Abstract:Lunar Capital is an unregulated UK broker offering forex, stocks, indices, and crypto. Learn about risks and trading features in this review.

Lunar Capital presents as a multi‑asset CFD broker targeting retail traders with high leverage and a slick web platform, but the core facts point to elevated risk and an absence of regulatory oversight. The firm is unregulated, lists a UK association without FCA authorization, and promotes leverage up to 1:200, paired with a minimum deposit of 500, which places novice capital at disproportionate risk.

Lunar Capital Review: Key Findings

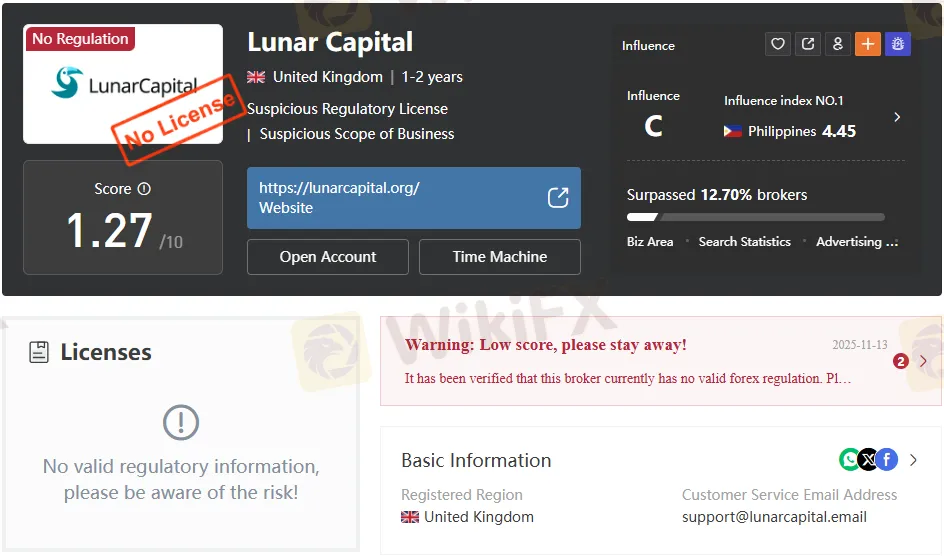

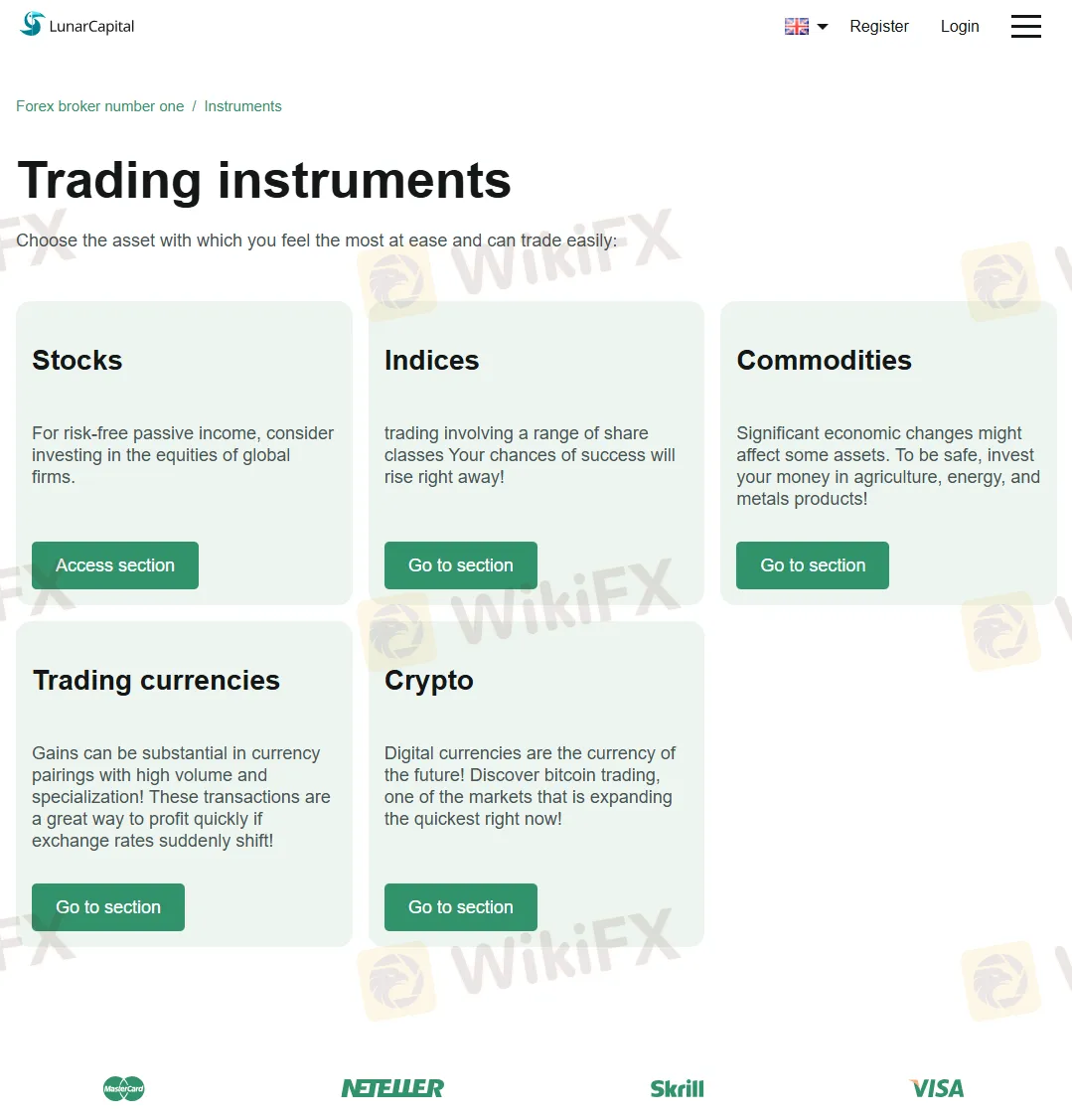

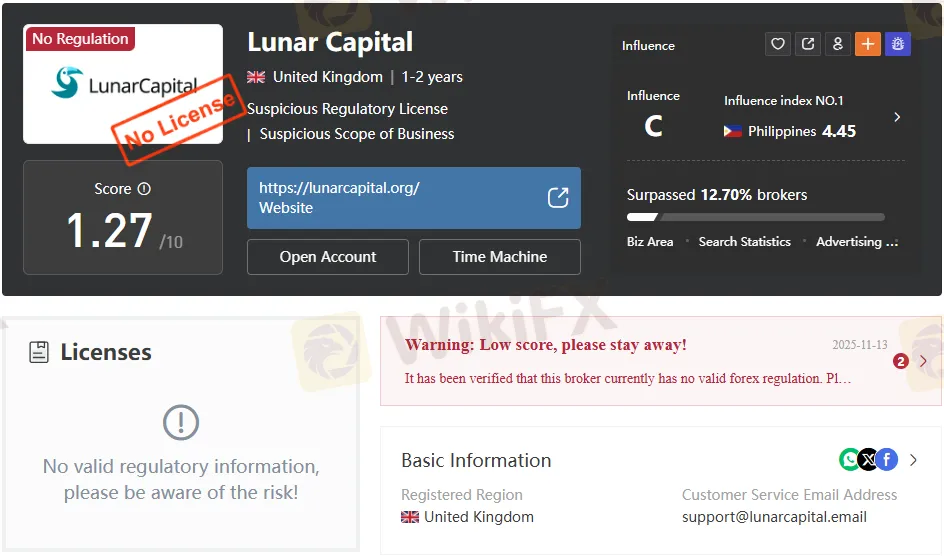

Lunar Capital operates without any recognized forex regulation and explicitly shows “No regulation,” while signaling a UK linkage that is not backed by FCA permissions; this combination is a red flag for consumer protection and recourse. The brokers score noted in the document is low (1.27/10), with a warning to stay away due to a lack of valid licensing, which aligns with the risk profile of offshore, lightly governed operations. The offering spans forex, indices, stocks, commodities, and cryptocurrencies via the proprietary XCritical web platform and mobile app, but does not provide MT4/MT5 or a demo account, limiting transparency and testing for new users.

Is Lunar Capital Regulated?

No—Lunar Capital is not regulated “No regulation” and “No valid regulatory information,” and that it does not hold FCA authorization despite indicating a UK connection. Absence of authorization means client money safeguards, negative balance protection, and dispute resolution standards typical of tier‑1 regimes are not assured. The document also flags a “Suspicious Regulatory License” status and advises caution, reinforcing consumer risk concerns.

Lunar Capital Regulation: Facts and Signals

The material shows registration or association with the United Kingdom but explicitly clarifies that there is no FCA license and no valid forex regulation in place. The brokers risk indicators include a low trust score (1.27/10), “Suspicious Scope of Business,” and a notice to stay away—signals commonly tied to unlicensed sales targeting global retail flows. Domain data lists lunarcapital.org registered on 2023‑04‑03, updated 2025‑03‑09, and using Cloudflare nameservers; operational timelines under two years increase the need for due diligence.

Lunar Capital Broker Review: Fees, Accounts, Platform

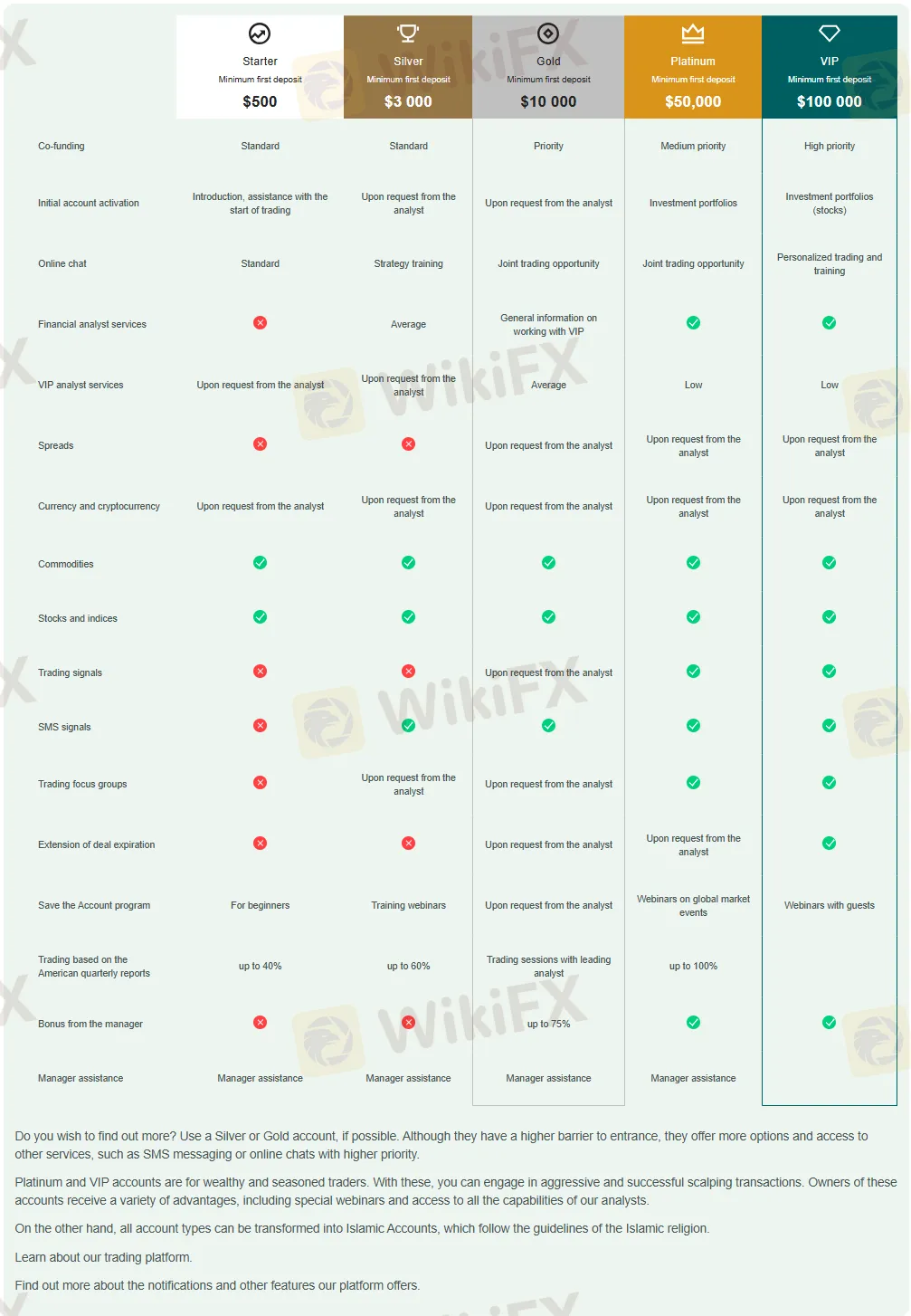

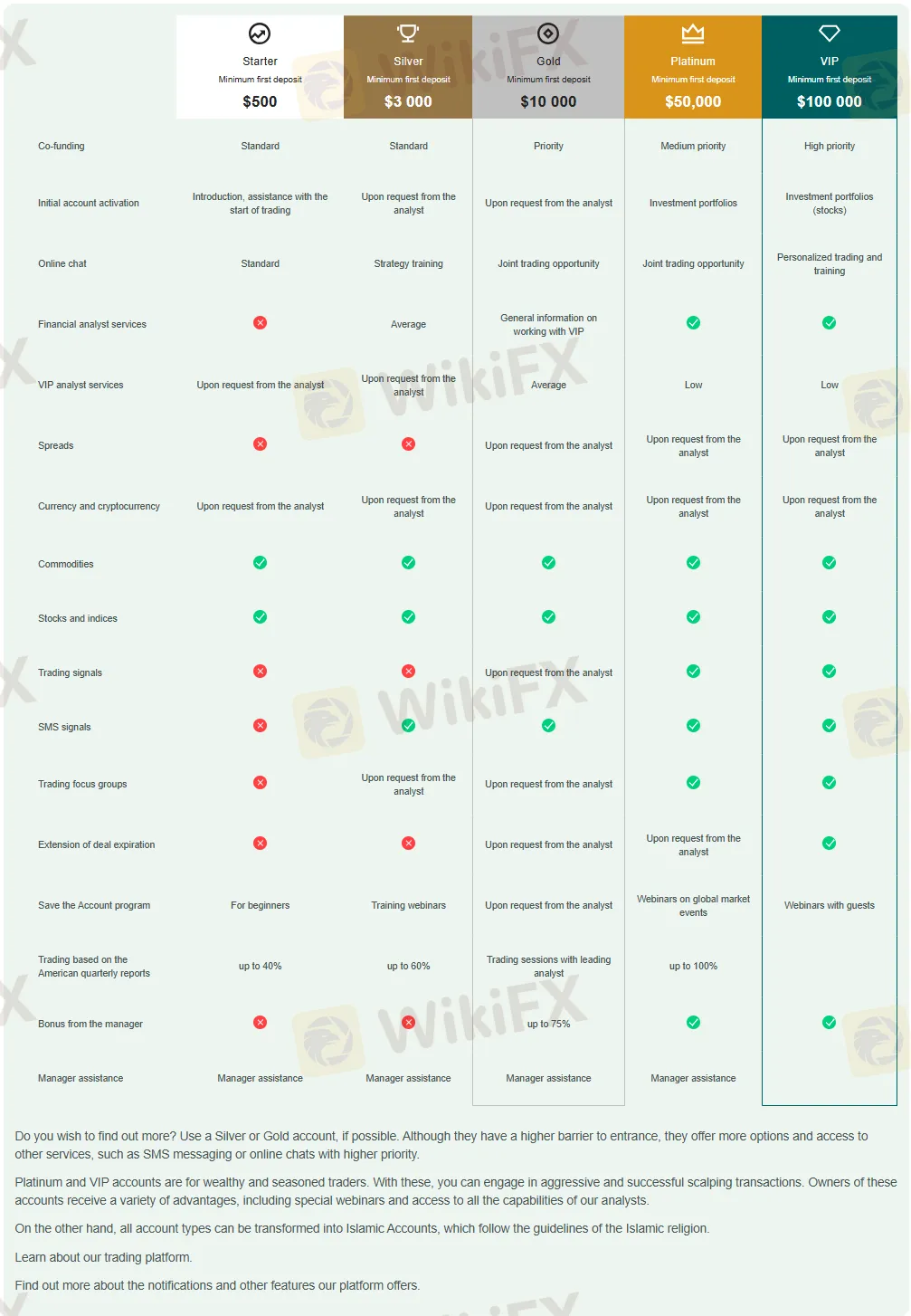

Account tiers include Starter, Silver, Gold, Platinum, and VIP, each with higher minimums, starting from a minimum deposit of 500 stated in the summary; leverage is advertised “up to 1:200,” which can amplify both profits and losses substantially. The spreads disclosed for major and minor FX pairs are generally wider than typical FCA‑regulated competitors, with examples such as AUDUSD listed thinning from 2.7 down to 1.2 at higher tiers, still above the sub‑1.0 pip benchmarks many regulated brokers quote on top‑tier accounts. Platform availability is limited to XCritical (web and mobile); MT4/MT5 are not supported, and a demo account is marked X, making pre‑funding testing difficult for prospective clients.

Lunar Capital FCA License and Domain Details

The broker has no FCA approval and reiterates “No License” despite the UK linkage, a critical point for any trader who prioritizes client fund segregation and recourse mechanisms. Domain information shows lunarcapital.org was created on 2023‑04‑03, status client‑transfer‑prohibited, and expiry of 2026‑04‑03, which is consistent with a relatively new brand lifecycle. Contact lines in the document include a UK phone number, a support email using “lunarcapital.email,” and a Skype handle, but such details do not substitute for formal authorization.

Pros and Cons

- Pros: Multi‑asset lineup across FX, indices, stocks, commodities, and crypto; several account tiers; supports Visa, MasterCard, Neteller, and Skrill; web and mobile access via XCritical.

- Cons: No regulation and no FCA authorization; no MT4/MT5; no demo account; higher‑than‑average spreads; minimum deposit from 500; low trust score with explicit risk warnings.

At‑a‑glance Comparison

Trading Instruments and Access

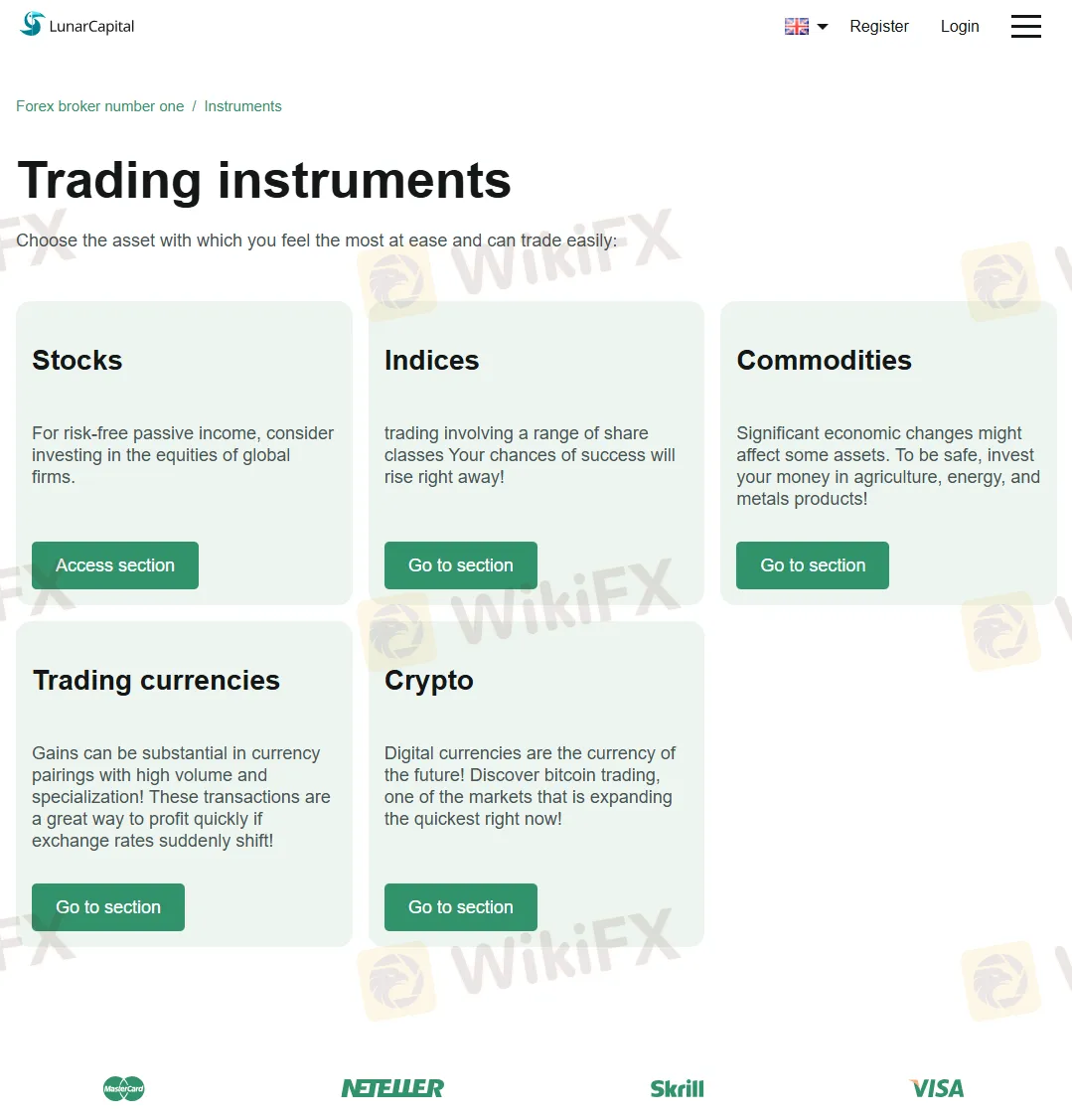

- Instruments: Forex, indices, stocks, commodities, cryptocurrencies; bonds/options/ETFs marked as unsupported.

- Platforms: XCritical web platform and mobile app on iOS/Android; positioning suggests ease of access but fewer third‑party integrations.

- Payments: Visa, MasterCard, Neteller, Skrill; the document claims no deposit/withdrawal fees from the broker side, though processor fees can still apply externally.

Risk and Suitability

- High leverage to 1:200 increases liquidation probability in volatile instruments; with wider spreads and no demo, real‑money testing risk escalates.

- Unregulated status removes formal complaint channels, compensation schemes, and mandated disclosures required under FCA or similar tier‑1 bodies.

- The UK phone and branding signals do not compensate for absent authorization; jurisdictional claims should be verified before any funding.

Actionable Guidance for Traders

- If prioritizing safety, consider an FCA‑regulated broker with negative balance protection, audited financials, and leverage limits aligned with retail protections.

- If evaluating Lunar Capital despite the risks, limit exposure, avoid large upfront deposits, and independently validate withdrawals with small test amounts before scaling.

- Document all communications and retain payment receipts; lack of regulation often correlates with fragile dispute pathways.

Bottom Line

Given the absence of recognized authorization, the low trust score, and operational constraints such as no demo and no MT4/MT5, Lunar Capital fits a high‑risk profile unsuitable for most retail traders; those requiring formal protections should opt for fully regulated alternatives.