Perfil de la compañía

| T&DResumen de la reseña | |

| Fundado | 1980 |

| País/Región registrado | Japón |

| Regulación | FSA |

| Servicios | AXIA (Valor), SOPHIA (Crecimiento principal) y Estrategia ESG |

| Soporte al cliente | Email: mkt_offshore@tdasset.co.jp |

| Dirección: T&D Asset Management Co., Ltd. Mita Bellju Building, 5-36-7, Shiba, Minato-ku, Tokyo, 108-0014, Japón | |

Fundada en 1980 y registrada en Japón, T&D es una empresa de gestión de inversiones aprobada por la FSA para proporcionar diversos servicios de gestión de inversiones, incluyendo AXIA (Valor), SOPHIA (Crecimiento principal) y Estrategia ESG.

Pros y contras

| Pros | Contras |

| Muchos años de experiencia en la industria | Solo soporte por correo electrónico |

| Regulado por la FSA | |

| Varios servicios de gestión de inversiones |

¿Es T&D legítimo?

Sí, T&D está autorizado y regulado por la Agencia de Servicios Financieros (FSA). El tipo de licencia es Licencia de Forex Minorista y el número de licencia es 関東財務局長(金商)第357号.

| País regulado | Regulador | Estado actual | Entidad regulada | Tipo de licencia | Número de licencia |

| Agencia de Servicios Financieros (FSA) | Regulado | T&Dアセットマネジメント株式会社 | Licencia de Forex Minorista | 関東財務局長(金商)第357号 |

Servicios

T&D ofrece diversos servicios de gestión de inversiones, incluyendo AXIA (Valor), SOPHIA (Crecimiento principal) y Estrategia ESG.

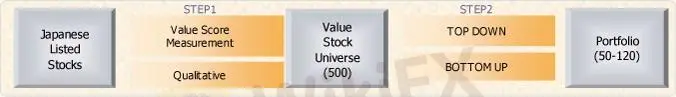

AXIA (Valor): AXIA invierte en empresas que aún están infravaloradas, pero que están haciendo esfuerzos persuasivos para reestructurar sus negocios, expandirse a nuevos negocios o volverse más rentables.

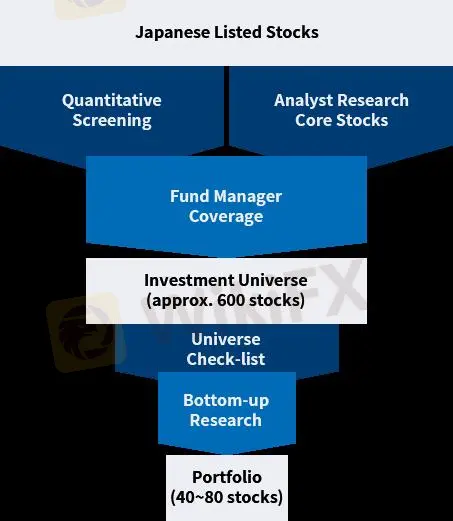

SOPHIA (Crecimiento principal): SOPHIA invierte en empresas que probablemente sean revalorizadas o que se encuentren mejorando en términos de rentabilidad, identificadas por un impulso positivo de crecimiento del ROE. La estrategia tiene como objetivo capturar alfa a partir del crecimiento del ROE.

Estrategia ESG: ESG invierte en empresas con un alto perfil ESG desde una perspectiva a largo plazo.