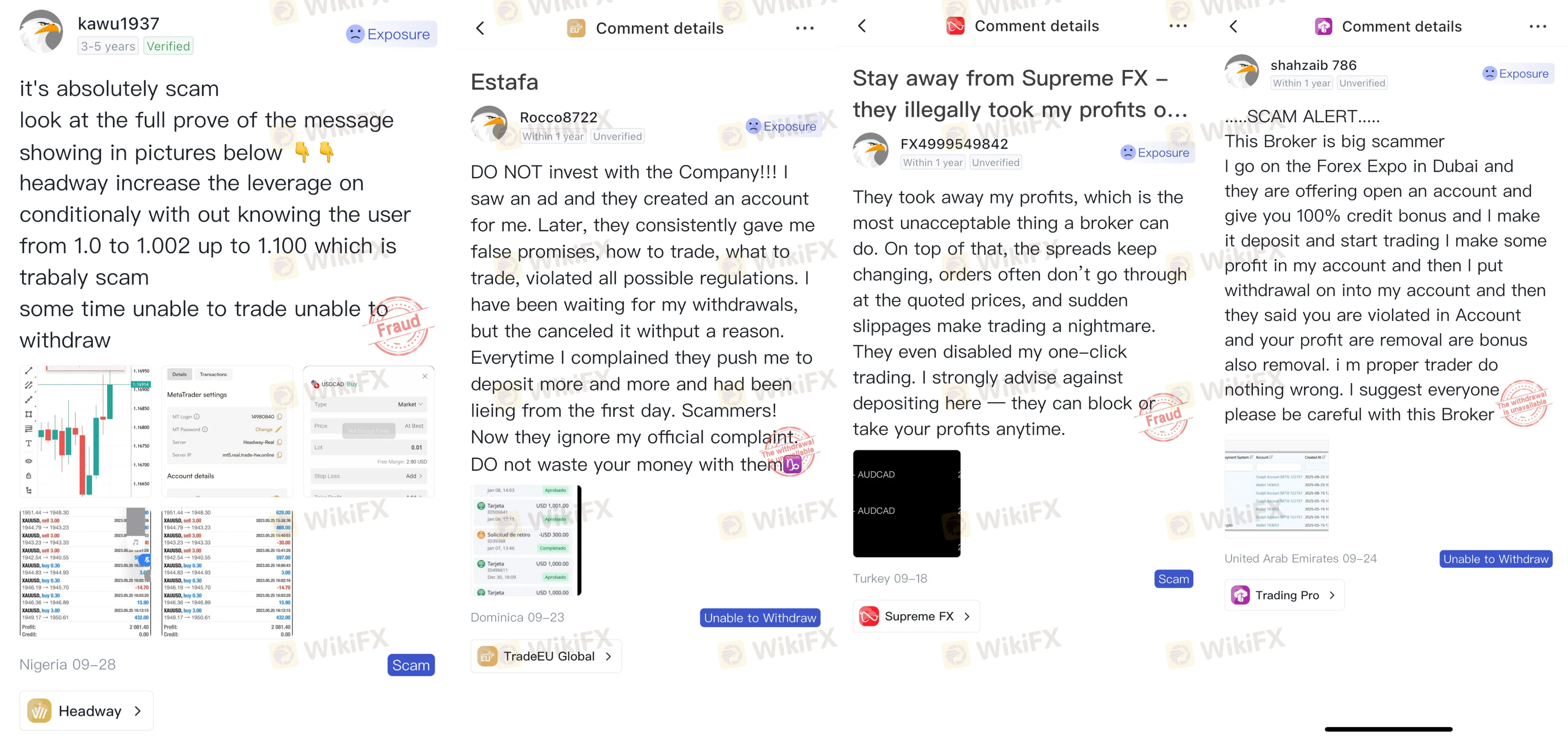

Behind every glossy marketing pitch are the experiences of real traders, including stories of delayed withdrawals, sudden margin calls, or unexplained platform downtime. Yet these experiences are often scattered across forums and social media, making them hard to verify or trust.

WikiFX consolidates these accounts, providing a clearer picture of how brokers truly operate. Beyond numbers and licences, this human layer of insight offers a stark reminder: if hundreds of traders are reporting suspicious practices, chances are the same could happen to you.

It is said that “where there is smoke, there is fire.” WikiFX helps traders see the smoke before the fire consumes their funds.

5. The Brokers True Rating

A brokers reputation is often carefully manufactured, such as polished websites, glowing testimonials, and professional endorsements, could easily create a façade of safety. But beneath the surface, how does the broker truly measure up?

WikiFX assigns each broker a rating based on a rigorous evaluation system that considers regulation, operational history, user feedback, and market reputation. Unlike promotional reviews, these ratings are impartial and data-driven. They cut through the noise and deliver what traders desperately need: a reliable measure of trustworthiness.

For traders weighing multiple brokers, these ratings offer an invaluable filter that can save them from placing their trust (and capital) in the wrong hands.

A Crucial Reminder to All Traders

The hard truth is that even experienced traders have been caught off guard by brokers who appeared legitimate. The financial markets move fast, and the pressure to open accounts, deposit funds, and seize opportunities often blinds traders to the basic due diligence required.

But when the façade crumbles: when withdrawals stall, when platforms malfunction, when brokers vanish, regret comes too late. The warning signs were always there; traders just didnt have the tools to see them.

WikiFX exists to ensure that traders are never forced to trade blind. By putting regulatory clarity, transparency, and global oversight into the palm of your hand, WikiFX levels the playing field in an industry where deception has often thrived.

What Can You Do to Avoid Choosing the Wrong Broker?

The offshore haven, the cloned licence, the hidden blacklist, the manipulated review are all threats to traders. And each is a secret that WikiFX is designed to uncover.

If you are trading or even thinking about trading without WikiFX, you are taking a gamble not just with your trades, but with your capital itself. Every minute spent trading without knowing who is really holding your money is a risk you cannot afford.

Download the free WikiFX mobile application today via Google Play or the App Store. Within seconds, you can verify brokers, check their ratings, and uncover the truths that many wish to keep hidden.

Conclusion

In an industry where fortunes are made and lost in moments, one fact remains unchanged: trust is everything. Yet trust must never be blind. Brokers may promise the world, but only platforms like WikiFX can reveal the reality.

Before you trade another pound, euro, or dollar, ask yourself: do I truly know my broker? If the answer is anything less than absolute certainty, the time to act is now.