简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stonefort Broker in India: A 2025 Complete and Fair Review

Abstract:Stonefort Securities has become a broker that many Indian traders are talking about. As more people become interested, we need a clear and honest look at how it works, how safe it is, and whether it's right for traders in India. When we looked into stonefort broker india, we found some confusing information. On one hand, many users say good things about its service and trading platform. On the other hand, there are serious problems with its licenses and safety ratings from industry experts. This creates a confusing situation for people who might want to use this broker.

Stonefort Securities has become a broker that many Indian traders are talking about. As more people become interested, we need a clear and honest look at how it works, how safe it is, and whether it's right for traders in India. When we looked into stonefort broker india, we found some confusing information. On one hand, many users say good things about its service and trading platform. On the other hand, there are serious problems with its licenses and safety ratings from industry experts. This creates a confusing situation for people who might want to use this broker.

This article will help clear up the confusion. We will give you a neutral and detailed breakdown of all the facts, from its licenses and company structure to its trading platforms, account rules, and real experiences from users. Our goal is to give Indian traders all the information they need to make a smart and careful decision.

Quick Look at Stonefort

For traders who want a fast overview, this table shows the most important information about Stonefort Securities. This data gives you a quick first look at what this broker offers.

| Feature | Details |

| Where It's Registered | Saint Lucia; also connected to Mauritius |

| How Long It's Been Running | 1-2 years |

| Main License | UAE SCA (Investment Advisory License) |

| Warning About License | Yes, “Exceeded” what they're allowed to do (Not a Forex License) |

| Trading Platforms | MetaTrader 5 (MT5 Full License), Stonefort Trader App |

| Highest Leverage | 1:200 (for Elite Account) |

| Smallest Starting Amount | $10,000 (for Elite Account) |

| Popularity in India | India is the top region where this broker is active |

Looking Closely at Licenses and Rules

A broker's licenses and rules are the foundation of a trader's safety. They decide what rules apply, how your money is protected, and what you can do if there's a problem. When we looked at Stonefort's licenses, we found serious issues that need careful attention.

The broker's main license is an Investment Advisory License (No. 20200000226) from the Securities and Commodities Authority (SCA) of the United Arab Emirates. While this looks like a real license at first, what type it is matters a lot. It's called a “Non-Forex License.” This means the license does not allow the company to run a forex brokerage business. The services allowed under this license are only for investment advice, not for actually doing forex and CFD trades.

This creates the biggest warning sign: an official warning that the broker has “Exceeded” what it's allowed to do. When a broker works outside what its license allows, it's basically working without protection from that regulatory body. For a trader, this can be very dangerous. If you do forex trading with a company that doesn't have the right license for it, your money may not be protected by any safety programs, and the regulator may not be able to help with problems about withdrawals, pricing, or trade execution. For any trader, checking a broker's current license status is absolutely necessary before investing. You can look at the complete and most recent regulatory details on Stonefort's profile page to make a fully informed decision.

Adding to these worries is a complicated and recently changed company structure. The broker is listed as being registered in Saint Lucia, an offshore location with loose financial oversight. Its listed contact address is in Mauritius. Its regulator is in the UAE. Also, public records show a new company, Stonefort Securities Ltd (Reg No. C209470), was created in Mauritius as recently as June 2024. Such a complex setup across multiple countries can hide who really owns the company and who's responsible, making it hard for traders to know which company they're making a contract with and under which legal system their money is held. This lack of clarity is a big concern for traders looking for a stable and straightforward brokerage partner.

Read this Article- Is PINAKINE Broker Safe or a Scam? A 2025 Complete Review- www.wikifx.com/en/newsdetail/202511076524163552.html

Trading Platforms and Account Rules

Beyond licenses, the actual trading experience depends on the platforms, account types, and costs. Stonefort gives its clients access to both a well-known global platform and its own app.

Our research shows that Stonefort has a Full License for the MetaTrader 5 (MT5) platform. This is worth noting. A full license, instead of a cheaper white-label solution, suggests a bigger investment in technology and possibly a more stable and reliable trading system. It gives the broker more control over server management and technical support. The MT5 servers are located in Singapore and Mauritius, which can offer good speed for traders in the Asia-Pacific region. Besides MT5, the broker also offers the “Stonefort Trader,” its own mobile app, which may appeal to traders who want convenience and trading on the go.

However, the account structure creates a big barrier for new traders and lacks transparency. The available information shows three account levels: Starter, Advanced, and Elite. Of these, only the Elite account has its details shared.

• Elite Account:

• Minimum Starting Amount: $10,000

• Spreads: From 0.1 pips

• Commission: $7 per lot

• Maximum Leverage: 1:200

The minimum starting amount of $10,000 for the only fully detailed account is extremely high and makes it impossible for most beginner and intermediate traders in India to afford. Importantly, there is no public information about the minimum starting amounts, spreads, commissions, or other rules for the Starter and Advanced accounts. Also, details about how to deposit and withdraw money, processing times, and possible fees are not given. This lack of information is a big problem, as traders cannot fully understand the cost of trading or how easy it is to move their money without first signing up for the platform.

What Users in India Are Saying

Very different from the license and structure concerns is the overwhelmingly positive feedback found in user reviews. We looked at 12 reviews from traders, with many coming from India, as well as the UAE and Indonesia. All 12 of these reviews are positive.

A main theme in this feedback is the quality of customer support. Several users from India specifically mention their positive experiences with a support person named Hassan Abdulla. One trader says, “Hassan takes time to explain market movements and gives me confidence in my trades.” Another states, “Hassan is knowledgeable, responsive, and always ready to guide me through the markets.” Other reviews praise a representative named Jack for being “very helpful” and providing daily market updates. This naming of specific people adds a sense of authenticity to the praise.

The second major theme is how well the platform and money operations work. A trader from Indonesia points out that while many brokers create problems with withdrawals, “Stonefort has been very smooth in withdrawals.” An Indian user agrees, describing withdrawals as “quick and hassle-free.” The platform itself is described as “user-friendly,” “smooth,” and having “fast execution.” One trader from the UAE simply states the “Stonefort Trader simplifies the entire trading experience.”

However, it's very important to look at these reviews carefully. The source data clearly labels all 12 of these reviews as “Unverified.” This means they have not been independently confirmed to come from real, funded clients. While the consistent praise for support and withdrawals creates a compelling story, potential clients must consider this evidence carefully, especially when it goes against objective and verifiable regulatory warnings.

Fair Assessment: Good Points vs. Risks

To help Indian traders understand these conflicting signals, we have put together our findings into a clear comparison. This balanced view shows the broker's potential advantages against the significant, documented risks.

Potential Good Points:

• Strong Positive User Feedback: The unanimous, though unverified, positive reviews from users in India and nearby regions suggest a satisfying client experience, especially regarding customer service and withdrawal processing.

• Focus on Indian Market: Data shows that India is the top region for Stonefort's business activity, suggesting a focus on and possible understanding of the local market.

• Full MT5 License: The use of a full MetaTrader 5 license points to a solid technology foundation and a commitment to providing a strong trading platform, which is better than a standard white-label offering.

Major Concerns:

• Critical License Warning: The broker's operation outside what its “Non-Forex” Investment Advisory license allows is the most serious risk. This removes regulatory protection for forex trading activities and puts client funds in significant danger.

• Very Low Trust Score: A combined score of 3.07 out of 10, along with an explicit warning, shows a high level of risk as judged by industry data platforms.

• High Cost to Start: The only account with fully shared trading conditions requires a prohibitive minimum starting amount of $10,000, leaving the terms for average retail traders completely unknown.

• Complex and Unclear Structure: The combination of a Saint Lucia registration, a Mauritius address, and a UAE regulator, along with a newly formed company, reduces transparency and complicates legal responsibility.

Final Thoughts for Indian Traders

Stonefort Securities presents a classic problem for careful traders in India. The broker is caught between glowing, experience-based user reviews and severe, fact-based regulatory warnings. The story of a helpful, efficient broker is powerful, but it cannot erase the fundamental risks highlighted in its licensing and company structure.

The main duty of any trader is keeping their money safe. The issue of operating outside a licensed scope is not a small problem; it is a fundamental flaw that undermines the very basis of a safe trading environment. Positive user experiences, while valuable, cannot replace proper regulatory authorization and financial transparency.

In the end, the choice to work with any broker depends on a person's tolerance for risk. Given the serious problems we have identified, extreme caution is needed. Before depositing any money, we strongly advise traders to do their own final check by looking at Stonefort's complete and interactive profile to review all the latest data points, user reviews, and any new regulatory developments. This final step of personal research is essential for making a responsible and secure trading decision.

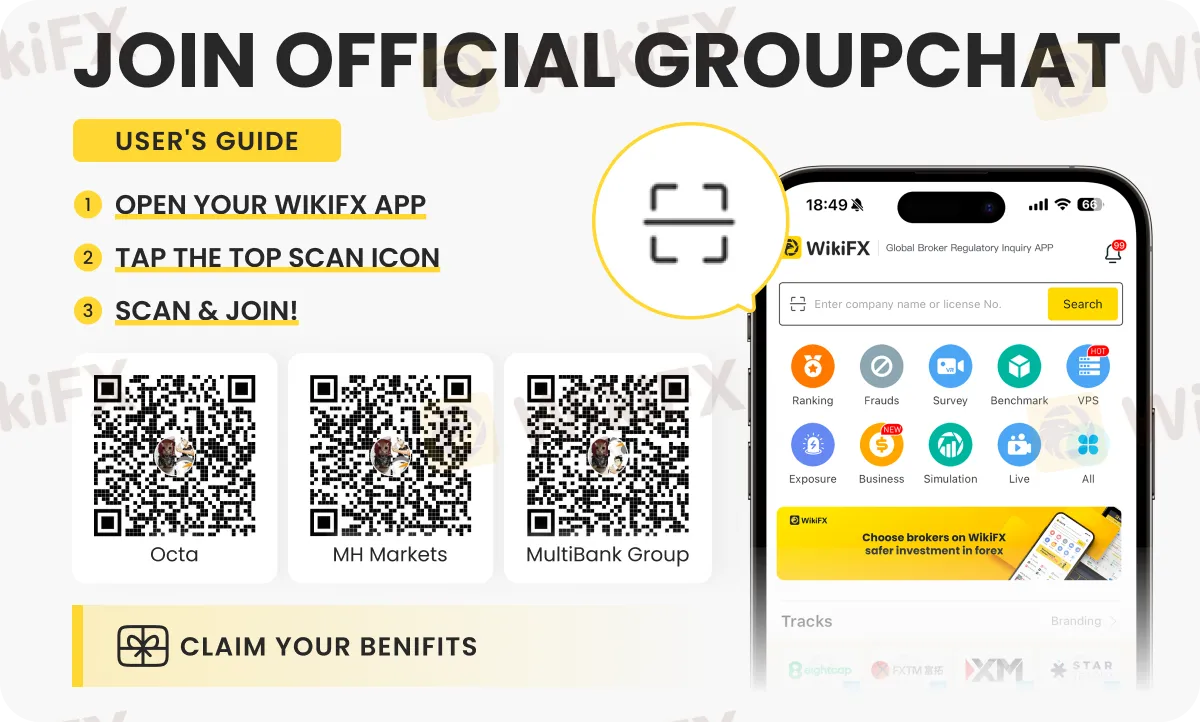

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator